Filling example

Covering letter for the updated VAT tax return for the __ quarter of 20__.

In accordance with paragraph __ Art. 81 of the Tax Code of the Russian Federation LLC "____" submits an updated tax return for VAT for _____.

In the originally submitted declaration, the amount of VAT payable was underestimated by ___ rubles. due to non-inclusion in the tax base of proceeds from the sale of goods under invoice No. __ dated ____. The unaccounted invoice is reflected in the additional sheet to the sales book.

Amount of unaccounted revenue__ rubles, including VAT — ____ rubles.

The following corrections were made to the VAT return for __:_.

The correct amount of VAT payable based on the results of _____ was _____ rubles.

"___" ___ 20___ additional VAT in the amount of ___ rubles was paid. and a penalty in the amount of ___ rub. using the following details: ____. Payment order No. ___ dated ___ is attached.

In the upper right corner you need to indicate to whom and from whom it is sent, and the details of the parties. The signature of the chief accountant and general director is placed below. Covering letters for the declaration are not mandatory elements when sending reports to the tax authorities, but their presence helps to avoid a number of problems and questions. Read about how to draw it up correctly, as well as whether it is necessary to provide such an annex to personal income tax and how to do it on our website.

In what cases is it necessary?

A covering letter is not a mandatory element when sending a document and its presence is not regulated by law. However, practice shows that the attached letter helps speed up and simplify the work of inspectors. If the information inspectors need or the note itself is missing, additional proceedings may follow.

You can attach a covering letter to the following types of declarations:

- Specified (submitted to the tax authorities before the deadline for filing a tax return, after the filing deadline, but before the end of the tax payment period, or after all deadlines have expired).

- Zero (submitted by the individual entrepreneur in the absence of activity; if there is no reporting, zero data must be provided).

- Lesnoy (contains data on the methods and timing of use of forest resources; the forest user is required to attach a report with actual data on deforestation).

- According to UTII (quarterly reporting in the tax return; submitted regardless of whether the activity was carried out or not, since tax is paid even in the absence of income).

- According to the simplified tax system (a declaration to the tax authorities with the reporting of an individual entrepreneur or LLC for the calendar year, also submitted regardless of the presence or absence of profit).

Results

Errors are occasionally made during the accounting process. Having considered the procedure for filing an updated tax return under the simplified tax system, we found out that it is not at all difficult to do. Moreover, it will be better for the organization if the accountant himself finds and corrects inaccuracies in accounting, without waiting for auditors. The main thing to remember is that taxes and penalties must be paid before filing an updated return.

Source of the article: https://nalog-nalog.ru/usn/deklaraciya_po_usn/kak_podat_utochnennuyu_nalogovuyu_deklaraciyu_po_usn/

Purpose of provision

The covering letter contains a list of the materials sent and explanations for them. These additions greatly facilitate interactions between tax authorities and taxpayers.

If there is a written listing of the submitted documents, the risk of additional questions from the inspectorate regarding the completeness of the reporting provided is minimized. The second reason why it is worth attaching an explanatory note to reporting to the inspectorate is to simplify the registration of incoming correspondence.

Note! The tax authorities will not ask the taxpayer for the purpose of filing a return (for example, an updated one) if a letter is attached with the reason for sending the documents.

A cover letter has no meaning, but its presence:

- is a confirmation of the fact of sending;

- contains a list of attached documents and instructions for handling them;

- allows you to determine the deadline due to the specified departure times.

Covering letter for the updated calculation of form 6-NDFL

An error in the data of the main section of the reporting submitted to the Federal Tax Service will have negative consequences for the person submitting the report in the form of a fine if the tax inspector manages to identify the error before submitting the clarification.

We recommend reading: After Dismissal Pregnancy

But the same article of the Tax Code of the Russian Federation provides the tax agent with the opportunity to avoid such a fine. This will happen in the case when the error is identified independently and corrected by submitting an update before the tax authority discovers it (Clause 2 of Article 126.1 of the Tax Code of the Russian Federation).

Who writes?

Covering letters are written by persons who are required to declare their income. These include:

- individual entrepreneurs (IP);

- legal entities;

- limited liability company (LLC).

Individuals may also need to submit reports to the tax authorities with an explanatory note. These cases include the sale of property, receipt of income from sources abroad, and the use of inherited intellectual property. Lottery winnings are also taxable.

You can submit documents to the inspectorate and write an appendix with an explanation to them yourself, but it is better to entrust this to a lawyer. The specialist will draw up a note for the documents according to all the rules and take into account all the necessary nuances.

Who draws up, signs and stamps?

If the cover letter is submitted by an individual, then, accordingly, the submitting person is responsible for writing it. If we are talking about a legal entity, then the letter is drawn up by employees of the submitting company: this can be done either by a full-time lawyer or by employees of the accounting department.

Most departments of the Federal Tax Service require that the cover letter be signed by the general director and chief accountant, and also accompanied by the seals of the organization, which will indicate the authenticity of the document.

General drafting rules

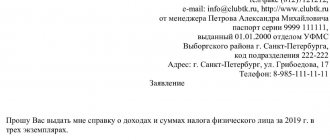

There is no statutory form for writing a cover letter, but there are rules for its composition that have been developed in practice. The annex to the reporting before the inspection must include:

- name of the tax office (if necessary, indicate the full name of the employee to whom the documents are sent);

- name of the tax organization and address of the sender;

- number and date of the request in response to which an explanation is sent;

- contacting an employee or tax authority;

- a list of documents and other materials indicating the number of sheets and copies;

- Full name and position of the sender, his signature and contact information (phone number, email).

Submission deadlines

It is necessary to respond to a request to clarify the declaration from the tax office within business days, otherwise penalties will be charged, and an audit may also be scheduled. For electronic document management, the period increases to 6 days from the date of receipt of the request .

It is worth noting that the clarifying declaration and cover letter add red tape to the accounting work, however, the correct submission of these documents can save the company from additional checks and corresponding fines.

How is it prepared for certain types of reporting?

In addition to the general rules for writing appendices to documents in the inspection, there are also additional requirements that must be taken into account when writing a particular declaration.

Zero

When sending a zero declaration, the accompanying note must explain why the reporting is zero. In the wording of the letter, it is enough to indicate that no activity was carried out in the quarter/year.

Lesnaya

When drawing up an annex to the forest declaration, it is necessary to indicate in it the volume of wood cut down and the time frame during which the forest was cut down. In addition, information about the intended purpose of forests and the form of felling should be contained.

According to the simplified tax system

In the accompanying letter to the reporting under the simplified taxation system, it is necessary to clarify the indicators from the declaration : the amount of income (even if there was none - indicate zero), expenses, as well as the amount of taxes paid for the calendar year. If an individual entrepreneur is on the PSN (patent taxation system), he does not need to submit a declaration annually.

In this case, taxes are paid in advance at the time of purchase of the patent, which has a certain validity period that can be extended.

Reference! When paying, the individual entrepreneur can also attach a letter indicating the date of payment and the validity period of the patent.

According to UTII

The appendix to the quarterly tax reporting must also list the income and expenses of an individual entrepreneur or LLC for a certain period, or the reason for the lack of income and the purpose of the expenses.

Refined

The annex to the updated declaration must contain:

- the reason for adjusting the amount of tax liabilities;

- amended declaration deadlines;

- details of the previously listed advances and penalties.

We invite you to read other equally useful and interesting articles that will help you understand the following issues:

- What is a cover letter for a declaration?

- What are the features of drawing up such a document in the INFS, for personal income tax and for VAT?

An example of filling out an updated VAT return

An updated declaration is an independent form that includes information that was not filled out correctly in the original declaration or was not included in it initially. When filling out, the difference between the original and corrected data is not shown, but only the correct indicators are reflected.

To fill out, you should take the same VAT declaration form as for the initial submission.

The “clarification” includes all the same sheets that were provided in the original form with the replacement of incorrect data with correct ones, as well as the addition of previously not reflected information.

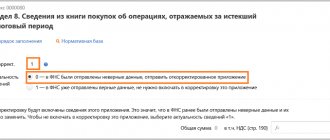

Sections 8, 9, 10, 11, 12 and their appendices have a special field that is filled in only when clarifications are submitted - 001 “Indicator of the relevance of previously submitted information.”

- 8 and 9 – taxpayers fill in with information about generated and submitted invoices;

- 10 and 11 – prepared by tax agents;

- Section 12 – completed by persons who do not pay VAT, but have provided an invoice to their client.

The field indicator 001 in these sections can take one of two values:

- 0 – if necessary, change the reflected indicators in this section; in the remaining fields of the section with the “0” attribute, the correct data is filled in;

- 1 – if changes do not need to be made to the section, since the previously submitted information is correct, dashes are placed in the remaining fields (information from the previously submitted report is not duplicated in order to reduce the volume of the updated document).

The title page also has a field that is required to be filled in when submitting an amended report - adjustment number, in which the number corresponding to the serial number of making adjustments to the declaration is entered. When submitting a “clarification” for the first time, “001” is entered, then with each subsequent correction, “002”, “003”, etc., in increasing order.

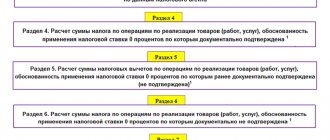

Examples of filling out sections 8 and 9 in various cases

| Event | Sec. 8 | Adj. to section 8 | Sec. 9 | Adj. to section 9 |

| The declaration does not include sales | 1 | – | 1 | 0 |

| VAT payable was calculated incorrectly | 1 | – | 1 | 0 |

| VAT deduction changes | 1 | 0 | 1 | – |

| VAT payable and refundable changes at the same time | 1 | 0 | 1 | 0 |

Submission rules

A covering letter is sent to the tax office along with the declaration . You can submit the application along with a package of documents to the organization in person. It is also possible to send reports with an explanatory note by mail.

Covering letters are not mandatory elements when sending reports to the tax authorities, but their presence helps to avoid a number of problems and questions. The main thing is to correctly compose the application and clearly indicate your requests and explanations in it.

Document flow terms

The exchange of documents between tax authorities and taxpayers is regulated by two main regulations:

- By Order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n “On approval of the Administrative Regulations of the Federal Tax Service. "

- Based on it, “Methodological recommendations for organizing electronic document management” were compiled. "(approved by order of the Federal Tax Service of the Russian Federation dated June 13, 2013 No. ММВ-7-6 / [email protected] ).

In them, participants in information interaction mean not only taxpayers (their representatives) and tax authorities, but also EDI operators (in the case of electronic document management).

Taxpayers mean payers of taxes, fees, insurance premiums, as well as tax agents. Taxpayer representatives are individuals or legal entities authorized by the taxpayer to represent his interests regarding taxes and fees.

An application to the Federal Tax Service is generated by the taxpayer (or his representative) and sent to the place of registration.

At the end of the article, you can download a current sample of how to write a cover letter to the tax office - we’ll look at it below.

Clarification 3 personal income tax sample

Secondly, it is necessary to correctly reflect all the necessary information, attaching supporting documents if necessary. The declaration is prepared in duplicate - one is submitted to the Federal Tax Service, the other remains with the taxpayer. The delivery format can be any: by mail, via a valuable letter, via the Internet or through a personal visit to the tax authorities. The document is filled out using computer programs or by hand. No crossings out/corrections are allowed - the tax authorities will most likely refuse to accept this form. If the filing of the declaration is accompanied by supporting documents, it is recommended to draw up an accompanying register listing all attachments (copies or originals).

- when renting out an apartment (other residential real estate) under a contract to individuals (the rental amount does not play any role);

- if any expensive property that belonged to an individual for less than 3 years was sold (land, car, gold jewelry, apartment, art values);

- one-time income as a result of concluding a civil contract (any service, contract work);

- if an individual has won a lottery, casino or received income as a result of other gambling;

- in the case when the income is received from activities carried out outside the Russian Federation.

Letter about zero 6-NDFL: sample

All tax agents must submit calculations using Form 6-NDFL (clause 2 of Article 230 of the Tax Code of the Russian Federation). Tax agents are, as a rule, employers or customers under civil contracts under which individuals receive income.

Unfortunately, there is a possibility of such a development of events. And in order to protect the business, it makes sense to submit a free-form letter to the tax office, in which it is reported that the organization or individual entrepreneur has neither employees nor contractors and therefore 6-NDFL is not submitted.

We recommend reading: Property Rights and Other Property Rights in Private International Law General Characteristics