Regulatory regulation The traffic police fine is taken into account for accounting purposes in other expenses (clause 12

As follows from Article 333.16 of the Tax Code, state duty is a fee for

To ensure the reliability of accounting and reporting data, organizations are required to conduct an inventory of property and

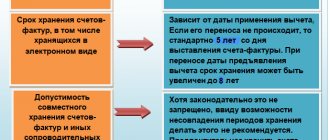

Each organization must be guided by Federal Law 125-FZ of October 22, 2004, in accordance with which it is necessary

Example of filling out a cover letter for the updated VAT tax return for the __ quarter of 20__

Every citizen is obliged to pay taxes to the country's budget, which is a payment for the use of the offered

In organizations and institutions, employers are obliged to guarantee timely payments to employees not only of wages,

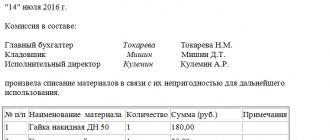

If equipment or other work supplies have lost their functions or due to any other circumstances

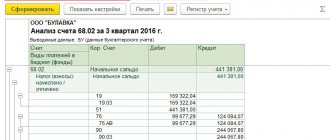

Home / Taxes / What is VAT and when does it increase to 20 percent?

Home / Complaints, courts, consumer rights / Consumer rights Back Published: 10/18/2018 Time on