Before sending the VAT tax return, check the details of your invoices with your counterparties. This will reduce the risk of rejection by the tax authority.

VLSI will check:

- is the information about the counterparty correct (at the time of the transaction, the company with the specified INN/KPP must be registered in the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs and not be liquidated);

- whether the counterparty’s declaration contains the invoice data that you indicated, and vice versa.

VLSI only verifies client documents. Not a single electronic document management operator has access to the NI database. Tensor does not provide the data of its counterparties to anyone and does not receive it from other operators.

Login to VAT+

You can log into the service using any browser at https://nds.kontur.ru. Login is carried out using a login/password or a certificate. To switch to Kontur.VAT+ from the Kontur.Extern system, use the menu “Kontour” > “VAT+”.

You can also go to Kontur.VAT+ from Kontur.Extern from the page for working with the VAT form.

Login using a certificate

After logging in to https://nds.kontur.ru, an authorization window will appear, select the desired certificate and click “Login”. To log in, you can only use those certificates that were received at SKB Kontur for working in the Kontur.Extern system.

Login using login and password

After logging in at https://nds.kontur.ru, an authorization window will appear, enter the required login (email) and password, and then click “Login.”

Work in the service

Working with service organizations

The service has the opportunity to work with organizations for maintenance; this opportunity is paid separately. To add organizations, you must contact the service center. If organizations have already been added to the service, a list of companies will appear when you log in. To get started, select the desired organization from the list.

Requirements for files to be uploaded

You can upload to the service both individual files of information from purchase books, sales books and invoice journals, as well as entire VAT declarations with attachments. You can upload files in the following formats:

- Xml files of information from sales and purchase books.

- Xml files of information from the logs of received and issued invoices.

- Xml and Xls files additional. sheets of sales and purchase books.

- Xls files of purchase / sales books.

- Xls log files of issued and received invoices.

- Zip archive with information files and a declaration in Xml format, or books with a declaration in Xls format (the file format in the archive must be one, not mixed).

Examples of excel files

Uploading documents to the service

When you first log into Kontur.VAT+, a button will appear to upload a declaration or individual books for reconciliation.

To load or view data for a different period, change it in the upper left corner.

To download a declaration, a book of purchases/sales, a journal of invoices, click the “Download” button and specify the type of file to download - a book of purchases/sales, a declaration or a directory of counterparties. If Kontur.VAT+ is not paid, but Kontur.Extern is connected, then only one item “Sales Book” will be available for downloading documents.

In the window that opens, select the files that need to be downloaded.

Immediately after selecting the files, downloading and automatic verification will begin. If you select Excel files of the purchase/sales book in xls, xlsx or csv format, they will be automatically converted to xml format and will be loaded into Kontur.VAT+. Similarly, upload all the documents that need to be verified.

What are the risks for taxpayers?

- There are a large number of requirements for which explanations will have to be given. It will be necessary to provide supporting documents for each case.

- Refusal to deduct VAT. Based on the results of a desk audit, the tax authority may recognize tax deductions as unlawful and assess additional tax or refuse a VAT refund, and in excess of this amount penalties and fines may be assessed.

- Additional VAT calculation. If during the inspection it turns out that the error is on the seller’s side, the inspectorate may charge additional VAT on sales and hold the company liable for taxation.

Reconciliation results

Reconciliation occurs automatically; the results of reconciliation for all uploaded documents appear on the main page of the service and are divided into categories:

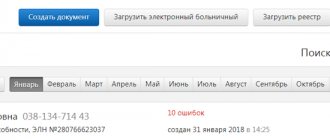

Errors in the declaration

When comparing invoices, logical control errors were discovered, in the presence of which the tax authority will not accept the declaration.

Control Ratio Warnings

When uploading documents to the service, inconsistencies were identified in the control ratios (for example, in sections 1-7 or 8-12 of the VAT return).

Book of purchases

With discrepancies – when comparing invoices (specified in the purchase book) of the user and his counterparties, discrepancies in the invoice data (for example, in the amount) were detected.

No discrepancies – reconciliation with counterparty data was successful, there are no discrepancies.

Sales book

With discrepancies – when comparing invoices (specified in the purchase book) of the user and his counterparties, discrepancies in the invoice data (for example, in the amount) were detected.

No discrepancies – reconciliation with counterparty data was successful, there are no discrepancies.

Warnings regarding the contents of the declaration

When comparing invoices, non-critical logical control declarations were discovered and recommended for correction.

Counterparties

Not yet verified - counterparties who have not uploaded their documents to the service in the selected quarter.

May be invited - these companies are not yet registered in Kontur.VAT+, they must be invited.

Ways to solve the problem

There are two ways to reduce the likelihood of errors:

- minimizing the “manual work” of entering data into the accounting system and

- conducting preliminary reconciliations with your counterparties.

These ways are not interchangeable - they complement each other perfectly and make it possible with a high degree of probability to avoid sanctions during a desk audit for VAT.

Transition to EDI

Electronic document management (EDF) allows the buyer and seller to use the same electronic document in accounting. Therefore, the risk of data discrepancies is completely eliminated. It is especially convenient if the accounting system and the EDI system used by the company are integrated with each other - in this case, invoices will be accepted for accounting automatically.

However, completely switching to EDI is problematic for many companies. Some organizations, especially small firms and individual entrepreneurs, manage document flow using the web version of the service, which requires manual receipt of documents for accounting. Thus, the influence of the human factor on the document flow process is not completely excluded.

Data reconciliation with counterparties

The most reliable way to eliminate discrepancies is to first carry out the same reconciliation process that will be carried out by the Federal Tax Service information system. Of course, you can try to do this manually, but it’s easier and more reliable to do it automatically.

With the “manual” method, a corresponding reconciliation report is generated for each counterparty, then they are sent out by mail (electronic or regular mail, depending on the presence or absence of EDI). The partner checks the received acts with his accounting data - he will have to do this, again, manually. The company does not have much time for this entire process, because at the end of the reporting period it is given only 25 days to report VAT to the tax service .

The disadvantages of the manual approach are obvious:

- the process is very labor-intensive and takes a lot of time, especially with a large number of counterparties;

- The human factor does not eliminate the possibility of error.

These disadvantages disappear when reconciliation is carried out automatically. For this purpose, special services have been created today, for example, the VAT+ module (Kontur.Sverka) from the SKB Kontur company.

Control Ratio Warnings

This category displays the number of errors in the control ratios in the uploaded declaration.

To view discrepancy details, click on a category.

To view the numbers from the declaration, open the “Section Contents” item. In Kontur.VAT+ it is impossible to correct data from the declaration. Errors and warnings must be corrected in the program in which the declaration was filled out.

With discrepancies (purchase book/sales book)

Transactions in which discrepancies were found in your data and in the data of your counterparties fall into this category.

Possible discrepancies:

- by the amount of VAT or the total value of the invoice;

- you or your counterparty do not have an invoice.

To go to a list of invoices with discrepancies, click on a category. If the transaction is reflected with the correct parameters, then you can remove the discrepancy using the “I have it correct” button. To transfer all invoices from the “Invoice with discrepancies” section to the “Invoice without discrepancies” section, click on the “All is correct” button and confirm the action.

When you click on the line with the document, a pivot table will appear, which will display your data and the data of the counterparty for the transaction.

The field in which a discrepancy is detected will be highlighted in red. It is necessary to find out on whose side the mistake was made. To communicate with the counterparty, you can use the chat, which is located to the right of the disagreement. If necessary, you can attach documents to the chat. When counterparties add new comments or documents to transactions with disagreements, information about them will appear in the message history on the main page of the service and will be sent as a notification to your email.

Errors must be corrected in the accounting system in which you keep your books and journals. The corrected document must be re-uploaded to Kontur.VAT+. You can also edit an invoice directly in Kontur.VAT+, to do this, click the “Edit” button. We recommend making changes to your accounting system. If the discrepancy is resolved, the number of transactions in the “With discrepancies ” will decrease.

Procedure 2: Checking the balance sheet and accounting

Check all taxable turnovers. The amounts in the calculation of turnover must correspond to the accounting information.

To do this, use accounts 46, 47, 48, reconcile the data from the order journal 11, 13, statements 16 and 16a.

List of documentation to check the total turnover of product sales for tax purposes:

- statements of current bank accounts of the enterprise.

- bank and cash documents.

- statements of product sales and settlements.

- paid customer invoice, etc.

From the statement, determine:

- when the amount from the advance payment will be in the buyer's settlement account, and not in the sales account;

- Are there any errors in tax calculations?

All tax return data must match the data on the accounting forms.

Within the specified period, the taxpayer can correct errors in the prepared annual report. Failure to do so on time may result in a fine.

If you want to find out how to solve your particular problem, please contact us through the online consultant form or call:

- Moscow.

- Saint Petersburg.

The inspector will review all records of sales of goods when reconciling the readings in VAT calculations for taxable turnover.

All of the above measures are necessary to prevent improper and unacceptable reduction in turnover and understatement of tax.

Author's rating Author of the article Andrey Chernov Lawyer. Practice in real estate, labor law, family law, consumer protection. 3159 articles written

Warnings regarding the contents of the declaration

This category includes transactions in which incorrect details of counterparties were indicated, if the counterparty is not registered in the Unified State Register of Real Estate, as well as transactions in which logical control errors were detected and recommended for correction. There can be multiple warnings on one invoice.

To go to a list of invoices with warnings, click on a category.

Possible reasons for warnings:

- The control ratio for TIN and/or checkpoint is not met;

- The counterparty is not registered in the Unified State Register of Real Estate;

- The invoice contains a negative value or tax amount;

- The invoice date in the sales book is not from the current tax period;

- An invoice with the number you specified was not found at the counterparty, but there is a similar one;

- Invoices for advance payments (quo 02, 05, 12) and invoices for sales (quo 01) must have different numbers.

To view the full text of the warning, hover your mouse over the line with the invoice and a tooltip will appear. Or click on the line and the invoice will open.

To correct the warnings, do one of the following:

- Edit the data directly in Contour.VAT+;

- Make changes to the book in the accounting system in which it was prepared. Then re-download information from purchase/sales books and invoice journals. Reconciliation will occur automatically, the counter of the “Warnings on the contents of the declaration” category will change.

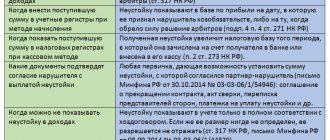

What might cause discrepancies?

There may be several reasons for data inconsistency. The most common of these are poor record keeping and mechanical errors.

The counterparty violates accounting rules

There is a risk that, due to inattention or negligence, a partner may violate accounting rules. For example, a supplier may “forget” to register an invoice in the Sales Book in the period when the goods were sold. Or do this in another period when the specified document was issued and received by the buyer. The result of such a violation can be disastrous - the Federal Tax Service will consider the fact of sale of products to be undocumented.

The presence of companies that deliberately evade taxes cannot be discounted. The risk of choosing such a “fly-by-night” as a partner can lie in wait for even the most cautious businessman. As a result, the accounting department of a bona fide taxpayer will have to respond to the demands of the tax authorities and provide explanations due to the violations of their “unclean” counterparties.

Errors associated with manual data entry

Errors often occur when an accountant enters information from “paper” invoices into the accounting system.

Most often, parameters such as date, amount, invoice number and organization tax identification number are entered incorrectly. Moreover, according to practice, the number of such errors is very large.

This fact was revealed when large taxpayers checked their partner directories through a special service of the Federal Tax Service. As a result, it turned out that the directories contain errors in the parameters of almost a third of the counterparties.

Often, errors creep into an organization’s TIN. In this case, during reconciliation, the automated Federal Tax Service system simply will not find the counterparty in its database. This will most likely lead to questions from inspectors about the validity of the tax benefit received by the buyer. If such a situation occurs occasionally, then there is nothing to worry about - the accountant will just need to provide an appropriate explanation. However, if there are a large number of incorrectly specified TIN (or other parameters), the company’s accounting department risks getting bogged down in the endless process of communication with the tax office.

Haven't checked yet

Counterparties in this category have already received invitations to the Kontur.VAT+ service, but have not yet uploaded their documents in the selected quarter.

To invite these counterparties to VAT+ again, click on the link of the same name. All companies on the list will receive an invitation to the previously specified e-mail addresses. At the moment, it is possible to automatically re-invite up to 200 companies. If there are more than 200 companies in the list of counterparties, then repeat invitations must be sent manually.

May be invited

This section displays counterparties that are not yet registered for VAT+ and cannot check with their counterparties. To invite these counterparties to the service, click on the “Specify email and send an invitation” link.

The list is initially generated for the selected period. To see counterparties for all periods, you need to check the box “Show counterparties for all periods”

In the list that opens, click on the “No email” link next to the desired organization.

In the “Invitation” item, select “Specify email and send an invitation.”

Enter your email address and click on the “Save” link.

In addition, you can download a directory of counterparties for sending mass invitations.

Editing invoices

In addition to correcting discrepancies in your accounting system, you can edit your invoice in the VAT+ service. To do this, find the invoice you need, open it and click the “Edit” button in the lower left corner. Make the necessary changes and click the “Save” button.

To download edited books from Kontur.VAT+, click the “Upload” > “Declaration” > “Upload to Computer” button.

In the window that opens, select the required partitions and click on the “Upload” button. The uploaded files can be uploaded to Kontur.Extern for sending to the Federal Tax Service.

Switch between sections

To switch between sections, use the top menu in the “Declaration” item. Red dots mean that the data of the specified partition has been loaded into the service. The absence of red dots means that there is no data in the service.

Any list for any loaded section can be downloaded from the service. To do this, click on the “Save” button on the desired section.

Specify the format of the uploaded file and click “Save to Computer.”

If you upload a VAT declaration to the service along with books and magazines, the data from it will be displayed in the “Declaration” section. Data from the declaration (sections 1-7) are available for viewing only and cannot be edited. It is allowed to download xml files of VAT declarations in the format approved by Order of the Federal Tax Service dated October 29, 2014 No. ММВ-7-3/ [email protected]

The “Help” section contains recommendations from SKB Kontur experts on working with discrepancies, requirements, composite invoices, additional sheets in 1C, warnings on invoices, and also describes the procedure for using the transaction type code.

Options for applying for reconciliation

Carrying out the reconciliation, the taxpayer's calculation of taxes is carried out in accordance with paragraph 3 of the Regulations from the order of the Federal Tax Service of Russia dated September 9, 2005 No. SAE-3-01/444 @.

You can contact the Federal Tax Service regarding the issue of reconciliation in different ways:

- By personal visit or by sending a representative. It is not necessary to go to “your” tax office - you can visit any territorial office of the Federal Tax Service. If you send a representative, do not forget to give him a power of attorney - an original and a copy.

- Through the taxpayer’s personal account on the Federal Tax Service website. This option is suitable for registered users. To become one, you still have to visit the Federal Tax Service. However, if you have access to the State Services portal, this can be avoided.

- In electronic form via TKS. Suitable for those who have connected electronic document management with the Tax Service.

Personal appeal

Let us immediately note that no special form has been approved for an application for reconciliation. You can compose an appeal in any form, without fail indicating all the important parameters :

- name of the company or full name of the entrepreneur;

- all codes - OGRN/OGRNIP, INN, KPP;

- contact details - address, telephone;

- a list of taxes that need to be checked;

- the name of “your” tax authority;

- the date on which the reconciliation is carried out;

- method of receiving the reconciliation report (in person, by mail).

Note! If you select the option of receiving the reconciliation report by mail, you must provide a postal address . Otherwise, the documents will be sent to legal.

The tax authority must review the application within 5 days and send a reconciliation report to the taxpayer in 2 copies .

Sample application for reconciliation with the budget

Features of electronic appeal

When applying via TKS, the application will be generated automatically. The user will only need to select taxes and reconciliation periods. However, the option of receiving the act is not subject to choice - it will come in electronic form (letter of the Federal Tax Service dated October 30, 2015 No. SD-3-3 / [email protected] ).

If the application is submitted through the personal account on the website https://www.nalog.ru, then it is also generated automatically. You can choose from options for receiving the certificate - in person or by mail.

Note! The electronic reconciliation report cannot be returned to the tax office if there is a disagreement. If they are found, you will have to contact the Federal Tax Service again.

Counterparties

The list of all counterparties, transactions with which are reflected in documents uploaded to the service in the selected quarter, is located on the “Counterparties” tab.

Using the “Download” > “Directory” button, you can download a pre-prepared list of counterparties in Excel format.

Required fields are “TIN” and “KPP”. The fields “Name of organization” and “Full name of contact person” are optional.

The reference book must be prepared according to the following template:

To send an invitation for reconciliation, you must go to the “Invitations” section, click on the line with the counterparty (but not the name), indicate the email address, and click on the “Save” button.

If for some reason the counterparty did not receive the invitation, then you need to select the required counterparties and click on the “Resend invitation” button.

The directory of counterparties contains a color indicator next to each counterparty. When you click on it, a short company card from the Kontur.Focus service appears.

The color indicator indicates the degree of reliability of the company:

- Green (positive facts) - not a single suspicious fact was found about the company;

- Yellow (important facts) – suspicious facts have been discovered about the company;

- Red (critical facts) - the company is liquidated or in the process of liquidation;

- White (the company is not in Kontur.Focus) - most often this happens with foreign companies, or if the TIN of the counterparty is incorrectly indicated in the uploaded book.

The company card also indicates statistics of transactions with a given counterparty, the status of document loading, information about contact persons, invitations and those responsible for reconciliation with the selected organization.

When you click on the company name in the list, invoices with this counterparty in the selected period appear.

In the list of counterparties, it is possible to assign employees responsible for reconciliation with specific counterparties. Additional workstations (possibility of adding responsible employees) are purchased separately. To assign responsibility, select one or more counterparties and click the “Assign Responsible” button.

In the window that appears, indicate the responsible employee from the list, or add a new one using the “Add employee” button.

When adding an employee, provide their first and last name, as well as their email address. A letter will be sent to the specified address notifying the employee that he has been appointed responsible for reconciliations with certain counterparties.

In addition, you can assign a person responsible for reconciliation with the entire organization. To do this, go to the list of organizations by clicking on the name of the current organization at the top of the page. Click on the “No responsible person” link under the desired organization (or on the link with the full name of the current responsible person).

Specify the responsible employee from the list or add a new one.

The responsible employee will be able to work in the service and log in using the email that was specified for him. When logging in, he will only be able to see those organizations for which he has been assigned responsibility.

The “Summary” tab of the “Counterparties” section displays summary information for all counterparties for the selected period. If you wish, you can see all the contractors, Fr.

The “Summary” displays the latest changes in the “Traffic Light” status of counterparties, the TOP organizations by the amount and number of invoices with discrepancies, information on invitations, as well as the percentage of counterparties by “Traffic Light” status.

The TOP discrepancies in the amount of VAT and the number of invoices show 5 organizations with the highest indicators. If you click on “See all”, a list will open, arranged in descending order by the corresponding indicator.

The “Invitation from counterparties” column shows how many invitations have been sent, read and accepted. By clicking on the number of counterparties, the corresponding list of companies will open.

“Last changes” shows the last 5 contractors whose status in the “Traffic Light” service has changed. Clicking on “View All” will open “Monitoring”.

“Monitoring” shows all contractors whose status in “Traffic Light” has changed. The information is broken down by date of modification.

Why are discrepancies dangerous?

For each identified fact of data discrepancy, the tax service will require explanations from the parties to the transaction. In this regard, the taxpayer faces additional risks, namely:

- the workload on the accounting department increases - it is necessary to spend time collecting documents and drawing up a response to the Federal Tax Service’s requirement;

- there is a risk of not meeting the deadlines set by law when communicating with the tax office - it is necessary to confirm receipt of the request within 6 working days , and send a response to it within the next 5 working days (violation of deadlines is punishable by up to blocking the current account );

- errors increase the chance that, based on the results of an audit, the company will be denied a deduction, additional VAT will be charged, and fines and penalties will be imposed.

Deductions

Deductions are amounts by which a taxpayer can reduce the tax assessed for payment to the budget. In most cases, this is the VAT that the buyer has already paid to suppliers in the chain of transactions. To receive a deduction, companies submit to the Federal Tax Service the Purchase Book (Section 8 of the declaration) with invoices received from suppliers.

Information on deductions can be viewed for the 4 most important time periods.

Reconciliation – a necessity or a taxpayer’s right?

Let us recall that the main document regulating the reconciliation procedure 1. Joint reconciliation of the taxpayer and the tax authority is regulated by Section 3 of the Regulations.

Please note that reconciliation with the tax authority is the right of the taxpayer. However, according to the above Regulations, the tax authority carries out a mandatory reconciliation with the taxpayer in the following cases:

– with the largest taxpayers – quarterly;

– at the initiative of the taxpayer.

Sometimes the reconciliation of calculations can also be initiated by the tax authority 2. As a rule, the tax inspectorate offers to reconcile calculations in cases of overpayment of taxes (penalties, fines) to the budget 3.