Each accountant, in the course of his work, interacts with primary accounting documents - they serve as the basis for making entries and confirm that the transaction was actually completed.

Without documentation, an accountant does not have the right to make entries in accounting accounts - this is an important rule that must always be remembered. At any time, regulatory authorities can request papers confirming figures in various reports (tax returns, balance sheets, financial statements); if there is no documentary evidence, the organization faces fines and problems.

Basic Concepts

Primary documentation in accounting – what is it? It is called evidence of the fact of a business transaction reflected on paper. Currently, many documents are compiled in the automated 1C system. Processing of primary documentation involves registration and recording of information about completed business transactions.

Primary accounting is the initial stage of recording events occurring in an enterprise. Business transactions are actions that involve changes in the state of the organization’s assets or capital.

Alteration

Often there is a need to make changes to the documentation and workflow in the accounting of an enterprise. This process is regulated in paragraph 7 of Article 9 of Law 402-FZ. Corrections must be dated and certified by the signatures of the responsible persons of the organization. Incorrect data is crossed out so that the information is not readable, and new data is written on top.

More often than not, a form that requires correction is replaced with a new one. There are forms that cannot be corrected, but only need to be replaced. These include invoices, cash discipline forms, and bank forms.

Processing of primary documentation in accounting: example of a diagram

As a rule, in enterprises the concept of “working with documentation” means:

- Obtaining primary data.

- Pre-processing of information.

- Preparation of documents.

- Approval by management or specialists authorized by order of the director.

- Re-processing of primary documentation.

- Performing actions necessary to conduct a business transaction.

Entera

Installing the Entera service is quite simple, it took no more than 15 minutes. To use the services there is no need to purchase a license; payment is made only for processed pages.

The program has one of the most convenient interfaces that allows you to control the accuracy of recognition (for each line of the document a tooltip appears indicating the corresponding line of the scan) and carry out group comparison of documents.

Entera developers have “trained” their product to recognize non-standard and unclear documents with a high degree of accuracy (it is enough that the characters are readable) and to determine their type well. When testing the program, there was almost no need to make manual adjustments.

The service includes: mathematical verification of tables, reconciliation with the Unified State Register of Legal Entities and verification of bank details, which further minimizes errors.

True, such high quality recognition takes a little longer compared to other programs. One page will have to “wait” for about a minute.

A big advantage of Entera in terms of time saving is the ability to batch process documents. You don’t have to bother with each sheet separately, but load a stack of papers at once. The service has a function for recognizing tangled pages and automatically matching them within one package of documents.

Launching in cloud-based 1C is as easy as in regular 1C, and integration with online accounting “My Business” takes 1 minute.

Among the limitations, it is worth noting that to work with the service you need an Internet connection, since it is located on a remote server.

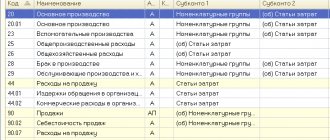

Classification

There is one-time and cumulative primary documentation. The processing of information contained in such papers has a number of features.

One-time documentation is intended to confirm an event once. Accordingly, the procedure for processing it is significantly simplified. Cumulative documentation is used for a certain time. As a rule, it reflects an operation performed several times. In this case, when processing primary documentation, information from it is transferred to special registers.

Docknet

When testing the Docnet service, I was pleased with the quick integration with 1C and detailed instructions for installing the program. Users have the opportunity to scan documents directly from the 1C interface. True, the database will be inaccessible during document recognition, which leads to significant loss of time when processing a large number of documents.

Unfortunately, the developers did not care at all about the ease of use of the service. To create a document, you need to go through a long stage of its preparation, click on each field several times, decide what to do with the elements of the directory, set the types of nomenclature and check all the values. To carry out all these manipulations, you must constantly switch between the scan and database windows.

The program has fairly good recognition quality, and yet in almost every document something has to be corrected. The document scan appears in a separate window in degraded quality. At the same time, the program is very sensitive to the quality of the downloaded image.

The service does not conduct any mathematical or spelling checks, and if the tabular part of the document is not recognized, you will have to enter the data yourself.

Docnet often cannot find the details (TIN, document number), and there are errors in the numbers. Users of the program do not have the ability to add and remove rows; it is quite inconvenient to work with filters and fill in fields.

The cost of a license to use Docnet is higher than its analogues, but due to the difficulties in working with the service, it can hardly save an accountant’s time significantly.

Stages of processing primary accounting documentation

Each enterprise has an employee on staff responsible for working with primary information. This specialist must know the rules for processing primary documentation, strictly comply with legal requirements and the sequence of actions.

The stages of processing primary documentation are:

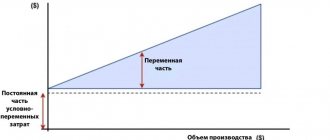

- Taxation. It represents an assessment of the transaction reflected on paper, an indication of the amounts associated with its implementation.

- Grouping. At this stage, documents are distributed depending on common features.

- Account assignment. It involves the designation of debit and credit.

- Extinguishing. To prevent repeated payments, the accountant puts o.

Control, storage and organization of accounting of primary documents

Accounting for primary documentation must be organized so that each form goes through the registration system within the enterprise. This is necessary to minimize the risk of losing certificates and other forms. The clerk or other responsible person keeps documentation logs. All incoming forms are processed as incoming. Outgoing forms are those that are created internally by the enterprise (regardless of whether they will be issued to third parties or remain within the enterprise).

Incoming documentation must go through several stages of accounting and registration:

- Acceptance.

- Initial processing.

- Distribution by types of forms and their purpose.

- Registration in accounting journals with a stamp affixed to the document and assignment of the incoming number to the acceptance date.

- Signing by the company's management (when the director reviews incoming correspondence, he puts resolutions on it).

- Execution of the document.

To organize an effective document flow system and ensure control over the safety of forms, it is necessary to develop and approve a document flow schedule with a list of cases. The schedule must disclose the stages of execution, registration of documents, the procedure for transferring them for storage, indicating the time frame, and list the employees responsible for each step.

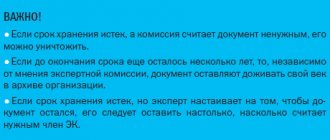

The completed and recorded primary documentation must be stored for at least 5 years. The Order of the Ministry of Culture dated August 25, 2010 No. 558 provides a classification of forms with reference to the timing of its submission to the archive:

- administrative documentation must remain available for 75 years (if orders and instructions affect the main activities of the company) or 5 years, provided that the form reflects the resolution of administrative issues;

- forms accompanying business transactions must be stored for 3-5 years.

FOR REFERENCE! Law No. 402-FZ in Art. 29 shelf life is limited to 5 years. Tax legislation requires that accounting documentation be kept safe and accessible for at least 4 years.

Special conditions and storage periods are provided for the following forms:

- Documents used to record the recording of assets subject to depreciation cannot be archived for 4 years from the date of write-off of this property.

- If the primary documentation was drawn up during the period when a loss occurred, which is used to reduce the amount of income tax, then it must be stored until the impact of such loss on the tax base ceases.

- The primary document characterizing transactions for the occurrence of receivables must be kept for 4 years from the moment the outstanding debt is recognized as bad (if such a fact occurs).

For electronic forms, retention periods are identical to paper documents. The procedure for writing off primary assets must be carried out with the participation of a specially created commission.

Errors in documents

They can occur for various reasons. Basically, their appearance is caused by the employee’s careless attitude towards the work he performs, the specialist’s illiteracy, and equipment malfunction.

Correction of documents is highly discouraged. However, in some cases it is impossible to do without error correction. The accountant must correct any deficiencies in the primary documentation as follows:

- Cross out the incorrect entry with a thin line so that it is clearly visible.

- Write the correct information above the crossed out line.

- Put o.

- Specify the date of adjustment.

- Put a signature.

The use of corrective agents is not permitted.

Efsol, aka 42clouds

The Efsol service was one of the first to appear on the Russian market. Due to the fact that it has existed for quite a long time, the creators of the service took into account the experience of a large number of users. But at the same time, the program uses older technologies and is not flexible to accounting innovations.

Efsol pleased me with its simple launch and quick integration with 1C. The undoubted advantages of the program: convenient and simple interface, control of duplicates, choice of the type of documents to be created, a unified dictionary of comparisons and mathematical verification of the tabular part of documents.

Efsol quickly recognizes good quality pages and allows you to create most of the document forms existing in 1C from them.

The main disadvantage is that documents of average quality are poorly recognized and unclear and non-standard documents are not recognized at all.

If you come across any of them among the accountant’s documents, you need to be prepared to enter their data manually. Moreover, you will be able to find out about the recognition result only by uploading documents to the service and paying for these pages.

In addition, the service is not designed to quickly process a stack of documents at the same time - each of them will need to be dealt with separately. The interface is not optimized and requires many common manual steps.

Data storage is possible only in the Efsol proprietary cloud.

Regarding the cost of services, it is important to note that in addition to paying for recognition of each page, to use this service you must additionally purchase an annual license for each workplace, which may not be affordable for small companies.

In general, we can say that the Efsol service is well implemented and is capable of solving many basic problems of standard accounting, but without fine-tuning for narrow accounting problems.

Working with incoming documents

The process of processing incoming papers includes:

- Determining the document type. Accounting papers always contain information about completed business transactions. For example, these include an invoice, an order for receiving funds, etc.

- Checking the recipient's details. The document must be addressed to a specific enterprise or its employee. In practice, it happens that documents for the purchase of materials are specifically issued to the company, although no agreement has been concluded with the supplier.

- Checking signatures and seal impressions. The persons signing the document must have the authority to do so. If the endorsement of primary documents is not within the competence of the employee, then they are considered invalid. As for stamps, in practice, errors often occur in those enterprises that have several stamps. The information on the print must correspond to the type of document on which it appears.

- Checking the status of documents. If damage is detected on the papers or any sheets are missing, it is necessary to draw up a report, a copy of which is sent to the counterparty.

- Checking the validity of the event reflected in the document. Employees of the enterprise must confirm information about the fact of the transaction. Documents on acceptance of valuables are certified by the warehouse manager, and the terms of the contract are confirmed by the marketer. In practice, there are situations when a supplier receives an invoice for goods that the company did not receive.

- Determining the period to which the document relates. When processing primary papers, it is important not to take into account the same information twice.

- Definition of accounting section. When receiving primary documentation, it is necessary to establish for what purposes the supplied values will be used. They can act as fixed assets, materials, intangible assets, goods.

- Determining the register in which the document will be filed.

- Registration of paper. It is carried out after all checks.

Tutorial for beginners from scratch

You can take the opportunity to study accounting on your own - we offer a simple tutorial “Accounting from scratch in 14 days”, it was created specifically for beginners who are just starting their journey in the world of accounting. Written in a very simple and accessible language.

The tutorial contains:

- e-Book with lessons;

- Collection of problems with answers and solutions;

- An example of accounting with year-end closing;

- Updated versions of PBU, Chart of Accounts, Law “On Accounting”.

Working with outgoing papers

The processing process for this type of documentation is somewhat different from the above.

First of all, an authorized employee of the enterprise creates a draft version of the outgoing document. Based on this, a draft paper is developed. It is sent to the manager for approval. However, another employee who has the appropriate authority can approve the draft document.

After certification, the project is drawn up according to the established rules and sent to the recipient.

Gendalf

The Gendalf service is the only one compared that works without an Internet connection. It is installed as an application on a specific computer, requiring high power from it: if there are not enough device resources, the program freezes. To use the program, a license is purchased for each workstation, then the number of pages for processing will be unlimited.

Installing Gendalf is quite labor-intensive: you need to create fresh libraries, prepare information for activation, etc. You may need technical support from a specialist.

Once the installation is done, the user will be pleased with the speed of document recognition. Another plus is the ability to work with the scanner directly from 1C with the appropriate settings.

But, alas, the quality of data recognition is quite low: in each tested document, even very clear ones, many adjustments must be made, which leads to a significant delay.

The types of standard documents are poorly recognized, for example, the program can confuse the UTD and the invoice, and “not see” the details of the supplier and payer, names and nomenclatures.

Excel tables are not recognized correctly by the program; the document type “act” is not supported.

The service does not have an electronic archive of documents and a history of processed files.

Gendalf can be considered as the simplest converter to help an accountant enter primary data. Poor document creation processes are comparable to manual data entry. The service is suitable for companies with documents of ideal quality and exactly conforming to standard forms that would like to try automation on a limited budget.

Document flow planning

This stage is necessary to ensure prompt receipt, sending and processing of documentation. For proper organization of document flow, the enterprise develops special schedules. They indicate:

- Place and deadline for processing primary papers.

- Full name and position of the person who compiled and submitted the documents.

- Accounting records made on the basis of papers.

- Time and place of storage of documentation.

Responsible persons

According to regulations (clause 1 of Article 7 of Federal Law-402), the organization of accounting at an enterprise and document flow are ensured by its manager and chief accountant. The responsibilities of these persons include:

- timely and correct preparation of the “primary”;

- reflection of the facts of economic activity in accounting within the established time limits;

- control of information reliability.

The head of the company is responsible for organizing the process.

ConsultantPlus experts discussed how to organize office work and document flow in an organization. Use these instructions for free.

Features of document recovery

Currently, the regulations do not contain a clear procedure for the restoration of papers. In practice, this process includes the following activities:

- Appointment of a commission to investigate the reasons for the loss or destruction of documents. If necessary, the head of the enterprise can involve law enforcement agencies in the procedure.

- Contacting a banking organization or counterparties for copies of primary documents.

- Correction of income tax return. The need to submit an updated report is due to the fact that undocumented expenses are not recognized as expenses for tax purposes.

In case of loss of primary documentation, the Federal Tax Service will calculate the amounts of tax deductions based on the available papers. In this case, there is a possibility that the tax authority will apply penalties in the form of a fine.

How to save on paper and improve relationships with clients

To save time, money and even office space, follow the principle: everything that can be transferred into electronic digital form, transfer it. You can eliminate paper documents partially or completely. Then you won’t have to waste time sorting through papers and you won’t need to allocate space for the archive (which means money saved on renting premises and equipment).

Another, no less important principle: automate everything that can be automated. A computer program will do the mechanical work of posting data from a bank statement or creating invoices from suppliers better and faster. Modern accounting services help systematize the transfer, placement of documents and their search in file storage. In such a service, you can attach a scan to an existing electronic document and easily find this document during a tax audit. It becomes easier for a remote accountant to monitor the list of missing “primary items”, closing transactions, payments and documents related to them.

Receive “primary” information from clients, keep records and submit reports via a web service

Let's consider what needs to be done in order to organize an effective process of working with the “primary”.

Give the client the right to create documents

Modern business owners and managers love freedom of action and do not like to wait: if an agreement on a transaction is reached on Sunday, the entrepreneur will want to issue an invoice immediately, without waiting for Monday. Accounting programs and services allow you to delegate the authority to issue invoices to an individual entrepreneur or the director of a company. An invoice created using such a service is automatically affixed with a logo, seal and signatures of the responsible persons; from the program the document is sent to the counterparty by email.

You can also transfer the rights to enter invoices, acts and invoices into the program. This is convenient and beneficial for everyone: the accounting company spends less time on services, and the client is not tied to the accountant’s work schedule.

Elena Spirova, financial director of outsourcing:

— By agreement with the client, all invoices for sales are entered into the program by the client’s employee. This is very convenient: the issuance of documents does not slow down, the program immediately stamps the documents with a seal, and the client sends the documents directly from the program to his buyer. The speed of issuing documents means the speed of payment from buyers. At the same time, directly in the program you can make reconciliations of calculations and see information on receivables. As a result, the client does not bother us with such issues. We also see the final data and do not waste time entering information from documents, which, accordingly, eliminates errors on our part. Kontur.Accounting has simple reports. They are convenient specifically for the director, since they are formed without accounting information (account, sub-account, sub-items, etc.).

Connect to Kontur.Accounting for remote work with employees and clients

Set up integration with banks

The area of work that definitely needs to be automated is the posting of data from a bank statement. Automatic downloading of statements from the client bank allows the accountant not to create each transaction separately. He can only control the correctness of filling.

The process of obtaining the extract itself is autonomous and secure. The client does not need to download and transfer the statement to the accountant: integration with banks allows everything to be done automatically. The remote accountant, in turn, cannot make any payments - only generate payment slips and send them to the client’s Internet bank for signing.

Organize the transfer of “primary assets” through an accounting service

To avoid losing or duplicating documents, organize their sending through a single channel - an accounting service. For example, in the “Kontur.Accounting” service, a connected chat has been implemented for this purpose, in which the client can communicate with a remote accountant and send scans of documents. Transferred copies can be downloaded, recorded and attached to transactions in the program. Thanks to this function, it is easy to track which documents are missing and what has already been transferred and accounted for.

The invoice recognition system is another tool that eliminates routine work. The system itself determines the nomenclature, quantity, and price of goods. If there are any doubts about the correctness of information recognition, the system will draw the accountant’s attention to this.

Help the client switch to electronic document management

Electronic document management (EDF) completely eliminates the exchange of “paper” documents with counterparties. This applies not only to invoices, acts, invoices or UPD, but also to letters, contracts, invoices, that is, to any documents that are drawn up when communicating with customers or suppliers. In order for the parties to exchange a legally significant electronic “primary” document, they must have electronic signatures and enter into an agreement to transfer documents electronically. Documents are exchanged through a special system with the participation of an EDF operator (for example, the Diadoc system).

Exchange legally significant “primary data” with counterparties via the Internet. Free inbox.

Electronic document management saves time and money for a business owner, and for an outsourced accountant it is important that this system allows you to work with documents 24 hours a day and without being tied to an office. All documents are stored on the servers of the EDF operator, and these documents can be easily found during tax audits. The electronic archive is protected and cannot be lost or destroyed.

Another important point: discrepancies when reconciling with the counterparty are excluded, since the work takes place with the same document, the signed copy of which can no longer be changed. Errors that occur during processing of the “primary” are also eliminated, because documents do not need to be entered into accounting manually - in the EDI system this is done instantly with a couple of clicks.

Tatyana Skuratova, head of the consulting group “Business Online”:

— “Diadoc” is an excellent way to receive most of the “primary” in a timely manner. We try to provide all clients with the opportunity to work in the Diadoc system, especially since it is included in all tariffs of the Kontur.Accounting service that our clients use. You just need to make a couple of clicks to configure.

Connect to the web service "Kontur.Accounting"

Also see “How to sign an electronic “primary document” and how to delegate the right to sign it.”

Common mistakes in the process of preparing primary papers

As a rule, those responsible for maintaining documentation commit the following violations:

- Fill out forms that are not unified or approved by the head of the enterprise.

- They do not indicate details or display them with errors.

- They do not endorse documents with their signature or allow employees who do not have the authority to sign documents.

Documentation confirming the facts of business transactions is extremely important for the enterprise. Its design must be approached very carefully. Any mistake can lead to negative consequences.

What you need to know about accounting?

Briefly about accounting we can say: “Everything has its price!”

Any transactions of purchase and sale of goods and services, contractual relations between partners, suppliers and customers, labor relations related to recording working hours and remuneration - everything can be reduced to a monetary “denominator”. With the help of accounting, the implementation of various business transactions is reflected, which reflects the activities of any enterprise, regardless of the form of ownership and type of activity.

The totality of accounting data allows you to determine the final financial result of the work, conduct an analysis and determine the prospects for further work to improve performance indicators.