Many accountants have already heard that from October 1, 2021, the employment service needs

Let us recall that paragraph 5 of Article 93 of the Tax Code allows organizations to refuse to auditors to re-provide

The operating cash desk can be used not only by banking institutions, but also by commercial enterprises. In both

How can selling goods under a commission agreement be beneficial? To whom and in what cases

Upon receipt of the request, the taxpayer is obliged to send it to the tax office within six working days

If before 2013 the pension fund notified each citizen in writing about his savings, then

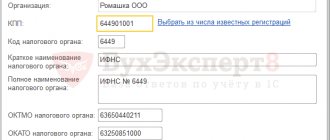

Settings that affect the calculation of personal income tax Setting up registration in the INFS of an organization and separate divisions For

Many who have heard that a 3-NDFL declaration can be filed in 3 years are trying as much as possible

Calculating profit is determining the difference between the amount of revenue received and costs. For that,

The Tax Code is one of the most dynamically changing laws in our country. Usually,