On November 25, 2021, Federal Tax Service Order No. ED-7-14/ [email protected] “On

Form INV-1 covers information on fixed assets both owned by the enterprise and presented

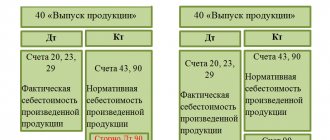

Classification of methods for accounting for production costs and calculating costs First, let’s determine what can

A citizen who purchased real estate in 2021 with money from which income tax was previously paid

Accounting is a system that allows for the collection and recording of data that is expressed in monetary terms.

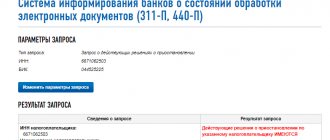

Checks Natalya Vasilyeva Certified tax consultant Current as of September 9, 2020 One of the responsibilities

How to use the calculator Instructions for using the penalty calculator All fields are required.

How to fill out a balance sheet under the simplified tax system for 2021: Enter the data in 5 lines

On January 1, 2019, the federal accounting standard for public sector organizations “Accounting

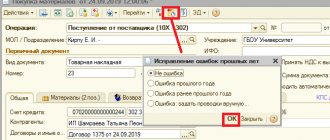

Commercial enterprises are often faced with the need to make cash payments. Accountable amounts are issued through