When moving materials from one organization to another, or between its departments, an M-15 invoice is issued for the release of materials to the outside . It is also compiled when transferring customer-supplied raw materials for processing.

forms M-15: Excel

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

In what cases is it prescribed?

This document applies only in cases where the releasing and receiving units are actually located at a significant territorial distance from each other. Otherwise, it is recommended to use other forms of documents that also reflect the movement of inventory items.

an invoice for the release of materials to the third party in the case when there is no sale of goods and materials when moving goods (for these purposes, a TORG-12 invoice is usually used). This operation can take place either within one organization or between two different enterprises by prior agreement. Such movements of inventory items include their transfer for safekeeping or transfer of customer-supplied raw materials.

When transferring goods and other inventory items for safekeeping

Material assets transferred without transfer of ownership rights to them, but with the obligation of the recipient to ensure their safety, are considered property under safekeeping.

The transfer of goods and materials for safekeeping is accompanied by the execution of a storage agreement and an invoice.

At the end of the storage period, material assets are returned . A similar document is issued for a return, only now the recipient is the sender.

For customer-supplied raw materials

Provided raw materials are materials that are received from the customer for processing or manufacturing of products.

In this case, goods and materials are accepted without payment of their cost and the performing organization is obliged to return them in processed form to the customer in full (paragraph 2, clause 156 of the Methodological Guidelines for Accounting for Inventories).

Exhibitor's Guide to the Warehouse Exhibition. Transport. Logistics-2010"

1 2 3 4 5 6 7

| ^ Please submit 2 copies on the exhibiting company’s letterhead. Specify the paying company that has entered into an agreement with Expocentre |

| Expocentre Fairgrounds To the Exhibition Directorate "Stock. Transport. Logistics-2010" |

We ask for permission to import/export the following exhibition equipment and materials that will be presented and/or used at stand No.____________ in pavilion No. ______ during the exhibition “Warehouse. Transport.

In what form is it formatted?

The release of inventory items to a third party can be formalized by a document developed within the organization, or the enterprise can use the unified form M-15.

If an enterprise uses its own form, then the form must be approved by order and contain the required details :

- document's name;

- its serial number and date of compilation;

- name of the issuing and receiving party;

- basis for release of inventory items;

- data on material assets: name, unit of measurement, quantity, price and cost;

- information about the responsible persons who released and accepted the goods.

For the convenience of warehouse accounting, it is recommended to provide columns in the invoice form containing more detailed information about the goods being moved (item number, inventory number or warehouse card number).

It is more rational to use your own form within one organization ; you can add columns with internal accounting information or data not intended for third parties.

When moving material assets between different organizations, it is appropriate to use the unified form M-15, thus the third-party organization will not have claims against the releasing party regarding the documentation of the operation.

If a carrier organization is involved in the movement of material assets, it is recommended to issue an invoice in the form 0504205 according to OKUD. It indicates not only the data of the issuing organization and the organization receiving the goods and materials, but also the data of the carrier.

Certificate of acceptance and transfer of building materials sample form

Logistics-2010"

| № p/p | Name | Quantity |

| 1 |

*Add lines if necessary. We guarantee removal of imported equipment, exhibits, containers, large packaging and construction materials for exhibition stands within the established time frame. Head of the organization _______________________/

(signature) (full name) M.P. ATTENTION!

If the cargo, in addition to exhibits, contains structural elements of the stand (wall panels, carpet, decorative structures and elements, etc.), it is necessary to undergo import approval at Expoconsta CJSC and PCH No. 160 of the Central Administrative District Directorate of the Ministry of Emergency Situations of Russia in Moscow.

powerful projection installations, sound reinforcement equipment and concert lighting equipment is carried out after agreement with the Telecommunications Department.

| Place of the stamp of JSC "Expokonsta" | Place of stamp IF No. 160 | Place of stamp of the Telecommunications Department |

D.04

employees of installation companies,

carrying out construction and installation work

exhibition stands and expositions

(provided in 1 copy)

on company/organization letterhead

To the Directorate of the exhibition “Warehouse. Transport. Logistics-2010"

We ask you to provide passes for entry to the Expocentre Fairgrounds for employees and workers of the installation organization ______________________, in the amount of _____ pieces, who are building the stand of our company _________________, taking part in the exhibition “Warehouse. Transport. Logistics-2010"

under Agreement No.________ dated “____” ____________ 20____ Pavilion No.________, hall_______, stand No.___________. The stand area is __________ sq. m.

List of employees (indicating passport details, place of residence; for non-residents it is necessary to provide a copy of registration of residence in Moscow):

| Item no. | Full name | Passport data (date and place of birth, places of permanent and temporary registration) | Instructions on safety precautions, fire safety and electrical work have been completed | |

| date | Signature | |||

| 1 | 2 | 3 | 4 | 5 |

1 2 3 4 5 6 7

Filling rules

M-15

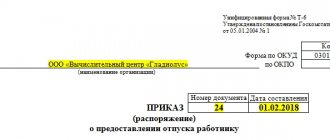

Form M-15 is filled out by employees of the organization or structural unit that issues goods and materials. This could be an accountant who issues and transfers the invoice to the warehouseman or the directly responsible warehouse employee. It is drawn up in two copies - one each for the releasing and receiving parties.

The invoice must contain the serial number and date of preparation, as well as the name of the organization that issued the document. The sending structural unit and the receiving structural unit are required. For ease of accounting, it is advisable to indicate the type of activity of these structural units (storage or production).

In the “Bases” column, details of documents authorizing the release of materials are written. This may be an order, an order for the release of materials, a work order or a power of attorney.

The tabular part of the M-15 form indicates information about the transferred material assets:

- name of the material indicating the brand, grade and size;

- its item number;

- unit of measurement;

- the quantity of goods and materials that must be issued according to the basis document, and the actual quantity of materials issued;

- price, amount, VAT amount and final amount of material assets including value added tax;

- additional information about the transferred materials - inventory number (if fixed assets are transferred for safekeeping).

Data on the quantity, amount and VAT of issued inventory items are summarized and indicated in words in separate columns.

Without data that allows one to sufficiently accurately identify the transferred goods and materials, their quantity and amount, and without data on the basis for such movement of materials, as well as without indicating the transferring and receiving parties, the invoice is invalid.

Below is the invoice form and an example of how to fill it out:

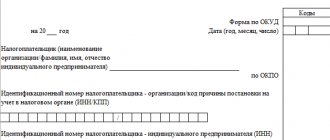

Forms 0504205 according to OKUD

The invoice in form 0504205 according to OKUD must also contain the number and date of registration . It indicates the name and tax identification number of the sender, recipient and organization transporting goods and materials.

In the “Bases” column, the details of the agreement between the sender and the recipient, the vacation order and the power of attorney to receive materials are indicated.

The tabular part of the document contains information about:

- material assets indicating the name, grade, brand and other necessary data;

- inventory number of goods and materials or passport number;

- unit of measurement and price;

- the amount of material assets that should be released and released in fact;

- cost of materials without VAT, the amount of VAT and cost of materials with tax.

Tabular data on quantity and cost are summarized, information on the total cost of materials including VAT is indicated in words in the corresponding column.

Basic information

The standard form M-15 is used when drawing up an invoice for the release of material assets to the outside. This type of invoice is issued by a warehouse worker or accountant.

In this case, two copies are created - for the receiving entity and the issuing organization. The basis for drawing up this invoice is a written order from the management of the organization. What is important is the fact that the receiving party has a power of attorney allowing them to receive inventory items. You can fill out the M-15 manually or using technical methods.

The finished document contains data that allows you to identify:

- document number and date of its preparation;

- name of the supplier and recipient;

- the name of the transferred values, their value and quantity.

Responsible persons for the accuracy of the contents of the document are the persons who are directly involved in the operation.

This is the employee who authorized the release of valuables, the person who released the materials, the chief accountant of the issuing enterprise and the recipient or his representative.

What it is

Form M-15 is a documentary form on the basis of which an invoice for the release of materials to the third party is drawn up.

It is used to take into account the release of inventory and materials to divisions of one’s own organization located outside the main representative office or when releasing valuables to third-party companies. The basis for creating a document, in addition to the administrative document of management, can be an agreement, order, or power of attorney to receive valuables.

The copy transferred to the recipient is used by him to post the received objects in his accounting. The second copy, which is retained by the issuing organization, is used to write off accounting objects.

Four signatures on the document are required - the chief accountant, the responsible employee who authorized the release of goods and materials, the person who directly released the materials and the recipient.

Moreover, one invoice in form M-15 can be filled out by both an accountant and a financially responsible employee.

The M-15 details that must be filled out are as follows:

- document number and date;

- names of the sender and recipient of the goods and materials;

- basis for leave;

- name of the recipient's organization or unit;

- name and quantity of valuables sold;

- signatures of responsible persons.

What is it for?

Documentation of the movement of valuables and materials between structural divisions of one company or in interaction with third-party enterprises can be carried out using several documents. The accounting policy of the organization stipulates which document should be used in a particular case and what its mandatory details should be.

To prepare an invoice for outsourcing of goods, it is convenient to use a unified form, since it contains all the necessary details. This is the M-15 form.

In addition, this form is available in the database of almost all specialized programs. If necessary, the organization can supplement the form or simplify it somewhat.

Just like the demand invoice M-15 can be used when transferring materials within an organization, which makes these two documents very similar. If necessary, the document is drawn up by the responsible person (storekeeper or accountant). Based on an order from management or an agreement concluded between organizations, valuables are released. In this case, the counterparty presents a power of attorney authorizing him to receive the valuables.

The person who issued the materials displays his copy of M-15 in the expenditure section of the material report and transfers it to the accounting department. The accountant, guided by the document, writes off the valuables from the organization's records. The recipient uses the M-15 form as an invoice, justifying the receipt of valuables and their acceptance for accounting.

Most often, the M-15 form is used when transferring various inventory items. For example, when issuing uniforms to staff and releasing materials into production.

Regulatory regulation

There are two forms used to transfer material assets. These are TORG-12 and M-15. Their forms are somewhat different, although the main purpose of both is considered to be to display the fact of the transfer of valuables. It is believed that the standard intersectoral form M-15, approved by Resolution of the State Statistics Committee of the Russian Federation No. 71a of October 30, 1997, can only be used when moving inventory items within the organization.

In case of interaction with third-party organizations, M-15 can only be used for non-trade transactions. For example, return of defective goods, transfer to the authorized capital, transfer of customer-supplied raw materials. Transactions related to the sale should be completed using the TORG-12 form. This position is not entirely correct. The Tax Code does not define any specific invoice.

There is also no list of documents that are used to document expenses. In matters of accounting and calculation of taxes, the main thing is the availability of documents.

That is, an invoice in form M-15 may well accompany the transfer of materials to a third party through sales. This point of view is confirmed by clause 120 of the Methodological Instructions adopted by Order of the Ministry of Finance of the Russian Federation No. 119n dated December 28, 2001.

Often, judicial practice is on the side of the taxpayer regarding the use of M-15 when selling goods and materials.

Signing the document

Form M-15 is signed by the person who authorized the release of material assets (for example, director, chief engineer, deputy for production or head of a structural unit). In addition, the invoice must be signed by the organization’s chief accountant and the financially responsible person.

The invoice in form 0504205 according to OKUD is certified by the responsible executor - this is, as a rule, the accountant of the material desk who issued the document. When releasing material assets, the invoice is endorsed by the materially responsible person shipping the materials.

Signatures of the manager and chief accountant are not provided here , because the release of material assets to third parties is carried out on the basis of an agreement concluded between two organizations and a power of attorney to receive goods and materials.

From the receiving side, the invoice is endorsed either by the storekeeper, who accepts the materials into his warehouse, or by the head of the production workshop, who will transfer the received materials to production.

All signatures must necessarily contain the name of the position of the person signing the document and a transcript of his signature. Without at least one signature, this document is invalid and cannot be taken into account.

FAQ

Despite the fact that filling out the M-15 form does not cause any particular difficulties, thanks to the intuitive form, certain questions arise when using the document.

For example, how to prepare closing documents when conducting operations using the M-15 consignment note. What documents are needed for the operation to be considered completed.

Some disputes arise regarding the display of accounting accounts in the invoice. Is it necessary to indicate the accounts on which transactions will subsequently be made to reflect the transaction. After all, materials are transferred, and they are listed in the organization’s records and it is necessary to somehow reflect the transfer of inventory items.

What closing documents are needed for it?

Final documents are those that certify the completion of the transaction on the part of both parties involved in terms of the execution of the main subject of the contract.

In order for a transaction to be considered not only paid, but also legally completed, there must be written confirmation.

The M-15 invoice is drawn up on the basis of an agreement for the transfer of goods and materials, a storage agreement, an order from the manager to transfer materials to production and similar documents. That is, the invoice closes these documents, confirming their execution, and is a confirmation of acceptance of the goods.

It is on the basis of the invoice that the value is written off in the accounting of the issuing value of the organization and accepted for accounting by the recipient of the value. That is, the invoice itself is a closing document. It is important to know that only original documents have legal force.

If, due to certain circumstances, a copy of the invoice was provided at an intermediate stage of the transaction, then the original must still be present in the accounting registers.

The absence of final documents may be grounds for recognizing the transaction as not complete and not closed.

The consequence may be additional tax assessment, since the accountant does not have the right to include undocumented expenses in the declaration.

Do I need to stamp it?

Forms of form M-15 and form 0504205 according to OKUD do not provide for stamping on them . Accordingly, these documents are valid even without a seal.

However, it is customary for business rules to certify the signatures of both parties when exchanging documents between two different enterprises. Organizations can record this point in an appendix to the custody agreement or to the toll agreement.

You can also affix stamps when moving materials between different structural divisions of the same organization, if this is provided for by an internal local document.

Is the M-15 always used?

The legislation does not prohibit an organization from developing its own form of a document and using it on an equal basis with the unified one or instead of it. However, in most cases there is no such need, and using a ready-made option is more convenient. If the company's accounting policy provides for the use of its own documentation, it must reflect all the data given above in any form (table, simple list, etc.).

NOTE. If the document contains factual quantitative errors (number of copies, prices, incorrect calculation of VAT, etc.), this cannot cause additional tax charges.

How is the fact of inventory movement recorded in accounting documents?

The invoice for the issue of materials is recorded in the journal of warehouse documents of the issuing and receiving parties. At the end of the reporting period (week, decade, month), the financially responsible person transfers primary documents to the accounting department through the register.

The accountant, based on the business transaction that was issued with an invoice for the release of materials to the third party, makes entries and reflects it in accounting.

If a transfer for safekeeping has been formalized, the receiving organization reflects them on off-balance sheet account 002 “Materials accepted for safekeeping.”

The sending organization does not write off inventory items from its balance sheet, and reflects their movement only on the subaccounts of analytical accounting of account 10 “Materials”.

Similarly, the sender will reflect material assets when transferring customer-supplied raw materials, but the organization carrying out processing records them in off-balance sheet account 003 “Materials accepted for processing.”

When transferring material assets between geographically distant structural divisions of one organization, accounting entries will depend on the purpose of the transfer.

- If this is a movement between warehouses, then postings will only be between different subaccounts of account 10 “Materials”.

- When materials are transferred to production, they are written off from the credit of account 10 to the debit of account 20 “Main production”.

Who can sign the form

Immediately after compilation, the form is signed by the employee who releases the goods, and upon receipt - by the employee (or buyer) who received it.

As for the final signature with the right to authorize the release of valuables from the warehouse and their subsequent movement to a specific recipient, the following has the right to put it:

- a representative of the accounting department - this can be either the chief accountant or an accountant directly responsible for a given area or division (branch);

- a designated responsible employee who replaces the accountant;

- any employee who has the right to sign a power of attorney issued by the employer (for example, in the absence of an accountant).

The seller must affix an original seal reflecting the full name and details of the company, since this is essentially about the execution of a purchase and sale transaction and the transfer of the relevant goods to the buyer. On the buyer's part, it is enough to simply put his signature.

How long does it last?

Like all primary documents, the invoice for the release of materials to third parties must be stored in the organization for at least five reporting years , after which it can be destroyed. Storage is carried out, as a rule, by the accounting department of the enterprise. In large enterprises with a large volume of document flow, this function is assigned to a separate official.

It is important to know what other invoices there are. We suggest you read about the following types: for the release of goods, for the movement of inventory items within the enterprise, incoming and outgoing, outgoing and incoming, transport, TTN, return.

An invoice for the release of materials is issued for the movement of goods and materials within one organization, but between its geographically remote divisions, or between different organizations when transferring materials for storage or processing. An enterprise has the right to develop its own form or use standardized forms.

If you find an error, please select a piece of text and press Ctrl+Enter.

Don't have a dacha yet?

Construction of houses in Pereslavl-Zalessky.

- huge lake

- pine forests

- hunting and fishing

- 1.5 hours from Moscow

An invoice (standard form No. M-15) is drawn up in case of supply of goods and materials on the basis of an agreement and other documents to business entities of their organization located outside its location, as well as to other third-party organizations.

The invoice must be drawn up in two copies, one is given to the warehouse (which is the basis for the release of goods and materials), and the other is given to the recipient of the goods and materials.

Persons who can issue this form:

- The accounting employee who is responsible for this area,

- Responsible employee of the structural unit,

- A storekeeper who acts on the basis of a power of attorney or order.

Service Temporarily Unavailable

It is calculated as the sum of indicators from columns 10 and 11.

Columns 13 to 15 are filled out by the storekeeper:

- Column 13 indicates the inventory number assigned to the material according to the warehouse card file;

- in column 14 - the passport number, which is usually available for material assets containing precious metals and stones. In other cases, a dash is placed in the column;

- Column 15 contains the entry number in the materials accounting card.

Based on the results of the invoice, the number of items of material assets issued, the total amount of goods and materials and VAT included in the total amount are indicated in words. Sign the invoice:

- the responsible person who authorized the release of material assets;

- the person who released the material assets;

- Chief Accountant;

- recipient of valuables.

Sample of filling out an invoice for issue of goods and materials on the side

Use of customer-supplied materials.

Every year, the numbering of invoices starts from one. When filling out the form (outsourcing of goods and materials), in the first table you must indicate:

- Date of registration,

- Sender. You must indicate the name of the structural unit and the type of its activity,

- Code of the type of operation performed (if the organization uses a code system),

- Recipient. You must indicate the name of the department, its type of activity,

- Responsible for the supply of goods and materials. Contractor code, unit name, type of activity.

After this, the document that serves as the basis for issuing the invoice is indicated. In the “To” line, write the name of the recipient of the goods and materials (the business entity of its organization or a third-party organization). In addition, write down the full name of the recipient and details of the power of attorney provided by him. Column 3. Write the name of the goods and materials, their characteristics: brand, size, grade. Column 4. Nomenclature number (if not available, then put a dash). Column 5. The code of units of measurement according to OKEI is recorded. Column 6. The name of the units of measurement is indicated. Column 7. Write the amount of material required for shipment. Column 8. Filled out by the storekeeper, indicating the actual quantity of materials released. Column 9. The price of one unit of goods and materials in rubles and kopecks without VAT. Column 10. Price of issued inventory items without VAT. Column 11. Total VAT amount. Column 12. Total cost of goods including VAT. (in total columns 10 and 11). Column 13. The inventory number is recorded. Column 14. The passport number of goods and materials (precious metals) is recorded. Column 15. Entry number in a special materials accounting card.

Read more: What documents are needed to register a foster family?

In the conclusion, indicate the number of items of goods and materials issued, the total amount of the invoice and additionally VAT, which is included in the total amount.

The invoice form is signed by: the responsible employee who authorized the release of goods and materials, the employee who released the goods and materials, the chief accountant and the recipient of goods and materials.