2-NDFL certificates are filled out for all employees who received income subject to income tax in a calendar year in accordance with Chapter. Tax Code of the Russian Federation. In the certificate form approved by Order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11/ [email protected], the accrued amounts are reflected along with the codes. The type of income is determined by the encrypted indicator. Sometimes doubts arise about which bonus code to choose in 2-NDFL in 2020 in one case or another. In the current directory there are several values that can include the amount of accrued remuneration.

Coding of payments to individuals for personal income tax

Each remuneration paid to an individual has a corresponding coding. The full list is contained in Appendix 1 of the Federal Tax Service order No. ММВ-7-11 dated September 10, 2015. What code the bonus has in 2-NDFL depends on what it was accrued for: for production results or on other grounds.

The certificate indicates the income code bonus for production results 2002, if the remuneration is related to the employee’s performance of his job duties: for performing certain work, for exceeding the plan, etc. Thus, if a monthly, quarterly or annual bonus is paid, the personal income tax code is always will be 2002 (letter of the Federal Tax Service dated 08/07/2017 No. SA-4-1/).

If a one-time bonus is paid that is not related to the performance of work duties: for a holiday, a bonus for an anniversary date, indicate a different income code - 2003.

Table: income code bonus in the 2-NDFL certificate

| Code | Type of payment |

| 2002 | Bonus for labor performance:

|

| 2003 | Bonus due to profit:

|

Table of other income in certificate 2-NDFL

| Encoding | Type of payment |

| 2000 | Wage |

| 2010 | Payments under contract agreements |

| 2012 | Vacation pay |

| 2013 | Compensation for unused vacation |

| 2300 | Payment of sick leave |

How to choose the right income code?

In this matter, two main guidelines can be identified that allow one to accurately determine the bonus category:

- Purpose of the award and reason for issuance. So, for example, if the purpose of the bonus is to encourage the employee’s activities favorable to the company, and, at the same time, the reason for issuing the money was the employee’s high production efficiency, this is a bonus under code 2002. If the purpose of the bonus is simply to increase the loyalty of the employee, and the reason for issuing does not apply to the production indicators of the enterprise - this is a bonus according to code 2003;

- Source of funding for bonus payments. Obviously, when using funds from targeted cash receipts, such a premium should be attributed to code 2002: since targeted receipts arise only as a result of the company’s effective activities, this is considered the result of the implementation of all production plans of the organization. And the same is true in the opposite direction: if the funds were taken from a special purpose fund, in no case should such a bonus be entered in column 2002, even if in fact it was an encouragement for the employee’s activities. The place for such an award is only in the 2003 column.

A reasonable question may arise here: if the purpose and reasons for bonuses refer to code 2002, but the source of funding refers to code 2003, where should the receipt of money be entered? You can swap these codes, the important point is the discrepancy between the goal and the procedure for issuing the bonus specified by the Order of the Federal Tax Service.

In such a situation, the source of financing remains a priority. In essence, the Federal Tax Service only in rare cases shows great attention to bonuses if everything looks more or less smooth. But if the reasons for the bonus indicate “production efficiency,” but the bonus is classified in the 2003 category, this may already become a reason for a large-scale inspection of the enterprise.

Remember: if the money was paid from earmarked funds or special-purpose funds, in 95 cases out of 100 you need to record the premium under code 2002. For payments from funds, write it down under code 2003.

Coding of personal income tax deductions

The 2-NDFL certificate encodes not only payments to individuals, but also deductions provided.

Currently, an employee has the right to receive standard, property and social deductions from the employer. Tax deduction coding table

| Encoding | Deduction |

| Standard | |

| 126 | For the first child |

| 127 | For a second child |

| 128 | For the third and subsequent children |

| Property | |

| 311 | For the purchase of housing |

| 312 | For mortgage interest |

| Social | |

| 320 | For your training |

| 321 | For a child's education |

| 324 | For treatment |

A complete list of deduction codings is contained in Appendix 2 of the Federal Tax Service order dated September 10, 2015 No. ММВ-7-11/

Structure of the new table of deduction codes

Thus, the new table of deduction codes consists of 14 sections named by types of deductions, and 1 additional code 620, which includes other types of deductions not listed in the table.

The sequence of sections and numbering of codes in them is as follows:

- standard deductions under Art. 218 Tax Code of the Russian Federation - codes 104, 105,126–149;

- reducing the base according to Art. 214.1 Tax Code of the Russian Federation - codes 201–203, 205–210;

- reducing the base according to Art. 214.3 Tax Code of the Russian Federation - codes 211, 213;

- reducing the base according to Art. 214.4 Tax Code of the Russian Federation - codes 215–220; 222–241;

- reducing the base according to Art. 214.9 Tax Code of the Russian Federation - codes 250–252;

- property deductions under Art. 220 Tax Code of the Russian Federation - codes 311, 312;

- social according to clause 2 p. 1 art. 219 Tax Code of the Russian Federation - codes 320, 321;

- social according to clause 3 p. 1 art. 219 Tax Code of the Russian Federation - codes 324–326;

- social according to clause 4 paragraphs 1 art. 219 Tax Code of the Russian Federation - code 327;

- social according to clause 5 p. 1 art. 219 Tax Code of the Russian Federation - codes 328;

- professional deductions under Art. 221 Tax Code of the Russian Federation - codes 403–405;

- deductions for non-taxable income under Art. 217 Tax Code of the Russian Federation - codes 501–510;

- reducing the base according to Art. 214 Tax Code of the Russian Federation - code 601;

- investment deductions under Art. 219.1 Tax Code of the Russian Federation - code 618;

- other deductions - code 620.

The table ends with 5 notes referring to the document details on the basis of which social deductions and deductions with codes 509 and 510 should be applied for non-taxable income.

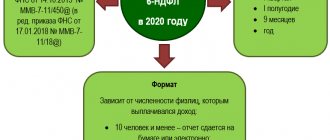

Deadline for submitting 2-NDFL in 2021

Employers report to the tax authorities on amounts paid to employees and personal income tax withheld from them in the form approved by Order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11/

Each type of employee remuneration corresponds to a four-digit digital coding. What income code the premium has depends on what the reward was paid for.

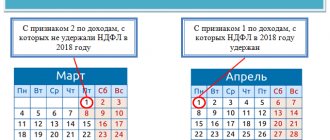

Starting with reporting for 2021, new deadlines for submitting certificates in form 2-NFDL have been established. Now there is one month less time allotted for reporting preparation. Previously, certificates were submitted no later than April 1. Now it is required to submit reports no later than March 1 (clause 2 of Article 230 of the Tax Code of the Russian Federation). If the due date falls on a weekend, the due date is postponed to the first next working day. So, in 2021, March 1 falls on a Sunday, so certificates of payments and taxes for employees are submitted no later than 03/02/2020.

Previously, before March 1, it was necessary to report only if income was paid to an individual from which it was impossible to withhold tax. This order has continued in 2021.

Thus, starting from 2021, one deadline has been set for all cases - no later than March 1.

Application of standard deductions when calculating bonuses

The bonus can be paid along with the advance payment, with the salary or during the interpayment period. Tax should be withheld simultaneously with the transfer of income to the employee. And in order to withhold tax, it is necessary to calculate the tax base. It is at this moment that the Tax Code of the Russian Federation provides for the provision of deductions (clause 1 of Article 218 of the Tax Code of the Russian Federation). But pre-payroll deductions may be unnecessary due to the fact that after payroll the employee's total income exceeds the deduction limit. Let us remind you that in 2021 the maximum tax base is 350,000 rubles.

The 1C: Salary and Personnel Management 8 program, edition 3, automatically processes such situations, and personal income tax is recalculated when payroll is calculated. Let's consider cases of additional personal income tax accrual and their reflection in the 6-NDFL report.

Case 1. A deduction was provided when calculating the bonus

Employee S.S. Gorbunkov has registered the right to social deduction with code 126 for the first child. After calculating wages for September, the tax base for determining the right to deduction amounted to 300,000 rubles. In mid-October, a decision was made to pay a bonus of 10,000 rubles.

In accordance with the bonus regulations adopted by the organization, the bonus with code 2002 has the category Other income from labor activities and is paid during the interpayment period. The payment date of the said premium is scheduled for 10/11/2017. When paying the premium, personal income tax must be withheld. Therefore, it is necessary to calculate the tax when it is calculated.

Since the calculation base as of October 11, 2017, taking into account the bonus, is 310,000 rubles, the social deduction for a child is 1,400 rubles. should be applied. Please note that at the time of accrual and payment of bonuses, the accountant cannot foresee how much the employee’s salary will be accrued, since unplanned events may occur (for example, unpaid leave, absenteeism, death, etc.). The calculated personal income tax is 1,118 rubles. ((RUB 10,000 - RUB 1,400) x 13%)). When transferring funds that must be paid to an employee, the tax is withheld and no later than the next day is transferred to the budget system of the Russian Federation.

Payroll period begins in early November. Employee S.S. Gobunkov worked regularly all month, and he receives his salary for October in full - 75,000 rubles. Taking into account the salary received, the tax base for calculating the right to deduction is 385,000 rubles. (RUB 300,000 + RUB 10,000 (bonus) + RUB 75,000 (salary)), which exceeds the limit of RUB 350,000. Thus, in October S.S. Gorbunkov loses the right to deduction. The deduction was excessively applied and must be reversed. When calculating wages, additional taxes are calculated.

The accrued personal income tax on salary is 9,750 rubles. (RUB 75,000 x 13%)).

Personal income tax on the premium is additionally charged in the amount of 182 rubles. (RUB 10,000 x 13% - RUB 1,118). The deduction applied to the premium is 1,400 rubles. now applies to all income for October (RUB 85,000). The deduction is distributed in proportion to income: 164.71 rubles. accounts for the premium and 1,239.29 rubles. - for payment according to salary.

Salaries are transferred to employee accounts on November 6, 2017. The payroll registers the amount of tax to be transferred separately by Type of income: Other income from labor activity - 182 rubles. and Salary - 9,750 rubles. Additional accrued 182 rubles. taxes must be transferred no later than the day following the day of payment of wages. This is exactly the picture that Section 2 of the annual report 6-NDFL displays (Fig. 2).

Rice. 2. Section 2 of form 6-NDFL for the year for Case 1

Lines 110 and 120 determine the period when tax in the amount indicated in line 140 is due to be transferred. That is, the additional accrued 182 rubles. must be transferred within the period 06.11.2017-07.11.2017. In this case, the value of line 130 of the block corresponding to additional tax calculation is equal to 0. Income in the amount of 10,000 rubles. and the tax withheld from him on October 11, 2017 in the amount of 1,118 rubles. are displayed as a separate block.

These blocks cannot be merged. If you add 182 rubles. in the block displaying the calculation of the premium, then a debt is generated for the tax agent, because the indicated 182 rubles. could not be transferred within the period 10/11/2017-10/12/2017, since at that time such debt did not exist. Inclusion of the premium amount of 1,000 rubles. and withheld tax of 1,118 rubles in the additional accrual block will lead to a violation of the reflection of the date of actual receipt of income and the date of tax withholding. And this is fraught with fines.

Generated in the 1C: Salaries and Personnel Management 8 program, edition 3, the 6-NDFL report is fully consistent with the situation in Case 1 and does not create any trouble for the tax agent due to the fact that social deductions legally applied in the middle of the month turned out to be unnecessary at the end of the month .

Case 2. Double deduction provided when calculating bonuses

Employee S.S. Gorbunkov has registered the right to social deduction with code 126 for the first child. After calculating wages for September, the tax base for determining the right to deduction amounted to 300,000 rubles. In mid-October, a decision was made to pay a bonus of 10,000 rubles. In accordance with the bonus regulations adopted by the organization, the bonus with code 2002 has the category Other income from work and is paid along with the October salary on the day established for the payment of salaries in November. Features of bonus distribution in the organization provide that accrual is made according to a separate document before salary calculation. At the time of accrual of the bonus (11.10.2017), which is planned to be paid on 06.11.2017, the employee’s total income including the bonus is 310,000 rubles. Social deductions per child in the amount of 1,400 rubles. should be applied twice: both for October and November. The use of deductions for two months is due to the fact that tax must be withheld when paying income. Accordingly, the calculation should be made on the date of payment of income. There is no information about subsequent charges yet. The calculated personal income tax is 936 rubles. ((RUB 10,000 - RUB 2,800) x 13%)).

The payment of the bonus is planned along with the salary. Payroll calculation occurs on November 3, 2017 before funds are transferred to the employee. Excessively applied deductions to income of the type Other income from labor activities are reversed, and an additional tax is charged in the amount of 264 rubles. The payroll registers in the 1C: Salary and Personnel Management 8 program, edition 3, the withholding of tax on the day of salary payment by income category, taking into account the documents accruing it. Please note that in the personal income tax decoding form in the payroll, the Income Category is named Type of Income.

Income tax of the type Payroll with the date of receipt of income on the last day of the month (October 31, 2017) is 9,750 rubles. Personal income tax on Other income from employment with the date of receipt of income on the day the money is transferred to the employee’s account (11/06/2017) is saved separately in two amounts in accordance with the accrual documents: 936 rubles. (document Award) and 364 rubles. (document Calculation of salaries and contributions). In this case (Case 2), in Section 2 of the annual report 6-NDFL, the premium tax is combined into one block due to the coincidence of the dates of actual receipt of income, tax withholding and transfer deadline (Fig. 3).

Rice. 3. Section 2 of form 6-NDFL for the year for Case 2

How to fill out a 2-NDFL certificate in 2021

The reporting form consists of a general part, three sections and an appendix. The bonus code in 2-NDFL, as well as other payments, is indicated in the application. Filling should be done in the following order:

- A common part. It indicates the details of the organization and the Federal Tax Service, the certificate number, and the reporting period.

- Section 1. It is intended to reflect the data of an individual: full name, taxpayer status, passport details.

- Application. It contains information about income and the corresponding tax deductions, including the bonus income code in 2-NDFL.

- Section 3 reflects the annual amounts of tax deductions provided.

- Section 2 is intended to reflect the total amount of payments to an individual, the calculated tax base, calculated, withheld and transferred to the budget tax

What has been changed in the list of deduction codes since 2018?

The adjusted table of deduction codes has retained the main set of codes used in the old table, but at the same time a number of codes have been excluded from it, new ones have been added, old codes have been replaced with new ones, and deduction description texts have been adjusted.

Broken down by type of deduction, the changes look like this:

- Standard codes - excludes codes 114-125. Codes 126–149 have been introduced instead. Now they differ depending on who the deduction is provided to: natural parents (adoptive parents) or persons who replace them.

- Reducing the base according to Art. 214.1 of the Tax Code of the Russian Federation (transactions with securities and financial instruments of forward transactions) - in codes 205–207, instead of expenses on operations with financial instruments of forward transactions, expenses on operations with derivative financial instruments are now indicated, and codes 209–210 reflect no loss on operations with financial instruments of futures transactions, and losses on transactions with derivative financial instruments. Additionally, code 208 was introduced, which reflects losses on transactions with derivative financial instruments.

- Reducing the tax base for securities lending transactions in accordance with Art. 214.4 - instead of code 221, which was used to reflect the amount of expenses on transactions with securities accounted for in an individual investment account, codes 225–252 were introduced. Codes 250–252 have been added, reducing the tax base for transactions accounted for on an individual investment account in accordance with Art. 214.9 Tax Code of the Russian Federation.

- From investment tax deductions provided for in Art. 219.1 of the Tax Code of the Russian Federation, code 617 is excluded.

What sections are included in the form?

Document 2-NDFL is presented in several sections, which are sequentially filled out in the accounting department of your place of work. They include the following information:

- name of the employing company;

- organization details;

- information about the employee;

- the amount of income received, subject to monthly taxation at a tax rate of 13%;

- tax deductions of three types (property, standard, social);

- the full amount of funds received, withheld in favor of the state and compensation.

Let's sum it up

Legislative changes in coding for various reporting forms occur quite often. Life does not stand still, and with it, control documentation. It is necessary to constantly monitor changes in this area, maintaining the established rhythm of life of the company. Falling out of it is fraught with problems with the inspection, unnecessary fines and headaches for the manager. We wish you to keep up with the times and good luck in your work!

It is important to closely monitor changes in legislation

Deadlines for obtaining a certificate

As already mentioned, the employee receives this form independently, in the accounting department of the company where he is employed. You won't have to wait long to receive it, just three days. To start the paper preparation process, you need to appear in person at the accounting department and write an application addressed to the manager.

Time limits for obtaining a certificate from the accounting department

When receiving a document, check the following important elements, without which it has no real weight:

- The signature of the head of the organization is required;

- The company seal must be placed on the pages of the form.

Social deduction codes

From 2021, in a manner similar to the provision of property deductions (with a permit issued by the Federal Tax Service after checking documents confirming the right to deduction), it is possible to receive social deductions at the place of work. Their codes have not changed:

- code 320 - deduction for expenses for own education or full-time education of a sister (brother) under the age of 24;

- code 321 - deduction for expenses for full-time education of children (including foster children or wards) under the age of 24 years;

- code 324 - deduction for medical expenses for yourself, your spouse, parents or children (including adopted or warded children) under the age of 18;

- code 325 - deduction for contributions paid for voluntary health insurance for oneself, spouse, parents or children (including adopted or warded) under the age of 18;

- code 326 - deduction for expenses for expensive treatment;

- code 327 - deduction for expenses on paying contributions to non-state pension funds or under long-term voluntary life insurance contracts for yourself, your family members, close relatives;

- code 328 - deduction for additionally paid by the taxpayer savings contributions to the Pension Fund.

See also “Documents for obtaining a tax deduction for treatment” and “Application for a personal income tax refund for education - sample and form.”

Property deduction codes

There are 2 main types of property deductions related to the purchase of housing, which, with permission obtained from the Federal Tax Service, can be fully used at work:

- code 311 - deduction for direct expenses on the purchase or construction of housing;

- code 312 - deduction for interest paid for a mortgage related to the acquisition of housing, which also takes into account interest paid when refinancing mortgage loans.

To learn how to get a deduction for an apartment purchased with a mortgage, read the material “Tax deduction when purchasing an apartment with a mortgage (nuances)” .