Which companies pay deductions for injuries?

Payments for compulsory social insurance against accidents and occupational diseases (insurance premiums against accidents, for injuries, under NS and PP) are mandatory contributions to the budget that are paid by each employer.

The payers are legal entities (commercial and non-commercial), individual entrepreneurs who hired a citizen under an employment contract or under a civil law contract (if it states that the customer pays contributions for injuries), in accordance with clause 1 of Art. 20.1 of Law No. 125-FZ. Contributions are deducted from all payments, with the exception of the following (Article 20.2 of Law No. 125-FZ):

- material aid;

- sick leave;

- compensation related to dismissal.

ConsultantPlus experts discussed how to charge insurance premiums against industrial accidents to the Federal Social Insurance Fund of the Russian Federation. Use these instructions for free.

What's new in 2021

Tariffs, categories of payers and beneficiaries remained the same, but the changes affected the following:

- On December 31, 2021, the deadline for completing the special assessment procedure for working conditions expired - in 2021, those who do not do this will face trouble;

- if a special assessment of working conditions in offices was carried out, data on this must be reflected in Table 5 of Form 4-FSS for the first quarter of 2019;

- do not forget to use this information in the application for calculating the tariff discount (the application for a discount in 2021 must be sent no later than November 1, 2019).

What payment percentages are established depending on the type of activity?

The percentage is determined depending on the class of professional risk, which is determined according to the main OKVED (Article 21 of Law No. 125-FZ, Article 1 of Law No. 179-FZ of December 22, 2005, Article 1 of Law No. 445-FZ of December 27, 2019, clauses 1, 2, 8 of the Rules, approved by government decree No. 713 of December 1, 2005). The rate of contributions to the Social Insurance Fund from NS and PP in 2021 according to OKVED for additional types of activities cannot be determined; only the main type is taken into account according to the data in the Unified State Register of Legal Entities.

For the next year, according to the table of occupational risk classes according to OKVED, the following indicators have been established in 2021:

| Occupational risk class | Insurance rate (%) | Occupational risk class | Insurance rate (%) |

| I | 0,2 | XVII | 2,1 |

| II | 0,3 | XVIII | 2,3 |

| III | 0,4 | XIX | 2,5 |

| IV | 0,5 | XX | 2,8 |

| V | 0,6 | XXI | 3,1 |

| VI | 0,7 | XXII | 3,4 |

| VII | 0,8 | XXIII | 3,7 |

| VIII | 0,9 | XXIV | 4,1 |

| IX | 1,0 | XXV | 4,5 |

| X | 1,1 | XVI | 5,0 |

| XI | 1,2 | XVII | 5,5 |

| XII | 1,3 | XVIII | 6,1 |

| XIII | 1,4 | XXIX | 6,7 |

| XIV | 1,5 | XXX | 7,4 |

| XV | 1,7 | XXXI | 8,1 |

| XVI | 1,9 | XXXII | 8,5 |

Tariffs by rates

For some categories of employers, reduced injury contribution rates apply in 2021. The amount of the contribution to compulsory social insurance from NS and PZ depends on whether the insuring organization has the right to receive benefits, and under what type of economic activity code the institution operates.

The FSS rate according to OKVED 2021 is set by specialists of the Social Insurance Fund and is determined on the basis of legally adopted tariffs for fees.

The regulatory framework for determining the rate in 2020 is as follows:

- Federal Law No. 179-FZ dated December 22, 2005 - establishes a tariff scale depending on the class of professional risk;

- Federal Law No. 484-FZ dated December 31, 2017 - the rate of insurance premiums against accidents for the billing period up to 2021 inclusive;

- Order of the Ministry of Labor of the Russian Federation No. 851n dated December 30, 2016 - approves the classification of types of economic activities in accordance with the degree of profrisk.

All rate standards in force in 2021, in accordance with OKVED 2, are presented in the table.

| Occupational risk class | NS and PZ rate according to OKVED 2021, in % | Code of types of economic activity from the OKVED 2 directory |

| 1 | 0,2 | 03.21.3, 03.21.5, 03.21.9, 03.22.4, 03.22.5, 03.22.6, 03.22.9, 06.20, 06.20.1, 06.20.2, 09.10.4, 10.89.6, 12.00, 12.00.1, 12.00.2, 12.00.3, 18.1, 18.11, 18.12, 18.13, 18.14, 18.20, 32.99.8, 35.11.1, 35.11.3, 35.14, 35.2, 35.21, 35.21.1, 35.21.11, 35.21.12, 35.21.13, 35.21.2, 35.21.21, 35.21.22, 35.21.23, 35.22, 35.22.1, 35.22.11, 35.22.12, 35.22.2, 35.22.21, 35.22.22, 35.23, 35.23.1, 35.23.11, 35.23.12, 35.23.2, 35.23.21, 35.23.22, 35.30, 35.30.1, 35.30.11, 35.30.12, 35.30.13, 35.30.14, 35.30.15, 35.30.2, 35.30.3, 35.30.4, 35.30.5, 35.30.6, 36.00, 36.00.1, 36.00.2, 41.10, 46.1, 46.11, 46.11.1, 46.11.2, 46.11.3, 46.11.31, 46.11.32, 46.11.33, 46.11.34, 46.11.35, 46.11.39, 46.12, 46.12.1, 46.12.2, 46.12.21, 46.12.22, 46.12.3, 46.12.31, 46.12.32, 46.13, 46.13.1, 46.13.2, 46.14, 46.14.1, 46.14.2, 46.14.9, 46.15, 46.15.1, 46.15.2, 46.15.3, 46.15.4, 46.15.9, 46.16, 46.16.1, 46.16.2, 46.16.3, 46.17, 46.17.1, 46.17.2, 46.17.21, 46.17.22, 46.17.23, 46.17.3, 46.18, 46.18.1, 46.18.11, 46.18.12, 46.18.13, 46.18.14, 46.18.2, 46.18.3, 46.18.9, 46.18.91, 46.18.92, 46.18.93, 46.18.99, 46.19, 46.2, 46.21, 46.21.1, 46.21.11, 46.21.12, 46.21.13, 46.21.14, 46.21.19, 46.21.2, 46.22, 46.23, 46.24, 46.3, 46.31, 46.31.1, 46.31.11, 46.31.12, 46.31.13, 46.31.2, 46.32, 46.32.1, 46.32.2, 46.32.3, 46.33, 46.33.1, 46.33.2, 46.33.3, 46.34, 46.34.1, 46.34.2, 46.34.21, 46.34.22, 46.34.23, 46.34.3, 46.35, 46.36, 46.36.1, 46.36.2, 46.36.3, 46.36.4, 46.37, 46.38, 46.38.1, 46.38.2, 46.38.21, 46.38.22, 46.38.23, 46.38.24, 46.38.25, 46.38.26, 46.38.29, 46.39, 46.39.1, 46.39.2, 46.4, 46.41, 46.41.1, 46.41.2, 46.42, 46.42.1, 46.42.11, 46.42.12, 46.42.13, 46.42.14, 46.42.2, 46.43, 46.43.1, 46.43.2, 46.43.3, 46.43.4, 46.44, 46.44.1, 46.44.2, 46.45, 46.45.1, 46.45.2, 46.46, 46.46.1, 46.46.2, 46.47, 46.47.1, 46.47.2, 46.47.3, 46.48, 46.48.1, 46.48.2, 46.49, 46.49.1, 46.49.2, 46.49.3, 46.49.31, 46.49.32, 46.49.33, 46.49.4, 46.49.41, 46.49.42, 46.49.43, 46.49.44, 46.49.49, 46.49.5, 46.5, 46.51, 46.51.1, 46.51.2, 46.52, 46.52.1, 46.52.2, 46.52.3, 46.6, 46.61, 46.61.1, 46.61.2, 46.62, 46.62.1, 46.62.2, 46.62.3, 46.63, 46.64, 46.65, 46.66, 46.69, 46.69.1, 46.69.2, 46.69.3, 46.69.4, 46.69.5, 46.69.6, 46.69.7, 46.69.8, 46.69.9, 46.7, 46.71, 46.71.1, 46.71.2, 46.71.3, 46.71.4, 46.71.5, 46.71.51, 46.71.52, 46.71.9, 46.72, 46.72.1, 46.72.11, 46.72.12, 46.72.2, 46.72.21, 46.72.22, 46.72.23, 46.73, 46.73.1, 46.73.2, 46.73.3, 46.73.4, 46.73.5, 46.73.6, 46.73.7, 46.73.8, 46.74, 46.74.1, 46.74.2, 46.74.3, 46.75, 46.75.1, 46.75.2, 46.76, 46.76.1, 46.76.2, 46.76.3, 46.76.4, 46.77, 46.90, 47.1, 47.11, 47.11.1, 47.11.2, 47.11.3, 47.19, 47.19.1, 47.19.2, 47.2, 47.21, 47.21.1, 47.21.2, 47.22, 47.22.1, 47.22.2, 47.22.3, 47.23, 47.23.1, 47.23.2, 47.24, 47.24.1, 47.24.2, 47.24.21, 47.24.22, 47.24.3, 47.25, 47.25.1, 47.25.11, 47.25.12, 47.25.2, 47.26, 47.29, 47.29.1, 47.29.11, 47.29.12, 47.29.2, 47.29.21, 47.29.22, 47.29.3, 47.29.31, 47.29.32, 47.29.33, 47.29.34, 47.29.35, 47.29.36, 47.29.39, 47.4, 47.41, 47.41.1, 47.41.2, 47.41.3, 47.41.4, 47.42, 47.43, 47.5, 47.51, 47.51.1, 47.51.2, 47.52, 47.52.1, 47.52.2, 47.52.3, 47.52.4, 47.52.5, 47.52.6, 47.52.7, 47.52.71, 47.52.72, 47.52.73, 47.52.74, 47.52.79, 47.53, 47.53.1, 47.53.2, 47.53.3, 47.54, 47.59, 47.59.1, 47.59.2, 47.59.3, 47.59.4, 47.59.5, 47.59.6, 47.59.7, 47.59.9, 47.6, 47.61, 47.62, 47.62.1, 47.62.2, 47.63, 47.63.1, 47.63.2, 47.64, 47.64.1, 47.64.2, 47.64.3, 47.64.4, 47.64.5, 47.65, 47.7, 47.71, 47.71.1, 47.71.2, 47.71.3, 47.71.4, 47.71.5, 47.71.6, 47.71.7, 47.71.8, 47.72, 47.72.1, 47.72.2, 47.73, 47.74, 47.74.1, 47.74.2, 47.75, 47.75.1, 47.75.2, 47.75.3, 47.76, 47.76.1, 47.76.2, 47.77, 47.77.1, 47.77.2, 47.78, 47.78.1, 47.78.2, 47.78.21, 47.78.22, 47.78.3, 47.78.4, 47.78.5, 47.78.6, 47.78.61, 47.78.62, 47.78.63, 47.78.7, 47.78.8, 47.78.9, 47.79, 47.79.1, 47.79.2, 47.79.3, 47.79.4, 47.8, 47.81, 47.81.1, 47.81.2, 47.82, 47.82.1, 47.82.2, 47.89, 47.89.1, 47.89.2, 47.9, 47.91, 47.91.1, 47.91.2, 47.91.3, 47.91.4, 47.99, 47.99.1, 47.99.2, 47.99.3, 47.99.4, 47.99.5, 49.31.24, 49.31.25, 49.39, 49.39.2, 49.39.31, 49.39.32, 49.39.33, 49.39.34, 49.39.35, 49.39.39, 49.50, 49.50.1, 49.50.11, 49.50.12, 49.50.2, 49.50.21, 49.50.22, 49.50.3, 53.10, 53.10.1, 53.10.2, 53.10.3, 53.10.4, 53.10.9, 53.20, 53.20.1, 53.20.2, 53.20.21, 53.20.22, 53.20.29, 53.20.3, 53.20.31, 53.20.32, 53.20.39, 55.10, 55.20, 55.30, 55.90, 56.10, 56.10.1, 56.10.2, 56.10.21, 56.10.22, 56.10.23, 56.10.24, 56.10.3, 56.2, 56.21, 56.29, 56.29.1, 56.29.2, 56.29.3, 56.29.4, 56.30, 58.1, 58.11, 58.11.1, 58.11.2, 58.11.3, 58.11.4, 58.12, 58.12.1, 58.12.2, 58.13, 58.13.1, 58.13.2, 58.14, 58.14.1, 58.14.2, 58.19, 58.2, 58.21, 58.29, 59.11, 59.12, 59.13, 59.14, 59.20, 59.20.1, 59.20.2, 59.20.3, 60.10, 60.20, 61.10, 61.10.1, 61.10.2, 61.10.3, 61.10.4, 61.10.5, 61.10.6, 61.10.8, 61.10.9, 61.20, 61.20.1, 61.20.2, 61.20.3, 61.20.4, 61.20.5, 61.30, 61.30.1, 61.30.2, 61.90, 62.0, 62.01, 62.02, 62.02.1, 62.02.2, 62.02.3, 62.02.4, 62.02.9, 62.03, 62.03.1, 62.03.11, 62.03.12, 62.03.13, 62.03.19, 62.09, 63.1, 63.11, 63.11.1, 63.11.9, 63.12, 63.12.1, 63.9, 63.91, 63.99, 63.99.1, 63.99.11, 63.99.12, 63.99.2, 64.1, 64.11, 64.19, 64.20, 64.30, 64.9, 64.91, 64.91.1, 64.91.2, 64.92, 64.92.1, 64.92.2, 64.92.3, 64.92.4, 64.92.6, 64.92.7, 64.99, 64.99.1, 64.99.2, 64.99.3, 64.99.4, 64.99.5, 64.99.6, 64.99.7, 64.99.8, 64.99.9, 65.1, 65.11, 65.12, 65.12.1, 65.12.2, 65.12.3, 65.12.4, 65.12.5, 65.12.6, 65.12.9, 65.20, 65.30, 66.1, 66.11, 66.11.1, 66.11.2, 66.11.3, 66.11.4, 66.11.5, 66.12, 66.12.1, 66.12.2, 66.12.3, 66.19, 66.19.1, 66.19.3, 66.19.4, 66.19.5, 66.19.6, 66.19.61, 66.19.62, 66.2, 66.21, 66.22, 66.29, 66.29.1, 66.29.2, 66.29.9, 66.30, 66.30.1, 66.30.2, 66.30.3, 66.30.4, 66.30.5, 66.30.6, 66.30.9, 68.3, 68.31, 68.31.1, 68.31.11, 68.31.12, 68.31.2, 68.31.21, 68.31.22, 68.31.3, 68.31.31, 68.31.32, 68.31.4, 68.31.41, 68.31.42, 68.31.5, 68.31.51, 68.31.52, 68.32, 68.32.1, 68.32.2, 68.32.3, 69.10, 69.20, 69.20.1, 69.20.2, 69.20.3, 70.10, 70.10.1, 70.10.2, 70.2, 70.21, 70.22, 71.11, 71.11.1, 71.11.2, 71.11.3, 71.12, 71.12.1, 71.12.11, 71.12.12, 71.12.13, 71.12.2, 71.12.4, 71.12.41, 71.12.42, 71.12.43, 71.12.44, 71.12.45, 71.12.46, 71.12.5, 71.12.51, 71.12.52, 71.12.53, 71.12.54, 71.12.55, 71.12.56, 71.12.57, 71.12.6, 71.12.61, 71.12.62, 71.12.63, 71.12.64, 71.12.65, 71.12.66, 71.12.7, 71.20, 71.20.1, 71.20.2, 71.20.3, 71.20.4, 71.20.5, 71.20.6, 71.20.61, 71.20.62, 71.20.7, 71.20.8, 71.20.9, 72.1, 72.11, 72.19, 72.19.1, 72.19.11, 72.19.12, 72.19.3, 72.19.4, 72.19.9, 72.20, 72.20.1, 72.20.2, 73.1, 73.11, 73.12, 73.20, 73.20.1, 73.20.2, 74.10, 74.20, 74.30, 74.90, 74.90.1, 74.90.2, 74.90.21, 74.90.22, 74.90.23, 74.90.24, 74.90.25, 74.90.26, 74.90.3, 74.90.31, 74.90.32, 74.90.4, 74.90.5, 74.90.6, 74.90.7, 74.90.8, 74.90.9, 74.90.91, 74.90.92, 74.90.99, 75.00, 75.00.1, 75.00.2, 77.21, 77.22, 77.29, 77.29.1, 77.29.2, 77.29.3, 77.29.9, 77.40, 78.10, 78.20, 78.30, 79.1, 79.11, 79.12, 79.90, 79.90.1, 79.90.2, 79.90.21, 79.90.22, 79.90.3, 79.90.31, 79.90.32, 80.10, 80.20, 80.30, 82.1, 82.11, 82.19, 82.20, 82.30, 82.9, 82.91, 82.92, 82.99, 84.1, 84.11, 84.11.1, 84.11.11, 84.11.12, 84.11.13, 84.11.2, 84.11.21, 84.11.22, 84.11.23, 84.11.3, 84.11.31, 84.11.32, 84.11.33, 84.11.34, 84.11.35, 84.11.4, 84.11.5, 84.11.6, 84.11.7, 84.11.8, 84.11.9, 84.12, 84.13, 84.2, 84.21, 84.22, 84.23, 84.23.1, 84.23.11, 84.23.12, 84.23.13, 84.23.14, 84.23.15, 84.23.16, 84.23.17, 84.23.18, 84.23.19, 84.23.2, 84.23.21, 84.23.22, 84.23.3, 84.23.31, 84.23.32, 84.23.33, 84.23.4, 84.23.5, 84.23.51, 84.23.52, 84.24, 84.25, 84.25.1, 84.25.2, 84.25.9, 84.30, 85.1, 85.11, 85.12, 85.13, 85.14, 85.2, 85.21, 85.22, 85.22.1, 85.22.2, 85.22.3, 85.23, 85.30, 85.41, 85.41.1, 85.41.2, 85.41.9, 85.42, 85.42.1, 85.42.2, 85.42.9, 86.10, 86.2, 86.21, 86.22, 86.23, 86.90, 86.90.1, 86.90.2, 86.90.3, 86.90.4, 86.90.9, 87.10, 87.20, 87.30, 87.90, 88.10, 88.9, 88.91, 88.99, 90.0, 90.01, 90.02, 90.03, 90.04, 90.04.1, 90.04.2, 90.04.3, 91.0, 91.01, 91.02, 91.03, 91.04, 91.04.1, 91.04.2, 91.04.3, 91.04.4, 91.04.5, 91.04.6, 92.1, 92.11, 92.12, 92.13, 92.2, 92.21, 92.22, 92.23, 93.1, 93.11, 93.12, 93.13, 93.2, 93.29.1, 93.29.2, 93.29.3, 93.29.9, 94.1, 94.11, 94.12, 94.20, 94.9, 94.91, 94.92, 94.99, 95.11, 95.2, 95.21, 95.22, 95.22.1, 95.22.2, 95.23, 95.24, 95.24.1, 95.24.2, 95.25, 95.25.1, 95.25.2, 95.29, 95.29.1, 95.29.11, 95.29.12, 95.29.13, 95.29.2, 95.29.3, 95.29.4, 95.29.41, 95.29.42, 95.29.43, 95.29.5, 95.29.6, 95.29.7, 95.29.9, 96.0, 96.01, 96.02, 96.02.1, 96.02.2, 96.03, 96.04, 96.09, 97.00, 98.10, 98.20 |

| 2 | 0,3 | 10.4, 10.41, 10.41.1, 10.41.2, 10.41.21, 10.41.22, 10.41.23, 10.41.24, 10.41.25, 10.41.26, 10.41.27, 10.41.28, 10.41.29, 10.41.5, 10.41.51, 10.41.52, 10.41.53, 10.41.54, 10.41.55, 10.41.56, 10.41.57, 10.41.58, 10.41.59, 10.41.6, 10.41.7, 10.42, 11.0, 11.01, 11.01.1, 11.01.2, 11.01.3, 11.01.4, 11.02, 11.03, 11.04, 11.05, 11.06, 11.07, 11.07.1, 11.07.2, 19.20, 19.20.1, 19.20.2, 19.20.9, 32.1, 32.11, 32.12, 32.12.1, 32.12.2, 32.12.3, 32.12.4, 32.12.5, 32.12.6, 33.13, 35.13, 37.00, 38.1, 38.11, 38.12, 38.2, 38.21, 38.22, 38.22.1, 38.22.11, 38.22.12, 38.22.13, 38.22.9, 38.3, 38.31, 38.32, 38.32.1, 38.32.11, 38.32.12, 39.00, 81.29.2 |

| 3 | 0,4 | 09.10, 09.10.1, 09.10.2, 09.10.3, 09.10.9, 09.90, 10.3, 10.31, 10.32, 10.39, 10.39.1, 10.39.2, 10.39.9, 10.5, 10.51, 10.51.1, 10.51.2, 10.51.3, 10.51.4, 10.51.9, 10.52, 10.7, 10.71, 10.71.1, 10.71.2, 10.71.3, 10.72, 10.72.1, 10.72.2, 10.72.3, 10.72.31, 10.72.32, 10.72.33, 10.72.34, 10.72.35, 10.72.39, 10.72.4, 10.73, 10.73.1, 10.73.2, 10.73.3, 10.8, 10.81, 10.81.1, 10.81.11, 10.81.12, 10.81.2, 10.81.3, 10.82, 10.82.1, 10.82.2, 10.82.3, 10.82.4, 10.82.5, 10.82.6, 10.83, 10.84, 10.85, 10.86, 10.86.1, 10.86.11, 10.86.12, 10.86.2, 10.86.3, 10.86.4, 10.86.5, 10.86.6, 10.86.61, 10.86.62, 10.86.63, 10.86.64, 10.86.69, 10.89, 10.89.1, 10.89.2, 10.89.3, 10.89.4, 10.89.5, 10.89.7, 10.89.8, 10.89.9, 13.20.5, 13.91.2, 14.1, 14.11, 14.11.1, 14.11.2, 14.12, 14.12.1, 14.12.2, 14.13, 14.13.1, 14.13.11, 14.13.12, 14.13.2, 14.13.21, 14.13.22, 14.13.3, 14.14, 14.14.1, 14.14.11, 14.14.12, 14.14.13, 14.14.14, 14.14.2, 14.14.21, 14.14.22, 14.14.23, 14.14.24, 14.14.25, 14.14.3, 14.14.4, 14.19, 14.19.1, 14.19.11, 14.19.12, 14.19.13, 14.19.19, 14.19.2, 14.19.21, 14.19.22, 14.19.23, 14.19.3, 14.19.31, 14.19.32, 14.19.4, 14.19.5, 14.20, 14.20.1, 14.20.2, 15.11.1, 35.11.2, 35.11.4, 35.12, 35.12.1, 35.12.2, 45.1, 45.11, 45.11.1, 45.11.2, 45.11.3, 45.11.31, 45.11.39, 45.11.4, 45.11.41, 45.11.49, 45.19, 45.19.1, 45.19.2, 45.19.3, 45.19.31, 45.19.39, 45.19.4, 45.19.41, 45.19.49, 45.20, 45.20.1, 45.20.2, 45.20.3, 45.20.4, 45.3, 45.31, 45.31.1, 45.31.2, 45.32, 45.32.1, 45.32.2, 45.32.21, 45.32.22, 45.32.29, 45.40, 45.40.1, 45.40.2, 45.40.3, 45.40.4, 45.40.5, 47.30, 47.30.1, 47.30.11, 47.30.12, 47.30.2, 49.10, 49.10.1, 49.10.11, 49.10.12, 49.10.2, 49.20, 49.20.1, 49.20.9, 49.31.1, 49.31.11, 49.31.12, 52.2, 52.21, 52.21.1, 52.21.11, 52.21.12, 52.21.13, 52.21.19, 52.21.2, 52.21.21, 52.21.22, 52.21.23, 52.21.24, 52.21.25, 52.21.29, 52.21.3, 52.22, 52.22.1, 52.22.11, 52.22.12, 52.22.13, 52.22.14, 52.22.15, 52.22.16, 52.22.17, 52.22.18, 52.22.19, 52.22.2, 52.22.21, 52.22.22, 52.22.23, 52.22.24, 52.22.25, 52.22.26, 52.22.27, 52.22.28, 52.22.29, 52.23, 52.23.1, 52.23.11, 52.23.12, 52.23.13, 52.23.19, 52.23.2, 52.23.21, 52.23.22, 52.23.23, 52.23.29, 93.19, 99.00 |

| 4 | 0,5 | 02.10.1, 02.10.11, 02.10.19, 03.21.1, 03.21.2, 03.21.4, 03.22.1, 03.22.2, 03.22.3, 06.10.1, 06.10.3, 22.2, 22.21, 22.22, 22.23, 22.29, 22.29.1, 22.29.2, 22.29.9, 23.31, 24.46, 26.51, 26.51.1, 26.51.2, 26.51.3, 26.51.4, 26.51.5, 26.51.6, 26.51.7, 26.51.8, 26.70, 26.70.1, 26.70.2, 26.70.3, 26.70.4, 26.70.5, 26.70.6, 26.70.7, 30.99, 49.31.2, 49.31.22, 49.31.23, 81.10, 81.2, 81.21, 81.21.1, 81.21.9, 81.22, 81.29, 81.29.1, 81.29.9 |

| 5 | 0,6 | 01.50, 03.11, 03.11.1, 03.11.2, 03.11.3, 03.11.4, 03.11.5, 26.11, 26.11.1, 26.11.2, 26.11.3, 26.11.9, 26.12, 26.20, 26.20.1, 26.20.2, 26.20.3, 26.20.4, 26.20.9, 26.30, 26.30.1, 26.30.11, 26.30.12, 26.30.13, 26.30.14, 26.30.15, 26.30.16, 26.30.17, 26.30.18, 26.30.19, 26.30.2, 26.30.21, 26.30.22, 26.30.29, 26.30.3, 26.30.4, 26.30.5, 26.30.6, 26.40, 26.40.1, 26.40.2, 26.40.21, 26.40.22, 26.40.23, 26.40.3, 26.40.4, 26.40.5, 28.23, 28.23.1, 28.23.2, 33.11, 33.19, 35.11, 52.10, 52.10.1, 52.10.2, 52.10.21, 52.10.22, 52.10.23, 52.10.3, 52.10.4, 52.24, 52.24.1, 52.24.2, 52.29, 68.20, 68.20.1, 68.20.2, 95.1, 95.12 |

| 6 | 0,7 | 01.13, 01.13.1, 01.13.11, 01.13.12, 01.13.2, 01.13.4, 01.13.6, 01.13.9, 01.19.2, 01.19.21, 01.19.22, 01.30, 02.30.11, 03.2, 03.21, 03.22, 08.93, 17.1, 17.11, 17.11.1, 17.11.2, 17.11.9, 17.12, 17.12.1, 17.12.2, 17.2, 17.21, 17.22, 17.23, 17.24, 17.29, 20.1, 20.11, 20.12, 20.13, 20.14, 20.14.1, 20.14.2, 20.14.3, 20.14.4, 20.14.5, 20.14.6, 20.14.7, 20.15, 20.15.1, 20.15.2, 20.15.3, 20.15.4, 20.15.5, 20.15.6, 20.15.7, 20.15.8, 20.16, 20.17, 20.20, 20.30, 20.30.1, 20.30.2, 20.4, 20.41, 20.41.1, 20.41.2, 20.41.3, 20.41.4, 20.42, 20.5, 20.51, 20.52, 20.53, 20.59, 20.59.1, 20.59.2, 20.59.3, 20.59.4, 20.59.5, 20.59.6, 20.60, 20.60.1, 20.60.2, 21.10, 21.20, 21.20.1, 21.20.2, 26.60, 26.60.1, 26.60.2, 26.60.3, 26.60.4, 26.60.5, 26.60.6, 26.60.7, 26.60.9, 26.80, 27.1, 27.11, 27.11.1, 27.11.11, 27.11.12, 27.11.13, 27.12, 27.20, 27.20.1, 27.20.2, 27.20.21, 27.20.22, 27.20.23, 27.20.3, 27.40, 27.5, 27.51, 27.51.1, 27.51.2, 27.51.3, 27.51.4, 27.51.5, 27.51.6, 27.52, 27.90, 27.90.1, 27.90.2, 27.90.9, 32.30, 32.50, 33.14, 33.15, 43.2, 43.21, 43.22, 43.29, 43.99.1, 49.4, 49.41, 49.41.1, 49.41.2, 49.41.3, 49.42 |

| 7 | 0,8 | 01.47, 01.47.1, 01.47.11, 01.47.12, 01.47.2, 01.47.3, 05.20.2, 10.1, 10.11, 10.11.1, 10.11.2, 10.11.3, 10.11.4, 10.11.5, 10.11.6, 10.12, 10.12.1, 10.12.2, 10.12.3, 10.12.4, 10.12.5, 10.13, 10.13.1, 10.13.2, 10.13.3, 10.13.4, 10.13.5, 10.13.6, 10.13.7, 10.13.9, 10.20, 10.20.1, 10.20.2, 10.20.3, 10.20.4, 10.20.5, 10.20.9, 10.41.4, 10.6, 10.61, 10.61.1, 10.61.2, 10.61.3, 10.61.4, 10.62, 10.62.1, 10.62.2, 10.62.3, 10.62.9, 15.1, 15.11, 15.11.2, 15.11.3, 15.11.4, 15.11.5, 15.11.51, 15.11.52, 15.12, 15.20, 15.20.1, 15.20.11, 15.20.12, 15.20.13, 15.20.14, 15.20.2, 15.20.3, 15.20.31, 15.20.32, 15.20.4, 15.20.41, 15.20.42, 15.20.5, 19.33, 28.21, 28.21.1, 28.21.2, 38.32.2, 38.32.3, 38.32.4, 38.32.41, 38.32.42, 38.32.43, 38.32.49, 38.32.5, 38.32.51, 38.32.52, 38.32.53, 38.32.54, 38.32.55, 38.32.59, 49.31, 49.31.21, 49.39.1, 49.39.11, 49.39.12, 49.39.13, 49.39.3, 77.1, 77.11 |

| 8 | 0,9 | 02.40.1, 03.12, 03.12.1, 03.12.2, 03.12.3, 03.12.4, 13.91, 13.91.1, 14.3, 14.31, 14.31.1, 14.31.2, 14.39, 14.39.1, 14.39.2, 30.12, 31.0, 31.01, 31.02, 31.02.1, 31.02.2, 31.03, 31.09, 31.09.1, 31.09.2, 32.40, 41.20, 42.11, 42.12, 42.13, 42.21, 42.22, 42.22.1, 42.22.2, 42.22.3, 42.9, 42.91, 42.91.1, 42.91.2, 42.91.3, 42.91.4, 42.91.5, 42.99, 43.3, 43.31, 43.32, 43.32.1, 43.32.2, 43.32.3, 43.33, 43.34, 43.34.1, 43.34.2, 43.39, 43.9, 43.91, 43.99, 43.99.2, 43.99.3, 43.99.4, 43.99.5, 43.99.6, 43.99.7, 43.99.9, 49.32, 50.10, 50.10.1, 50.10.11, 50.10.12, 50.10.2, 50.10.21, 50.10.22, 50.10.3, 50.10.31, 50.10.32, 50.10.39, 50.20, 50.20.1, 50.20.11, 50.20.12, 50.20.13, 50.20.14, 50.20.15, 50.20.19, 50.20.2, 50.20.21, 50.20.22, 50.20.23, 50.20.24, 50.20.25, 50.20.29, 50.20.3, 50.20.31, 50.20.32, 50.20.4, 50.20.41, 50.20.42, 50.30, 50.30.1, 50.30.2, 50.40, 50.40.1, 50.40.2, 50.40.3 |

| 9 | 1,0 | 22.1, 22.11, 22.19, 22.19.1, 22.19.2, 22.19.3, 22.19.4, 22.19.5, 22.19.6, 22.19.7, 23.32, 23.5, 23.51, 23.52, 23.52.1, 23.52.2, 23.52.3, 26.52, 26.52.1, 26.52.2, 29.10, 29.10.1, 29.10.11, 29.10.12, 29.10.13, 29.10.2, 29.10.3, 29.10.31, 29.10.32, 29.10.4, 29.10.5, 29.20, 29.20.1, 29.20.2, 29.20.3, 29.20.4, 29.20.5, 29.3, 29.31, 29.32, 29.32.1, 29.32.2, 29.32.3, 32.13, 32.13.1, 32.13.2, 32.9, 32.91, 32.99, 32.99.1, 32.99.2, 32.99.3, 32.99.4, 32.99.5, 32.99.6, 32.99.7, 32.99.9, 71.1, 71.12.3 |

| 10 | 1,1 | 10.9, 10.91, 10.91.1, 10.91.2, 10.91.3, 10.92, 24.41, 24.42, 24.43, 24.43.1, 24.43.2, 24.43.3, 27.31, 27.32, 27.32.1, 27.32.2, 27.32.3, 27.33 |

| 11 | 1,2 | 01.44, 01.46, 01.46.1, 01.46.11, 01.46.12, 01.46.2, 01.49, 01.49.1, 01.49.11, 01.49.12, 01.49.13, 01.49.2, 01.49.21, 01.49.22, 01.49.3, 01.49.31, 01.49.32, 01.49.4, 01.49.41, 01.49.42, 01.49.43, 01.49.44, 01.49.5, 01.49.6, 01.49.7, 01.49.9, 01.6, 01.61, 01.62, 01.63, 01.64, 08.99, 08.99.1, 08.99.2, 08.99.21, 08.99.22, 08.99.23, 08.99.3, 08.99.31, 08.99.32, 08.99.33, 08.99.34, 08.99.35, 08.99.36, 23.9, 23.91, 23.99, 23.99.1, 23.99.2, 23.99.3, 23.99.4, 23.99.5, 23.99.6, 23.99.61, 23.99.62, 30.91, 30.92, 30.92.1, 30.92.2, 30.92.3, 30.92.4, 43.11, 43.12, 43.12.1, 43.12.2, 43.12.3, 43.12.4, 43.13, 51.10, 51.10.1, 51.10.2, 51.10.3, 51.2, 51.21, 51.21.1, 51.21.2, 51.21.3, 51.22, 51.22.1, 51.22.2, 51.22.3, 51.22.4, 68.10, 68.10.1, 68.10.11, 68.10.12, 68.10.2, 68.10.21, 68.10.22, 68.10.23, 81.3, 81.30 |

| 12 | 1,3 | 01.2, 01.21, 01.22, 01.23, 01.24, 01.25, 01.25.1, 01.25.2, 01.25.3, 01.27, 01.27.1, 01.27.9, 01.28, 01.28.1, 01.28.2, 01.28.3, 02.30.12, 02.30.13, 23.1, 23.11, 23.11.1, 23.11.2, 23.11.3, 23.11.4, 23.12, 23.12.1, 23.12.2, 23.12.3, 23.13, 23.13.1, 23.13.2, 23.13.3, 23.13.4, 23.13.5, 23.13.6, 23.14, 23.19, 23.19.1, 23.19.2, 23.19.3, 23.19.4, 23.19.5, 23.19.6, 23.19.7, 23.19.9, 24.45, 24.45.1, 24.45.2, 24.45.3, 24.45.4, 24.45.5, 24.45.6, 24.45.7, 24.45.8, 24.45.9, 25.1, 25.11, 25.12, 25.2, 25.21, 25.21.1, 25.21.2, 25.29, 25.30, 25.30.1, 25.30.2, 25.30.21, 25.30.22, 25.50, 25.50.1, 25.50.2, 25.6, 25.61, 25.62, 25.7, 25.71, 25.72, 25.73, 25.9, 25.91, 25.92, 25.93, 25.93.1, 25.93.2, 25.94, 25.99, 25.99.1, 25.99.11, 25.99.12, 25.99.2, 25.99.21, 25.99.22, 25.99.23, 25.99.24, 25.99.25, 25.99.26, 25.99.27, 25.99.29, 25.99.3, 28.11.1, 28.12, 28.12.1, 28.12.2, 28.13, 28.14, 28.15, 28.15.1, 28.15.2, 28.15.9, 28.93, 28.94, 28.94.1, 28.94.2, 28.94.3, 28.94.4, 28.94.5, 28.95, 28.96, 28.99, 28.99.1, 28.99.2, 28.99.4, 28.99.41, 28.99.42, 28.99.43, 28.99.49, 28.99.9, 33.12, 77.12, 77.34, 77.35, 77.39, 77.39.1, 77.39.11, 77.39.12 |

| 13 | 1,4 | 16.10, 16.10.1, 16.10.2, 16.10.3, 16.10.9, 16.2, 16.21, 16.21.1, 16.21.11, 16.21.12, 16.21.13, 16.21.2, 16.21.21, 16.21.22, 16.22, 16.23, 16.23.1, 16.23.2, 16.24, 16.29, 16.29.1, 16.29.11, 16.29.12, 16.29.13, 16.29.14, 16.29.15, 16.29.2, 16.29.21, 16.29.22, 16.29.23, 16.29.3, 24.5, 24.51, 24.52, 24.53, 24.54, 28.1, 28.11 |

| 14 | 1,5 | 03.1, 07.10.2, 08.12, 08.12.1, 08.12.2, 23.6, 23.61, 23.61.1, 23.61.2, 23.62, 23.63, 23.64, 23.65, 23.65.1, 23.65.2, 23.69, 23.70, 23.70.1, 23.70.2, 23.70.3, 24.20, 24.20.1, 24.20.2, 24.20.3 |

| 15 | 1,7 | 08.11, 08.11.1, 08.11.2, 08.11.3, 10.41.3, 13.10, 13.10.1, 13.10.2, 13.10.3, 13.10.4, 13.10.5, 13.10.6, 13.10.9, 13.20, 13.20.1, 13.20.11, 13.20.12, 13.20.13, 13.20.14, 13.20.19, 13.20.2, 13.20.3, 13.20.4, 13.20.41, 13.20.42, 13.20.43, 13.20.44, 13.20.45, 13.20.46, 13.20.6, 13.30, 13.30.1, 13.30.2, 13.30.3, 13.30.4, 13.30.5, 13.9, 13.92, 13.92.1, 13.92.2, 13.93, 13.94, 13.94.1, 13.94.2, 13.95, 13.96, 13.96.1, 13.96.2, 13.96.3, 13.96.4, 13.96.5, 13.96.6, 13.96.7, 13.99, 13.99.1, 13.99.2, 13.99.3, 13.99.4, 13.99.9, 24.10.14, 24.10.7, 24.10.9, 24.3, 24.31, 24.32, 24.33, 24.34, 28.99.3, 30.30, 30.30.1, 30.30.11, 30.30.12, 30.30.13, 30.30.14, 30.30.2, 30.30.3, 30.30.31, 30.30.32, 30.30.39, 30.30.4, 30.30.41, 30.30.42, 30.30.43, 30.30.44, 30.30.5, 33.16 |

| 16 | 1,9 | 24.10, 24.10.1, 24.10.11, 24.10.12, 24.10.13, 24.10.2, 24.10.3, 24.10.4, 24.10.5, 24.10.6, 24.44, 25.40, 30.40 |

| 17 | 2,1 | 01.11, 01.11.1, 01.11.11, 01.11.12, 01.11.13, 01.11.14, 01.11.15, 01.11.16, 01.11.19, 01.11.2, 01.11.3, 01.11.31, 01.11.32, 01.11.33, 01.11.39, 01.12, 01.13.3, 01.13.31, 01.13.39, 01.13.5, 01.13.51, 01.13.52, 01.14, 01.15, 01.16, 01.16.1, 01.16.2, 01.16.3, 01.16.9, 01.19, 01.19.1, 01.19.3, 01.19.9, 01.26, 01.29, 05.20.11, 28.22, 28.22.1, 28.22.2, 28.22.3, 28.22.4, 28.22.41, 28.22.42, 28.22.5, 28.22.6, 28.22.7, 28.22.9, 28.25, 28.25.1, 28.25.11, 28.25.12, 28.25.13, 28.25.14, 28.25.2, 28.29, 28.29.1, 28.29.11, 28.29.12, 28.29.13, 28.29.2, 28.29.21, 28.29.22, 28.29.3, 28.29.31, 28.29.32, 28.29.39, 28.29.4, 28.29.41, 28.29.42, 28.29.43, 28.29.5, 28.29.6, 93.21, 93.29 |

| 18 | 2,3 | 08.92, 08.92.1, 08.92.2 |

| 19 | 2,5 | 01.41, 01.41.1, 01.41.11, 01.41.12, 01.41.2, 01.41.21, 01.41.29, 01.42, 01.42.1, 01.42.11, 01.42.12, 01.42.2, 05.10.2, 05.10.21, 05.10.22, 05.10.23, 19.3, 19.31, 19.32, 19.34, 19.34.1, 19.34.2, 19.34.3, 23.20, 23.20.1, 23.20.2, 23.20.3, 23.20.9, 23.4, 23.41, 23.41.1, 23.41.2, 23.41.3, 23.42, 23.43, 23.44, 23.44.1, 23.44.2, 23.49, 23.49.1, 23.49.9, 28.2, 28.24, 28.29.7, 28.41.2, 28.49, 28.49.1, 28.49.11, 28.49.12, 28.49.13, 28.49.2, 28.49.3, 28.49.4, 33.20 |

| 20 | 2,8 | 08.91, 19.10, 28.11.2, 28.11.21, 28.11.22, 28.11.23, 28.9, 28.91, 28.91.1, 28.91.2, 28.91.3, 28.92, 28.92.1, 28.92.11, 28.92.12, 28.92.2, 28.92.21, 28.92.22, 28.92.23, 28.92.24, 28.92.25, 28.92.26, 28.92.27, 28.92.28, 28.92.29, 28.92.3, 28.92.4, 28.92.5, 30.11 |

| 21 | 3,1 | 02.20 |

| 22 | 3,4 | 77.3, 77.31, 77.32, 77.33, 77.33.1, 77.33.2, 77.39.2, 77.39.21, 77.39.22, 77.39.23, 77.39.24, 77.39.25, 77.39.26, 77.39.27, 77.39.29, 77.39.3 |

| 23 | 3,7 | 07.29.4, 07.29.41, 07.29.42 |

| 24 | 4,1 | 05.10.11, 05.10.12, 05.10.13, 30.20, 30.20.1, 30.20.11, 30.20.12, 30.20.13, 30.20.2, 30.20.3, 30.20.31, 30.20.32, 30.20.33, 30.20.4, 30.20.9 |

| 25 | 4,5 | 01.43, 01.43.1, 01.43.2, 01.43.3, 01.45.1, 01.45.2, 01.45.3, 01.45.4, 28.41, 28.41.1, 32.20 |

| 26 | 5,0 | 02.10.2, 02.40, 02.40.2, 08.1, 08.11.4, 28.30.3, 28.30.4, 28.30.5, 28.30.51, 28.30.52, 28.30.53, 28.30.59, 28.30.6, 28.30.7, 28.30.8, 28.30.81, 28.30.82, 28.30.83, 28.30.84, 28.30.85, 28.30.89, 33.17 |

| 27 | 5,5 | 07.10, 07.10.1, 07.10.3 |

| 28 | 6,1 | 02.10, 02.30, 02.30.1, 02.30.14, 02.30.2, 28.30, 28.30.1, 28.30.2, 28.30.21, 28.30.22 |

| 29 | 6,7 | 07.29.1 |

| 30 | 7,4 | 06.10, 06.10.2, 07.29.3, 07.29.31, 07.29.32, 07.29.33 |

| 31 | 8,1 | 07.21, 07.21.1, 07.21.11, 07.21.12, 07.21.2 |

| 32 | 8,5 | 01.70, 05.10, 05.10.1, 05.10.14, 05.10.15, 05.10.16, 05.20, 05.20.1, 05.20.12, 07.29, 07.29.2, 07.29.21, 07.29.22, 07.29.5, 07.29.6, 07.29.7, 07.29.8, 07.29.9, 07.29.91, 07.29.92, 07.29.93, 07.29.99 |

How can the policyholder find out the rate?

The territorial body of the Social Insurance Fund indicates the rate of contributions to the Social Insurance Fund for accidents in 2021 according to OKVED for the current year in a notification sent to the organization upon confirmation of its main type of activity. Before receiving the notification, apply the rate of the previous year (clauses 3, 4, 11 of the Procedure, approved by order of the Ministry of Health and Social Development No. 55 of January 31, 2006).

The Fund has the right to establish a discount or premium to the current rate of insurance premiums for injuries according to OKVED (Clause 1, Article 22 of Law No. 125-FZ).

If the organization has not confirmed its main type of activity within the prescribed period, the department will send a notification about the amount of payments before May 1 of the current year.

When answering the question of how to find out the size of the insurance tariff from the Social Insurance Fund, we recommend that you find the corresponding notification or request it again by sending a free-form application.

Organizations registered for the first time do not confirm their main type of activity; the rate of payments to the Social Insurance Fund for NS and PP is reported in writing upon registration.

You can find out the rate yourself on the FSS website in the section for determining the insurance tariff according to OKVED, indicating the main type of activity in the field:

Changes for 2021

Since 2021, the bulk of the powers regarding contributions to social funds have passed to the Russian Tax Service.

This fully applies to insurance contributions to the Social Insurance Fund in 2021. First of all, we are talking about monitoring deductions at current rates, collecting debts on them, receiving and analyzing reports. These amendments are already present in the regulatory framework. Thus, from January 1, 2021, the Law on Insurance Contributions No. 212-FZ ceases to exist, and a new Chapter 34 of the Tax Code takes its place.

From Law No. 212-FZ on insurance premiums, the following rules migrated to the Tax Code of the Russian Federation:

- about reporting periods: first quarter, half a year and 9 months;

- billing period: year;

- who is obliged to pay: firms, individual entrepreneurs, lawyers, notaries and other private practitioners;

- object: same payments;

- the size of reduced insurance premium rates;

- base for calculating contributions (the rules are almost the same).

True, you will have to deal with new reporting forms, because you will have to send them to the tax authorities. In addition, the deadlines for submitting reports have been shifted.

For more information, see “Deadline for submitting reports to the Social Insurance Fund in 2017.”

The criteria that must be met in order to be eligible for reduced rates of insurance contributions to the Social Insurance Fund in 2021 are spelled out in more detail. Plus, the list of such requirements has been expanded.

The moment of loss of the right to reduced rates of insurance contributions to the Social Insurance Fund in 2021: now the Tax Code of the Russian Federation states that this happens “retroactively” - from the beginning of the last annual period.

The most basic thing regarding policyholders has not undergone major changes: the procedure for calculating and making contributions to the Social Insurance Fund in 2021 remains the same.

Most of the powers have been transferred from the Social Insurance Fund to the National Assembly since January 1, 2017. It controls the regularity of deductions by persons conducting business activities, debt collection, and reporting analyses.

Monitoring staff performance: get ready-made reports in 2 clicks?

Main changes:

- reports are submitted for the first quarter, half a year and 9 months. Contains only the calculation algorithm;

- the calculation period is taken to be a calendar year;

- the forms of some documents have undergone changes: forms No. 22-24 have come into effect;

- The deadlines for submitting reports to authorities have been delayed.

The redistribution of functions for accepting contributions has led to the fact that they now have to be transferred to two authorities:

- in the FSS parts relating to sick leave and maternity;

- Individual entrepreneurs continue to transfer money to the Pension Fund and the Compulsory Medical Insurance Fund for themselves.

The settlement procedure is legally established in a special chapter of the Tax Code. This has led to the fact that these contributions are now equated to the movement of budget funds, that is, they are subject to the relevant requirements:

- regarding registration rules;

- including the use of special details.

Where to transfer

Payers are required to pay all contributions described in the Tax Code to the accounts of the relevant branch of the Federal Tax Service:

- at the place of registration;

- at the location of the branch maintaining separate accounting;

- Individual entrepreneurs are guided by the registration address.

Payments should be made for each type of contribution separately (as before). However, in 2021, you need to use the details provided for budget contributions. The injury tax is transferred according to the old rules:

- to the Social Insurance Fund branch where the payer is registered;

- at the location of the separate branch;

- at the place of residence of the individual entrepreneur (charitable only).

Have the deadlines changed?

According to regulatory requirements, the “accidental” fee must be transferred to the Social Insurance Fund account by the 15th day of the month following the reporting month.

In 2021, there were significant changes in the payment of insurance premiums, which remain in force in 2021. In particular, the administration of some types of insurance premiums was transferred to the Federal Tax Service. In this regard, the question of where to pay insurance premiums for injuries in 2021 has become relevant. As before, insurance premiums for injuries are administered by the Social Insurance Fund.

Let us remind you that changes in the payment of insurance premiums for individual entrepreneurs “for themselves” were discussed in this article.

The changed procedure for filling out payment orders in 2021 is published here.

It is important to remember that the amount of payments to the Social Insurance Fund is influenced by a number of factors. In particular:

- type of activity of the organization (IP);

- availability of benefits for this category of contributions;

- current tariffs for contributions for injuries.

READ MORE: Can I change my mortgage insurance company?

In 2021, the FSS has the following powers:

- control the flow of money;

- calculate the amount of insurance payments payable;

- demand explanations for contributions from policyholders.

In addition, Law No. 125-FZ of 1998 was supplemented with articles, in accordance with which methods for calculating penalties and collecting arrears are determined. The law introduced provisions on conducting desk audits.

Legislators specified the procedure for calculating insurance payments, and also established settlement and reporting periods.

How to change the tariff

The payment rate changes when the main type of activity changes, which must be notified to the Social Insurance Fund (for example, OKVED 70.22 falls under the reduced tariff).

The tariff is reduced when a discount is provided if the conditions are met (clauses 4, 6–8 of the Rules for Establishing Discounts and Surcharges):

- Injury rates are below industry values. To find out the injury rates by industry according to OKVED 09.10.9 (or another code), use the values of the main indicators, approved. by FSS resolution No. 107 of June 25, 2020.

- The organization is registered until 2021.

- There are no outstanding dues.

- There are no workplace fatalities.

To receive a discount, send the appropriate application to the Social Insurance Fund in the form established by Regulation No. 231 of April 25, 2019.

Basic provisions

Insurance premiums are mandatory types of payments that are paid by the employer to the Social Insurance Fund. Each director of the company must transfer a certain amount monthly, from which the employee will be paid compensation for industrial accidents and other types of benefits.

Cash compensation paid to workers is designed to protect the interests of employees in the event of an injury that occurs on the job. Such payments are regular and are paid individually for each person, but only upon the occurrence of an insured event.

The insurer is the employer with whom the employee has entered into an employment agreement. This can be either a legal entity or an individual entrepreneur.

If the personnel carries out labor activities under a civil contract, the obligation to pay the contribution may be removed. The exception is cases when the employment agreement provides for this condition.

If a work-related injury occurs, deductions will be made to the following types of payments:

- Wage.

- Separate allowances, vacation pay.

- Prize.

- One-time financial assistance, severance pay.

- Expenses for employee retraining.

- Various targeted government benefits and subsidies.

All of the above payments, in turn, are not subject to any deductions.

Different types of activities can fall into the same class, but only on the condition that similar indicators on occupational injuries were obtained for them. In connection with this class, the costs of insurance coverage are distributed.

The higher the established class, and the risk that the employee may receive one or another injury, the higher the rate is set.

Publishing activity, which has code 1 according to OKVED, is an activity with a low level of professional risk. In this regard, the tariff for insurance premiums for industrial injuries has a rate of 0.2%.

In turn, work at peat mining enterprises is characterized by a high level of injuries and is classified as class 18 according to the risk table. The insurance rate in this case is 2.3%.

What the law says

Contributions for injuries are funds sent through the Social Insurance Fund to an employee as compensation for harm to health caused in the performance of their work functions.

The employer is obliged to accrue a certain amount monthly in relation to the labor income received by the subordinate. It is influenced by many factors, including:

- availability of benefits on insurance premiums for injuries;

- Kind of activity;

- approved tariffs for insurance premiums for injuries.

Despite the transfer of the bulk of contributions to tax authorities, in 2019 the FSS continues to oversee the contributions in question. Therefore, there are some changes.

Let us recall that the features and rules for deductions for injuries are regulated by Law of 1998 No. 125-FZ.

How to find the address of your FSS branch

Enter your TIN and click the “Search” button. The code of the FSS branch in which we are registered will appear. The first two digits are the region code, the second two digits are the FSS Branch number.

(Using the example, code 7707, means Moscow region, Branch No. 7). If you have saved the letter received upon registration with the Social Insurance Fund, then there is a subordination code in the Social Insurance Fund, the first two digits of which also indicate the region of registration, the second two - the branch number, which also allows you to proceed to the next step.

- Opening of a separate division. In accordance with current regulations, it must be registered with the funds at its location;

- Submitting reports if done in person;

- If there are pregnant women in the organization, whose benefits are generated from the Social Insurance Fund;

- In the event of a work-related injury to an employee, to provide the necessary materials;

- When interacting on issues related to registration of sick leave.

How to obtain and how to find out the FSS registration number

The need to register a company may arise when opening a separate division located in another area. In this case, the company will need to register with the Fund’s branch and at the location of the corresponding separate division. The order of the Ministry of Labor dated April 29, 2016 No. 202n regulates the registration procedure. To do this, the company submits an application to the Fund’s branch within 30 days from the date of creation of a separate division.

So, the company does not need to do anything to assign this number. Since the company is supposed to have one employee (at least the head of the organization in companies of the same person), their registration with the Social Insurance Fund occurs through the exchange of data between tax authorities and the Fund.

We recommend reading: Pledge of Real Estate in a Purchase and Sale Agreement

How to find out the FSS registration number: what actions to take

The FSS policyholder code and the so-called subordination code can be indicated in documents in paper or electronic form. The subordination code is needed by organizations and entrepreneurs to send reports through special information channels called gateways. The main thing is that the information and the files that contain it are properly encrypted. This is necessary to organize competent protection.

When submitting reports, one of the mandatory requirements is to indicate the registration number. The number is written in one or another column. Typically, policyholders remember and know their details after they have completed the procedure. But if the need arises, you can find out the designation using several methods:

How much to transfer

Employers must calculate personal injury insurance premiums monthly for 2021 , taking into account accruals for the past 30 (31) days. This can be done using the formula:

CONTRIBUTIONS = B x TARIFF Where:

B – base for contributions for injuries. This is the amount of money received by the employee, on the basis of which the required value is calculated. The legislation does not provide for any restrictions on the amount. The calculation is made as follows:

B = Paymentstd/gpd – Payments/o Where:

Payments/gpd – funds paid to an individual in accordance with an employment (civil) contract.

Payments/o – non-contributory payments.

EXAMPLE

The travel agency "Prestige" offers vacationers excursion tickets, as well as places to stay and vehicles. OKVED – 63.30.2. In February 2021, employees received a salary in the total amount of 3 million 500 thousand rubles, including financial assistance of 32 thousand rubles. Determine the amount of insurance contributions to the Social Insurance Fund.

B = 30 = 3,468,000 rub.

- According to the Classification of Activities by Risk, the travel agency "Prestige" is classified in class I of professional risk, which corresponds to a tariff of 0.2%. As a result, deductions for injuries are equal to:

CONTRIBUTIONS = 3,468,000 x 0.2 = 6936 rubles.

The Social Insurance Fund makes allowances or discounts for some enterprises. Therefore, the amount of final contributions may be further increased or decreased.

How can an individual entrepreneur obtain a registration number in the Social Insurance Fund and what is the amount of the contribution for voluntary insurance?

As soon as the entrepreneur hires his first employee, he must register with the social insurance fund and the Social Insurance Fund for individual entrepreneurs will generate a unique policyholder number. Payments and reporting will be initialized based on this indicator in the future.

Unlike companies, whose data is entered into the FSS database automatically through interdepartmental interaction channels, an entrepreneur, as a person paying insurance premiums, is required to register with the fund only when forming a staff. The entire procedure for registering an individual entrepreneur is given 30 days from the date of registration of the first employee.

Reporting on insurance premiums in 2021

Calculation of insurance premiums

Based on the results of calculating contributions for compulsory health insurance, compulsory medical insurance, compulsory insurance, the policyholder submits a report Calculation of insurance premiums

(RSV) (clause 7 of article 431 of the Tax Code of the Russian Federation).

Starting with reporting for the first quarter of 2021, changes were made to the regulated report by order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

Differences between the contribution reporting form in force in 2021 and the 2021 report:

1. In accordance with the requirements of Federal Law No. 325-FZ of September 29, 2019, employers whose number of individuals in whose favor payments were made in the reporting period are more than 10 are required to submit the DAM only in electronic form.

2. A separate division that independently makes payments in favor of individuals submits a calculation of insurance premiums to the inspectorate at the place of its registration. If a separate division is closed or its authority to accrue payments to individuals is terminated, but an updated calculation is required, then it must be submitted by the parent organization. In this case, special fields are filled in on the Title Page: “Code - 9”, indicating the deprivation of authority or closure of a separate unit, and the INN/KPP of such unit.

3. In the absence of payments, individuals should fill out a new column 001 of Section 1:

- if payments were made, then code 1 is indicated in column 001;

- if there were no payments - code 2. If there are no payments, the report can only contain the Title Page and Section 1.

4. To reflect the expenses of an individual arising as part of the execution of an author's agreement, an agreement on the alienation of the exclusive right to the results of intellectual activity or a license agreement, new lines are intended: 045 of subsection 1.1 and line 045 of subsection 1.2 of Appendix 1 to Section 1. Remunerations under such agreements are taxable contributions to compulsory health insurance and compulsory medical insurance (contributions to compulsory health insurance are not assessed). When determining the base for calculating contributions, the remuneration accrued to an individual is reduced by documented expenses (clause 8 of Article 421 of the Tax Code of the Russian Federation) or a fixed deduction amount if supporting documents are missing (clause 9 of Article 421 of the Tax Code of the Russian Federation).

Consequently, lines 045 in subsections 1.1 and 1.2 reflect either the amount of expenses supported by documents or the amount of the deduction.

5. Appendix 2 to Section 1, reflecting information on the calculation of contributions to OSS, is supplemented with the following fields and lines:

- field 001 “payer tariff code”. The codes are established in accordance with the basis for the application of reduced contribution rates;

- line 015 “Number of individuals from whose payments insurance premiums are calculated” (as opposed to line 010 “Number of insured persons”).

6. The 2021 RSV form no longer contains:

- sheet “Information about an individual who is not an individual entrepreneur.” This does not mean an exemption from the obligation to pay contributions and report on them for citizens without individual entrepreneur status, but paying remuneration to other individuals. Now they must fill out a separate sheet with information about themselves - only full name. in special fields on the Title Page;

- Appendices 6 and 8 to Section 1 (for payers on the simplified tax system and individual entrepreneurs on the PSN, to confirm their right to reduced contribution rates). From 01/01/2019, such reduced rates do not apply.

7. A special subsection has been added for organizations producing animation products - Appendix 5 to Section 1.

8. The content of Section 3 has changed:

- lines 010-050 were excluded, which indicated: adjustment number, settlement (reporting) period, calendar year, number, date;

- excluded lines that indicate the characteristics of the insured person for each type of compulsory insurance (compulsory insurance, compulsory medical insurance, compulsory insurance);

- a field has been added - “Sign of cancellation of information about the insured person” with the value “1”, which is used when it is necessary to cancel or correct information previously submitted for an insured individual;

- in subsection 3.2.2 the column “Insured Person Code” has been added. The codes correspond to the working conditions established based on the results of the special assessment;

- information about the amount for 3 months of the billing (reporting) period is excluded. This information is reflected only on a monthly basis.

9. The list of codes for payers applying reduced tariffs has been updated.

Form 4-FSS

Based on the results of calculating contributions to OSS NS and PZ, the policyholder submits a report in Form 4-FSS, approved. by order of the FSS of the Russian Federation dated September 26, 2016 No. 381 as amended by order of the FSS of the Russian Federation dated June 7, 2017 No. 275. Data on SKE are included in the 4-FSS report as a whole for the policyholder in a separate table (Fig. 5).

Rice. 5. Report on SKE as part of 4-FSS

How to determine the amount

The amount of the insurance tariff in accordance with the class of professional risk is established according to the table:

You can set a certain class for professional risks, and as a result, find out the tariff, taking into account the OKVED code. This is enshrined in Russian Government Decree No. 713.

Each company is required to submit annual reports to confirm the main code of economic activity. In accordance with the norms of Government Resolution No. 713, reports must be submitted no later than April 15 of each year. Documents are submitted to the FSS.

The employer must provide:

- A statement confirming the continuation of the main type of economic activity. The document must be drawn up according to the official form used.

- A copy of the explanatory note attached to the balance sheet. Data for the past year must be provided.

- Certificate – a confirmation indicating that the company continues to operate under the same code that was originally indicated.

An explanatory note may not be provided if the policyholder-employer operates as a small business entity. Based on the data that will be transferred to the Social Insurance Fund, the organization can set one or another tariff for the payer. The new data will only come into effect next year.

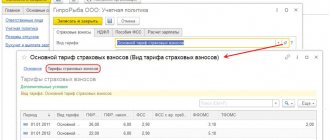

Reporting on insurance premiums in “1C: Salaries and personnel management 8” (rev. 3)

In the 1C: Salary and Personnel Management 8 program, edition 3, all insurance premiums are calculated automatically in accordance with the specified tariffs for each individual on the Contributions tab when filling out documents:

- Calculation of salaries and contributions;

- Dismissal;

- Holiday to care for the child.

It is convenient to analyze the calculation of contributions using the Analysis of Fund Contributions report. 1C-Reporting service built into 1C

allows you to submit regulated reports to regulatory authorities, including the Federal Tax Service of Russia, the Pension Fund of the Russian Federation, the Social Insurance Fund directly from the 1C program, without uploading or downloading to other programs.

The service supports automatic completion of regulated reports, including Calculation of insurance premiums and 4-FSS. The 1C-Reporting service allows you to:

- send electronic reports to regulatory authorities directly from the program in electronic form using an electronic signature;

- make requests for certificates about the status of settlements;

- receive responses to requirements and other types of electronic interaction with regulatory authorities;

- visually monitor the status of document flow with regulatory authorities.

Find out the FSS registration number by TIN

Special assistant programs allow you to find out the FSS registration number by the organization’s TIN online. With their help, you can easily find the necessary information about your own company or a partner. We will tell you in detail how to use programs for verifying counterparties to find the necessary information.

A registration number in the Social Insurance Fund is assigned after registration of a legal entity or individual entrepreneur. The registration authorities themselves transmit information about the newly formed company or entrepreneur to the fund.