If circumstances arise due to which an employee cannot work, the employer is required by law to pay him insurance coverage. To reimburse these funds, he can submit an application to the Social Insurance Fund, attaching an approved list of documents to it.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

This is legislatively enshrined in Law No. 255-F3, which regulates payments for temporary disability or in connection with maternity.

What else do you need to provide?

In addition to writing the application, the employer's representative must create a package of several more papers. These include:

- calculation according to form 4-FSS;

- copies of documents serving as evidence of the validity and reliability of expenses for compulsory insurance payment.

The latter include pregnancy certificates, birth certificates, certificates of incapacity for work issued in clinics and antenatal clinics, as well as payment forms drawn up in accounting departments with the amounts of payments for these benefits indicated in them and other papers. All of them must be current and properly certified.

You also need to attach a certificate confirming that there is no debt to the fund or, if there is a debt, data on its amount; in addition, you must have on hand a list of social payments made during the compensation period.

Types of insurance payments

Insurance payments assigned to a citizen in the event of loss of ability to work due to an occupational illness or accident during work are of two types:

- one-time;

- monthly.

The amount of payments depends on the average earnings of the insured person, which is calculated based on his total income for a certain period of time. To calculate the amount of insurance payment, it is necessary to multiply the average income of a citizen by the degree of loss of ability to work.

The last component of the algorithm is determined by a specially created commission after conducting a medical and social examination (otherwise MSA). In addition, when calculating the amount of payments, salary bonuses and regional coefficients are taken into account.

In the event of the death of an insured citizen, a one-time payment of 1 million rubles is received by his close relatives. In this case, the amount is divided between each family member in equal shares.

According to Article 11 of Federal Law No. 125 of July 24, 1998, monthly payments are subject to adjustment taking into account the level of inflation in the country.

In addition, the legislation establishes maximum amounts of compensation in favor of employees who have lost their professional performance. In 2021, the maximum payment amount reaches 72,290 rubles 40 kopecks, and in 2021 – 75,182 rubles.

How long to wait for a refund

After the collected package of documents is transferred to the Social Insurance Fund, the policyholder can wait to receive funds within no more than ten days from the date of transfer of the papers.

However, it should be remembered that in some cases, the insurer may initiate a desk or on-site audit in order to analyze the fairness and reliability of the costs of paying benefits.

This is due to the fact that from the beginning of 2021, the responsibility for administering and monitoring the payment of insurance premiums has transferred to the tax authorities. During the inspection, inspectors may request additional information and papers from the organization.

In such cases, the duration and even the very possibility of paying insurance coverage depends solely on the results of the verification event.

In this case, the organization must receive the insurer’s decision no later than three days after its adoption.

If the company does not agree with the results of the inspection, it can appeal them in court (of course, it is better to do this only when there is one hundred percent confidence in its own rightness).

When an organization has the right to reimburse money from the Social Insurance Fund

It is not always necessary to apply for restoration of expenses through an extra-budgetary fund. To determine the amount to be reimbursed, an organization needs to compare two indicators:

- the amount of accrued insurance premiums for VNIM;

- the amount of expenses incurred to pay for sick leave, benefits and maternity leave at the expense of Social Insurance.

If the costs of paying social benefits exceed the accrual of contributions for VNIM, then reimburse the difference to the Social Insurance Fund. If there is no excess, the employer has the right to reduce the next VNIM payment by the amount of sick leave.

IMPORTANT!

When calculating the amount to be reimbursed, do not take into account the amount of benefits that the employer pays at his own expense (for the first three days of the employee’s illness).

Drawing up an application

The application for the allocation of funds for the payment of insurance coverage has a unified form , which is recommended for use. You must be extremely careful when drawing up your application, trying to avoid any mistakes or inaccuracies.

If some error nevertheless crept into the document, there is no need to try to correct it, it is better to issue a new form. And even more so, it is unacceptable to include unreliable or deliberately false information in the application - if such facts are discovered, the organization and its management may face serious punishment.

Documents attached to the application for insurance payment to the Social Insurance Fund

How to evict a person from an apartment -. Eviction from public housing - .

How to register land under the dacha amnesty - .

The following are the papers that the insured person must provide to the territorial department of the fund along with a completed application form for receiving insurance payments:

- a conclusion on the degree of disability of a citizen, issued by the institution that carried out the medical examination;

- a certificate of the average monthly earnings of the injured person;

- a document certifying the existence of an employment relationship with the employer (for example, an employment contract, a copy of the work record book);

- report of an accident during work;

- applicant's passport;

- power of attorney (if the applicant acts through a representative).

A certificate of the average income of a citizen is usually issued by the accounting department at the place of his employment. However, in its absence, the insured person can send an application to the Social Insurance Fund to receive the necessary data from the Pension Fund of Russia.

The documents listed above are sent to the fund department in the form of originals or notarized copies.

Filling out the document

- At the beginning of the document we write the addressee: the name of the institution to which the application is being submitted, the position of the head and his last name, first name and patronymic.

- Then detailed information about the insured is entered: the name of the enterprise, its constituent details: registration number in the Social Insurance Fund, subordination code, tax identification number, checkpoint, legal address.

- Next, enter the amount that is required for compensation (in numbers and words), as well as the specific reason.

- After this, the form includes information about the bank details of the recipient company.

- Finally, the application is signed by the responsible employees: the director and the chief accountant.

It is not necessary to certify the application using a seal or stamp - from 2021 this must be done only if the standard for the use of stamped products is enshrined in the internal regulations of the company.

The application is written in two copies, one of which is submitted to the social insurance fund, the second, after being endorsed by a representative of the Social Insurance Fund, remains in the hands of the employees of the applicant organization.

General rules

The key responsibility of all policyholders is the timely accrual and payment of insurance coverage in favor of working citizens. VNiM contributions generate funds from the Social Insurance Fund, which pays for sick leave, maternity leave and other categories of social benefits.

The first three days of sick leave are paid by the employer, the rest is paid by the extra-budgetary fund. This rule applies only if the employee himself is ill. For example, when calculating maternity leave or monthly child care benefits, the payment amounts are fully compensated by Social Insurance.

If the organization is a participant in the Social Insurance pilot project, then sick leave and benefits are paid directly from the Fund. But those companies that do not participate in the pilot project must reimburse the costs themselves.

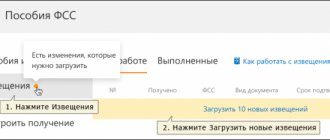

How to submit an application

There are several ways to submit your application:

- The fastest, most accessible and easiest way today is electronic means of communication. True, there are some peculiarities here:

- firstly, the sender must have an officially registered electronic digital signature;

- secondly, sending a letter in this way does not guarantee that it will not accidentally get lost in the recipient's mailbox.

- Handover personally into the hands of an FSS employee.

- Sending an application through a representative.

- via regular Russian Post by registered mail with acknowledgment of delivery.

All these methods guarantee that the letter reaches the addressee and will be read and processed by him.

"Sberbank Insurance" - and applications for payment

Despite the large number of insurance products in different categories, the application forms for them are mostly standard.

There are 2 websites of Sberbank subsidiaries that provide online insurance:

- sberbank-insurance.ru – Sberbank Life Insurance LLC. The company insures life and health, savings, investments, and the borrower;

- sberbankins.ru – Sberbank Insurance LLC. Offers insurance for apartments, houses, mortgages, bank cards, equipment, travelers, and in case of a tick bite.

Each company has various application forms, which differ in content, but the following main ones can be identified:

- for payment . Mandatory document required to obtain insurance. You need to enter personal and passport data, contract or policy number, and list documents confirming the occurrence of the event;

- to make changes to the contract . Required when the client changes his personal data or corrects errors made when filling out the contract;

- to terminate the contract . There are two types: an application for termination with a refund of the paid insurance premium - if the contract is terminated within 14 days after its conclusion; second type – no refund of premium;

- to replace the beneficiary.

That is, one typical sample fits many programs. At the moment, the user can download statements relating to the following areas of cooperation with the insurer:

- Actions related to the insurance contract. Actually, a citizen can upload a request to terminate this document, make changes to it (change the beneficiary), or refuse to terminate if a corresponding application has already been submitted.

- termination of the contract (a general form that can be used when applying for another purpose);

- refusal of insurance;

- preservation of the contract (refusal to terminate if an application has been submitted);

- change of beneficiary.

- A refund. The application is used if a citizen needs to return part of the money paid as an insurance premium.

- request for a refund.

- Insurance case. The insurer must be notified of the incident specified in the insurance contract. A special form has been developed for this.

- the occurrence of an event that has signs of an insured event and a slightly different form.

- Receiving compensation. The document is submitted to the insurer’s office if an insured event occurs under one of the programs promoted by the organization.

- application for payment of compensation;

- request to receive funds under life and health insurance programs.

Since the documents are common to all programs, applications will have to clarify for what purpose the citizen is applying. In most cases, this is done by checking the boxes provided.

There are forms that are designed for a specific program. They are presented in the table:

| Program | Risk | Statements |

| Life and health | Accident insurance online | On cancellation of the insurance contract |

| On cancellation of the insurance contract within 14 days after its conclusion | ||

| To replace the beneficiary under the agreement | ||

| About insurance payment | ||

| Airbag | To terminate the insurance contract | |

| Credit Credit | Protected borrower | To terminate the insurance contract |

| Life insurance for Sberbank loan borrowers | For refund of premium (late and incomplete payment of premium) | |

| About insurance payment | ||

| On cancellation of the insurance contract (premium is not refundable) | ||

| For administrative changes to the insurance contract | ||

| About replacing the beneficiary | ||

| Accumulation | Savings insurance | To replace the beneficiary |

| Investments | Protected investment program | To make an additional contribution |

| To change the ILI | ||

| For early payment of additional investment income | ||

| To revoke a previously written application for ILI options | ||

| To replace the fund | ||

| Fixation of BIT |

Now let’s look at applications for insurance programs of Sberbank Insurance:

- for payment of temporary residence permit (for those traveling abroad);

- for payment by bank cards or another option;

- for payment to NS;

- for payment of property;

- for payment under the risk “Gulf”;

- for payment for equipment insurance;

- for payment under the Home Protection program;

- for payment under the “Private Home Protection” program;

- to make changes and issue a duplicate (Protection of a Private Home program);

- for the return of erroneously transferred money;

- to make changes or terminate the contract;

- separately for changing the contract or another version of the form;

- separately for termination of the contract or another form or another option;

- application for redevelopment;

- about the occurrence of an event that has signs of an insured event.

The downloaded application must be completed and submitted to the insurance company in writing along with other documents.

"RESO" - List of documents for receiving payment

Downloading and filling out the request is not enough. You will also need to provide a package of documents to IC RESO-Garantiya. The specific list depends on the insurance industry. You need to figure out what papers a citizen will have to collect to receive compensation.

OSAGO and CASCO

If citizens have the opportunity to film the scene of an accident (with a photo or video camera), it is advisable to use it, and then provide the video or photo to the RESO-Garantiya insurer. And you need to prepare:

- Personal passport.

- The rights of the citizen who was driving at the time of the accident.

- Policy (original).

- PTS (or registration certificate).

- Notification of an accident (filled out immediately after the accident).

- Account details of the injured party (where the funds will be transferred).

You may also need a protocol and a resolution on an administrative violation from the traffic police, a determination to initiate/refuse to initiate a case (if department employees were called to the scene of the accident). Residents of some other countries may be required to provide a Russian translation of their documents.

Property

To receive compensation for property insurance, you should prepare an application for RESO-Garantiya, a policy (a copy will do), a personal passport and documents confirming the ownership of real estate. Depending on your specific situation, you will also need to bring:

- A receipt for utility bills for the past month (before the flood) and a statement in which the cause of the incident will be stated, the culprit indicated (taken from the organization responsible for the operation of the facility), if there was a flood.

- Data on the initiation of a criminal case, as well as a certificate and a fire report (the first document is mandatory) in the event of a fire.

- A resolution from the law enforcement agencies to initiate a criminal case and a certificate from the police department if there has been a burglary.

- If property is damaged due to a natural disaster - a certificate from the Ministry of Emergency Situations or other authorities about the incident and a paper from the administration indicating the damage caused to the property.

In all cases except the bay, you will have to provide photographs. They should show the damage caused.

Travel insurance

The list of documents that must be collected to receive compensation under this program depends on the specific case. Possible problems include:

- The trip did not take place. You will have to provide a copy of your passport (foreign), an insurance policy and an application. If the trip was booked with a travel company, you will need to prepare a certificate from this company about fines for refusal to leave, as well as provide the details of the participants in the canceled trip, the date of its cancellation and information about the amounts paid to the tour operator and returned to them after the cancellation.

- Medical assistance abroad. Documents are required to be collected only if the citizen paid for the treatment himself. You will need bills from medical institutions, prescriptions, and all checks/receipts related to payment for therapy. The insurance policy and application are submitted to the office.

- Accident. Regardless of the nature of the incident, a written request and insurance policy will be required. The following documents may also be required:

- a certificate or other document confirming the injury;

- a paper indicating the death of the insured, as well as a certificate giving the right to receive the inheritance of the deceased (in case of death);

- a certificate of an accident, documents from a medical institution with a diagnosis and an extract from the medical history (for insured persons who have lost their ability to work).

- Lost luggage. As in previous cases, an insurance policy and application will be required. In addition, you need to provide a baggage receipt, a ticket and documents that confirm the fact of the loss of property (for example, a commercial act).

If the problems are related to the provision of low-quality services by the tour operator, you will need to prepare a personal passport, an agreement concluded with the travel company, as well as certificates of financial expenses. In case of difficulties with transportation or accommodation, documents from hotels/carriers are needed, which will document the fact of failure to fulfill obligations by the tour operator.

Accident

The list depends on the consequences of the accident. There are two options for the list of documents:

- If you receive an injury that leads to loss of ability to work (both partial and complete), it is necessary to prepare an insurance policy, paper confirming the fact of injury or loss of ability to work (in the case of an injury at work, the H-1 form is used), as well as the passport of the insured.

- Upon the death of the insured person, you will need to provide an insurance policy, death certificate, death certificate (the document indicates the cause of the incident). The person submitting the request also needs to have an N-1 certificate or an ATS report (depending on the cause of death of the insured citizen), and a personal passport.

In the latter case, a certificate will also be required, which will indicate that the citizen who applied for compensation is the heir of the deceased.

Reimbursement under this program is possible only if it has been agreed upon with the employees of the RESO dispatch service. When visiting the office you need to have with you:

- passport;

- original policy;

- migration card;

- extract from the medical history;

- checks and receipts, as well as an invoice (containing data on payment for services and goods related to the provision of medical care).

You also need to fill out an application for reimbursement of expenses and indicate your bank account. Funds will be transferred according to the details provided.

Where to complain if the insurance company does not pay? How to proceed?

There are situations when the insurance company, without legal grounds, refuses to pay the applicant or underestimates the amount of compensation. In such cases, you must proceed as follows:

- Write a claim to the senior management of the insurance company, having previously received an opinion on the amount of damage from independent experts. Within 10 calendar days (clause 1 of Article 16.1 of Law No. 40-FZ), the insurer is obliged to respond to the claim.

- If the claim does not produce results, then the next step is to contact the RSA with a complaint against the unscrupulous insurer.

- If the actions of the insurer contradict the law, the car owner can send a complaint to the Central Bank of the Russian Federation.

- The most effective way to resolve a dispute is to go to court. When filing a claim, you must provide evidence of pre-trial consideration of the case (claim to the insurer).

Where to submit?

- The insurer of the guilty party of the road accident , if the road accident was registered by employees of the State Traffic Inspectorate, and harm was caused to the life and health of the injured party.

- To your insurer (with whom the MTPL agreement was concluded), if, by mutual decision of both participants, the accident was registered under the European Protocol.

Expert opinion

Sokolov Sergey Igorevich

Legal consultant with 6 years of experience. Specialization: family law. Extensive experience in defense in court.

If the injured party received direct compensation for damage from its insurer, then it has the right to receive insurance compensation for personal injury, if such a fact is discovered after receiving payment.