In trading, it is important not only to sell and buy goods, but also to store them in the process between these operations. In theory, the owner of the goods must provide storage. But in practice, the service of storing cargo, goods, equipment, etc. is often in demand. In addition, there are situations when the buyer refuses the delivered goods and must save them until they are returned to the seller.

Let's consider all the nuances of the term “secure storage” and the features of this procedure.

obligations for responsible storage of goods arise and are fulfilled ?

What is responsible storage of goods?

When engaged in wholesale or retail trade, you need a warehouse to be able to store inventory items until they are sold.

Considering the costs of maintaining a warehouse, in fact, this is not always profitable, just like renting premises that are partially used, if not all of the rented space is occupied, since the cost of production increases.

Sometimes it is more acceptable for an enterprise to use a comprehensive service provided by firms specializing in this field of activity.

Having concluded the appropriate agreement, the client transfers material and commodity assets for safekeeping, secured by:

- creating optimal temperature and humidity conditions;

- loading, unloading;

- assembly of components according to the submitted application;

- release of products;

- preparation of relevant export documentation.

The terms of the legal relationship between the depositor (transferring commodity valuables for temporary storage) and the custodian, who has undertaken obligations for the safety of the goods, are regulated by a storage agreement of a civil legal nature.

Despite the fact that the party that accepted the product is responsible for its integrity, serviceability, damage or damage, loss, in this case we are talking about a storage agreement, in accordance with the norms of Chapter. 47 Civil Code of the Russian Federation.

Warehouse accounting for retail trade

A retail warehouse is designed to store and accumulate commodity assets in order to increase the range of products. The main purpose of maintaining such a warehouse is to be able to replenish the stocks of a retail outlet in a timely manner. This explains the need for special warehouse equipment, such as to ensure easy accessibility of the entire product range and prevent the products from affecting each other.

The retail warehouse also provides for the completion of the TORG-29 report, which reflects the movement of goods and is filled out by the financially responsible person according to the same rules that apply in wholesale warehouses.

Transportation of products from a warehouse to a retail store is issued with a TORG-13 consignment note, containing information about the sender of the goods, its recipient, the number of units of the goods, its cost and nomenclature. It is necessary to make two copies, one to leave with the sender (he will attach it to the receipt papers), the second to give to the recipient (he will attach the document to the receipt papers). Invoice TORG-13 is an integral appendix of the report in form TORG-29.

It often happens that a retail store does not have a separate warehouse, and in such cases the products are delivered directly to the point of sale, where the financially responsible employee (represented by the store manager or seller) submits the TORG-29 report to the accountant as reporting on the flow of goods. He also attaches all the primary documentation required in this situation. The report displays retail prices. The expense part of the document will include not only information about shrinkage, shaking, write-off and other cases of disposal, but also information about revenue for each reporting day separately.

Proof of receipt of income will be cash or sales receipts attached to the TORG-29 consumable every day. They are the basis for the execution of an oral purchase and sale agreement with the buyer, which ends with the deposit of money into the cash register and the transfer of rights to the purchased product. A retail store is required to maintain cash reports, which will reflect information about incoming and outgoing transactions that took place during the reporting period. They must certainly be accompanied by documents confirming the commodity transaction.

Definition of safekeeping from a legal perspective

The potential buyer has the right to refuse the delivered products in accordance with the terms of the contract or based on other legislative acts.

At the same time, he is obliged to notify the supplier about this, accept the goods for safekeeping until the seller takes the products, or dispose of them within a reasonable time at his own discretion.

It is precisely this finding of products with the buyer, which in fact does not belong to him, if he refuses the transaction to purchase the goods, that is defined by civil law as responsible storage.

By and large, it does not matter for the seller whether there is either a warehouse directly at the buyer returning the goods, whether this space is rented, or whether companies specializing in this area will be involved, providing services for responsible storage of goods.

According to Art. 514 of the Civil Code of the Russian Federation, the buyer has the right:

- send the goods to the seller yourself;

- sell products not picked up by the supplier on time;

- demand reimbursement from the supplier for costs associated with acceptance of goods, safe storage or return.

Note. In case of sale of products during safekeeping, the cost of the goods is returned to the supplier, taking into account the difference in funds due to the buyer.

Sample custody agreement

Mandatory and optional acceptance of goods for safekeeping

According to the law, a potential buyer, having refused to purchase a product after delivery, is obliged to ensure its return in the same form and quantity, warning about the refusal of payment.

When concluding an agreement, the parties can stipulate the conditions when goods that do not meet the quality and assortment will be returned without accepting it for safekeeping, which is not the responsibility of the buyer.

Every rule has exceptions.

Considering that such safekeeping is not provided if the conditions are violated by the supplier himself, the buyer, without warning, without paying for the order, has the right to send it back if:

- the assortment does not comply with the contractual conditions (according to clause 1 of Article 468 of the Civil Code of the Russian Federation);

- the goods are accepted in the presence of the supplier who has delivered the products in quantities larger than the ordered quantity, about which a report is drawn up and the unpaid inventory items are immediately taken back;

- delivered goods that do not meet the required characteristics must be stored in certain conditions, the costs of which will exceed the transportation costs of returning to the supplier.

We are strictly obliged to organize the safety of delivered materials, equipment, products, etc., when:

- it is impossible to immediately check and test for compliance with technical data and the quality of the supplied products;

- the cargo was delivered by third-party transport companies, since otherwise it would be necessary to compensate for losses incurred due to vehicle downtime.

Warehouse accounting for wholesale trade

Goods brought to the warehouse are registered using one of the following methods:

- varietal,

- party,

- batch-varietal.

If the assortment is small and the goods are supplied in small volumes, they can be taken into account in the accounting register using the TORG-18 form. The storekeeper can make entries. If the organization has a large turnover and there is a significant assortment of goods in the warehouse, warehouse accounting cards (form M-17) and batch cards (if the batch accounting method is approved) must be filled out.

Document flow during responsible storage of goods

If the received goods are temporarily placed in a warehouse, this naturally requires certain costs for loading and unloading operations, its maintenance in certain conditions, and subsequent shipment to the supplier.

Materials transferred for safekeeping must be properly accounted for in the quantities specified in the goods acceptance documents.

If the customer, having refused to pay for the products for legal reasons, does not have suitable premises for storage and the creation of appropriate conditions so that nothing is lost until it is returned to the supplier, he enters into a storage agreement with companies providing such services.

When transferring material assets to the warehouse, a transfer and acceptance certificate is drawn up. You can use the MX-1 form or prepare it arbitrarily, observing the basic requirements.

Certificate of acceptance and transfer of goods for storage

The transfer process must take place in the presence of representatives of the parties authorized to attest to the fact of shipment of products.

In essence, the act is a document where the transfer of material assets is confirmed in writing, their value, quality and quantity are recorded.

The act must contain:

- information about the parties transferring and receiving material assets - names, details of enterprises, positions and surnames, first names, patronymics of persons authorized to represent interests;

- a list of transferred valuables specifying the quantity for each item from the accepted assortment and cost;

- presence of damage, defects, malfunctions.

The document is signed in two copies, for each of the parties.

Having properly executed the act of acceptance of material assets, the party that received them assumes full responsibility for the subsequent transfer to the supplier.

The length of time the products are in the warehouse can be stipulated by contractual terms.

When handing over the goods to the supplier, an act must also be drawn up (for example, you can take the unified form MX-3).

In addition to listing the name, quantity, and cost of the returned products, they document the amount and amount of work performed to ensure safety.

Responsible storage in accounting

Order of the Ministry of Finance of the Russian Federation No. 94, as amended on November 8, 2010, approved instructions for the use of accounting accounts for the financial and economic activities of organizations.

Accounting for responsible storage of goods

Buyer's accounting

Having accepted goods and materials (inventory), however, the buyer does not have the right to dispose of them, since it remains the property of the supplier.

Therefore, they are accounted for separately from the organization’s property on off-balance sheet accounts under code 002.

In accordance with clause 54 of the Guidelines for accounting of inventories, approved by Order of the Ministry of Finance of Russia No. 119n, (last edition dated October 24, 2016), recorded by the storekeeper in a separate journal (card), materials accepted for safety must be kept separately.

If we are talking about perishable food products or maintenance costs, creating favorable conditions above their cost, it is permitted:

- use the specified materials for production and other purposes;

- sell.

Attention! These materials must be capitalized at market value.

The proceeds from the sale or market value (if used for one's own needs), less expenses incurred, must be returned to the owner.

Let’s show an example of how the acceptance of inventory items for safekeeping is documented, what it is in accounting.

Products with a total cost of 203,000 rubles were delivered.

The amount of services provided is 18,520 rubles (including VAT 2,825.00).

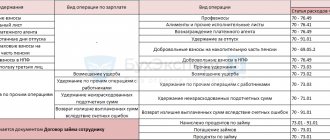

| Dt | CT | Operation description | Sum | Documentary basis |

| 002 | Inventories accepted for safety | 203 000 | Warehouse certificate, acceptance certificate f. MX-1 | |

| 62 | 90.1 | Remuneration for services | 18 520 | Certificate of performance of services |

| 90.3 | 68.02 | VAT | 2825 | Certificate of performance of services |

| 51 | 62 | Payment for services rendered | 18 520 | Payment order |

| 002 | Inventories returned to the owner | 203 000 | Act of acceptance of transfer f. MX-3, painting in the magazine f. MX-2 |

Accounting with the custodian

The accounting entries of a company providing comprehensive services for the safety of entrusted goods will be documented:

| Dt | CT | Operation description | sum | Documentary basis |

| 41 Main warehouse | 41 Responsible storage warehouse | Inventories transferred for safekeeping | 203 000 | Warehouse certificate, acceptance certificate f. MX-1 |

| 44 | 60 | Costs of providing services according to the contract | 18 520 | Certificate of performance of services |

| 60 | 51 | Payment for services | 18529 | Payment order |

| 19.03 | 68 | VAT for services provided | 2825 | Transfer and Acceptance Certificate |

| 68 | 19.03 | VAT is accepted for deduction | 2825 | Invoice |

| 41 Responsible warehouse | 41Main warehouse | Inventories returned to the owner | 203 000 | Delivery acceptance certificate, warehouse receipt, invoice |

Postings for storage

Revenue is reflected in accounting if the following conditions are met: – the organization has the right to receive it; – the amount of revenue can be determined; – the service is actually provided to the customer; – the costs associated with the operation can be determined.

Such rules are established by paragraph 12 of PBU 9/99. When providing storage services, all of the above conditions can be considered fulfilled on the last day of each month during the contract period.

Moreover, the custodian has the right to receive remuneration, even if the storage agreement is terminated early (clause 3 of Article 896 of the Civil Code of the Russian Federation). Remuneration will also be received if the owner refuses the goods and materials transferred for storage. The custodian may sell such property (with notification to the owner) (clause

2 tbsp. 899 of the Civil Code of the Russian Federation). Consequently, the custodian should reflect the revenue from the provision of services under the storage agreement in accounting based on the results of each reporting period, that is, monthly (clause 29 of the Regulations on Accounting and Reporting)