The minimum authorized capital threshold for registering an LLC is 10 thousand rubles. In most cases, the specified amount is only enough to provide minimal intermediary services. What should you do if you need a large amount of money to carry out your activities, but there is no desire to increase the authorized capital?

To get out of this situation, you can use an interest-free loan from the founder. But before implementing this method, we recommend that you familiarize yourself with the tax consequences of such a decision.

Justification of the legality of a loan from the founder

The founder of a legal entity (individual or organization) has the right to provide borrowed funds to the entity created by him, since the provisions of par.

Chapter 1 42 of the Civil Code of the Russian Federation allows this to be done without establishing any restrictions on such actions for the founders. Moreover, the essence of these provisions was not affected by the adjustments made by the Law “On Amendments...” dated July 26, 2017 No. 212-FZ, by virtue of which Ch. 42 of the Civil Code of the Russian Federation acquired a new edition as of June 1, 2018. The advantages of a loan provided by the founder are obvious, since the question of obtaining it:

- resolved promptly;

- does not require preliminary approvals and systematic provision of data for control, as in the situation with a loan issued by a bank;

- can be accepted on very favorable terms for the borrower (with a longer repayment period or lower interest rate than when applying for a loan from a bank);

- may result in debt forgiveness.

Why does the founder providing the loan agree to such conditions? Because he himself is interested in ensuring the successful operation of the organization in which he has a stake and from which he expects to receive income.

How to take into account the receipt and repayment of an interest-free loan from the founder - a legal entity? The answer to this question is in ConsultantPlus. Learn the material by getting trial access to the system for free.

Basic moments

In order for a borrowing transaction from the founder to be valid, a written agreement must be drawn up. It is drawn up in two copies - one for each side.

The document must contain the following conditions:

| Essential | without which it will not have legal force |

| Additional | which will not affect its legality in any way |

Essential conditions include:

| Subject of the agreement | that is, the amount of funds loaned. It must be indicated not only in numbers, but also in words |

| Intelligence | about each side of the transaction |

| Borrower's obligation | for refund, with or without interest |

| Sanctions for the borrower’s neglect of his duties | for debt repayment |

Additional conditions include:

- Borrowing term.

- Loan interest.

- The rights and obligations of each party in relation to each other.

- Force majeure circumstances.

- Final provisions.

How to profitably take out loans online without refusal on a card, read the article: online loans without refusal. Read about applying for a loan through the fast loan service here.

Sample contract

To avoid misunderstandings, it is necessary to carefully draft the contract. It must indicate in detail:

| Information about each party to the transaction | Since the lender is an individual, the following is indicated about him:

Since the borrower is a legal entity, you must indicate:

|

| Describe the subject of the transaction | if this is a specific amount, then you need to indicate it first in numbers and then in words, and also indicate the method of issuance. If this is a cash advance, the borrower must also draw up a receipt. If a thing or property is given on loan, then you need to describe it and indicate the details of the document confirming ownership |

| Deal validity period | It is recommended to indicate a specific number, for example, “17. 01. 2020”, and not “six months after receiving funds” |

| Order | pre-trial dispute resolution |

| Reasons | so that one of the parties can terminate the contract unilaterally |

| List of applications, if any | and details of the parties |

Required documents

The following documents must be attached to the contract:

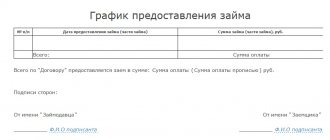

| Payment schedule | if the debt will be repaid in installments over a certain period of time |

| Copies of passports | lender and borrower's representative |

| A copy of the borrower's charter | and a receipt if the money was transferred in cash |

| Document | confirming bank transfer if funds were transferred to a current account |

| Copy of property documents | if the subject of the transaction is property |

| Other documents | which may be needed, depending on the nuances of the transaction |

How does the process of receiving funds work?

You can get a loan in several ways:

| Cash | at the company's cash desk |

| By non-cash method | through a current account |

| In the form of materials | equipment or other property |

When depositing funds in cash at the cash desk of an enterprise, it is worth considering that there are some features:

- under one loan agreement you can deposit no more than 100,000 rubles in cash;

- these funds cannot be used to pay employee salaries.

The deposit of funds is formalized by a receipt order, which is signed by the accountant and manager. The “stub” of the PKO is given to the person who contributed the funds.

When transferring funds to a company bank account, no such restrictions are established. You can transfer any amount. But, when transferring more than 600-hundred thousand rubles at a time, the competent authorities may become interested in the transaction.

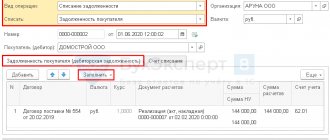

Therefore, when making a transfer, you must always indicate the details of the loan agreement under which the transfer is carried out.

A copy of the payment must be kept, it will be proof that the transfer was made. But in order for the funds to “reach” the borrower, it is necessary to correctly indicate all payment details.

You can issue a loan with materials, equipment or other things that belong to the lender by right of ownership.

Such a subject of transaction is transferred only from hand to hand; it is necessary to draw up an acceptance and transfer certificate, which will spell out all the nuances of the subject of the transaction.

But this method of issuing debt is not popular because it has a number of features:

| Repayment of the debt must also be made “in kind” | that is, the borrower will have to return similar material, the same manufacturer, model, quality and quantity |

| Items cannot be returned | which is “similar” to the one that was issued on loan |

| Sanctions must be prescribed | for if the subject of the transaction is damaged, lost or rendered unusable |

Debt repayment methods

You can repay the loan in the same ways you received it:

- Cash.

- By non-cash method.

- Property.

But, the contract must specify how the funds will be returned:

| Annuity | that is, equal payments at regular intervals. As a rule, with a long-term loan, the amount of debt, along with interest, is repaid every month |

| One-time payment at the end of the borrowing period | this method is chosen if the loan is short-term, that is, does not exceed a year |

With the annuity method of loan repayment, it is necessary to draw up a payment schedule, which is signed by both parties and is an appendix to the agreement. The schedule must indicate the debt repayment dates, as well as the amount due.

Loan agreement from the founder: registration

Relations arising in relation to a loan received by a legal entity, regardless of who the lender is and what the amount lent to him, must be formalized in writing, that is, by concluding an agreement (Clause 1 of Article 808 of the Civil Code of the Russian Federation).

It is in this document that you need to indicate:

- data of both parties;

- information about what exactly is being loaned (cash, things or securities) and what is the amount (or value) of the transferred;

- conditions for using borrowed funds (period, purpose, interest rate, availability of collateral);

- the procedure for the transfer and return of borrowed property (including early return) and payment of interest;

- other rights and obligations of the parties;

- types of liability arising from violation of the terms of the contract;

- rules that come into force in force majeure circumstances;

- procedure for resolving disputes.

In relation to the items and securities to be transferred, you will additionally need to draw up an inventory containing indications of the specific characteristics of the items being transferred.

Read more about drawing up a loan agreement in the following articles:

- “Ordinary and gratuitous loan agreement from the founder”;

- “Sample interest-free loan agreement from the founder.”

Loan repayment

The funds received are returned within the period specified in the agreement (one-time or according to a payment schedule). If a period is not specified in the contract, then the return occurs within 30 days after receipt of the written request of the owner. The method of return is also usually provided for in the contractual terms.

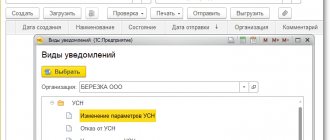

Is it possible to return material assets, such as goods, to the lender instead of borrowed money? No, you can’t, the loan is returned with property of the same kind that was taken. If any other property is returned instead of money, then this situation is interpreted as a sale, i.e. that the participant bought something from his company. In this case, the organization will have to pay tax according to the chosen regime, for example, for the simplified tax system for Income it will be 6% of the amount.

Key points of the borrowing agreement

There are a number of points that are of particular importance for the tax consequences of a loan agreement with the founder. Among them is the ability to make an agreement:

- Provides for the payment of interest at a frequency convenient for its parties. The absence of reservations in this regard will require monthly interest accrual (clause 3 of Article 809 of the Civil Code of the Russian Federation).

- Interest-free (in the case of loaning things, the absence of interest becomes mandatory - clause 4 of Article 809 of the Civil Code of the Russian Federation). In order for an agreement to be considered interest-free, the condition of non-accrual of interest must be fixed in the text of the document, since the absence of such a condition will entail the need to calculate interest on the key rate of the Bank of Russia (clause 1 of Article 809 of the Civil Code of the Russian Federation).

- Targeted. For this situation, the contract will have to provide for a procedure for monitoring the use of what was loaned and a procedure for returning it if misuse is identified (Article 814 of the Civil Code of the Russian Federation). Accordingly, interest accrued on borrowed funds used for other purposes will not be taken into account to reduce the tax base for profits or the simplified tax system; It will also be impossible to take into account the negative exchange rate difference on a loan issued by a foreign founder in foreign currency.

- Does not contain an indication of the repayment period or makes it dependent on the moment of reclaiming the loan from the lender. Under such conditions, the debt must be repaid no later than the 30th day from the date of the demand from the lender, unless a different period is specified in the text of the agreement (clause 1 of Article 810 of the Civil Code of the Russian Federation). Moreover, the date of return (unless otherwise provided by the agreement) will be considered the day of actual receipt of the debt by the lender (clause 3 of Article 810 of the Civil Code of the Russian Federation).

In order to avoid undesirable consequences, it is recommended to stipulate each of the listed points in detail in the text of the loan agreement.

How to get a loan

If the owner or one of the founders of the company provides a loan to the organization, then a borrowing relationship arises. In this case, there are no restrictions on the share. Also, the law does not stipulate the loan amount.

To confirm the transfer of money, a corresponding agreement is drawn up. When compiling it, it is recommended to use a company letterhead. If it is limited to a payment order or a receipt order, then if controversial issues arise, the judicial authorities may not recognize the fact of the existence of a borrowing relationship.

The subject of a loan agreement can be not only money, but also other valuables. When repaying the loan, the Borrower is not obliged to return the same thing. Returns can be made for similar items. Construction materials, raw materials or other goods can be transferred as a loan. But in most cases, when a loan occurs, money is transferred.

The agreement may indicate the purpose of the loan. The manager documents the intended use of funds, and the founder has the right to control the use of the loan.

The following documents may be proof of intended use:

- Agreements, invoices, receipts and other documents that are evidence of the intended use of funds;

- Notification of the purchase of goods;

- Access to the place of storage of purchased products, goods or property.

If the borrowed funds are not used for the intended purpose, the other party has the right to demand the repayment of the loan provided before the end of the contractual obligations or demand penalties if they are provided for by the contractual obligations.

By default, the agreement is considered remunerative, which means interest accrues, even if this is not specified in the loan agreement. Interest is calculated at the refinancing rate on the date of repayment of the entire debt amount. If, by agreement of the parties, interest is not accrued, then this fact must be stated in the agreement. If there is a clause about a zero rate or an indication without an interest option, interest is not accrued for the use of borrowed funds.

Interest-bearing loan: tax implications

Quite often, a loan agreement, even one concluded with the founder, provides for the payment of interest on it. What tax consequences will an interest-bearing loan from the founder bring in 2021?

The interest amounts received by the lender will become his taxable income. The founder-individual (both Russian and foreigner) will have to pay personal income tax from them at a rate of 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation) or 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation), respectively, and withholding tax on income will be carried out by the borrower (clause 1 of Article 209 of the Tax Code of the Russian Federation). And the founder - a legal entity of Russian origin, upon receipt of interest, will be the payer of income tax (clause 6 of Article 250 of the Tax Code of the Russian Federation) or the simplified tax system (clause 1 of Article 346.15 of the Tax Code of the Russian Federation) at rates of 20% (clause 1 of Article 284 Tax Code of the Russian Federation) and 15% or 6% (clause 1 of Article 346.20 of the Tax Code of the Russian Federation), respectively. On the income of the founder, who is a foreign organization, when paying interest to him, the borrower will also have to withhold tax himself (clause 1 of Article 310 of the Tax Code of the Russian Federation) at a rate of 20% (subclause 1 of clause 2 of Article 284 of the Tax Code of the Russian Federation). Under certain conditions, part of the interest accrued in favor of a foreign founder is equated to dividends (clause 6 of Article 269 of the Tax Code of the Russian Federation) and is taxed at the corresponding rate of 15% (clause 3 of Article 224 and clause 3 of Article 284 of the Tax Code of the Russian Federation) .

From what base will the tax be calculated: from interest, the amount of which is provided for in the borrowing agreement, or from those that correspond to the real market level of such income? This question arises because the parties to the loan agreement may be mutually dependent. Let us recall that the interdependence between the founder and the legal entity in which he participates is directly related to the share of such participation (both direct and taking into account indirect contribution). For a dependence to arise, it is enough for the share to slightly exceed 25% (subclauses 1, 2, clause 2, article 105.1 of the Tax Code of the Russian Federation).

Thus, in relation to an interest-bearing borrowing agreement, the following situations are possible:

- There is no dependency. Then the prices agreed upon by the parties to the transaction are considered market prices (clause 1 of Article 105.3 of the Tax Code of the Russian Federation), and there is no need to revise them.

- There is a dependence. Its consequences will be different for resident founders and non-resident founders. In the first case, transaction prices will be controlled only when the amount of all transactions between the parties for a calendar year exceeds 1 billion rubles. (Subclause 1, Clause 2, Article 105.14 of the Tax Code of the Russian Federation). In the second case (with a non-resident), the transaction will always be controlled.

The recipient of the loan has the right to accept interest accrued in accordance with the terms of the agreement as a reduction in the profit base (subclause 2, clause 1, article 265 of the Tax Code of the Russian Federation) or the simplified tax system, the base of which is determined taking into account expenses (subclause 9, clause 1, article 346.16 Tax Code of the Russian Federation). However, in relation to a controlled transaction with a foreign founder, the determination of the amount of interest included in expenses occurs in a special order (Article 269 of the Tax Code of the Russian Federation), and it is here that, if the maximum permissible amount is exceeded, the question arises of equating interest to dividends for tax purposes .

Types of replenishment

Today there are several types of contributions. They differ in the purpose of the transaction:

- Change in the authorized capital (authorized capital) of the company towards an increase.

- Increasing the net assets parameter (the capital does not change).

- Depositing money into the reserve part.

- Update of additional capital.

- Depositing a loan into a current account.

To avoid difficulties with the Federal Tax Service, enterprises, as a rule, choose the latter option. But here questions regarding design and wiring may arise.

Loan without interest: what taxes are possible

What tax consequences does an interest-free loan from the founder have? For a loan taken without interest, the issue of taxation also turns out to be related to the presence of mutual dependence between the parties to the transaction and whether the founder is a resident or non-resident. The situations here are:

- There is no dependency. In this case, the lack of taxable income in the form of interest from the lender is completely legal (Clause 1, Article 105.3 of the Tax Code of the Russian Federation). Accordingly, the borrower has no expenses.

- There is a dependency. For her, the inclusion of the founder as a resident becomes significant. If the founder is the founder, then the transaction to provide an interest-free loan is not recognized as controlled (subclause 7, clause 4, article 105.14 of the Tax Code of the Russian Federation). If the founder turns out to be a non-resident, then the absence of interest on the loan makes the transaction not subject to control, since in this case the conditions for him, provided for in Art. 269 of the Tax Code of the Russian Federation.

Thus, an interest-free loan will not have tax consequences in any case.

Read about the reflection of a loan in accounting in the material “Accounting for loans and borrowings in accounting.”

Accounting for an interest-free loan in foreign currency

If the Russian participant provides assistance in foreign currency, it will be necessary to use PBU 15/2008 and PBU 3/2006 in accounting, which require the conversion of currency into rubles at the Central Bank exchange rate on the dates of capitalization, repayment and reporting dates.

Consider an interest-free foreign currency loan from the founder; the wiring will be as follows:

- Dt 51 Kt 66 - the amount of debt converted into rubles at the Central Bank exchange rate on the date of receipt of money;

- Dt 91.2 Kt 66 - negative exchange rate difference;

- or Dt 66 Kt 91.1 - positive exchange rate difference calculated on the last day of each month until the obligation is repaid;

- Dt 66 Kt 68 - personal income tax is charged if the exchange rate difference was positive and the participant is an individual;

- Dt 66 Kt 51 - the amounts taken were returned excluding personal income tax;

- Dt 68 Kt 51 - Personal income tax is transferred to the budget.

Options for terminating the borrowing agreement

The loan agreement with the founder can end in the usual manner: at the end of its term or ahead of schedule - by returning the borrower with payment of the due interest, if any was provided for.

Read how to return the loan to the founder on the card here.

However, it is not uncommon for a loan taken from the founder to have the debt forgiven. This opportunity is provided by Art. 415 of the Civil Code of the Russian Federation. True, it is impossible to provide for it in an agreement (just like issuing a loan for an unlimited time). The forgiveness will have to be completed in a separate document.

See also “Procedure for writing off a loan agreement (nuances)”.

What are the tax consequences of a loan from the founder ending in forgiveness in 2021? The loan amount transferred free of charge into the ownership of the borrower will become his income, which, as non-operating income, will fall under the income tax or simplified tax system. However, there are exceptions that allow such income not to be considered taxable. They relate to a situation where the founder’s share exceeds 50% of the contribution to the authorized capital (clause 11 of Article 251 of the Tax Code of the Russian Federation). In this case, non-monetary funds cannot be transferred by the borrower to a third party during the year.

How to issue a loan

If there are several founders, then before drawing up an agreement, you need to check whether the transaction is large. These include transactions in an amount exceeding 25% of the value of assets on the balance sheet as of the last reporting date.

A major transaction can be made only after the approval of the general meeting of participants (Article 46 of Law No. 14-FZ dated 02/08/1998).

Cash loans can be issued both in cash and in non-cash form.

However, it should be remembered that if the founder is an organization or individual entrepreneur, then the “cash” part of payments under one loan agreement cannot exceed 100 thousand rubles. (Instruction of the Bank of Russia dated October 7, 2013 No. 3073-U).

If the lender is an “ordinary” individual, then any amount can be issued in cash.

If the loan amount exceeded 600 thousand rubles, then Rosfinmonitoring may be interested in the transaction. In this case, the parties to the transaction will have to justify its economic feasibility.

Results

A loan from the founder is an operation not prohibited by current legislation. Its provision must be accompanied by the execution of an agreement, a number of conditions of which should be treated with special attention. The interest stipulated by the agreement will be the lender's income and the borrower's expense. With an interest-free loan, there are no tax consequences. A loan forgiven by the lender will become non-operating income of the borrower if the share of the founder in its authorized capital does not exceed 50%.

Sources: civil code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Nuances of borrowing relationships

A fairly common question we face: can a loan only be financial? Not really. You can also borrow valuables whose value can be clearly assessed. In some cases, the founder lends the company specific assets that the company needs due to the current situation. For example, these could be building materials that are needed to solve current issues. Of course, in this case the company does not return the same materials, but similar ones.

If the agreement specifies the reason why the loan is taken, it will be considered targeted. In this situation, the owner directs finances to the specific needs of the company. If we are talking about a targeted loan, then the terms of the agreement must contain a clause regulating control over the use of funds for expected needs. How exactly can you control such expenses? In fact, like any other - documented. There are several options for document control of targeted spending:

- Preparation and transfer of documentation confirming the purpose of expenses (a contract for the supply of a particular product, invoice, check, payment order).

- A message about the terms of delivery of the purchased products, signing documentation stating that the delivery took place (time, date).

- Providing information about the place where the goods are stored and providing access to its location (in this case we are not talking about a document, but about the actual ability to verify that the goods were purchased and located on site).

If the above conditions are not met, you can demand not only the return of funds, but also fines and sanctions. This is exactly the situation with official relationships regarding the provision of a targeted loan.

Mandatory clauses of the loan forgiveness agreement:

- Date of agreement

- Name of the legal entity and full name of the creditor's representative

- Name of the legal entity and full name of the debtor's representative

- Number and date of signing the loan agreement

- Loan amount under agreement

- Loan interest under the agreement, if any

- Penalty for delay under the contract, if any

- Amount required for return

- Interest required for refund

- Return deadlines

- Details of the parties