Rosstat, by order of 06/09/2015 No. 263, approved a new form of statistical observation for individual entrepreneurs

Who provides SZV-M The main reason for creating this report was to obtain information from business entities

When explanations are required During an inspection, the inspector has the right to request written explanations. Situations in

The work book insert is an additional form that is needed if the main one has run out. Let's talk

Article 346.24 of the Tax Code of the Russian Federation obliges firms and individual entrepreneurs who have chosen the simplified tax system to keep tax records

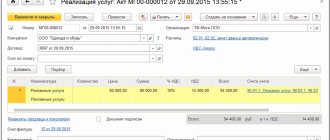

Chart of accounts in 1C Accounting 8 Accounting mechanism implemented in 1C Accounting on the plan

In accounting, fixed assets worth no more than 40,000 rubles can be taken into account in

VAT reporting has already been submitted, but suddenly you discovered that one of the invoices on

Why is the issue of collecting insurance premiums accrued by the fund relevant in 2021? From 2021

The state controls all processes occurring within it. The business sector is no exception. Any