Organizations must prepare financial statements based on the results of 2021.

Accounting (financial) statements for 2021 Simplified accounting statements for 2021 in “1C: Accounting 8” (rev. 3.0)

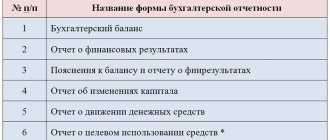

The composition of the accounting (financial) statements of commercial organizations that do not have the right to use simplified accounting methods, including simplified accounting (financial) statements, for 2021:

- balance sheet;

- income statement;

- appendices to the balance sheet and income statement: statement of changes in equity;

- cash flow statement;

- other annexes (explanations), if required.

Reporting is prepared according to forms approved. by order of the Ministry of Finance of Russia dated 07/02/2010 No. 66n (as amended on 04/06/2015):

- balance sheet and financial results statement - according to the forms given in Appendix No. 1 to Order No. 66n;

- reports on changes in capital and cash flows - according to the forms given in Appendix No. 2 to Order No. 66n;

- Explanations to the balance sheet and financial results statement (when prepared in tabular form) - according to the forms given in Appendix No. 3 to Order No. 66n.

We will consider the preparation of accounting (financial) statements in “1C: Accounting 8” using the following example.

Example

Belaya Akatsiya LLC is a small enterprise, but has decided to prepare financial statements for 2021 in the scope of the accounting reporting forms provided for “ordinary” organizations.

Let's look at how to make a balance sheet in 1C: Accounting

One of the main reports among a company’s financial statements is its balance sheet (balance sheet in 1C).

It shows the financial and property situation of the company at the reporting date in monetary terms. The balance sheet contains information about assets, liabilities and equity.

The balance sheet refers to regulated reporting, that is, it is used both by the company itself and is generated for the regulatory authorities at the place of state registration of the organization: the tax inspectorate and the state statistics body.

What does code 384 mean?

Accounting statements are prepared in the currency of the Russian Federation, i.e. in rubles (clause 16 of PBU 4/99). Moreover, depending on the significance of the reporting indicators and to make it easier to “read,” data can be presented either in thousands of rubles or in millions of rubles. The organization itself decides in which units of measurement to prepare its reports.

The units of measurement in the reporting forms correspond to the code according to the All-Russian Classifier of Units of Measurement (OKEI) (Gosstandart Decree dated December 26, 1994 No. 366):

| OKEY code | Unit name |

| 384 | Thousand rubles |

| 385 | One million rubles |

Accordingly, if the organization’s financial statements are prepared in thousands of rubles, then in the line “Unit of measurement” in the machine-readable reporting form (namely, this form must be submitted to the tax office), you need to indicate 384. But when preparing reports in millions of rubles, you need to indicate code 385 .

OKEI also provides other codes for monetary units of measurement. For example, 383 “Ruble”, 386 “Billion rubles”. However, codes other than 384/385 are not used when preparing financial statements for official purposes.

Balance sheet in 1C

Accounting has become fast and convenient thanks to the 1C program. Forms of financial statements are regulated by government agencies on the basis of regulations. The balance sheet in 1C is formed taking into account all changes, since using the built-in parameters for updating the configuration, the form of regulated reporting is promptly updated.

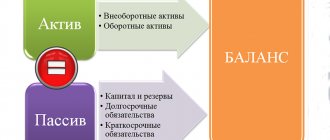

The printed form of the balance sheet in 1C is compiled according to Form No. 1, approved by Order of the Ministry of Finance of the Russian Federation No. 66n “On Forms of Accounting Reports of Organizations” dated 07/02/10, as amended on 04/06/15. The report form has the form of a table consisting of two parts:

- Asset – property of the organization;

- Liabilities are the things by which property is formed.

Photo No. 1. Printable balance sheet form in 1c accounting 8 edition 2:

Balance sheet.

All information about the organization is formed in the header of the printed form of the document:

- Full name;

- TIN;

- Kind of activity;

- Type of ownership;

- Currency and units of measurement of indicators;

- Legal address.

This data is taken into the printed form of the document automatically from the section containing information about the company.

The document displays the date of compilation, the name of the indicators, their line code, the value of the indicator in monetary terms at the beginning and end of the reporting period.

In order for the balance to converge in the 1C program, it is necessary to first carry out all the documents and operations on the basis of which it is formed.

Photo No. 2. Screen balance form in 1C:

Screen form

Photo No. 2 shows that the document cells are painted in several colors:

- White means the cell cannot be manually edited;

- In yellow, users can enter the required information;

- In light green fields, indicators can also be changed, and they are generated automatically by the program, based on data from yellow and white cells;

- Indicators in green cells also appear automatically. They change if the data in the light green cells is edited.

In the electronic form of the report, you can manually change the settings of light green cells to the following parameters:

- Only automatic filling, no manual adjustment;

- Automatic filling with adjustment;

- No auto-fill.

Photo No. 3. Balance sheet section in 1C 8:

By right-clicking on any balance sheet indicator in 1C 8, a section will appear as shown above. The “Decipher” button will make it possible to track the algorithm for calculating the indicator and see from which standard report the amount is added to the report. The “Add and remove line” buttons will perform the corresponding actions in the balance sheet form.

Passive part of the balance

The second section informs the reader of the balance sheet about how its active part is formed. It also has certain sections within itself:

- Loans and credits, as well as salaries to subordinates;

- External obligations of a long-term nature;

- Authorized and equity capital of the company.

Every accountant, when starting to compile a reporting form, is obliged to remember and observe the following equality:

Assets = Capital + Liabilities

The report is compiled not only to help management understand the vector of development of their business, but also represents regulated reporting for regulators.

Step-by-step formation of a balance sheet in 1C 8.2

It’s easy to create a balance sheet in 1C Accounting 8 edition 2, to do this you need to follow these steps:

- Open the program, in the working field that appears in the top menu, click on the “Reports” button, select the 1C-Reporting item, sub-item “Regulated reports”;

Photo No. 4. Regulated reports:

Regulated reports

2. By left-clicking on the sub-item “Regulated reports”, a window will open as shown below. Here you need to select an organization, in this example – Trading House “Complex LLC” and the reporting period, in the example 1st quarter of 2021. Then click on the “Create” button - the “Types of reports” window will open;

Photo No. 5. Menu “Types of reports”:

Types of reports

3. In the “Types of reports” window that opens, in the “All” tab, in the “By categories” section, select the “Accounting statements” item, to do this, click on “+”. A list of financial statements will appear on the screen. In this list, find the item “Accounting statements since 2011” and click on the “Select” button;

Photo No. 6. Accounting statements since 2011:

4. In the “Accounting Statements” window, you need to specify the organization for which the balance sheet will be generated in 1C 8 2, specify the period of compilation, and indicate a commercial or non-profit organization. The printed form of the document is formed taking into account the latest changes in legislation - current information is reflected in the line “Form edition”. When all parameters are specified, click the “Create” button;

Photo No. 7. Specified parameters for financial statements:

5. An empty balance sheet in 1C will appear on the screen. It is filled in with data when you click on the “Fill” - “Current Report” button. The total in the asset cell must agree with the total in the liability cell. Otherwise, the balance in 1s will be drawn up incorrectly;

Photo No. 8. Filling out an empty balance with data:

6. The document is generated, filled out, the indicators match. Now they print it, click on the “Print” button, it is located in the first top line above the document screen form. The “Select printed form” window that opens gives you the right to select the printed form of the document, depending on which regulatory authority the reporting will be submitted to. In 1C, the balance is printed immediately or a printed form of the form is viewed on the screen;

Photo No. 9. Balance print:

Balance print

7. The balance is saved in 1C 8 by clicking on the “Write” button; in the picture above it is highlighted with an orange background.

The program provides a calendar for an accountant. He tells you what report and within what time frame must be submitted to the regulatory authorities. Information in 1C is generated according to the due date of delivery. To open it, click on the “Main” menu - in the “Tasks” section, select the “Task List” item, as in the picture below.

Photo No. 10. Accountant’s calendar:

Business transactions

The time has come to understand business operations and their essence.

A business transaction is an event in the activities of an enterprise that leads to either a change in the balance sheet or a change in the structure of the balance sheet. Such transactions are reflected in accounting using the double entry principle. And an event of an enterprise that does not in any way affect the state of the balance sheet and its structure is also called a business transaction. But this event is reflected in accounting on a single entry basis.

It's not clear yet. Let's figure it out. Let's deal with the event first. The company purchased goods. Purchasing a product is an event. Have the company's assets increased? Naturally, an additional asset appeared - goods. And since there can never be more assets than liabilities, liabilities have increased accordingly. accounts payable acted as a liability . What happened? Overall the balance has increased. And since the balance has increased, therefore, this event can be called, by definition, a business transaction . Those business transactions that lead to an increase in the balance are conditionally classified as group I of business transactions.

Now the situation is different. A trading company writes off a consignment of goods from a warehouse. It doesn't matter for what reason. Writing off a batch of goods from a warehouse is also an event. What happens? At the moment the goods are written off from the warehouse, the amount of assets decreases, and, consequently, the amount of liabilities decreases. the income acts as a liability . The balance overall decreases. And if the balance has changed, therefore, writing off a consignment of goods can, by definition, be called a business transaction. Those business transactions that lead to a decrease in the balance are conditionally classified as group II of business transactions.

The following situation. The company withdrew cash from the current account and placed it in the cash register. What happened? Cash withdrawal is an event in the activities of the enterprise. Did this event somehow change the balance? There is no balance itself. The amount of assets has not changed, the amount of cash remains the same. What has changed? Non-cash funds have turned into cash. In other words, the structure of assets has changed. By definition, this event is also a business transaction. And those business transactions that lead to a change in the structure of assets are conventionally classified as group III of business transactions.

Another example. The company replenished the reserve fund from retained earnings. Retained earnings and the reserve fund are the liabilities of the enterprise. The redistribution of the volumes of these liabilities did not in any way affect the value of assets, only the structure of liabilities changed. The amount of retained earnings decreased and the amount of the reserve fund increased. Those. there is a business transaction. This type of operations, which lead to a change in the structure of liabilities, is conventionally classified as group IV of business operations.

Every day, in the course of the activities of each enterprise, dozens, or even hundreds and thousands of business transactions occur. Depending on which group each business transaction belongs to, it affects the balance sheet in its own way. Business transactions of the first group increase the balance. Business transactions of the second group reduce the balance. Business transactions of the third group redistribute assets, and business transactions of the fourth group redistribute liabilities. If you imagine the many business transactions taking place at an enterprise and how they affect the balance sheet, you get the feeling that the balance sheet is breathing.

This point is very important from the point of view of understanding the essence of accounting. The bottom line is that accounting deals with the accounting of business transactions of an enterprise, each of which affects either the state of the balance sheet or its structure.

Now, for a more complete understanding of this issue, it is necessary to note that there are business transactions that do not in any way affect the state of the balance sheet, or the state of assets, or the state of liabilities. For example, taking someone else's property for safekeeping. The company took a batch of raw materials for safekeeping. What happened? From an accounting point of view, only that someone else’s property has appeared at the enterprise. This business transaction did not in any way affect the size and structure of the balance sheet.

So we figured out what a business operation is. Now let's figure out how to reflect a business transaction in accounting. But first, let’s figure out what an accounting account is.

Other operations for balance in 1C 8.2

In addition to the fact that a balance sheet can be generated and printed in the 1c program, other operations are also performed with it, for example:

- Reuse it. It will be located in the “1C - Reporting” section. You can open the section using the commands Reports - 1C-Reporting - Regulated reports. You can reopen the document and make changes to it if necessary;

Photo No. 11. Balance adjustment menu:

Balance adjustment menu

Check the report. You must select “Check” - “Check upload”. 1C shows existing errors for further correction;

- After correcting errors, the balance can be uploaded to any external media and sent to the Federal Tax Service.

In addition to the balance sheet, in 1C such operations can be done with other regulated reports. By left-clicking on the “Regulated Reports” sub-item, a window will open as shown below.

Here you need to select an organization, in this example - Trading House "Complex LLC" and the reporting period, in the example, the 1st quarter of 2021. Then click on the "Create" button - the "Types of reports" window will open; In the "Types of reports" window that opens, In the “All” tab, in the “By categories” section, select the “Accounting statements” item, to do this, click on “+”. A list of financial statements will appear on the screen. In this list, find the item “Accounting statements since 2011” and click on the “Select” button;

Synthetic and analytical accounting

Synthetic accounting is generalized accounting. Any account reflects generalized information on a particular asset or liability. Well, for example, account “51” “Current accounts” reflects the state of the enterprise’s non-cash funds. In other words, we will have information about how much non-cash money is in the enterprise. What if a company has several accounts in different banks? And do you need to know how much money is in each of these accounts? In this case, analytical accounting .

Analytics serves to personalize the accounting of this or that asset or this or that liability.

Previously, when accounting was carried out on paper, group statements were used to maintain analytical accounting, which reflected transactions specifically for each object of analytical accounting. In our example, the object of analytical accounting is the specific current accounts of the enterprise.

With the advent of computer technology and the transfer of accounting to digital media using special accounting programs, for example the 1C Accounting program, a special object called subconto is used to maintain analytical accounting. Subconto is linked as necessary to one of the accounts. There may be several of them. As a rule, from one to five subcontos are used. In the process of creating accounting entries by the user, these sub-accounts are associated with specific values of analytical accounting objects. In our example, this is a specific current account. And when reflecting transactions on specific current accounts, the information is recorded as the value of a certain sub-account. Subsequently, an accountant can always easily obtain information about how much money is in each specific current account. I will not go into detail about the mechanism for linking a subaccount to an account; this is not the scope of this article.

In addition, maintaining analytical accounting is possible by opening second-level accounting accounts. They are called subaccounts. The number of subaccounts is not limited by current legislation. Their chief accountant opens exactly as much as is necessary to organize analytical accounting. All lower-level subaccounts are subordinate to the account within which they were created. This account is also called the parent account. Sub-accounts can be not only active, but also passive, regardless of the type of parent account. The balance on the parent account will be equal to the total balance on each sub-account. But if the parent account is active, then the balance on the parent account simply must be debit, and vice versa, on the passive account the balance must be credit. This is also an axiom. Each sub-account can also additionally organize analytical accounting using sub-account analytical accounting objects.

At the end of the story about accounting accounts, we need to talk about one more group of accounting accounts. It was said above that there are business transactions that do not in any way affect the balance sheet of the enterprise (example with safekeeping). This is the state of the assets and liabilities of the enterprise, which in their accounting sense cannot be included in the balance sheet of the enterprise, is reflected in off-balance sheet accounts. The status of assets and liabilities that relate to the balance sheet is reflected in the balance sheet accounts.

Why are accounting accounts needed? Well, firstly, we already know that the accounts reflect the state of the assets and liabilities of the enterprise. And secondly, accounts are needed to record business transactions using accounting entries .

A formalized record of a business transaction is called an accounting entry.

An accounting entry links the parties to two accounts. This is the essence of the double entry principle. The connection of two accounts using an accounting entry is called correspondence. And the related accounts are correspondent ones.

However, transactions in off-balance sheet accounts are reflected on a single entry basis. One entry is made only for debit or one entry only for credit of the off-balance sheet account.

Accounting entries

Above I have already given the definition of an accounting entry. Now let's look at how and where postings are recorded. But first we need to talk about the accounting entry details. These details are:

- Posting date or period

- Debit account

- Debit sub account 1

- Subconto debit 2

- ….

- Credit account

- Loan subconto 1

- Subconto loan 2

- …

- Quantity (if the posting uses an account with the “quantitative” attribute

- Currency (if the transaction uses an account with the “currency” attribute

- Sum

- Posting Contents

An accounting entry can be briefly written down on paper. Moreover, the accounting entry begins from the debit account. This is also an axiom. Debit on the left, credit on the right. An example of a wiring record is given below.

01/14/2017 Dt 71 [Gusev V.N.] Kt 50 [Central Cash Office] 1000, issued for reporting

This posting states that employee V.N. Gusev 1000 rubles were issued from the central cash register for reporting on January 14, 2017.

In addition, entries can be entered into a database using a computer accounting program. What types of wiring are there? Wiring can be simple or complex . If a business transaction can be described by one entry, then it is called simple. If two or more entries are required to describe a business transaction, and if the debit or credit accounts in such entries are the same, then such an entry is called complex.

An example of complex wiring is shown in the table below:

| Period | Account Dt | Subconto Dt | Kt account | Subconto Kt | Amount/Content |

| 01.03.17 | 26 | Delivery by road | 60.01 | Autoservice LLC | 6200 |

| Contract for services | Delivery services by road transport | ||||

| 01.03.17 | 19.03 | VAT on purchased services | 60.01 | Autoservice LLC | 1116 |

| Contract for services | VAT allocated on purchased services |

Why explain the balance?

Reporting must be reliable and complete and provide the user with a clear picture of the financial position of the organization. In the balance sheet and Form 2 we present generalized indicators, from which, as a rule, it is difficult to draw comprehensive conclusions. This means that they need to be explained.

Let’s take the line “Accounts receivable” as an example. To put this figure in the report, you need not only to collect the balances of all settlement accounts, but also to take into account the amount of the reserve for doubtful debts (if any). It is not shown separately in the balance sheet, and interested users (owners, investors, regulatory authorities) need additional explanations in this regard.

All organizations must formulate explanations, with the exception of:

- small enterprises entitled to simplified accounting and reporting;

- public organizations that do not conduct business activities and have no sales.

Moreover, explaining the balance is in the interests of everyone who cares about their reputation. The more fully the figures from the report are disclosed, the more transparent the company’s activities will appear. Such reporting will help not only strengthen your credibility, but also attract new investors. Explanations on the balance sheet will also allow you to avoid unnecessary questions from regulatory authorities.

NOTE! Clause 39 of PBU 4/99 (approved by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n) stipulates that companies have the right to provide additional information along with reports if it is useful for external users of the reports. At the same time, the Ministry of Finance believes that companies are obliged to disclose information related to accounting reporting (information of the Ministry of Finance dated December 4, 2012 No. PZ-10/2012).

What information does the balance sheet note contain?

Usually, no explanations are provided separately for the balance sheet alone. Since it is not compiled alone, but as part of the reporting, an explanation is given immediately for all submitted reports.

It should be noted that all traditional reports decipher some lines of the balance sheet, that is, they are also its explanations.

So, from the financial results report we learn about the amount of net profit for the period, and it is an integral part of the line “Retained earnings (uncovered loss)” of the balance sheet.

The cash flow statement provides information on how the “Cash and Cash Equivalents” line indicator is generated (broken down by line of business).

The statement of changes in capital deciphers the information reflected in section 3 of the balance sheet.

The remaining lines also require decoding and explanation. They are usually presented in the form of tables - they are convenient and visual. You can develop their form yourself, or you can use ready-made samples - they are in Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

NOTE! Order No. 66n contains an example of preparing explanations for balance sheet information about intangible assets, R&D, fixed assets, financial investments, inventories, debts of debtors and creditors, estimated liabilities, and state aid.

Financial results report for 2021

The section “Report on financial results” is intended for drawing up a report on financial results.

The header part of the report contains indicators characterizing the organization. They are filled in automatically based on the data available in the information base (Fig. 10).

Rice. 10

To fill out the indicators of the financial results report according to the accounting data, you must click on the “Fill” button and select the “Current report” item. All indicators for which accounting data is available in the information base are filled in automatically (Fig. 11, 12).

Rice. eleven

Rice. 12

Due to the lack of necessary data in the information database, automatic completion of the reference indicators “Result from other operations not included in the net profit (loss) of the period”, “Basic profit (loss) per share” (indicator code 2900) and “Diluted profit (loss) per share” share" (indicator code 2910) is not supported.

In the profit and loss report, compiled using the regulated “Accounting Statements” report, it is possible to separately bring indicators about individual income and expenses in the “including” lines to the corresponding indicator of the report form if they are significant and if without knowledge of them by those interested It is impossible for users to assess the financial position of the organization or the financial results of its activities. You can add such indicators automatically, manually, or in a combined way.

In automated mode, you can add predefined indicators to the financial results report, a list of which is given in the form of settings for deciphering indicators of the financial results report, which opens by clicking the hyperlink “Setting up the composition of lines” (Fig. 13).

Rice. 13

The marked measures are automatically added to the “including” lines of the corresponding income statement measure. To display the values in these indicators, you need to automatically fill out the report again (Fig. 14).

Rice. 14

Manual decoding is performed of those indicators of the financial results report that are not mentioned in the decryption setup form, but for them in the report form there are lines “including” - changes in deferred tax liabilities, changes in deferred tax assets, etc. To add an indicator manually, you must By typing from the keyboard, fill in the corresponding line “including”, highlighted in yellow. If one line is not enough, then to add lines you should use the “Add line” hyperlink.

You can also use a combined method of disclosing information in the financial performance report: add predefined indicators that the organization considers significant in an automated manner, and detail the remaining indicators manually. This method can be used, for example, if an organization considers information about income and expenses, in the assessment of which permanent differences have arisen, to be significant.

What does a sample explanatory note to the balance sheet look like?

There is no single sample of explanations for the balance sheet. Everyone explains what they consider necessary and useful for reporting users.

We'll show you what an explanation of a balance sheet might look like using an example.

Explanations to the balance sheet

JSC "Symphony" for 2021

1. General information

Joint Stock Company (JSC) "Symphony" was registered by the Federal Tax Service No. 6 for Moscow on October 29, 2009. (The following information can be provided: OGRN, INN, KPP, details of the state registration certificate, address.)

The balance sheet has been compiled in accordance with the accounting and reporting rules in force in the Russian Federation (if the balance sheet is prepared according to IFRS, this must be indicated).

Authorized capital: 1,000,000 (one million) rubles.

Number of shares: 1,000 pieces with a par value of 1,000 (one thousand) rubles.

Main activity: milk processing and cheese production (OKVED 10.51).

Composition of affiliates:

Steklov Andrey Anatolyevich - member of the board of directors;

Zavarzin Stepan Nikolaevich - member of the board of directors.

2. Basic accounting policies

The accounting policy was approved by order of the director dated December 25, 2017 No. 156 (the following is a brief summary of its main provisions: depreciation methods, methods of assessing assets and liabilities, etc.).

3. Balance sheet structure (each line is shown as a percentage of the balance sheet currency, changes for the period are calculated).

4. Assessment of the value of net assets (the value of net assets is correlated with the authorized capital).

5. Analysis of the main financial indicators (financial ratios are indicated: liquidity, reserve coverage, autonomy, return on assets, etc.; this section also analyzes the degree of dependence on creditors, position on the securities market, etc.).

6. Composition of fixed assets (rub.):

| Name | Initial cost | Depreciation | Book value as of 12/31/2018 |

| Land | 1 270 000 | 1 270 000 | |

| Buildings, structures | 58 321 000 | 6 987 000 | 1 334 000 |

| Vehicles | 1 256 000 | 342 000 | 914 000 |

| Equipment | 32 598 000 | 4 984 000 | 27 614 000 |

| Inventory | 352 000 | 78 000 | 274 000 |

7. Estimated liabilities and provisions

As of 12/31/2018, an estimated liability for payment of regular vacations was formed in the amount of RUB 1,426,000, the number of unpaid vacation days is 67, the due date is 2021.

The reserve for doubtful debts was formed in the amount of RUB 1,678,000. due to the presence of overdue and unsecured debt of Quiet Dawns LLC.

A reserve for impairment of the value of inventories was not created due to the absence of signs of impairment of inventories.

8. Labor and wages

Payables for wages as of December 31, 2018 amounted to RUB 1,679,000. (for December 2021, payment deadline: 01/15/2019). Personnel turnover in the reporting period was 24.98%, the payroll number was 167 people. The average monthly salary is 20,675 rubles.

9. Issued and received security and payments (all their types are indicated).

10. Other information

(A list of extraordinary facts, their consequences, a description of significant facts that affected the balance sheet indicators, major transactions completed, events after the reporting date, adjustments made and other necessary information is provided.)

Director of JSC "Symphony" Devyatov Devyatov A. N. 03/20/2019

AUDIT OF GENERAL DOCUMENTS AND REVIEW OF ACCOUNTING STATEMENTS

1) Audit of constituent, registration documents and authorized capital

2) Audit of the management system, setting up accounting records and accounting records

3) Examination of economic contracts

4) BO review

5) Main directions of analysis of the financial position of the audited entity

1) Objects of inspection: charter, amendments to the charter, decisions of participants to amend the founding documents, founding agreement, registration documents, business licenses, registers of shareholders, prospectuses, minutes of meetings, synth and anal accounting registers for accounting accounts 75 and 80.

-The auditor checks the availability of charters, amendments to the charter, other founding and registration documents, and valid licenses for the types of activities actually carried out in accordance with the requirements of the law;

- A check was made of the appropriate amount of the authorized capital according to the balance sheet, the general ledger (turnover balance sheet), account 80 and according to the charter, taking into account the latest registered changes;

-The auditor checks the completeness and timeliness of participants' contributions;

-The auditor checks the validity of the founders’ contribution to the authorized capital of assets other than monetary assets

-Checks the availability of documents in which the agreed valuation of the article is drawn up...an independent valuation of property is required in an OJSC;

-The auditor must look at what the intangible assets made as a contribution are;

-The auditor checks the completeness of capitalization and the correctness of the assessment of property in accounting and tax accounting, made as a contribution to the Criminal Code;

-Evaluation of deposits in foreign currency;

-Checks the correctness of the accounting of capital at the stage of its formation;

-Checks the establishment of analogous capital accounting for participants and shareholders;

-Looks to see if there is data on the organization’s additional capital in the balance sheet and synthetic accounting.

If yes, then he studies the structure of additional capital.

2) Basic regulatory documents used by the auditor: FPSAD No. 8 “Understanding the activities of an audit entity...”; FPSAD No. 29; z-n “About BU”; Order of the Ministry of Finance “On forms of BO”; PBU 1 “Accounting Policies for Organizations”

The auditor takes for inspection:

-organizational management scheme;

- regulations on departments, accounting services;

-accounting policies for accounting and tax accounting purposes;

- internal audit documentation;

-and other documents as needed.

-the auditor studies the organization’s management system using a diagram, questionnaires, and conversations;

- clarifies the appropriateness of the organizational structure to the scale and nature of the activities;

- finds out how the document flow and internal control system are organized at the audited enterprise;

- establishes whether there is a special internal audit service, its effectiveness, and whether its work can be used for external audit purposes.

- finds out how the work of accounting personnel is organized;

-gets acquainted with the organizational structure of the accounting and financial departments;

-finds out whether there are regulations on these departments;

- clarifies the distribution of responsibilities;

-finds out the level of accounting automation (which accounting program is used for accounting)

- carries out an examination of the accounting shelf for accounting purposes for compliance with the requirements of PBU 1, other regulatory documents on accounting, the Chart of Accounts of accounting and the corresponding features of the financial economic activity of the audited entity.

The examination of the accounting shelf is carried out in accordance with the requirements of the Tax Code, laws of the Russian Federation and constituent entities of the Russian Federation, regulatory documents of the Ministry of Finance of the Russian Federation, in accordance with the peculiarities of the financial activities of the organization.

-must study changes and additions made to the accounting policy;

-conducts an examination of the working chart of accounts of the accounting system.

3) The examination is carried out in accordance with the current law and, above all, the Civil Code of the Russian Federation. It included the following procedure:

1. a circle of contracts has been established, the cat uses the audit person in his activities

2. finds out whether there is a journal or book of contracts

3. finds out how contracts are stored and whether they are registered

4. Does the company’s management collect the necessary information about the counterparty before concluding an agreement?

5. checks who signs contracts on the part of the audited entity and on the part of the counterparty. The official must have appropriate authority

6. finds out whether contracts with lawyers are endorsed

7. are agreements agreed with the chief accountant and financial director?

8. finds out whether there are ambiguous unclear phrases in contracts

9. The payment procedure is being studied

4) Basic regulatory documents: z-n “On financial accounting”, PBU 4 “BO”, order of the Ministry of Finance of the Russian Federation “On forms of financial accounting of organizations” dated 07/02/2010. No. 66n

4 main areas of verification:

-audit for compliance with regulatory documents on formal grounds (the presence of all forms of reporting provided for by regulatory documents, finds out who signed the reporting, pays attention to the timeliness of its preparation and submission, studies the reporting of production divisions, branches, including those on a separate balance sheet , the correctness of reporting as a whole will be checked, including divisions allocated to a separate balance sheet; when checking holdings, subsidiaries, the auditor checks whether a consolidated financial statement is drawn up, finds out the completeness of the preparation of explanations of the financial statements, whether the explanations contain significant information about the organization, its financial position, transactions with affiliated parties, information about the main indicators for previous and reporting years, methods for assessing significant BO items, finds out whether the annual BO indicators are confirmed by the results of the inventory of property and financial liabilities)

- checking the interrelation of indicators of various forms of financial statements (the Auditor checks the correspondence and interrelation of indicators in different forms of accounting reporting. Currently, such interrelation is checked with the implementation of special programs);

- the correctness of filling out reporting forms based on the general ledger and other registers of synthetic and analogous accounting (the auditor checks the correspondence of balance sheet items and indicators of other reporting forms with the data of the general ledger. The auditor pays attention to the detailed reflection in the accounting records receivables and payables. At the same time, the auditor identifies possible errors in accounting and reporting, as well as areas where there is the greatest risk of errors, attention is drawn to the presence of credit balances on accounts and sub-accounts that are usually active and vice versa. At the stage of reviewing the accounting statements, the auditor may discover distortions BO. The actions of auditors in such cases are regulated by FPSAD No. 13 “Obligations of the agency to address errors and dishonest actions during the audit”);

- identification of those areas of accounting where audit risk is most significant.

09/12/11

5) assessment of financial status including 2 stages:

1. preliminary general assessment of the financial condition of the organization, which includes an analysis of changes in financial indicators for the reporting period compared to previous periods and verification of calculations of net asset value.

2. detailed - the auditor makes an assessment of the financial situation not only at the reporting date but also long-term and short-term prospects (analysis of financial results, analysis of solvency and financial stability, analysis of balance sheet liquidity, creditworthiness of the organization, analysis of turnover of current assets...)

Date: 2015-06-11; view: 83; Copyright infringement

Did you like the page? Like for friends:

Current as of: February 8, 2021

The current forms of financial statements, approved by Order of the Ministry of Finance dated July 2, 2010 No. 66n, provide for the reflection of certain codes in them. What does code 384 mean in financial statements?