Chart of accounts for accounting in budgetary organizations: important provisions, explanations and analysis of the latest amendments.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

What is a chart of accounts

A unified chart of accounts of a government institution (CA) is needed to systematize accounting registers according to quantitative, group and digital values, depending on the object of accounting and the target functioning of a particular organization. It is the link between accounting indicators and financial statements. The plan combines those accounts that are used in operations directly related to the financial and economic activities of enterprises. All reflected information is used to analyze the functioning of institutions and forecast its further financial development.

The plan is used in accounting for absolutely all organizations, regardless of their form of ownership. The following types are distinguished according to the types of economic entities:

- register for business entities;

- for budgetary institutions;

- accounts for credit institutions.

Each PS created for different types of economic entities reflects data grouped in accordance with the sectoral and organizational specifics of the institutions. Intersectoral ministries and departments are responsible for the content and regulatory regulation of the document. For each type of institution, its own instructions for use have been developed, which provide details of accounts and subaccounts to them.

The plan aims to:

- to simplify and create a unified accounting methodology;

- ensuring variability in records of similar operations;

- improvement of control measures regulating the correctness of accounting transactions;

- generalization of similar indicators obtained from various sources both at the enterprise and across regions and the country as a whole;

- streamlining the preparation of accounting documentation, interim and final reporting;

- reducing errors in invoice correspondence.

Autonomous institutions: reporting and deadlines for its submission

AU reporting is generated based on data from the General Ledger and related registers. Data on business transactions is filled in with an increasing amount, reflecting not only rubles, but also kopecks.

AUs are required to prepare financial statements:

- intermediate (quarterly);

- annual.

The deadline for the latter is set in February-March. It is presented in paper form and electronically. For each type of application, the deadline for submitting documents is different.

Who is required to use the chart of accounts?

All economic entities that maintain accounting records are required to apply the chart of accounts. Exemptions are provided only for individual entrepreneurs and private practitioners. Other commercial firms, government agencies and enterprises are required to maintain accounting.

But merchants also have the right to organize accounting as part of their activities. There is no prohibition on conducting. Individual entrepreneurs make decisions independently. If accounting is necessary, you will have to comply with the current rules:

- Develop and approve accounting policies.

- Appoint responsible persons.

- Maintain primary and accounting documentation.

- Conduct audits, inventories and inspections.

- Prepare financial statements.

Some economic entities have the right to conduct accounting in a simplified form. For example, non-profit organizations, small businesses, representatives of Skolkovo. But even the transition to a simplified method does not exempt you from using a single PS.

IMPORTANT!

The use of a chart of accounts is mandatory for all economic entities that must maintain accounting records. There are no exceptions even for simplifiers.

The essence of autonomous institutions and the directions of their work

Autonomous institutions (AI) mean non-profit organizations created in such areas of activity as:

- science and education;

- job search for the population and its employment;

- health and social protection;

- culture, physical education and sports.

The formation of autonomous entities is carried out by the subjects of the Russian Federation, as legal entities that have the opportunity to act on their own behalf, disposing of property and exercising non-property rights.

Plan for state employees

The unified chart of accounts for accounting in budgetary institutions for 2021 is regulated by Order of the Ministry of Finance of Russia No. 157n dated December 1, 2010. Instruction 157n regulates the financial and economic activities of institutions operating in the Russian budget system.

All budgetary organizations are divided into autonomous, budgetary and state-owned. For each structure, various regulations have been approved that are responsible for accounting within a given organizational form:

- Order of the Ministry of Finance of the Russian Federation No. 162n dated December 6, 2010 - for government institutions, extra-budgetary funds and government bodies;

- order No. 174n dated December 16, 2010 - for BU;

- order No. 183n dated December 23, 2010 - for AU.

Clause 21 of Order No. 157n of the Ministry of Finance states what a budget accounting chart of accounts is (with explanations and entries) - this is a register used by government agencies, extra-budgetary funds and government bodies. That is, those organizations that operate within the framework of order 162n.

IMPORTANT!

The Ministry of Finance approved changes to Order 162n (Order of the Ministry of Finance No. 246n dated October 28, 2020). Now, when maintaining budget accounting, business transactions are reflected in the accounts of the working PS, approved by the institution as part of the formation of the institution’s accounting policy, using the financial security code in the 18th digit of the account number. When financed from the budget of the Russian Federation - code 1, from funds at temporary disposal - 3. This rule is used starting from 01/01/2021. Another important innovation is accrual accounting. According to the rules of this method, all operating results are recognized upon completion of transactions.

All other state employees use accounting software in their work. This difference arose in connection with the possibility of budgetary and autonomous institutions conducting business activities and receiving income from it (clauses 2, 3 of Article 298 of the Civil Code of the Russian Federation). Budgetary organizations formulate a work plan based on instruction No. 157n. The numbering of working accounts consists of 26 digits, which reflect the analytical accounting code, the type of cash security, the synthetic accounting account code and the code of the financial and economic transaction according to KOSGU.

The budget plan consists of balance sheet and off-balance sheet accounts. It is carried out in accordance with funding sources: budgetary and extra-budgetary.

What has changed in reporting

The developers of the federal standard did not ignore reporting issues. As of January 1, 2021, accountants must report the book value of assets, depreciation method, accumulated depreciation, and more. It is important to reflect in the reporting changes in the valuation of objects in the reporting period, which will affect the SPI, and the depreciation method. In addition, it is necessary to provide a comparison of the residual value of the object at the beginning and end of the reporting period.

Maintain budget accounting and generate reports in the Kontur-Accounting Budget program

Information must be prepared for all groups of fixed assets, this applies to investment real estate, assets with zero residual value, idle facilities, etc. Before the FAS “Fixed Assets” came into force, the institution included reporting information only for some types of fixed assets. Now information about the amounts is reflected in the reporting, but not for all groups that are listed in the standard. Therefore, in the near future we expect changes to Instruction No. 157n, related, in particular, to accounts 0 10100 000, as well as the appearance of new lines in forms 0503168, 0503768, as well as balance sheet 0503130, 0503730. These changes will be reflected in the reporting for 2018.

Structure of the budgetary chart of accounts

The structure of the budget plan is presented in the following sections:

| Chart of accounts section | Contents of accounts | Account code, example |

| Non-financial assets | The “Non-financial assets” section reflects information about all non-current assets of an economic entity. The section includes accounting for the following objects:

New groups:

| 0 101 05 000 “Vehicles” - generation of information on the initial cost of vehicles owned (operably managed) by the enterprise. 0 108 51 000 “Real estate that constitutes the treasury” - reflects the initial cost of real estate located in the treasury. No depreciation is charged on such property. Also, for assets located in the treasury, there is no provision for the allocation of particularly valuable and other property. |

| Financial assets | The “Financial Assets” section accumulates information about all current assets of the institution. Current assets are understood not only as funds in the cash desk and current accounts of an institution, but also as investments in financial assets, advances and receivables. The section includes the following groups:

| 0 201 11 000 “Cash in the institution’s accounts” - discloses information about the availability of finances in current accounts opened with the body providing cash services to the entity (in rubles and foreign currency). 0 205 31 000 “Calculations for income from the provision of paid services (work).” It accrues income from business and other income-generating activities. |

| Liabilities | The “Obligations” section discloses data on accepted obligations:

| 0 302 11 000 “Payroll calculations” - reflects the amount of accrued wages in favor of employees working under an employment contract. 0 302 21 000 “Settlements for communication services” - reflects accounts payable arising under contracts for the provision of communication services. 0 303 01 000 “Calculations for personal income tax” - records data on tax deductions made from the salaries of employees of the organization and from other taxable income. |

| Financial results | A special section “Financial result” is used to reflect income and expenses based on the results of the activities of an economic entity for a certain period. Detailing by time intervals is provided. Information is grouped according to the results of the current period, previous years and future periods. | 0 401 10 000 “Current period income” - used to calculate the institution’s income due in the current financial year. 0 401 28 000 “Expenses of the financial year preceding the reporting year” - discloses information about incurred expenses of the previous period. |

| Authorization of expenses | The registers in the “Authorization of Expenses” section disclose accounting information on:

| 0 501 11 000 “Adjusted LBO” - reflects the amount of completed limits of budget obligations within the current financial year. |

PS with explanations and postings

For clarity, we will give an example of how to create an active debit account for such a fact of economic life as taking newly built buildings onto the balance sheet . Documentation of this operation is carried out through an act of acceptance and transfer of objects or a receipt order.

The resulting debit account 0.101.11.130 corresponds with the credit account 0.106.11.310, which means an increase in investments in fixed assets - the institution’s real estate.

Let's consider another typical operation: withholding personal income tax by the institution as a tax authority from the accrued salaries of employees . In this case, there will be an increase in debt on payments to the budget. This operation is documented using a payroll slip.

For most accounts, the KOSGU code is uniquely determined by whether it is a debit or credit of the account.

Find out what the procedure for registering dismissal is in the process of transferring an employee to another organization. How to calculate vacation pay upon dismissal? Details here.

Law FZ-131 in the new edition with amendments is possible.

Chart of accounts for budgetary and government institutions

Current table of budget accounting accounts in 2021 for state and budgetary institutions according to instruction 157n:

| Balance account name | Synthetic account of an accounting object | Group name | ||

| Synthetic | Analytical | |||

| Group | View | |||

| 1 | 2 | 3 | 4 | 5 |

| NON-FINANCIAL ASSETS | 1 0 0 | 0 | 0 | |

| Fixed assets | 1 0 1 | 0 | 0 | |

| 1 0 1 | 1 | 0 | Fixed assets - real estate of the institution | |

| 1 0 1 | 2 | 0 | Fixed assets - especially valuable movable property of an institution | |

| 1 0 1 | 3 | 0 | Fixed assets - other movable property of the institution | |

| 1 0 1 | 9 | 0 | Fixed assets - other movable property of the institution | |

| 1 0 1 | 0 | 1 | ||

| 1 0 1 | 0 | 2 | ||

| 1 0 1 | 0 | 3 | ||

| 1 0 1 | 0 | 4 | ||

| 1 0 1 | 0 | 5 | ||

| 1 0 1 | 0 | 6 | ||

| 1 0 1 | 0 | 7 | ||

| 1 0 1 | 0 | 8 | ||

| Intangible assets | 1 0 2 | 0 | 0 | |

| 1 0 2 | 2 | 0 | Intangible assets - especially valuable movable property of an institution | |

| 1 0 2 | 3 | 0 | Intangible assets - other movable property of the institution | |

| Non-produced assets | 1 0 3 | 0 | 0 | |

| 1 0 3 | 1 | 0 | Non-produced assets - real estate of the institution | |

| 1 0 3 | 3 | 0 | Non-produced assets - other movable property | |

| 1 0 3 | 9 | 0 | Non-produced assets - as part of the grantor's property | |

| 1 0 3 | 0 | 1 | ||

| 1 0 3 | 0 | 2 | ||

| 1 0 3 | 0 | 3 | ||

| Depreciation | 1 0 4 | 0 | 0 | |

| 1 0 4 | 1 | 0 | Depreciation of the institution's real estate | |

| 1 0 4 | 2 | 0 | Depreciation of particularly valuable movable property of the institution | |

| 1 0 4 | 3 | 0 | Depreciation of other movable property of the institution | |

| 1 0 4 | 4 | 0 | Depreciation of rights of use of assets | |

| 1 0 4 | 5 | 0 | Depreciation of property constituting the treasury | |

| 104 | 6 | 0 | Amortization of rights to use intangible assets | |

| 1 0 4 | 9 | 0 | Depreciation of the property of an institution in a concession | |

| 1 0 4 | 0 | 1 | ||

| 1 0 4 | 0 | 2 | ||

| 1 0 4 | 0 | 3 | ||

| 1 0 4 | 0 | 4 | ||

| 1 0 4 | 0 | 5 | ||

| 1 0 4 | 0 | 6 | ||

| 1 0 4 | 0 | 7 | ||

| 1 0 4 | 0 | 8 | ||

| 1 0 4 | 0 | 9 | ||

| 1 0 4 | 2 | 9 | ||

| 1 0 4 | 3 | 9 | ||

| 1 0 4 | 4 | 9 | ||

| 1 0 4 | 5 | 1 | ||

| 1 0 4 | 5 | 2 | ||

| 1 0 4 | 5 | 4 | ||

| 1 0 4 | 5 | 9 | ||

| Material reserves | 1 0 5 | 0 | 0 | |

| 1 0 5 | 2 | 0 | Material reserves are particularly valuable movable property of an institution. | |

| 1 0 5 | 3 | 0 | Material reserves - other movable property of the institution | |

| 1 0 5 | 0 | 1 | ||

| 1 0 5 | 0 | 2 | ||

| 1 0 5 | 0 | 3 | ||

| 1 0 5 | 0 | 4 | ||

| 1 0 5 | 0 | 5 | ||

| 1 0 5 | 0 | 6 | ||

| 1 0 5 | 0 | 7 | ||

| 1 0 5 | 0 | 8 | ||

| 1 0 5 | 0 | 9 | ||

| Investments in non-financial assets | 1 0 6 | 0 | 0 | |

| 1 0 6 | 1 | 0 | Investments in real estate | |

| 1 0 6 | 2 | 0 | Investments in particularly valuable movable property | |

| 1 0 6 | 3 | 0 | Investments in other movable property | |

| 1 0 6 | 4 | 0 | Investments in financial lease objects | |

| 1 0 6 | 6 | 0 | Investments in the rights to use intangible assets | |

| 1 0 6 | 0 | 1 | ||

| 1 0 6 | 0 | 2 | ||

| 1 0 6 | 0 | 3 | ||

| 1 0 6 | 0 | 4 | ||

| Non-financial assets in transit | 1 0 7 | 0 | 0 | |

| 1 0 7 | 1 | 0 | The institution's real estate is in transit | |

| 1 0 7 | 2 | 0 | Particularly valuable movable property of the institution is in transit | |

| 1 0 7 | 3 | 0 | Other movable property of the institution in transit | |

| 1 0 7 | 0 | 1 | ||

| 1 0 7 | 0 | 3 | ||

| Non-financial assets of treasury property | 1 0 8 | 0 | 0 | |

| 1 0 8 | 5 | 0 | Non-financial assets that make up the treasury | |

| 1 0 8 | 5 | 1 | ||

| 1 0 8 | 5 | 2 | ||

| 1 0 8 | 5 | 3 | ||

| 1 0 8 | 5 | 4 | ||

| 1 0 8 | 5 | 5 | ||

| 1 0 8 | 5 | 6 | ||

| 1 0 8 | 5 | 7 | ||

| 1 0 8 | 9 | 0 | ||

| 1 0 8 | 9 | 1 | ||

| 1 0 8 | 9 | 2 | ||

| 1 0 8 | 9 | 5 | ||

| Costs of manufacturing finished products, performing work, services | 1 0 9 | 0 | 0 | |

| 1 0 9 | 6 | 0 | Cost of finished products, works, services | |

| 1 0 9 | 7 | 0 | Overhead costs of production of finished products, works, services | |

| 1 0 9 | 8 | 0 | General running costs | |

| Rights to use assets | 1 1 1 | 0 | 0 | |

| 1 1 1 | 4 | 0 | Rights to use non-financial assets | |

| 1 1 1 | 4 | 1 | ||

| 1 1 1 | 4 | 2 | ||

| 1 1 1 | 4 | 4 | ||

| 1 1 1 | 4 | 5 | ||

| 1 1 1 | 4 | 6 | ||

| 1 1 1 | 4 | 7 | ||

| 1 1 1 | 4 | 8 | ||

| 1 1 1 | 4 | 9 | ||

| 1 1 1 | 6 | 0 | Rights to use intangible assets | |

| Impairment of non-financial assets | 1 1 4 | 0 | 0 | |

| 1 1 4 | 1 | 0 | Depreciation of the institution's real estate | |

| 1 1 4 | 2 | 0 | Depreciation of particularly valuable movable property of an institution | |

| 1 1 4 | 3 | 0 | Depreciation of other movable property of the institution | |

| 1 1 4 | 4 | 0 | Impairment of rights to use assets | |

| 1 1 4 | 6 | 0 | Impairment of rights to use intangible assets | |

| 1 1 4 | 0 | 1 | ||

| 1 1 4 | 0 | 2 | ||

| 1 1 4 | 0 | 3 | ||

| 1 1 4 | 0 | 4 | ||

| 1 1 4 | 0 | 5 | ||

| 1 1 4 | 0 | 6 | ||

| 1 1 4 | 0 | 7 | ||

| 1 1 4 | 0 | 8 | ||

| 1 1 4 | 0 | 9 | ||

| 1 1 4 | 6 | 0 | ||

| 1 1 4 | 6 | 1 | ||

| 1 1 4 | 6 | 2 | ||

| 1 1 4 | 6 | 3 | ||

| FINANCIAL ASSETS | 2 0 0 | 0 | 0 | |

| Institutional funds | 2 0 1 | 0 | 0 | |

| 2 0 1 | 1 | 0 | Cash in the institution’s personal accounts with the Treasury | |

| 2 0 1 | 2 | 0 | Funds of the institution in a credit institution | |

| 2 0 1 | 3 | 0 | Cash in the institution's cash desk | |

| 2 0 1 | 0 | 1 | ||

| 2 0 1 | 0 | 2 | ||

| 2 0 1 | 0 | 3 | ||

| 2 0 1 | 0 | 4 | ||

| 2 0 1 | 0 | 5 | ||

| 2 0 1 | 0 | 6 | ||

| 2 0 1 | 0 | 7 | ||

| Funds in budget accounts | 2 0 2 | 0 | 0 | |

| 2 0 2 | 1 | 0 | Funds in budget accounts with the Federal Treasury | |

| 2 0 2 | 2 | 0 | Funds in budget accounts in a credit institution | |

| 2 0 2 | 3 | 0 | Budget funds in deposit accounts | |

| 2 0 2 | 0 | 1 | ||

| 2 0 2 | 0 | 2 | ||

| 2 0 2 | 0 | 3 | ||

| Funds in the accounts of the body providing cash services | 2 0 3 | 0 | 0 | |

| 2 0 3 | 0 | 1 | ||

| 2 0 3 | 1 | 0 | Funds in the accounts of the body providing cash services | |

| 2 0 3 | 2 | 0 | Funds in the accounts of the body providing cash services are in transit | |

| 2 0 3 | 3 | 0 | Funds in accounts for cash payments | |

| 2 0 3 | 0 | 2 | ||

| 2 0 3 | 0 | 3 | ||

| 2 0 3 | 0 | 4 | ||

| 2 0 3 | 0 | 5 | ||

| Financial investments | 2 0 4 | 0 | 0 | |

| 2 0 4 | 2 | 0 | Securities other than shares | |

| 2 0 4 | 3 | 0 | Shares and other forms of capital participation | |

| 2 0 4 | 5 | 0 | Other financial assets | |

| 2 0 4 | 2 | 1 | ||

| 2 0 4 | 2 | 2 | ||

| 2 0 4 | 2 | 3 | ||

| 2 0 4 | 3 | 1 | ||

| 2 0 4 | 3 | 2 | ||

| 2 0 4 | 3 | 3 | ||

| 2 0 4 | 3 | 4 | ||

| 2 0 4 | 5 | 2 | ||

| 2 0 4 | 5 | 3 | ||

| Income calculations | 2 0 5 | 0 | 0 | |

| 2 0 5 | 1 | 0 | Calculations for tax revenues, customs duties and insurance contributions for compulsory social insurance | |

| 2 0 5 | 2 | 0 | Calculations for property income | |

| 2 0 5 | 3 | 0 | Calculations of income from the provision of paid services (works), compensation of costs | |

| 2 0 5 | 4 | 0 | Calculations of fines, penalties, penalties, damages | |

| 2 0 5 | 5 | 0 | Calculations for gratuitous cash receipts of a current nature | |

| 2 0 5 | 6 | 0 | Calculations for gratuitous cash receipts of a capital nature | |

| 2 0 5 | 7 | 0 | Calculations of income from operations with assets | |

| 2 0 5 | 8 | 0 | Calculations for other income | |

| 2 0 5 | 1 | 1 | ||

| 2 0 5 | 2 | 1 | ||

| 2 0 5 | 2 | 2 | ||

| 2 0 5 | 2 | 3 | ||

| 2 0 5 | 2 | 4 | ||

| 2 0 5 | 2 | 6 | ||

| 2 0 5 | 2 | 7 | ||

| 2 0 5 | 2 | 8 | ||

| 2 0 5 | 2 | 9 | ||

| 2 0 5 | 3 | 1 | ||

| 2 0 5 | 3 | 2 | ||

| 2 0 5 | 3 | 3 | ||

| 2 0 5 | 3 | 5 | ||

| 2 0 5 | 4 | 1 | ||

| 2 0 5 | 4 | 4 | ||

| 2 0 5 | 4 | 5 | ||

| 2 0 5 | 5 | 1 | ||

| 2 0 5 | 5 | 2 | ||

| 2 0 5 | 5 | 3 | ||

| 2 0 5 | 6 | 1 | ||

| 2 0 5 | 7 | 1 | ||

| 2 0 5 | 7 | 2 | ||

| 2 0 5 | 7 | 3 | ||

| 2 0 5 | 7 | 4 | ||

| 2 0 5 | 7 | 5 | ||

| 2 0 5 | 8 | 1 | ||

| 2 0 5 | 8 | 3 | ||

| 2 0 5 | 8 | 4 | ||

| 2 0 5 | 8 | 9 | ||

| Calculations for advances issued | 2 0 6 | 0 | 0 | |

| 2 0 6 | 1 | 0 | Calculations for advances on wages, accruals on wage payments | |

| 2 0 6 | 2 | 0 | Calculations for advances for work and services | |

| 2 0 6 | 3 | 0 | Calculations for advances on receipt of non-financial assets | |

| 2 0 6 | 4 | 0 | Calculations for advance gratuitous transfers of a current nature to organizations | |

| 2 0 6 | 5 | 0 | Calculations for gratuitous transfers to budgets | |

| 2 0 6 | 6 | 0 | Social Security Advance Settlements | |

| 2 0 6 | 7 | 0 | Calculations for advances for the purchase of securities and other financial investments | |

| 2 0 6 | 8 | 0 | Calculations for advance gratuitous transfers of capital nature to organizations | |

| 2 0 6 | 9 | 0 | Calculations for advances on other expenses | |

| 2 0 6 | 1 | 1 | ||

| 2 0 6 | 1 | 2 | ||

| 2 0 6 | 1 | 3 | ||

| 2 0 6 | 2 | 1 | ||

| 2 0 6 | 2 | 2 | ||

| 2 0 6 | 2 | 3 | ||

| 2 0 6 | 2 | 4 | ||

| 2 0 6 | 2 | 5 | ||

| 2 0 6 | 2 | 6 | ||

| 2 0 6 | 2 | 7 | ||

| 2 0 6 | 2 | 8 | ||

| 2 0 6 | 2 | 9 | ||

| 2 0 6 | 3 | 1 | ||

| 2 0 6 | 3 | 2 | ||

| 2 0 6 | 3 | 3 | ||

| 2 0 6 | 3 | 4 | ||

| 2 0 6 | 4 | 1 | ||

| 2 0 6 | 4 | 2 | ||

| 2 0 6 | 5 | 1 | ||

| 2 0 6 | 5 | 2 | ||

| 2 0 6 | 5 | 3 | ||

| 2 0 6 | 6 | 1 | ||

| 2 0 6 | 6 | 2 | ||

| 2 0 6 | 6 | 3 | ||

| 2 0 6 | 7 | 2 | ||

| 2 0 6 | 7 | 3 | ||

| 2 0 6 | 7 | 5 | ||

| 2 0 6 | 9 | 6 | ||

| Calculations for credits, borrowings (loans) | 2 0 7 | 0 | 0 | |

| 2 0 7 | 1 | 0 | Calculations for granted credits, borrowings (loans) | |

| 2 0 7 | 2 | 0 | Settlements within the framework of targeted foreign loans (borrowings) | |

| 2 0 7 | 3 | 0 | Settlements with debtors under state (municipal) guarantees | |

| 2 0 7 | 0 | 1 | Settlements for other debt claims | |

| 2 0 7 | 0 | 3 | ||

| 2 0 7 | 0 | 4 | ||

| Calculations with accountable persons | 2 0 8 | 0 | 0 | |

| 2 0 8 | 1 | 0 | Settlements with accountable persons for wages, accruals for wage payments | |

| 2 0 8 | 2 | 0 | Settlements with accountable persons for payment for work and services | |

| 2 0 8 | 3 | 0 | Settlements with accountable persons for receipt of non-financial assets | |

| 2 0 8 | 5 | 0 | Settlements with accountable persons for gratuitous transfers to budgets | |

| 2 0 8 | 6 | 0 | Settlements with accountable persons for social security | |

| 2 0 8 | 9 | 0 | Settlements with accountable persons for other expenses | |

| 2 0 8 | 1 | 1 | ||

| 2 0 8 | 1 | 2 | ||

| 2 0 8 | 1 | 3 | ||

| 2 0 8 | 2 | 1 | ||

| 2 0 8 | 2 | 2 | ||

| 2 0 8 | 2 | 3 | ||

| 2 0 8 | 2 | 4 | ||

| 2 0 8 | 2 | 5 | ||

| 2 0 8 | 2 | 6 | ||

| 2 0 8 | 2 | 7 | ||

| 2 0 8 | 2 | 8 | ||

| 2 0 8 | 2 | 9 | ||

| 2 0 8 | 3 | 1 | ||

| 2 0 8 | 3 | 2 | ||

| 2 0 8 | 3 | 4 | ||

| 2 0 8 | 6 | 1 | ||

| 2 0 8 | 6 | 2 | ||

| 2 0 8 | 6 | 3 | ||

| 2 0 8 | 9 | 1 | ||

| 2 0 8 | 9 | 3 | ||

| 2 0 8 | 9 | 4 | ||

| 2 0 8 | 9 | 5 | ||

| 2 0 8 | 9 | 6 | ||

| Calculations for damage and other income | 2 0 9 | 0 | 0 | |

| 2 0 9 | 3 | 0 | Cost compensation calculations | |

| 2 0 9 | 3 | 4 | ||

| 2 0 9 | 3 | 6 | ||

| 2 0 9 | 4 | 0 | Calculations of fines, penalties, penalties, damages | |

| 2 0 9 | 4 | 1 | ||

| 2 0 9 | 4 | 3 | ||

| 2 0 9 | 4 | 4 | ||

| 2 0 9 | 4 | 5 | ||

| 2 0 9 | 7 | 0 | Calculations for damage to non-financial assets | |

| 2 0 9 | 7 | 1 | ||

| 2 0 9 | 7 | 2 | ||

| 2 0 9 | 7 | 3 | ||

| 2 0 9 | 7 | 4 | ||

| 2 0 9 | 8 | 0 | Calculations for other income | |

| 2 0 9 | 8 | 1 | ||

| 2 0 9 | 8 | 2 | ||

| 2 0 9 | 8 | 9 | ||

| Other settlements with debtors | 2 1 0 | 0 | 0 | |

| 2 1 0 | 0 | 2 | ||

| 2 1 0 | 8 | 2 | Settlements with the financial authority to clarify unknown revenues to the budget of the year preceding the reporting year | |

| 2 1 0 | 9 | 2 | Settlements with the financial authority to clarify unclear revenues to the budget of previous years | |

| 2 1 0 | 0 | 3 | ||

| 2 1 0 | 0 | 4 | ||

| 2 1 0 | 0 | 5 | ||

| 2 1 0 | 0 | 6 | ||

| 2 1 0 | 1 | 0 | Calculations for tax deductions for VAT | |

| 2 1 0 | 1 | 1 | ||

| 2 1 0 | 1 | 2 | ||

| 2 1 0 | 1 | 3 | ||

| Internal settlements based on receipts | 2 1 1 | 0 | 0 | |

| Internal settlements for disposals | 2 1 2 | 0 | 0 | |

| Investments in financial assets | 2 1 5 | 0 | 0 | |

| 2 1 5 | 2 | 0 | Investments in securities other than shares | |

| 2 1 5 | 3 | 0 | Investments in shares and other forms of participation in capital | |

| 2 1 5 | 5 | 0 | Investments in other financial assets | |

| 2 1 5 | 2 | 1 | ||

| 2 1 5 | 2 | 2 | ||

| 2 1 5 | 2 | 3 | ||

| 2 1 5 | 3 | 1 | ||

| 2 1 5 | 3 | 2 | ||

| 2 1 5 | 3 | 3 | ||

| 2 1 5 | 3 | 4 | ||

| 2 1 5 | 5 | 2 | ||

| 2 1 5 | 5 | 3 | ||

| OBLIGATIONS | 3 0 0 | 0 | 0 | |

| Settlements with creditors on debt obligations | 3 0 1 | 0 | 0 | |

| 3 0 1 | 1 | 0 | Settlements on debt obligations in rubles | |

| 3 0 1 | 2 | 0 | Settlements on debt obligations for targeted foreign loans (borrowings) | |

| 3 0 1 | 3 | 0 | Calculations for state (municipal) guarantees | |

| 3 0 1 | 4 | 0 | Settlements on debt obligations in foreign currency | |

| 3 0 1 | 0 | 1 | ||

| 3 0 1 | 0 | 2 | ||

| 3 0 1 | 0 | 3 | ||

| 3 0 1 | 0 | 4 | ||

| Calculations for accepted obligations | 3 0 2 | 0 | 0 | |

| 3 0 2 | 1 | 0 | Calculations for wages, accruals for wage payments | |

| 3 0 2 | 2 | 0 | Calculations for works and services | |

| 3 0 2 | 3 | 0 | Calculations for receipt of non-financial assets | |

| 3 0 2 | 4 | 0 | Calculations for gratuitous transfers of a current nature to organizations | |

| 3 0 2 | 5 | 0 | Calculations for gratuitous transfers to budgets | |

| 3 0 2 | 6 | 0 | Social security payments | |

| 3 0 2 | 7 | 0 | Calculations for the acquisition of financial assets | |

| 3 0 2 | 8 | 0 | Calculations for gratuitous capital transfers to organizations | |

| 3 0 2 | 9 | 0 | Calculations for other expenses | |

| 3 0 2 | 1 | 1 | ||

| 3 0 2 | 1 | 2 | ||

| 3 0 2 | 1 | 3 | ||

| 3 0 2 | 2 | 1 | ||

| 3 0 2 | 2 | 2 | ||

| 3 0 2 | 2 | 3 | ||

| 3 0 2 | 2 | 4 | ||

| 3 0 2 | 2 | 5 | ||

| 3 0 2 | 2 | 6 | ||

| 3 0 2 | 2 | 7 | ||

| 3 0 2 | 2 | 8 | ||

| 3 0 2 | 2 | 9 | ||

| 3 0 2 | 3 | 1 | ||

| 3 0 2 | 3 | 2 | ||

| 3 0 2 | 3 | 3 | ||

| 3 0 2 | 3 | 4 | ||

| 3 0 2 | 4 | 1 | ||

| 3 0 2 | 4 | 2 | ||

| 3 0 2 | 5 | 1 | ||

| 3 0 2 | 5 | 2 | ||

| 3 0 2 | 5 | 3 | ||

| 3 0 2 | 6 | 1 | ||

| 3 0 2 | 6 | 2 | ||

| 3 0 2 | 6 | 3 | ||

| 3 0 2 | 7 | 2 | ||

| 3 0 2 | 7 | 3 | ||

| 3 0 2 | 7 | 5 | ||

| 3 0 2 | 9 | 3 | ||

| 3 0 2 | 9 | 5 | ||

| 3 0 2 | 9 | 6 | ||

| Calculations for payments to budgets | 3 0 3 | 0 | 0 | |

| 3 0 3 | 0 | 1 | ||

| 3 0 3 | 0 | 2 | ||

| 3 0 3 | 0 | 3 | ||

| 3 0 3 | 0 | 4 | ||

| 3 0 3 | 0 | 5 | ||

| 3 0 3 | 0 | 6 | ||

| 3 0 3 | 0 | 7 | ||

| 3 0 3 | 0 | 8 | ||

| 3 0 3 | 0 | 9 | ||

| 3 0 3 | 1 | 0 | ||

| 3 0 3 | 1 | 1 | ||

| 3 0 3 | 1 | 2 | ||

| 3 0 3 | 1 | 3 | ||

| Other settlements with creditors | 3 0 4 | 0 | 0 | |

| 3 0 4 | 0 | 1 | ||

| 3 0 4 | 0 | 2 | ||

| 3 0 4 | 0 | 3 | ||

| 3 0 4 | 0 | 4 | ||

| 3 0 4 | 8 | 4 | ||

| 3 0 4 | 9 | 4 | ||

| 3 0 4 | 0 | 5 | ||

| 3 0 4 | 0 | 6 | ||

| 3 0 4 | 8 | 6 | ||

| 3 0 4 | 9 | 6 | ||

| Calculations for cash payments | 3 0 6 | 0 | 0 | |

| Settlements on transactions on the accounts of the body providing cash services | 3 0 7 | 0 | 0 | |

| 3 0 7 | 1 | 0 | Settlements on transactions on the accounts of the body providing cash services | |

| 3 0 7 | 0 | 2 | ||

| 3 0 7 | 0 | 3 | ||

| 3 0 7 | 0 | 4 | ||

| 3 0 7 | 0 | 5 | ||

| Internal settlements based on receipts | 3 0 8 | 0 | 0 | |

| Internal settlements for disposals | 3 0 9 | 0 | 0 | |

| FINANCIAL RESULTS | 4 0 0 | 0 | 0 | |

| Financial result of an economic entity | 4 0 1 | 0 | 0 | |

| 4 0 1 | 1 | 0 | Revenues of the current financial year | |

| 4 0 1 | 1 | 6 | Income of the financial year preceding the reporting year, identified through control measures | |

| 4 0 1 | 1 | 7 | Income of previous financial years identified through control measures | |

| 4 0 1 | 1 | 8 | Income of the financial year preceding the reporting year, identified in the reporting year | |

| 4 0 1 | 1 | 9 | Income of previous financial years identified in the reporting year | |

| 4 0 1 | 2 | 0 | Expenses of the current financial year | |

| 4 0 1 | 2 | 6 | Expenses of the financial year preceding the reporting year, identified through control activities | |

| 4 0 1 | 2 | 7 | Expenses of previous financial years identified through control activities | |

| 4 0 1 | 2 | 8 | Expenses of the financial year preceding the reporting year identified in the reporting year | |

| 4 0 1 | 2 | 9 | Expenses of previous financial years identified in the reporting year | |

| 4 0 1 | 3 | 0 | Financial results of previous reporting periods | |

| 4 0 1 | 4 | 0 | revenue of the future periods | |

| 4 0 1 | 4 | 1 | Deferred income to be recognized in the current year | |

| 4 0 1 | 4 | 9 | Deferred income to be recognized in subsequent years | |

| 4 0 1 | 5 | 0 | Future expenses | |

| 4 0 1 | 6 | 0 | Reserves for future expenses | |

| Result for budget cash transactions | 4 0 2 | 0 | 0 | |

| 4 0 2 | 1 | 0 | Receipts | |

| 4 0 2 | 2 | 0 | Disposals | |

| 4 0 2 | 3 | 0 | The result of past reporting periods for cash budget execution | |

| AUTHORIZATION OF EXPENSES | 5 0 0 | 0 | 0 | |

| 5 0 0 | 1 | 0 | Validation for current financial year | |

| 5 0 0 | 2 | 0 | Authorization for the first year following the current (next financial year) | |

| 5 0 0 | 3 | 0 | Authorization for the second year following the current one (first year following the next one) | |

| 5 0 0 | 4 | 0 | Authorization for the second year following the next one | |

| 5 0 0 | 9 | 0 | Authorization for other subsequent years (outside the planning period) | |

| Limits on budget obligations | 5 0 1 | 0 | 0 | |

| 5 0 1 | 0 | 1 | ||

| 5 0 1 | 0 | 2 | ||

| 5 0 1 | 0 | 3 | ||

| 5 0 1 | 0 | 4 | ||

| 5 0 1 | 0 | 5 | ||

| 5 0 1 | 0 | 6 | ||

| 5 0 1 | 0 | 9 | ||

| Liabilities | 5 0 2 | 0 | 0 | |

| 5 0 2 | 0 | 1 | ||

| 5 0 2 | 0 | 2 | ||

| 5 0 2 | 0 | 5 | ||

| 5 0 2 | 0 | 7 | Obligations accepted | |

| 5 0 2 | 0 | 9 | Deferred liabilities | |

| Budget allocations | 5 0 3 | 0 | 0 | |

| 5 0 3 | 0 | 1 | ||

| 5 0 3 | 0 | 2 | ||

| 5 0 3 | 0 | 3 | ||

| 5 0 3 | 0 | 4 | ||

| 5 0 3 | 0 | 5 | ||

| 5 0 3 | 0 | 6 | ||

| 5 0 3 | 0 | 9 | ||

| Estimated (planned, forecast) assignments | 5 0 4 | 0 | 0 | |

| Right to assume obligations | 5 0 6 | 0 | 0 | |

| Approved amount of financial support | 5 0 7 | 0 | 0 | |

| Financial support received | 5 0 8 | 0 | 0 | |

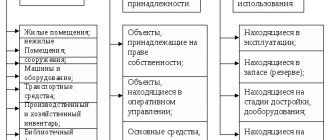

How to group objects

The federal standard introduces new principles for combining fixed assets. Instead of two groups (“Non-residential premises” and “Structures”), the new classification has one - “Non-residential premises (buildings and structures)”. In the new classification, there were also no separate groups for the library collection, soft furnishings, jewelry and jewelry; all these accounts are transferred to the “Other fixed assets” group.

Keep records according to the new rules in the program “Kontur-Accounting Budget”

But investment real estate is allocated - real estate, parts thereof or movable property intended for rental. The accountant should study which of the objects that are listed on account 01 will need to be transferred to the OS category.

| Instruction No. 157n (as amended on September 27, 2017) | Federal standard "Fixed assets" |

| 0 10101 000 “Residential premises” | 0 10101 000 “Residential premises” |

| 0 10102 000 “Non-residential premises” | 0 10102 000 “Non-residential premises (buildings and structures)” |

| 0 10103 000 “Structures” | 0 10103 000 “Investment property” |

| 0 10104 000 “Machinery and equipment” | 0 10104 000 “Machinery and equipment” |

| 0 10105 000 "Vehicles" | 0 10105 000 "Vehicles" |

| 0 10106 000 “Industrial and household equipment” | 0 10106 000 “Industrial and household inventory” |

| 0 10107 000 “Library fund” | 0 10107 000 “Biological resources” |

| 0 10108 000 “Soft inventory” 0 10109 000 “Jewelry and jewelry” 0 10110 000 “Other fixed assets” | 0 10108 000 “Other fixed assets” |

To correctly take into account OS according to the updated groups, objects must be moved: exclude objects from one group and include them in another. Their cost does not change.

Fixed assets between accounts are transferred one-time, based on the situation at the beginning of January 2021, through account 0 401 30 000 “Financial result of past reporting periods”. The basis for the transfer is an accounting certificate (form 0504833).

The principle of working with a register

Accounting accounts are numerical codes that indicate a specific type of asset, liability, income, expense and capital. They are used to systematize information about accounting objects.

The key principle of working with these accounting registers is the preparation of accounting entries using the double entry method. Transactions on off-balance sheet accounts are reflected in a simple way. Double entry involves the simultaneous reflection of one transaction in two accounts at once: the debit of one and the credit of the other. For example, when the size of an enterprise’s assets changes, the importance of their sources of financing will necessarily change. The principle also applies to the preparation of reports and balance sheets.

All accounts are classified into:

- Active. They can only have a debit balance of the account (positive value). The balance of active accounts at the end of the reporting period forms the active part of the balance sheet.

- Passive. Can only have a credit balance (debt, obligation, debt). Indicators of passive accounts reflect the liabilities of the balance sheet.

- Active-passive. Mixed type: characterized by balances of both debit and credit. Balances are included in the reporting, depending on the type of balance for the reporting period.

Read more: “Active and passive accounts: what is the difference and how to work with them.”

Which depreciation method to choose

With the introduction of the federal standard, the list of methods for calculating depreciation expanded, while Instruction No. 157n offered only the linear method. The federal standard offered more options. In total, the accountant has three methods for calculating depreciation.

- Linear method. It involves the accrual of equal amounts of depreciation monthly over the entire useful life (USI). To calculate the payment, you need to divide the initial cost of the object by the investment cost.

- Reducing balance method. Convenient for those objects that quickly become obsolete or are operated in difficult conditions, in an aggressive environment. The method allows for accelerated depreciation by applying an increasing factor from 1 to 3 to the annual amount. The residual value of the object is taken as a basis (costs of purchase and commissioning minus accruals already paid off at the beginning of the reporting year), the depreciation rate is also taken into account based on the SPI and wear indicator.

- Method of calculating the amount of depreciation proportional to the volume of production. The method is good for objects for which the production potential inherent in them is indicated (that is, it is clear how many products the object can produce over its entire service life). The calculation is based on the actual volume of products produced for the reporting period, multiplied by the depreciation rate (initial cost / estimated volume of products over the useful life).

The institution has the right to determine the depreciation method independently, taking into account the specifics of the activities, but the main criterion should be the potential economic benefit. The chosen method must be indicated in the accounting policy.

Important! The purpose of operating an asset may change, which means the organization must check whether the chosen depreciation method is appropriate. This must be done at the beginning of the reporting year. If necessary, the method can be changed, but previous accruals do not need to be recalculated.

Another innovation: the federal standard obliges to charge depreciation even on those objects that are idle, temporarily not used, or prepared for further write-off. The exception is objects whose residual value is equal to zero. Instruction No. 157n allowed to suspend the accrual of depreciation amounts during such periods.

The federal standard also shifted the initial cost boundaries for low-value operating systems. Objects worth up to 10,000 rubles are accounted for on an off-balance sheet account; depreciation is not charged on them. Previously, there was a limit of 3,000 rubles. For objects costing from 10,000 to 100,000 rubles, depreciation is equal to 100% of the original cost at the time of commissioning. A special rule for the library fund is that the amount of depreciation for objects of the library fund worth up to 100,000 rubles is calculated and accrued at 100 percent at the time of commissioning. For objects over 100,000 rubles, depreciation amounts are determined according to the method chosen by the institution. This limit was previously set at 40,000 rubles.

Unified Chart of Accounts

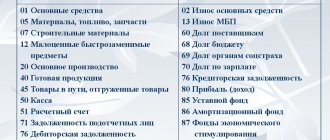

And this is a table of the chart of accounts with a breakdown for 2021 for commercial enterprises and non-profit organizations by order of the Ministry of Finance No. 94n dated October 31, 2000:

| Account number | Name |

| 01 | Fixed assets |

| 02 | Depreciation of fixed assets |

| 03 | Profitable investments in material assets |

| 04 | Intangible assets |

| 05 | Amortization of intangible assets |

| 07 | Equipment for installation |

| Investments in non-current assets | |

| 09 | Deferred tax assets |

| Materials | |

| 11 | Animals being raised and fattened |

| 14 | Reserves for reduction in the value of material assets |

| 15 | Procurement and acquisition of material assets |

| 16 | Deviation in the cost of material assets |

| 19 | Value added tax on purchased assets |

| Primary production | |

| 21 | Semi-finished products of our own production |

| 23 | Auxiliary production |

| 25 | General production expenses |

| General running costs | |

| 28 | Defects in production |

| 29 | Service industries and farms |

| 40 | Release of products (works, services) |

| Goods | |

| 42 | Trade margin |

| 43 | Finished products |

| Selling expenses | |

| 45 | Goods shipped |

| 46 | Completed stages of unfinished work |

| 50 | Cash register |

| 51 | Current accounts |

| 52 | Currency accounts |

| 55 | Special bank accounts |

| 57 | Transfers on the way |

| 58 | Financial investments |

| 59 | Provisions for impairment of financial investments |

| 60 | Settlements with suppliers and contractors |

| 62 | Settlements with buyers and customers |

| 63 | Provisions for doubtful debts |

| 66 | Calculations for short-term loans and borrowings |

| 67 | Calculations for long-term loans and borrowings |

| 68 | Calculations for taxes and fees |

| 69 | Calculations for social insurance and security |

| 70 | Payments to personnel regarding wages |

| 71 | Calculations with accountable persons |

| 73 | Settlements with personnel for other operations |

| 75 | Settlements with founders |

| 76 | Settlements with various debtors and creditors |

| 77 | Deferred tax liabilities |

| 79 | On-farm settlements |

| 80 | Authorized capital |

| 81 | Own shares (shares) |

| 82 | Reserve capital |

| 83 | Extra capital |

| 84 | Retained earnings (uncovered loss) |

| 86 | Special-purpose financing |

| 90 | Sales |

| 91 | Other income and expenses |

| 94 | Shortages and losses from damage to valuables |

| 96 | Reserves for future expenses |

| 97 | Future expenses |

| 98 | revenue of the future periods |

| 99 | Profit and loss |

Review of recent changes

Let's consider some of the latest changes by order of the Ministry of Finance of the Russian Federation dated November 16, 2021 No. 209n , issued by the Ministry of Justice. The full list of amendments can be found in the original source.

- In the Chart of Accounts, changes affected the names of the accounts themselves (for example, the previously named account “Estimated (planned) assignments” began to include, among others, the definition of “forecast”).

- Also, new analytical accounts have been added to some accounts. For example, the “Income of an economic entity” account previously included eleven analytical accounts, and with the new rules, another analytical account 040110174 “Lost income” appeared.

- There have been significantly more changes in the Instructions to the Chart of Accounts. Only in 2021 it was clarified what is meant by the 24-26 digits of the account number. The regulations for the formation of some accounts were more precisely defined (for example, 020400000 “Financial investments” from 1 to 17 categories includes zero values).

- To organize management accounting, now, at the request of the founder, you can specify analytical codes of inflows and outflows from 1 to 17 digits instead of zeros. This possibility must be specified in the accounting policy.

- The changes affected the correspondence of some accounts (not all cases were considered):

- We excluded the correspondence of accounts 040120272 for Debit and 010537440 for Credit when transferring the cost of sold GP to the costs of this financial year.

- We created correspondence accounts 021013.560 for Debit and 021012660 for Credit, characterizing the recalculation of the total value added tax on advances taken for withholding.

- The posting was changed: Debit 050209000 Credit 050201000 to Debit 050299000 Credit 050201000 for the operation of obtaining liabilities by using the reserve for future expenses.

Accounts for business entities

The plan for business entities that keep records using the double entry method, including non-profit organizations, is fixed and regulated by Order of the Ministry of Finance No. 94n dated October 31, 2000. This plan is the same for all institutions, except budgetary and credit (banks).

PAS consists of synthetic and analytical accounts, each of which has a specific numbering. Thus, the register structure represents first and second order accounts. The working document of each organization is developed in accordance with a single PS and includes synthetic and subaccounts.

Accounting registers differ in their content and are active, passive and active-passive. In total, the PAS, which is used by non-profit organizations and other business entities, contains 71 synthetic accounts, including 11 off-balance sheet accounts. The following sections of the PS for business entities are distinguished:

- fixed assets;

- productive reserves;

- production costs;

- finished products, goods;

- cash;

- calculations;

- capital;

- financial results.

Instructions for use of PS

Appendix 2 of Law No. 174n provides instructions for using the Chart of Accounts. It defines a system for displaying property, debts and events in the economic life of an institution. Budgetary organizations are guided by the Instructions for the use of the Unified Chart of Accounts and these Instructions.

The Instructions classify in more detail:

- accounts;

- divided into synthetic and analytical;

- the correspondence of accounts on the main events is commented on.

In the absence of a suitable entry in the current Instructions, the organization has every reason to develop its own, subject to an agreement not to violate the law.

Accounts for banking organizations

The Central Bank of the Russian Federation has made significant changes to the current plan for credit institutions. Now the procedure by which the bank’s chart of accounts is applied is regulated by the regulation of the Central Bank of the Russian Federation No. 579-P dated 02/27/2017 (as amended on 02/28/2019) with the indication of the Central Bank of the Russian Federation No. 4722-U dated 02/15/2018.

The structure of the plan consists of the following chapters:

- Chapter A - balance sheet accounts;

- Chapter B - trust management accounts;

- Chapter B - off-balance sheet accounts;

- Chapter D - accounts for accounting for claims and obligations under derivative financial instruments and other agreements (transactions), under which settlements and delivery are carried out no earlier than the next day after the conclusion of the agreement (transaction).

Each chapter includes specific sections and subsections.

New electronic forms of primary documents

Bodies and institutions that have delegated the authority to maintain budget accounting by decision of the supreme executive body or local administration will use new forms of electronic primary reporting. Among them: a decision on a business trip to the territory of the Russian Federation, a decision on a business trip to the territory of a foreign state, an application to justify the purchase of goods, works, small-scale services, etc.

In addition, for such bodies and institutions, new forms have been provided for the register of PKOs and RKOs and statements of additional income of individuals subject to personal income tax and insurance contributions.

Anyone who has transferred record keeping to centralized accounting for other reasons can use the new forms at their own discretion.