More and more organizations and entrepreneurs are working without a cash register. Non-cash payments to employees have become commonplace, but the transfer and return of accountable amounts by bank transfer is still not fully regulated by law. We'll tell you how to do it correctly and register it in the accounting department. What are reportable amounts?

When accountable funds need to be returned

Is it possible to return the accountable amount to the organization’s current account?

- Details for transfer

- Purpose of payment

What to do with the transfer fee

How to process the return of accountable amounts in accounting

How to properly return accountable money to the organization’s account?

These days, almost every employee has a salary card.

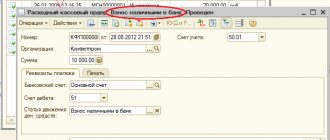

It is to this card that money can be transferred to the account. It is more convenient for an individual to return the balance of unused funds to the organization’s account from the same card through online banking. How to do this in practice?

Firstly, the possibility of issuing and returning accountable money through a current account to or from employee salary cards or bank cards of persons involved under civil law contracts must be enshrined in a local act of the enterprise - for example, draw up a Regulation on settlements with accountable persons or include it in the Accounting Policy .

Secondly, it is necessary to return accountable funds to the current account by making an entry “return of unused accountable amounts” in the “payment name” field. This entry will allow you to avoid problems with the tax authorities and not include the amounts received in the tax base for profit tax, VAT and income when applying the simplified tax system. If, when making a payment, the accountant did not indicate that the money transferred is a return of the unused amount, it is better to formalize this with an explanatory note to the payment.

Lawyers' answers (2)

“Contribution of own funds” is not revenue, not borrowed funds. Since you are an individual entrepreneur, a cash deposit from you to a bank account is really a transfer of your funds. If such funds are considered accountable, then they still remain your personal. This is one of the main differences between individual entrepreneur accounting and legal entity accounting.

Therefore, in internal accounting documents, indicate the purpose of payment and correspondence that is more convenient for you to use in your accounting policy. THOSE. you can use account 70 and count. 71 treats you equally. For greater purity, I would recommend using a count. 71 for accountable transactions, and account. 70 - as the income of an entrepreneur.

Dt 71 Kt 50, 51 - receipt of accountable amounts

Dt 50, 51 Kt 71 - return of unspent accountable amounts (contribution of own funds)

Dt 70 Kt 50, 51 - entrepreneur’s funds withdrawn for his own needs.

Client clarification

That is, depositing personal funds into a bank account to pay off expenses, not revenue, should still be reported as income according to the declaration?

03 April 2021, 11:59

Yulia, the simplified tax system applies the concept of tax accounting. Returns of unspent accountable funds are not taxable income. Such income does not increase the amount of income taxed under the simplified tax system. Such amounts are not reflected in the income declaration.

Likewise for the amounts issued. A tax expense is recognized as an amount given to an accountable person and for which an advance report is approved by the manager. Both conditions must be met simultaneously.

>Looking for an answer? It's easier to ask a lawyer!

to our lawyers - it’s much faster than looking for a solution.

What to do with the transfer fee?

If a transfer fee was charged for a refund transaction, whether to reimburse it or not and accept it as expenses or not will depend on the wording in the organization’s local act on the procedure for reimbursement of travel expenses and in the local act on non-cash payments.

If the local regulations of the enterprise do not provide for a way to return an unspent advance through an online bank, as well as reimbursement of the bank’s commission for such a transaction, then the employer is not obliged to return to the employee the amount paid to the bank for the transaction.

Thus, a collective agreement or a local act of an organization may establish the types and amounts of reimbursable travel expenses, the procedure for their reimbursement, the procedure and method (cash and/or non-cash, including through online banking) of returning an unused advance, a list of documents accepted in confirmation of expenses (including in the form of a bank commission charged when returning an unspent advance through online banking).

An example of including in a local act a provision on the method of returning unused amounts to the organization’s current account:

The employer's local act may contain a provision on reimbursement to the employee for any expenses incurred with the permission or knowledge of the employer. In this case, the decision to reimburse the bank’s commission for returning money through online banking can also be made.

If reimbursement of the commission is provided for by local regulations, then the employer can take it into account in income tax expenses, like other expenses associated with production and (or) sales (clause 49, paragraph 1, article 264 of the Tax Code of the Russian Federation, Letters No. 03-03 -06/1/18005, No. 16-15/105572).

How to file an overexpenditure on an advance report

LEARN MORE ABOUT THE APPLICATION Money paid by a reporting employee in foreign currency can be reflected both in foreign currency and in rubles according to the current exchange rate at the time of payment for goods or services. Previously, reimbursement of expenses according to the expense report began with the preparation of an order from management on the employee’s performance of an official task, which could be issued in the form of an order listing accountable persons and a list of goods or services for which money belonging to the organization was issued. Today it is not necessary to draw up an order - it is enough to simply add the corresponding clause to the accounting policy document.

1 tbsp.

129 of the Labor Code of the Russian Federation, wages (employee remuneration) - remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions that deviate from from normal, work in special climatic conditions and in areas exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

- from the date the employee returns to work. As a rule, this period is “used” when the employee returns from a business trip. But it would not be a mistake to apply the specified period to an employee’s return from sick leave or vacation, for example. Also, very often this formulation is used in the case when the three-day period for the report falls on weekends and (or) non-working holidays.

Expenses associated with a business trip are reimbursed to the employee in the manner established by the collective agreement or local regulations of the organization (if the organization is a commercial one). Legal basis: According to Part 1 of Art. 129 of the Labor Code of the Russian Federation, wages (employee remuneration) - remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions that deviate from from normal, work in special climatic conditions and in areas exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

In accordance with Art.

- For travel expenses. If cash is issued against the report - until the end of the fifth banking day, which follows the day on which the employee completed his business trip. If payments were made after they were withdrawn from the card - before the end of the third banking day, which follows the day the employee completed his business trip.

- To execute a production and economic order before the end of the fifth banking day, which follows the day on which the employee completed the execution of the order.

Documents for the expense report submitted by an employee of the organization must include slips of all checks. Example Let's look at how settlements with accountable persons are displayed in NU and BU. From the cash desk of the enterprise on April 25, 2016, a sum of funds was provided to the office manager of the conditional LLC in the amount of 2,000 rubles for a period of 4 days for the purchase of office supplies.

On the same day, the accountant issued the accountable amounts based on an application signed by the manager: DT71 KT50 - 2000 rubles.

Features of returning money to the cash desk by an accountable person

Organizations (IP) can issue funds on account in two ways:

- transfer to an employee’s account or corporate card (letter of the Ministry of Finance of the Russian Federation dated October 5, 2012 No. 14-03-03/728);

- issuing cash (directive of the Bank of Russia “On the procedure for conducting cash transactions...” dated March 11, 2014 No. 3210-U).

If an employee has not used all the accountable money issued to him, he must return it within the time period established for this by the employer (clause 6.3 of instruction No. 3210-U).

The amount of the refunded amount is determined based on the results of verification and approval of the advance report on the amounts spent. Such a report must be drawn up no later than 3 business days from the expiration date for which the money was issued (clause 6.3 of instruction No. 3210-U). The issuance period is fixed in the application drawn up by the employee for the issuance of an advance, or in the employer’s administrative document on the issuance of money on account. From 08/19/2017 (instruction of the Bank of Russia dated 06/19/2017 No. 4416-U), the completion of an application by an employee is no longer a mandatory condition for the payment of accountable amounts. It can be carried out on the basis of an administrative document of the head of the legal entity (or individual entrepreneur).

IMPORTANT! Directive No. 3210-U applies its rules only to the rules for issuing and returning funds in cash. For non-cash payments for accountable amounts, its provisions do not apply, and an employer using this method must approve the procedure for settlements with accountables by an internal document.

general information

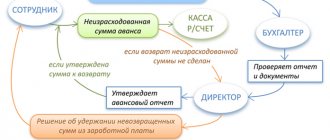

Companies provide employees with accountable money for expenses on business trips and do this through the cash register or using the employee’s salary card. Does the employee have the right to choose how to return the money:

- To the cashier;

- To a current account or;

- By deduction from his income.

The employee should be notified in advance and officially about the existence of receivables and in particular about the full amount. The reporting employee has the right:

- Agree with the verdict presented to him;

- Try to challenge it.

The return of the remaining, unused money must be made within the next three days from the end of the period for returning the advance payment issued on account (this point is discussed in UBR No. 3210-U, clause 6.3).

But this rule can only be applied in case of cash return. If it is necessary to return non-cash funds, the management of the organization must establish a separate return schedule with the reporting employee. Each of the processes must be recorded in the relevant regulatory documents of the organization.

Funds received from the reporting employee must be reflected in accounting with the following entries:

Important: in order to make a non-cash payment, management must independently establish the procedure for settlement with the reporting employee.

The procedure for issuing funds for reporting

Giving an employee money for travel, business and other expenses related to the company’s activities is a common practice. The procedure for issuing funds for reporting is regulated by the Directive of the Central Bank of the Russian Federation dated March 11, 2014. No. 3210-U.

To minimize cash turnover, payments with employees are also transferred to non-cash form. The possibility of using bank cards of employees, including salary cards, for settlements of accountable amounts was confirmed by the Ministry of Finance back in 2013 in Letter No. 02-03-10/37209.

Quite often the question arises: if it is possible to transfer money against an account to an employee’s bank card, is it possible to return the accountable amounts to the company’s current account?

The employee must return the amounts received for travel or business expenses that were not spent by him within the following periods:

- on the day of expiration of the period for which the funds were issued;

- on the first day of returning to work after the end of a business trip, vacation, illness, etc., if the end of the period for which the money was issued on account falls within these periods.

Russian legislation does not contain any explanations on how an employee can return money received on account: by returning the accountable amounts to the cash desk or by wire transfer. Order of the Ministry of Finance No. 94n allows the correspondence of account 71 “Settlements with accountable persons” for the return of funds with accounts 50 “Cash” and 51 “Settlement accounts”. Thus, a return to the current account is possible, and if the organization has minimal or no cash handling, it is the only possible option.

General information

The employee must be officially notified of the formation of receivables and their amount. The defendant can either agree with the verdict presented or try to refute it.

The balance of unused accountable amounts is returned no later than 3 days from the end of the period established for the return of the advance on account (according to UBR No. 3210-U, clause 6.3). This rule only applies to cash refunds. For non-cash payments, the head of the institution is obliged to establish a settlement procedure with accountable persons independently. In addition, both processes are recorded in the regulatory documents of the enterprise.

The money received from the responsible employee is reflected in the accounting records in the following entries:

- Debit account 50, credit account 71 - return of funds to the institution's cash desk.

- Debit 52, credit 71 – return in excess of issued finances to the organization’s foreign currency account.

- Debit 94, credit 71 – a record of the debt of the accountable person in the event of non-repayment of unspent funds.

- Debit account 51, credit account 71 – return of the excess amount issued to the company’s bank account.

Establishing deadlines for which cash can be issued on account

Figure 1. ORDER FOR APPROVAL OF DEADLINES FOR ISSUING CASH ON ACCORDANCE

| Limited Liability Company "Yarilo" ORDER No. 4 On approval of the terms for which they can be issued cash on account Yaroslavl 01/11/2011 For the purpose of carrying out business expenses by employees of the enterprise I ORDER: Approve for 2011 the following terms for which cash can be issued on account: Purpose of issuing money | Deadlines in calendar days |

| Purchase of household equipment | 21 days from the date of issue |

| Purchasing office supplies | 7 days from the date of issue |

| Payment for minor repairs of office equipment | 28 days from the date of issue |

| Payment of postal and telegraph expenses | 7 days from the date of issue |

General Director A.A. Veselov Veselov

In addition to the order on employees who have the right to receive money on account, it makes sense for the head of the enterprise to issue an order approving the deadlines for which cash can be issued on account. After all, it is possible that one of the accountable persons will delay reporting on the amounts spent and making the final payment for them. And if the employee has not reported on the previously received advance, then, according to the above-mentioned paragraph 11 of the Procedure, he cannot receive the next amount of cash on account. This order helps organize work with cash and discipline the workforce.

Please note that the time period for which an employee can be given cash on account is determined by the head of the enterprise at his own discretion. There are no restrictions in the legislation.

Establishing the period for which employees are given accountable money is the right, and not the responsibility, of the head of the enterprise. However, if the specified period of time is not determined, then the employee must report on the day the accountable amounts are received. This follows from the letter of the Federal Tax Service of Russia dated January 24, 2005 No. 04-1-02/704.

Example 1

The head of JSC "Perun" did not establish the period for which the company's employees are given cash for business expenses.

On May 12, 2011, office manager of Perun CJSC V.P. Lastochkina received money to buy stationery. On the same day, she is obliged to complete the task, submit an advance report and return the unspent balance of accountable money to the cashier.

For organizations that do not review during the year the deadlines for which cash can be issued on account for business expenses, it is advisable to specify these deadlines in their accounting policies.

Cash register receipt

Situation: is it necessary to issue a cash receipt for the amount of unspent accountable money that the employee returns to the organization?

Answer: no, it is not necessary.

Cash register systems must be used when receiving cash for goods sold, work performed or services provided (Clause 1, Article 2 of Law No. 54-FZ of May 22, 2003). The return by an employee of the balance of the amount given to him on account does not apply to such operations. Therefore, there is no need to issue a cash receipt for the accountable amount that the employee returned to the organization. This conclusion is confirmed by the Russian Ministry of Finance in letter dated November 30, 2004 No. 03-01-20/2-47.

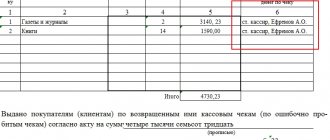

An example of reflecting in accounting the return of unspent accountable amounts

On April 11, Secretary of Alpha LLC E.V. Ivanova received 2000 rubles. for the purchase of office supplies (paper, staplers, pens, etc.) for the organization. The cost of the goods she purchased was 1,500 rubles. (the purchase was not subject to VAT, since the seller applies a simplification). The deadline set by the manager for the return of accountable amounts is April 14.

On April 14, the head of Alpha approved Ivanova’s advance report. On the same day, she returned the unspent balance of accountable money in the amount of 500 rubles to the organization’s cash desk. (2000 rub. – 1500 rub.).

In accounting, Alpha's accountant made the following entries.

11 April:

Debit 71 Credit 50 – 2000 rub. – money was issued against Ivanova’s report.

14th of April:

Debit 10 Credit 71 – 1500 rub. – stationery purchased by the employee has been received;

Debit 50 Credit 71 – 500 rub. – the balance of unspent accountable amounts is entered into the cash register.

Retention of unspent imprest amounts

So, let’s say that an employee, from the funds received as an account, paid for the business expenses of the enterprise, while he still had a certain amount of money left unspent. Or, during the period for which he was given cash on account, he did not carry out or pay business expenses at all.

In the first case, the employee must submit a report to the organization’s accounting department on the amounts spent and make a final payment for them: return the remaining money to the company’s cash desk. In the second case, the employee must return to the company’s cash desk all the money he received on account. In this case, they do not prepare a report on the amounts spent.

Please note that the document confirming the employee’s return of unspent amounts and the acceptance of these amounts by the company’s accountant is a cash receipt order. Its unified form No. KO-1 was approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

An advance report is provided for settlements with accountable persons. Its unified form No. AO-1 was approved by Decree of the State Statistics Committee of Russia dated August 1, 2001 No. 55. To this document, the reporting employee must attach documents confirming the expenses incurred: travel certificate, business trip report, cash receipts, receipts and other documents for payment of business expenses. expenses.

Let us repeat that three working days are allotted for submitting a report on the amounts spent and making a final settlement on them. They should be counted either after the expiration of the period established by the head of the enterprise for which cash can be issued on account, or from the day the employee returns from a business trip.

The accountable person must return the unspent accountable amounts to the enterprise's cash desk simultaneously with the submission of an advance report to the accounting department.

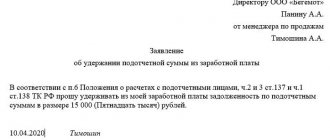

If the employee does not return the unspent accountable amounts, they are withheld from his salary. Paragraph 2 of Part 2 of Article 137 of the Labor Code allows this to be done.

Holding order

According to Part 3 of Article 137 of the Labor Code, in order to repay an unspent and not timely returned advance previously issued to an employee for reporting, the employer has the right to decide to deduct from the salary of the specified employee no later than one month from the date of expiration of the period established for the return of the advance. Condition - the employee must not dispute the grounds and amounts of the withholding.

The employer makes and formalizes the decision, usually in the form of an order or instruction. Normative legal acts have not established a unified form for such an order. To deduct amounts from wages, his written consent must be obtained. Such conclusions are given in the letter of Rostrud dated August 9, 2007 No. 3044-6-0.

Please note that deductions from wages can be made in a limited amount. Unspent accountable amounts should be withheld for each payment of wages to an employee who has not returned them on time, in the amount of no more than 20 percent of the unpaid amount. The basis is Article 138 of the Labor Code.

Example 2

Manager of Yarilo LLC N.K. Razin received 4,000 rubles as a report on May 16, 2011. to pay for printer repairs in a specialized organization. Repairing the printer cost only 2,500 rubles.

At Yarilo LLC, cash on account for payment for minor repairs of office equipment based on the order of the manager is issued for a period of 28 calendar days from the date of issue. According to clause 11 of the Procedure, the amounts spent must be reported within three working days. Thus, submit the advance report to the accounting department and unspent accountable amounts to the cash desk of Yarilo LLC. Razin must until June 15, 2011 inclusive.

On June 15, 2011, Razin brought a repaired printer from a specialized organization to Yarilo LLC. On the same day, he submitted an advance report to the organization’s accounting department, to which he attached a cash receipt and an acceptance certificate for the work performed. In this case, the balance of the unspent accountable amount is 1,500 rubles. (4000 – 2500) — Razin did not return.

On June 27, 2011, Razin gave written consent to withhold 1,500 rubles. from his salary. On the same day, the head of Yarilo LLC issued an order to make the appropriate deductions.

Salary N.K. Razin for June 2011 amounted to 24,000 rubles. This means that the accountant of Yarilo LLC has the right to withhold 4,176 rubles from his salary for the specified month. . Since the unreturned balance of the unspent accountable amount (1,500 rubles) is less than this amount, the accountant withheld it in full from Razin’s salary for June 2011.

Figure 2. WRITTEN CONSENT OF THE EMPLOYEE TO RETENTION

to CEO

LLC "Yarilo"

A.A. Veselov

From the manager

N.K. Razin

Due to my failure to return unspent accountable amounts in the amount of 1,500 rubles within the prescribed period. I don’t mind their deduction from my salary.

June 27, 2011 Razin N.K. Razin

Limited Liability Company "Yarilo"

ORDER No. 61

About deduction from wages

unspent accountable amounts

Yaroslavl 06/27/2011

1. To repay the unspent and not returned timely advance payment issued for printer repairs, deduct from the salary of manager N.K. Razin a sum of money in the amount of 1500 rubles.

2. Accountant Z.P. Stepanova to deduct from the salary of the specified employee starting in June 2011.

General Director A.A. Veselov Veselov

Contractor accountant Stepanova Z.P. Stepanova

The order has been reviewed by: Razin N.K. Razin

Figure 3. HOLD ORDER

The following entries were made in the accounting records of Yarilo LLC:

DEBIT 94 CREDIT 71

— 1500 rub. — the accountable amount not returned on time is reflected;

DEBIT 20 CREDIT 70

— 24,000 rub. – salary accrued for June 2011 N.K. Razin;

DEBIT 70 CREDIT 68 SUB-ACCOUNT “PIT SETTLEMENTS”

— 3120 rub. (RUB 24,000 × 13%) – personal income tax withheld from N.K.’s salary. Razin;

DEBIT 70 CREDIT 94

— 1500 rub. — the accountable amount not returned on time is withheld;

DEBIT 70 CREDIT 50

— 19,380 rub. (24,000 – 3120 – 1500) – N.K.’s salary was paid. Razin.

Let’s say that the head of an organization missed the deadline allotted for making a decision on withholding from an employee’s salary an advance that was not spent and not returned in a timely manner. Or the employee disputes the grounds and amounts of the withholding. In this case, the organization will have to go to court.

If the employee repays the debt on the previously received accountable amount on his own, then the unspent and not returned on time accountable amount in accounting should also be written off to the shortage account by posting to the debit of account 94 and the credit of account 71. Then, when the amount of debt is returned, for example, to the cash desk of the enterprise it is necessary to make an accounting entry on the credit of account 94 in correspondence with the debit of account 73 subaccount “Settlements with personnel for shortages”.

The amount is credited to the resigned employee

If an employee who did not return the accountable amounts was fired, then after the expiration of the statute of limitations, the organization may recognize his debt as uncollectible and write off as expenses in the amount in which it was reflected in the organization’s accounting records (clause 14.3 of PBU 10/99 ).

Debt with an expired statute of limitations must be written off:

- or through the reserve for doubtful debts (if the organization created such a reserve). In this case, a posting is made to the debit of account 63 and the credit of account 71;

- or on the financial results of the organization’s activities with an accounting entry on the debit of account 91 and the credit of accounts 71.

Then such debt is subject to reflection on the balance sheet in account 007 “Debt of insolvent debtors written off at a loss” within five years from the date of write-off (clause 77 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

Please note that the limitation period for accountable amounts that the employee has not returned begins to count at the end of the period for which the money was issued. This follows from paragraph 2 of Article 200 of the Civil Code. The limitation period is three years (Article 196 of the Civil Code of the Russian Federation). If there are grounds for interrupting the limitation period, the said period begins to count anew (Article 203 of the Civil Code of the Russian Federation).

Example 3

Yarilo LLC issued 3,000 rubles for reporting on May 18, 2011 to office manager Shorkina. for the purchase of household equipment. Let us recall that, according to the order of the head, in the specified organization, cash on account for the named purposes is issued for a period equal to 21 calendar days, starting from the day of issue.

May 25 M.A. Shorkina quit, did not report on the accountable amounts, and did not return the funds to the company’s cash desk.

Yarilo LLC began to count the limitation period for accountable amounts that the employee did not return at the end of the period for which the money was issued - from June 8, 2011.

On June 8, 2014, Yarilo LLC will finish counting the limitation period if there are no reasons for its interruption.

Tax accounting

Issuing money on account does not lead to expenses for the organization, both general and special taxation systems (USNO and UTII). This follows from paragraph 14 of Article 270, paragraph 3 of Article 273, paragraph 2 of Article 346.17, paragraph 1 of Article 346.29 of the Tax Code.

Returned unspent accountable amounts do not increase taxable income, both when calculating income tax and the single tax under the simplified tax system or UTII. After all, accountable amounts do not become the employee’s property, but are his receivables until he reports on them and returns the unused amounts. The basis is Articles 41 and 346.29 of the Tax Code.

Uncollectible accounts receivable in tax accounting are subject to write-off as non-operating expenses. If a reserve for doubtful debts is created for non-operating expenses, the amounts of bad debts not covered by the created reserve should be written off (subclause 2, clause 2, article 265 of the Tax Code of the Russian Federation). An organization using the general taxation system can do this.

Please note that the expiration of the statute of limitations is one of the criteria for recognizing a debt as bad and, therefore, taking it into account as expenses for corporate income tax purposes. To include amounts of receivables for which the statute of limitations has expired, documents confirming the expiration of the statute of limitations are required as expenses. This is stated in the letter of the Ministry of Finance of Russia dated September 15, 2010 No. 03-03-06/1/589.

An organization that applies the simplified tax system, regardless of the chosen object of taxation, does not have the right to reduce the base for a single tax by the amount of written off bad receivables (letter of the Ministry of Finance of Russia dated November 13, 2007 No. 03-11-04/2/274).

The amount of written off bad receivables does not matter for organizations paying UTII. This follows from paragraph 1 of Article 346.29 of the Tax Code.

Responsibility

According to the Labor Code of the Russian Federation, Art. 243, paragraph 2, for accountable money, in particular the unspent balance, the authorized employee bears financial responsibility. In the event of non-return of funds issued in excess, the accountant recognizes the shortage, and the employee loses the status of a responsible person.

Once a shortage is identified, the company must conduct an inspection to determine the reasons for its occurrence. The employee is required to provide an explanation in writing about the reason for non-refund of the excess amount. If, for one reason or another, an employee refuses to report a shortage, an authorized specialist draws up a report that meets the requirements in accordance with Art. 247 Labor Code of the Russian Federation.

The manager needs to know that the return of unspent accountable amounts must be accompanied by appropriate accounting entries in order to avoid problems with the tax authority. In addition, do not forget that an employee’s statement is the basis for deducting debt from his salary. In the absence of such a document, the manager does not have the right to withhold the debt from the employee’s salary. Otherwise, the responsible person may be punished for this. Knowing these features of the return, you can avoid many difficulties in this matter.

Withholding personal income tax

When an employee is dismissed and has a debt in the form of a previously issued advance, the organization is recognized, on the basis of Article 226 of the Tax Code, as a tax agent for personal income tax and is obliged to calculate, withhold from the taxpayer and pay the amount of tax to the budget.

The organization must take all measures provided for by law to return the funds issued to the employee on account. If this turned out to be impossible due to, for example, the expiration of the statute of limitations or if the organization decided to forgive the employee’s debt, then the date the former employee of the organization received income in the form of unreturned amounts issued on account will be the date from which such collection became impossible, or the date of the relevant decision.

In accordance with paragraph 5 of Article 226 of the Tax Code, if it is impossible to withhold the calculated amount of personal income tax from the taxpayer, the tax agent is obliged, no later than one month from the date of the end of the tax period in which the relevant circumstances arose, to notify in writing the taxpayer and the tax authority at the place of his registration about the impossibility of withholding the tax and the amount of tax.

Similar explanations are given in the letter of the Ministry of Finance of Russia dated September 24, 2009 No. 03-03-06/1/610.

Practical encyclopedia of an accountant

All changes for 2021 have already been made to the berator by experts. In answer to any question, you have everything you need: an exact algorithm of actions, current examples from real accounting practice, postings and samples of filling out documents.

When an employee is sent on a business trip, he must be given money for rent, travel and funds for daily expenses, the amount of which is established on the basis of regulatory documents. How to determine the amount of the advance and how to issue and return the remaining amount of money, as well as how to deal with recalculation?

Determining the amount of advance for a business trip

The amount of the advance is determined independently by the organization, taking into account the duration of the business trip, the norms of expenses for renting housing, daily expenses, as well as the cost of travel to the destination and back. The amount of daily allowance and standards must be specified in a collective agreement or in the local regulations of the organization.

Currently, the daily allowance is set at 700 rubles for trips within Russia and 2,500 rubles for trips abroad. Please note that the organization has the right to set the amount either less or more than the established amounts. The question is about additional taxes on daily allowances, so if these amounts are exceeded, income tax will be charged to the employee.

What happens if the daily allowance is less than 700 rubles? Daily allowances can be set in a smaller amount; the organization has such a right. The established norms do not oblige them to be adhered to; the established value affects taxation. However, you should take a reasonable approach to determining the amount of daily allowance, because an employee leaves on a train to perform the organization’s tasks, and not of his own free will, and setting small amounts means that he will have to spend his personal money on food, travel, etc.

Read more about how to send an employee on a business trip under the new rules here.

Issuing an advance for a business trip

The procedure for issuing funds from the cash desk of an enterprise is determined by the Regulations on the procedure for conducting cash transactions, which was approved by the Bank of Russia No. 373-P dated October 12, 2011 (hereinafter referred to as the Regulations).

The advance is issued from the following funds:

- Receipts to the organization's cash desk for the sale of goods (Services, works).

- Received from the current account.

An advance is not issued from money received from citizens for payment in favor of third parties (for example, under an agency agreement in payment for communication services).

Important! A person who has no debt on previously received advances can receive money for a business trip on account.

Travel allowances are issued on the following grounds:

- If there is an order drawn up in form T-9 (collective form T-9a).

- Statements from the employee regarding the amount of the advance and the period of issue with the director’s visa.

Money is issued according to a cash receipt order, which is issued in one copy. In the “consumables”, the employee must write down the amount of money received by hand (rubles are written in words, and kopecks in numbers, for example, five thousand rubles 38 kopecks), and then sign the receipt. The money must be counted in the presence of the cashier, otherwise claims for missing amounts will not be accepted.