The question is how to return income tax on the purchase of a residential building and

Taxes, state duties, insurance and social transfers are marked with a special code. This article provides information:

Tax payment deadlines in 2021: main table New payment deadlines taking into account postponement

Drawing up a vacation schedule is the responsibility of all employers, regardless of the number of employees in the company. This

Electronic document management with counterparties is commonplace for many companies. The basis of traffic between accounting departments

The Russian budget functions, like in many other countries, using a special codified system,

Regional law on property tax based on cadastral value Possibility of paying tax based on cadastral value

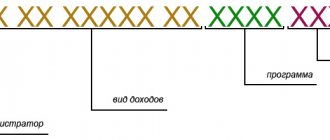

A budget classification code is a combination of numbers that characterizes a monetary transaction. This is a convenient way to group

The special tax regime of the simplified tax system (simplified taxation system, “simplified”) is primarily aimed at individual

There are special requirements for issuing an invoice, since it is necessary for VAT accounting. This means,