Home • Blog • Blog for entrepreneurs • What taxes does an individual entrepreneur pay on the simplified tax system?

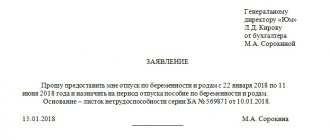

Most Russians believe that a certificate of incapacity for work (sick leave) is issued only for periods of illness or maternity leave.

The work of some employees is inextricably linked with business trips. Travel to other cities, regions and countries

Cash is the most liquid part of operating assets and represents money on hand, and

Among the main reasons for closing an individual entrepreneur is not only the voluntary decision of the entrepreneur, but also the court decision on

The concepts of “operating income and expenses” are used in financial analysis and in international financial standards

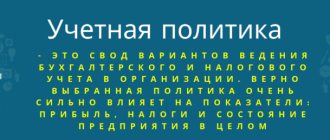

The role and basis for the formation of accounting policies in accounting All organizations, both large and

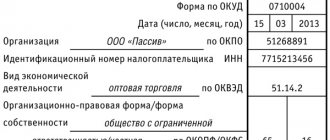

What forms to submit to Rosstat: 1-enterprise and 1-individual entrepreneur - basic data on activities; 1-T

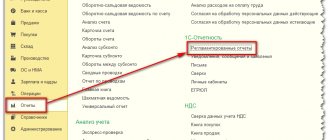

How to work according to the new rules of PBU 18/02 from 2021? In what ways can you take into account

(14 votes, average rating: 4.93 out of 5) lawyer Labor law Questions on the topic “Maternity