Accounting is a system that allows you to collect and register data that is expressed in cash and reflects the debts and obligations of the enterprise to counterparties and the condition of all property of the enterprise. All accounting is based on recording certain data in special registers called accounts, which include homogeneous economic data. One of them is the non-passive accounting account 43, which stands for Finished Goods. To understand what we are talking about and understand the nuances, it is recommended to delve deeper into the topic. This material will tell you what account 43 is in accounting and how account 43 is closed at the end of the month.

Account 43 in accounting

Account 43 takes into account products manufactured by the enterprise intended for sale or for internal use.

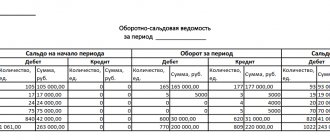

The balance on account 43 is formed only by debit and represents the balance of finished products at any point in time. When products/items arrive at the warehouse, account 43 is debited. When selling or otherwise transferring finished products (rejection, write-off, consumption, etc.), the account is credited.

Analytical accounting for account 43 is carried out both for individual categories of finished products and for places (warehouses) of their storage.

Important! Finished products need to be accounted for in both monetary and natural units to increase the accuracy of accounting and ease of calculating the cost per unit of production.

In addition, within account 43 you can create subaccounts for accounting for finished products:

- 43.1 – at planned cost;

- 43.2 – at actual cost.

Accounting at planned or actual cost is determined by the accounting policy adopted by the organization.

Characteristic

Active account 43 is one of the accounting accounts, which means “Finished Products” and is intended to summarize data on the availability and movement of state enterprises. Finished products are products or semi-finished products that were completely finished in condition, began to comply with all current norms and standards and were accepted for registration in the warehouse of the enterprise or customer. This register is used by enterprises engaged in industrial, agricultural or other production activities.

Accounting is an important section of all accounting in an enterprise.

The goal pursued by accounting when tracking SOEs is the prompt and complete reflection in the accounting accounts of data describing the release and shipment of finished products in an enterprise or organization. The main tasks of accounting for finished products and the 43rd register itself are:

- Prompt and accurate “paper” registration of GP and operations related to its release, transportation and release;

- Monitoring the safety of the GP.

It is to record this information that account 43 is needed, in which finished products can be accounted for in one of the following ways:

- At actual production cost;

- At planned cost or accounting price. This method includes or does not include the use of 40 accounts indicating the release of products, works or services;

- For direct cost items.

Accounting is based on storing information about transactions on accounts

Accounting at actual cost

If the enterprise begins to accept GP at its actual production cost, it will be accounted for only on the basis of account 43. When entering the warehouse, objects are registered only using the posting: Debit 43 Credit 20, which means the products are accepted for accounting.

Accounting at planned cost or book price

There are two options here:

- Accounting using the fortieth production account;

- Accounting without using it.

If the first method is used, then the GP corresponds with an account of 40 according to the planned cost or standard price. Immediately after the products are produced and considered complete, they are transferred to the warehouse and the following posting entry is made: Debit 43 Credit 40, indicating capitalization at the planned cost.

Important! If the GP was manufactured by the main production facility, then the posting is Debit 40 Credit 20, meaning the actual cost of the goods manufactured by the main production facilities. It is also worth noting that the planned (standard) cost usually never coincides with the actual one.

Due to the mismatch, register 40 has a balance, which can be either a debit or a credit. At the end of the accounting month it is written off and account 40 is left without any balance.

Scheme of active and passive accounts

A debit balance in register 40 means that the actual cost exceeded the standard cost and there was an overrun. Credit balance is the predominance of accounting cost over actual cost (their difference). As a result of the second case, money is saved. The first entry each month is written off from the account with the entry Debit 90/2 Credit 40. The credit balance is reversed with a similar entry.

Accounting for revenue from sales of finished products

The implementation of the enterprise's GP is also reflected in accounting and is made by the following entry: Debit 62 Credit 90/1, meaning the reflection of revenue from the sale of manufactured products. After the proceeds from the sale are recognized by accounting, it is written off from register 43 to debit 90 “Sales”.

If until some point the revenue cannot be recognized, for example, this happens when exporting goods, then until the moment of recognition it is recorded in account 45 in goods shipped.

Reflected account 43 in the accounting balance sheet

Typical transactions for account 43

Account 43 correspondence

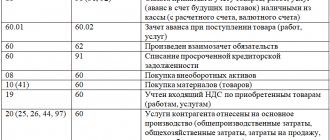

Account 43 corresponds in debit with the accounts of production (20, 23, 29), production output (40), internal expenses (79), authorized capital (80) and other income and expenses (91). Such postings indicate the acceptance of finished products for accounting.

For the loan, account 43 corresponds with the accounts of production (20, 23, 29), materials (10), general production, general and commercial expenses (29, 26, 44), defects in production (28), shipped goods (45), settlements - with debtors and creditors and intra-economic (76, 79), authorized capital (80), sales (90), shortages and losses from damage to valuables (94), deferred expenses (97), profits and losses (99). With similar postings, finished products are written off from account 43.

Postings to account 43

When accepting finished products for accounting, the accountant makes the following posting options:

| Dt | CT | Content | A document base |

| 43 | 20, 23, 29 | Receipt of GP from any production to the warehouse | Purchase Invoice |

| 43 | 79 | Receipt of GP from any division of the enterprise | Transfer and Acceptance Certificate |

| 43 | 98 | Accounting for GP as a discount for the buyer | Packing list |

| 43 | 80 | The entry of a state enterprise as a contribution to the authorized capital | Minutes of the board's decision |

Postings for writing off the cost of finished products from the balance sheet:

| Dt | CT | Content | A document base |

| 45 | 43 | Shipment of GP to third parties | Transfer and Acceptance Certificate |

| 80 | 43 | Transfer of a state enterprise under a simple partnership agreement | Transfer and Acceptance Certificate |

| 94 | 43 | Write-off of GP when a shortage is detected | Commission report, Inventory sheet |

| 44 | 43 | GP consumption for commercial purposes | Expense report |

| 97 | 43 | The cost of the GP used to perform the work is written off as deferred expenses. | Work contract |

The accounting scheme for finished products looks like this:

What is “finished product”?

To carry out accounting operations, it is necessary to clearly understand what is hidden behind the term “finished products”. These are assets included in the inventory, which are the final result of production and are intended for sale. At the same time, they are properly modified, are fully equipped and meet all the requirements put forward by customers. These can be either individual products or semi-finished products. Some of the finished products are sometimes sent to the needs of the enterprise itself.

Do not confuse finished products with goods. These are also assets within the inventory, but only those that were acquired for sale from other companies or individuals. persons, and not produced independently. Goods are accounted for separately.

Examples of transactions on account 43

Example 1. Accounting for finished products at actual cost

Milk LLC produces milk. In October, 145 liters of milk were produced. The expenses of the main production amounted to 3,625 rubles, and auxiliary ones - 870 rubles.

The following entries were made for account 43:

| Dt | CT | Content | Amount, rub. | A document base |

| 20 | 10, 70, 69 | Costs of main production are reflected | 3 625 | Bill of lading, certificate of completion of work, payroll, etc. |

| 23 | 10, 70, 69 | Auxiliary production costs taken into account | 870 | Same as in main production |

| 20 | 23 | The cost of production takes into account the costs of auxiliary production | 870 | Costing |

| 43 | 20 | The batch of milk has been received into the warehouse | 4 425 | Purchase Invoice |

Organization of production of finished products

After the products have passed the final stage of the production cycle, they are transferred to the customer immediately for sale or to the financially responsible person to the warehouse. In this case, the procedure is accompanied by the execution of various documents, including: an acceptance certificate for goods and materials, delivery and delivery notes, payment orders and others. The storekeeper accepts the goods and materials into the warehouse on the basis of these papers, keeping one copy for himself.

The main feature of reflecting products ready for sale in accounting is its assessment in monetary terms. As a rule, when a product is released from production, it is impossible to establish for certain how much it cost to produce it. During the period, adjustments are made to the cost of products. The previously reflected amount is adjusted to the actual amount.

Accounting for finished products (account 43) can be carried out at the following prices:

- actual (production, abbreviated);

- normative;

- wholesale;

- free vacation pay;

- free market.

Each method of evaluating finished products is convenient in its own way. It is up to the management to decide which one to use at an individual enterprise; this point must be indicated in the accounting policy.

Other methods for evaluating products ready for sale

In addition to actual and pre-calculated (normative) prices, the company has the right to use other types of costs. For example:

- Wholesale – involves calculating the difference between actual prices and the cost of wholesale supplies. The stability of wholesale prices allows us to reliably estimate the volume of products produced and most accurately draw up production plans for the following periods.

- Free including VAT - applicable for accounting for products or work that are carried out to order individually. The VAT amount is taken into account separately.

- Free market - used to evaluate products that are sold through retail.

All valuation methods, with the exception of the use of actual cost values, require the calculation of deviations of estimated amounts from production amounts.

Results

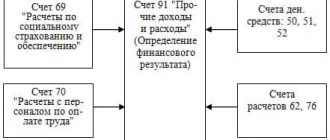

Posting Dt 90 Kt 90 means closing the internal subaccounts of account 90 in accordance with the financial result obtained.

For more information about what a company’s financial results are, read the article “Accounting and analysis of financial results.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Analytical accounting on account 62 and its subaccounts

Under loan 62, the account receives funds from the sale of shipped products, as well as prepayment amounts for goods and services. In this case, payments for services rendered and advances are taken into account in different subaccounts:

- Invoice 62.01 – payment received in accordance with the general procedure;

- Account 62.02 – advances from buyers.

In addition, there is a sub-account for separate accounting of bills received (62.03). If the supplier receives a bill of exchange from the buyer providing for the payment of interest, the amount of interest is reflected in accounting account 91 “Other income and expenses.” Repayment of the principal amount of the debt is reflected by posting Dt account 51 (for foreign currency accounts DT) and Kt 62.

For the convenience of the accountant, analytics for account 62 are carried out in the context of each invoice sent to the buyer, as well as separately for each counterparty and agreement with him. In addition, operations can be classified according to the following criteria:

- payment method (availability of advance payment or payment upon shipment, provision of services);

- payment deadline (payment is overdue or not due);

- presence of a bill of exchange (the bill of exchange has been accounted for in the bank, its maturity has not yet come, or payment on the bill of exchange is overdue).

The accountant has the right to independently choose the criteria on which the analytical accounting of account 62 at the enterprise will be based.