Who provides SZV-M

The main reason for creating this report was to obtain information from business entities about retirees who continued to work.

The thing is that since February 2021, the indexation of pension payments has been cancelled. However, the report must include all people, regardless of age or pension eligibility. This report is required to be submitted by all organizations, as well as individual entrepreneurs who have concluded contracts with employees in the past period. Thus, if an individual entrepreneur operates alone and is not registered as an employer, he does not need to submit this form.

The report must include data both on employees with employment contracts and on people with whom civil law contracts have been concluded - in case they involve payment of contributions to the pension fund.

Also, companies that do not conduct business activities and do not even have a single employee are required to submit the form. The fact is that, according to the adopted law, the director is in any case an employee.

Attention! Each branch submits separate information on employees listed among its personnel. In this case, when filling out the document, the TIN of the main company is indicated, and the checkpoint of a separate division.

Who must submit a report for June

All employer-insurers must submit the SZV-M for June 2021. In particular:

- companies and their divisions;

- private entrepreneurs (who have employees or contractors);

- lawyers, detectives, notaries.

Please note that as part of the SZV-M form for June 2021, inspectors from the Pension Fund of the Russian Federation want to see information about all individuals who performed work on the basis of employment agreements from June 1 to June 30. And it doesn't matter:

- whether the company (IP) actually carried out activities in June;

- were there any accruals and payments to “physicists” in June?

If individuals perform work (provide services) under civil law contracts, then do not get confused. In 2021, a clarification was issued (PFR letter No. LCH-08-19/10581 dated July 27, 2016) that data on such employees must be included while simultaneously meeting the following conditions:

- The performers were paid remuneration;

- Contributions are calculated on the amount of the reward.

However, as of June 2021, the PFR authorities believe this: if in June 2021 you did not pay remuneration under a civil law contract and did not accrue contributions for it, then such freelancers should still be included in the SZV-M form for June 2021 .

That is: in order to understand whether or not to include a specific insured person in the SZV-M, you must proceed from the following:

- What type of contract has been concluded?

- Was the agreement valid in the reporting month (if at least 1 day, then it must be included in the SZV-M).

- It does not matter in the reporting period - June 2021 - the existence of facts of accrual and payment of wages (remuneration) under this agreement, as well as the accrual of insurance premiums.

SZV-M if there are no employees

If an individual entrepreneur does not have hired employees and is not registered as an employer, then he does not need to submit this report. All other categories of business entities are required to submit this form, and it must contain at least one line. The concept of zero reporting SZV-M does not exist!

Even if the company does not operate and submits blank reports, including RSV-1, the form in question must contain one line for the director himself, who is usually also the only founder. It makes no difference whether any accruals were made on it in a given period or not. If the report is not submitted within the established time frame, the company will be subject to an appropriate minimum fine.

Also, it does not appear to be peasant farms, where, in addition to the head, members of his family work.

Zero report: why is it needed?

Do I need to submit a zero SZV-M report for June 2021? Interesting question!

The fact is that there cannot be a zero SZV-M in principle. If not a single person is included in the June report, then the delivery of such an empty SZV-M loses all meaning. No one needs blank forms because they do not contain the necessary information.

The electronic format of SZV-M provides for filling out at least one line of the list of insured persons. It is impossible to send a report without the “Information about insured persons” block. Therefore, it will not be possible to submit a completely blank form.

Also see “Zero SZV-M: is it necessary to submit it and how to fill it out.”

Deadlines for delivery of SZV-M

This form must be submitted to the regulatory authorities no later than the 10th day of the month following the reporting month. If this day falls on a holiday or weekend, the deadline is extended to the next working day.

The law does not establish a minimum date for submitting the document. In fact, it can be submitted before the end of the reporting period, but you need to be completely sure that no employee will be hired during the remaining time. Otherwise, you will need to submit an additional form, or the authorities will impose a fine for submitting incomplete data.

Attention! Starting from 2021, the deadlines for submitting reports in the SZV-M form have been changed, in accordance with Article 2. paragraph 4, paragraph “g” of Federal Law No. 250-FZ of July 3, 2021.

For the first time this year, the report was submitted for April, and it had to be sent by May 10, 2021. For the remaining months of this year, the following deadlines are set:

| Deadlines for the provision of SZV-M in 2016-2017 | ||

| Reporting period | 2016 | 2017 |

| For January | No reporting provided | until 16-02-2017 |

| For February | until 15-03-2017 | |

| For March | until 04/17/2017 | |

| For April | until 05/15/2017 | |

| For May | until 10-06-2016 | until 06/15/2017 |

| For June | until 11-07-2016 | until 07/17/2017 |

| For July | until 10-08-2016 | until 08/15/2017 |

| For August | until 12-09-2016 | until 15-09-2017 |

| For September | until 10-10-2016 | until 16-10-2017 |

| For October | until 10-11-2016 | until 15-11-2017 |

| For November | until 12-12-2016 | until 15-12-2017 |

| For December | until 10-01-2017 | until 01/15/2018 |

Attention! If the company has less than 25 people, then reporting can be provided in paper form, and if more, then only in electronic form.

In what form should I report?

SZV-M can be submitted on paper or electronically, depending on the number of insured persons:

If the number of insured persons for the last reporting period is less than 25 people, the employer has the right to choose between a paper and electronic report. In other cases, there is no right to choose - you can only report to the Pension Fund electronically (Clause 2, Article 8 of Federal Law No. 27-FZ of April 1, 1996).

About

SZV M 2021 sample filling

This report can be compiled using specialized programs and Internet services, as well as by hand.

The document includes 4 sections.

Section 1

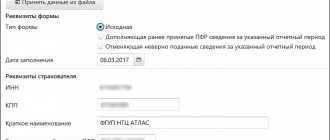

In the first of them, immediately below the name of the form, the number of the organization or individual entrepreneur received when registering with the Pension Fund of Russia, the name of the business entity, the registration code with the tax authority, and for companies also the checkpoint.

Section 2

The second section contains the reporting period code, consisting of two digits, and the year the report was submitted. These fields must be filled in, and for those who have problems identifying the code, there is explanatory data below with this information.

Section 3

Next, indicates the type of form. According to the law, it can have three varieties:

“ISH” - initial, issued for the first time during the reporting period;

“ADP” is an additional one, submitted by policyholders as an attachment to the first one, if there is a need to correct information or add one more person after submitting the previous document. For example, when filling out an employee who was on vacation was missed. It must be submitted separately for the SZV-M for the same period;

Common mistakes when filling out a form

| Type of error | It should be | Correction procedure |

| There is no information about the insured person. | It should be! The form must reflect all employees with whom an employment contract and a GPC agreement were concluded, even for 1 day. Information is also submitted if there have been no accruals and payments to the employee at the Pension Fund. | A supplementary calculation is submitted, which indicates those employees who were not reflected in the outgoing form. |

| There is an extra worker on uniform. | The presence of extra employees is equivalent to false information. The form cannot contain information if the employee received payments for the reporting period (for example, compensation) if they were fired in previous periods. | A cancellation form is provided, listing only the excess employees. |

| The employee's TIN was entered incorrectly. | Although the absence of the TIN itself will not be an error, nevertheless, if it is indicated, it must be correct. | At the same time, the following are provided: a canceling report for an employee with an incorrect TIN and, along with it, a supplementary report in which information on him is corrected. |

| Forgot to include employees. | Information must be provided for all employees, both those hired at the end of the month and those dismissed at the beginning. | A supplementary form is provided to include the missing employees. |

| Invalid SNILS specified. | Please check the information you are sending before sending, otherwise you may receive a fine. | If the report is not accepted, it must be corrected and submitted again as an outgoing report. If only correct information is accepted, corrections are provided to employees with errors in a supplementary form. |

| The reporting period is incorrect. | Make sure you fill it out correctly before submitting your reports. | You must resubmit the form with the status outgoing, indicating the correct reporting period. |

How to fix errors

The error is discovered by the institution’s accountants or Pension Fund employees. In the first case, corrective documents should be sent immediately. And if an error is found by a Pension Fund employee, then an official demand will come. In this case, 5 working days are given to correct the inaccuracy in the report.

To correct the inaccuracy, a special additional or canceling form is prepared. The same form is used. We will show the procedure for filling out the SZV-M report in 2021 for adjustment using an example: the accountant discovered that employee Viktorova V.V. changed her last name to Simonova. Simonova provided documents under her new surname after sending the reports. We are preparing a cancellation form.

There is no need to include all employees in the canceling adjustment, only those for whom errors were made.

Now we generate a supplementary report.

Another example. The accountant sent the reports for January on 01/27/2020. The director announced the hiring of a new employee, I.V. Pozdnyakov. from 01/30/2020. In this case, you do not need to provide a cancellation form. As well as duplicating employees again for whom a report has already been accepted. Only the complementary form is prepared.

Fine for SZV-M

The report must be submitted to the Pension Fund within the deadlines established by law. If they are violated, a fine may be imposed on the business entity for late submission of the SZV-M, amounting to 500 rubles for each person for whom the document should have been submitted, but was not sent. Therefore, being late for entrepreneurs and companies with a large staff of employees can entail a fairly large amount of money.

The same punishment awaits an organization if it submitted an erroneously completed or incomplete report to the Pension Fund. The amount of the penalty is calculated in the same way, based on the number of employees with incorrect or incomplete information.

In addition, a fine for failure to submit the SZV-M may also be established in cases where the policyholder sent the report in a form other than that required by law. For business entities that have employees of more than twenty-five people, the law provides for the obligation to send reports only in electronic form.

When a fine cannot be avoided

Let's talk about extraordinary cases when judges supported the Pension Fund of Russia and imposed a fine for SZV-M:

- The company received a protocol from the Pension Fund of the Russian Federation with the following set of information: about errors in SZV-M with their description, about the fund’s refusal to accept incorrect information and about the need to submit corrected statements. At the same time, the fund did not formalize or send the notification. The company submitted the adjustment later than 5 days from the date of receipt of the protocol. She was fined for this. The court equated the protocol to a notification and did not accept the arguments that the Pension Fund of the Russian Federation did not send a notification to the company (Resolution of the Court of Justice of the North-Western District dated April 23, 2020 in case No. A42-9736/2019).

- The company did not manage to submit SZV-M on time due to the fact that the programmer was on vacation, and the SZV-M program was not working on the last day of the deadline. In support, the company provided screenshots and a memo stating that it was impossible to provide information due to technical problems. However, the court did not consider the presented evidence to be objective and did not accept the company’s arguments (Resolution of the Administrative Court of the East Siberian District dated March 26, 2020 in case No. A19-13913/2019).

Nuances

When a report is submitted with information about the insured persons marked “ADOP” to a previously sent document, there is no need to re-compile a complete list of company employees.

You just need to provide information to correct incorrect entries or enter data on missing people. In cases where an employee quit in the previous month, and in the next month the amounts due are paid to him, then information about this person is not included in the form in the month the funds were spent, since the employment relationship has ceased to exist.

In March 2021, clarifications from the competent authority regarding the SZV-M form were issued. According to them, at the time of dismissal of a former employee, the HR inspector must be given this document, which contains only data on this person. Information containing the data of other employees must be excluded in order to prevent disclosure.

At the same time, these reports are issued for each month of the employee’s work. For example, when a person worked from April to June 2016, he will receive three reports. It is also advisable to issue a receipt from the employee that he has received all these documents.

It is also possible that a person working in a company will have a last name change, for example, marriage. If this employee does not have time to exchange SNILS for a new one with the correct information this month, then the HR specialist must submit an SZV-M with the old last name.

Current report form

The appearance of the SZV-M report for the first summer month of 2021 has not changed in any way. Use the form approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p:

Traditionally, the SZV-M form consists of 4 sections:

- Details of the policyholder.

- Reporting period.

- Form type.

- Information about the insured persons.

Also see “SZV-M in 2021: form and sample filling.”

The SZV-M form for the report for June 2021 on paper from our website can be found at the following link.