As already mentioned in the previous article, the invoice confirms the conclusion of the contract for the carriage of goods.

The consignment note, unless otherwise provided by the contract for the carriage of goods, is drawn up for one or more consignments of cargo transported on one vehicle, in 3 copies (originals) for the shipper, consignee and carrier. There is a principle according to which one invoice is drawn up for one vehicle. However, if one vehicle delivers cargo to several consignees, it is necessary to draw up a consignment note for each consignee separately.

By default, the waybill is filled out by the carrier and shipper. That is, the form of the document is drawn up under the condition that the shipper and the customer for the transportation coincide. However, under the contract of carriage, the parties have the right to change the procedure for filling out the invoice and assign the responsibility for filling it out entirely to the carrier.

The order (application) is submitted by the customer for transportation to the carrier. The latter is obliged to review the order (application) and, within 3 days from the date of its acceptance, inform the transportation customer about the acceptance or refusal to accept the order (application). Moreover, a written justification for the reasons for refusal is required.

The order (application) form is not provided for by the transportation rules, but the parties have the right to approve it independently. The initial issuance of the waybill is carried out by the carrier based on the application. Therefore, the application must contain all the information necessary to fill out the invoice and calculate the cost of transportation.

We suggest using the following order (application) form.

When accepting an application (order), the carrier puts a mark on acceptance of the order, signature and seal in clause 9 of the technical document “Information on acceptance of the order”.

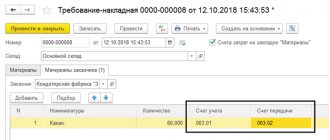

When considering an order (application), the carrier, in agreement with the customer, determines the conditions for transporting the goods. He fills out paragraphs 8-11, 13, 15 and 16 (in the carrier's part) of the waybill.

The shipper (customer of transportation) fills out clauses 1-7, unless otherwise provided by the contract of carriage (or order). The contract can stipulate that the specified items of the invoice are filled out by the carrier himself according to the order (application) data. The columns in paragraphs 6 and 7 below the acceptance and shipment addresses are not filled in when drawing up the waybill. These columns are filled in during the acceptance and delivery of cargo by representatives of the consignor and consignee.

The transportation customer and the carrier indicate in clause 16 the date of preparation of the invoice, signature and seal. This means the parties agree on all terms of transportation.

In clause 6 “Acceptance of cargo” the shipper puts his signature and seal. Upon completion of loading, the carrier (driver) signs the invoice in clause 6. If necessary, he indicates in clause 12 his comments and reservations when accepting the cargo.

In clause 7 “Deliverance of cargo,” the consignee puts his signature and seal. The carrier (represented by the driver), who handed over the cargo to the consignee, signs.

In all unfilled columns you must put a dash (you can use a pen).

If the waybill is signed by representatives by proxy, then stamps may be missing.

The above procedure for filling out a waybill does not take into account many realities that arise in practice, such as:

- the customer of the transportation is not the shipper;

- the transportation order is received by e-mail or fax, and the transportation customer does not have the opportunity to issue an invoice and sign it.

Let’s say the customer and the carrier cannot quickly sign the invoice, as happens in most cases. In this situation, it is necessary to assign the responsibility for filling out the invoice to the carrier based on the order.

Coordination of transportation conditions is carried out by fax or e-mail. Then the carrier sends the completed invoice with his signature and seal in scanned form by email or a copy by fax to the customer for registration on his part.

However, an invoice issued in this way will raise questions from the tax authority. For this reason, the final copy of the document with all the notes on acceptance of the cargo for transportation and delivery to the consignee must be sent to the customer by mail (duplicate by fax or e-mail). In addition, a fully completed invoice with the consignee's mark is confirmation that the carrier has fulfilled its obligations.

The waybill must be fully prepared and present in the original to the customer of the transportation, the consignor, the consignee and the carrier.

We present the filling algorithm in relation to three possible situations.

The customer of the transportation is the shipper (for this case, a form of consignment note has been prepared and Transportation Rules have been drawn up)

| TN points | Who fills out/signs | Note |

| 1. Shipper | Shipper | Detailed information about the shipper and his representative |

| 2. Consignee | Shipper | Detailed information about the consignee and his representative |

| 3. Name of cargo | Shipper | Information about the name and parameters of the cargo (volume, weight, quantity, etc.) |

| 4. Accompanying documents for the cargo | Shipper | Filled out if there are certificates, quality passports and other mandatory documents for the cargo |

| 5. Shipper's instructions | Shipper | Parameters of the vehicle necessary for transporting cargo and the value of the cargo |

| 6. Reception of cargo | Shipper/Carrier | The acceptance address, the date and time of delivery of vehicles for loading in accordance with the contract and the actual time and date of delivery of vehicles are indicated. Signature and seal of the shipper, signature of the driver. A seal is not required if there is a power of attorney |

| 7. Delivery of cargo | Shipper/Carrier | The unloading address, the date and time of delivery of the vehicle for unloading in accordance with the contract and the actual time and date of arrival of the vehicle are indicated. Signature and seal of the consignee, signature of the driver. A seal is not required if there is a power of attorney |

| 8. Conditions of transportation | Carrier | In the absence of entries in this paragraph, the conditions for the transportation of goods provided for by the Federal Law “Charter of Road Transport and Urban Ground Electric Transport” and the new Rules of Transportation apply |

| 9. Information on acceptance of an order (application) for execution | Carrier | Information about the time and place of acceptance of the order is indicated. The signature and seal of the carrier is affixed. If you have a power of attorney, a seal is not required |

| 10. Carrier | Carrier | Detailed information about the carrier and driver |

| 11. Vehicle | Carrier | For the vehicle, the type, make, and state license are indicated. number, load capacity in tons and capacity in cubic meters |

| 12. Reservations and notes | Carrier | To be filled in after loading, the carrier indicates his comments |

| 13. Other conditions | Carrier | When transporting dangerous, large or heavy cargo, the number, date and validity period of the special permit, as well as the transportation route, must be indicated. |

| 14. Forwarding | Carrier | To be filled in if the delivery address of the cargo has changed en route |

| 15. Cost of carrier services and procedure for calculating freight charges | Carrier | The cost of transportation or the procedure for its calculation (reference to the contract is possible) |

| 16. Date of preparation and signature of the parties | Shipper, carrier | Signatures and seal impressions (if there is a seal) of the shipper and carrier |

| 17. Marks of shippers, consignees and carriers | Shipper, carrier and consignee | To be completed when the terms of the contract are violated. The interested party draws up a violation report, and a note is made about the fact of its existence |

New form of consignment note for cargo transportation

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- waybill

- Fill out and print the document online (this is very convenient)

In 2021, the form of the waybill has changed. A new edition of the rules for transporting goods by road is in effect (Government Decree No. 1529 dated December 12, 2017). They now regulate the transport of goods by heavy or large vehicles (and not the transport of heavy or large goods, as before). Along with the rules, the forms of the relevant documents have also been updated.

Section 13 of the consignment note now indicates the route of movement of heavy or oversized transport, or transport carrying dangerous goods. Similar changes are in section 15. Now it provides the cost of carrier services and the procedure for calculating fees for the transportation of dangerous goods or goods transported by heavy or large vehicles. How to fill out a waybill? A sample with modified sections is below.

And from January 1, 2021, some indicators were added to the document that were not there before:

- In Section 1 “Shipper” there is a place to indicate that the shipper is the forwarder.

- Section 1a has been added, in which, if necessary, you can specify information about the client.

- In section 3 “Cargo” you will need, among other things, to indicate the declared value (value) of the cargo and details of the document confirming the shipment of the goods.

- In Section 6 “Reception of Cargo” you will need to additionally enter information about the person from whom the cargo is being collected. This person's signature will be required, as well as the carrier's signature if necessary.

Who is required to complete it?

The TNN is filled out by the enterprise that ships alcohol or spirits. This rule is relevant even if transportation is carried out from one warehouse of the organization to another (clarification of Rosalkogolregulirovanie No. 2148/03-04 dated January 31, 2017). The form is prepared by the employee whose job responsibilities include such responsibility. In some services on the Internet, it is possible to fill out a new TTN online for free; all you need to do is enter the current data.

The TN is filled out when drawing up an agreement with the carrier, the organization carrying out the delivery, the form is drawn up by the purchasing manager, accountant, or forwarder.

How is TTN different from TN?

Before the introduction of the consignment note (BW), another document was used: the consignment note (BWB). However, after the first one came into practice, the second one was not cancelled. Now both documents are used: both TN and TTN. What is the difference between them?

Waybill (Bill of Lading):

- Serves to record the movement of goods between the seller and the buyer.

- Confirms the legality of transportation when checked on the road.

- Includes two sections: commodity and transport. They indicate information about the cargo and the stages of its transportation.

- Serves as the basis for (a) payments for cargo transportation by road, (b) write-off of goods by the sender and their receipt by the recipient.

- Filled out in four copies. More details about the rules for issuing TTN, form and sample - here >>

Waybill (TN):

- Confirms the conclusion of a cargo transportation contract.

- Confirms the legality of transportation.

- Includes only the transport section. It contains information about the carrier, shipper, recipient, transportation conditions, as well as data confirming the fact of cargo transportation and the costs of it.

- Includes information about the containers used for cargo transportation, the packaging method, labeling, and cargo items: their weight, volume, dimensions. TTN does not have this information.

- Includes instructions from the shipper about the required parameters of the vehicle, data on transportation conditions, the actual condition of the cargo, seals, containers and packaging, reservations and comments from the carrier. This information is not indicated in the TTN.

- Does not include telephone numbers of legal entities (senders, recipients, carriers), but contains numbers of persons responsible for transportation.

- Does not require signatures of officials who authorized the release of cargo and persons who released the cargo. Also, the signature of an accountant, chief or senior is not required. The TTN must contain all these signatures - in the product section.

- It does not include information about the payer - name, address, bank details - unlike the TTN.

- Serves as the basis for payments for the transportation of goods by road.

- Confirms the costs of road transportation.

- It cannot serve as a basis for the receipt of inventory items by the buyer and for their write-off by the supplier. The TN does not contain a section with the necessary information: the price per unit of goods and the total cost of all transported goods are not given. You can only indicate the declared value of the cargo. Then, in the event of a shortage or damage to the goods due to the fault of the carrier, it will be possible to calculate the amount of compensation.

- Filled out in triplicate. Instructions for issuing a consignment note, an example of filling out and a blank form for 2021 are below.

If you are issuing a technical document, in order to write off and capitalize inventory items, you also need to issue a TORG-12 consignment note. It contains the necessary information about the product: price per unit, quantity and name.

Get the document for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the list of goods that can be sold during quarantine and other regulations on business operations

- Download the full list of industries affected by coronavirus and a table with new tax payment deadlines

- Filling out and printing documents online is very convenient

Functions

There are a number of them provided.

- Confirmation of the conclusion of the transaction. A kind of transfer and acceptance certificate, only not for material assets, but for the fact of provision of transportation services.

- A way to clarify settlement details with an agent.

- Accompanying document to confirm the legality of the act.

- Reporting. Accordingly, it is intended for the tax service.

- The ability to accurately check the quality of cargo transportation, the absence of thefts and losses, damage to material objects, deadlines and related factors.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Rules for filling out the bill of lading 2021

In 2021, the bill of lading form is filled out in accordance with the updated Rules for the carriage of goods:

- The shipper must fill out paragraphs 1-6 and 16 in the document (“Consignor”, “Consignee”, “Name of the cargo”, “Accompanying documents for the cargo”, “Instructions of the shipper”, “Acceptance of the cargo”, “Date of compilation, signatures of the parties”) .

- The carrier must determine (in agreement with the sender) the conditions of transportation. He fills out (in his part) paragraphs 8-11, 13, 15, 16 of the TN (“Conditions of transportation”, “Information on acceptance of the order for execution”, “Carrier”, “Vehicle”, “Other conditions”, “Cost of services” carrier and the procedure for calculating freight charges”, “Date of preparation, signatures of the parties”).

- The driver signs the waybill in paragraphs 6 and 7 (“Acceptance of cargo”, “Deliverance of cargo”), fills out paragraph 15 (“Cost of carrier services and the procedure for calculating the freight charge” - the amount of the freight charge is indicated here), if necessary - paragraph 12 (“ Reservations and comments of the carrier" - here are comments about the actual condition of the cargo, containers, packaging, marking, sealing - when delivering the cargo, changes in transportation conditions - when unloading). On the way, the driver, as necessary, has the right to make notes about changes in transportation conditions (clause 12) and redirection (clause 14 “Readdressing”).

- The consignee fills out clause 7 (“Deliverance of cargo”) in the waybill.

- Paragraph 5 (“Consignor’s instructions”) provides the value of the cargo declared by the consignor. It should not be more than its actual value.

- The absence of an entry in the cargo transportation invoice form is confirmed by a dash. There should be no empty fields in the document.

- If there are no entries in paragraph 8, the general conditions under the Rules for the Transportation of Goods and the Federal Law “Charter of Motor Transport and Urban Ground Electric Transport” apply.

- The consignment note is drawn up in three copies: for the shipper, the consignee and the carrier. All copies are originals.

- The consignment note is signed by the shipper and the carrier or their authorized representatives. Corrections are certified by the same signatures.

- The form of the consignment note for the transportation of goods includes information about all consignments of cargo transported in one transport.

- If several cars are involved, the number of copies of the waybill must correspond to their number: for each car - three TN.

When transporting dangerous goods or when using large or heavy vehicles, in paragraph 13, if necessary, information about the route, as well as the number, date and validity period of the special permit is indicated.

Concept and application in accounting

This documentation contains basic information about the cargo. Weight parameters, dimensions, distance traveled. Provides information about the sender and the company, employees performing transportation. Accordingly, it is on the basis of paper that settlement takes place between the parties to the transaction. That is, this is a kind of confirmation of expenses that go into the accounting department as a separate line. And they help the tax service form a correct picture of production costs.

But at the same time, the TTN will not become the basis specifically for creating an accounting entry. This is a kind of evidence base, a way of confirmation. But this is not the basis for making an accounting entry in the financial statements.

The consignment note is a confirmation that the terms of the transaction have been fulfilled. This means that they are distributed on several sides. It is often customary to use 4 copies so that everyone has their own evidence base. The sender, the customer, persons authorized to accept the cargo and carry out posting, as well as the intermediary himself. That is, a private carrier or a logistics company.

It's hard not to understand the value of this documentation. In case of any deviation of the material component of the cargo from the order, a reconciliation is immediately carried out with the specification specification. Therefore, filling it out must always be correct, strictly according to the model, without liberties or amateur performances. Registration with deviations from existing norms and rules, with violations on forms - will automatically deprive the paper of legal force.

freight bill of lading

Do you want to forget about the problems with issuing a new waybill once and for all? The MoySklad online service has developed a system specifically for you to automatically fill out and print all the necessary accounting documents. To work with it, you only need a computer with a printer and Internet access. And you will be able to draw up and print documents at any time of the day and from anywhere, wherever you are.

More than 1,500,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

Registration in EGAIS

This is the only case when a document becomes reportable at all stages. It is entered into the system at the time of sending. According to the law, all participants in the process must be in the database. Therefore, at each point of cargo transfer, as well as during capitalization, it is necessary to check the Unified State Automated Information System. Conduct a complete product check.

In principle, to post goods with automatic accounting of the invoice, it is better to use a single operating system. Suitable software can be found in Cleverence. We offer:

- Solutions for any type of business.

- Manage all operations from a single device.

- Fast pace of execution of work processes.

We looked at how to work with a consignment note, what it is in accounting, what types and functions this document has, and found out that the invoice becomes vital in many cases.

Especially with increased interest from the Federal Tax Service. Number of impressions: 1745

Consignment note: who should issue it?

In general, the shipper, unless otherwise provided by the contract of carriage. But this can be inconvenient, since the sender, having filled out his part of the document, will have to hand over the original to the driver along with the cargo. He, instead of transporting the goods directly to the recipient, will first have to go to the office of the carrier company with a bill of lading so that the responsible persons fill it out. And only after this the driver will deliver the goods. It is more convenient to stipulate in the contract that the freight forwarder will issue the waybill. Then the transport company fills out its part of the form in its office, the original is given to the driver, and he takes it to the shipper, leaving for the cargo.

Can the shipper (carrier) and the seller be different legal entities?

Shipper and seller may differ . For example, the seller of a product is located in one city, and the cargo itself is stored in a warehouse in another city. It turns out that the shipper listed in the invoice will be the company that manages the warehouse. It is the employee of this organization who should be responsible for completing the 1-T form.

Another case is when the buyer of the goods is a company located in one city, and its warehouse may be located in another city. In this case, the consignee will not be the buyer of the goods, but the organization managing the warehouse, with which the buyer has a cargo storage agreement.

Thus, an employee of the company from whose warehouse the goods will be sent will be responsible for drawing up the primary documentation.

TN or TTN: which document to issue?

Now the TN and TTN forms are in effect simultaneously. What is the difference - read above. In short: the TTN contains information about the product necessary for write-off and capitalization, which eliminates the need to issue the TORG-12 form. However, the TN contains more detailed information about cargo transportation. Which document to issue depends on the specific situation:

- To justify the costs of transporting goods when a third party is involved: TTN or TN. Any of these forms confirms the fact of expenses incurred for road transportation.

- To confirm the legality of cargo transportation: TTN or TN. Any shape will do.

- To write off and record goods: TTN (or TN + TORG-12).

- When the supplier himself delivers to the buyer: TN.

- When the buyer himself picks up the goods from the supplier’s warehouse: neither a specification form nor a specification form is needed. If delivery is not included in the contract, then a consignment note in form No. TORG-12 is sufficient for capitalization, and a waybill can be used to justify the costs of fuel and lubricants and calculate the driver’s salary.

- When transporting any alcohol and alcohol-containing products: both TN and TTN. Only TTN can serve as an accompanying document for alcoholic products, confirming the legality of its production and circulation. TTN (consignment note): and sample filling for 2021 >>

Responsibility

What is the risk for a company that does not issue a waybill in a timely manner?

Since it confirms the existence of a contract of carriage, inspectors may interpret its absence as a failure to perform the service of transporting goods by road. This means that if there was no service, then the costs incurred by the organization cannot be recognized as expenses and the taxable base for profit cannot be reduced. It is also possible that officials will try to admit that there were no goods at all and they were not capitalized. In this case, the very cost of the goods and the deduction of VAT on them will be at risk.

Therefore, in order to avoid conflicts with tax authorities, it is necessary to prepare transport documents in a timely manner: both the transport invoice in the new form and the usual TTN.

S. Strizhov, chief economist, Practical Accounting

Accounting Features

After delivering the goods to the recipient, the driver gives him a second copy of the TTN . The consignee certifies the third and fourth copies of 1-T with his signatures and hands them over to the driver. These papers are submitted to the accounting department of the company that carried out the cargo transportation.

The third copy is the basis for settlements with the customer of the vehicle. The company, that is, the owner of the vehicle, issues an invoice for the services provided, attaches a third copy of the invoice to it and sends it to the payer, that is, the customer of the vehicle.

The fourth paper is attached to the waybill and is the basis for accounting for transport work, as well as calculating the driver’s wages. It is submitted to the accounting department of the relevant company, where the documents are recorded.

What to check when receiving the goods

Before signing at the time of receipt of the cargo, the document must be carefully checked and attention to a number of important nuances that arise when filling out:

- If goods and materials are accepted by power of attorney, then the person who accepted the goods puts his signature with a transcript, as well as the date and number of the power of attorney, which must be attached to the invoice. In such cases, no stamp is placed.

- If the financially responsible person of the organization acting as the customer receives the products independently, then a signature, transcript and seal are placed in the lower right corner.

- If both organizations do not officially use a seal, then the document can be issued without a stamp.

IMPORTANT! If there are no signatures in TORG-12, full name. signatories and a seal impression, then it is considered invalid and does not prove the fact of transfer of the goods to the customer.

Strict reporting form

According to the laws in force on the territory of the Russian Federation, namely No. 402, all facts of the activities of enterprises or persons registered as individual entrepreneurs must be formalized and confirmed by primary accounting documents; the responsibility for maintaining such papers rests with the official who is responsible for maintaining accounting records.

According to the Federal Law, Article 9, Clause 4 “On Accounting,” a sample invoice must be issued for each shipment of goods to budgetary institutions, legal entities and entrepreneurs, regardless of whether a permanent purchase agreement or a one-time one has been concluded, which makes it important for daily activities.

An ordinary individual does not need such a document.

Goskomstat Resolution No. 132 contains a list and ready-made samples of unified forms for commodity and transport operations.

Also, the delivery note of the TORG-12 sample provides for the development of a printing form by a company or private entrepreneur at its own discretion.

Most business entities use ready-made versions of documents in their activities.

This is explained by the fact that the sample delivery note 2018 allows you to almost completely avoid mistakes and protect yourself from unnecessary questions during tax control.

Electronic documents

The delivery note form 2021, a sample of submission and completion in electronic format, is no different from the features of drawing up an analogue.

The main feature is that the electronic form implies the preparation of one copy, but consisting of two documents.

One document is drawn up by the seller, and the second, after delivery, by the buyer.

An electronic signature (ES) is used to certify the invoice. Moreover, a sample invoice without VAT is signed once by each party.

Features of accounting and storage

The legislation, other than the requirements for how to fill out a delivery note and a sample, no longer provides any rules for recording and storing such documents.

This means that the organization itself decides in what forms these operations will be carried out.

In practice, the following form of accounting is often used: a commodity report is generated at the warehouse, to which, in chronological order, a delivery note of the sample established by the State Statistics Committee is attached.