An order on the right to sign primary documents is written in cases where the head of an enterprise needs to authorize one of his subordinates to endorse various documentation. As a rule, this practice is common in large and medium-sized organizations, where the director does not physically have the opportunity to get acquainted with and endorse all current papers.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Why and when are they given the right to sign papers?

Documents are endorsed not only by the manager, but also by other employees - within the limits of their functionality.

Accountants endorse balance sheets, accounts and reconciliation reports, economists – plans, reports and calculations, lawyers – contracts, specifications and claims, personnel officers – personnel orders, work books and memos. Who and what exactly is authorized to endorse is included in the sample order granting the right to sign or power of attorney. The right of first and second signature is distinguished. The first belongs to the leader. To grant such a right, a sample order on the right of first signature is used. The second is provided to an authorized representative - an employee of a budget organization. Such information is reflected in:

- order;

- job description;

- position;

- powers of attorney.

The first three relate to internal documentation. It is unacceptable to register them in the name of a person who is not in an employment relationship with the organization. But a power of attorney can be issued both to a regular person and to a third party.

Personal identification procedure

Even if the direct managers of the counterparties do not take any action to abandon the company’s activities and recognize the fact that they act as the real managers of the commercial structure, the tax service begins to initiate a handwriting study , which can confirm the fact that those written on the documentation signatures are not management signatures.

In such situations, tax officials often refer to Art. 252 of the Tax Code of the Russian Federation, as well as the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 53.

Today, it is customary to understand documented expenses as all expenses that have documentary evidence. In this case, all supporting documents must be drawn up in accordance with the current provisions of the legislation of the Russian Federation.

All documents with unreliable or contradictory data, or incomplete information, cannot serve as a basis for acquiring tax benefits . Due to the fact that the primary documentation contains the signature of a person who does not have the appropriate authority, this document will be recognized as containing false information. As a result, he cannot confirm the VAT deduction in any way.

The right to sign primary documents: order or power of attorney

Any option is suitable, but it is necessary to specify which documents the employee can endorse. It happens that the accounting department issues a power of attorney to sign a delivery note one-time - to receive a specific batch of goods or products. Usually we are talking about granting powers to a person who performs such tasks occasionally.

The director must approve the list of persons authorized to sign primary documents by order.

IMPORTANT!

Responsibility for the execution of a business transaction and the accuracy of the data lies with the person who endorsed the primary document, and not with the person who keeps the accounting records.

Terms of office also differ. Thus, a power of attorney is limited to the period specified in it. Local acts are valid until the employment relationship with the employee is terminated or until it is canceled or a new version is adopted. You can specify the duration of powers in the document itself, for example, set a one-year period. Often powers are assigned for the period of absence of an employee; the period in this case is determined by the period of replacement.

Who should sign the document if the director is absent?

If the person with the absolute right to sign is for any reason absent from his/her workplace at the time the signature is required, this option should be provided in advance. There are several ways to resolve this situation:

- Provide in the constituent documents the possibility of signature for the deputy director or other official.

- Issue a power of attorney for signature by an authorized person (you can do this immediately for a long period, for example, for a year).

- Issue an order or instruction for the right to sign a specific document (one-time option).

- Use a facsimile version of the signature in cases where this does not contradict the law.

Signed by I.O.

If the document is signed by the acting director or his deputy, the right to sign is delegated to him on the basis of the above documents. At the same time, there is no need to indicate “acting” in the signature itself; according to GOST rules, only the name of the position is required, which for the employee who temporarily assumed management responsibilities remained the same. This must be indicated when the document is endorsed. It is also unacceptable to use a slash and the use of the preposition “for” before the signature.

IMPORTANT INFORMATION! Documents signed by the acting official in violation of the design of this detail (with the letters “i.o”, slash or preposition “for”) cannot be notarized, they can be challenged in court.

In the place of the director - the signature of the acting director

If on the form the position of director is in the place intended for signature, and the person signing is acting, then you need to cross out the printed phrase and enter the name of the real position of the signatory. The same should be done if the surname and initials of the absent manager are printed. Corrections are made in handwritten form.

What cannot be a facsimile?

An imprint of a sample signature, which is so easy to give to any employee and therefore very convenient to use, cannot be left on all documents. Legal grounds prohibit placing such a signature, which does not require the “live” participation of an authorized person, on the following documents:

- related to bank payments;

- various statements;

- personnel papers;

- declarations;

- invoices;

- cash documents;

- contracts that need to be registered;

- powers of attorney.

You can leave a facsimile signature when exchanging documents within the framework of one contract if:

- a contract signed in the usual way provides for this possibility;

- There is an agreement between the partners on the use of facsimile clichés.

Such papers can be commercial offers, letters, acts, specifications, etc.

What to write in the order

Formulations are at the discretion of the administration. Typically, a sample order for the right to sign documents contains general phrases, and a power of attorney details the rights. If we are talking about the endorsement of contracts, representation of the interests of a budgetary organization in third-party institutions, government bodies, then it is advisable to issue a power of attorney. Counterparties always insist on confirmation of the representative’s authority, requiring a power of attorney.

When approving personnel documents, no reference is made to the details, but when approving contracts, on the contrary, the date and number of the authorizing act are indicated.

Sample collection

To date, there is not a single legislative act that would require the need to verify the signature of the counterparty. But despite this fact, increasingly prudent managers of commercial organizations require from all their counterparties special signature samples belonging to the persons who are directly responsible for signing primary documentation, as well as invoices.

Based on this, if the company’s representatives still manage to collect a sufficient amount of evidence that will confirm the reality of the operations, and also if there is an appropriate level of caution when choosing a partner, then it is quite possible that the organization will be able to eliminate all the claims of the tax service . Similar processes take place in higher tax authorities or in court.

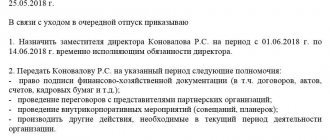

Sample order on the right to sign primary documents

Agreement, invoice, delivery note, invoice are the most common official documents of primary accounting. The list is open: the administration can expand it by establishing other forms in the accounting policy.

The primary document first of all confirms the fact of a business transaction. And it also serves as the basis for recording transactions in accounts. Issued upon completion of the fact or after the completion of the transaction.

Personal identification procedure

Such processes require the need to carry out a signature identification procedure , which must belong to the person who put his own signature in the transcript. This stage is extremely necessary due to the fact that now almost all tax audits are carried out with the identification of counterparties that deliberately refuse to fulfill their own tax obligations.

Even if the direct managers of the counterparties do not take any action to abandon the company’s activities and recognize the fact that they act as the real managers of the commercial structure, the tax service begins to initiate a handwriting study , which can confirm the fact that those written on the documentation signatures are not management signatures.

Ultimately, this will serve as a basis for the tax office to officially refuse to recognize such expenses for the enterprise .

In such situations, tax officials often refer to Art. 252 of the Tax Code of the Russian Federation, as well as the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 53.

Today, it is customary to understand documented expenses as all expenses that have documentary evidence. In this case, all supporting documents must be drawn up in accordance with the current provisions of the legislation of the Russian Federation.

All documents with unreliable or contradictory data, or incomplete information, cannot serve as a basis for acquiring tax benefits . Due to the fact that the primary documentation contains the signature of a person who does not have the appropriate authority, this document will be recognized as containing false information. As a result, he cannot confirm the VAT deduction in any way.

Sample order for the right to sign financial documents

Financial papers show solvency and profitability. In this sense, the balance is informative. It reflects the financial position at the end of the period. By looking at the balance sheet, a specialist can easily determine whether the counterparty has sources of funds, property, or only debts and obligations. Other financial papers: consolidated income statement, statement of funds and their use.

Loans and credit agreements can also be classified as financial securities.

Sample order on the right to sign invoices

An invoice is proof of the completed shipment of goods or provision of services. The cost is also indicated. Registration is regulated by Article 169 of the Tax Code of the Russian Federation, which allows the following options for signing a paper version:

- manager and chief accountant;

- leader;

- by another person by order;

- person by proxy.

The electronic version is endorsed with an enhanced qualified electronic signature.

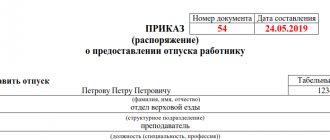

Content

The order for signing invoices must include the following information:

- The header of the document.

- Number and title, date of approval, and place of compilation.

- The “body” of the document (this point will be covered in more detail below).

- Applications.

- Signature of the head of the organization.

- List of persons who must read this document and sign.

We invite you to read other materials from our experts about invoices. Read about what a code in an invoice is, what a customs declaration or customs declaration number is, how to find out the values and units of measurement by code, how to correctly indicate transaction codes, how to correctly fill out the “address” and “country code” columns, and also what information about the recipient and sender of the cargo should be indicated in the document.

Sample order for the right to sign the chief accountant

Previously, monetary and settlement documents not signed by the chief accountant were considered invalid and were not accepted for execution. With the adoption of the Federal Law “On Accounting” No. 402, the situation changed. According to Art. 73, accounting must be entrusted by the head to the chief accountant. Alternative options include another employee and a third-party accountant. It is allowed for the manager to conduct accounting personally, unless we are talking about a credit organization.

How to revoke signature rights

A previously issued act is canceled by issuing a new one - a repealing one. It must indicate:

- which act is being repealed;

- from what date;

- column for reference.

Informing the authorized person about the cancellation is mandatory. Such a person can sign both on the order itself and on a separate familiarization sheet.

A power of attorney executed on the organization's letterhead is canceled by an administrative document of the head. Notarized - by a notary. The provision of information is mandatory, as in the case of cancellation.

Design features

It should be noted that currently there is no single template according to which an order should be drawn up . However, when developing this document, the following rules must be adhered to:

- the document is drawn up on A4 paper;

- the content should be short, clear and concise;

- Only business style writing is allowed;

- The presence of grammatical and lexical errors is unacceptable;

- All necessary details must be provided (name of organization, registration data, etc.).

This document must contain all the necessary signatures. As noted earlier, the order is signed by the general director and the persons mentioned in it.

Regarding the seal of a legal entity, it should be noted that in this case it is optional, since this document is internal. A stamp is only needed if a copy of the order is made .

Thus, the order to sign invoices is an integral part of the internal document flow of any organization. In this regard, it is necessary to be able to correctly compose and format it.