Most companies are faced with the need to build a facility using fixed assets. In order to do this, most often they turn to third-party organizations, and in order to ensure the greatest control over those who perform the work, they purchase materials themselves.

This is especially true in those companies that operate and manage residential buildings and other real estate. A simple example: a management company intends to improve the territory of the village it serves. They also need to build a playground, or a winter shed to store equipment for work.

To do this, the management company hired a contractor to carry out the work and purchased all the necessary materials. In this case, the organization’s accountants may have reasonable questions: how is the accounting of trade and material assets organized? Do you need documents from the contractor? If necessary, what documents should be required from him? How is an object registered? We decided to show you, using the example of the 1C: Accounting program, how all this is formalized and done officially and correctly.

For example, you have an agreement, the clause of which sounds something like this:

In this case, the customer takes into account not only his own costs for the material, but also the cost of the contractor’s work, which is why the total cost will be the sum of these two factors and will be much higher, which is not always profitable.

The next step is the purchase of trade and material assets that may be needed for construction, as well as their further transfer to the contractor. To reflect this operation in the 1C: Accounting program there are two methods:

- through a system for recording trade and material assets, which are transferred to the contractor through a separate warehouse;

- through a special document “Transfer of raw materials for processing”, which is generated in the program.

We will now talk about the advantages and disadvantages of both methods using examples:

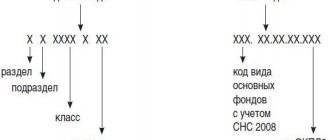

How is the OS created?

In fact, there are two possible ways to organize the OS creation process:

- create an object on your own;

- involve contractors and third-party resources in the process - accounting for the contract method of construction.

In both cases, the accountant’s task is to correctly take into account all expenses and reflect the accepted object correctly at its original cost.

To organize correct accounting of a created, constructed, erected object, it is necessary to correctly determine the costs incurred, make sure that the created property is really a fixed asset, and determine how VAT on expenses will be taken into account. Accounting depends on the method of creating an asset - business or contract. Postings and paperwork will be slightly different.

Standardization of direct costs is another important nuance of construction

From the above, one significant conclusion can be drawn - during the construction process, accounting is carried out based on calculated indicators. In order for the final result to not differ much from the planned one, strict planning and cost regulation are necessary.

IMPORTANT! Rationing of costs in construction is carried out not only for accounting purposes. Construction is one of the most highly regulated industries, so setting and complying with standards is mandatory from both a technology and safety point of view, as well as several other parameters.

First of all, the contractor's direct costs accounted for in account 20 are subject to rationing. These include:

- cost of materials and structures used;

- wages of construction workers;

- depreciation of own construction equipment;

- rental of construction equipment;

- transportation and procurement costs related to the items listed above (for example, costs of moving equipment and machinery).

How standards are set in practice can be read here: “We approve standards for the write-off of building materials.”

When can an object be capitalized?

Conditions for including created property in the OS:

- Long service life - over 12 months.

- Making a profit from use - the object must participate in economic activity to obtain benefits.

- No intention to sell the asset in the next year.

If these three conditions are not met, the manufacturing object is not accepted as part of fixed assets, but is included as inventory.

Important! If we are talking about construction, then the constructed real estate before the state registration of rights to it is accounted for in an independent subaccount 01 of account.

Construction in progress

Construction in progress - the developer’s costs for the construction of objects from the beginning of construction until their commissioning. Until the complete completion of construction work on objects, the costs of their construction (construction) are taken into account as part of construction in progress.

After completion of construction, acceptance and commissioning of completed fixed assets are carried out, which is documented in the following documents:

- Acceptance certificate for a completed construction facility (form No. KS-11);

- Certificate of acceptance of the completed construction of the facility by the acceptance committee (form No. KS-14).

On account 08-3, the inventory value of completed construction of fixed assets is formed. To be reflected in accounting, an act is drawn up in form No. OS-1, an entry is made: Debit 01 Credit 08-3 and an inventory card is created.

The inventory cost of an object is the developer’s costs for the construction of the object from its inception to its commissioning. The sources of financing for capital construction projects are own and borrowed sources, as well as targeted financing (budget funds received on a non-repayable basis).

Accounting when creating in an economic way

The economic method assumes that the company will engage in construction, creating an OS facility on its own, without receiving the help of contract companies.

Acceptance of independently created or constructed fixed assets for accounting is carried out at a cost called the initial one.

Components of the initial cost of an OS when manufactured independently:

- cost indicator of the materials used, spare parts, components (MP) without added tax;

- salary of the company’s own personnel involved in the creation of the OS object;

- insurance contributions for employee salaries;

- depreciation of equipment used in the process;

- VAT on inventories, which cannot be accepted for reimbursement, for example, due to the lack of an invoice.

The sum of all these costs forms the initial cost of an economically created fixed asset, at which it must be accepted for accounting.

Accounting in construction for a contractor

Keeping records of construction activities of organizations is enshrined in PBU 9/99, PBU 10/99, PBU 2/94, PBU for investment accounting. All costs in a construction company are subject to division into the elements mentioned above.

To reflect construction costs in accounting, accounting account 20 “Main production” is used. The debit of account 20 reflects the following expenses:

- for materials with simultaneous reflection of costs on the credit of account 10 “Material inventories”;

- for the salary of construction company personnel under loan 70 “Payroll calculations”;

- for settlements with suppliers on account credit 60.

When receiving step-by-step acceptance, you should use account 46 “Completed stages of work in progress”, forming the posting Dt 46 Kt 90 - the work in progress is reflected.

Paperwork

Accounting for incurred costs and recording of transactions is carried out using the following documents :

- invoices for receipt and transfer of goods;

- accounting information;

- invoice – in relation to tax on construction work, subject to accounting as part of the cost of a fixed asset due to the full application of the latter in non-VAT-taxable activities;

- payslips.

Postings

Account 08 is used to collect all expenses . All cost amounts are collected in the debit of this accounting account; upon completion of the creation of the object, the total value of the recorded costs is transferred to account 01 , where the object will be accounted for until it is disposed of from the organization or written off.

When collecting costs for the construction or creation of an object, account 08 corresponds with various accounts, depending on the type of expense.

List of corresponding accounts:

- 10 – to account for inventories invested in the manufacture of an object;

- 02 – to account for depreciation charges if depreciable equipment is involved in construction or manufacturing;

- 70 – to account for the remuneration of employees of the enterprise engaged in the creation of fixed assets;

- 69 – to account for insurance contributions accrued for employee benefits.

As a result of production, the total indicator of all expenses is transferred in one transaction from credit 08 to debit 01. Thus, the created object is accounted for as a fixed asset at its original cost.

A summary table with accounting entries for the construction (creation) of an operating system using an economic method using one’s own resources is given below.

Postings for the economic method:

| Business transaction | Debit | Credit |

| The cost of inventories allocated for the construction (manufacturing) of fixed assets is taken into account (excluding tax) | 08 | 10 |

| Expenses for paying staff are taken into account | 08 | 70 |

| Reflects the costs of compulsory labor insurance for personnel | 08 | 69 |

| Depreciation on equipment used in creation is taken into account | 08 | 02 |

| VAT on SMP is shown in the cost of an object intended entirely for non-taxable activities | 08 | 19 |

| The constructed (created, manufactured) object is capitalized as a fixed asset | 01 | 08 |

Accounting for other methods of acquiring fixed assets:

- contribution to the management company in the form of a contribution from the founder;

- free receipt;

- purchase.

Manufacturing example

Example conditions:

The company purchased computer components for RUB 448,400. (VAT including RUB 68,400).

From these components, 7 computers were assembled on our own without the involvement of third parties, while all components were involved in the assembly.

All computers were capitalized as fixed assets on the balance sheet of the enterprise.

The cost of wages for workers involved in the manufacture of computers amounted to 75,000 rubles, the total amount of insurance contributions was 22,500 rubles.

The assembly of computers from components does not relate to construction and installation work, and therefore this operation is not subject to VAT, and accordingly, in this example there is no need to account for VAT.

Example accounting entries:

| Sum | Operation | Debit | Credit |

| 380000 | Computer components supplied to the parish | 10 | 60 |

| 68400 | VAT allocated on supplier invoice | 19 | 60 |

| 68400 | VAT is accepted for deduction | 68 | 19 |

| 448400 | Transferred non-cash payment to the supplier for components | 60 | 51 |

| 380000 | All components were transferred for computer assembly | 08 | 10 |

| 75000 | Reflects the calculation of salaries for personnel engaged in the manufacture of computers | 08 | 70 |

| 22500 | The accrual of insurance coverage is reflected | 08 | 69 |

| 477500 (380000 + 75000 + 22500) | 7 computers accepted for registration | 01 | 08 |

Example of building construction

Example conditions:

The company built an office building for itself using its own resources.

Expenses:

- materials – 1,180,000 (180,000 – tax included);

- builders' salary – 300,000;

- wage contributions for builders – 90,000;

- depreciation of construction equipment – 150,000.

Example accounting entries:

| Sum | Operation | Debit | Credit |

| 1000000 | Construction materials were delivered to the parish | 10 | 60 |

| 180000 | VAT allocated on supplier invoice | 19 | 60 |

| 180000 | Tax accepted for deduction | 68 | 19 |

| 1180000 | Transferred non-cash payment to the supplier for construction materials | 60 | 51 |

| 1000000 | All materials were transferred to construction | 08.3 | 10 |

| 300000 | Reflects the calculation of salaries for personnel involved in construction | 08.3 | 70 |

| 90000 | The accrual of insurance coverage is reflected | 08.3 | 69 |

| 150000 | Accrued depreciation on equipment is taken into account | 08.3 | 02 |

| 1540000 (1000000 + 300000 + 90000 + 150000) | The office is included in fixed assets | 01 | 08.3 |

| 277200 (1000000 + 300000 + 90000 + 150000) * 18% | VAT accrued on SMP for own needs | 19 | 68 |

| 277200 | VAT is accepted for deduction, since the constructed office is planned to be used in taxable activities | 68 | 19 |

Are there any special features?

Often, organizations erect various buildings and structures for their own use, and not for sale or to third-party investors. For example, a company is building an office building for itself (a warehouse, a production base for the production of building materials, etc.) both with the involvement of contractors and with its own resources. For the construction of the facility, special machinery and equipment is purchased. Let’s assume that the tax accounting policy calculates depreciation using the straight-line method and provides for the use of a depreciation bonus. How to take into account the costs of “auxiliary” fixed assets involved in the creation of “capital” fixed assets? Are there any peculiarities in calculating depreciation in such a situation? Questions arise due to the fact that a specific list of costs included in the initial cost of a fixed asset is not established by regulation (neither in accounting nor in tax legislation).