Who has the opportunity to transfer property free of charge?

Transferring anything free of charge is a fairly common occurrence in budgetary institutions.

There are several sources of transfer of property to an institution:

- Property can be transferred from one institution to another

- It may come from commercial organizations. An interesting fact is that donating property between commercial companies is illegal and is not used, but you can transfer property to a budget organization free of charge

- The receipt of property can be made from an ordinary person, that is, an individual

- Probably the most common way to receive property for a budget organization free of charge is its transfer by the owner of the institution. In this case, the transferred property is assigned to the institution

Receiving property from companies and individuals is their kind of charitable gesture. At the same time, it may be stipulated how the transferred property should be used .

Budget accounting of fixed assets in 2021-2021 (nuances)

One of the main criteria for recognition of fixed assets is the service life of the property, namely an interval exceeding 12 months. In addition, the facility must be used to carry out the activities of the institution permanently or repeatedly. Another feature is that the operating systems are not owned by the institution, but are quickly managed.

Fixed assets in budget accounting - 2021-2021: introductory information

The remaining government institutions, maintaining accounting and tax accounting of fixed assets in 2021-2021, in addition to the unified chart of accounts, use charts of accounts approved by order of the Ministry of Finance of Russia dated December 16, 2021 No. 174n or dated December 23, 2021 No. 183n (depending on the type of organization) and others regulations.

In the mentioned Letter N 03-03-06/1/667, officials strongly recommended that the taxpayer, who received property for free use from its sole shareholder (founder), include in non-operating income income in the form of the free right to use the property, determined based on market prices for the rental of identical property.

In terms of ensuring measures aimed at reducing industrial injuries and occupational diseases of workers (purchase of special clothing) towards the accrued insurance contributions for compulsory social insurance against industrial accidents and occupational diseases.

We recommend reading: List of Affordable Housing Tambov District

Free receipt and transfer of property in budgetary institutions

But the receipt of property to budgetary institutions free of charge is possible from various legal entities and individuals. The most common transactions involve the receipt of property from the owner (secured property by the owner), as well as from other public sector institutions.

Transfer of state and municipal property for free use Since the rules of the Civil Code of the Russian Federation on a loan agreement do not provide otherwise, property owned by the right of ownership of the Russian Federation, a constituent entity of the Russian Federation or a municipal entity can be transferred for free use. Transfer for free use is a form of property disposal. Therefore, if property belongs to an institution or state-owned enterprise with the right of operational management, it can be transferred for free use with the consent of the owner of this property (Civil Code of the Russian Federation).

A state or municipal unitary enterprise has the right, with the consent of the owner, to transfer for free use real estate that belongs to it under the right of economic management. As a general rule, a unitary enterprise disposes of movable property independently (Civil Code of the Russian Federation).

Encyclopedia of solutions.

The amendments are due to the entry into force of federal accounting standards on January 1, 2021, as well as the approval. Innovations are subject to application in the formation of accounting policies and accounting indicators, starting from 2021.

Lack of funds is not a reason to refuse to purchase property, since in modern conditions there is a practice of transferring it for temporary use. An object transferred for temporary use can be a computer, a car, an industrial machine, and even real estate, for example, office or warehouse space.

What can be transferred and in what cases

So, the decision was made to transfer it free of charge. In what cases can it be transferred:

- One institution has a surplus of property and has the opportunity to transfer part of the assets to another institution that needs them

- The property belongs to a budgetary institution, but is not used and remains unclaimed

- There is property, but it is not used for its intended purpose

- Property can be transferred in the form of donations from commercial organizations or individuals

According to the first three points, it is possible to take away property from the management of one institution and transfer it to the state or another budgetary organization.

The concept of property is quite broad. In this regard, both fixed assets, materials, land, other similar objects, and cash can be transferred .

| IMPORTANT! In accordance with Article 689 of the Civil Code of the Russian Federation, the recipient of property that is transferred free of charge undertakes to return it within the prescribed period and in the appropriate form, if such a condition is provided for in the contract |

It should also be taken into account that if the property is received from the owner of the institution, then the recipient does not generate income. The same approach applies when property is transferred in accordance with certain legislative acts. For example, clarifications regarding the gratuitous transfer of premises are contained in the letter of the Ministry of Finance No. 02-07-10/84404 dated November 22, 2018.

Postings at the receiving party when transferring OS for free use

In clause 23. Methodological guidelines for accounting for fixed assets, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n (hereinafter referred to as Order 91n), it is stated that fixed assets received by the organization are reflected in accounting at their original cost. One of the options for receiving these assets to an enterprise is to receive them free of charge from other institutions. For such fixed assets, the initial cost is the market price on the date of their reflection on the company’s accounts (clause 29 of the Guidelines).

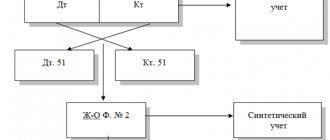

The costs associated with the gratuitous receipt of fixed assets are accumulated on account 08, and the following entry is made:

Dt 08 Kt 98.

Additional costs (costs of delivery or bringing the OS into working condition) are also included in the debit of account 08:

Dt 08 Kt 60 (10, 23, 26, 76).

IMPORTANT! The gratuitous transfer of fixed assets from the donor is subject to VAT. But the organization receiving fixed assets cannot accept this tax for reimbursement and does not reflect information about it in accounting. For details, see the material “Is VAT paid when transferring property free of charge?”

VAT on additional expenses is reflected in the accounts:

Dt 19 Kt 60.

The commissioning of the facility is reflected in the following correspondence:

Dt 01 Kt 08.

Since assets received free of charge are recognized as other income, as depreciation is calculated, their value is written off on credit 91. In this case, two accounting entries are made - one reflects the amount of accrued depreciation, the second - the amount of deferred income included in other income:

Dt 20 Kt 02;

Dt 98 Kt 91.

To learn more about operations with fixed assets, read the article “Accounting for fixed assets - accounting entries.”

How to formalize a gratuitous transfer of property on paper

According to the provisions of the Civil Code, free movement of property is possible in two ways:

- Give. In this case, a gift agreement is drawn up in accordance with the provisions of Article 572 of the Civil Code of the Russian Federation

- Draw up a gratuitous loan (use) agreement, that is, transfer it for a specified time (possibly indefinitely), in accordance with Article 689 of the Civil Code of the Russian Federation

In the case of a donation procedure, the agreement must be in writing (Article 574 of the Civil Code of the Russian Federation). The agreement for free use is also concluded in writing.

These documents record what exactly is being transferred, to whom and, possibly, for how long. If the property is transferred for use, then the conditions of use and the possibility of return are clearly stated.

In addition to contracts, it is necessary to draw up a document stating that one party transferred and the other accepted values. Usually such a document is an act.

It must be taken into account that, subject to the use of property, the contract can be terminated if:

- The property is not used for the purposes specified in the contract

- The recipient does not keep it in the required condition

- The property was transferred to a third party

- Damage was caused to the property during use

Retirement and write-off of materials

Reflect the write-off of inventories in budget accounting in the following cases:

- when selling an asset to a third party;

- when used in the activities of a government agency;

- in connection with the transfer to the authorized capital of other organizations;

- as a result of natural disasters, terrorist attacks, or other actions;

- in connection with gratuitous transfer to third parties;

- as a result of unsuitability, shortage, theft;

- when transferred to employees of the institution for personal use to perform their official duties;

- when transferring special equipment for R&D.

The method of writing off the cost should be fixed in the accounting policy. It is possible to choose: write-off at the actual cost of the unit or at the average cost. The chosen method must be applied within a calendar year. It is allowed to use different methods for individual groups.

Transfer of property from the founder free of charge

Very often, property is transferred to a budget organization from its founder.

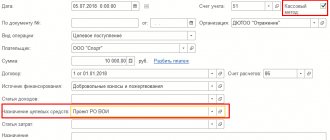

In order for the transfer to take place, the founder draws up a notice. Its form is regulated by order No. 173n. Based on the available primary documents, the recipient fills out his part of the notice and sends it back.

Property received free of charge must be accounted for at book value, taking into account depreciation.

Let's give an example. The founder donated 20 pairs of roller skis to the budgetary institution. They were registered in the amount of 180,000 rubles, and an entry was drawn up D 1 101 36 310 K 1 401 10 190.

In the event of such a transfer, there is no obligation to pay VAT.

Receipt of property

Receipt of property from the founder, the main manager (manager), from state (municipal) institutions. According to Art. 26 of the Federal Law of January 12, 1996 No. 7-FZ “On Non-Profit Organizations”, the source of formation of property of a non-profit organization (state (municipal) institution) is regular and one-time receipts from the founders, transfer of property to operational management. The gratuitous transfer of property from the founder or chief manager of budgetary funds (GRBS) occurs on the basis of a notice (f. 0504805), the form of which is approved by Order No. 173n , and with the relevant accompanying documents. The notice (f. 0504805) is drawn up by the transmitting party in at least two copies. This document confirms the implementation of settlements between institutions. The institution that received the notification (f. 0504805) with documents attached confirming the fact of acceptance and transfer of accounting objects (acts of acceptance and transfer, inventories, registers, supporting documents from suppliers, acts of shortage and damage to valuables or incompleteness of items identified during acceptance valuables, etc.), fills it out in his part of the details and sends a second copy to the party participating in the calculations.