Standard reports

One of the main standard reports is the balance sheet created for account 01.

The report allows you to access not only the turnover of fixed assets and balances, but also access to various additional information, for example, the serial number of the equipment or its inventory number at the enterprise. Data is accessed by setting values in the “Show Settings” tab.

For additional fields, you can configure the output in one or several columns. In general, setting up reports in the program is identical for all existing options, which simplifies the work of an accountant.

Report on fixed assets in 1C 8.3

The accounting system "1C: Accounting 8" (rev. 3.0) has four forms of reporting on fixed assets:

- Standard report form;

- Specialized report forms;

- Universal report;

- Tax accounting register.

The general scheme of working with fixed assets in the same program consists of the following stages:

- Receipt and registration of OS;

- Putting them into operation;

- Move;

- Repair and/or modernization;

- Depreciation;

- Write-off;

- Inventory.

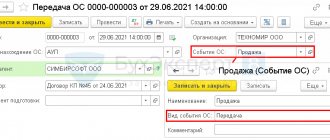

The acceptance and registration of fixed assets for an enterprise for any type of reporting on the main fixed assets can be viewed using the documents posted and registered.

Fig. 1 Acceptance and registration of fixed assets for the enterprise

The standard report form is balance sheets for given accounts. This type of report is located in the “Reports” tab.

Fig.2 Standard report form

In addition to the fact that in this report form you can view fixed assets, their turnover and movement, additional information is also entered on the “Show settings” tab: the location of the fixed assets, their inventory numbers, serial numbers or transaction codes, which will also be included in the report on the fixed assets in 1C 8.3 and will give a more detailed idea of the balance.

Fig.3 Settings

This report can be generated for any of the existing accounts, and “Additional fields” can be used both for one column and for individual columns.

Based on this principle, other types of reports are configured and generated in Accounting.

Specialized report forms can be found in the contribution of the OS and intangible assets.

Fig.4 Specialized report forms

The inventory book is used mainly to account for fixed assets in small businesses. You can apply various settings to it, including viewing the location of the operating system, financially responsible persons, and departments. A report is displayed on custom dates, from year to day.

Fig.5 Report on custom dates

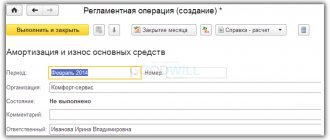

Here you can generate a report on accrued depreciation in the “Asset Depreciation Statement” tab.

Fig.6 Statement of depreciation of fixed assets

One of the most extensive and most commonly used reports in 1C is the Universal Report. It helps to create a structured and detailed report in which you can view all operating system receipts for the entire period, as well as use a variety of additional settings. In generating this report, all data registers entered into the working database are used.

Fig.7 Universal report

In order to generate this report on the fixed assets already on the balance sheet of a company or enterprise, you must use the “Reports-Universal Report” tab. In the upper part of the settings panel, set the required period for generating the report, in the “Data Type” cell select the “Information Register” value, in the “Object” cell – the location of the OS (accounting).

Fig.8 Setting

In the "Table" object, you must set the value of an empty field.

Fig.9 Table

Next, set the following settings: in the “Selections” tab – selection for the required enterprise. If there is not one, but several of them in the database, select the necessary one.

Fig.10 Settings

In the next tab “Indicators”, add a new field and select “Fixed Asset” from the drop-down list.

11 Indicators

With all the above settings, we generate a report and get a detailed form of a universal report on the OS.

Fig. 12 Generating a report

You can customize this report in accordance with the description above, add inventory numbers, transaction codes, or build a report based on MOL.

The tax accounting register is mainly used to obtain the necessary information on the operating system, but much less frequently than other forms of obtaining this report. The register can be found in the tab of the same name, in the section “Registers for recording the status of a tax accounting unit.”

Fig. 13 Tax accounting register

It is generated in the same way as other reports, in accordance with the specified parameters and settings.

Fig.14 Register formation

We saw that there are quite a lot of tools to get a report on OS groups in 1C 8.3, and you can choose those that are most convenient for a particular situation, and following the recommendations given, also create other reports.

Unified forms

Access to the reports of this group is carried out through the section “OS and intangible assets”.

The Inventory Book report is used by small business entities to account for fixed assets.

The report allows, through a filter system, to provide information on the divisions where fixed assets are located, materially responsible persons, and so on.

The “Depreciation Sheet” report is intended to analyze depreciation charges charged on fixed assets.

Where can I find a form for a certificate of book value?

The form of a certificate of the book value of fixed assets is not approved at the legislative level. This means that you can use any form of this document. Let us remind you that business entities have the right to develop forms of certain documents based on their needs and characteristics of their activities. Therefore, the enterprise can also approve the form and type of this document independently, securing it with the appropriate order.

Fixed assets in the certificate can be listed by name (if there are a small number of them) or divided into groups: non-residential buildings, machinery, inventory and equipment for production needs, and so on.

You can see an example of preparing such a certificate on our website. We offer two options for formatting this document (they are shown in the file, which you can download from the link below):

Bookmark Cost

All asset valuations are entered here. Moreover, the system itself calculates the residual value based on the data of the Replacement Cost and Accumulated Depreciation.

Tab Cost of document line Entering initial balances of VNA in 1C Integrated Automation 2 and ERP 2

If the cost according to BU and NU differs, then the system automatically tries to calculate the differences using the formula:

BP = BU - NU - PR.

That is, as soon as the amounts of BU and NU differ, the difference falls into VR. You cannot change the amount in the BP column.

If the differences are constant, then you should simply indicate the amount in the PR. The amount in the BP column will be adjusted automatically.

Generating transactions

All bookmarks are completed. Click the Finish editing button and the line is written to the document.

Document Entering initial balances of non-current assets in 1C Integrated Automation 2 and ERP 2

With one document you can enter several fixed assets belonging to one division. After posting the document, it generates all the necessary movements in the accounting registers, except for the accounting and accounting entries.

To generate transactions, you need to either click on the button in the regulated accounting transactions and click the Reflect in regulated button. accounting

Reflect in regulated accounting in 1C Integrated Automation 2 and ERP 2

Or go to the Reflection of documents in regulatory accounting workplace and create transactions there for all entered documents at once.

Tab Reflection of expenses

This tab indicates the expense items to which depreciation and property taxes should be allocated.

Tab Reflection of document line expenses Entering initial balances of VNA in 1C Integrated Automation 2 and ERP 2

Example of setting up an expense item for depreciation:

Setting up depreciation expense items in 1C Integrated Automation 2 and ERP 2

On the “Main” tab

We indicate that our expenses are for core activities.

We distribute to production costs the costing item Depreciation of equipment.

We distribute it to the department based on the cost of materials.

Distribution of costs by materials in 1C Integrated Automation 2 and ERP 2

And within product divisions it is proportional to the amount of output.

Distribution of costs by quantity of release in 1C Integrated Automation 2 and ERP 2

On the “Regulated Accounting” tab we set up tax accounting costs and default accounting accounts.

Setting up depreciation expense items in 1C Integrated Automation 2 and ERP 2

These accounting accounts will be inserted into document postings and can be changed manually if necessary.

Example of setting up an expense item for property expenses:

Setting up expense items for property taxes in 1C Integrated Automation 2 and ERP 2

We indicate that expenses for other activities. Otherwise, we will not be able to establish expense account 91.02.

We distribute the financial result according to the areas of activity:

Distribution of costs per line of business in 1C Integrated Automation 2 and ERP 2

At the same time, the distribution method indicates the distribution coefficient only for the main activity - production.

On the “Regulated Accounting” tab, we set up tax accounting and accounting account - 91.02 Other expenses.

Setting up expense items for property taxes in 1C Integrated Automation 2 and ERP 2