Reconciliation with the Social Insurance Fund: how to complete it, reconciliation report form

The Social Insurance Fund (SIF) performs a fairly wide range of functions. He is in charge of issues of payments for sick leave, industrial accidents, birth certificates, registration of sanatorium and resort treatment, as well as maintenance of disabled people.

The reconciliation act, which can be initiated by both parties to the interaction (the fund and the reporting organization), allows you to check the data for any reporting period. In its actions to reconcile calculations, the FSS is guided by the provisions given in Federal Law 212 of 2009.

Recent changes in legislation are reflected in the Tax Code. Legal regulation of the procedure for accruals and payments under fund items. Article 34 of the Code provides detailed descriptions of the following categories:

- Detailing the parameters of the object and the base for calculating taxes;

- Tariffs for deductions, including descriptions of previously abolished standards;

- The procedure for determining amounts that are not included in the tax base;

- Terms and procedure for payment and reporting on assessed contributions;

- Form for declaring charges and paying mandatory fees from business entities.

The reconciliation report (AC) is the primary document on the basis of which the quality of the accounting work is checked.

It is this format of working with the Social Insurance Fund that makes it possible to identify and eliminate the recording of serious financial violations. Preparation of reconciliation acts reduces the fiscal burden on the enterprise in the form of fines and penalties for arrears.

Also, based on the information in the document, you can generate an application for a refund of overpaid taxes.

It is worth noting that the application form as such is not established by law. Important parameters of the appeal are the details of the business entity, the account number of the reconciliation report and the date of the appeal. According to current legislation, a government agency has 5 days to respond to a written initiative to provide information for verification.

An alternative option for contacting regulatory authorities is to use the capabilities of telecommunication channels. The response from the fund may come in the form of a certificate with data on contributions already accrued, as well as fines.

Form 21-FSS RF

A unified reporting form introduced by order of the Social Insurance Fund number 457 in 2021. The current version of the document includes details of accruals for debt or arrears of insurance premiums, penalties, fines, as well as outstanding payments.

There are three columns for reconciliation. The first is for information provided by the policyholder, the second is for data in the fund’s database, and the third is for clarifying discrepancies.

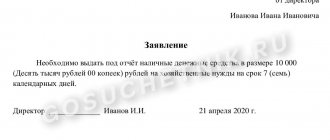

Application and letter

The application to the FSS should reflect the following points:

- Information about who the request is being sent to (territorial representation);

- Detailed information about who is sending the appeal;

- Document details, date, contacts. The request is signed by the head of the enterprise;

- Formulation of the request.

Receiving the form

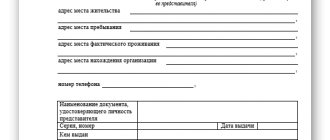

The act of reconciliation of mutual settlements for penalties, fines, taxes and fees between the taxpayer and the tax inspectorate, form according to KND 1160070 (approved by Order of the Federal Tax Service of the Russian Federation No. MM-3-25/494 dated August 20, 2007) consists of:

- Title page

- Section 2 on the list of specified taxes

Why and why is mutual settlements analysis needed?

- Checking the absence of debt upon deregistration.

- Inventory when preparing financial statements for the year, monthly comparison of accrued and paid taxes.

- In order to understand the payment procedure, and to avoid overpayments, fines, arrears, and interest for the use of funds.

- Controlling budget payments.

Some people mistakenly believe that settlements approved by the other party can be used in court if necessary. However, in itself it is not proof of debt without primary documents. This document is informational.

The law does not provide any specific requirements for filling out a statement of reconciliation of mutual settlements with counterparties, but there are still several basic points on how to do this correctly.

- The document must contain its title, date and names of the parties;

- The initials of the officials who sign it are indicated;

- Data is strictly distributed according to contracts;

- This document must be filled out in two copies.

It is also advisable to comply with the basic requirements applicable to all primary documents.

Who signs the settlement analysis?

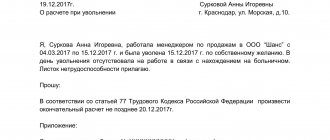

Although a joint reconciliation of mutual settlements is drawn up in the accounting department, this does not mean that the manager’s signature is not required. So, first of all, after drawing up the document, you need to sign the manager, then send 2 copies by mail to the partner with whom you are reconciling.

We invite you to familiarize yourself with a sample of a completed application form for a Finnish visa.

Topic: Documents for obtaining a quota for an operation - quota conditions

It happens that the other party is in no hurry to approve the debt comparison. Unfortunately, it does not say anywhere within how long it must be returned. So, if this condition is not specified in the contract, repeated documents can be sent again and again without a response.

These laws do not provide for a specific format for this joint document, so the organization can independently develop the form of mutual settlements with which it will work.

It is important to keep in mind how things are going with the budget for every organization - from tiny private enterprises to huge holdings. To avoid any unexpected unpleasant surprises, it is better to carry out reconciliations with the Federal Tax Service in advance and regularly.

Any act of reconciliation of mutual settlements with the Inspectorate of the Federal Tax Service of the Russian Federation begins with a letter of application. It does not have a special recognized form.

However, it is imperative to indicate in such a letter the period for which the analysis of mutual settlements is carried out (the period is not legally limited, although, as a rule, in practice it does not exceed 3 years).

Also, it is better to deliver the letter by courier. The stamp and date of acceptance on it will serve you well, as you will be confident in the date when the reconciliation will begin.

Within five working days, the inspector will personally provide you with a report with completed Section I.

The data graphs you should pay attention to will have something like this{amp}lt;p{amp}gt;

When there are no discrepancies, all filling out comes down to signing the document. But, alas, this is rare in practice.

If there are discrepancies, you should enter your data in the appropriate columns.

Appendix No. 2 to the Order of the Ministry of Labor and Social Protection of the Russian Federation dated December 4, 2013

N 712н

arrears (except for those suspended for collection)

suspended for collection

excess of expenses for payment of insurance coverage in relation to accrued insurance premiums

debt (except those suspended for collection)

Funds written off from the accounts of the payer of insurance premiums, but not credited to accounts for accounting for budget revenues

1 To be filled in by the head of the organization (separate division).

Source - Order of the Ministry of Labor of Russia dated December 4, 2013 No. 712n

It is important to understand that this kind of document does not have a specific form in law. This means that payers will fill it out on their own.

Valentina Abramova Connoisseur (316), closed 2 years ago

I especially want to appeal to accountants.

The question is, you need a certificate (or reconciliation report) from the Social Insurance Fund as of June 1, 2012 about the debt for mandatory social benefits. insurance. They don’t just give it, they demand a report, but when asked what regulatory document can confirm this (request for a report). They don’t answer, remain silent and transfer calls to each other. Or they just “growl” into the phone.

I myself am not an accountant, but I need this certificate for work, and the accountants at the enterprise just shrug their shoulders. It’s understandable; no one wants to make a report again.

Accountants simply don’t want to make an “extra” report, but I need to include this certificate in the competition documentation (tender).

form of the act of joint reconciliation of calculations for insurance premiums, penalties and fines (form 21-FSS of the Russian Federation)

application form for offset of amounts of overpaid insurance premiums, penalties and fines (form 22-FSS of the Russian Federation)

application form for the return of amounts of excessively collected insurance premiums, penalties and fines (form 24-FSS of the Russian Federation)

application form to clarify the basis, type and affiliation of the payment, reporting (settlement) period or status of the payer of insurance premiums.

Sample notification of the payer of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity about opening (closing) a bank account

An application for tax reconciliation is an official request from several persons or one citizen to an official, government agency, administration of an institution or local government regarding tax reconciliation.

An application, unlike a complaint, is not related to a violation of his legitimate interests and rights and does not contain a request to eliminate such a violation, but is aimed solely at realizing the interests and rights of the applicant or eliminating any shortcomings in the work of enterprises, organizations, institutions.

Applications can be submitted either orally or in writing. The procedure for their consideration is similar to how complaints are considered.

Sample application for tax reconciliation

Send by mail

Credit or refund

The object related to the documents considered in our commentary is the amount of insurance contributions (penalties, fines) that the payer of insurance premiums contributed excessively to the budget of the social insurance fund.

In this case, amounts contributed in excess to the FSS of Russia can either be paid by the policyholder himself or collected from him by the territorial branch of the FSS of Russia. In the first case, the “further fate” of excess amounts is regulated by Article 26 of Federal Law 212-FZ on insurance premiums.

According to this rule, the amount of overpaid insurance premiums is subject to:

- offset against future payments of the payer of insurance premiums;

- offset against debt repayment of penalties and fines for offenses provided for by the legislation on compulsory insurance;

- return to the payer of insurance premiums.

The legislation obliges the insurer to inform the payer of insurance premiums about each fact of excessive payment of insurance premiums that becomes known within 10 days from the date of discovery of such a fact.

When an employee of the social insurance fund discovers excess amounts in the payer’s personal account, he invites him to make a reconciliation. This reconciliation is joint, each party reflects its own data. The result will be either confirmation of the overpayment from the payer, or otherwise it will be necessary to submit an updated calculation with correct information on accrued and paid insurance premiums.

Next, the organization submits to the FSS of Russia an application for offset or return of the amount, indicating the purpose of the offset or details for its return. If the payer for any reason has not carried out a reconciliation, the fund employee will independently offset the overpayment.

Reference: an application for offset or refund of the amount of overpaid insurance premiums can be submitted within three years from the date of payment of the amount in question.

Article 27 of Federal Law No. 212-FZ regulates the relationship regarding the offset and return of excess amounts of insurance premiums collected from the payer.

Please note that a refund to the payer’s bank account is made only after repayment of all debts from him to the Federal Insurance Service of Russia, including penalties and fines, regardless of whether the policyholder himself overpaid, or the fund collected these amounts from him independently.

In all cases, refunds are made only at the request of the payer. In case of excessive collection, the refund is carried out with interest accrued from the budget.

Since 2015, all documents (notices of identified overpayments, payer’s application for offset or refund, decision of the Social Insurance Fund authority on offset or refund) can be sent not only in writing, but also in electronic form. This amendment was introduced by Federal Law No. 188-FZ of June 28, 2014. The same law introduced an amendment according to which from now on the Social Insurance Fund, at the request of the payer, has the right to make offsets between the types of insurance that it controls (Part 21, Article 26 of Federal Law No. 212-FZ). As is known, the jurisdiction of the FSS includes:

- compulsory social insurance in case of temporary disability and in connection with maternity;

- compulsory social insurance against industrial accidents and occupational diseases.

Reconciliation of insurance premiums in 2020

Since 2021, the fiscal service has assumed responsibilities for monitoring the accrual and payment of insurance premiums, and therefore the amounts of contributions accrued for reporting periods after 01/01/2017 are subject to payment to the accounts of the Federal Tax Service.

We suggest you read: The employer sued me after an audit carried out after my dismissal || The employer sued me after an audit carried out after my dismissal

The FSS bodies retained the right to control the repayment of debt on contributions accrued for reporting periods up to December 31, 2017 inclusive. Also, fines and penalties accrued for debts before 01/01/2017 should be paid to the Social Insurance Fund accounts.

If the payer is reconciling payments accrued for the period from January 1, 2017, then to obtain a reconciliation report, the organization should contact the Federal Tax Service at the place of registration.

For a sample of filling out a reconciliation report for insurance premium payments, see below.

If discrepancies arise based on the results of the reconciliation, their reasons must be clarified. If the organization agrees with the differences, you can sign a reconciliation report for calculations of insurance premiums without disagreement and adjust the data in the accounting. If you do not agree, you should make a note in the act.

- Insurance premiums from 2021: all changes

The debt that was discovered as a result of the reconciliation of insurance premiums should be repaid as soon as possible. Otherwise, penalties will be charged for each day of delay. But, if there are actually no arrears, they can be canceled.

For example, due to an incorrect BCC, payments were stuck in the unknown. The payment should be clarified, and if the fund does not reset the penalty, a recalculation can be achieved in court (resolution of the Ninth Arbitration Court of Appeal dated March 6, 2014 No. A14-9859 /2013).

The Fund will credit contributions within 10 working days from the date of receipt of the application in Form 22-FSS. But if the company submitted applications before the reconciliation of insurance premiums, then the fund has the right to initiate it itself. Then the fund will offset the amounts within 10 working days after the act is signed by both parties.

If the company does not agree with the fund’s data, it should be noted in the reconciliation report that it agrees “with the disagreements.” For example, if the company does not agree with penalties. After reconciliation, it is necessary to find out the reasons for the discrepancies and eliminate them. For example, if the arrears arose due to an error in the payment order, then it will need to be clarified by submitting an application in free form.

Sample of filling out the act of joint reconciliation of calculations for insurance contributions to the Social Insurance Fund

Expected response

In response to a written request, the organization can count on receiving a written response in the form of a reconciliation report, which can be received within 5 working days in person or by mail (clause 3.4 of Order No. SAE-3-01 / [email protected] dated 09.09.2005. ) Options for receiving the act are indicated in the text of the application when preparing it for transfer.

In response to an electronic request, the Federal Tax Service Inspectorate will respond with an electronic version of the reconciliation report , which is intended only to inform the taxpayer about the status of settlements (clause 2.22 of the Recommendations for organizing electronic document management, approved by Federal Tax Service Order No. ММВ-7-6 of June 13, 2013 / [email protected] , edition 4.04.2017).

Obviously, the electronic version does not involve comments about disagreement, and in the paper version the taxpayer has the right to mark the presence of discrepancies or confirm agreement with the specified amounts.

Read more about how to properly respond to a request for information here.

The current financial position of an organization is largely assessed by the state of its property (including accounts receivable) and financial liabilities (including accounts payable). A timely and competently completed reconciliation request will help avoid litigation.

Reconciliation of settlements with the Social Insurance Fund: how to complete it, reconciliation report form, sample filling

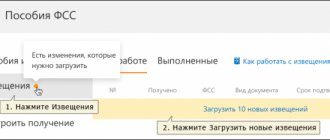

Below is an algorithm of actions according to which a business entity can carry out a reconciliation with the Social Insurance Fund based on calculations for the period before 01/01/2017.

The first stage of mutual settlements with social insurance authorities is the payer’s request for a reconciliation report by drawing up a corresponding application.

The current legislation does not contain an approved form, in accordance with which a business entity must submit a request to the Social Insurance Fund. Therefore, the payer of contributions can fill out an application in free form, indicating the following information:

- name of the Social Insurance Fund body, address, full name and position of the head in whose name the application is submitted;

- information about the applicant (name of organization, legal address, TIN, KPP, registration number, full name, position of manager);

- date of reconciliation of balances (“Please reconcile as of ____);

- the desired form of receiving the reconciliation report (postal delivery/receipt at the FSS office through a personal visit by the payer);

- date of application.

After registration, the document is signed by the head and sealed with the seal of the organization. Also, a request to the FSS for reconciliation can be issued in the form of a letter with an outgoing registration number and date.

To carry out reconciliation, the payer of contributions should submit applications to the territorial body of the Social Insurance Fund with which the organization is registered (in the general order - Social Insurance Fund in accordance with the legal address).

The application can be submitted to:

- personally visiting the FSS;

- by mail, having issued a letter with notification and an inventory of the attachment at the nearest Russian Post office.

The date of the payer’s application to the Social Insurance Fund is the date indicated by the Fund employee at the time the application was accepted.

Within 5 working days from the date of application, FSS employees are required to generate a reconciliation report and submit it to the payer.

The mutual settlement act is drawn up on form 21-FSS and contains the following details:

- full name of the FSS body;

- information about the payer (full name of the organization/full name of the individual entrepreneur, registration number of the payer in the Social Insurance Fund, code of subordination, location of the organization/address of the individual entrepreneur);

- Full name of officials from the Social Insurance Fund and the payer;

- reconciliation period (“from ___ to ___, as of _____”).

Also see "".

Please note that this application form does not have an official electronic format, although the law provides for the possibility of submitting it in the form of an electronic document.

Shipping methods

In case of a personal visit to the office of the Federal Tax Service, the application is transferred to the tax office. On the second copy of the application, the secretary will put a mark indicating acceptance of the application (clause 3.4.1 of the Regulations).

Sending an application by mail is standard: a registered letter with an inventory and return receipt will allow the applicant to be confident that the request has been received; the date of delivery will help calculate the date of expected receipt of the response.

Healthy. The Federal Tax Service must respond to a taxpayer’s request for a reconciliation report within 10 days (clause 3 of Article 78 of the Tax Code of the Russian Federation).

A modern and reliable way to submit an application to the Federal Tax Service is electronic document management . The resources on the official website allow you to send a request electronically and receive the same (electronic) response.

In accordance with Order No. ММВ-7-8/781, the exchange of documents can be carried out using special software “Taxpayer Legal Entities”. The program can be downloaded from the Federal Tax Service website www.nalog.ru. The software's capabilities are broader than just exchanging letters.

Reconciliation goals

Reconciliation allows you to track outgoing deductions and control the formation of debts. It is usually initiated by the payer when there is a likelihood of a conflict with the fund regarding the volume of transferred contributions. It is also needed to detect overpayments as part of liquidation or reorganization. Reconciliation is usually carried out in the presence of these circumstances:

- Reorganization.

- Liquidation.

- The need to track the presence of debt.

- Establishing the amount of overpayments.

- Systematization of information.

- The company plans to participate in government competitions and tenders.

We invite you to familiarize yourself with the Salary Slip: Explanation

At the end of the event, a reconciliation report is issued. It is an essential document within the financial activities of the enterprise.

Every month the legal entity must make contributions to the fund. If they don't exist, debt will form. Its presence can negatively affect a variety of aspects of activity. These consequences are possible:

- Negative reputation in the market.

- Failure of transactions with counterparties.

- Loss of public investment.

- Negative payment history.

- Judicial debt collection.

- Seizure.

Reconciliation allows you to monitor the status of your payments. It is recommended to carry it out at least once a quarter. This frequency ensures timely tracking of all debts.

FOR YOUR INFORMATION! Regular control allows you to reduce the fiscal burden on the entity in the form of fines and penalties for debts.

IMPORTANT! It is on the basis of the reconciliation report that an application for the refund of tax overpayments is drawn up.