The balance sheet is a reporting form that systematizes and presents all information about the financial condition of the company as of a certain date. The balance is divided into two parts of equal value. On its left side - “Asset” - grouped data on the availability of property in the enterprise (real estate, financial investments, production assets and inventories, accounts receivable, cash, etc.) at the end of the reporting period, and on the right side - “Liabilities” are combined information about the sources of financing with which existing assets were acquired: capital (own and borrowed), as well as obligations to creditors. Both parts of the balance sheet must be equal, since the value of the property cannot exceed the available capabilities of the company, i.e., the size of its sources. Today, the balance sheet form approved by order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n is in force (as amended on April 19, 2019).

Let's get acquainted with the balance sheet items for 2021: their codes and explanations

Everyone who has ever held a balance sheet in their hands, much less drawn it up, paid attention to the “Code” column.

Thanks to this column, statistical authorities are able to systematize the information contained in the balance sheets of all companies. Therefore, it is necessary to indicate codes in the balance sheet only when this report is submitted to state statistics bodies and other executive authorities (Article 18 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, clause 5 of the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n). Let us remind you that only organizations whose reports contain information classified as state secrets, as well as in cases established by the Government of the Russian Federation, need to submit their balance sheet for 2021 to the statistics. Other companies do not need to submit a balance sheet.

If the balance is not annual and is needed only by owners or other users, it is not necessary to indicate the codes.

ATTENTION! From 2021, financial statements will be submitted exclusively in electronic form. Paper forms will no longer be accepted. Read more about changes to the rules for presenting financial statements here.

From 06/01/2019, the balance sheet form is valid as amended by Order of the Ministry of Finance dated 04/19/2019 No. 61n.

The key changes in it (as well as in other financial statements) are as follows:

- now reporting can only be prepared in thousand rubles, millions can no longer be used as a unit of measurement;

- OKVED in the header has been replaced by OKVED 2;

- The balance sheet must contain information about the audit organization (auditor).

The auditor mark should only be given to those companies that are subject to mandatory audit. Tax authorities will use it both to impose a fine on the organization itself if it ignored the obligation to undergo an audit, and in order to know from which auditor they can request information on the organization in accordance with Art. 93 Tax Code of the Russian Federation.

What negative consequences are possible if the auditor’s report is not yet ready at the time of reporting, find out from a typical situation from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

In the balance sheet, line codes from 2014 must correspond to the codes specified in Appendix 4 to Order No. 66n. At the same time, outdated codes from the expired order No. 67n with the same name, dated July 22, 2003, are no longer applied.

It is not difficult to distinguish previously used codes from modern ones - by the number of digits: modern codes are 4-digit (for example, lines 1230, 1170 of the balance sheet), while outdated ones contained only 3 digits (for example, 700, 140).

For information on what the form of the current balance sheet with line codes looks like, read the article “Filling out Form 1 of the balance sheet (sample)” .

Comparison with old format codes

Previously, the line code consisted of three digits. At the moment, only those codes that are specified in a special appendix to Order 66 of the Ministry of Finance are being considered. This is app #4 which sets up four digit codes for use.

The encoding of the old form differs from the new one only in that the list of these lines changes, their encoding turns into a four-digit indicator, and the detail of the information provided in the balance sheet changes slightly. The row assignments remain the same.

How to decipher balance sheet asset lines

Before deciphering an asset item, let’s consider its code - it carries certain information. So, the first digit shows that this line refers to the balance sheet (and not to another accounting report); 2nd - indicates the section of the asset (for example, 1 - non-current assets, etc.); The 3rd digit reflects assets in increasing order of their liquidity. The last digit of the code (initially it is 0) is intended to help in line-by-line detailing of indicators considered significant - this allows you to fulfill the requirement of PBU 4/99 (clause 11).

NOTE! The requirement for detail may not be fulfilled by small businesses (clause 6 of Order No. 66n).

Read about what distinguishes accounting carried out by small businesses in the material “Features of accounting in small enterprises” .

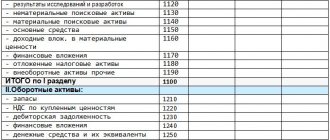

The asset lines of the balance sheet with codes and explanations are shown in the table:

| Line name | Code | Decoding the string | |

| By order No. 66n | By order No. 67n | ||

| Fixed assets | 1100 | 190 | The total amount of non-current assets is reflected |

| Intangible assets | 1110 | 110 | The information reflected in lines 1110–1170 is explained in the notes to the statements (information on the availability of assets at the reporting dates and changes for the period is disclosed) |

| Fixed assets | 1150 | 120 | |

| Profitable investments in material assets | 1160 | 135 | |

| Financial investments | 1170 | 140 | |

| Deferred tax assets | 1180 | 145 | The debit balance of account 09 is indicated |

| Other noncurrent assets | 1190 | 150 | Filled in if there is information about non-current assets that are not reflected in the previous lines |

| Current assets | 1200 | 290 | The final result of current assets is determined |

| Reserves | 1210 | 210 | The total balance of inventories is given (debit balance of accounts 10, 11, 15, 16, 20, 21, 23, 28, 29, 41, 43, 44, 45, 97 without taking into account the credit balance of accounts 14, 42) |

| Value added tax on purchased assets | 1220 | 220 | Indicate account balance 19 |

| Accounts receivable | 1230 | 240 | The result of adding the debit balances of accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 minus account 63 is reflected |

| Financial investments (excluding cash equivalents) | 1240 | 250 | The debit balance of accounts 55, 58, 73 (minus account 59) is given - information on financial investments with a circulation period of no more than a year |

| Cash and cash equivalents | 1250 | 260 | The line contains the balance of accounts 50, 51, 52, 55, 57, 58 and 76 (in terms of cash equivalents) |

| Other current assets | 1260 | 270 | Filled in if data is available (for the amount of current assets not indicated in other lines of the section) |

| Total assets | 1600 | 300 | Total of all assets |

You can see line-by-line comments on filling out asset lines in the ConsultantPlus system. Get trial access to the K+ system and proceed to the explanations for free.

Cash concept

Definition 1

Cash is a universal subject of exchange for various tangible and intangible values.

Cash can be in the form of:

- Cash in the form of paper money (treasury notes) and coins.

- Non-cash funds circulating in bank accounts.

- Electronic money circulating in various payment systems.

The role of money in the economic space is quite high, since with its help the exchange of goods is constantly carried out in society. For legal entities and individuals, cash is both an object of accumulation and a means of payment.

Interpretation of individual balance sheet liability indicators

Liability codes are also 4-digit: the 1st digit is the line’s belonging to the balance sheet, the 2nd is the number of the liability section (for example, 3 is capital and reserves). The next digit of the code reflects obligations in order of increasing urgency of their repayment. The last digit of the code is for detail purposes. Total liabilities in the balance sheet are line 1700 of the balance sheet. In other words, total liabilities in the balance sheet are the sum of lines 1300, 1400, 1500.

Liability items of the balance sheet with codes and explanations are shown in the table:

| Line name | Code | Decoding the string | |

| By order No. 66n | By order No. 67n | ||

| TOTAL capital | 1300 | 490 | The line contains information about the company's capital as of the reporting date |

| Authorized capital (share capital, authorized capital, contributions of partners) | 1310 | 410 | Information on lines 1300–1370 is detailed in the statement of changes in equity and the statement of financial results (in terms of net profit for the reporting period). The company has the right to determine the additional amount of explanations about capital. |

| Revaluation of non-current assets | 1340 | 420 | |

| Additional capital (without revaluation) | 1350 | ||

| Reserve capital | 1360 | 430 | |

| Retained earnings (uncovered loss) | 1370 | 470 | |

| Long-term borrowed funds | 1410 | 510 | The information is deciphered in tabular (Form 5) or text form in the explanations to the balance sheet |

| Deferred tax liabilities | 1420 | — | Indicate the credit balance of account 77 |

| Estimated liabilities | 1430 | — | The credit balance of account 96 is reflected - estimated liabilities, the expected fulfillment period of which exceeds 12 months |

| Other long-term liabilities | 1450 | 520 | Provides information about long-term liabilities not indicated in the previous lines of the section |

| TOTAL long-term liabilities | 1400 | 590 | The final result of long-term liabilities is reflected |

| Short-term debt obligations | 1510 | 610 | Account credit balance 66 |

| Short-term accounts payable | 1520 | 620 | The total credit balance of accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 is reflected. The information is deciphered in the notes to the balance sheet (for example, in Form 5) |

| Other current liabilities | 1550 | 660 | Filled in if not all short-term liabilities are reflected in other lines of the section |

| Total current liabilities | 1500 | 690 | The total total of short-term liabilities is indicated |

| Liabilities of everything | 1700 | 700 | Summary of all liabilities |

ConsultantPlus experts have prepared a line-by-line commentary on filling out the balance sheet, including liability lines. If you don't have access to K+, get it for free.

Read about what characterizes simplified accounting in the article “Simplified reporting for small businesses.”

Pros and cons of availability

Positive aspects of having:

- maturity and ease of conversion. They are beneficial from a business perspective because a company can use them to meet any short-term needs;

- financial repository. Retained equity is a way of storing money until a business decides what to do with it.

Negative aspects of having:

- loss of income: sometimes companies set aside an amount in equivalents that exceeds the amount needed to cover immediate obligations, depending on market conditions. When this happens, the company loses potential income because money that could have generated higher profits elsewhere has been transferred to a cash account;

- low yield: many equivalents have yield. However, the interest rate is usually low. A low interest rate makes sense given that equivalents are low risk.

Results

Decoding the balance sheet allows users to extract as much useful information as possible from its meager figures. For automated processing of data from accounting reports carried out by statistical authorities, accounting lines are encoded.

Sources:

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

- Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Work in progress: accounting account

Costs in work in progress are taken into account in production cost accounts: 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”. But the answer to the question whether the costs of work in progress in accounting will be formed taking into account the costs accumulated in accounts 25 “General production expenses” and account 26 “General expenses” depends on what the organization has written down in its accounting policy.

Costs collected on account 25 for the month can be fully attributed to the main production cost account (20), or can be distributed either to 2 accounts (20 and 23) or to all 3 direct cost accounts (20, 23, 29) . The expenses accumulated on account 25, together with direct costs, form the production cost of products, works or services.

Account 26 can be distributed similarly to account 25 (then the full cost will be collected on the corresponding accounts), or you can write off the entire amount collected on it every month to the financial result (to the debit of account 90). In the latter case, the cost of a specific product (work, service) will not include its data.

Read more about account 20 in the material “Account 20 in accounting nuances).”

Composition of main production costs

Account 20 is used to account for direct and indirect expenses incurred in connection with:

- with the production of products of any kind;

- provision of all types of services;

- performing construction and contracting, design, survey and geological exploration work;

- carrying out repair work;

- carrying out design and research work, etc.

Direct expenses are written off to the debit of the “Main production” account from the credit of the accounts:

- 02 and 05 - regarding depreciation of property used for main production

- 10, 15, 16, 21 - for used inventories and costs associated with their acquisition;

- 60 and 76 - for production services directly related to the main production;

- 69 and 70 - regarding the salaries of the main production personnel and charges for it.

Defects subject to correction are also written off for the main production (Dt 20 Kt 28). Every month, from the credit of account 23 to account 20, part of the costs of auxiliary production is received, from the credit of account 25 - indirect costs (or part thereof) to ensure production, from the credit of account 26 - part of general business expenses (if the organization does not use the direct costing method and does not write off these expenses are debited to account 90).

Where can I find financial reporting forms for business?

By law, all enterprises that issue shares must disclose their information (in accordance with the requirements of paragraph 1.7. “Regulations on the disclosure of information by issuers of equity securities”, approved by Order of the Federal Service for Financial Markets of the Russian Federation dated October 4, 2011 No. 11-46 /pz-n).

All financial statements of joint stock companies can now be viewed. Public reporting means that it is publicly available to all users. For example, on enterprise websites you can see the “Information Disclosure” section and there, as a rule, there is a “Shareholders and Investors” tab. It will contain the financial results of the year or financial reports by quarter.

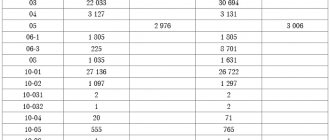

The figure below, on the website of JSC Tupolev, shows the financial statements of the enterprise for 2013. There are 4 forms of financial reporting. An audit report is a fact of verification by an independent body of financial statements. There's no point in watching it for us. We also don’t really need explanations for the balance sheet to carry out financial analysis.

Forms of financial (accounting) statements of JSC Tupolev on the company website