At the end of the year, companies submit various reports to the Federal Tax Service. The main accounting statements are the balance sheet and income statement. This is the set that a small business entity can limit itself to. Large enterprises, in addition to the forms mentioned, submit several other types of reports. Among them is a cash flow statement. Form 4 is a very familiar and common name for a report among accountants.

As is clear from the name of the form, in the report the organization shows information about the movement of cash and non-cash funds and their balances. All transactions for the receipt and expenditure of money are shown in three areas of activity.

Who will have to submit a cash flow statement (CFT)

As mentioned above, the DDS report form is included in the annual financial statements. However, a number of taxpayers have the right not to submit this form. Such advantages are available to persons who have the right to submit simplified reporting (Part 4, Article 6 of Federal Law No. 402-FZ of December 6, 2011).

If persons exempt from submitting a DDS report decide that information about cash flows needs to be disclosed and shown to the Federal Tax Service, they should fill out this report.

Fill out and send reports to the Federal Tax Service on time and without errors with Kontur.Extern. 3 months of service are free for you!

Try it

Line 4122 “in connection with the payment of employees”

This line reflects the amount of funds transferred as wages to employees of the organization engaged in current activities, or in their favor to third parties.

At the same time, payments to employees of the organization in connection with the acquisition, creation, modernization, reconstruction and preparation for use of non-current assets, including costs of research, development and technological work, are not reflected in this line, since they relate to cash flows from investment activities (clause “d”, clause 9, clause “a”, clause 10 of PBU 23/2011).

In our opinion, line 4122, in addition to amounts paid directly to employees of the organization as wages, may also reflect:

- personal income tax amounts that the organization, as a tax agent, withheld from employee income and transferred to the budget;

— amounts withheld from workers’ compensation, transferred to claimants under writs of execution;

- amounts withheld from employee wages, transferred at the request of employees to third parties (for example, payments to repay consumer loans, for charitable purposes).

This conclusion can be made by referring in addition to paragraphs. “d” clause 9 of PBU 23/2011 to the norm of clauses. “d” clause 14 IAS 7 “Cash Flow Statement” (clause 7 PBU 1/2008). According to IFRS, cash flows from operating activities include cash payments to and on behalf of employees. However, it is not specified that payments should be made in favor of employees.

Accounting data used to fill out line 4122 “in connection with compensation of employees”

When filling out line 4122, data on credit turnover is used in correspondence with the accounts for accounting for settlements of wages with employees engaged in current activities, according to the accounts:

— 50 “Cashier”;

— 51 “Current accounts”;

— 52 “Currency accounts”;

— 55 “Special bank accounts.”

The indicator for this line is indicated in parentheses.

Column “For the reporting year” of line 4122 “in connection with the remuneration of employees” = Credit turnover for the reporting year on accounts 50, 51, 52, 55 in correspondence with account 70 + Credit turnover for the reporting year on accounts 51, 55 in correspondence with account 68 + Credit turnover for the reporting year on accounts 50, 51, 55 in correspondence with settlement accounts (in terms of amounts withheld from the wages of employees engaged in current activities)

In the “For the previous year” column, in general, data from the “For the reporting year” column of the Cash Flow Statement for this previous year is transferred.

Example of filling out line 4122 “in connection with remuneration of employees”

Turnovers for 2014 on the credit of accounts 50 and 51 in correspondence with accounts 70, 76 (analytical accounts for accounting of settlements with recipients of amounts withheld from employees’ wages), 68 (sub-account “Settlements for personal income tax”) in terms of settlements for employees’ wages , engaged in current activities:

| Index | Amount, rub. |

| 1 | 2 |

| 1. Turnover on the credit of account 50 in correspondence with account 70 | 60 000 |

| 2. Turnover on the credit of account 51 in correspondence with accounts 68 (sub-account “Settlements for personal income tax”), 76 (analytical accounts for accounting settlements with recipients of amounts withheld from employees’ wages) | 14 950 000 |

Fragment of the Cash Flow Statement for 2013

| Indicator name | Code | For 2013 | For 2012 |

| in connection with the remuneration of employees | 4122 | (12 921) | (14 516) |

Solution

Indicator of the column “For 2014” on line 4122 is 15,010 thousand rubles. (RUB 60,000 + RUB 14,950,000).

Indicator of the column “For 2013” on line 4122 is 12,921 thousand rubles.

A fragment of the Cash Flow Statement will look like this.

| Indicator name | Code | For 2014 | For 2013 |

| in connection with the remuneration of employees | 4122 | (15 010) | (12 921) |

Procedure for filling out a cash flow report

PBU 23/2011 will tell you how to fill out a report and how to classify certain cash flows.

All line codes are recorded in Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66N.

To enter data into the report, the accountant will need turnover on accounts 50, 51, 52, 55, 57.

Each line of the report has its own digital code. For example, the salary paid must be shown in line No. 4122 in the first section.

Nuances of filling out the section on current operations

This section includes lines 4110–4100.

In general, line titles give the accountant a complete idea of what information to enter into them.

Sales proceeds (line 4111) must be shown without VAT.

Other income includes: return of accountable amounts or loans, penalties from counterparties, etc.

Nuances of filling out the section on investment operations

This section includes lines 4210–4200, which reflect transactions on non-current assets. Including transactions for the sale and purchase of shares and fixed assets, dividends, etc., are noted in the section.

Line 4221 records the payment of fixed assets, intangible assets, and unfinished construction projects. All payments here must be shown without VAT.

Nuances of filling out the section on financial transactions

This section includes lines 4310–4300.

Credits, borrowings, bills - these are just some of the transactions that are reflected in this section.

Detailed instructions for classifying transactions as one or another type of cash flow are contained in PBU 23/2011.

At the end of the DDS report, the results are summarized.

It is important that the following equality holds: the sum of lines 4450, 4400 and 4490 is equal to line 4500.

Analysis of the cash flow statement allows you to assess the overall financial position of the company, its capabilities and stability. First of all, Federal Tax Service inspectors will pay attention to the numbers. Sometimes such a report may be requested by banks or counterparties.

Form 4 “Cash Flow Statement” new procedure for filling out (PBU 23/2011)

In 2011, by Order of the Ministry of Finance dated 02/02/2011. No. 11n approved the accounting regulations “Cash Flow Statement” (PBU 23/2011). Its introduction was due to an attempt to bring Russian accounting standards closer to international financial reporting standards (IFRS).

PBU 23/2011 came into force starting with reporting for 2011, adding (like any innovation in the field of accounting) additional difficulties to the work of the accounting department.

The new PBU establishes the rules for drawing up cash flow statements (Form 4 of financial statements) by commercial organizations, with the exception of credit institutions.

In accordance with the new PBU, the cash flow statement reflects not only data on cash. Starting from 2011, the Report should reflect information on cash equivalents (highly liquid financial investments).

Please note: According to clause 5 of PBU 23/2011, highly liquid financial investments are investments that can be easily converted into a known amount of cash and that are subject to an insignificant risk of changes in value (hereinafter referred to as cash equivalents ).

Changes regarding indicators characterizing cash have been made not only in the form of the cash flow statement. In the balance sheet, the line previously called “Cash”, starting with the reporting for 2011, began to be called “Cash and cash equivalents ”

Balance sheet indicators do not contain information about the structure of cash inflows and outflows, which entails the problem of assessing the actual financial position of the organization. The cash flow statement is a transcript of line 1250 “Cash and cash equivalents” of the balance sheet.

Cash equivalents include, for example, the organization's demand deposits in banks.

The organization's cash flow statement reflects:

- Payments and receipts of cash, as well as cash equivalents (hereinafter referred to as the organization's cash flows).

- Balances of cash and cash equivalents at the beginning and end of the reporting period.

The organization's cash flows are not :

- payments related to investing them in cash equivalents (for example, amounts sent from current accounts to deposit accounts);

- proceeds from the repayment of cash equivalents excluding accrued interest (return of money from the deposit to the current account);

- foreign exchange transactions, excluding the difference between the Central Bank rate and the bank exchange rate;

- exchange of some cash equivalents for other cash equivalents (excluding losses or gains from the transaction);

- other similar payments and receipts that change the composition of cash or cash equivalents, but do not change their total amount, including the receipt of cash from a bank account, the transfer of funds from one account of an organization to another account of the same organization.

In the cash flow statement, as before, cash flows are reflected separately:

- from current operations.

- from investment operations.

- from financial transactions.

At the same time, payments and receipts from one transaction may relate to different types of cash flows.

For example:

- payment of interest relates to current operations;

- repayment of principal is a financial transaction.

When repaying the loan, both of these parts can be paid in one amount. In this case, the organization divides the single amount into appropriate parts and reflects them separately in the cash flow statement.

Please note: In accordance with paragraph 12 of PBU 23/2011, cash flows of an organization that cannot be clearly classified are classified as cash flows from current operations .

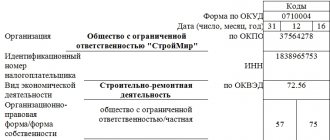

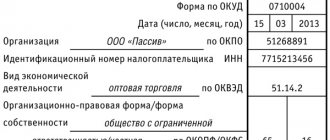

Guided by accounting regulations, in our article we will fill out a cash flow statement for Romashka LLC with comments and explanations.

Please note: Cash flow statements are not allowed to be submitted to small businesses and non-profit organizations (clause 85 of the Regulations on Accounting and Reporting in the Russian Federation, Order of the Ministry of Finance dated July 29, 1998 No. 34n).

The procedure for reflecting the organization's cash flows.

According to the rules established by PBU 23/2011, information on cash flows must be reflected in such a way that the user of the statements can get an idea of the real financial position and solvency of the company.

Please note: In accordance with clause 15 of PBU 23/2011, each significant type of cash and (or) cash equivalents received by the organization is reflected in the cash flow statement separately from the organization's payments.

In accordance with paragraph 16 of PBU 23/2011, cash flows are reflected in the report on a collapsed basis when they characterize not so much the activities of the organization as the activities of its counterparties, and (or) when receipts from some persons determine corresponding payments to other persons.

For example:

- Receipts and outflows of funds from a commission agent or agent in connection with the provision of commission or agency services (with the exception of fees for the services themselves).

- Indirect taxes (VAT, excise taxes) as part of receipts from buyers and customers, payments to suppliers and contractors and payments to the budgetary system of the Russian Federation or reimbursement from it;

- Receipts from the counterparty for reimbursement of utility bills and the implementation of these payments in rental and other similar relationships (re-invoicing of “utilities”).

- Payment for transport services upon receipt of compensation from the counterparty in the same amount (rebilling of transport costs).

Paragraph 16 of the new PBU calls on organizations to show “collapsed” VAT amounts. This means that we must subtract the amount of “incoming” VAT from the amounts of payments received, and subtract the “outgoing” VAT from the amounts paid; the VAT paid to the budget is also not shown in the report.

The amounts of “outgoing” VAT are added to the VAT paid to the budget, the “incoming” VAT is subtracted from the received amount and the balance of VAT calculations is reflected in other receipts, if it is positive, and other payments, if it is negative.

Such a filling procedure can cause a lot of difficulties for an accountant if the organization has a busy cash flow, different VAT rates, export transactions and transactions not subject to VAT. When filling out a report, he will no longer be able to rely on the analysis of accounts 50, 51, 52, because It is necessary to “pull” VAT out of all turnover.

It can take weeks to complete a cash flow statement for a large company. Therefore, we recommend not to forget about the provisions of the organization’s accounting policy, which can reflect the method of calculating indicators included in the cash flow statement, guided by PBU 21/2008 “Accounting Policy of the Organization.”

In accordance with paragraph 6 of PBU 21/2008, the accounting policy of the organization must ensure rational accounting, based on business conditions and the size of the organization (rationality requirement).

The indicators of the organization's cash flow statement are reflected in Russian rubles .

The amount of cash flows in foreign currency is recalculated into rubles at the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation on the date of payment or receipt

Please note: The difference arising in connection with the recalculation of the organization's cash flows and balances of cash and cash equivalents in foreign currencies at rates at different dates is reflected in the statement of cash flows separately from the organization's current, investing and financing cash flows as the impact of exchange rate changes foreign currency against the ruble.

Cash flow statement indicators for the previous period.

The figures in the report for the previous year are transferred from the statement of cash flows for 2010, with adjustments for the purpose of comparability of data.

In accordance with clause 10 of PBU 4/99 “Accounting statements of an organization”, if the data for the period preceding the reporting period are not comparable with the data for the reporting period, then the first of these data are subject to adjustment based on the rules established by regulatory acts on accounting. Each material adjustment must be disclosed in the notes to the balance sheet and income statement along with the reasons for the adjustment.

Those. cash flow statement data for 2010 needs to be adjusted:

- reflect cash equivalents;

- “pull out” the amounts of indirect taxes and show the balance of mutual settlements for them;

- “collapse” turnovers that are not cash flows of the organization;

Make other changes that affect the comparability of indicators.

If adjusting last year's indicators is difficult, it is necessary to calculate the indicators based on accounting data for 2010 (which means, in fact, drawing up a new cash flow statement for 2010).

Please note: When filling out the report, you must remember that deductible or negative indicators are shown in the report in parentheses (Order of the Ministry of Finance dated July 2, 2010 No. 66n “On the forms of financial statements of the organization”).

Filling out the “Cash flows from current operations” section.

The section “cash flows from current operations” contains indicators characterizing the receipts and outflows of funds associated with the main activities of the organization (receipts from customers and payments to suppliers).

Also reflected in this section:

1. Income:

- rent, license payments, royalties, commissions and other similar payments;

- from interest on receivables from buyers (customers);

- from resale of financial investments;

- others (including positive final balance for VAT).

2. Payments:

- on employee remuneration;

- income tax;

- interest on debt obligations (except for interest taken into account in the value of investment assets);

- others (including negative final balance for VAT).

3. Balance of cash flows from current operations (receipts from current operations minus payments for current operations).

Please note: In accordance with clause 12 of PBU 23/2011, cash flows of an organization that cannot be clearly classified in accordance with clauses 8-11 of the Regulations are classified as cash flows from current operations.

INCOME FROM CURRENT OPERATIONS

Receipts - total (line 4110 ) - indicates the total amount of receipts from current operations (calculated as the sum of lines 4111-4119 ).

Including:

from the sale of products, goods, works and services (line 4111 ) - indicates the amount of cash and equivalents received to current accounts and to the organization's cash desk (as well as to accounts for cash equivalents) for goods, works, services sold (including . commissions and agency fees).

These receipts are reflected in the accounting registers in the debit of the following accounts:

- 50 "Cashier";

- 51 “Current accounts”;

- 52 “Currency accounts”;

- 58 “Financial investments” (in terms of accounting for cash equivalents related to financial investments);

- 76 “Settlements with various debtors and creditors” (in terms of accounting for other cash equivalents);

and are reflected in the statement of cash flows less the following amounts:

- indirect taxes (we deduct VAT amounts, except for VAT on refunds and amounts due to principals and principals);

- received by agents, commission agents, intermediaries due for transfer to principals, principals, clients of intermediaries;

- received as compensation for expenses incurred (transport, utilities, etc.).

lease payments, license payments, royalties, commissions and other similar payments (line 4112 ) - indicates the amount of cash and equivalents received for lease payments, royalties, commissions and other similar payments.

These receipts are also reflected in the debit of accounts 50, 51, 52, 58, 76, minus the amounts:

- indirect taxes (we deduct VAT amounts, except for VAT on refunds and amounts due to principals and principals);

- received by agents, commission agents, intermediaries due for transfer to principals, principals, clients of intermediaries;

- received as compensation for utility and other expenses incurred.

Please note: If, when deducting the above amounts from the amount of receipts, a negative result is obtained, then this amount should be reflected in lines 4121 “suppliers (contractors) for raw materials, supplies, work, services” and/or 4129 “other payments”.

from resale of financial investments (line 4113 ) - indicates the amount of cash received and equivalents for financial investments acquired for the purpose of resale in the short term (usually within three months).

Please note: In accordance with paragraph 17 of PBU 23/2011, cash flows are reflected in the cash flow statement on a collapsed basis in cases where they are characterized by rapid turnover, large amounts and short repayment periods.

Thus, receipts from financial investments are shown only in the amount of economic benefits received by the organization (the total amount of receipts minus the amounts spent on the acquisition of realized financial investments).

(lines 4114 - 4118 ) - indicate the names of additional lines and the amounts of receipts corresponding to these names.

In additional lines, the accountant can reflect, taking into account the level of materiality, income from current activities that are not taken into account in the amounts of income on other lines.

Such receipts may be those receipts that cannot be unambiguously classified.

The amounts of these receipts are reflected according to the same principles as the amounts of receipts from sales on line 4111.

other income (line 4119 ) - indicates the amount of other income from the current activities of organizations. Such receipts could be:

- the amount of benefit from the sale/purchase of currency;

- positive balance of VAT payments;

- compensation amounts;

- interest due on receivables from buyers (customers);

- proceeds from the sale of other property (except for the sale of fixed assets);

The amounts of these receipts are reflected according to the same principles as the amounts of receipts from sales on line 4111.

Amounts of indirect taxes received by an organization from the budget (for example, VAT refunds) are reflected in this line “collapsed”.

PAYMENTS FOR CURRENT OPERATIONS

Payments - total (line 4120 ) - indicates the amount of payments for current transactions (calculated as the sum of lines 4121-4129 ). Indicators for line 4120 and lines 4121-4129 are indicated in parentheses.

Including:

to suppliers (contractors) for raw materials, materials, works, services (line 4121 ) - indicates the amount of payments to suppliers and contractors for received goods and materials, works and services related to the current activities of the organization.

These payments are reflected in the accounting registers on the credit of the following accounts:

- 50 "Cashier";

- 51 “Current accounts”;

- 52 “Currency accounts”;

- 58 “Financial investments” (in terms of accounting for cash equivalents related to financial investments);

- 76 “Settlements with various debtors and creditors” (in terms of accounting for other cash equivalents);

and are reflected in the statement of cash flows less the following amounts:

- indirect taxes (we deduct the amounts of VAT paid, except for VAT on refunds and VAT related to principals and principals);

- amounts paid by agents, commission agents, intermediaries, due for transfer to principals, principals, clients of intermediaries;

- reimbursable expenses (transport, utilities, etc.).

in connection with remuneration of employees (line 4122 ) - indicates the amount of payments related to remuneration of employees of the organization (including payments for employees of organizations in favor of third parties).

These payments are reflected in the accounting registers on the credit of the following accounts:

- 50 "Cashier";

- 51 “Current accounts”;

- 52 “Currency accounts”;

- 58 “Financial investments” (in terms of accounting for cash equivalents related to financial investments);

- 76 “Settlements with various debtors and creditors” (in terms of accounting for other cash equivalents);

interest on debt obligations (line 4123 ) - indicates the amount of payments related to the payment of interest on debt obligations, with the exception of interest included in the cost of the investment asset.

income tax (line 4124 ) - indicates the amount of payments related to the payment of the organization’s income tax, including advance payments of tax, with the exception of corporate income tax directly related to the organization’s investment or financial operations.

(lines 4125-4128 ) – indicate the names of additional lines and the payment amounts corresponding to these names.

In additional lines, the accountant can reflect, taking into account the level of materiality, payments for current activities that are not taken into account in the amounts of payments on other lines.

Such payments may be payments that cannot be clearly classified.

The amounts of these payments are reflected on the same principles as the amounts of payments to suppliers and contractors for received goods and materials, works and services related to the current activities of the organization in the line 4121.

other payments (line 4129 ) - indicates the amount of other payments related to the current activities of organizations. Such payments may be:

- the amount of loss from the sale/purchase of currency;

- the amount of loss received during the exchange of cash equivalents;

- negative balance of payments (debt to the budget) for VAT;

- penalties, fines and sanctions paid by the organization under agreements with counterparties.

The amounts of other payments are reflected on the same principles as the amounts of payments to suppliers and contractors for received inventory, work and services related to the current activities of the organization in the line 4121.

Amounts of indirect taxes paid by an organization to the budget (for example, VAT) are reflected in this line “collapsed”.

Balance of cash flows from current operations (line 4100 ) - indicates the amount of the difference between receipts from current operations and payments for current operations.

Line 4100 = line 4110 – line 4120 .

If the result is negative, it is indicated in parentheses.

Filling out the “Cash flows from investment operations” section.

In this section, organizations reflect cash flows associated with investment activities - the acquisition, creation or disposal of non-current assets.

In accordance with paragraph 10 of PBU 23/2011, information on cash flows from investment operations shows users of the organization’s financial statements the level of the organization’s expenses incurred to acquire or create non-current assets that provide cash receipts in the future.

Examples of cash flows from investment transactions:

- payments to suppliers (contractors) and employees of the organization in connection with the acquisition, creation, modernization, reconstruction and preparation for use of non-current assets, including costs of research, development and technological work;

- payment of interest on debt obligations included in the value of investment assets in accordance with PBU 15/2008;

- proceeds from the sale of non-current assets;

- payments in connection with the acquisition of shares (participatory interests) in other organizations, with the exception of financial investments acquired for the purpose of resale in the short term;

- proceeds from the sale of shares (participatory interests) in other organizations, with the exception of financial investments acquired for the purpose of resale in the short term;

- providing loans to others;

- repayment of loans provided to other persons;

- payments in connection with the acquisition of debt securities (rights to claim funds against other persons), with the exception of financial investments acquired for the purpose of resale in the short term;

- proceeds from the sale of debt securities (rights to claim funds against other persons), with the exception of financial investments acquired for the purpose of resale in the short term;

- dividends and similar income from equity participation in other organizations;

receipts of interest on debt financial investments, with the exception of those acquired for the purpose of resale in the short term.

INCOME FROM INVESTMENT OPERATIONS

Receipts - total (line 4210 ) - indicates the total amount of receipts from investment operations (calculated as the sum of lines 4211-4219 )

Including:

from the sale of non-current assets (except for financial investments) (line 4211 ) - indicates the amount of receipts of cash and cash equivalents associated with the sale of non-current assets.

For example, proceeds from sales:

- fixed assets;

- intangible assets;

- capital investments in non-current assets (including in the form of construction in progress);

- R&D results.

These receipts are reflected in the accounting registers in the debit of the following accounts:

- 50 "Cashier";

- 51 “Current accounts”;

- 52 “Currency accounts”;

- 58 “Financial investments” (in terms of accounting for cash equivalents related to financial investments);

- 76 “Settlements with various debtors and creditors” (in terms of accounting for other cash equivalents);

and are reflected in the statement of cash flows less the following amounts:

- indirect taxes (we deduct VAT amounts, except for VAT on refunds and amounts due to principals and principals);

- received by agents, commission agents, intermediaries due for transfer to principals, principals, clients of intermediaries;

- received as compensation for expenses incurred (transport, utilities, etc.).

from the sale of shares (participatory interests) in other organizations (line 4212 ) - indicates the amount of proceeds from the sale of shares and shares in the authorized capital of other organizations.

from the return of loans provided, from the sale of debt securities (rights to claim funds from other persons) (line 4213 ) - the amount of receipts is indicated:

- from returns of previously issued interest-bearing loans (excluding interest received);

- from the sale of bills and bonds (excluding interest received);

- from the assignment of previously acquired rights of claim to third parties.

dividends, interest on debt financial investments and similar income from equity participation in other organizations (line 4214 ) - indicates the amount of receipts of dividends, other types of payments in connection with equity participation in other organizations, as well as the amount of interest received on debt securities and provided loans to other organizations.

other income (line 4219 ) - indicates the amount of other income related to the investment activities of the organization, for example, income from participation in joint activities.

PAYMENTS FOR INVESTMENT OPERATIONS

Payments - total (line 4220 ) - indicates the amount of payments for investment transactions (calculated as the sum of lines 4221-4229 ). Indicators for line 4220 and lines 4221-4229 are indicated in parentheses.

Including:

in connection with the acquisition, creation, modernization, reconstruction and preparation for use of non-current assets (line 4221 ) - indicates the amount of payments to counterparties, as well as payments to employees of the organization related to operations for the acquisition, creation, modernization, reconstruction and preparation for use of non-current assets .

These payments are reflected in the accounting registers on the credit of the following accounts:

- 50 "Cashier";

- 51 “Current accounts”;

- 52 “Currency accounts”;

- 58 “Financial investments” (in terms of accounting for cash equivalents related to financial investments);

- 76 “Settlements with various debtors and creditors” (in terms of accounting for other cash equivalents);

and are reflected in the statement of cash flows less the following amounts:

- indirect taxes (we deduct the amounts of VAT paid, except for VAT on refunds and VAT related to principals and principals);

- amounts paid by agents, commission agents, intermediaries, due for transfer to principals, principals, clients of intermediaries;

- reimbursable expenses (transport, utilities, etc.).

in connection with the acquisition of shares (participatory interests) in other organizations (line 4222 ) - the amount of payments associated with the acquisition of shares and shares in the authorized capital of other organizations is indicated.

in connection with the acquisition of debt securities (rights to claim funds against other persons), provision of loans to other persons (line 4223 ) - the amount of payments directed to:

- to provide interest-bearing loans;

- for the purchase of bills and bonds;

- on acquired rights of claim against third parties.

interest on debt obligations included in the value of the investment asset (line 4224 ) - indicates the amount of interest paid attributable to the increase in the value of the investment asset.

other payments (line 4229 ) – indicate the amount of payments:

- on income tax from investment transactions (if it is possible to determine it correctly);

- directed towards contributions to joint activities;

- other payments related to the organization’s investment operations.

Balance of cash flows from investment operations (line 4200 ) - indicates the amount of the difference between receipts from investment operations and payments for investment operations.

Line 4200 = line 4210 – line 4220 .

If the result is negative, it is indicated in parentheses.

EXAMPLE OF COMPLETING A CASH FLOW REPORT sheet 1.

1. Filling out the “Cash flows from financial transactions” section.

The section “Cash flows from financial transactions” reflects the amounts of cash flows associated with raising financing on a debt or equity basis.

Such operations entail changes in structure and size:

- capital of the organization;

- borrowed funds of the organization.

Examples of cash flows from financial transactions:

- cash contributions from owners (participants), proceeds from the issue of shares, increases in participation interests;

- payments to owners (participants) in connection with the repurchase of shares (participatory interests) of the organization from them or their withdrawal from membership;

- payment of dividends and other payments for the distribution of profits in favor of owners (participants);

- proceeds from the issue of bonds, bills and other debt securities;

- payments in connection with the redemption (redemption) of bills and other debt securities;

- obtaining loans and borrowings from other persons;

- return of loans and borrowings received from other persons.

INCOME FROM FINANCIAL TRANSACTIONS

Receipts - total (line 4310 ) - indicates the total amount of receipts from financial transactions (calculated as the sum of lines 4311-4319 )

Including:

receipt of credits and borrowings (line 4311 ) - indicates the amount of receipts of cash and cash equivalents as credits and borrowings (including receipts from interest-free loans).

cash deposits of owners (participants) (line 4312 ) - indicates the amount of cash deposits of owners (participants) of the organization that do not lead to an increase in participation shares.

from the issue of shares, increase in participation interests (line 4313 ) - the amount of proceeds received as payment is indicated:

- shares of the organization (by its shareholders);

- shares in the authorized capital of the organization (by its founders);

- additionally placed shares;

- additional cash deposits leading to an increase in the share of participation.

from the issue of bonds, bills and other debt securities, etc. (line 4314 ) - the amount of proceeds from payment is indicated:

- bills issued by the organization;

- bond issues;

- other debt securities.

other receipts (line 4319 ) - indicates the amount of other receipts related to the financial operations of the organization.

PAYMENTS FOR FINANCIAL TRANSACTIONS

Payments - total (line 4320 ) - indicates the amount of payments for financial transactions (calculated as the sum of lines 4321-4329 ). Indicators for line 4320 and lines 4321-4329 are indicated in parentheses.

Including:

to owners (participants) in connection with the repurchase of shares (participatory interests) of the organization from them or their withdrawal from the membership (line 4321 ) - the amount of payments is indicated:

- the actual value of the share (part of the share) to the participant/his creditors/heirs/legal successors;

- for own shares purchased from shareholders (their creditors, heirs, assigns).

for the payment of dividends and other payments for the distribution of profit in favor of the owners (participants) (line 4322 ) - the amount of actual payments of dividends and other amounts associated with the distribution of profit in favor of the owners (participants) is indicated.

in connection with the repayment (redemption) of bills and other debt securities, repayment of loans and borrowings (line 4323 ) - indicates the amount of payments aimed at repaying debt obligations (credits, loans, own bills and other debt securities) with the exception of the amounts of interest paid.

other payments (line 4329 ) - indicates the amount of other payments related to the financial transactions of the organization. This line may reflect, for example, lease payments paid by the organization.

Balance of cash flows from financial transactions (line 4300 ) - indicates the amount of the difference between receipts from financial transactions and payments for financial transactions.

Line 4300 = line 4310 – line 4320 .

If the result is negative, it is indicated in parentheses.

1. Resulting data.

Balance of cash flows for the reporting period (line 4400 ) - indicates the amount obtained by adding:

- Balance of cash flows from current operations (line 4100);

- Balance of cash flows from investment operations (line 4200);

- Balance of cash flows from financial transactions (line 4300);

Line 4400 = Line 4100 + Line 4200 + Line 4300 .

If the result is negative, it is indicated in parentheses.

Balance of cash and cash equivalents at the beginning of the reporting period (line 4450 ) - indicates the amount of the balance of cash and cash equivalents at the beginning of the year.

This indicator must be linked to the indicator of balance sheet line 1250 “Cash and cash equivalents” at the beginning of the year. If these amounts are not equal, then it is necessary to decipher and explain the deviations that have arisen.

Balance of cash and cash equivalents at the end of the reporting period (line 4500 ) - indicates the amount of the balance of cash and cash equivalents at the end of the year.

This indicator should be linked to the indicator of balance sheet line 1250 “Cash and cash equivalents” at the end of the year. If these amounts are not equal, then it is necessary to decipher and explain the deviations that have arisen.

The magnitude of the impact of changes in the exchange rate of a foreign currency against the ruble (line 4490 ) - indicates the “collapsed” total amount of exchange rate differences that arose in connection with the conversion of foreign currency funds and equivalents into rubles.

The amount of the difference is determined as follows:

The magnitude of the impact of changes in the exchange rate of foreign currency against the ruble = the total amount of positive exchange rate differences for the reporting year – the total amount of negative exchange rate differences for the reporting year.

If the result is negative, it is indicated in parentheses.

Data for determining the final balance for exchange rate differences are reflected in accounting account 91 “other income and expenses.”

EXAMPLE OF COMPLETING A CASH FLOW REPORT sheet 2.

1. Accounting policy.

For accounting purposes, the organization’s accounting policies must reflect the following information:

1. Level of materiality and procedure for its calculation (for example, 15% of the cash flow item).

2. The procedure for separating cash equivalents from other financial investments.

3. Methods of classification (with subsequent reflection in the cash flow statement) of cash flows not specified in paragraphs 9 - 11 of PBU 23/2011.

4. Methodology for converting cash flows in foreign currency into rubles.

5. The procedure for the collapsed presentation of cash flows.

6. other explanations necessary to understand the information presented in the statement of cash flows.

Cash flows from investment operations

<<back to the second part of the article Preparing a cash flow statementOn line 4211 Report “from the sale of non-current assets” indicate the amounts that the company received from the sale of fixed assets, intangible assets, capital construction in progress and equipment for installation (excluding VAT).

Take this data from the debit turnover on accounts 50, 51, 52, 58 of the sub-account “Cash equivalents” (less received VAT) in the correspondence of account 62 “Settlements with buyers and customers” or 76 “Settlements with various debtors and creditors”.

In line 4212 of the Report, indicate the company's income from the sale of shares (participation interests) in other organizations, and on line 4214 - income in the form of dividends, interest on debt financial investments.

Take the data on dividends from the debit turnover on accounts 50, 51, 52, 58 subaccount “Cash equivalents” in correspondence with account 76 “Settlements with various debtors and creditors” subaccount “Settlements for dividends”.

To identify the amount of interest that your company actually received in the reporting year from financial investments (for example, bonds, bills, loans issued, etc.), you need to take the debit turnover on accounts 50, 51, 52 in correspondence with account 76 “Calculations with different debtors and creditors" subaccounts "Interest on bills", "Interest on bonds", etc.

Show repayment of interest-bearing loans issued in line 4213.

Let us recall that in accounting these transactions are reflected in the debit of accounts 50 or 51 in correspondence with account 58 “Financial investments”.

All other income from investment activities is reflected in line 4219 “other income”.

In line 4221 “in connection with the acquisition, creation, modernization, reconstruction and preparation for use of non-current assets” of the Cash Flow Statement, reflect the amounts transferred in the reporting year to pay for fixed assets (real estate, production equipment, etc.), intangible assets (rights to patents, inventions, etc.) and unfinished capital construction projects. Take the data for this line from credit turnover on accounts 50, 51, 52, 55, 58 subaccount “Cash equivalents” (less received VAT) in the correspondence of account 60 or 76 regarding purchases of fixed assets, intangible assets, etc. In addition, cash for these purposes can be spent through accountable persons.

The amount of funds allocated for long-term financial investments is recorded in line 4222 “in connection with the acquisition of shares (participatory interests) in other organizations” and 4223 “in connection with the acquisition of debt securities (rights to claim funds against other persons), provision of loans to other persons." To fill out this line, take the necessary data from the turnover in the debit of account 58. Although cash equivalents are reflected in account 58, they are not long-term assets.

Interest payments are shown as part of current transactions (line 4123), unless you include them in the cost of investment assets. In the latter case, show interest as part of investment transactions (line 4224).

Show the result of cash flows from investment activities in line 4200 “Balance of cash flows from investment operations .” That is, enter here the difference between the amounts of money and cash equivalents received and spent as part of investment activities.

go to the fourth part of the article Preparation of a cash flow statement>>

Accounting, tax accounting, company audit

Who is required to take f. 4 – cash flow statement

The Accounting Law allows for accounting in a simplified form (Clause 4, Article 6 of Federal Law No. 402-FZ dated December 6, 2011):

- SMEs;

- non-profit enterprises;

- participants of the Skolkovo project.

It is these entities that are not required to include a cash flow statement (hereinafter referred to as the cash flow statement) as part of the financial statements, but have the right to do so if they consider it necessary.

All other enterprises must generate this document annually and submit it to the Federal Tax Service as part of their accounting reports no later than three months after the end of the year: for 2021 - until 03/31/2021 inclusive.

Form 4 \"Cash Flow Statement\". Filling procedure No. 3 (128) 2013

This is the fourth form that small businesses must submit for 2012 as an attachment to their annual balance sheet.

We will look at how to fill out this form for small businesses. Many lines are not filled in by representatives of this part of the business.

This report contains not only data on the organization’s cash resources, but also information on cash equivalents – highly liquid financial investments. According to paragraph 5 of PBU 23/2011, highly liquid financial investments are investments that can be easily converted into a known amount of cash and that are subject to an insignificant risk of changes in value (hereinafter referred to as cash equivalents ).

Let us tell readers who are not accountants, so that they are not afraid of an incomprehensible abbreviation, that PBU is a document “Accounting Rules”. They are approved in order to uniformly reflect certain business transactions and are applicable to all operations carried out by a commercial organization.

Balance sheet indicators do not contain information about the structure of cash inflows and outflows, which entails the problem of assessing the actual financial position of the organization. The cash flow statement is a transcript to line 1250 \"Cash and cash equivalents\" of the balance sheet.

Cash equivalents include, for example, the organization's "on demand" deposits in banks.

The organization's cash flow statement reflects:

– payments and receipts of cash, as well as cash equivalents (hereinafter referred to as the organization’s cash flows);

– balances of cash and cash equivalents at the beginning and end of the reporting period.

The organization's cash flows are not :

– payments related to investing them in cash equivalents (for example, amounts sent from current accounts to deposit accounts);

– proceeds from the repayment of cash equivalents excluding accrued interest (return of money from the deposit to the current account);

– foreign exchange transactions, with the exception of the difference between the Central Bank rate and the bank exchange rate;

– exchange of some cash equivalents for other cash equivalents (excluding losses or benefits from the transaction);

– other similar payments and receipts that change the composition of cash or cash equivalents, but do not change their total amount, including the receipt of cash from a bank account, the transfer of funds from one account of an organization to another account of the same organization.

The cash flow statement shows separately the following cash flows:

– from current operations;

– from investment operations;

– from financial transactions.

In this case, payments and receipts from one transaction may relate to different types of cash flows.

For example:

– payment of interest relates to current operations;

– repayment of the principal amount of the debt refers to financial transactions.

When repaying the loan, both of these parts can be paid in one amount. In this case, the organization divides the single amount into appropriate parts and reflects them separately in the cash flow statement.

The procedure for reflecting the organization's cash flows

According to the rules established by PBU 23/2011, information on cash flows must be reflected in such a way that users of the statements can get an idea of the real financial position and solvency of the company.

Note! In accordance with clause 15 of PBU 23/2011, each significant type of cash and (or) cash equivalents received by the organization is reflected in the cash flow statement separately from the organization's payments.

In accordance with paragraph 16 of PBU 23/2011, cash flows are reflected in the report on a consolidated basis when they characterize not so much the activities of the organization as the activities of its counterparties, and (or) when receipts from some persons determine corresponding payments to other persons.

For example:

1. Receipts and outflows of funds from a commission agent or agent in connection with the provision of commission or agency services (with the exception of fees for the services themselves).

2. Indirect taxes (VAT, excise taxes) as part of receipts from buyers and customers, payments to suppliers and contractors and payments to the budget system of the Russian Federation or reimbursement from it;

3. Receipts from the counterparty for reimbursement of utility bills and the implementation of these payments in rental and other similar relationships (re-billing of utility bills).

4. Payment for transport services upon receipt of compensation from the counterparty in the same amount (rebilling of transport costs).

Reflection of VAT amounts in the report

Paragraph 16 of the new PBU calls on organizations to show VAT amounts “collapsed.” This means that we must subtract the amount of “incoming” VAT from the amounts of payments received, and subtract the “outgoing” VAT from the amounts paid. And we indicate the amount of VAT paid to the budget in other expenses.

Since the amounts of income and expenses themselves are “exempt” from VAT, this tax must also be taken into account in income and expenses. This is done like this: from the amount of VAT “outgoing” (the one that we received from buyers), we subtract the VAT paid to the budget and the VAT “incoming” (the one that we listed). If the result is positive, then it is reflected in other income, if negative - in other expenses.

Such a filling procedure can cause a lot of difficulties for an accountant if the organization has a busy cash flow, different VAT rates, export transactions and transactions not subject to VAT. When filling out a report, he will no longer be able to rely on the analysis of accounts 50, 51, 52, because from all turnovers it is necessary to “pull out” VAT.

The indicators of the organization's cash flow statement are reflected in Russian rubles.

The amount of cash flows in foreign currency is recalculated into rubles at the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation on the date of payment or receipt.

Note! When filling out the report, you must remember that deductible or negative indicators are shown in the report in parentheses (Order of the Ministry of Finance dated 07/02/2010 No. 66n \"On the forms of financial statements of the organization\").

Cash flow statement indicators period

In principle, since this type of report is being prepared by a small business for the second time, you will have to fill in the corresponding lines from the previous report. For large businesses that previously filled out similar reports, it’s a little easier. Accountants of such organizations will only have to slightly correct the numbers.

Filling out the section \"Cash flows from current operations\"

This section contains indicators characterizing the receipts and outflows of funds related to the main activities of the organization (receipts from customers and payments to suppliers).

This section also reflects:

1. Income:

– rent, license payments, royalties, commissions and other similar payments;

– from interest on receivables from buyers (customers);

– from the resale of financial investments;

– other (including positive final balance for VAT).

2. Payments:

– on remuneration of employees;

– income tax;

– interest on debt obligations (except for interest taken into account in the value of investment assets);

– other (including negative final balance for VAT).

3. Balance of cash flows from current operations (receipts from current operations minus payments for current operations).

Receipts from current operations

Receipts - total (line 4110, cell labeled \"A\" ) - indicates the total amount of receipts from current operations (calculated as the sum of lines 4111 - 4119 ).

Including:

from the sale of products, goods, works and services (line 4111, cell labeled \"B\" ) - indicates the amount of cash and equivalents received to the current accounts and to the organization's cash desk (as well as to the cash equivalent accounts) for goods sold, works, services (including commissions and agency fees).

These receipts are reflected in the accounting registers in the debit of the following accounts:

50 \"Cashier\";

51 \"Current accounts\";

52 \"Currency accounts\";

58 \"Financial investments\" (in terms of accounting for cash equivalents related to financial investments);

76 \"Settlements with various debtors and creditors\" (in terms of accounting for other cash equivalents);

and are reflected in the statement of cash flows less the following amounts:

– indirect taxes (we subtract the amounts of VAT, except for VAT on the amounts of refunds and due to principals and principals);

– received by agents, commission agents, intermediaries due for transfer to principals, principals, clients of intermediaries;

– received as compensation for expenses incurred (transport, utilities, etc.).

lease payments, license payments, royalties, commissions and other similar payments (line 4112) – indicates the amount of cash and equivalents received for lease payments, royalties, commissions and other similar payments.

These receipts are also reflected in the debit of accounts 50, 51, 52, 58, 76, minus the amounts:

– indirect taxes (we subtract the amounts of VAT, except for VAT on the amounts of refunds and due to principals and principals);

– received by agents, commission agents, intermediaries due for transfer to principals, principals, clients of intermediaries;

– received as compensation for utility and other expenses incurred.

Note! If, when deducting the above amounts from the amount of receipts, a negative result is obtained, then this amount should be reflected in lines 4121 \"suppliers (contractors) for raw materials, materials, work, services\" and/or 4129 \"other payments\".

from resale of financial investments (line 4113 ) - indicates the amount of cash received and equivalents for financial investments acquired for the purpose of resale in the short term (usually within three months).

other income (line 4119 ) - indicates the amount of other income from the current activities of organizations. Such receipts could be:

– the amount of benefit from the sale/purchase of currency;

– positive balance of VAT payments;

– amount of compensation;

– interest due on receivables from buyers (customers);

– proceeds from the sale of other property (except for the sale of fixed assets);

The amounts of these receipts are reflected according to the same principles as the amounts of receipts from sales in the line 4111.

Amounts of indirect taxes received by an organization from the budget (for example, VAT refunds) are reflected in this line “collapsed”.

Payments for current transactions

Payments – total (line 4120, cell labeled \”B\” ) – indicates the amount of payments for current transactions (calculated as the sum of lines 4121-4129) . Indicators for line 4120 and lines 4121-4129 are indicated in parentheses.

Including:

to suppliers (contractors) for raw materials, materials, works, services (line 4121 , cell labeled \"G\" ) - indicates the amount of payments to suppliers and contractors for received goods and materials, works and services related to the current activities of the organization.

These payments are reflected in the accounting registers on the credit of the following accounts:

50 \"Cashier\";

51 \"Current accounts\";

52 \"Currency accounts\";

58 \"Financial investments\" (in terms of accounting for cash equivalents related to financial investments);

76 \"Settlements with various debtors and creditors\" (in terms of accounting for other cash equivalents);

and are reflected in the statement of cash flows less the following amounts:

– indirect taxes (we deduct the amounts of VAT paid, except for VAT on refunds and VAT related to principals and principals);

– amounts paid by agents, commission agents, intermediaries, due for transfer to principals, principals, clients of intermediaries;

reimbursable expenses (transport, utilities, etc.)

in connection with the remuneration of employees (line 4122 , cell labeled \"D\" ) - indicates the amount of payments related to the remuneration of employees of the organization (including payments for employees of organizations in favor of third parties).

These payments are reflected in the accounting registers on the credit of the following accounts:

50 \"Cashier\";

51 \"Current accounts\";

52 \"Currency accounts\";

58 \"Financial investments\" (in terms of accounting for cash equivalents related to financial investments);

76 \"Settlements with various debtors and creditors\" (in terms of accounting for other cash equivalents);

interest on debt obligations (line 4123 ) - indicates the amount of payments related to the payment of interest on debt obligations, with the exception of interest included in the cost of the investment asset.

income tax (line 4124, cell labeled \"E\" ) - indicates the amount of payments associated with the payment of corporate income tax, including advance tax payments (lines 4125-4128 ) - indicates the names of additional lines and the amounts of payments corresponding to these names .

In additional lines, the accountant can reflect, taking into account the level of materiality, payments for current activities that are not taken into account in the amounts of payments on other lines.

Such payments may be payments that cannot be clearly classified.

The amounts of these payments are reflected on the same principles as the amounts of payments to suppliers and contractors for received goods and materials, works and services related to the current activities of the organization in the line 4121.

other payments (line 4129, cell labeled \"F\" ) - indicates the amount of other payments related to the current activities of organizations. Such payments may be:

– the amount of loss from the sale/purchase of currency;

– the amount of loss received during the exchange of cash equivalents;

– negative balance of payments (debt to the budget) for VAT;

– penalties, fines and sanctions paid by the organization under agreements with counterparties;

– bank expenses;

– expenses not included in the previous paragraphs.

The amounts of other payments are reflected on the same principles as the amounts of payments to suppliers and contractors for received inventory, work and services related to the current activities of the organization in the line 4121.

Amounts of indirect taxes paid by the organization to the budget (for example, VAT) are reflected in this line “collapsed”.

Balance of cash flows from current operations (line 4100 ) - indicates the amount of the difference between receipts from current operations and payments for current operations.

Line 4100 ( cell labeled \”W\” ) = line 4110 (cell labeled \”A\”) – line 4120 (cell labeled \”B\”) .

If the result is negative, it is indicated in parentheses. Getting a negative result is normal. After all, it shows that this year you spent more money than you received. The most important thing is that your cash balance is not negative (it is indicated on the third page of the report). In our example, this is what happens in 2012 (cell labeled “A” = 1567, cell labeled “B” = 1865). The final cell labeled “Z” turned out to be negative – minus 298.

Filling out the section \"Cash flows from investment operations\"

In this section, organizations reflect cash flows associated with investment activities - the acquisition, creation or disposal of non-current assets. This section is unlikely to be filled out by representatives of small businesses, but we will still talk about some of the nuances.

The procedure for calculating it is the same as “cash flows for current operations.”

Examples of cash flows from investment transactions:

– payments to suppliers (contractors) and employees of the organization in connection with the acquisition, creation, modernization, reconstruction and preparation for use of non-current assets, including costs of research, development and technological work;

– payment of interest on debt obligations included in the cost of investment assets in accordance with PBU 15/2008;

– proceeds from the sale of non-current assets;

– payments in connection with the acquisition of shares (participatory interests) in other organizations, with the exception of financial investments acquired for the purpose of resale in the short term;

– proceeds from the sale of shares (participatory interests) in other organizations, with the exception of financial investments acquired for the purpose of resale in the short term;

– providing loans to other persons;

– repayment of loans provided to other persons;

– payments in connection with the acquisition of debt securities (rights to claim funds against other persons), with the exception of financial investments acquired for the purpose of resale in the short term;

– proceeds from the sale of debt securities (rights to claim funds against other persons), with the exception of financial investments acquired for the purpose of resale in the short term;

– dividends and similar income from equity participation in other organizations;

– receipts of interest on debt financial investments, with the exception of those acquired for the purpose of resale in the short term.

Filling out the section \"Cash flows from financial transactions\"

This section reflects the amounts of cash flows associated with raising financing on a debt or equity basis.

Such operations entail changes in structure and size:

– capital of the organization;

– borrowed funds of the organization.

Examples of cash flows from financial transactions:

– cash contributions of owners (participants), proceeds from the issue of shares, increase in participation shares;

– payments to owners (participants) in connection with the repurchase of shares (participatory interests) of the organization from them or their withdrawal from the membership;

– payment of dividends and other payments for the distribution of profits in favor of the owners (participants);

– proceeds from the issue of bonds, bills and other debt securities;

– payments in connection with the redemption (redemption) of bills and other debt securities;

– obtaining credits and loans from other persons;

– return of loans and borrowings received from other persons.

results

Balance of cash flows for the reporting period (line 4400 , cell labeled \"L\" ) - indicates the amount obtained by addition:

Balance of cash flows from current operations (line 4100, cell labeled \"З\" );

Balance of cash flows from investment operations (line 4200, cell labeled “AND” );

Balance of cash flows from financial transactions (line 4300, cell labeled \"K\" );

Line 4400 = Line 4100 + Line 4200 + Line 4300 .

If the result is negative, it is indicated in parentheses.

In our example, in 2012 it is negative (-298), and in 2011 it is positive (434).

Balance of cash and cash equivalents at the beginning of the reporting period (line 4450 ) - indicates the amount of the balance of cash and cash equivalents at the beginning of the year. This indicator should be linked to the balance sheet line indicator 1250 “Cash and cash equivalents” at the beginning of the year. If these amounts are not equal, then it is necessary to decipher and explain the deviations that have arisen.

Balance of cash and cash equivalents at the end of the reporting period (line 4500) – indicates the amount of the balance of cash and cash equivalents at the end of the year.

This indicator should be linked to the balance sheet line indicator 1250 “Cash and cash equivalents” at the end of the year. If these amounts are not equal, then it is necessary to decipher and explain the deviations that have arisen.

The magnitude of the impact of changes in the foreign currency exchange rate against the ruble (line 4490 ) - indicates the “collapsed” total amount of exchange rate differences that arose in connection with the conversion of foreign currency funds and equivalents into rubles.

In our example, the value of the line \”L\” is equal to the value of the line \”Z\”, because We had no investment or financial transactions. Next, we indicate the cash balances at the beginning and end of the year and check the control ratios. The cash balance on the “M” line at the beginning of 2012 is equal to the cash balance at the end of 2011, that is, the value on the “N” line in the 2011 column. And the balance of funds at the beginning of 2011 is indicated in the corresponding column on the line \"M\". In our example it is 24.

The cash balance at the end of the year 2012 is indicated on the line \"Н\" in the corresponding column.

Now let's check the control ratios. Balance at the beginning of the year + cash flow balance (plus or minus) = cash balance at the end of the year.

It turns out that the value in the \"M\" line plus the value in the \"L\" line must be equal to the value in the \"H\" line of the corresponding column

And they, in turn, must coincide with the “cash” line in the balance sheet. If these control ratios are met, then we have filled out the report correctly. It can be handed over.

In order to fill out the report, we advise you to print out the analysis of accounts 50, 51 and 52 from the accounting program - after all, this is where the numbers come from. These accounts reflect cash flows. And by analyzing these accounts, you can see where the money went. Actually, this is what the form is about. Of course, it is not easy. Therefore, the article is loaded with many concepts that may not be familiar to you. But try to understand: once you understand the structure of the form and the procedure for filling it out, it will not seem very complicated to you. I believe in you!

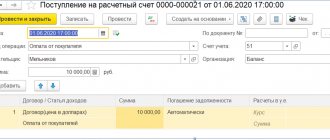

VAT in the cash flow statement: line 4119

At the beginning of 2021, the company has 60,000 rubles in its cash register, and 560,000 rubles in its current account. In the ODDS, the total balance will be reflected in line 4450 (RUB 620,000). Operations performed during the year:

| Operations | Amount in rub. | Reflected in ODDS | |

| № p. | Sum | ||

| Balance of money in the cash register and in the current account at the beginning of the period | 620 000 | 4450 | 620 000 |

| Income: | |||

| — sales revenue | 18,000,000 (including VAT 3,000,000) | 4111 | 15 000 000 |

| — advances received | 480,000 (including VAT 80,000) | 4111 | 400 000 |

| - fines from counterparties | 200 000 | 4119 | 200 000 |

| - budget allocation | 100 000 | 4319 | 100 000 |

| - from the OS implementation | 2,400,000 (including VAT 400,000) | 4211 | 2 000 000 |

| — loan repayment by partner | 200 000 | 4213 | 200 000 |

| Expenses: | |||

| - OS purchased | 3,600,000 (including VAT 600,000) | 4221 | 3 000 000 |

| — a long-term loan was issued to the counterparty | 2 000 000 | 4223 | 2 000 000 |

| — goods purchased for resale | 12,000,000 (including VAT 2,000,000) | 4121 | 10 000 000 |

| - salaries paid to staff | 1 900 000 | 4122 | 1 900 000 |

| - income tax paid | 580 000 | 4124 | 580 000 |

| - insurance premiums are listed | 570 000 | 4129 | 570 000 |

| — VAT transferred | 800 000 | ||

Let's adjust the amount of tax that must be indicated in the ODDS, for which we sum up the VAT on receipts and reduce it by the tax paid:

3 000 000 + 80 000 + 400 000 – 600 000 – 2 000 000 – 800 000 = 80 000

Based on the results of VAT calculations, the amount is 80,000 rubles. will be reflected in line 4119 of the ODDS “Other income”, increasing the indicators already available there. The value in line 4119 will be 280 thousand rubles. (200,000 + 80,000).

Features of tax reflection

VAT is an indirect tax; the cash flows generated for it are shown collapsed and separately from the flows of receipts/payments. This means that in order to register data in the ODDS, it is necessary to highlight and take into account the tax amounts:

- received from customers or buyers;

- listed to contractors and suppliers;

- paid to the budget;

- reimbursed from the budget.

In this case, only those amounts of tax that the company claims for deduction should be taken into account in the ODDS, i.e., there is no need to allocate tax for transactions performed that are not subject to VAT, and the payment in full should be included in the total amount of payments to suppliers accumulated in line 4121 of the report.

The resulting cash flow for VAT is determined in the amount of all operations performed by the company - current, investment and financial, but is recorded in the structure of the flow for current operations. That is, the final balance of received and transferred VAT will be reflected:

- or in line 4119 “Other receipts”, if the amount of tax on receipts exceeds the amount of transferred VAT;

- or in line 4129 “Other payments”, if the amount of VAT transferred and paid is higher than the tax on receipts and refunds.

Let's look at the methodology for generating VAT data in these lines using examples.