Surely those taxpayers who have at least once filed a return under the simplified tax system to the tax office know how long and tedious it is to calculate and fill it out. But for those who value their time, our website provides the opportunity to calculate and fill out the declaration form for KND 1152017 online.

To do this, you need to fill in the fields, indicating the quarterly values of income and expenses for the object of taxation “income minus expenses”, or the values of income and contributions paid to the Pension Fund and the Federal Compulsory Medical Insurance Fund for the object “income”. By clicking the “Calculate” button you will receive the calculated values of the declaration lines according to the simplified tax system.

If you need to prepare and print a declaration using the simplified tax system online, then Fr. In the “Data for title page” form that appears, fill in the required fields. Now, when you click the “Calculate” button, a declaration according to the simplified tax system will be generated in PDF format, which can be downloaded by clicking on the link that appears.

How to work in the online service for preparing a simplified taxation system declaration

First, you need to register in the service by indicating your email address and accepting the terms of processing of personal data.

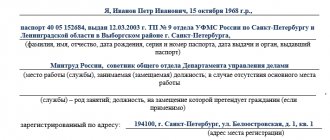

When you go to your personal account to the page for generating a simplified taxation system declaration, the following window opens.

Here you need to select the category of taxpayer and the taxation option for the simplified tax system: Income or Income minus expenses.

Pay attention to the line “Title Page”. If, for some reason, you do not want to indicate the registration data of an individual entrepreneur or LLC in the service itself, then you can prepare a declaration without them. In this case, choose the excel format and, after downloading the declaration with numerical indicators, enter your data yourself.

But, of course, it’s easier to provide the necessary data directly in the service. We guarantee our users compliance with the privacy policy.

If you check the “Fill in” box next to the title page, new fields will open in the interface. Next to each of them there are corresponding footnotes and hints.

Now, using examples, let's see what a completed simplified taxation system declaration looks like in the service interface and in finished form for printing.

An example of filling out a simplified taxation system Income declaration in the online service

First, we will select the payer category of the simplified tax system 6 percent. In our example, this will be a declaration for individual entrepreneurs without employees. We prepare the title page directly in the online service, so we have a checkmark next to the “Fill in” field.

Please note: for example, we have indicated a conditional TIN, but you need to enter your real tax number, otherwise the declaration will not be generated.

If the declaration is not submitted by the taxpayer himself, then in the field “Submits the declaration” you must select the “Representative” option. In this case, additional fields will open to indicate the details of the power of attorney.

As for the date of filing the declaration, if you are not sure that you will file the report on a specific day, you do not need to tick the appropriate box. In this case, you will add the date and personal signature later by hand.

We proceed to filling out the second part of the simplified tax system declaration - income received and insurance premiums paid. According to tax accounting rules, these indicators are reflected in the declaration in an increasing order from the beginning of the year.

However, in the service fields you need to indicate income and contributions separately for each quarter, and not from the beginning of the year. This is stated in the footnotes of the corresponding fields.

Let's assume our entrepreneur received the following income:

- 1st quarter – 100,000 rubles;

- 2nd quarter – 230,000 rubles;

- 3rd quarter – 170,000 rubles;

- 4th quarter – 220,000 rubles.

It is in this form that income data must be entered into the fields of the service. In the finished declaration, they will be displayed, as expected, on an accrual basis from the beginning of the reporting year.

Next, you need to indicate in the service fields the insurance premiums paid in each quarter separately. The declaration will reflect not just the contributions paid, but those amounts that reduce the calculated tax payment.

For example, the individual entrepreneur from our example paid 7,000 rubles in contributions for himself in the 1st quarter. But since the advance payment for the 1st quarter is equal to 6,000 rubles, then this amount will appear in the corresponding line of the declaration (the maximum possible to reduce the tax), and not the 7,000 rubles that were paid.

All that remains is to indicate the tax rate. The standard simplified tax rate is 6%, but individual entrepreneurs apply a zero tax rate during the holidays, then they need to indicate 0% in these fields.

If there was no income in a certain quarter or the individual entrepreneur was registered in the last months of the year, then you still need to fill out all the fields at the rate that was in effect during the year. An exception is USN Income payers who moved to or left Crimea during the year. Then some quarters may be taxed at a rate of 6%, and some at a rate of 3%.

In addition, the service for generating simplified taxation tax declarations allows you to take into account expenses when paying the trade tax (currently valid only in Moscow). If necessary, indicate the paid trading fee, you must check the appropriate box.

The entrepreneur from our example does not pay a trade tax, so the fields of his declaration in the interface look like this.

All that remains is to choose in what format you want to receive the completed simplified taxation system declaration and download it for printing. The finished declaration following our example, prepared in the online service, can be downloaded here for review.

Your simplified taxation system declaration will, of course, indicate the data that you entered into the service fields.

Section 1.1

| Line or block | Entered data | Note |

| Line 010 | 46647000 | Indicate the OKTMO code of the municipality in which the individual entrepreneur resides. You can find out OKTMO on the tax service website. |

| Lines 030, 060, 090 | — | If during the tax period (year) the entrepreneur did not change his place of residence and place of registration, a dash is placed on these lines. |

| 020 | 13 712 | Lines 020, 040, 070 indicate the amount of the advance payment to be paid to the budget at the end of the reporting period (1st quarter, half year and 9 months). Line 020 reflects the amount of the advance calculated for payment at the end of the 1st quarter, already reduced by the insurance premiums paid. In our example, this is 19,500 – 5788 = 13,712 If a negative or zero value is obtained (for example, there was no income), dashes are added. Trade tax payers take into account the amount paid here. Currently, the trade tax has been introduced only in the territory of Moscow; our individual entrepreneur does not pay it. |

| 040 | 19 148 | On line 040, reflect the amount of the advance calculated for payment at the end of the first half of 2021, taking into account the advance payment paid for the 1st quarter and contributions for two quarters. In our example, this is 44,436 – 13,712 – 11,576 = 19,148. |

| 070 | 2 006 | The amount of advance payment calculated for the first 9 months of 2021 is indicated, taking into account contributions made and advance payments. In our example, this is 52,230 – 17,364 – 13,712 – 19,148 = 2006. |

| 100 | 15 974 | This reflects the amount of tax that must be paid at the end of the year. In our example, this is 73,992 – 23,152 – 13,712 – 19,148 – 2,006 = 15,974. If a negative or zero value is obtained for this line (for example, there was no income), this line cannot be filled in, and the resulting value is entered into line below (110) |

At the bottom of the page you also need to put the date of completion and signature.

An example of filling out a simplified taxation system declaration in the online service: Income minus expenses

The first part of the declaration for the simplified tax system Income minus expenses is filled out in the same way as the declaration for the simplified tax system Income, so we will not repeat it.

The second part of the declaration is filled out differently. Firstly, there are separate fields for indicating expenses incurred. Secondly, insurance premiums for this version of the simplified system are included in the total amount of expenses and are therefore not indicated separately. Thirdly, for the simplified tax system Income minus expenses, other tax rates are applied: from 5% to 15% (rates are established by regulations of the constituent entities of the Russian Federation). Fourthly, there is a separate field for reflecting losses from previous years in the declaration, if any.

Tax accounting rules for the simplified tax system Income minus expenses are close to the calculation of income tax. In addition, there are features of accounting for certain types of costs, for example, goods purchased for resale. If you are unsure whether you have accounted for your expenses correctly, we recommend that you seek a free tax consultation.

For an example of online filling out a declaration under the simplified tax system Income minus expenses, let’s take Vega LLC. The organization did not have any losses in previous years, the tax rate is standard – 15%. This is what the completed interface fields look like.

In the completed declaration for this example, income and expenses are reflected in an accrual order, as for the simplified tax system Income.

Procedure for filling out the report

The declaration consists of a title page and six sections. When preparing the simplified tax system “income” declaration for 2021, the filling rules approved by the same order as the form are applied. Among the main requirements it is necessary to highlight the following:

- Individual entrepreneurs and organizations using the simplified tax system must fill out the title page and sections directly related to the object of taxation;

- when filling out the simplified taxation system “income” declaration, section 3 is attached only to “simplified people” who received funds as part of targeted financing;

- the report does not need to be stapled, it is better to fasten it with a paper clip;

- all indicators are indicated in full rubles, without kopecks;

- It is recommended to write in black ink;

- all letters must be printed in capitals (the same applies to filling out on a computer);

- errors in the document cannot be corrected using a correction tool;

- all pages must be numbered;

- You can specify only one indicator in each field;

- Document printing should only be one-sided;

- empty cells must be filled with dashes.

An example of filling out the simplified tax system “income” declaration for 2021 is presented below.

Deadlines for submitting the simplified tax system declaration

Please note - due to the coronavirus pandemic, for some individual entrepreneurs and organizations the deadlines for paying taxes and filing reports may be postponed, brief information in the summary table from the Federal Tax Service, details are described in this article.

The deadline for submitting a declaration under the simplified taxation system depends on the legal form of the taxpayer:

- organizations - no later than March 31 of the year following the reporting year;

- individual entrepreneurs - no later than April 30 of the year following the reporting year.

The zero declaration for the year is submitted within the same deadlines. In addition, special deadlines have also been established for filing a simplified taxation system declaration for certain situations: deregistration or violation of the requirements for this regime.

Declaration form

In case of closure of an individual entrepreneur, the same declaration is submitted as for annual reporting - forms according to KND 1152017. The form of the declaration, as well as the procedure for filling it out, is regulated in the order of the Federal Tax Service No. ММВ-7-3 / [email protected] dated February 26, 2021 . Over the subsequent years, the procedure for filling out and the declaration form have not changed, so reporting must be submitted in accordance with this document.

Is a two-dimensional barcode required for a simplified taxation system declaration?

Note! Some tax inspectorates have a practice of refusing to accept declarations without a two-dimensional barcode. Refusal for such a reason is not legal.

An exhaustive list of legal grounds is contained in clause 28 of Order No. 99n of the Ministry of Finance of Russia dated 07/02/2012 and does not contain a requirement for a two-dimensional barcode. The Federal Tax Service writes about the same in a letter dated April 18, 2014 N PA-4-6/7440: “The absence of a two-dimensional barcode on the tax return form or the submission of a tax return in a form that corresponds in terms of the composition of indicators to the approved form, but is not subject to processing in an automated way, are not reasons for refusing to accept the corresponding tax return.”

If you are denied acceptance of a declaration for this reason, request a written refusal indicating the reason (most likely at this stage the problem will be resolved in your favor) and appeal it through pre-trial dispute resolution.

When to pay pension contributions

Individual entrepreneurs on the simplified tax system without employees in 2021 must pay at least 40,874 rubles in insurance premiums (from income up to 300 thousand rubles). If he ceased activity, he pays an amount proportional to the time worked. An exact calculation can be made using our calculator. The individual entrepreneur has the right to deduct the entire amount paid from the tax, since there are no employees.

The deadline for paying these contributions is specified in paragraph 5 of Article 432 of the Tax Code of the Russian Federation - no later than 15 days (calendar) from the date of deregistration. From the next day, penalties will be charged. However, there is an important nuance. You can claim a deduction only for the amount of deductions that were paid before the day of deregistration (letter of the Ministry of Finance of Russia dated August 27, 2015 No. 03-11-11/49540).

Therefore, before closing an individual entrepreneur on the simplified tax system without employees, it is wise to pay contributions. Well, or at least that part of them that can be taken into account when calculating the tax. And everything else can be paid within 15 days after deregistration.