What is EO

Electronic reporting (ER) - provision of established forms of reports to the Social Insurance Fund, Pension Fund of the Russian Federation, tax authorities and Rosstat - is used by organizations and individual entrepreneurs both on a mandatory and voluntary basis.

This depends on the type of tax and the size of the taxpayer’s staff. How to submit reports to the tax office electronically for free - register a personal account and receive an electronic signature. The services of specialized operators are more convenient in that they allow you to generate and check reports before sending them.

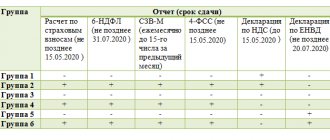

Let's sum it up

Let's summarize all of the above in a summary table.

Who submits reports exclusively electronically?

How many of you continue to report on paper? Why don't you switch to electronic reporting? We are interested in your opinion - tell us in the comments what makes you remain committed to paper reports.

We offer our clients to submit reports only electronically, and we also generate them ourselves. And accountants with us are not only freed from routine, but also earn money. Do you want to visit us?

Mandatory electronic tax reporting in 2021

In 2021, declarations in electronic form must be submitted by:

- all VAT payers, including those who are tax agents;

- taxpayers whose average number of employees for the previous calendar year exceeds 100 people;

- established organizations (including those formed during reorganization), in which the number of employees is more than 100 people;

- the largest taxpayers, regardless of the average number of employees.

Also, personal income tax reports are sent via TKS if the number of employees in the company is more than 25.

To send all these reporting forms, an electronic signature is required for the Federal Tax Service. The operator helps you arrange it.

Let us recall that the list of the largest taxpayers is compiled annually by the Federal Tax Service on the basis of certain criteria (order of the Ministry of Taxes of Russia No. SAE-3-30 / [email protected] dated April 16, 2004). These criteria are regularly updated by tax authorities. For such enterprises, it is provided not only for submitting reports through the tax website, but also for support from the Federal Tax Service, in particular tax monitoring.

Penalty for failure to provide balance electronically

As for organizations that violated the procedure for filing mandatory reports, penalties are applied to them in accordance with Art. 15.11 Code of Administrative Offences.

Failure to submit or untimely submission of financial statements to the Federal Tax Service is punishable by a fine of 5,000 rubles. up to 10,000 rub. If such an administrative offense is committed repeatedly, the fine increases to 10,000 rubles. – 20,000 rubles, and company officials responsible for the violation may be disqualified.

Similar to the VAT tax return, balance sheets and other reporting forms submitted to the Federal Tax Service on paper are considered not provided if they were provided by a business entity that has obligations to file financial statements. For this violation, the Federal Tax Service has the right to impose a fine in accordance with the Code of Administrative Offenses. The timeliness of submitting the balance does not matter in this case.

Mandatory reporting on insurance premiums in 2021 according to TKS

In 2021, a new unified calculation of insurance contributions must be submitted to the tax office by:

- payers of insurance premiums whose average number of individuals in whose favor payments and other remunerations are made for the previous billing period exceeds 25 people (before 2015 this number was 50);

- established organizations in which the number of specified individuals exceeds 25 people (before 2015 this number was 50).

To the Federal Tax Service, organizations submit a unified calculation of insurance premiums using the KND 1151111 form. It replaced the RSV-1 and 4-FSS forms previously used for these purposes.

Starting with reporting for the first quarter of 2021, only the calculation of contributions for injuries must be submitted to the Social Insurance Fund.

Starting from 2021, the Pension Fund of Russia receives monthly forms SZV-M, SZV-TD (information about the insurance period of employees, the form has not yet been approved) and other personalized forms.

The Pension Fund and the Social Insurance Fund submit reports electronically if there are 25 or more people on staff.

This rule applies not only to payers of insurance premiums who fall under the scope of Federal Law No. 212-FZ of July 24, 2009. Payers who transfer contributions for insurance against accidents and occupational diseases if they have employees are also subject to the same requirements.

How to submit an electronic report to the tax office: step-by-step instructions

In order to submit a report in electronic form, the taxpayer must connect to the electronic document management system with the Federal Tax Service. We will tell you how to do this below.

Step 1. Connect to the electronic document management system of the Federal Tax Service

To connect to the electronic document flow of the Federal Tax Service, an organization should:

- conclude an agreement with an electronic document management operator for the provision of telecommunications services;

- select, purchase and install software that will ensure the exchange of electronic information with the fiscal service. As a rule, the software is installed by the electronic document management operator as part of the provision of services provided for in the contract;

- obtain electronic digital signature (EDS) keys, which are necessary for signing electronic documents. The issuance of keys is carried out by the Certification Center of the Ministry of Telecom and Mass Communications.

After concluding an agreement with the operator and receiving digital signature keys, the taxpayer must contact the territorial body of the Federal Tax Service at the place of registration with an application to connect to the electronic document flow of the Federal Tax Service. Based on the request, the fiscal service invites the taxpayer to enter into an agreement, in accordance with which the organization (IP) is included in the number of participants in the electronic document management system.

A sample agreement can be downloaded here ⇒ Agreement on connection to EDI with the Federal Tax Service.

Step #2. Compile and submit a report

Using special software, the taxpayer prepares a report in electronic form. This method of generating a report has a significant advantage - the document can be edited and corrected an unlimited number of times before signing.

After preparation, the electronic report is signed by the head of the organization and the chief accountant. When signing, officials use EDS keys.

The prepared declaration must be sent to the Federal Tax Service via telecommunication channels.

Step #3. Accept a receipt from the Federal Tax Service

Upon receipt of an electronic tax return, the Federal Tax Service accepts the document and sends the taxpayer an electronic receipt of receipt. The taxpayer is obliged to accept the receipt within 5 days from the date of its receipt.

A receipt for receipt of a tax return confirms the fact that the Federal Tax Service has received the document and it has been accepted for verification. Subsequently, the fiscal service conducts a desk audit of the declaration and documents. If no errors are identified during the inspection by the Federal Tax Service, the tax service sends the taxpayer an electronic receipt for acceptance of the declaration. From this moment, tax reporting is considered submitted.

Voluntary submission of EO

In all other cases, reporting in electronic form is submitted at the request of the taxpayer or policyholder. Over the past few years, there has been a noticeable trend towards the transfer of reporting submitted by companies in all fields of activity to reporting through electronic channels.

This is convenient for regulatory authorities because it reduces the time for processing paper reports and brings everything to a single format.

This is convenient for legal entities and individual entrepreneurs, because it allows them to avoid exhausting visits to the tax office and funds and eliminates the possibility of disputes with government agencies about the timing of sending reports by mail in controversial cases.

On paper

Tax returns may be submitted on paper . In this case, a tax return can be submitted either personally by the head of the organization (entrepreneur) or an accountant, or by an authorized representative of the organization (entrepreneur). In addition, a paper declaration can be sent by mail. According to paragraph 1 of Art. 26 of the Tax Code of the Russian Federation, a taxpayer can participate in relations regulated by legislation on taxes and fees through a legal or authorized representative. Legal representatives in accordance with Art. 27 of the Tax Code of the Russian Federation recognizes: - for a taxpayer-organization - persons authorized to represent the specified organization on the basis of the law or its constituent documents; - for a taxpayer - an individual - persons acting as his representatives in accordance with the civil legislation of the Russian Federation. For organizations, the legal representatives are the director, general director, president of the company, etc., manager or management organization or other person according to the constituent documents. An authorized representative of the taxpayer in accordance with Art. 29 of the Tax Code of the Russian Federation recognizes an individual or legal entity authorized by the taxpayer to represent his interests in relations with tax authorities (customs authorities, bodies of state extra-budgetary funds), other participants in relations regulated by the legislation on taxes and fees. In this case, the authorized representative of the taxpayer-organization exercises his powers on the basis of a power of attorney issued in the manner established by the civil legislation of the Russian Federation. Consequently, an accountant or other person submitting tax reports to the tax authority must present a power of attorney confirming his authority to participate in tax legal relations. Thus, Letters of the Federal Tax Service of Russia dated February 15, 2007 N 18-0-09/0070 and the Ministry of Finance dated April 25, 2008 N 03-02-08/9 indicate the need for a mandatory power of attorney. An authorized representative of a taxpayer - an individual exercises his powers on the basis of a notarized power of attorney or a power of attorney equivalent to a notarized one in accordance with the civil legislation of the Russian Federation. notarization of a power of attorney to represent the interests of an individual entrepreneur is controversial Thus, in Letter dated August 10, 2009 N ШС-22-6/ [email protected] the Federal Tax Service of Russia explained that the power of attorney issued by an individual entrepreneur requires his signature and seal. Notarization is not required. The Ministry of Finance in Letter dated August 7, 2009 N 03-02-08/66, on the contrary, indicated that when submitting a tax return by a representative of a taxpayer - an individual, including in electronic form, the representative must have a notarized power of attorney, since an individual An entrepreneur is an individual and the rule in paragraph. 2 p. 3 art. 29 of the Tax Code of the Russian Federation. The date of submission of tax returns and financial statements by the legal or authorized representative of the organization is the date of their actual submission to the tax authority on paper . If tax reporting is submitted by mail, it must be in the form of a postal item with a description of the attachment. According to paragraph 4 of Art. 80 of the Tax Code of the Russian Federation, when sending a tax return (calculation) by mail, the day of its submission is considered the date of sending the postal item with a description of the attachment . Based on the norms of Art. 6.1 of the Tax Code of the Russian Federation, an action for which a deadline has been established can be performed until 24.00 on the last day of the deadline. If documents or funds were submitted to the communications organization before 24:00 on the last day of the deadline, then the deadline is not considered missed. The question of whether the declaration will be considered submitted on time if it is submitted to the post office on the last day of reporting, and processed by the post office on the next day, is controversial. The Letter of the Ministry of Taxes and Taxes of Russia dated May 13, 2004 N 03-1-08/1191/ [email protected] indicates that the date of submission of reports with a list of attachments for the purpose of applying Art. 80 of the Tax Code of the Russian Federation is considered the date indicated in the Russian Post stamp. Arbitration practice on this issue is in favor of the taxpayer. Thus, in the Resolution dated July 5, 2006 N F04-4150/2006(24268-A81-37), the Federal Antimonopoly Service of the West Siberian District, in relation to determining the date for submitting an income tax return by mail, directly indicated that in accordance with the norms of the Federal Law dated July 17, 1999 N 176-FZ “On Postal Services” and the Rules for the provision of postal services for a taxpayer, the date of sending the letter is considered the day of delivery of this postal item to the postal operator. Users of postal services are not responsible for the timely performance of their duties by the postal operator. Similar conclusions are contained in the Resolutions of the FAS of the East Siberian District dated August 28, 2006 N A19-5810/06-33-F02-4448/06-S1, FAS of the West Siberian District dated August 10, 2005 N F04-5028/2005 (13671-A27-33) and FAS Volga-Vyatka District dated June 15, 2005 N A28-25566/2004-1009/18.