The federal accounting standard for public sector organizations “Rent”, applied since 2021, has changed the order of reflection

Types of liability of accountants for incorrect calculation of wages Accounting errors, as well as deliberate violation

Bank, cash desk Natalya Vasilyeva Certified tax consultant Current as of February 4, 2020 When preparing

Repairs in rented premises According to the general rule set forth in Article 616 of the Civil Code, when

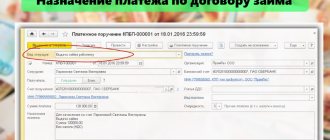

Filling out payment orders is a fairly common operation. For greater convenience of its design and

To calculate many taxes, special documents have been introduced to confirm the taxpayer’s data and the correctness of his assessment

The seller is a VAT payer. Until 01/01/2019, clause 31 clause 2 art. 149 NK

Individuals and legal entities are responsible for paying taxes and fees to budgets

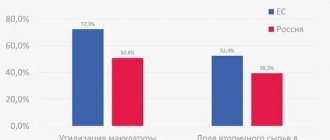

Since January 10, 2002, the federal law “On Environmental Protection” has been in force in Russia, one of

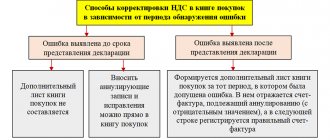

Adjustment of receipts is in many ways similar to the same purpose Adjustment of Sales (see article about