What to reflect on account 71 Order of the Ministry of Finance of the Russian Federation No. 94n approved that account 71

The next reporting campaign has begun, someone hastened to submit the first declarations, others are summarizing the results, pulling out

The patent tax system does not completely exempt people from tax accounting. Entrepreneurs still have the responsibility to conduct

Accounting entries for insurance premiums: DT 20 CT 69.1 - accruals for mandatory social benefits

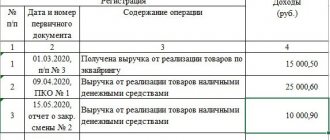

Sales income is the proceeds from the sale of goods, works, services and property rights. Day

Which regions are participating? Since 2011: Karachay-Cherkess Republic and Nizhny Novgorod region. Since 2012:

A shift work schedule is a special scheme for distributing working time in an organization, in which

1. For the purposes of this chapter, depreciable property is property, results of intellectual activity and other

To whom and where to submit reports on contributions The functions of policyholders for compulsory social insurance are assigned

How the Direct Payments project works Algorithm for assigning and paying benefits Step 1. The employer receives