The high motivational component of working in private companies is ensured by various methods of financial and non-material incentives (bonuses, bonuses, vouchers, personal discounts, etc.). Against this background, civil service, even having some special prestige, is still considered the most inconvenient for the development of an employee’s potential. To correct the material incentive system in the public sector, the concept of a personal increasing coefficient was developed. This is a method of rewarding employees for conscientious performance of duties, for an innovative approach to work, or for combining positions.

What is a personal increase factor (PPC)?

The Labor Code of the Russian Federation guarantees employees of budgetary enterprises the same working conditions and equal salaries for employees of the same level. But, such a clause to some extent demotivates staff and neutralizes financial incentives to work efficiently and diligently.

In order to introduce the possibility of financial incentives for employees for high-quality performance of their duties, it was decided to develop a system of personal bonuses taking into account an increasing coefficient to the salary. This increase in wages not only stimulates the growth of professional skills and quality of work, but also provides additional socio-economic protection.

In a number of cases, PPC is awarded to staff not only as a motivating component, but also as an incentive for working at high intensity (working at night, on weekends, etc.).

An increasing coefficient is a personal increase in salary, which can be set for a certain period (for a month, quarter or year). The calculation of this personal allowance must be included in the clause of the employment contract with the employee and established in the regulations on remuneration of state companies. This provision is developed in cooperation with the representative body of workers (trade union, etc.)

Example of calculations for an incomplete billing period

In practice, a situation where all quarters of a year are worked in their entirety is quite rare. However, the calculations here are much simpler. You can find the average daily earnings if the total payment for the entire period is divided by 12 and by 29.3.

Let's consider the example of an employee who worked last year without sick leave or business trips. During this time, she was credited with only 450,000 rubles. Of these, 50,000 are training costs. At the end of the year, she writes an application for leave for 28 days. In addition to her salary, she was not accrued any allowances or bonuses for this period.

- First, we find the total salary for the past year. In the case of this employee, training costs are not included in the calculation. Therefore, total earnings are taken equal to 400,000 thousand rubles.

- We calculate the average fee per day: 400,000 / 12 / 29.3 = 1,137.66.

- The amount paid for vacation is calculated using the formula: 1,137.66 * 28 = 31,854.48.

It is more difficult to calculate the amount in the case where the period has not been fully worked out. However, most often in practice it is necessary to work with these formulas.

First, you should determine the total number of days in those months that are fully worked. To do this, you need to multiply their number and the indicator 29.3. Next, you need to calculate how many days worked in an incomplete month. Here 29.3 should be divided by the number of calendar days, and then multiplied by the number of days worked.

Important! If there are several incomplete months, the calculation is carried out for each separately. The found values are rounded to hundredths and added.

Then you need to find the total number of days. To do this, add up the results obtained for full and incomplete months. In the end, all that remains is to find the average daily salary and multiply by the number of days of rest.

Now let’s calculate payments for an employee who has been working in the company since May 2015. In May 2021, he plans to take a 14-day vacation. Moreover, in March 2021 he was on a business trip for 17 days, and in September 2015 he was on sick leave for 14 days. The amount he received for the entire period reached 500,000 rubles.

- In the case of this employee, the pay period is 12 months. Of these, 10 were fully worked; in September there was sick leave, and in March there was a business trip.

- We count days for full months. 29.3 * 10 = 293.

- Find the number of days in each partial month. In September, 14 days are sick leave, leaving 16 calendar days. We find the number of days for calculation using the formula 29.3 * 16 / 30 = 15.63. In March, the employee was on a business trip, which means the number of calendar days will be 31 – 17 = 14. The calculation includes 29.3 * 14 / 31 = 13.23. Total number of days 15.63 13.23 = 28.86.

- We add the resulting values and find the number of days in the billing period: 293 28.86 = 321.86.

- We find the average payment per day by dividing the total payment by the number of days: 500,000 / 321.86 = 1,553.47.

- To calculate the amount of vacation pay, we multiply the average daily indicator and the number of days of rest 1,553.47 * 14 = 21,748.58.

RO = NW x DO, where

An increase in salary leads to changes in the benefits that depend on it. For this reason, adjustments must be made whenever tariff rates change. In addition, there are a number of payments that are not affected by the changes. These allowances are not subject to indexation. Their size is set in fixed amounts. These include:

- payments, the ratio of which to salary, tariff rate or monetary remuneration is established as a percentage or share,

- payments for which absolute values are established and used in calculating average earnings.

There are important facts to consider when making benefit adjustments. Firstly, indexation of earnings is only possible with a massive increase. In isolated cases, recalculation is not performed. Secondly, for part-time workers there is a general scheme for determining the final amount. Thirdly, the reduction in rates does not affect average earnings.

When issuing vacation pay, the “three-day” rule applies, that is, it must be transferred to the employee no later than three days before the start of the vacation. The employee must be notified of the fact of the upcoming vacation at least fourteen days in advance. For violation of the established rules of labor legislation, various types of penalties and fines are provided. In some cases, criminal liability may be applied.

Timely recalculation of vacation pay when salaries increase will save the employer from paying compensation to employees in the future for incorrectly issued amounts during an audit. In most cases, the accountant is responsible for the accuracy of the data. It is he who is responsible for the correctness of the calculations made.

Conversion algorithms

Z1 – salary, rate, monetary reward after promotion;

Z – salary, rate, monetary remuneration before promotion.

2. The increase occurred after the end of the billing period, but before the start of the vacation. In this case, the calculated average earnings are multiplied by the conversion factor.

3. If the promotion occurred during the vacation period. The average earnings for the days of vacation before the increase remain unchanged, and the average earnings from the day of the increase to the day the vacation ends are increased by a conversion factor.

Average earnings are adjusted only in terms of wages, excluding compensation, incentives and social payments. The promotion should be for all employees, not just one.

In July 2014, the manager of Mechta Accountant LLC, I.P. Shilov, went on another vacation of 28 calendar days. The billing period from 07/01/2013 to 06/30/2014 has been fully worked out. The employee's salary in 2013 was 10,000 rubles. From January 1, 2014, employee salaries increased by 10%. Bonuses and other additional payments were not accrued during the billing period.

K = 11,000 / 10,000 = 1.1

SDZ = (10,000 * 1.1 * 6 11,000 * 6) / (29.3 * 12) = 375.43 rubles.

RUB 375.43 * 28 days = 10,512.04 rubles.

Since April 16, 2014, the secretary of LLC “Dream of an Accountant” Lyubimova N.K. goes on another vacation for a period of 28 calendar days. The average earnings calculated by the accountant for the billing period from 04/01/2013 to 03/31/2014 amounted to 420 rubles. Bonuses and other additional payments were not accrued during the billing period. Vacation pay amounted to: 420 * 28 = 11,760 rubles.

From May 1, 2014, salaries increased by 20%. In this regard, from May 1 until the end of the vacation, it is necessary to recalculate the amount of accrued vacation pay.

15 days * 420 rub. 13 days * 420 rub. * 1.2 = 12,852 rub.

Thus, the indexation of vacation pay for a salary increase is made depending on when the increase took place: before the start of the vacation or during it.

How are things going at your work? Does your employer often index your salary and is such indexation comparable to the inflation rate? Please share in the comments!

Electronic requirements for payment of taxes and contributions: new referral rules

Recently, tax authorities updated forms for requests for payment of debts to the budget, incl. on insurance premiums. Now it’s time to adjust the procedure for sending such requirements through the TKS.

It is not necessary to print payslips

Employers are not required to issue paper payslips to employees. The Ministry of Labor does not prohibit sending them to employees by email.

"Physicist" transferred payment for the goods by bank transfer - you need to issue a receipt

In the case when an individual transferred payment for goods to the seller (company or individual entrepreneur) by bank transfer through a bank, the seller is obliged to send a cash receipt to the “physician” buyer, the Ministry of Finance believes.

The list and quantity of goods at the time of payment are unknown: how to issue a cash receipt

The name, quantity and price of goods (work, services) are mandatory details of a cash receipt (CSR). However, when receiving an advance payment (advance payment), it is sometimes impossible to determine the volume and list of goods. The Ministry of Finance told what to do in such a situation.

Medical examination for computer workers: mandatory or not

Even if an employee is busy working with a PC at least 50% of the time, this in itself is not a reason to regularly send him for medical examinations. Everything is decided by the results of certification of his workplace for working conditions.

Changed electronic document management operator - inform the Federal Tax Service

If an organization refuses the services of one electronic document management operator and switches to another, it is necessary to send an electronic notification about the recipient of the documents via TKS to the tax office.

Special regime officers will not be fined for fiscal storage for 13 months

For organizations and individual entrepreneurs on the simplified tax system, unified agricultural tax, UTII or PSN (with the exception of certain cases), there is a restriction on the permissible validity period of the fiscal drive key of the cash register used. Thus, they can only use fiscal accumulators for 36 months. But, as it turned out, this rule does not actually work so far.

The article from the magazine "MAIN BOOK" is current as of August 13, 2012.

E.A. Shapoval, lawyer, Ph.D. n.

Info

For example, in one of the cities of the Chelyabinsk region, with an employee’s salary of 30,000 and a bonus of 7,500 rubles, the salary calculation will look like this: (30,000 7,500) × 1.15 = 43,125 rubles (salary before personal income tax); 43,125 –13% = 37,518.75 rubles (take-home salary). What is the difference between calculating wages for a military personnel? The differences begin with the name of wages (service).

Info

The amount of earnings depends on:

- the amount of income tax. If the employer pays insurance premiums at the expense of the enterprise, then personal income tax is withheld directly from the employee’s earnings. In this case, they take into account the presence of deductions, for example, for children under 18 years of age.

- employee's work experience;

- professional excellence;

- working with trade secrets;

- knowledge of a foreign language;

- academic degree;

- work results.

Important

Recommended sizes of the increasing coefficient: - 0.20 - in the presence of the highest qualification category; — 0.15 — in the presence of the first qualification category; — 0.10 — if there is a second qualification category. 3. An increasing coefficient to the salary for the position held.

In what areas is it common to accrue PPC to employees?

The increasing coefficient on salary is accrued mainly to employees of budgetary institutions. This type of incentive is intensively used in educational and health care enterprises, and especially in military units of federal or local significance, to financially reward mid-level employees for quality work and additional responsibilities (extracurricular work, extra lessons, night shifts).

But, government agencies in various areas can resort to calculating PPC for employees: in state museums, libraries, foundations, scientific institutes.

For owners of private houses

Important! In order for an increasing factor to be applied to a private household, garden house or individual housing construction, the individual house must be recognized as a “residential premises”.

That is, there must be a corresponding decision from the local government on the suitability of the house for permanent residence of people. And the living conditions meet sanitary and technical requirements.

Private households must be equipped with the necessary metering devices. In this case, the consumption of cold water must be taken into account, especially if it is used for agricultural needs. And the house itself stands on a separate plot of land.

If you know the tariffs that apply in a particular region, you can determine how much you will have to pay if your home is not equipped with a meter. The data can be found from the payment slip. The base rate and consumption standards must be indicated there.

What laws and regulations govern the administration and withdrawal of PPCs?

An approximate provision approved by order of the Ministry of Health and Social Development of the Russian Federation No. 463 n dated August 28, 2008 is a by-law that establishes the right of employers to calculate a personal increasing coefficient to the salary.

Also, the nuances of assigning PPC are stipulated in a number of articles of the Labor Code of the Russian Federation: Art. 72, Art. 57, art. 135.

In turn, the accrual of an increasing coefficient does not contradict the requirements of Art. 22 of the Labor Code.

The amount of the PPC is calculated for the employee based on Article 152 of the Labor Code.

In the educational sphere, the right of employees to CPD is also considered in Presidential Decree No. 597 dated May 4, 2015 “On measures for the implementation of social policy.”

Which payments are subject to adjustment and which are not?

An increase in salary leads to changes in the benefits that depend on it. For this reason, adjustments must be made whenever tariff rates change. In addition, there are a number of payments that are not affected by the changes. These allowances are not subject to indexation. Their size is set in fixed amounts. These include:

- payments, the ratio of which to salary, tariff rate or monetary remuneration is established as a percentage or share,

- payments for which absolute values are established and used in calculating average earnings.

There are important facts to consider when making benefit adjustments. Firstly, indexation of earnings is only possible with a massive increase. In isolated cases, recalculation is not performed. Secondly, for part-time workers there is a general scheme for determining the final amount. Thirdly, the reduction in rates does not affect average earnings. Adjustments are provided only in case of increase. All indicators that must be taken into account when determining average earnings are taken in actual amounts.

When issuing vacation pay, the “three-day” rule applies, that is, it must be transferred to the employee no later than three days before the start of the vacation. The employee must be notified of the fact of the upcoming vacation at least fourteen days in advance. For violation of the established rules of labor legislation, various types of penalties and fines are provided. In some cases, criminal liability may be applied.

Timely recalculation of vacation pay when salaries increase will save the employer from paying compensation to employees in the future for incorrectly issued amounts during an audit. In most cases, the accountant is responsible for the accuracy of the data. It is he who is responsible for the correctness of the calculations made. Employees have the right to know what indicators the payments due to them consist of. If you have any questions, you can always contact the accounting department or your employer for clarification regarding accruals.

Conditions for applying PPC on employee salaries

A personal coefficient for the position held can be assigned to all employees who occupy positions that provide for categorization within the same salary.

PPK to the salary is assigned to employees to emphasize the level of their professional skills, the uniqueness of their skills, the importance of the work performed, the degree of independence and professional experience in the company.

It is recommended to assign PPC for length of service to employees who hold a position, depending on the total number of years that they have worked in federal government bodies or their territorial divisions.

PPK size recommended by law

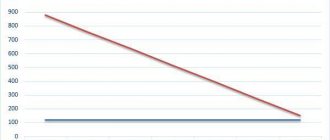

It is considered legal to establish a maximum personal increasing coefficient for an employee’s salary of up to 2.0 units equal to the salary itself. A completely objective provision of the Regulations leaves the employer the right to calculate the amount of the increase for each specific employee within this legally prescribed range.

For employees of universities and premium research institutes, the maximum PPC size can be 3.0 in absolute size for specialists and senior academic staff.

Also, for heads of organizations whose activities directly depend on government subsidies and revenues, it is strongly recommended to abandon fixed PPC rates for employees. Because budget financing is a very unstable category of income; it can be cut, delayed, and sometimes cancelled. And employers do not have the right to unilaterally change the size of the PPC, unless otherwise agreed in the employment contract.

The state allows heads of government agencies to bonus staff very generously, almost double the salary (200% more), but the employer himself decides on the size of the coefficient for each employee based on the size of the wage fund.

Remember

RF PP No. 354 regulates cases when the provider of a public utility service has the right to apply increasing coefficients when calculating fees for individual consumption of resources. Their use has a different impact on the volume of CD on SOI, which management organizations must take into account in their work.

Sources

- https://ozhkh.ru/kommunalnye-uslugi/povyshayushhie-koeffitsienty

- https://uslugi-zhkh.ru/kommunalnye-uslugi/povyshayushhie-koeffitsienty-na-kommunalnye-uslugi/

- https://o-vode.net/vodosnabzhenie/holodnaya/povyshayushhij-koeffitsient-hvs

- https://uristdnya.com/pravo/zhilishnoe/soderzhanie/o-povyshayushhem-koeffitsiente-k-kommunalnym-uslugam.html

- https://prosadidom.ru/nedvizhimost/gkh/povyshayushhij-koeffitsient-pri-otsutstvii-pribora-ucheta/

- https://neuristu.ru/zhkh/povyshayushhij-koeffitsient-na-kommunalnye-uslugi-gaz-vodu-bez-schetchika.html

- https://roskvartal.ru/soderzhanie-mkd/10288/kogda-primenenie-povyshayuschih-koefficientov-vliyaet-na-obyem-kr-na-soi

What schemes for calculating PPC are most common in enterprises?

In the field of education and healthcare, it has been established that motivational payments, which include an increasing coefficient, must be set as a percentage of the salary. Considering that these payments are calculated for the complexity of the work performed, length of service, and the presence of the highest category, they are calculated by assessing the employee according to these criteria based on the accepted point system.

If an employee performs the duties of a temporarily absent second employee without being relieved of his own duties, the additional payment to him is made using an increasing coefficient as agreed by the parties in the annex to the employment contract.

It is recommended to assign coefficients for length of service in the following amount:

- If the length of service is from 1 to 3 years, the bonus is 0.05% of the monthly salary;

- For service from 3 to 5 years, the bonus is 0.2% of the monthly salary;

- With more than 5 years of service - the PIC becomes 0.3%

Objectively, during the period of vacation, sick leave, maternity leave or child care leave, there is no PPC added to the employee’s salary. After the employee returns from vacation to work duties, a new increasing factor can be calculated only after the employer issues a new regulation.

Salary increase periods and calculation recommendations

The amount of payments in general cases is determined according to the established form. It is equal to the quotient of dividing the total salary for the calculation period by twelve and by 29.3. Recalculation of vacation pay when salaries increase takes place according to a slightly different scheme. And it depends on the period when the increase occurred. There can be three of them in total:

- during the billing period,

- at the end of the billing period, but before the occurrence of the event of interest (in this case, vacation),

- while maintaining average earnings.

Paragraph 16 of the Resolution contains recommendations for determining the amount of payment in these cases. Let's look at each of them using specific examples. For convenience, we present below four basic formulas by which calculations are made.

Formula No. 1 - indexation coefficient:

CI - indexation coefficient, NO - new salary, SO - salary before increase

Formula No. 2 - the amount of payments taken into account for the reporting period:

HC = (CO x RPs x CI + NO x N), where

УУ - taken into account payments, РПs - billing period with the old salary, N - number of months with an increased salary

Formula No. 3 - average earnings per day:

SZ = (UV/RP/29.3), where

SZ - average earnings per day, RP - billing period, 29.3 - average number of calendar days in a month

Formula No. 4 - amount of vacation pay:

An example of an order for calculating PPC

The manager also needs to issue an internal departmental order to accrue a personal increasing coefficient.

The order must be in the following form:

Name, address and details of the government agency

ORDER

No. _______ on the calculation of a personal increasing coefficient to the official salary from (date of signing the order) in order to stimulate the employee’s work (or another reason: acquisition of an increased category, combining positions, etc.).

In accordance with Article 135 of the Labor Code of the Russian Federation, accrue ___________________, (full name of the employee) occupying the position _________________ (full name of the position) a personal increasing coefficient to the official salary for the period from "___" _________ ____ to " ___" _________ ____ in the amount of ______.

Director: ______________________ (Signature, initials)

Chief Accountant: _________________ (Signature, initials)

Principles for calculating PPC to employees for night and overtime working hours

In situations where an employee performs work duties at night, he is also entitled to additional payment for each hour of additional work. The calculation of the increasing coefficient recommended by the Labor Code is 20% of the hourly salary during the daytime. To calculate the amount of an employee's hourly salary, the amount of his monthly salary must be divided by the number of hours worked.

Also, an employee of government agencies is entitled to payment for work on weekends and holidays in the amount of at least one daily rate in addition to the salary, if such additional payment does not exceed the fixed monthly number of working hours. And, if work on weekends is carried out in excess of the monthly working time norm, then it is paid in the amount of no less than 200% of the daily salary.

Payment for water without a meter in 2021: government decree

According to Article 157 of the Housing Code of the Russian Federation, payment for utilities is calculated based on the volume of resources consumed . This volume is determined by meter readings by the consumer himself. In their absence, payments are calculated based on established standards.

The standards are approved by regional authorities in the manner established by the Government of the Russian Federation. This procedure is established by Decree of the Government of the Russian Federation May 23, 2006 N 306. In accordance with its provisions, the authorities of the constituent entities establish standards for cold and hot water supply, sewerage, electricity supply, gas supply, heating.

For each of these housing and communal services, its own indicators are established. When calculating them, the technical characteristics of residential premises are taken into account.

For water, for example, the average consumption per month is:

- for cold water supply - 6.935 cubic meters per person;

- for hot water supply - 4.75 cubic meters per person.

In addition to the specified standards, to calculate payments for housing and communal services, you need to know the tariff. Rates for making payments in each region are set differently. For example, in the capital of our country, Moscow, the following prices apply:

- for drinking water - 35.40 rubles. per cubic meter;

- for electricity - 5.38 rubles/kWh;

- for hot water - 180.55 rubles. per cubic meter

In addition to the tariff and standard, when calculating payments in apartments without a meter, an increased coefficient is used.

Thus, consumers who do not use meters will have to make payments according to the formula:

Payment amount = number of residents * standard * tariff * coefficient.

In what cases can an employer cancel the accrual of PPC to salary?

Although the PPC belongs to the category of incentive, and not mandatory payments, the employer still cannot cancel the accrual of the personal coefficient to the employee unilaterally if the validity period of the order on the assignment of payments has not yet expired.

Since this category of payments does not belong to the list of direct and urgent expenses of the enterprise, the manager can include in the salary regulations a clause on the possibility of changing the size of the PPC, even if the validity period of the bonus has not yet expired. There must be a good reason for such a step, for example, a reduction in government subsidies and funding.

Also, the manager, for maximum reinsurance in order to avoid potential conflicts with staff, must include in the Regulations a clause on the possibility of canceling the increasing coefficient for an employee in the event of this employee’s failure to comply with internal regulations, labor discipline, tardiness, or dishonest performance of duties.

How does the Labor Code guarantee employees the right to retain PPC in addition to their salary?

If the employer did not include such a clause in the Regulations, and the possibility of canceling or cutting the PPC were not stipulated in the employment contract with the employee at the time of signing this very contract, then the employer does not have any legal right to cut the bonus to employees. This contradicts Art. 72. Labor Code. The salary amount is specified in the employment contract in the “mandatory conditions” column and cannot be changed without agreement with the employee.

To prevent conflicts due to cuts in bonuses for employees under PPC, the employer must take a responsible approach to drawing up an employment contract. It is not advisable to specify the size of the increasing coefficient in a fixed form (rate); it is much more reasonable to indicate it as a percentage of the salary. If the employer, without good reason, intends to reduce or cancel the employee’s PPC, this citizen has every legal right to maintain his bonus and appeal its cancellation in court.