Inventories are part of an organization’s tangible property intended for the production of final products.

By showing them on the balance sheet, the company reflects information about resources at the end of the reporting year. Raw materials and supplies - which were not used in the production process, for them, in line 1210 of the balance sheet, information about the balances of funds in the debit and credit of accounts is formed. The composition of raw materials may vary depending on the products manufactured by the enterprise.

For example, if we are talking about winemaking, it could be grapes or another product involved in the preparation process.

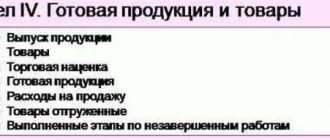

Accounting for finished products

To summarize information about the availability and movement of finished products, account 43 “Finished products” is intended.

This account is used by organizations carrying out production activities.

Finished goods can be accounted for in one of three ways:

- at actual production cost;

- at accounting prices (standard (planned) cost) - using account 40 “Output of products (works, services)” or without its use;

- for direct cost items.

Accounting for products at actual cost

If an organization decides to account for finished products at actual cost, then in this case they will be accounted for only using account 43 “Finished products”.

In this case, the receipt of finished products at the warehouse is reflected by the following posting:

Debit 43 Credit 20 - finished products are accepted for accounting.

Accounting for products at accounting prices (planned cost)

There are two ways to account for such products:

- without using account 40 “Output of products (works, services)”;

- using account 40 “Output of products (works, services)”.

If the first method is used, then when transferring finished products to the warehouse, reflected at accounting prices (planned cost), the following entry is made:

Debit 43 Credit 20 (23, 29) - finished products were capitalized at accounting prices (planned cost).

If the second method is used, then the finished products are reflected in correspondence with account 40 “Output of products (works, services)” at standard or planned cost.

After the products are manufactured and transferred to the warehouse, a record is made:

Debit 43 Credit 40 - finished products were capitalized at standard (planned) cost.

The cost of products manufactured by the main production is reflected by posting:

Debit 40 Credit 20 - reflects the actual cost of products produced by the main production.

As a rule, the accounting standard (planned) cost of finished products does not coincide with its actual cost.

As a result, account 40 has a balance - debit or credit.

At the end of the month it is written off, and as a result account 40 will have no balance.

The debit balance on account 40 is the excess of the actual cost over the standard or planned cost (overexpenditure), the credit balance is the excess of the standard or planned cost over the actual cost (savings).

The debit balance of account 40 is written off monthly by posting:

Debit 90-2 Credit 40 - the excess of the actual cost of manufactured products over its standard (planned) cost is written off.

The credit balance on account 40 is written off monthly with a reversal entry:

Debit 90-2 Credit 40 - the excess of the standard (planned) cost of manufactured products over its actual cost is reversed.

Accounting for revenue from the sale of finished products

Transactions related to the sale of finished products are reflected in accounting using the following accounting entries:

Debit 62 Credit 90-1 - revenue from the sale of finished products is reflected.

When revenue from the sale of finished products is recognized in accounting, its value is written off from account 43 “Finished Products” to the debit of account 90 “Sales”.

Topic 2.2. Production cost accounting

1. The basis for dividing costs into direct and indirect is:

a) range of products;

b) place of cost occurrence;

+c) economic homogeneity of costs;

d) volume of production.

2. The full cost of production is determined:

a) by summing up all production costs;

+b) by summing production costs and non-production expenses;

c) by subtracting the costs of selling products from production costs;

3. The economically justified basis for the distribution of costs for the maintenance and operation of equipment is:

a) the basic salary of production workers;

b) the amount of direct costs for manufacturing products;

+c) estimated (normative) rate;

d) volume of production.

4. If a final defect is discovered in the main production workshop, an accounting entry is made:

5. Accounting entry D-t 20 K-97 reflects:

a) write-off of losses from defects;

+b) creating a reserve for the repair of fixed assets;

c) repayment of expenses for the development of new types of products.

6. When writing off the expenses of the assembly shop, an accounting entry is made:

a) D-t 02 K-t 10; b) D-t 23 K-t 26;

+c) D-t 20 K-t 25; d) D-t 44 K-t 25.

7. An accounting entry is made for the identified shortage of work in progress in the main workshops:

a) D-t 10 K-t 20; +b) D-t 94 K-t 20;

c) D-t 84 K-t 20; d) D-t 99 K-t 20.

8. What kind of posting reflects the write-off of the cost of services rendered and work performed?

9. What kind of entries reflect unreimbursed losses from defects?

10. Representative expenses include:

a) for personnel training;

+b) for an official reception;

c) for the maintenance of the organization’s administration.

11. Costs for the development of new types of products are recorded in the account:

Documentation of the movement of finished products

The transfer of finished products to the warehouse is formalized by a requirement-invoice (form N M-11 “Requirement-invoice”) (approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a).

When finished products arrive at the warehouse, materials accounting cards are opened according to Form N M-17 “Material Accounting Card” (approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a), which are issued against receipt to the financially responsible person.

The operation of selling finished products is documented with a consignment note (standard form TORG-12).

Reflection of finished products in the balance sheet of the enterprise

Finished products are reflected in the balance sheet at the actual or standard (planned) production cost (clause 59 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n).

In the balance sheet, the value of balances of finished products not sold and not shipped to customers as of the reporting date is indicated on line 1210 “Inventories”.

Organizations independently determine the details of this indicator.

For example, the balance sheet may separately contain information on the cost of materials, finished products and goods, costs in work in progress, if such information is recognized by the organization as significant.

If in current accounting finished products are reflected at actual production cost, then in the balance sheet they are reflected at actual production cost (debit balance of account 43).

When recording the production of finished products at standard (planned) production cost using account 40, the balance sheet shows the standard (planned) production cost of finished products.

Write-off of materials

Materials can be supplied to the needs of various departments of the company - main, auxiliary or service production, for use for administrative, managerial or general production purposes.

For the cost of materials sold, make the following entry:

Debit 20 (23, 29, 25, 26) Credit 10 - materials written off.

When using materials to sell finished products and goods, make a note:

Debit 44 Credit 10 - the cost of materials used in the process of selling products (goods) has been written off.

The organization can donate excess materials free of charge.

The cost of donated materials is subject to VAT.

This operation is reflected in accounting records:

Debit 91-2 Credit 10 - materials transferred free of charge are written off;

Debit 91-2 Credit 68, subaccount “Calculations for VAT” - VAT is charged on materials transferred free of charge;

Debit 99 Credit 91-9 - reflects the loss from the gratuitous transfer of materials (at the end of the month).

The loss from the gratuitous transfer of materials is not included in expenses when determining the tax base for income tax (clause 16 and clause 19 of Article 270 of the Tax Code of the Russian Federation).

Materials are assessed upon disposal in one of three ways:

- FIFO;

- at average cost;

- at the cost of each unit.

The specific method of writing off materials should be established in the accounting policies of your company. Different assessment methods can be used for different types of materials.

FIFO method

This method assumes that materials that arrived earlier than others are transferred to production first.

If the materials were purchased in batches, then it is understood that the first batch is transferred to production first, then the second, etc. If there are not enough materials in the first batch, then some of the materials from the second are written off.

EXAMPLE 14. HOW TO WRITE OFF MATERIALS USING FIFO METHOD

Zenit LLC purchased M-150 brick to carry out repair work. The bricks were bought in three lots of 10,000 pieces each.

The first batch was purchased on January 1 at a price of 35,000 rubles. (without VAT). The second one is on February 3 at a price of RUB 36,667. (without VAT). The third – March 2 at a price of 39,167 rubles. (without VAT).

25,000 bricks were written off for repair work. The work was carried out in March.

When using the FIFO method, the accountant must write off:

— 10,000 bricks from the first batch worth 35,000 rubles;

— 10,000 bricks from the second batch worth 36,667 rubles;

— 5,000 bricks from the third batch costing 19,584 rubles. (RUB 39,167 × 5,000 pcs.: 10,000 pcs.).

The total cost of bricks to be written off will be 91,251 rubles. (35,000 + 36,667 + 19,584).

When decommissioning a brick, it is necessary to make the following wiring:

Debit 20 Credit 10 - 91,251 rub. – the brick was written off for repair work.

Average cost method

When writing off valuables using this method, the accountant needs to determine the average cost per unit of materials. This monthly average is determined by the formula:

To determine the cost of materials to be written off, the average unit cost is multiplied by the total amount of materials written off.

EXAMPLE 15. HOW TO WRITE OFF MATERIALS AT AVERAGE COST

Zenit LLC purchased M-150 brick to carry out repair work. The bricks were bought in three lots of 10,000 pieces each. The first batch was purchased on January 1 at a price of 35,000 rubles. (without VAT). The second one is on February 3 at a price of RUB 36,667. (without VAT). The third – March 2 at a price of 39,167 rubles. (without VAT).

25,000 bricks were written off for repair work. The work was carried out in March.

When using this method, the accountant needs to determine the average cost per unit of materials (one brick). It will be:

(35,000 rub. + 36,667 rub. + 39,167 rub.) : (10,000 pcs. + 0,000 pcs. + 10,000 pcs.) = 3.69 rub./pc.

The cost of bricks to be written off will be:

RUB 3.69/piece × 25,000 pcs. = 92,250 rub.

When decommissioning a brick, it is necessary to make the following wiring:

Debit 20 Credit 10 - 92,250 rub. – the brick was written off for repair work.

Write-off method at cost of each unit

This method is used to evaluate materials used in a special manner (precious metal ingots, precious stones, car engines, etc.).

A unit of such materials, as a rule, is unique, that is, there is a single copy.

In most cases, such materials are very expensive.

EXAMPLE 16. INCLUDING THE COST OF A UNIQUE OBJECT IN THE COST OF PRODUCTS

JSC Aktiv assembles cars. The engines installed in them are numbered units. Thus, the engine is a unique object. The cost of the car includes the individual actual cost of each engine, recorded in the suppliers’ documents.

The described methods of writing off materials are also applicable to goods.

The method of writing off at the cost of each unit is least suitable for retail trade.

After all, keeping piece records for a large number of different small goods is very labor-intensive and in most cases unjustified.

But writing off goods at the cost of each unit allows you to obtain absolutely accurate information about the cost of goods sold without any averaging or deviations. Each type of material can have its own assessment method.

| Annual report 2021 edited by V.I. Meshcheryakova Bestseller of the year for an accountant. A book that every accountant needs so that preparing a report does not turn into an ordeal of performance. |

What does line 1210 of the balance sheet consist of?

Line 1210 of the balance sheet is called “Inventories”. As the name suggests, this line needs to be shown (clause 20 of PBU 4/99):

- raw materials, materials and other similar values;

- costs in work in progress (distribution costs);

- finished goods, goods for resale and goods shipped;

- Future expenses.

This means that to fill out line 1210 of the balance sheet as of the reporting date, you need to add up the debit balance of the following accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

- 10 “Materials;

- 11 “Animals in cultivation and fattening”;

- 15 “Procurement and acquisition of material assets”;

- 16 “Deviation in the cost of material assets”;

- 20 “Main production”;

- 21 “Semi-finished products of own production”;

- 23 “Auxiliary production”;

- 28 “Defects in production”;

- 29 “Service industries and farms”;

- 41 "Products";

- 43 “Finished products”;

- 44 “Sales expenses”;

- 45 “Goods shipped”;

- 97 “Deferred expenses”.

We remind you that in financial statements, indicators must be presented in a net assessment, i.e., minus regulatory values (clause 35 of PBU 4/99). This means that if an organization has an amount of reserve for depreciation related to inventories (credit balance of account 14 “Reserves for depreciation of material assets”) or a trade margin (credit balance of the same name account 42), the debit balance of the above accounts should be equal to their amount decrease. And the already “cleared” balance of inventories should be reflected on line 1210. And information about regulatory values that are not given separately in the balance sheet must be disclosed in the explanations to it.

Please also note that if the organization’s reserves include, for example, raw materials or materials used to create non-current assets, then these amounts are not reflected on line 1210 as current assets (Letter of the Ministry of Finance dated January 29, 2014 No. 07-04-18 /01). The amount of such inventories will need to be shown in line 1190 “Other non-current assets”. Similarly, the balance of accounts 15 and 16 related to the acquisition of non-current assets will also not be shown on line 1210. It is quite natural that the balance of account 97 is reflected on line 1210 only in that part that relates to expenses with a write-off period not exceeding 12 months after the reporting date. The remaining deferred expenses are included in non-current assets.

Contribution of materials to the authorized capital

If your company received materials as a contribution to the authorized capital, you must record them on the balance sheet at the cost agreed upon between the founders (participants).

The monetary valuation of a non-monetary contribution to the authorized capital of a business company must be carried out by an independent appraiser (Clause 2 of Article 66.2 of the Civil Code of the Russian Federation).

note

The party transferring materials as a contribution to the authorized capital is obliged to restore the previously deductible VAT on materials and pay it to the budget. The receiving party can accept this tax as a deduction (clause 1, clause 3, article 170 of the Tax Code of the Russian Federation). Her VAT amount increases her additional capital.

EXAMPLE 12. HOW TO ACCOUNT FOR MATERIALS AS A CONTRIBUTION TO THE AUTHORIZED CAPITAL

One of the founders of Passiv LLC is Aktiv JSC. In the reporting year, “Active” transferred materials to “Passive” as a contribution to the authorized capital. The nominal value of the share is 90,000 rubles. The cost of materials, agreed upon between the founders and confirmed by an independent appraiser, also amounted to 90,000 rubles. The amount of VAT recovered by Aktiv and indicated by it in the transfer documents is 18,000 rubles.

The Passiv accountant made the following entries:

Debit 75-1 Credit 80 - 90,000 rub. – the debt of “Aktiva” for its contribution to the authorized capital is reflected;

Debit 10 Credit 75-1 - 90,000 rub. – received materials for the contribution to the authorized capital;

Debit 19 Credit 83 - 18,000 rub. – VAT on materials is taken into account;

Debit 68, subaccount “Calculations for VAT” Credit 19 - 18,000 rubles. – accepted for deduction of VAT on materials.

In the Liability balance sheet for the reporting year, line 1210 will indicate the cost of materials in the amount of 90 thousand rubles.

Encyclopedia of solutions. Inventories (line 1210)

Inventories (line 1210)

Line 1210 reflects data on the total cost of the organization's inventories listed as of December 31 of the reporting year.

The cost of inventories to be reflected in the balance sheet is determined based on the valuation methods used (clause 24 of PBU 5/01 “Accounting for inventories”, hereinafter referred to as PBU 5/01). The organization establishes the choice of a specific method in its accounting policies.

The actual cost of inventories is not subject to change, except in cases established by the legislation of the Russian Federation (clause 12 of PBU 5/01).

Paragraph 35 of PBU 4/99 “Accounting statements of an organization” establishes the requirement to fill out the balance sheet in a net assessment, i.e. excluding regulatory values, which are disclosed in the notes to the balance sheet. Such a regulating value when reflecting the cost of inventories is the amount of the reserve for reducing the cost of material assets (clause 25 of PBU 5/01). The reserve is not formed for all inventories, but only for those that:

— morally outdated;

— completely or partially lost their original quality;

— the current market value of the sale of which has decreased.

For example, in the Recommendations to auditors for 2013 (attachment to the letter of the Ministry of Finance of Russia dated January 29, 2014 N 07-04-18/01), the Ministry of Finance of Russia draws attention to the fact that if an organization has entered into an agreement for the sale of finished products at a price lower than its cost, then at the end of the reporting year in the balance sheet the specified finished products are reflected minus the reserve for a decrease in the value of material assets.

To account for the reserve, account 14 “Reserves for reducing the value of material assets” is intended.

Attention

Reservations are not made for goods listed as shipped goods at the end of the reporting year (letter of the Ministry of Finance of Russia dated January 29, 2008 N 07-05-06/18).

Information about reserves is provided in the balance sheet without being broken down by type. Data on the movement of inventories by type and group are reflected in the notes to the balance sheet, in table 4.1 “Availability and movement of inventories” and in table 4.2 “Inventory pledged”.

When filling out line 1210, the following data will be required:

- about the cost of raw materials and materials, purchased semi-finished products and components, containers, spare parts, and other material assets that are used to produce products, perform work, provide services not written off in production, recorded in the debit of accounts 10 “Materials”, 11 “ Animals for growing and fattening", 15 "Procurement and acquisition of material assets", debit or credit account 16 "Deviation in the cost of material assets";

- about the cost of goods intended for resale, recorded in the debit of account 41 “Goods”. Organizations engaged in retail trade, when accounting for goods at sales prices, use account 42 “Trade margin”.

The receipt of goods and containers can be reflected using account 15 “Procurement and acquisition of material assets” or without using it in a manner similar to the procedure for accounting for relevant transactions with materials;

— about the cost of finished products, recorded in the debit of account 43 “Finished products”;

— about the cost of finished products and goods shipped to customers, recorded as the debit of account 45 “Goods shipped”;

A property transferred to a buyer, the transfer of ownership of which has not yet been registered as of the reporting date, is reflected in the balance sheet as part of current assets. To reflect a disposed fixed asset item until the recognition of income and expenses from its disposal, account 45 “Goods shipped” (a separate sub-account) can be used (letter of the Ministry of Finance of Russia dated January 27, 2012 N 07-02-18/01).

- on the amount of costs in work in progress, recorded in the debit of accounts 20 “Main production”, 21 “Semi-finished products of own production”, 23 “Auxiliary production”, 29 “Service production and facilities”;

- about the amount of the amount of circulation costs not written off to the accounts for accounting for sales revenue, recorded in the debit of account 44 “Costs of circulation”;

- on the amount of amounts of deferred expenses recorded in the debit of account 97 “Deferred Expenses”, provided that these expenses comply with the conditions for asset recognition.

Thus, the procedure for generating the final value for line 1210 will look like this:

Topic 2.1. Inventory accounting

1. What kind of transaction is used to record the operation “accepted supplier’s invoice for materials received at the warehouse”?

+a) D-t10 K-t 60, D-t 19 K-t 60;

2. What kind of posting is used to document the release of material from the warehouse for packaging finished products in the warehouse?

3. At what valuation are materials reflected in the balance sheet?

c) by agreement;

+d) at actual cost.

4. Specify the posting of the transaction for transferring funds to the transport organization for the delivery of materials:

5. What does it mean to evaluate materials using the FIFO method?

+a) the first batch for receipt - the first for expenditure;

b) the last one for income - the first one for expenses;

c) first for receipt - last for expenditure.

6 What accounting entry is made for the shortage of materials identified when accepting cargo from a transport organization?

7. What do accounting entries mean in accounting accounts: D-t. 91 “Other income and expenses”, subaccount 91-2 “Other expenses” Account number. 10 "Materials":

a) deviations in the cost of materials are written off;

b) materials were released from the warehouse for the needs of auxiliary production;

+c) materials released for external sales?

8.Which synthetic account is used to determine the result from the sale of materials:

b) 51 “Current accounts”;

+d) 91 “Other income and expenses”?

9. Which account is debited when transferring funds to a transport organization for the delivery of materials:

a) 51 “Current accounts”;

+b) 60 “Settlements with suppliers and contractors”;

d) 15 “Procurement and acquisition of material assets”?

What reserves are included in the balance sheet?

To begin with, it is worth saying that the resources themselves for the production of products are only part of what is recognized as reserves, and what line 1210 of the balance sheet consists of. They are divided into several categories:

- Materials and raw materials used for the manufacture of goods or work.

- Financial costs for materials and raw materials. Materials for production also include fuel, repair tools, clothing and waste generated at the enterprise.

- Money for employee salaries, as well as social benefits.

- The number of products that are not yet completed in production.

- Finished products for sale, as well as services, works, animals. Before shipment they undergo mandatory quality checks.

- Expenses for new production equipment and its modernization.

- Depreciation expenses.

- Cost of gross output.

- Costs for customs duties.

- Taxes belonging to the non-refundable category.

- Funds paid by an enterprise to the seller of products for his services.

- Consulting services if the company's activities related to the sale and purchase of inventories.

- Transportation of goods, storage services in warehouses.

- Costs related to advertising.

The balance sheet reflects only general information about all these categories, without decoding. And all purchases, payments and sales of shipped goods must have documentary evidence. Inventory analysis is needed in order to optimize them, because a shortage is just as bad as an excess. The consequence of the first scenario is a delay in the production of goods, and the second is the withdrawal of money from the company’s turnover, which will be spent on the purchase of goods that were not included in production.

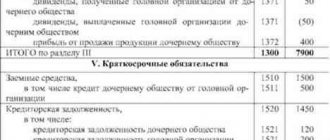

Balance sheet

The balance sheet is one of the basic forms of accounting for commercial enterprises, thanks to which you can obtain information about:

- Property status of the company.

- Her financial stability.

- Liquidity.

- Solvency, etc.

The balance sheet consists of two parts - assets and liabilities, equal to each other in amounts. Inventories and expenses in the balance sheet are indicated in line 1210, and relate to the Assets part, subsection “Current assets”. There you can also find information about VAT on purchased assets, financial investments and receivables. But here it is worth recalling that all inventories are reflected in account 002, which is classified as off-balance sheet.

Line "Inventories" in the balance sheet

Now the balance sheet for accounting has a new form to fill out, which, according to accountants, has become simpler than the previous one. Now there is no need to detail the data, highlighting only the main thing. But they need to be filled out correctly, and for this you need to know the decoding of line 1210 of the balance sheet. Thus, to reflect information, the following manipulations are carried out with debit and credit account balances:

- 10, containing data on raw materials and supplies in the balance line, is added to 11 - it contains information about fattening animals. This category includes not only artiodactyls, but also birds, rabbits, bees, etc.

- The credit balance 14 is subtracted from the addition result.

- Add 15 – purchase of material assets.

- 16 is either added or subtracted, depending on the circumstances. Data on 15 and 16 should be entered only for stocks of raw materials and materials.

- The balances from 20, 21, 23, as well as 28 and 29 accounts are added to the result obtained.

- Then you need to find the balance of 41 and also add it.

- The credit balance of account 42 is deducted.

- The last steps are to add balance 43 - “Finished products”, as well as 44, 45 and 97. The latter includes only those expenses that were written off within one year.

After the calculations, an assessment is made. There are several methods available to an accountant to carry it out, for example:

- Calculate the average commodity cost.

- Accounting at cost of all production goods, etc.

The most commonly used method is one associated with recording the time of purchase of goods, since it is recognized as more convenient than others.

What entries reflect the acquisition of intangible assets from a legal entity?

Topic 1. Business process of supply/procurement/purchase. Accounting for material and industrial inventories.

1. What kind of transaction is used to record the operation “accepted company invoice for materials received at the warehouse”? ( D10-K60)

2. What kind of posting is used to document the release of material from the warehouse for packaging of finished products shipped to the buyer? ( D44-K10)

3. At what valuation are materials reflected in the balance sheet? ( According to their actual cost)

4. Specify the posting of the transaction of transferring funds to the transport organization for the delivery of materials? ( D76-K51)

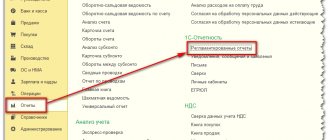

5. What is the register for analytical accounting of materials? ( Turnover balance sheet)

6. In which accounting register are the amounts and percentages of transportation and procurement costs calculated? (SHEET No. 10)

What document is used to document uninvoiced deliveries?

Certificate of acceptance of valuables

What does the FIFO method mean for valuing materials?

FIFO is a method for valuing inventories when they are written off for sale. Means that the inventory that is first received into production should be valued at the cost of the first acquisitions.

Another answer: This means that the goods accepted for registration first are also deregistered first.

What document is used to document the permanent release of materials for production?

Limit – fence card

Topic 2. Accounting for fixed assets.

At what cost are fixed assets included in the balance sheet currency?

At the original cost of these funds

What documents are used to document the receipt of fixed assets?

Certificate of acceptance and transfer of fixed assets

What entries reflect the purchase of equipment from a supplier that does not require installation?

Inventory cards are opened on the basis of what documents?

Based on the act of acceptance and transfer of fixed assets

What document is used to document the gratuitous transfer of an object to another company?

Donation agreement or Certificate of gratuitous transfer/acceptance

Which entry reflects the depreciation of the workshop's fixed assets?

What is the register of analytical accounting of fixed assets?

What accounting entry reflects the profit from the sale of fixed assets?

D91-K01 – the cost of fixed assets is written off.

D76-K91 + D51-K76 – accrued revenue from the sale of fixed assets

What transactions are used to record the write-off of the value of a retired fixed asset?

D01 (sub-account “Retirement of fixed assets”) - K01 – write-off of primary cost

D02-K01 (sub-account “Disposal of fixed assets”) - depreciation on retired assets is written off

D91-K01 (sub-account “Retirement of fixed assets”) – residual value written off

(Most likely there will be only the last 2 postings or only the last one)

10. How to reflect the capitalization of scrap from the disposal of fixed assets? ( like D.10 - K 91.1)

What transactions reflect the gratuitous transfer of fixed assets to another organization?

D01 (sub-account “Retirement of fixed assets”) - K01 – write-off of primary cost

D02-K01 (sub-account “Disposal of fixed assets”) - depreciation on retired assets is written off

D91-K01 (sub-account “Retirement of fixed assets”) – residual value written off

D91-K10 or 70 or 69 – expenses for the transfer of fixed assets are written off

D91-K68 – VAT is charged on transferred funds to the receiving company

(There will be some 2 or 1 of these postings)

What entries reflect the revaluation of fixed assets for production purposes?

D01-K83 – revaluation amount

D01-K84 – repayment of early assessment

D83/84-K02 – adjustment of depreciation

D83-K84 – transfer of the revaluation amount upon disposal of fixed assets

D84-K83 – transfer of the amount of adjusted depreciation upon disposal of an object

(There will be some 2 or 1 of them, most likely the last 2 will not be)

13. How to reflect the acquisition of property that requires installation? D07-K60

Topic 3. Accounting for intangible assets.

How is straight-line depreciation calculated for intangible assets?

Based on the original cost of the intangible asset and the depreciation rate calculated based on the useful life of this object

In what valuation are intangible assets reflected on the balance sheet?

Reflected at the residual value (original - depreciation accrued for the balance sheet)

What transactions reflect the write-off of intangible assets?

D05-K04 – depreciation on intangible assets written off

D91-K04 – the residual value of intangible assets is written off

D99-K91 – financial result from writing off intangible assets

What entries reflect the acquisition of intangible assets from a legal entity?

D08-K60 – reflects the enterprise’s debt to sellers of intangible assets

Notes on future expenses

In order for the documents to reflect costs in subsequent periods, they must be described according to all the rules. This can be done on the balance sheet line, but this accounting procedure must be noted in the company’s accounting policy. For example, account 97 will allow you to create additional subaccounts in line 1210, which will contain information about expenses in the following purchasing periods.

All resources used for production are accounted for in the debit balance of account 10. For this, the initial price of those goods that will be written off before the end of the next reporting period is used. To simplify this process, accounts 15 and 16 are usually taken. The first reflects information about acquired and procured assets, the cost of material assets, the second - about deviations in their cost. This allows you to describe materials and raw materials, as well as reflect their accounting price in as much detail as possible.

Information about manufactured products is included in line 1210.

Here it is important to mention account 14. It will come in handy if production decides to create a reserve fund, with the help of which it will be possible to depreciate the total amount of inventory. Depreciation here is a decrease in the value of inventories.

So, in account 14, raw materials and supplies are recorded, minus the reserve for their depreciation. Subsequently, their cost should be several times lower than the initial one by the date of the report. To determine whether these conditions are met, an impairment test is performed:

- It is determined which assets are involved in testing.

- The value of the asset to be recovered is calculated.

- Impairment losses are determined.

- The loss is recognized as a gain or loss from impairment over a specified period of time.

- An analysis of the resulting calculations is being prepared.

- All data is documented.

- Reporting is completed.

Thanks to this process, it is possible to reduce the price of consumed resources several times, thereby stopping overconsumption in further periods.

The company's reserves noted in the documentation allow us to assess its material security. The availability of resources must be maintained at a certain level so that there is no shortage or overexpenditure in the reserve. The balance sheet stability of an organization's inventory indicates its competent management policy and good marketing, since the income of the entire enterprise depends on the speed of inventory turnover.

When preparing financial statements, a special form approved by law is used. All reports must be submitted in this form and filled out according to certain rules so that the documentation is without violations. The tax authorities are provided with statistics on certain data indicated in the appropriate lines. Each line has its own code, which is deciphered in a certain way. There is also a transcript to line 1210 of the balance sheet. To correctly fill out this column, you need to understand what exactly is included in it and enter all the necessary information.

How to keep records of the sources of an organization's property

Accounting for an organization's property implies identifying the sources of formation of such property. All sources can be divided into two main groups - own funds and attracted resources. Often, an enterprise acquires property through the use of its own capital. The organization creates equipment and, using funds from its sale, updates the machine park: it expands the list of fixed assets with the help of which it makes a profit in the future. But equity capital is not always enough for large-scale activities. It is especially difficult to implement a developed business plan at the initial stage, when there are very few such funds. Often, a company attracts resources by concluding loan agreements with credit institutions, as well as with business partners. From an accounting point of view, property formed from borrowed funds is also considered to be property acquired by an enterprise on the terms of deferred or installment payment. In other words, the counterparty credited the organization for the amount of the cost of material assets supplied and services provided.

It is extremely difficult to carry out business activities without using attracted financing. In truth, there are no organizations that operate without borrowed funds.

Read material on the topic: Accounting services for companies

Next, we will consider what equity and borrowed capital are and what they consist of.

Each enterprise has certain assets on its balance sheet. But it is not always fully paid for by the company. That is, part of the property, as we have already said, can be formed through borrowed funds. Therefore, the value of its liabilities should be subtracted from the value of the organization’s property, and then you will receive the net value of the property - that is, the enterprise’s equity capital. It consists of several parts:

- The authorized capital is formed at the stage of formation of the enterprise from the contributions of the founders. The percentage of these contributions and their amount are not specified by law; there is only a minimum limit for the authorized capital - 10,000 rubles. If the owners of the company do not raise this amount initially, then they will not be able to register the organization.

- Additional capital is the amount formed as a result of the additional valuation of non-current assets, which is periodically carried out as part of accounting for the organization’s property. In general, ways to generate additional capital can be: revaluation of fixed assets as a result of inflationary processes, which led to an increase in their value;

- the result of conversions into domestic currency of contributions from foreign owners to the company’s authorized capital, the result of the impact of exchange rate differences on the assessment of the value of the company’s property. The day of registration of the enterprise and the day of actual payment of the authorized capital do not always coincide. That is why, on the day of registration, the founder’s contribution was valued at one amount, and at the time of payment this amount could increase significantly due to changes in the exchange rate;

- the appearance of share premium of a joint-stock company in cases where the real value of the shares sold exceeds their nominal value. The opposite situation during the initial issue of shares is simply unacceptable. And selling at a price higher than the nominal price is a common thing.

- Credit debt is the organization's obligations to counterparties. This may be arrears for settlements with partners, or perhaps the obligation to distribute GDP.

What does column 1210 consist of?

In reporting, balance sheet line 1210 is called “Inventories”; it usually reflects the following items that relate to any material assets of the organization, raw materials, related costs and expenses, as well as goods received during the production process:

- Raw materials used in production, as well as other valuables that have a similar purpose.

- Costs with distribution costs.

- Products received or goods used for resale.

- Possible future expenses.

Given this information, it is necessary to add up the debit balance of certain accounts for the required period of time for which the report is required. This list includes the following items:

- Materials that are used in production to obtain finished products, all kinds of raw materials used.

- Animals raised and fattened by the organization.

- Procurement or purchase of various valuables necessary for the functioning of production.

- Permitted deviations in the cost of acquired assets.

- The main operating production.

- The resulting semi-finished products are made in-house.

- Operating auxiliary production facilities.

- Manufacturing defects and related costs.

- Maintenance of the farm and the costs of this work.

- Received goods in production.

- Finished products.

- Sale of created products.

- Shipment of goods produced by the company.

- Future costs and potential costs.

All these points allow you to understand what balance line 1210 is made up of. Also, when preparing reports, it is worth remembering that the indicators in the documentation are given in a net assessment, that is, the data when compiling a summary should be indicated after the deduction of regulated quantities.

If a company has a reserve amount in its account for a possible reduction in cost or trade margin, then the debit balance must be reduced by this amount. After this, the information should be reflected in the completed line. As for regulated quantities that are not themselves included in the balance sheet, information about them is reflected in the explanations.

In cases where the organization’s balance sheet contains raw materials or materials used for use in non-current assets, then these amounts are not reflected as current assets when filling out line 1210. The amount of these inventories is reflected in the line used for other non-current assets, its number – 1190. Also, balances related to the acquisition of non-current assets will not be reflected in 1210. As for expenses for future expenses, only those whose write-off dates do not exceed exactly one year from the date of filing the report are mentioned. The remaining expenses are classified as non-current assets and must be recorded accordingly, in the appropriate line.

If you find an error, please select a piece of text and press Ctrl+Enter.

How to keep records of corporate property taxes

The regional tax on property of enterprises is provided for by Chapter 30 of the Tax Code of the Russian Federation. The amount of tax paid depends entirely on the tax rate, which is established by law in the regions of the Russian Federation. The maximum amounts are indicated by the Tax Code of the Russian Federation. The tax payment deadline and procedure are also set out in this basic set of laws.

Bodies of constituent entities of the Russian Federation have the right to establish their own tax benefits for certain categories of taxpayers. But in addition to benefits and privileges, there is also such a thing as the complete exemption of individual objects from the need to pay taxes.

Objects not subject to property tax:

- natural resources, environmental management facilities;

- objects used for the needs of state defense, security and law enforcement that are under the operational management of federal executive authorities (that is, objects of military service and other equivalent service);

- objects of cultural heritage of the peoples of the Russian Federation;

- especially dangerous facilities that serve to store nuclear materials, radioactive waste, as well as nuclear installations themselves;

- shipping transport for nuclear technology services and ships containing nuclear installations;

- space objects;

- ships registered in international registries;

- fixed assets classified as the first and second depreciation groups according to the Classification of fixed assets approved by the Government of the Russian Federation.

Read the material on the topic: Optimization of company taxes