The provisions of Law No. 402-FZ of December 6, 2011 “On Accounting” separate the concepts of preparation and approval of annual accounting reports (clauses 8, 9, Article 13 of Law No. 402-FZ). It becomes fully formed after the paper copy is signed by management or certified with an electronic signature by the corresponding electronic version of the report, but the reporting of companies of different organizational forms is approved in different ways. In addition, due to the complicated situation in the country due to the pandemic, legislators have made changes to the deadlines for approving reports. Let's try to understand this issue.

Approval of annual reporting in LLC and changes in the timing of the procedure

According to Law No. 14-FZ of 02/08/1998 “On LLC”, approval of the annual report and annual balance sheet is attributed to the powers of the general meeting of owners (clause 6, paragraph 2, article 33), which is convened at least once a year. In this case, the company's charter must specify the time limit for convening the meeting - no earlier than 2 and no later than 4 months after the end of the reporting year (Article Law No. 14-FZ). Those. LLC reporting should be approved within a very strict time frame - from March 1 to April 30. The decision made by the meeting is recorded in the minutes; the date of its holding is the date of approval of the reporting.

These are the general rules for the procedure for approving the results of an LLC’s activities for the year. But with the onset of a difficult sanitary and epidemiological situation in the country, Law No. 115-FZ dated 04/07/2020 was adopted, and the Ministry of Finance published information message No. IS-accounting-26 dated 04/09/2020, which recorded changes regarding the timing of approval of annual reporting (consolidated ) enterprises of various organizational and legal forms.

Thus, the second part of Art. is suspended. 34 of Law No. 14-FZ, which determines the timing of holding meetings of LLC owners in 2021. This year (and so far only this year) different time frames are established - after 2 months and no later than 9 months after the end of the financial year. This means that the annual accounting statements of the LLC for 2021 must be approved no later than September 30, 2021.

The amount of debt is significant

In this case, the amounts of both receivables and payables should be disclosed separately. This can be done by entering new lines in the appropriate section or additionally deciphering existing balance lines.

So, an advance payment for the construction of a building (if it is a significant amount) must be shown in a separate line of section I of the balance sheet. Or enter the substring as a decryption of line 1150.

Apply essentially the same procedure to other types of debt, depending on whether they are long-term or short-term debts.

The correctness of this approach was confirmed by officials of the Ministry of Finance of Russia in letters dated January 9, 2013 No. 07-02-18/01, dated April 11, 2011 No. 07-02-06/42 and dated January 24, 2011 No. 07-02- 18/01.

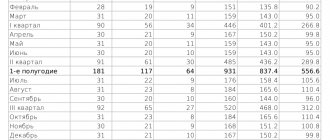

An example of how to reflect in the balance sheet information about advances issued (received) against the upcoming delivery of goods. VAT on the transferred advance was accepted for deduction

In November 2015, Alpha LLC received an advance from the buyer Torgovaya LLC for the upcoming delivery of goods in the amount of 118,000 rubles. (including VAT – 18,000 rubles). In December 2015, the organization transferred an advance to the supplier Master LLC in the amount of 236,000 rubles. (including VAT – 36,000 rubles). The Alpha accountant reflected these business transactions with the following entries:

Debit 51 Credit 62 subaccount “Settlements on advances received” – 118,000 rubles. – an advance has been received from the buyer for the upcoming delivery of goods;

Debit 76 subaccount “Calculations for VAT on advances received” Credit 68 subaccount “Calculations for VAT” - 18,000 rubles. (RUB 118,000 × 18/118) – VAT is charged on the advance received;

Debit 60 subaccount “Settlements for advances issued” Credit 51 – 236,000 rub. – an advance payment has been made towards the upcoming delivery of goods;

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances issued” – 36,000 rubles. – VAT transferred to the supplier as part of the advance payment is accepted for deduction (after receiving an invoice from the supplier for the amount of the advance).

In 2015, Alpha LLC did not ship goods to Torgovaya LLC on account of the advance received. The goods were also not received from the supplier Master LLC against the advance payment transferred by Alpha.

Thus, as of December 31, 2015, account 62 of the subaccount “Advances received” contains accounts payable in the amount of RUB 118,000. The debit balance of account 76 subaccount “Calculations for VAT on advances received” is 18,000 rubles. On account 60 subaccount “Settlements for advances issued” there are receivables in the amount of 236,000 rubles. The balance on the credit of account 76 subaccount “Calculations for VAT on advances issued” is 36,000 rubles. According to the accounting policies of the organization, all these debt amounts are immaterial.

In the Balance Sheet, the accountant reflected, in particular:

– on line 1230 “Accounts receivable” – 200,000 rubles. – advance payment to the supplier minus VAT accepted for deduction;

– on line 1520 “Accounts payable” – 100,000 rubles. – advance payment from the buyer minus VAT payable to the budget.

Guided by the clarifications of the Ministry of Finance of Russia, the balances on the debit of account 76 subaccount “Calculations for VAT from advances received” and the credit of account 76 subaccount “Calculations for VAT from advances issued” are not reflected in the balance sheet.

Moreover, even if you did not exercise the right to deduct VAT from the advance paid to the supplier (for example, all the necessary conditions for deducting VAT from the advance were not met), the supplier’s receivables will still be reflected in the Balance Sheet minus VAT.

That is, what matters here is the fact that the organization has the right to deduct tax. And it doesn’t matter when she used it: at the time of transferring the advance payment or later, when goods, work or services on account of this advance payment are received and registered.

An example of how to reflect information on advances issued in the balance sheet. VAT on the transferred advance payment was not deducted

In December 2015, Torgovaya LLC transferred an advance to the supplier in the amount of 236,000 rubles. (including VAT – 36,000 rubles). No goods were received from the supplier against the advance payment transferred in 2015. The agreement with the supplier does not provide for the payment of an advance payment. Therefore, having transferred the prepayment, the accountant did not accept VAT as a deduction.

The Hermes accountant reflected these business transactions with the following entries:

Debit 60 subaccount “Settlements for advances issued” Credit 51 – 236,000 rub. – an advance payment has been made towards the upcoming delivery of goods;

Debit 19 subaccount “VAT on advances issued” Credit 76 subaccount “Calculations for VAT on advances issued” – 36,000 rubles. – VAT transferred to the supplier as part of the advance payment is reflected.

As of December 31, 2015, account 60 subaccount “Settlements for advances issued” contains receivables in the amount of RUB 236,000. The balance on the credit of account 76 subaccount “Calculations for VAT on advances issued” is 36,000 rubles. According to the accounting policies of the organization, all these amounts are immaterial.

In the Balance Sheet, the accountant reflected, in particular:

– on line 1220 “Value added tax on acquired assets” – 36,000 rubles. – the amount of VAT to be deducted;

– on line 1230 “Accounts receivable” – 200,000 rubles. – supplier’s receivables minus VAT.

The balance on the credit of account 76 subaccount “Calculations for VAT on advances issued” is not reflected in the balance sheet.

The procedure for approving annual reports in a joint-stock company

A different system for approving financial statements has been developed for joint-stock companies; it consists of several stages and is regulated by the provisions of Law No. 208-FZ of December 26, 1995 “On Joint-Stock Companies.” The deadline for approval of the balance sheet is set in the range of 2 and no later than 6 months after the end of the reporting year, i.e. from March 1 to June 30. First, the accuracy of the data in the reports is confirmed by the audit commission, then (30 days before the day of convening the meeting of shareholders) the reporting package is approved by the board of directors.

If there is no such body in the JSC, the reporting is approved by the head of the company. And only after completion of all the listed stages is a general meeting of shareholders convened. True, approval of reporting may also fall within the competence of the board of directors if such a provision is enshrined in the company’s Charter (Article of Law No. 208-FZ).

For both LLC and JSC, approval of reporting is documented in the minutes of the general meeting.

The conditions for the duration of the period for convening a meeting of shareholders were adjusted in 2021 by the above-mentioned legislative norms, i.e. the deadline for approving the balance sheet and reporting of the joint-stock company has been increased and falls on the period from March 1 to September 30.

Date of approval of statements in the balance sheet: what to put

Since 2021, all enterprises, except for SMEs, submit their reports to the Federal Tax Service in electronic format. The title page of the electronic version of the balance sheet contains not only a line to indicate the date of preparation of the report, but also a field “Date of approval of statements.” In this line, the company enters the date of approval, if before the reporting was submitted to the Federal Tax Service, a general meeting was held, the reporting was approved and the result was recorded.

But since legislators allow more time for approval of balance sheets and statements than for submitting reports to the Federal Tax Service (until March 31), companies often do not have time to approve the results. In 2021, the deadline for submitting accounting reports for most companies is 05/06/2020, and the deadline for approval of LLC and JSC reports, as is already known, has been extended until September 30. If the reports have not yet been approved before submission to the regulatory authority, then the “Date of balance sheet approval” field is not filled in.

And one more nuance: starting from 2021, the minutes of general meetings of an LLC with any decision made must be notarized, since now they can be declared invalid and decisions canceled. This became clear from the “Review of judicial practice on the application of legislation on business companies”, approved by the Presidium of the Supreme Court of the Russian Federation on December 25, 2019.

From the conclusions given in this document, it follows that every decision of the general meeting of the LLC, including those for which an alternative confirmation method is used, requires notarization. This condition also applies to LLCs with a single participant (clause 3 of Article 67.1 of the Civil Code of the Russian Federation). Taking into account this position of the Supreme Court, the LLC will have to notarize each decision or amend the charter in terms of the possibility of using alternative methods of confirming decisions.

About assets, liabilities and their balance

You have already become familiar with accounting concepts such as debit, credit and double entry. You have learned what a count is, learned how to count its turnover. And you know what a balance is - final and incoming. Let's quickly continue to get acquainted with accounting. We'll just let you know right away.

As you read, you may get the feeling that in some places we are marking time, explaining the same thing several times. This is true. But it is necessary. We act this way because we are now laying the foundation of accounting knowledge. And the foundation must be strong.

Well, now - forward to mastering accounting!

Where do assets and liabilities come from?

Let's say you have some important and useful knowledge - let's say, in accounting. You also know how to convince people and are not afraid to talk to them. You love to learn new things and educate yourself. And, for example, you have an empty apartment that can be used as an office for your company, and there is a telephone installed in it. So, all of this will be your advantages, or your assets. Some of them you had from birth, others you got from your parents, and others you acquired yourself.

Well, if you regularly borrow money, and you have accumulated a whole bunch of debts to neighbors, acquaintances or work colleagues, then they can be called your liabilities.

Each enterprise (organization) also has its own assets and liabilities. When the founders decide to create their own company, they submit an application to the tax office to register their brainchild. And already at this moment they contribute some ASSETS as contributions to the authorized capital of the new enterprise: money, computers, equipment, cars, etc.

Then the enterprise, using these assets, begins its activities, makes a profit and acquires other assets it needs. But the organization does not live by its assets alone. Like any person, she too may find herself in debt to someone. In this case, all debts of the enterprise will be called LIABILITIES.

Every business must keep records of all its assets and liabilities in order to better manage them.