The form of the payment order is fixed in a special form according to “OKUD-0401060”, which is contained in a separate Appendix No. 2 in the Bank of Russia Regulation “On the Rules for the Transfer of Funds” dated June 19, 2012 No. 383-P.

| • regulation No. 383-P; • by order of the Ministry of Finance of Russia “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation” dated November 12, 2013 No. 107n - when preparing payments for taxes, fees and contributions. |

Basic documents that must be followed when filling out payment orders:

Filling out a payment order in 2020-2021

When filling out a payment order, you should be guided by:

- regulation No. 383-P;

- Order of the Ministry of Finance of Russia “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budgetary system of the Russian Federation” dated November 12, 2013 No. 107n - when drawing up payments for taxes, fees and contributions.

Note! Since 2021, there have been changes in the details of tax payments.

Let's present a short step-by-step instruction. In this case, we will focus on filling out the details of a paper order, although at present few people make payments simply on a form. As a rule, special accounting programs are used for this, and for electronic payments, software of the “Bank-Client” type is used.

Step 1. Indicate the number and date of the payment.

Payment orders are numbered in chronological order. The number must be non-zero and contain no more than 6 characters. The date in a paper document is given in the format DD.MM.YYYY. In an electronic order, the date is filled in in the format established by the bank.

Step 2. Specify the type of payment.

It can have the meaning “Urgent”, “Telegraph”, “Mail”. A different value or its absence is possible if such a filling procedure is established by the bank. In an electronic payment, the value is indicated in the form of a code established by the bank.

Step 3. Payer status.

It is indicated in field 101, but only for payments to the budget. The list of status codes is given in Appendix 5 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. The typical payer may find the following useful:

- 01 - taxpayer (payer of fees) - legal entity;

- 02 - tax agent;

- 06 - participant in foreign economic activity - legal entity;

- 08 - payer - a legal entity (individual entrepreneur) transferring funds for payment of insurance premiums and other payments to the budget system of the Russian Federation;

- 09 - taxpayer (payer of fees) - individual entrepreneur;

- 10 - taxpayer (payer of fees) - a notary engaged in private practice;

- 11 - taxpayer (payer of fees) - lawyer who established a law office;

- 12 - taxpayer (payer of fees) - head of a peasant (farm) enterprise;

- 13 - taxpayer (payer of fees) - another individual (bank client (account holder));

- 14 - taxpayer making payments to individuals;

- 16 - participant in foreign economic activity - an individual;

- 17 - participant in foreign economic activity - individual entrepreneur;

- 18 - a payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties;

- 19 - organizations and their branches (hereinafter referred to as organizations) that have drawn up an order for the transfer of funds withheld from the wages (income) of a debtor - an individual to repay arrears in payments to the budget system of the Russian Federation on the basis of an executive document sent to the organization in in the prescribed manner;

- 21 - responsible participant in the consolidated group of taxpayers;

- 22 - participant of a consolidated group of taxpayers;

- 24 - payer - an individual who transfers funds to pay insurance premiums and other payments to the budget system of the Russian Federation;

- 25 - guarantor banks that have drawn up an order for the transfer of funds to the budget system of the Russian Federation upon the return of the amount of value added tax excessively received by the taxpayer (credited to him), in a declarative manner, as well as upon payment of excise taxes calculated on transactions of sale of excisable goods for limits of the territory of the Russian Federation, and excise taxes on alcohol and (or) excisable alcohol-containing products;

- 26 - founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise or third parties who have drawn up an order for the transfer of funds to repay claims against the debtor for the payment of mandatory payments included in the register of creditors' claims, during the procedures applied in a bankruptcy case;

- 27 - credit organizations or their branches that have drawn up an order for the transfer of funds transferred from the budget system of the Russian Federation, not credited to the recipient and subject to return to the budget system of the Russian Federation;

- 28 - participant in foreign economic activity - recipient of international mail.

Read more about payer status in this material.

Step 4. Specify the payment amount.

The amount of the paid amount in the payment order is given in numbers and words.

The amount in words is indicated from the beginning of the line with a capital letter - in rubles and kopecks (kopecks are written in numbers). In this case, the words “ruble” and “kopeck” are written in full, without abbreviation. If the amount is in whole rubles, then kopecks may not be indicated.

In the amount of numbers, rubles are separated from kopecks by a “–” sign. If the payment is without kopecks, put an “=” sign after the rubles.

For example:

- the amount in words “Twelve thousand three hundred forty-five rubles fifty kopecks”, in numbers “12 345–50”;

- or the amount in words “Ten thousand rubles”, in numbers “10,000=”.

In the electronic order, the payment amount is indicated in numbers in the format established by the bank.

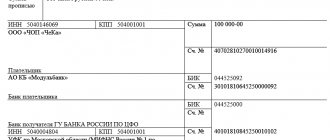

Step 5. Fill in the payer's details.

This:

- TIN and checkpoint;

- name or full name, if you are an individual entrepreneur or other self-employed person;

- bank details: account number, name of the bank, its BIC and correspondent account.

As a rule, the details are already entered into the program, so you don’t have to fill them out. At the same time, if you, for example, have several current accounts, make sure to indicate the one from which you were going to transfer money.

Step 6. Fill in the recipient's details.

They are the same as those of the payer:

- TIN and checkpoint;

- Name;

- account details.

If a payment order for the payment of taxes is filled out, then the corresponding UFK is indicated as the recipient, and next to it in brackets is the name of the revenue administrator (inspectorate or fund). Payment details can be obtained from the Federal Tax Service or the fund.

If the payment is not tax, the payment details are taken, for example, from the contract or invoice for payment.

Step 7. We provide additional codes and ciphers.

This is the table below the payee's bank details. It always indicates:

- Type of operation. The payment order is assigned code 01.

- Code purpose of payment (“Name of pl.”)

From 06/01/2020, the code for the type of income is entered here when making payments to employees. Find out what value to enter in this field in ConsultantPlus. To do everything correctly, get trial access to the system and go to the Review material. It's free.

- Sequence of payment. Payments to counterparties and for self-payment of taxes, fees, and contributions have the 5th priority.

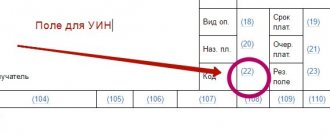

- Code. For current tax and non-tax payments, you need to enter 0. If the payment is made according to a document that has a UIP (unique payment identifier), a 20-digit UIP code is entered.

Step 8. Specify payment information.

If the payment is not tax, everything is simple. In field 24 you must indicate the basis on which the payment is made. This may be the number of the contract, account, etc. Information about VAT (rate, tax amount) is also provided here or a note is made: “VAT is not subject to.”

See also the article “Indicate the purpose of payment correctly in the payment order.”

In tax payments, you additionally need to fill out a number of cells above field 24.

First of all, the BCC is reflected in accordance with the order of the Ministry of Finance on the approval of codes for the corresponding year.

Read about the currently used BCCs in this article.

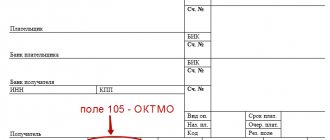

Next comes the OKTMO code in accordance with the All-Russian Classifier of Municipal Territories (approved by order of Rosstandart dated June 14, 2013 No. 159-ST). It must match the OKTMO in the declaration for the relevant tax.

The next cell indicates the two-digit code of the payment basis. The main codes are as follows:

- TP - payments of the current year;

- ZD - voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the tax authority to pay taxes (fees);

- TR - repayment of debt at the request of the tax authority to pay taxes (fees);

- AP - repayment of debt according to the inspection report.

The next field is the tax period. The format XX.XX.XXXX indicates either the frequency of payment of the tax payment or the specific date of its payment. The frequency can be monthly (MS), quarterly (QU), semi-annually (SL) or annual (YA).

Samples of filling out the tax period indicator:

MS.02.2021; KV.01.2021; PL.02.2021; GD.00.2020; 02/04/2021.

This is followed by cells for the number and date of the document that is the basis for the payment. For current tax payments, enter 0 in the number, and indicate the date of signing the declaration (calculation) as the date.

Field 110 “Payment type” is not filled in.

Step 9. Sign the payment order.

The paper payment must be signed by the person whose signature is on the bank card. The electronic order is signed by the person who owns the signature key. If there is a seal, it is affixed to a paper copy.

See also “Basic details of a payment order”.

If you have access to ConsultantPlus, check whether you have filled out payments for taxes and contributions correctly. If you don't have access, get a free trial of online legal access.

"Payment" according to UTII

The above points from 1 to 7 are filled out for payment, both tax and non-tax payments, then we will specify it on the “payment” for UTII

Puntk-8. Payment information (field 24).

Field “24” contains information on what grounds the payment is made, this could be details of a contract, account, etc. For tax payments, for example, for UTII, the entry “Single tax on imputed income for the second quarter of 2021” is made.

In payment orders for taxes, all required fields are filled in.

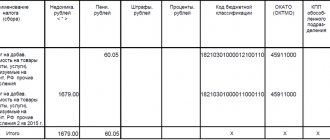

Field “104” displays information about the KBK. The code consists of 20 digits, tax payments begin at 182... For UTII KBK:

| Payment type | KBK number |

| A single tax on imputed income | 182 1 0500 110 |

| Penalties for UTII | 182 1 0500 110 |

| Fine according to UTII | 182 1 0500 110 |

When filling out other fields regarding the UTII payment, the following is indicated:

| - in field “105” “OKTMO” - OKTMO of the municipality in which the company or entrepreneur is registered as a payer of “imputed” tax; - in field “106” “Base of payment” - for current “imputed” payments - “TP”, “ZD” - voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the tax authority to pay taxes (fees); “TR”—repayment of debt at the request of the tax authority to pay taxes (fees); “AP” - repayment of debt according to the inspection report; -in field “107” “Tax period indicator” - the number of the quarter for which UTII is transferred. Let’s say “KV.02.2019”; -in field “108” “Document number” – for current payments “0”; -in field “109” “Date of payment basis document” – for current payments – the date of signing the UTII declaration; - in field “110” “Payment type” is not filled in. |

Clause 9. Signature on the payment order.

On paper, the signature is placed by the person who is responsible and entered into the bank card. The order is signed electronically by the owner of the signature key.

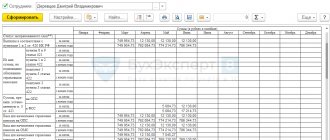

Example of filling out a payment order in 2020-2021: sample

Let's show a sample of filling out a payment order using a conditional example.

Let's say the organization ICS LLC needs to pay personal income tax for January 2021 in the amount of 22,340 rubles.

About the deadlines established for paying personal income tax on wages, read the material “When to transfer income tax from wages?” .

The specific features of the order will be:

- payer status - code 02, since the payer organization is a tax agent;

- KBK for personal income tax - 18210102010011000110;

- the basis of the payment is the TP code, since this is a payment of the current period;

- The frequency of payment is MS.01.2021, since this is a payment for January 2021.

You can fill out the payment order - 2021 on our website.

Sample “payment” for UTII.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Results

The fields of the payment order can be filled in partially or completely depending on the type of payment (regular or tax).

Field 22 “Code” can take the value 0 or be filled in if the payment identifier is known. For tax payments, fields 104–109 are additionally filled in in the payment order. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to indicate the number and date of the document - grounds for paying penalties

A striking example of such a tax is personal income tax paid by an individual entrepreneur to the OSN for himself (not as a tax agent). After all, he must transfer the tax at the end of the year no later than July 15 of the year following the reporting year, and during the year advances are transferred (clause 9 of Article 227 of the Tax Code of the Russian Federation): no later than July 15, October 15 of the reporting year and January 15 of the year following for reporting.

As we can see, the Code does not contain wording regarding this tax, as for other taxes (for example, “the tax is paid no later than the 28th day of the month following the reporting period”), but specific dates are indicated. Accordingly, in field 107 of the personal income tax payment for an individual entrepreneur, you need to put exactly the date for yourself, for example, “07/15/2019” when paying an advance for January - June 2021.

We indicate KBK

The budget classification code (BCC) in accordance with the order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n is given in field 104.

In connection with the transfer of insurance premiums (except for payments for injuries) under the control of the tax authorities, the BCC for contributions has been updated. Moreover, their different values should be used depending on the period in which contributions transferred to the budget after 01/01/2017 were accrued:

- until 2021;

- after 2021.

Read about the meanings of these BCCs in the material “Deciphering the BCCs in 2021 - 18210102010011000110, etc.”

Attention! Changes to the BCC are expected from 2021. See here for details.

Codes in field 106 basis of payment for tax amounts according to requirements

- 6 - the amount is written in words. This field must be filled in on paper orders. The amount is indicated from the beginning of the line with a capital letter, while the word “ruble” in the corresponding case is not abbreviated. Kopecks are given in numbers; the word “kopek” in the corresponding case is also not abbreviated. If the amount is expressed in whole rubles, then kopecks may not be indicated.

- 7 - it indicates the amount in numbers. In paper payments, rubles are separated from kopecks by a dash “-”. If the amount is in whole rubles, then kopecks can be omitted; in this case, the payment amount and the equal sign “=” are given. In an electronic order, the amount is entered in bank format.

Legal basis of the issue

Features of the application of the UTII taxation system are regulated in Chapter 26.3 of the Tax Code of the Russian Federation. Article 346.28 defines the circle of entrepreneurs and organizations that have the right to apply this individual entrepreneur tax system. These are often small shops, studios, shoe repair shops, dry cleaners and many other small organizations and individual entrepreneurs that provide household services to people.

The reporting period for “imputation” is a quarter. Tax obligations must be paid to the budget by the 25th day of the month following the reporting period. If the deadline for payment falls on a non-working day off or holiday, then the payment deadline is postponed to the first next working day. The deadlines for transferring the single tax on imputed income in 2021 are as follows:

If you pay your tax late, the tax office will charge a penalty for each day of delay. In 2021, penalties for late payment are accrued at the rate:

- 1/300 of the refinancing rate for each day of delay in the first 30 days;

- 1/150 of the refinancing rate – after 30 days.

There are several ways for private entrepreneurs to pay UTII obligations:

- in cash through a bank cash desk;

- payment order from the individual entrepreneur's current account;

- on the website of the Federal Tax Service;

- through online terminals and payment systems;

- at the Russian Post office.

In any case, you will need a receipt for payment of UTII for individual entrepreneurs in 2020 - to fill out and present to the bank.

If you don’t want to do the calculations yourself, the 1C:BusinessStart program will help you, which will calculate your contributions, taxes and help you submit reports to regulatory authorities.