To calculate many taxes, special documents have been introduced that confirm the taxpayer’s data and the correctness of his assessment of obligations to the budget. For VAT, there are more such documents: a variety of invoices (regular, advance, adjustment), and books of purchases and sales, and a log of received and issued invoices. Therefore, even an experienced accountant has a difficult time. To whom, when and how should these documents be drawn up? Let's figure it out together.

Document types

It must be said that there are many different types of primary documents . But first of all, the individual entrepreneur needs to remember the following:

- Agreement.

- An invoice for payment.

- Cash receipt or other payment document (BSO, sales receipt).

- Packing list.

- Certificate of work performed, services provided.

- Invoice.

It is not at all necessary that an entrepreneur will use all these documents in his work. For example, if an individual entrepreneur provides services to legal entities and other entrepreneurs using the simplified tax system, then he will enter into contracts, issue invoices for payment, and sign certificates of services rendered . But he will not deal with documents such as invoices and cash receipts.

Let's look at each of these documents in more detail.

How long should I wait for a refund?

The speed of tax refund depends on the place of filing the application:

- customs (verification will take a month from the date of submission of the full set of documents);

- tax (the audit will last three months from the date of application).

The company will be able to receive a VAT refund through the tax office only after checking the documents by employees of the desk departments of the tax authorities. As soon as the supervisory action is completed, a decision is made on the possibility of tax refund.

After a decision is made, the following actions are carried out:

- within 10 days, information about the results of the inspection is transmitted to the applicant;

- funds are transferred to the company's accounts within 12 days.

Thus, only after more than 100 days have passed and the verification results are positive, the company will be able to receive its deduction.

But for some legal entities the verification may be completed faster. Since June 2021, tax authorities have launched the Risk Management System of JSC VAT. This program automatically distributes all companies into three risk levels: low, medium and high. Those who are included in the low or medium risk group have the right to count on accelerated verification activities. However, such companies must additionally meet several more conditions:

- the amount claimed for reimbursement must be equal to or less than the amount of taxes paid for the last three years;

- almost all transactions (90%) must involve low-risk counterparties.

Since 2021, this list includes organizations that are ready to provide a bank guarantee in the amount of the refunded amount, as well as those that have provided a guarantee ensuring the return of illegally received funds.

The accelerated procedure for refunding import VAT is applied only at the request of the taxpayer.

To receive an accelerated refund of the tax paid, you will need to submit a corresponding application within 5 days from the date of filing your tax return. The text of the application must reflect the applicant's obligation to return the refunded tax if, based on the results of the audit, its refund is denied.

What you need to know about the contract

An agreement is the first document signed by the parties to a transaction. The agreement in its classic form is drawn up on paper in 2 copies and signed by both parties indicating their details. In the contract, the parties stipulate important points of their cooperation :

- The subject, that is, the thing in relation to which the transaction is concluded. For example, an agreement for the sale of a certain product or for the provision of a service.

- The cost of the subject of the contract and the payment procedure.

- Rights, obligations and responsibilities of the seller and buyer.

- The procedure according to which the parties can make changes to the contract, terminate it and resolve any disagreements that have arisen.

The contract does not necessarily have to be in writing. For example, if an individual entrepreneur is engaged in the retail sale of goods, then he, in fact, enters into an oral agreement with each of his customers. The object of this contract is the offered product, the price is its value on the price tag. If the buyer pays for this product, it means he accepts the proposed conditions. The fact of concluding such an agreement is confirmed by issuing to the buyer a cash receipt or a document replacing it.

One of the forms of agreement is an offer - this is a proposal to conclude a transaction sent to an unlimited number of persons. The offer is most often posted publicly, for example, on a website. The fact of payment is considered acceptance of the terms of the contract - acceptance of the offer.

Confirmation of VAT Payment

Please comment on the letter of the Ministry of Finance of Russia dated October 2, 2021 No. 03-07-08/198. Is it necessary to obtain confirmation from the customs authorities of payment of customs duties in Form No. 647-r in order to accept VAT deduction on imported goods?

VAT amounts paid

by a taxpayer when importing goods into the customs territory of the Russian Federation under the customs regimes of release for domestic consumption, temporary import and processing outside the customs territory,

they are subject to deduction

(

clause 2 of Article 171 of the Tax Code of the Russian Federation

).

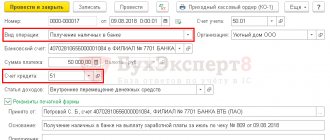

An invoice for payment

In fact an invoice for payment is more of a convenience document than a document necessary for accounting. It contains information about the quantity/volume and cost of goods or services to be paid. Typically, an invoice is sent to the buyer - a legal entity or individual entrepreneur - for payment by “non-cash” payment, that is, through a bank.

The invoice form can be developed by the entrepreneur independently. Below is one of the possible forms, which is quite often used by business entities.

Sample invoice

By the way, there is a document that combines an agreement and an invoice for payment. That's what it's called - an invoice agreement . In essence, this is an account in which the mandatory terms of the contract are entered (they are called essential). A sample of it is presented below.

Sample invoice agreement

Filling out a VAT return. Basic rules, filling example

The declaration consists of a title page and 12 sections. There are also appendices for sections 3, 8 and 9.

The title page and section 1 are always required.

Sections 2–12, as well as appendices, are included in the declaration only when the relevant operations are carried out (clause 3 of the Procedure for filling out a VAT tax return).

For information on the rules for filling out a declaration by tax agents, read the article How to correctly fill out section 2 of a VAT return for a tax agent .

Let's look at an example of filling out a new VAT return for 2020.

05/06/20XX purchased a car for 2.5 million rubles. (including VAT RUB 416,667). 06/03/20XX the car was sold for 2.9 million rubles. (including VAT RUB 483,333).

The accountant of Elbrus LLC filled out the title page, indicating information from the constituent documents.

Next, the accountant transferred information about amounts, dates, invoice numbers, as well as information about counterparties from the sales book and purchase book to sections 9 and 8, respectively.

Based on these data, the accountant filled out consolidated section 3, reflecting:

- in line 010 the amount of sales and the amount of calculated tax;

- in line 120 the amount of tax claimed for deduction.

Calculated the amount of tax payable and recorded it in line 200.

See also the procedure for filling out other lines in section 3:

- How to fill out line 030 of section 3 of the VAT return»;

- How to fill out line 090 of section 3 of the VAT return»;

- “What is reflected in line 130 of the VAT return.”

Section 1 was completed last, because the final data on the amount of VAT payable or refundable is transferred here. The OKTMO codes are also reflected here (more about them in the material Where to pay VAT and how and where to find the correct details for payment?) and KBK.

The remaining sections of the declaration are filled out if the following data is available:

- Section 2 is completed by tax agents. How to fill out this section correctly, read here.

- Sections 4-6 are completed during export. We talk about this in more detail in the next section.

- Section 7 is completed in the absence of taxable transactions. Details here.

- Information from the invoice journal is transferred to sections 10 and 11. We talked about how to fill out these sections correctly here and here.

Important! Tip from ConsultantPlus Submit the VAT return in electronic form via TKS through an electronic document management operator (clause 5 of Article 174 of the Tax Code of the Russian Federation). The exception to this rule is... For those who can report VAT on paper, see K+. This can be done for free.

Payment acceptance documents

There are several such documents, and the choice is made not at will, but depending on the working conditions.

Important! The only case when an individual entrepreneur should not give anything to the buyer when receiving funds from him is when he receives payment directly to a bank account . In this case, the buyer remains in possession of a document from the bank, which will confirm that he has made the payment.

Typically, legal entities and entrepreneurs pay each other through a bank. But settlements with buyers—individuals—must be supported by business entities with documents. This is necessary when accepting payment in cash, bank cards or electronic means of payment (Qiwi wallets, Yandex.Money and others). The document remains with the buyer and serves as confirmation of payment.

In most cases, an individual entrepreneur is deprived of the right to choose which document to draw up - everything is regulated by law. So, if an entrepreneur uses OSNO or the simplified tax system and trades at retail, then he is required to use a cash register. Accordingly, the buyer must be issued a cash receipt . If an individual entrepreneur applies UTII or buys a patent and at the same time is engaged in retail trade or works in the catering industry, the issue with the cash register is resolved as follows:

- if there are employees, CCP is mandatory from July 1, 2018 ;

- when working independently, CCP may not be used until July 1, 2021 .

As for the provision of services to the population, regardless of the availability of employees and the applied taxation system, you can work without a cash register until July 1, 2021. However, instead of a cash receipt, the buyer must be given a strictly reporting form (SSR). And always, and not just on demand. BSO can be ordered/purchased at a printing house, generated through an automated system, including online through a special service.

Attention! It is impossible to generate BSOs on a regular computer - they will not be valid.

In what cases is VAT not paid on imports?

Cases of exemption from VAT are listed in Art. 150 of the Tax Code of the Russian Federation and cover 15 positions of various goods, materials, equipment and other objects. In order to exempt a company from paying tax, it is not enough to import certain goods according to the list specified in the code. Customs will necessarily require permits issued by various government agencies.

A fairly wide range of objects are not subject to VAT. Let's name just a few of them (the full list is indicated in Article 150 of the Tax Code of the Russian Federation, you can find it on the official website of the Federal Tax Service):

- goods transferred to the Russian Federation as gratuitous assistance (this exception does not apply to excisable goods);

- goods that are not subject to taxes on Russian territory, as well as components for their production (for example, products for the rehabilitation of disabled people, prosthetic and orthopedic products, etc.). The full list is contained in sub. 1 clause 2 art. 149 of the Tax Code of the Russian Federation, and more detailed lists are determined by legal acts of the Government of the Russian Federation;

- raw materials for the production of immune preparations, the list of which is established by the Government of the Russian Federation;

- exhibits purchased (received as a gift) by government agencies that are of special cultural value;

- works of cinematography and printed materials, if they are imported as part of a free international exchange.

According to the provisions of Art. 151 of the Tax Code of the Russian Federation, VAT is not charged in the following cases:

- if the products are subject to placement under customs procedures such as transit or re-export, placement in customs or free warehouses, duty-free trade, the need for destruction or refusal in favor of the state, special customs procedures, as well as in the case of filing a declaration for supplies;

- when goods are located on customs territory or outside this territory for the purpose of processing;

- if the products are under a time-limited export procedure.

To resolve the issue of exemption from VAT in each specific case, you must first refer to the provisions of the Tax Code of the Russian Federation, and then study the lists of goods that specify these norms.

Please help make this article better. Answer just 3 questions.

Packing list

An invoice is used if an individual entrepreneur sells goods to another entrepreneur or legal entity. When selling to ordinary individuals (not individual entrepreneurs), this document is not issued. A consignment note is drawn up in 2 copies:

- one for the supplier as confirmation of the fact of shipment of the goods ;

- another for the buyer - through it he will receive this product.

Most often, the consignment note is drawn up in the form TORG-12 .

Sample invoice TORG-12

Document confirming payment of VAT

For taxation purposes, the import of goods into the territory of the Russian Federation is equated to operations for the import of goods into the territory of the Russian Federation and other territories under its jurisdiction, subject to value added tax.

(Although for supposedly problematic counterparties, I still send such a request, receive a response with a message and carefully add it to the counterparty’s folder as confirmation of my good faith and the meanness of the tax).

Acceptance certificate

Acceptance certificates for work performed or services provided are important primary documents. They confirm the fact that the service was performed (the work was completed), as well as the fact that the customer accepted them and has no claims against the contractor.

The act is drawn up in two copies and signed by both parties. From the name it is clear that this document is drawn up based on the results of the performer’s work . If the cooperation is long-term and services are provided frequently, the act can be drawn up periodically. For example, the contract is concluded for a year, the service is provided once a week - in this case, the act can be drawn up once a month.

Drawing up a VAT return. How to draw up and fill out a declaration correctly

The VAT declaration form was approved by order of the Federal Tax Service dated October 29, 2014 No. ММВ-7-3/ [email protected] The same order also establishes the rules for filling it out.

We remind you: in most cases it is submitted electronically using TKS. Clarifications have already been made to the original form more than once. As of reporting for the 4th quarter of 2021, an updated form is used. You can see what has changed in the VAT report since the 4th quarter of 2020 and how these amendments will affect your declaration in ConsultantPlus. Trial access to the system can be obtained for free.

The basis for filling out a VAT return is:

- purchase book and sales book;

- journal of invoices (for those who conduct intermediary activities);

- invoices issued by VAT non-payers (clause 5 of Article 173 of the Tax Code of the Russian Federation);

- accounting and tax data.

To check the correctness of filling, use the control ratios from the letter of the Federal Tax Service of the Russian Federation dated March 23, 2015 No. GD-4-3 / [email protected]

Read more about the current control ratios in the material “How to check a VAT return (control ratios).

Important! Tip from ConsultantPlus You have the right not to submit a VAT return to the tax authorities if: you apply a special regime (USN, UTII or PSN) provided... For a complete list of persons who do not have to report VAT, see K+. It's free.

Invoice

An invoice is an important document for VAT payers. This tax is paid by individual entrepreneurs (and companies) that apply the main tax regime. When applying the simplified tax system, UTII, unified agricultural tax (until 2019) and the patent system, VAT is not paid (although there are exceptions to this rule). Therefore, if an individual entrepreneur uses one of the special modes, he should not generate an invoice. Moreover, if, at the buyer’s request, he issues an invoice and allocates the amount of VAT in it, he will be obliged to pay this tax to the budget and file a declaration .

Individual entrepreneurs - VAT payers are required to issue an invoice. This must be done no later than 5 days after shipment of the goods. The document is drawn up in 2 copies - one each for the buyer and the seller.

If an individual entrepreneur is a VAT payer, it is also important for him to receive invoices from his suppliers in a timely manner, since this document is the basis for his application of VAT deduction .

Book of purchases

This document is used to register invoices that give the right to a tax deduction for VAT. The rules for maintaining a purchase book are presented in section. II of Appendix 4 to Resolution No. 1137. Along with invoices, the following are recorded in the purchase book (clauses 17, 18 of the Rules for maintaining the purchase book):

— customs declarations and payment documents confirming payment of VAT at customs (for goods imported into the territory of the Russian Federation);

— strict reporting forms giving the right to deduct VAT on travel and accommodation expenses included by the employee in the business trip report.

The purchase book indicates the data of the registered documents and the amount of tax that the buyer (customer) claims for deduction. At the same time, there is a nuance when a taxpayer carries out taxable and non-taxable transactions. In this regard, there is a rule according to which the invoice is reflected in the purchase book not for the entire amount, but only for a part (in proportion to the revenue received from transactions subject to VAT in the total amount of revenue for the quarter) (clause 4 of article 170 of the Tax Code of the Russian Federation , clause 13 of the Rules for maintaining a purchase book).

For your information.

Deductions are made on the basis of invoices, and not on the basis of the purchase book, therefore errors in the design of this book cannot lead to a refusal to make deductions (resolution of the Tenth Arbitration Court of Appeal dated 03.24.2014 N A41-7289/13, FAS MO dated 19.02 .2013 N A40-40052/12-90-210).

You cannot ignore filling out additional sheets of the purchase book. What are they needed for? In order to register corrections relating to the previous tax period. If the data changes for the current period, then there is no need to prepare an additional sheet. The principle of using an additional sheet is reminiscent of the “red reversal” method in accounting and is as follows. First, an incorrect (erroneous) invoice with negative cost indicators in the quarter to which it belongs (when it was registered) is reflected. After this, the corrected (correct) invoice is recorded in the purchase book (with positive numbers) in the period of its receipt.

As a result of the above actions, the tax base for the past and current periods changes, which obliges the accountant to submit an updated declaration to the tax authority for the closed period (Clause 1, Article 81 of the Tax Code of the Russian Federation, Clause 6 of the Rules for maintaining an additional sheet of the purchase book specified in Section IV Appendix 4 to Resolution No. 1137).

Results

Among the situations that allow the use of a 0% VAT rate, the prevailing ones are those related to the export of goods from the Russian Federation and the provision of transportation services that involve crossing the Russian border.

The right to such a bet must be confirmed by collecting documents indicating the possibility of using it. Lists of documents are contained in Art. 165 of the Tax Code of the Russian Federation in relation to the situations given in paragraph 1 of Art. 164 Tax Code of the Russian Federation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.