Hello, dear readers! In touch, Evgeniy Zhukov is an expert on legal issues on the Papa Help portal. The topic of our article is self-employment in the light of innovations in legislation. You will find out what changes will come into force in 2021, what promises citizens a special tax regime, and also what people working for themselves in Russia should do now.

According to tax data, there are about 465,000 self-employed citizens in Russia. This number does not even come close to reflecting the real state of affairs. In fact, the number of such people, according to the most conservative estimates of experts from the Ministry of Labor, is 17-20 million people . At the same time, some combine self-employment with legal income, while others live only on unofficial earnings.

The new law is currently in force in 23 regions of the Russian Federation, but panic has gripped the entire population of the country, one way or another involved in self-employment, freelancing and remote work without employment contracts. But I urge you not to panic, but to calmly and thoroughly understand all the nuances of the issue. Let’s dot all the “e”s on the topic of self-employment and unofficial income.

Don't switch, a lot of interesting things await you!

Many people are conflicted about the new law. Let's figure out together what's what on the pages of “PAPA”...

Who are self-employed citizens?

These are individuals who receive income from activities in which there is no employer or employees hired under employment contracts.

These are also people who rent out their property. This income (rent) is called professional income. According to Federal Law No. 422-FZ dated November 27, 2018 (hereinafter referred to as the Law on the Self-Employed), these individuals can become payers of professional income tax (PIT). To do this, they must voluntarily register with the tax office and receive the appropriate status.

REFERENCE. Payment of NAP is an experiment that will last ten years: from January 1, 2021 to December 31, 2028 inclusive. At first, the experiment does not operate throughout Russia, but only in certain regions. And only from July 2021 it applies to the entire country.

What are the fines?

Violation of the requirements of federal law threatens financial problems. The tax must be paid by the 25th of the following month after the receipt is issued. This is easy to do through “My Tax”. Payments are also accepted by any Sberbank branch.

Failure to pay entails a fine of 20% of income, then 100% (if the violation is repeated within six months). Therefore, it is better to immediately set up automatic withdrawal of payments, for example, from a Sberbank card. If information about the revenue is not sent to the tax office, then the citizen will be charged 2% of this amount.

If a person does not register as self-employed, he will be an illegal entrepreneur. For this you will be fined more than 3 thousand.

More and more people want to join the ranks of the self-employed. Citizens want to work legally, and the NAP gives them this opportunity. The low level of taxation makes this mode comfortable to use.

Which regions support the new special mode?

From January to June 2021, NAP can be paid in 23 regions. These include:

- cities of federal significance: Moscow, St. Petersburg;

- regions: Volgograd, Voronezh, Kaluga, Leningrad, Moscow, Nizhny Novgorod, Novosibirsk, Omsk, Rostov, Samara, Sakhalin, Sverdlovsk, Tyumen, Chelyabinsk;

- regions: Krasnoyarsk, Perm;

- autonomous okrugs: Nenets, Khanty-Mansi Yugra, Yamalo-Nenets;

- republics: Bashkortostan, Tatarstan.

When selling goods remotely (for example, over the Internet), the place of business is determined by the self-employed citizen. He must choose between the location of the seller and the location of the buyer. This is stated in the letter of the Federal Tax Service dated November 18, 2019 No. SD-4-3 / [email protected] (see “How can a self-employed person determine the place of business when trading via the Internet”).

Starting from July 2021, NAP is allowed to be applied in all constituent entities of the Russian Federation without exception.

Who can become self-employed in 2021

Any citizen of Russia and other countries of the Eurasian Economic Union (Belarus, Armenia, Kazakhstan, Kyrgyzstan) has this right. The main thing is that he receives professional income in the region participating in the experiment on paying NAP (from July 2021 - in any subject of the Russian Federation).

ATTENTION. A person who plans to pay tax on professional income does not have to register as an individual entrepreneur. But if you already have the status of an individual entrepreneur or want to acquire it, then the status of an individual entrepreneur will not become an obstacle to paying NAP.

Fill out documents for registering an individual entrepreneur in a special service

There is a limit on the amount of professional income. If its value since the beginning of the current calendar year has exceeded 2.4 million rubles, the special regime cannot be applied to the self-employed. We'll have to wait until next year when the countdown starts from scratch.

Can a self-employed person be an employee? Yes, he has the right to combine his business and work under an employment contract. He will receive professional income from entrepreneurial activity, and salary from hired work.

Nuances

Re-registration as a self-employed person is possible, but only after all tax debts (fines and penalties) have been settled.

At the end of 10 years, the text of the law will be finalized, after which a similar norm will either be adopted throughout the country or repealed.

Self-employed people are prohibited from hiring workers . Only the conclusion of a civil agreement with workers is allowed.

The maximum income limit for SZ for a calendar year has been set at 2,400,000 rubles. If it is exceeded, the person will be automatically deregistered.

The fee will be charged on “professional income” in a fixed amount:

- 4% of the taxpayer’s profit from the sale of goods and services in favor of individuals;

- 6% from the income of a self-employed person from the sale of goods and services to individual entrepreneurs and legal entities.

Consequently, the term NPA includes not only the services provided, but also the profit from the rental of real estate.

NAP is the only tax that SZ citizens will pay to the budget. They are exempt from paying VAT and personal income tax . Payment must be made no later than the 25th day of the new month.

Such a citizen will not accumulate work experience, since he does not pay fees to the Pension Fund. Production will only occur when free and hired work is combined. Or the payer himself will want to voluntarily make payments to the Fund. To get 1 year of work experience, it is enough to transfer 30,000 rubles.

Types of activities for the self-employed in 2021

What can a self-employed person do? Tutoring, cleaning premises, preparing homemade baked goods, providing cosmetologist services, etc. Also, owners of apartments and rooms for rent often switch to paying NAP.

At the same time, there are types of business that do not give the right to become a professional tax payer. The black list includes:

- sale of excisable goods;

- sales of products subject to mandatory labeling (tobacco products, medicines, shoes, etc.);

- resale of goods, property rights (except for property that was used for personal, household and other similar needs);

- extraction and (or) sale of minerals;

- intermediary services on the basis of commission, commission or agency agreements (except for the situation when the intermediary uses cash register equipment registered by the principal, principal or principal);

- services for delivering goods and receiving money from the buyer (except for cases when cash register equipment registered by the seller of the goods is used).

Object of taxation and restrictions

The object of taxation means earnings from the sale of goods, services and property rights, with the exception of:

The date of completion of the transaction is the day the income is received. It is on this day that the self-employed must register the transaction in the mobile application and generate a receipt for the sale. The check can be transferred to the client either in paper form or electronically via SMS or email.

How to become self-employed in 2021

Registration in the My Tax application

To become a tax payer, you must submit an application through the “My Tax” mobile application.

First you need to download this application for free from the Federal Tax Service website and install it on your smartphone, tablet or computer. Then, using the same device, take a scan of your passport and your photo. Then go through a simple registration procedure in the application. A paper application with the personal signature of a self-employed citizen is not required.

REFERENCE. You can register as self-employed in another way - through the taxpayer’s web account of the “Professional Income Tax”. In it you need to indicate the TIN and access code to the taxpayer’s personal account. In this case, you will not need any passport data, or a photo, or a paper application.

Tax officials will check the information provided. If everything turns out to be in order, the inspectors will send the citizen a notification about registration. It will come through the My Tax app.

Transition to self-employed from other tax regimes

It is possible that before the transition to the NAP, a person had already received professional income and paid another tax on it: UTII, a single tax according to the simplified tax system, a single agricultural tax, a tax according to the personal income tax or personal income tax. Then, by registering in the “My Tax” application, an individual is obliged to abandon the previous tax regimes. The corresponding application must be submitted to the Federal Tax Service at the place of registration or place of business. This must be done within one month from the date of registration as self-employed. If the deadline is missed, the inspectors will cancel the registration.

Submit a notice of refusal from the simplified tax system, UTII or unified agricultural tax via the Internet Submit for free

IMPORTANT. Is it possible to transfer only part of the business income to NAP, and leave the other part to the simplified tax system, UTII, Unified Agricultural Tax, PSN or the main system? No you can not. Combining the professional income tax with the listed tax regimes is unacceptable (subclause 7, clause 2, article 4 of the Law on the Self-Employed). It’s another matter if an individual is engaged in business and at the same time works for hire. In this case, his salary will be subject to personal income tax, and professional income will be subject to NPT.

The purpose of introducing the law on self-employed

When introducing Federal Law No. 422 on self-employed citizens of the Russian Federation, the legislator pursued several goals at once.

First of all, this is a large-scale “removal from the shadows” of people who currently do not have an official place of work, but at the same time regularly receive income from any activity. In order to understand the scale, at the beginning of 2021 the number of self-employed people was about 22,000,000 people. The second goal is to generate additional income for the benefit of the state. With such a huge number of people belonging to this category, the introduction of a tax law for self-employed citizens has been long overdue. This conclusion can be made by referring to the legislation, and specifically to the Tax Code of the Russian Federation. It was there that the concept of a self-employed person appeared in 2021, but so far no legal consequences associated with obtaining such status have been determined.

In addition, the introduction of a law for the self-employed from January 1, 2019 should regulate at the legislative level both the rights and obligations of both parties (both customers and service providers), since civil legal relations will fall under the scope of this federal law and in the event of violation, any of the parties will be able to apply for restoration of their violated rights without any problems.

The last point is rather a formality, since in order to prove the existence of certain agreements and be able to defend the right to their implementation, an agreement must previously be concluded between both persons, which will be the subject of the proceedings. In case of its absence, in fact, you will be deprived of the right to protect your interests by the state.

Deregistration of a self-employed person

To deregister as an NPT payer, you need to submit an application through the “My Tax” application. This is done in one of the following cases:

- Professional income since the beginning of the year has exceeded 2.4 million rubles.

- The citizen began to engage in activities from the “black” list.

- A self-employed person now has hired workers.

- The citizen has lost the desire to be a NAP taxpayer.

Inspectors will deregister a self-employed citizen on the day the application is submitted.

It may happen that a person continues to consider himself self-employed, although his income has exceeded the limit, he has hired employees, or he has started running a business from the “black” list. If employees of the Federal Tax Service discover this, they themselves will stop registering an individual as an NPT payer, without waiting for an application from him.

Why can't the professional tax law be ignored?

Based on the results of preliminary surveys, at the end of 2018, only 0.5% of the total number of people employed in this area were ready to register as self-employed citizens. In this regard, in order to stimulate people’s desire to “come out of the shadows,” the adopted law contains a fairly strict system of sanctions that will be applied to those who decide to evade official registration.

If a person is caught carrying out such activities, a fine will be collected from him for the first time. The fine is currently 20% of the identified income, but cannot be less than 1,000 rubles).

If this measure does not work on you, and within the next 6 months after the first violation you commit a second violation, the fine will be more significant. Thus, in the event of a relapse, you risk losing 100% of your identified income, but not less than 5,000 rubles).

Thus, if your income is large enough, you inevitably risk suffering large losses if one of your transactions is detected by the Tax Service.

Taxation for self-employed citizens in 2021

What income is taxed

NPA is paid on professional income received within one calendar month. There are two rates.

If the client is an individual without individual entrepreneur status, then the rate is 4%.

If the client is an organization or individual entrepreneur, then the rate is 6%.

When calculating tax, income is not taken into account:

- from the sale of: real estate, transport, personal property, securities, derivative financial instruments, shares and shares in the authorized capital;

- from the transfer of rights to real estate (except for rental housing);

- from activities under a simple partnership agreement or trust management of property;

- from the provision of services under a civil contract, if the customer is the contractor’s employer, or a former employer from whom the self-employed citizen left less than two years ago;

- from the assignment and assignment of rights of claim;

- received in kind;

- from the arbitration department, from the activities of a mediator, appraiser, private notary, lawyer.

How income is accounted for

Money from the sale of goods (works, services, property rights) are recognized on the day they are received.

Revenue received under a commission agreement (order, agency agreement), when the intermediary participates in the settlements, is recognized on the last day of the month in which the money is received by the intermediary.

Income that was previously taken into account under any tax system before the transition to NAP does not need to be reflected. This rule applies even if the money arrived after such a transition.

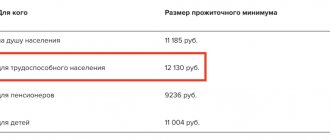

Tax deduction for self-employed

It is determined according to the following rule:

- if professional income is received from an individual, the deduction is equal to 1% of the amount of income;

- if professional income is received from an individual entrepreneur or organization, the deduction is equal to 2% of the amount of income.

The deduction amount, calculated on an accrual basis from the moment of switching to NAP, cannot exceed 10,000 rubles. for the entire period of activity as a self-employed person.

An individual who has lost the status of an NAP payer without spending all 10,000 rubles. deduction, retains the right to use the balance. It will be restored upon re-registration in this status. In a situation where 10,000 rub. have been spent, you cannot use the deduction again.

IMPORTANT. Temporary rules have been introduced for NPAs payable from 1 July to 31 December 2021. During the specified period of time, 12,130 rubles are added to the balance of the “regular” deduction. The received amount can be used unlimitedly, regardless of revenue. Due to the deduction, the debt on the NAP is paid off, and the remaining part goes to pay the current tax. The balance of the deduction is carried over to 2021 within the limit: no more than the balance that was listed as of June 1, 2021. Anyone who became self-employed for the first time after June 1, 2021 will be able to transfer no more than RUB 10,000 to 2021. (See “New “anti-virus” benefits: deduction for the self-employed, increase in child benefits, rent discount”).

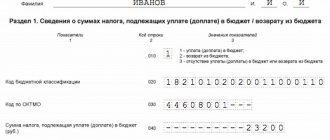

How to calculate tax for self-employed people: example

Teacher Aleksandrov was registered as a NAP payer at the beginning of February 2021.

In February, he conducted classes at the training center and received payment in the amount of 150,000 rubles. In the same month, Alexandrov provided tutoring services to private clients, and earned 50,000 rubles from this.

The deduction amount is equal to RUB 3,500 ((RUB 150,000 x 2%) + (RUB 50,000 x 1%)).

The NPA payable for February 2021 will be 7,500 rubles ((150,000 rubles x 6%) + (50,000 rubles x 4%) – 3,500 rubles).

In the future, Alexandrov will be able to apply a deduction in the amount of no more than 6,500 rubles (10,000 rubles - 3,500 rubles).

Paying tax for self-employed people

The tax authorities calculate the amount of NAP payable. Data for calculations is provided by a self-employed citizen. He must do the following:

- In the “My Tax” application, indicate how much professional income and from whom it was received in cash, credited to a bank account or to a card.

- Create a receipt and send it to the buyer electronically or in paper form. The receipt is generated in the “My Tax” application, so there is no need to buy cash register equipment. Deadline for transferring a check: for payments in cash or electronic means of payment - immediately after receipt of money; for other forms of payment - no later than the 9th day of the month following the month in which the money was received.

IMPORTANT. The professional income tax transferred in 2019 will be returned to payers, including those who have already been deregistered. From the Decree of the Government of the Russian Federation dated May 29, 2020 No. 783, it follows that there is no need to write an application. It is only necessary that a bank card be linked in the “My Tax” application (see “New “anti-virus” benefits: deduction for the self-employed, increased child benefits, rent discount”).

At the end of the month, inspectors will calculate the amount of NPA payable. They will report the result to the self-employed individual no later than the 12th day of the month following the end.

Tax must be paid no later than the 25th day of the month following the end. If the amount payable is less than 100 rubles, then it will be added to the tax for the next month. Overpayments can be returned or offset against future periods.

ATTENTION. When receiving professional income, the NPT payer is exempt from value added tax (except for VAT on imports), personal income tax and insurance premiums. But a self-employed person is required to pay taxes on personal property: land, transport and personal property taxes.

Submit a notification and submit all declarations for individual clients with a 50 percent discount

Automatic payments and tax capital

The bill presented to the Russian public contains several innovative solutions that are unprecedented for Russia.

In particular, tax authorities want tax payment to occur in a fully automatic mode for each transaction on the taxpayer’s account.

For this purpose, self-employed people will be offered a special mobile application, which will automatically not only debit money from the account, but also inform the tax authorities about the amounts. The application will use the principle of online cash registers, which also provide tax authorities with information about all punched checks.

In addition, to make coming out of the shadows attractive, officials are ready to provide individuals who earn money on their own with so-called tax capital in the amount of 30 thousand rubles.

No, the Federal Tax Service, of course, will not allocate this money for business development. And in general, as its head Mishustin told Vladimir Putin, no transfers to potential taxpayers are provided. They will only receive a deduction of 30 thousand rubles to pay a single fee when installing a mobile application and registering in it.

The first 30 thousand of tax will be paid through this deduction, and only then will the taxpayer begin to pay his own money.

However, the deduction can only be used for partial repayment of a single payment. Initially, it was only about tax capital in the amount of 10 thousand rubles.

At the same time, self-employed clients will also receive a bonus. They are provided with a tax deduction in the amount of 1.5% of the paid NAP, but not more than 10,00 rubles per year.

Experts from the Ministry of Finance claim that both the rates and the conditions of deduction for the self-employed are not yet final, the discussion process is underway.

Until now, only tax deductions have been practiced in Russia, in other words, refunds of funds already paid to the budget. Providing an advance deduction has been proposed for the first time.

Pros and cons of self-employment

Pros:

- low tax rate;

- simple, convenient and free registration;

- no need to purchase a cash register;

- there is no need to pay insurance premiums;

- There is no need to keep records and submit reports.

Minuses:

- You cannot hire employees;

- The period when a citizen pays NAP is generally not counted towards the insurance period. And only if a person voluntarily makes pension contributions, the time of “self-employment” is included in the length of service when assigning a pension;

- expenses do not reduce the taxable base;

- This regime is allowed to be applied as long as revenue from the beginning of the year does not exceed 2.4 million rubles:

- You can become self-employed in 2021 only in 23 regions.

Keep records and submit all individual entrepreneur reports via the Internet

Tax payment procedure

Article 11 of the Law defines the procedure for its payment. Professional income tax is paid monthly. All main operations take place in the My Tax application.

The application is very easy to use and has a user-friendly interface

Before the 12th day of each month, the tax office notifies you in the application about the amount of tax to be paid. It will then need to be paid no later than the 25th of the same month.

If the tax amount for a month is less than 100 rubles, it will be added to the amount for the next month.

The law also provides that a taxpayer can simplify the procedure by allowing the Federal Tax Service to send tax payment requests directly to the bank. In this case, the write-off will occur without any action on your part.

The “My Tax” application is key to simplifying the interaction between the taxpayer and the Federal Tax Service. Thanks to it, you will be able to pay taxes and take into account all your taxable income, literally without leaving your home, through your phone.

Video: about using the “My Tax” mobile application

https://youtube.com/watch?v=5N4UDvznzVU

At first glance, the introduction of a special tax regime for the self-employed is an excellent idea by the legislator. This significant concession in the form of a reduction in tax for individuals from 13% to 4–6% should facilitate their entry into the legal field. In addition, this situation is beneficial to both parties. The state will receive additional revenues to the budget, and taxpayers will have the opportunity to act within the law without fear of deception from their counterparties.

- Author: ozakone

Rate this article:

- 5

- 4

- 3

- 2

- 1

(1 vote, average: 4 out of 5)

Share with your friends!

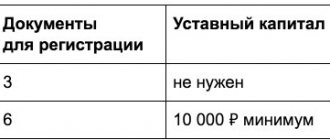

The main differences between individual entrepreneurs and self-employment

Let's compare the most significant parameters in the work of a tax payer and an individual entrepreneur in a different mode (see table).

Comparison of the activities of a self-employed person and an individual entrepreneur in a different mode in 2021

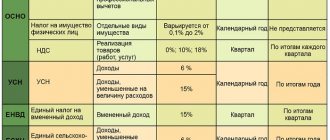

| NAP payer | Individual entrepreneur in a different tax regime |

| Place of business | |

| 23 regions | UTII and PSN are regions where these special regimes have been introduced in relation to specific types of activities; OSNO, simplified tax system and unified agricultural tax - the entire territory of Russia. |

| Income restrictions | |

| 2.4 million rubles. year to date | Depends on the tax regime: “simplified” - 150 million rubles. year to date; PSN - 60 million rubles. year to date; the rest - without restrictions. |

| Limitations on the number of employees | |

| You cannot hire a single employee under an employment contract | Depends on the tax regime: “simplified” - no more than 100 people; UTII - no more than 100 people; PSN - no more than 15 people; the rest - without restrictions. |

| Tax rate | |

| 4% of revenue received from individuals; 6% of revenue received from organizations and individual entrepreneurs | Depends on the tax regime. Under the basic system, personal income tax is 13% of the difference between income and professional deductions, VAT is 20% of the difference between accrued tax and deductions; with “simplification” - in the general case, 6% of income or 15% of the difference between income and expenses; for PSN - in general, 6% of potential income; for UTII - 15% of imputed income; for Unified Agricultural Tax - in general, 6% of the difference between income and expenses plus VAT on a general basis. |

| Payment of insurance premiums | |

| No need to pay | Need to pay: fixed contributions “for yourself”; contributions from employee salaries. |

| Reporting | |

| No need to introduce | You need to submit: — tax returns (for everyone except individual entrepreneurs with a patent); — reporting on insurance premiums from employee salaries; — reporting to the Pension Fund of the Russian Federation on insured persons and personnel activities (if there are employees); — statistical reporting (in some cases). |

| Record keeping | |

| No need to lead | Need to lead: — tax accounting; — personnel records (if there are employees). Accounting is carried out at will. |

| Cash register | |

| Not required | In general, PSN is not needed (with the exception of some types of business, for example, hairdressing services). Under other tax regimes, in most cases, it is needed by everyone who makes payments to individuals (except for delivery trade and a number of other exceptions). |

| Formation of insurance experience for a pension | |

| In general, there is no length of service. If a person voluntarily pays pension contributions (in 2021 - 32,448 rubles per year), then the length of service is formed. | Experience is being formed |

| Payment of sick leave benefits | |

| Not provided | In general, it is not provided. If an individual entrepreneur voluntarily pays social insurance contributions “for sick leave” (in 2021 - 4,221.24 rubles per year), then benefits are paid. |

Freely calculate contributions “for yourself”, taxes according to the simplified tax system and UTII, fill out payments for taxes and contributions

Deductions and benefits

For all taxpayers, a tax deduction in the amount of 10 thousand rubles is provided on a cumulative basis. The tax is reduced by the taxpayer independently on the following grounds:

- for transactions with individuals no more than 1% of the tax rate;

- for transactions with legal entities no more than 2% of the tax rate.

The period for using the tax deduction is not limited. If a self-employed person is deregistered for some reason and becomes a taxpayer again, the deduction is not lost. It can be used at any time.

What to choose in the end - individual entrepreneur or self-employment?

If a novice businessman works in a region where it is allowed to pay NAP, he has a choice: obtain self-employed status or become an entrepreneur in a different mode. Each case is individual, and it is impossible to give universal advice.

In practice, the status of individual entrepreneurs and tax regimes not related to the payment of non-refundable income are chosen by those who plan to conduct business on a grand scale. Namely, to increase turnover, hire staff, expand the sales network, etc. But the self-employed in 2021, as a rule, are people for whom income is a side income. These are company employees who do something else in their free time (baking for sale, grooming animals, etc.). Another example is housewives. For them, the main thing is child care, and small business (selling handmade jewelry, cloth dolls, etc.) is an addition.

Please note: newly registered entrepreneurs can use the Kontur.Elba web service for free for a year, which allows you to conduct all necessary accounting and submit reports via the Internet.