Moral damage is physical or moral suffering of an individual that was caused

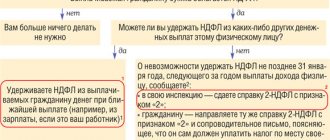

Hello! In this article we will talk about the need to stamp new 2-NDFL certificates

One of the basic conditions for the effective operation of an enterprise is constant accounting and control of the movement of material

Excise tax Excise tax is an indirect tax on the production of certain types of goods. Economic meaning of excise duty

HR records for an individual entrepreneur are no less important than for a large company. Why?

Most companies are faced with the need to build a facility from basic

How leave is granted in part-time mode Chapter 19 of the Labor Code of the Russian Federation regulates issues

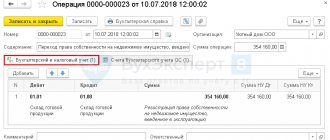

All income of enterprise employees, including standard and social deductions, at the end of the year is recorded in

Types and functions of off-balance sheet accounts Off-balance sheet accounts (AB) are intended for storing information about objects,

What types of work are exempt from VAT? Clause 3 of Article 149 of the Tax Code of the Russian Federation