The concept of net assets is regulated by the Civil Code of the Russian Federation, defining them as a liquidity criterion for an organization, regardless of its legal form. Net assets are the difference reflected in the balance sheet between the value of all types of property of the institution (fixed and cash assets, land property, etc.) and the amount of established liabilities (accounts payable of the organization). In other words, these are the own capital funds of any enterprise, in other words, the capital property that will remain at the disposal of the institution after the repayment of all debts incurred to creditors and the sale of property assets.

The calculation of the value of net assets on the balance sheet must be carried out annually during the preparation and preparation of annual financial statements. The calculated value of net assets demonstrates the real financial position of the enterprise as of the current date. The amount of net assets in the balance sheet is line 3600 in section 3 of the Statement of Changes in Capital.

Net assets

Net assets (English Net Assets) – reflect the real value of the enterprise’s property.

Net assets are calculated by joint stock companies, limited liability companies, state-owned enterprises and supervisory authorities. The change in net assets allows you to assess the financial condition of the enterprise, solvency and level of bankruptcy risk. The methodology for assessing net assets is regulated by legislation and serves as a tool for diagnosing the risk of bankruptcy of companies.

Balance sheet changes since 2019

From 06/01/2019, the balance sheet form is valid as amended by Order of the Ministry of Finance dated 04/19/2019 No. 61n. The key changes in it (as well as in other financial statements) are as follows:

- now reporting can only be prepared in thousand rubles, millions can no longer be used as a unit of measurement;

- OKVED in the header has been replaced by OKVED 2;

- The balance sheet must contain information about the audit organization (auditor).

The auditor mark should only be given to those companies that are subject to mandatory audit. Tax authorities will use it both to impose a fine on the organization itself if it ignored the obligation to undergo an audit, and in order to know from which auditor they can request information on the organization in accordance with Art. 93 Tax Code of the Russian Federation.

https://www.youtube.com/watch?v=u1NjIGJ1NWs

More significant changes have occurred in Form 2. Read more about them here.

What is net asset value? Calculation formula

Take our proprietary course on choosing stocks on the stock market → training course

| Net asset value is the difference between all the assets and liabilities of a business. |

The assets include non-current and current assets, with the exception of the debt of the founders for contributions to the authorized capital and the costs of repurchasing their own shares. Liabilities include short-term and long-term liabilities excluding deferred income. The calculation formula is as follows:

Where:

NA – the value of the enterprise’s net assets;

A1 – non-current assets of the enterprise;

A2 – current assets;

ZU – debts of the founders for contributions to the authorized capital;

ZBA – costs of repurchase of own shares;

P2 – long-term liabilities

P3 – short-term liabilities;

DBP – deferred income.

Formula for calculating net assets on balance sheet

Take our proprietary course on choosing stocks on the stock market → training course

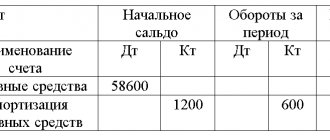

Let's look at how to calculate net assets in the balance sheet of an enterprise. They can be determined on the basis of balance sheet data (Form No. 1). The formula looks like this:

Ways to increase NA

You don’t have to reduce the MC, but increase the NA. This procedure can be performed using one of 2 methods:

- Carry out a revaluation of intangible assets and fixed assets, and this must be done before the end of the financial year. With this procedure, the initial cost of objects is brought into line with their market value, and in addition, the amount of calculated depreciation is recalculated.

IMPORTANT! This procedure must be carried out in the future. It must be carried out by an independent expert who has no interest in increasing the value of the objects.

- Increase the size of assets by contributing funds or property by the founders to directly increase the NAV. In this case, they will be classified as other income, which will entail an increase in the amount of retained earnings and, ultimately, an increase in the size of the NAV.

ATTENTION! These receipts are not taken into account when determining the taxable base for income tax on the basis of subparagraph. 3.4 clause 1 art. 251 Tax Code of the Russian Federation.

For more information about methods for reducing authorized capital or increasing net assets, read the article “What are the consequences of negative net assets?” .

Example of calculating the net asset value of a business in Excel

Let's consider an example of calculating the value of net assets for the organization OJSC Gazprom. To estimate the value of net assets, it is necessary to obtain financial statements from the official website of the company. The figure below highlights the balance sheet lines necessary to estimate the value of net assets; the data is presented for the period from the 1st quarter of 2013 to the 3rd quarter of 2014 (as a rule, the assessment of net assets is carried out annually). The formula for calculating net assets in Excel is as follows:

Net assets =C3-(C6+C9-C8)

Main differences

The main distinguishing feature of the two indicators will be assessment methods , which are developed taking into account individual characteristics.

One of the popular methods that helps estimate the value of an enterprise or business is the net asset method. It is based on the fact that the price of the enterprise will be equal to their price and considers it together with the costs incurred.

market and book value . Due to various fluctuations in the economy associated with such phenomena as inflation, changes in the behavior of subjects in the market, and an incorrectly selected accounting method, it is impossible to talk about their compliance.

As a consequence of this, there is a need to regulate the balance sheet of the enterprise, which is carried out in several stages:

- Preliminary analysis related to the reasonableness of the market value of all assets on the balance sheet.

- Determine the correspondence between the balance sheet amount and its market value.

- Calculate current liabilities from the principal market value of total assets.

The advantage of this method: it refers to the quote of assets that already exist. It is not subjective and is more transparent. But due to its persistence, it misses the assessment of the level of profitability and development prospects.

Regarding the cost of equity method, it is worth saying that it is used in financial statements, which are consolidated. It will also help to consider all lost profits, but then you should take into account the circumstances due to which the individual components are formed.

One of the most difficult points in working with the methodology is to set the price of share capital . This is due to the owners of the purchased shares, who expect to receive income after the net profit is distributed among the owners of the securities. The amount received for such owners is fixed. Since income from shares is expected to be received at the very last moment, this indicator is not fully known.

The method is the basis for the formation of various models that take part in the analysis of the company. These include: discounted cash flow model, economically added value.

Net Asset Analysis

Net asset analysis is carried out in the following tasks:

- Assessment of the financial condition and solvency of the company (see → “Company Solvency Indicators”).

- Comparison of net assets with authorized capital.

Solvency assessment

Solvency is the ability of an enterprise to pay for its obligations on time and in full. To assess solvency, firstly, a comparison is made of the amount of net assets with the size of the authorized capital and, secondly, an assessment of the trend of change. The figure below shows the dynamics of changes in net assets by quarter.

Analysis of the dynamics of changes in net assets

Solvency and creditworthiness should be distinguished, since creditworthiness shows the ability of an enterprise to pay off its obligations using the most liquid types of assets (see → How to assess the creditworthiness of a company). Whereas solvency reflects the ability to repay debts both with the help of the most liquid assets and those that are slowly sold: machines, equipment, buildings, etc. As a result, this may affect the sustainability of the long-term development of the entire enterprise as a whole.

Based on an analysis of the nature of changes in net assets, the level of financial condition is assessed. The table below shows the relationship between the trend in net assets and the level of financial health.

| Trend in net assets | Financial analysis |

| CHA ↗ | Improving the financial condition of the enterprise and the solvency of the enterprise, reducing the risk of bankruptcy |

| Cha ↘ | Deterioration of the financial condition of the enterprise, decrease in solvency, which leads to an increase in the risk of bankruptcy |

Comparison of net assets with authorized capital

In addition to the dynamic assessment, the amount of net assets for an OJSC is compared with the size of the authorized capital. This allows you to assess the risk of bankruptcy of an enterprise (see → 4 bankruptcy assessment models). This comparison criterion is defined in the law of the Civil Code of the Russian Federation (clause 4, article 99 of the Civil Code of the Russian Federation; clause 4, article 35 of the Law on Joint Stock Companies). Failure to comply with this ratio will lead to the liquidation of this enterprise through judicial proceedings. The figure below shows the ratio of net assets and authorized capital. The net assets of OJSC Gazprom exceed the authorized capital, which eliminates the risk of bankruptcy of the enterprise in court.

Reducing the capital as a way to correct the situation

Before a decision is made to terminate activities, a business entity must take measures aimed at correcting the current situation. In accordance with Art. 90 of the Civil Code of the Russian Federation, if the size of net assets is less than the authorized capital, it is necessary to equalize their values, for which the capital can be reduced.

This operation can be carried out only if the new size of the capital is not less than the legal minimum. If the size of the NA is already less than the minimum permissible value of the authorized capital, then it is impossible to equalize their amounts by reducing the size of the authorized capital. In such a situation, the Federal Tax Service may file a lawsuit to liquidate the company. But if an organization pays wages, transfers payments to the budget, settles accounts with counterparties and generally has a good reputation, the courts, as a rule, reject claims regarding liquidation.

Read about the procedure for reducing the authorized capital here.

Net assets and net profit

Net assets are also analyzed with other economic and financial indicators of the organization. So the dynamics of growth of net assets is compared with the dynamics of changes in sales revenue and net profit. Sales revenue is an indicator reflecting the efficiency of an enterprise's sales and production systems. Net profit is the most important indicator of the profitability of a business; it is through it that the assets of the enterprise are primarily financed. As can be seen from the figure below, net profit decreased in 2014, which in turn affected the value of net assets and financial condition.

What do the indicators have in common?

In order to assess financial stability and solvency, specialists in modern theory and economic analysis have created a number of numerous criteria. In this list, they classified net assets and equity as special indicators.

The need to measure net assets is associated with the dual nature of some of the organization's funds that are on its balance sheet. On the one hand, they appear in the form of own funds (as an option, dividends), but on the other hand, they are the direct property of shareholders and employees.

Analysis of the indicator will give a clear understanding of its size, and will help to understand how many times it exceeds the obligations associated with both the long-term and short-term periods. This will help assess the level of solvency.

It is solvency is the common factor that connects equity with net assets. The size of assets can be equated to equity capital. Their main task is to show how the assets, which consist of funds invested by the owners, are backed up, and whether this picture corresponds to reality.

Own capital shows the level of provision of the enterprise with the funds necessary for its normal functioning. If the net asset indicator turns out to be negative, we can say that equity capital is not enough and it is necessary to change the operating strategy.

Analysis of net asset growth rate and international credit rating

In the scientific work of Zhdanov I.Yu. shows that there is a close connection between the rate of change in the net assets of an enterprise and the value of the international credit rating of such agencies as Moody's, S&P and Fitch. A decrease in the economic growth rate of net assets leads to a decrease in the credit rating. This in turn leads to a decrease in the investment attractiveness of enterprises for strategic investors.

Summary

Net asset value is an important indicator of the amount of real property of an enterprise. Analysis of the dynamics of changes in this indicator allows us to assess the financial condition and solvency. The value of net assets is used in regulated documents and legislation to diagnose the risk of bankruptcy of companies. A decrease in the growth rate of an enterprise's net assets leads to a decrease not only in financial stability, but also in the level of investment attractiveness. Subscribe to the newsletter on express methods of financial analysis of an enterprise.

Author: Ph.D. Zhdanov Ivan Yurievich

Matching two categories

When NA is lower than UC

If a business entity experiences a negative situation when the value of the asset price becomes lower than the value of the capital asset, it should take certain actions. They are coordinated with the change in the authorized capital and specifically with its reduction to the NAV value. The volume of the Criminal Code is reduced, and this action is necessarily enshrined in the constituent documents and recorded in the regulatory government bodies.

A particularly important point: the company has the right to reduce the amount of authorized capital to the size of the charter capital only under those circumstances if this does not lead to the creation of a charter capital below its minimum permitted legal size. In a situation where the authorized capital cannot be reduced to the NAV value, since its value will be less than the minimum amount, the enterprise will close.

The value of net assets below the authorized capital is not yet a reason for liquidation, as this video will tell you:

When NA is higher than UC

The opposite situation is also possible, that is, when the value of the private equity is higher than the amount of the authorized capital. In this case, of course, it would be possible to increase the size of the criminal capital by any of the legal means.

However, experts do not advise doing this, since the value of net assets is calculated at the end of each calendar year. It is possible that in the subsequent period the value of net assets will become lower than the value of the authorized capital, and then it will need to be reduced again. Each action to increase or decrease the authorized capital must be registered with the regulatory authorities, and therefore with such an action it will be necessary to perform this operation twice.

Analysis of the results obtained

The resulting value determines the organization's solvency, profitability, and sometimes further development. The indicator should be used to judge the company’s ability to pay off its obligations, invest in expanding production, or open new directions.

Therefore, the normal value of net assets must be positive. When the NAV value is negative, the firm is considered insolvent, dependent on loans and has no income of its own. The higher the indicator, the more solvent and attractive the company is to investors.

The indicator analysis includes:

- Monitoring changes in the size of the net assets; for this purpose, they are compared at the beginning and end date of the reporting period. And based on the results obtained, the reasons that contribute to the increase or decrease of own funds are identified.

- An assessment of the reality of the dynamics of the net asset value is used to calculate the proportion of net and total assets at the beginning and end of the reporting period. A large increase in the indicator at the end date is associated with an increase in total funds, and the increase in the NAV is actually insignificant.

- Evaluating the effectiveness of use. Determined by calculating and studying turnover and profitability ratios.

Since during the analysis this value is compared with data on revenue and net profit for the year, when making calculations it is more correct to use not a fixed figure of net assets as of the end date, but the average value for this period.