What is a staffing table? This is a document that is used to formalize the company structure, composition and

VAT are three letters that each of us has definitely heard. Even if you don't

Dear Colleagues! We are starting a series of publications on an important topic for every organization - briefings

When to apply the new FSBU 6/2020 by Order of the Ministry of Finance of Russia dated September 17, 2021 No.

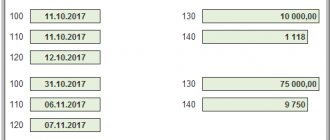

2-NDFL certificates are filled out for all employees who received income subject to income tax in the calendar year.

One of the most important points to decide on sooner or later one way or another

Certificate 2-NDFL discloses information about the salary and other income of an employee of the organization. In it

We all receive income from different types of sources. In the Russian Federation, as in

In the previous publication about the self-employed, we found out who they are, what they can do, and how

Has a new form 4-FSS “for injuries” been introduced? When and what changes were made to the form