Each organization must be guided by Federal Law 125-FZ of October 22, 2004, according to which it is necessary to ensure the correct storage of primary documentation for a specified period. The duration of deadlines for certain groups of documents may be regulated by various federal laws, as well as other legal acts of the Russian Federation, lists and regulations. We will tell you in the article what is the legal storage period for invoices and other documents at an enterprise.

When determining the storage period, you must be guided by the Accounting Law, according to which primary accounting documentation must be stored five years after the year in which it was compiled. Certain laws and regulations may require longer retention periods. If different legal acts establish different time periods for the same document, then you need to focus on the longer one.

Commercial activity - you can’t do without documents

Any commercial activity cannot be done without documents.

Sometimes, to store them, companies are forced to create archives and allocate considerable space and labor resources. Moreover, documents not only accompany the company during the period of its activity, but are also forced to continue its existence after its closure (liquidation, bankruptcy, etc.). Even if a businessman has worked for only 1 month, a whole package of documents is collected for the closure of the company: tax reporting, documents on the sale of goods, receipt of goods and materials, payroll, etc. This list may also include invoices (if the businessman was a VAT payer). We will talk further about the problems that arise when storing documents after a businessman decides to cease his activities.

Document flow in private companies

The basis of any accounting process is documents, so no organization can do without their creation and accumulation. Filling out a document and filing it in a folder is not enough. It is also necessary to ensure its proper storage for a pre-agreed period. In implementing this task, companies have to equip special places for storing documentation, maintain employees who control its movement and ensure its safety. The lifespan of a paper or electronic storage medium is not limited to the period of operation of the company; even after its closure, documents must be preserved for some time.

The minimum period of operation of the company, limited even to a month of operation, is not a basis for refusal to maintain documentation. Even with this development of events, the organization generates declarations, papers for the receipt and write-off of material assets, and accrues remuneration for labor. Firms that pay VAT also generate invoices. The procedure for ensuring the safety of papers during the liquidation of an enterprise has a number of features.

Closed the business - must keep invoices and other documents

Let's look at an example. Individual entrepreneur K.N. Ryabinin decided to cease commercial activities. Since the landlords urgently demanded to vacate the premises, the businessman transported all the documents to his home and placed them in the free space in the utility room. Invoices took up a considerable volume, since the sale of goods was carried out in small batches to numerous counterparties. Some time passed and the documents stored in an unsuitable room faded, became damp and lost their original appearance.

However, the law states that businessmen are obliged to ensure the safety of archival documents during their storage period (Part 1 of Article 17 of the Law “On Archival Affairs in the Russian Federation” dated October 22, 2004 No. 125-FZ) - otherwise they may be punished under Art. 13.20 (from 300 to 500 rubles for officials) or 13.25 of the Code of Administrative Offenses of the Russian Federation (from 200 to 300 thousand rubles for legal entities). We should also not forget that tax authorities have the right to conduct an on-site audit for the last 3 years of activity of an individual entrepreneur/organization, therefore, even after closure, the entrepreneur will have to keep documents (including invoices) if they confirm the calculation of taxes and their payment (clause 48 of the Procedure accounting of income and expenses and business transactions for individual entrepreneurs, approved by order of the Ministry of Finance No. 86n, Ministry of Taxes of Russia No. BG-3-04/430 dated 08.13.2002).

If the right to deduction is used later

The right to deduct tax is valid for three years after the end of the period for receiving the invoice. If the company decides to exercise its right later, then the storage periods are shifted, since the four-year storage period of the s/f begins to count from the end of the period in which the refundable VAT is included in the declaration.

For example, if the company received goods in the second quarter. 2021, and VAT on them was deducted in the II quarter. 2021, then the beginning of the storage period for c/f and invoices for tax purposes is shifted by one year.

How long should documents be kept?

Retention periods for different documents can vary significantly. Thus, tax documents must be stored for at least 4 years (subclause 8, clause 1, article 23, subclause 5, clause 3, article 24 of the Tax Code). The storage period for documents generated in the course of the activities of organizations is also established by the List of standard management archival documents generated in the process of activities of state bodies, local governments and organizations, indicating their storage periods, approved by Order of the Federal Archive of December 20, 2019 No. 236 (valid from 18.02 .2020, hereinafter referred to as list No. 236). Yes, Art. 317 of list No. 236 for invoices, a 5-year storage period is established. Since the deadlines vary, you need to focus on the larger of them.

In some cases, this period may increase to 6 years. For example, a 6-year period is provided for participants in regional investment projects (clause 3 of Article 89.2 of the Tax Code). The annual financial statements, together with the audit reports, await permanent storage (Part 1, Article 29 of the Law “On Accounting” dated December 6, 2011 No. 402, Article 268 “a”, 286 “a” of List No. 236).

If a company has hired employees, it collects a decent amount of documents that need to be retained for much longer than the specified deadlines. For example, an act on the investigation of an industrial accident with investigation materials must be stored for at least 45 years (Part 6 of Article 230 of the Labor Code of the Russian Federation), and an act on the case of an occupational disease - for 75 years (clause 33 of the regulation “On the investigation and recording of occupational diseases ", approved by Decree of the Government of the Russian Federation dated December 15, 2000 No. 967).

The legally established periods for storing documents cannot be reduced. For violating the terms of storage of accounting documents, a fine of 5 to 10 thousand rubles. provided for officials of Art. 15.11 Code of Administrative Offences.

For information on what liability is provided for a businessman for tax violations, see the material “Responsibility for tax violations: grounds and amount of sanctions .

We organize the correct storage of invoices

Let's continue with the example. Stepanova P.A., who previously worked as the chief accountant for individual entrepreneur K.N. Ryabinin, found a similar job in the newly opened one. Remembering the previous employer's omissions to ensure the safety of invoices and other documents, she decided to take control of this issue in the new company.

Since the company had just started operating, it was necessary first of all to organize the storage of documents, including invoices. She did not find any special requirements for storing invoices in the legislation, so she decided to follow the storage procedure established for accounting documents, according to which accounting documents must be stored in special rooms, safes or cabinets (clause 6.2 of the regulation, approved by the Ministry of Finance on July 29, 1983 No. 105).

Meanwhile, invoices do not belong to strict reporting forms and are not documents containing commercial secrets, so they can be stored without safes and metal cabinets. The management of Vozrozhdenie LLC allocated a separate isolated room in the company’s office for this purpose. The Chief Accountant identified those responsible for the safety of documents (clauses 6.2–6.4 of the regulations, approved by the Ministry of Finance No. 105).

Vozrozhdenie LLC did not file invoices in the journal of received and issued invoices, since since 01/01/2015 companies do not keep this journal unless they are developers or forwarders and do not carry out intermediary operations.

They also decided not to make separate files of invoices - they simply filed invoices together with invoices.

Place

The storage space for primary documentation must meet the following requirements:

- Be inaccessible to unauthorized persons.

- Suitable for ambient air conditions.

- Possess fire-fighting properties.

The storage space can be a metal cabinet that is locked . A responsible person is appointed whose responsibilities include ensuring the safety of archival documentation. After the document storage period has expired, a commission is convened at the enterprise. She must decide whether the papers can be destroyed.

Learn how to correctly calculate the shelf life of an invoice

Now it's time to figure out how to determine the start date of the invoice retention period.

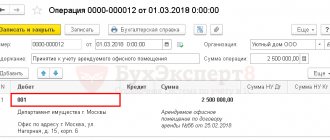

The procedure for storing invoices is described in clause 10 of the Rules for maintaining invoices, approved by Government Decree No. 1137 dated December 26, 2011. According to this regulatory document, invoices must be stored in chronological order, according to the date of their issuance or receipt for the corresponding tax period.

The Ministry of Finance of the Russian Federation in letters dated July 19, 2017 No. 03-07-11/45829, dated March 30, 2012 No. 03-11-11/104 explains that the storage period begins to count after the end of the period in which the invoice was last used for preparation of tax reporting, calculation and payment of tax, confirmation of income and expenses. That is, if the company reflects the VAT from the specified invoice in the declaration for the 3rd quarter of 2021, the countdown of the 5-year storage period will begin on 10/01/2019 and end on 09/30/2024.

For information on how to correctly fill out a VAT return, read the material “What is the procedure for filling out a VAT return (example, instructions, rules)” .

In practice, it often happens that when filing documents, invoices are not separated from delivery notes. This approach does not contradict the law, especially since as of February 18, 2020, the storage periods for invoices and invoices have become equal (5 years). However, with this method, the established storage period for invoices will be violated in the event of:

- their receipts after the end of the tax period;

- there are errors that require correction;

- untimely submission for some reason.

To prevent this violation, it is recommended to organize the storage of invoices and primary documents separately.

TTN for transit delivery

Transit trade consists of two transactions independent from each other: a trading company enters into a contract for the purchase and sale of goods with a supplier, on the basis of which it undertakes to pay for the purchased goods, and the supplier undertakes to ship the goods to the warehouse specified by the trading organization, and a separate agreement with the buyer of the goods , within the framework of which he undertakes to supply goods for a fee.

In this case, the trading company will act as the buyer of the goods in the first contract, and as its seller in the second.

In this case, the commodity transport lines are filled in as follows.

The line “Payer” indicates the trading company.

Who to put in the “Consignor” line depends on the moment of transfer of ownership.

If at the time of dispatch of the goods the trading company became its owner, then it will be indicated in this line. If after dispatch the supplier remains the owner, then the supplier will appear in the “Consignor” line.

Filling out the “Consignee” line depends on who actually accepts the goods at the final buyer’s warehouse.

If this is done by the buyer himself, then he needs to be indicated.

If unloading is carried out by a representative of a trading company, then the name, address and telephone number of the trading company should be indicated as the consignee.

In any case, the “Loading point” field should contain the supplier’s address, and the “Unloading point” field should contain the address of the final buyer.

When should an invoice's shelf life be extended?

The previously agreed mandatory 5-year storage period for invoices may be extended. This is due to the fact that from 01/01/2015 companies can transfer tax deductions. The right to transfer VAT deductions within a 3-year period from the date of registration of goods (works, services) is enshrined in clause 2 of Art. 171 Tax Code of the Russian Federation.

Taking into account the date of receipt of goods from the example considered (08/11/2019), it must be declared in the declaration for the 3rd quarter of 2022 if the company postpones the deduction for exactly 3 years. The 5-year shelf life will need to be counted from 10/01/2022, i.e. in this case it will actually be 8 years.

When considering the extended shelf life of invoices when transferring deductions, it is necessary to remember that it cannot be transferred to a deduction when returning the advance to the buyer for 3 years. The deduction can be made only in the tax period in which the conditions provided for in the articles of Art. 171, 172 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated July 21, 2015 No. 03-07-11/41908).

Certificate of services rendered (work performed)

An act is a two-sided primary document that confirms the fact of a transaction, the cost and timing of services or work.

Articles on the topic (click to view)

- Do you know what a trademark is and what its meaning is? Definition of concept and types, characteristics and examples

- What to do if your credit history is damaged: how to “rehabilitate” the borrower

- Classification of industrial goods

- What financial guarantee is required for a visa to Italy?

- Fedresurs bankruptcy of individuals

- How does a simplified bankruptcy procedure for a legal entity occur: procedure

- The procedure for dismissing employees in the event of bankruptcy of an enterprise, required compensation and payments

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

The act is issued by the contractor to his client based on the results of the provision of services or work performed. This primary document confirms the compliance of the services provided (work performed) with the terms of the concluded contract.

Storage period for electronic invoices

Now more and more businessmen are switching to electronic document management, including using electronic invoices. An electronic invoice is equivalent to a paper one (clause 1 of Article 169 of the Tax Code), the procedure for its execution is regulated by the order of the Ministry of Finance of Russia “On approval of the procedure for issuing and receiving invoices in electronic form via telecommunication channels using an enhanced qualified electronic signature” dated November 10. 2015 No. 174n.

Read about the features of an electronic invoice here.

Even before the storage of an electronic invoice is organized, i.e. already during its execution, it is necessary to take into account that it must be signed with a qualified electronic signature (clause 6 of Article 169 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 05/05/2015 No. 07-01-06/25701).

The storage period for electronic invoices is the same as for paper ones - 5 years. Companies are not required to store printed paper copies of electronic invoices (letter of the Federal Tax Service dated 02/06/2014 No. GD-4-3/1984).

See also “How to properly store electronic invoices?”

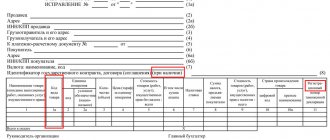

Bill of lading form

According to clause 1.2. Resolution of the State Statistics Committee of Russia dated November 28, 1997 N 78, when transporting goods, motor transport organizations must draw up a consignment note in form No. 1-T.

The form of the consignment note consists of two sections:

1. Commodity, which determines the relationship between shippers and consignees and serves to write off inventory from shippers and post them to consignees.

2. Transport, which determines the relationship of shippers of motor transport customers with organizations - owners of motor vehicles that carried out the transportation of goods, and serves to record transport work and settlements of shippers or consignees with organizations - owners of motor vehicles for the services provided to them for the transportation of goods.

Results

The usual storage period for invoices from 02/18/2020 is 5 years, regardless of their form (electronic or paper). However, the period may increase if deductions are claimed in later periods.

Sources:

- Tax Code of the Russian Federation

- Code of Administrative Violations of the Russian Federation

- Regulations on documents and document flow in accounting, approved by the Ministry of Finance on July 29, 1983 No. 105

- Order of Rosarkhiv dated December 20, 2019 No. 236

- Government Decree No. 1137 dated December 26, 2011

- Order of the Ministry of Finance No. 86n, Ministry of Taxes of Russia No. BG-3-04/430 dated 08/13/2002

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Changes from October 1, 2021

On October 1, 2021, Government Decree No. 981 dated August 19, 2017 comes into force.

This document puts into effect:

- new invoice form;

- new form of sales book;

- new form of purchase book;

- a new form of the journal for recording received and issued invoices.

However, in addition to this, amendments were also made to the rules that relate to the storage of invoices. Let's tell you more about them.

Storing invoices in chronological order

The provisions of the commented resolution provide for more detailed rules for storing invoices. It is envisaged that invoices will need to be stored in chronological order as they are issued (compiled, corrected) or received. The same approach should be applied to storing confirmations from the electronic document management (EDF) operator and notifications to customers about receipt of an invoice. Also see “Register of electronic document management (EDF) operators”.

Storage periods for invoices

From October 1, 2021, you will still need to store invoices for 4 years. During this period, it is necessary to organize storage:

- to the principal (principal) - copies of invoices that were given to him by the intermediary. The intermediary receives them from sellers when purchasing goods (works, services) for the principal (principal);

- to the customer of construction work (investor) - copies of invoices that were handed over to him by the developer (customer performing the functions of a developer). He, in turn, receives them from sellers when purchasing goods (works, services) for the buyer (investor);

- to the customer of forwarding services - copies of invoices that were handed over to him by the forwarder. He receives these invoices from sellers when purchasing goods (works, services) for the customer.

It is required to store all types of invoices: primary, adjustment and corrected. Copies of paper invoices received from intermediaries must be certified by their signatures (principals, principals, developers or forwarders).