Distinctive features of an employee employment agreement

The main differences between a employment contract and an employment contract are as follows:

- the employee who signed the employment agreement performs clearly regulated job duties, while the hired employee only performs certain ones and is not subject to the provisions of the internal regulations;

- legally established relationships oblige the employee to submit to higher management, the parties to the employment contract are conditionally equal;

- wages to an employee are paid by agreement of the acting parties. The employment relationship obliges the employer to pay remuneration twice a week or more often. What are the rules for calculating payroll tax - read the link;

- a contract of employment provides for the performance of a specific task or work. An employee with a formalized employment relationship undertakes to perform the functions provided for by job obligations;

- The “expiration” period of an employment contract is indicated only in rare cases, while hiring presupposes a clearly defined duration.

Strengths and weaknesses of the contract

Why is it beneficial for an employer to have an employee?

- The employee is responsible for organizing the required conditions to complete the assigned task. The duration and place of execution are also chosen by the “mercenary”.

- The manager is exempt from paying taxes to the Social Insurance Fund.

- The employer does not comply with the guarantees provided for by the provisions of the Labor Code of the Russian Federation.

- The manager is exempt from paying social insurance contributions.

- Material remuneration is paid after completion of the work, and the amount is fixed at the stage of drawing up the relevant paper.

Disadvantages for a manager

- The performer is not subject to internal regulations. There are no clear regulations for the work carried out, since the final result is important.

- The result of the trial is the reclassification of the contract into an employment contract if the relationship between the employee and senior management is determined.

- Illegal business activity threatens an employer who has signed an employment agreement with an individual.

Concept

Hourly wage is a monetary remuneration for work, which is calculated by the employer based on the amount of time worked by the employee. This method of calculating salaries is convenient in cases where the nature of the work requires an irregular schedule .

In this case, it is most convenient to take into account the amount of time worked by a person in hours, charging a set amount of money for each hour .

IMPORTANT! With this form of payment to an employee, sometimes it can be important not only the number of hours of his employment, but also the quality of performance of assigned tasks and the qualifications of the specialist.

For this reason, in addition to the fixed amount for each hour of work, the possibility of calculating bonuses . A similar benefit for the employee is included in the employment contract.

Hourly wages are often set for teachers engaged in private tutoring, for nannies, housekeepers, bartenders and waiters , and for a number of other categories of workers.

In this case, the total working time should not exceed the maximum norm - 40 hours per week.

The rules for hourly wages are fixed in local regulations and in the employment contract concluded with the employee.

The provisions of local documents should not contradict the norms of labor legislation . So, in accordance with Art. 135 of the Labor Code, when a person with a time-based wage performs duties of different qualifications, wages are calculated based on the work done of a higher qualification.

Structure and content of the mutual agreement

Current legislation does not provide for a unified document format. In practice, the following structure is used:

- preamble – time frame for concluding the document, passport details of the actors;

- subject of the agreement - describes job responsibilities, information about the position. Additionally, a ban on part-time activities or the main place of work is indicated (if necessary);

- the duration of civil relations between the parties;

- specific tasks are described, the completion of which involves the payment of remuneration;

- the rights and obligations of acting persons regulated by the Labor Code;

- the amount and timing of payment of material remuneration, guarantees of satisfaction of the financial component;

- circumstances entailing administrative or criminal liability of the parties;

- contact information of the contractor and the customer;

- grounds for early termination of the above agreement.

The document describes the required level of qualifications and a set of professional qualities, the presence of which is necessary to complete the task.

Sample employment contract.

The agreement comes into force after it is signed by both parties and receives one copy in hand.

Lease agreement between individuals

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

Article 303 of the Labor Code of the Russian Federation provides for the possibility of formalizing civil law relations between persons who do not have the status of an individual entrepreneur or a legal address.

Labor Code of the Russian Federation Article 303. Conclusion of an employment contract with an employer - an individual

When concluding an employment contract with an individual employer, the employee undertakes to perform work not prohibited by this Code or other federal law, as determined by this contract. A written employment contract must include all conditions essential for the employee and the employer. An individual employer is obliged to: draw up an employment contract with an employee in writing; pay insurance premiums and other obligatory payments in the manner and amounts determined by federal laws; issue insurance certificates of state pension insurance for persons entering work for the first time. An employer who is an individual who is not an individual entrepreneur is also required to register an employment contract with an employee with a notification procedure with the local government body at his place of residence (in accordance with registration).

This agreement has a number of features:

- is drawn up in writing in the presence of both parties;

- registration of the document is carried out in local government bodies (executive committee) in the territory of residence of the employer.

The following information is required:

- place and date of entry into force of the agreement;

- passport details of the parties or other identification documents;

- Contact Information.

The provisions of the executed paper may be challenged in court.

Agreement between an individual and an individual entrepreneur

Individual entrepreneurship involves making a profit, which requires attracting labor. However, the formalization of relationships is quite often replaced by oral agreements that have no legal force.

Illegal use of labor resources is subject to criminal liability. This forces employers to deal with the formalization of employment agreements.

Such a document obliges the manager to pay contributions to the pension fund and tax authorities, but social and medical insurance is not provided for the employee.

Interesting to know! A rental agreement drawn up between an individual entrepreneur and an individual is drawn up taking into account the maximum benefit for the legal entity.

An example of an employment contract form.

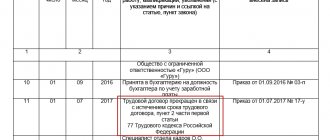

Entry in the work book

Labor legislation states that the employer makes a corresponding entry in the employment record within 5 days from the date of the start of fulfilling job obligations. An exception is the registration of civil law relations. The manager is exempt from the need to pay certain taxes and fulfill guarantees.

However, the employee has the right to apply to the courts to requalify the form of labor relations. A positive result will oblige the employer to compensate all payments (vacation pay, sick leave).

Is it possible to get a job without a work book and what does this mean for an employee? You will find out here.

Employment without a contract

Fulfilling official obligations or one-time work without completing regulatory documentation is a risky decision. There are several options for the development of events:

- The work process is not accompanied by a violation of the employee’s rights; the individual collects evidence of the labor relationship.

- An employee's appeal to government authorities with a complaint against the employer.

- Initiating legal proceedings while performing official duties and collecting evidence.

Oral agreements have no legal force, so it is quite difficult to prove the involvement of an individual in the labor process of the organization.

The advantages of such an event are the implementation of one-time work, the legal registration of which takes a long time. In case of long-term performance of the functions of a hired employee, we recommend that you contact the above-mentioned authorities.

Here you will read what the risks of informal employment are for the employee and for the employer.

Kinds

There are three types of hourly wages:

- A simple form of payment implies a fixed cost per hour and calculation of wages based on the number of hours worked. A similar scheme for paying employees is most often used in budgetary institutions. In this case, the quality of the duties performed does not affect the amount of remuneration received, which remains unchanged.

- The amount of payment can be influenced by the quantity and quality of duties performed by a person . This is expressed in the fact that in addition to receiving a fixed amount for each hour worked, the employee also receives a bonus in accordance with his performance indicators. The amount of pay per hour and the amount of the bonus must be specified in the employment contract signed by the parties.

- Payment can be made taking into account the established tariff rate per hour and the possibility of receiving additional payment if all established conditions are met. This option is used by companies that need employees to complete specific standardized tasks on time without exceeding existing plans.

Differences between employment contracts for officially and unofficially employed workers

According to the legislative framework of the Russian Federation, an employment contract is drawn up and protected by the Labor Code, and an employment agreement by the Civil Code.

When an employee is officially employed

There are several features on the basis of which a formal employment contract :

- This is a legally regulated labor relationship between a manager and an employee.

- The amount of money that the contractor receives, the timing of vacations and the number of working hours are specified. The organization is responsible for delays in payments.

- If a superior or a subordinate fails to comply with the terms of the contract, each, accordingly, is subject to administrative liability.

- The employee performs only those duties that are specified in the document.

- An employee has the right to refuse to perform a certain function if it is not part of his main duties.

- The employee is subject to superior specialists and the internal regulations of the company.

- The document may have no deadlines or be drawn up with a provision for extension.

Temporary employment contract without official employment

- This is a document that does not regulate the relationship between an employee and his superiors.

- Does not provide guarantees for the protection of rights under the Labor Code.

- The internal regulations of the organization do not affect the temporary performer in any way.

- The work must be completed within a clearly defined time frame.

- The boss and the employee have equal legal rights.

- Salary is based on mutual agreement.

- The agreement has strict time limits.

Compilation rules

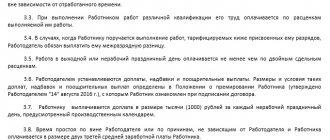

When drawing up and signing an employment contract with an hourly wage, the parties need to pay attention to the presence of the following provisions in the document:

Terms of payment

The text of the contract must contain a separate clause indicating the cost of one hour of the employee’s working time. This amount is a flat rate. The procedure for determining earnings for the billing period must be specified .

Also, the labor contract must stipulate the rules for payment for work on holidays and weekends , the rules for calculating vacation pay and overtime pay, etc.

Article 112 of the Labor Code states that payment for working weekends and holidays includes not only the amount for the number of hours worked, but also additional compensation. Its size must be determined by regulations and an employment contract. The amount of vacation pay is calculated based on the number of days worked over 12 months and the income received during this period.

Payment dates

The employment contract must indicate specific dates for the transfer or issuance of funds to the employee. Payment can be made weekly, biweekly, etc.

Awards

If the quantity and quality of duties performed by an employee are important to the employer, then in addition to the basic rate, a bonus is included in the amount of earnings.

ATTENTION! The amount of the bonus is set in advance and reflected in the employment contract. The document must also specify the conditions for calculating the bonus.

Opportunity to increase earnings

If desired, the employer can decide to increase wages.

In this case, an additional agreement is attached to the existing contract, which indicates the new tariff rate per hour of labor.

An employee's income level may increase as a result of his transfer to another higher-paying position with an increase in salary.

These changes must also be noted in the employment contract. An increase in earnings also occurs as a result of overtime , work on holidays and weekends, etc.

Availability of advance payment

The Labor Code does not define the concept of “advance”. Only the fact is indicated that the employer is obliged to make payments at least 2 times a month . If desired, you can specify the specific amount of the advance in contracts or in local regulations.

But with hourly wages, it is impossible to determine the amount in advance, since it will consist of the actual time worked for the first part of the month and may differ each time.

For this reason, in an hourly wage agreement, it is sufficient to indicate at least two dates per month on which payments will be made. The advance amount itself will be calculated based on the number of hours worked.

Reasons why a temporary rental agreement is concluded

A mandatory procedure for concluding a document is required in cases where a temporary employee is hired (instead of a permanent one) for a certain period or when applying for seasonal work. And also when carrying out duties outside of Russia, to support the work of the election commission and when taking on internships.

By agreement of the parties, the document is drawn up when performing part-time activities, when training an employee full-time, and also if there are certain medical indications.

Temporary contract and probationary period

A contract concluded for a certain period is called a fixed-term contract. When concluding it, it is important to remember the test time limits. If a temporary employment contract has been signed with an employee, a sample for a probationary period (given in the appendix) shows that if the duration of the labor contract is up to 2 months, it is impossible to set a time for testing the employee’s knowledge and skills.

If an employee is hired under a temporary contract concluded for a period of 2 to 6 months, then the probationary period is established for a period of no more than 2 weeks.

Fixed-term employment contracts concluded for a longer period - from 6 months or more - may have the same probationary period as regular, open-ended employment contracts, that is, from one to three months. The same rule applies to TD for individual entrepreneurs. The test time clause is included directly in the text of the contract.

How to conclude a contract with an individual?

In the case where an individual has not registered his activities as a business, it is required to observe a number of features when hiring another individual:

- the agreement is drawn up in writing;

- municipal authorities must put a seal and signature on the document;

- the contract specifies the dates for drawing up the document, completion of the work, as well as the passport details of each party;

- in the event of emergency situations, all responsibilities and rights of everyone must be spelled out in the document.

The more detailed the agreement is, the higher the chances of getting quality work and remuneration. Also, detailed filling helps to avoid litigation in the event of an emergency.

Dismissal during probation period

The point of establishing a temporary trial is to check the professional qualities of the employee, and if they do not meet expectations, dismiss him without unnecessary problems and restrictions. Some employers resort to a trick and conclude a separate special TD for this period. In essence, this is a fixed-term contract that does not have any legal basis for its urgency. But in this case, the duration of the inspection may be much longer than that allowed by law. This is a violation, and if such a fact becomes known to the regulatory authorities, the employer will be punished.

Dismissal during the probationary period must be properly prepared at the start of the employment relationship. To avoid appealing dismissal in court, you need to draw up a specific work plan for the first months during employment and bring it to the attention of the candidate:

- formulate and assign tasks to the employee;

- determine the dates by which the employee must acquire knowledge and skills;

- appoint someone responsible who will check and document the success of the newcomer;

- hand over the document to the new employee for signature.

When termination of a TD is initiated by the employer, the employee is given a notice of unsatisfactory performance, indicating the reasons. The notice period for dismissal is defined in Article 71 of the Labor Code of the Russian Federation and is only 3 days. Often, employers comply with the employee’s request to formalize his dismissal at his own request, since he does not want to have a record of dismissal in his work book under Part 1 of Art. 71 of the Labor Code of the Russian Federation, that is, he does not want to admit his professional unsuitability to other possible employers. When agreeing to this, it should be understood that the employee can change his mind and challenge the dismissal in court, even if it was made “on his own.” In this case, such wording can be harmful; the court will recognize a violation of the dismissal procedure, and the negligent specialist will be reinstated in his previous position. In addition, he will have to pay him compensation for forced absence. Therefore, it is better to draw up all documents about the employee’s performance as it actually happened and not enter into any dubious transactions.

The first three months of work, in addition to the difficult adaptation period, give the employee the opportunity to quit without working within 3 days after writing a letter of resignation if the job did not suit him or he could not cope. In the case when the TD is terminated by an employee, it is enough for him to write a letter of resignation of his own free will. The employer has no right to retain an employee for more than three days.

How to conclude an agreement as a legal entity?

If an individual and a legal entity interact, it is mandatory to draw up an agreement. This is necessary so that the employer is confident that he will receive high-quality work, and the employee will receive a decent remuneration. There are several features of the deal:

- Contributions to funds and insurance companies are not required;

- the performer is not required to receive vacation pay and bonuses;

- the employee has the right to receive wages, but no one is responsible for its delay;

- the contractor is not provided with a workplace in the company/

Does the form have legal force?

The concept of working relationships is defined in Art. 15 Labor Code of the Russian Federation. As such, we understand relationships in which the parties are the employee and the employer, for the purpose of performing certain functions by the employed person, with his subordination to the internal working order, as well as the creation by the employer of such working conditions as determined by the legislator or the provisions of the employment contract.

Almost all the conditions that are fixed are determined by law. The parties do not have the right to change them, except in cases where such changes improve the situation of the participants.

In situations where an agreement implying the existence of civil legal relations is recognized by the court as one that regulates labor relations, labor law norms are applied to it.

The main task assigned to the legislator is to provide citizens who are participants in labor relations with the full range of guarantees stipulated by the Labor Code of the Russian Federation and other legislative acts regulating labor relations.

Is entry in the work book required?

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

According to the legislative acts of the Russian Federation, the manager is obliged to make notes in the employee’s work book if he has worked for more than five years. However, there are exceptions.

If the contractor has been cooperating with the company for quite a long time, he has the right to apply to the judicial authorities to change the form of the contract. In this case, the court will be on the employee’s side.

After the trial, the employer is obliged to make the appropriate entries in the work book, pay all sick leave and vacation pay, and also pay a certain amount of money to the Pension Fund and the insurance company.

If the employee does not agree with the transfer to hourly wages

If the organizational working conditions have changed in the institution and the employee does not agree with the innovations, then the manager must act in full accordance with Art. 74 of the Labor Code of the Russian Federation according to the following algorithm:

- In writing, offer the employee a vacant position (both equivalent to his qualifications and lower), which corresponds to the capabilities and health status of such an employee.

- If such an option is provided for in collective and labor agreements, then the employer offers vacancies in other locations.

- If no suitable vacancies are found for the employee or the employee himself refuses to be transferred to a vacant position, then the employment contract is terminated under clause 7 of Part 1 of Art. 77 Labor Code of the Russian Federation.

How to draw up an agreement?

This type of contract can be reclassified as an employment contract if it contains the following information:

- Wages are clearly defined and paid twice every 30 days.

- The performer has a workplace. For example, a desk and computer equipment in an office.

- The daily routine is written down.

- There are no deadlines for the implementation (termination) of the agreement.

Before drawing up an agreement, the employer must discuss all clauses of the contract with the contractor.

Temporary employment contract sample:

The document is kept by the contractor and the employer. Signed no later than three days after the employee begins performing his duties.

⚖ Legislative innovations in 2020

According to the national plan for economic recovery, among the measures aimed at normalizing the situation in the labor market, it is planned to establish a minimum hourly wage. It will begin to apply in October 2021 when signing fixed-term contracts for a period of up to 3 months. The purpose of this measure is to combat shadow earnings and protect the interests of workers.

During the spread of coronavirus, employers sometimes set a fictitious shortened day to reduce their costs in order to avoid paying personal income tax and contributions to extra-budgetary funds. In fact, most of the profits are transferred in envelopes, and employees are forced to agree to the proposed conditions in order not to lose their jobs in difficult conditions.

The LDPR submitted to the State Duma a legislative initiative to increase the incomes of Russians during the spread of coronavirus infection through the introduction of the concept of a minimum hourly wage. When signing an employment contract with part-time conditions, it is expected to set the minimum wage at 150 rubles. at one o'clock.

The specified fee is 150 rubles. per hour is planned to be used only when concluding a fixed-term employment contract on a part-time basis. This indicator cannot be used in other forms of contractual relations.

Tariff 150 rub. will not be fixed, but is subject to annual indexation once a year based on the results of inflation dynamics. For comparison, today the minimum hourly rate, calculated from the minimum wage of 12,130 rubles, is from 89.85 rubles. for May and 65.92 rub. for July. Raising the minimum wage will be a step towards bringing the level of wages to the level of industrialized countries.

For example, in EU countries the average hourly rate is 31.4 euros (in Denmark - 44.7 euros, in Germany - 35.6 euros). In the USA, the minimum hourly wage is $7.5. In Russia, even after increasing the minimum hourly wage, it can reach $2.17 or 1.91 euros.

Another goal of increasing the “cost per hour” is to increase labor productivity (in Russia this indicator is one of the lowest). Workers will begin to value their time and complete work faster.

In May 2021, a similar bill was already submitted for discussion in the State Duma and then did not pass beyond the first reading. If the amendments are approved, the new minimum rates will come into effect in 2021.

Unlawful dismissal. How to punish an employer

More details

What actions of a boss can you complain about to the Labor Inspectorate?

Look

Video on the topic

The main advantage of drawing up this agreement is the simplified drafting procedure for each party. The boss does not pay any money, with the exception of wages.

It is worth remembering that if the contract is filled out incorrectly, the executor will go to court. If the judiciary is on his side, the manager may suffer great expenses.

The relationship between an employee and an employer, regardless of the period of time they arise, must be formalized accordingly. All details regarding registration and hiring can be read in the Labor Code of the Russian Federation.

You can find out about the labor agreement between the employee and the employer in Article 16 of the Labor Code of the Russian Federation. It acts as confirmation of the existing labor relationship between the employee and the employer.

Labor relations can be divided into three main types, depending on the period for which they arise. This includes fixed-term, temporary employment relationships and employment relationships concluded for an indefinite period. The latter include employment relationships for a labor period not clearly established by the contract, which does not exceed 5 years.

Labor relations, in addition to being confirmed by an employment contract, can also be confirmed by an entry in the work book. But in the case of concluding a temporary employment contract, an entry into the employment record is very rarely made.

This type of relationship between an employee and an employer is often called temporary, without official registration (since no entry is made in the employment record).

Advantages and disadvantages

advantages from hourly wages , but there are also disadvantages .

Benefits for employers :

- cost savings , since only time actually worked is paid;

- effective planning of employee activities and the production process;

- accuracy of calculation of monetary reward;

- setting optimal salary amounts for part-time workers and part-time specialists;

- the ability to provide unpaid days off at any time.

Disadvantages for employers:

- the difficulty of monitoring the actual time worked by each employee;

- the need to identify one or more persons who will carry out accounting and control;

- lack of motivation among staff to perform their duties efficiently due to the lack, as a rule, of bonuses and allowances.

Benefits for employees :

- receiving income for the time actually worked in the absence of a clear work schedule;

- the ability to combine several jobs in different organizations;

- the ability to build your work schedule taking into account different workloads. That is, employees can work fewer hours during slow periods and more hours, including overtime, during more stressful periods;

- ease of calculating your income.

Cons for employees:

- the desire of employers to use people to the maximum leads to large volumes of work responsibilities that must be performed per hour;

- often lack of bonuses , allowances and bonuses;

- unreliable amounts of income in the absence of records in the employment contract about the size of the tariff rate and the payment procedure for the billing period.

Under what conditions is an employment contract drawn up without formal registration?

What is a temporary employment contract without official registration? This is a type of employment relationship between an employee and an employer, the term of which has a clearly defined expiration date. Moreover, the contract may be completed upon the arrival of a certain date, or it may be terminated when the employee completes the amount of work assigned to him.

With such employment, no entry is made in the employee’s work book, a personnel card is not created for him, and other documents are not needed if the employee is hired as a full-time employee. Therefore, this type of work is called “without official registration.”

But this is only one point in which the relationship between employee and employer differs. Otherwise, all guarantees for such an employee remain as with a regular employment arrangement.

For HR officers, the best option would be to indicate in the contract that the moment it ends will be when the employee performs a certain type of work. In this case, the employer does not need the services of the employee as soon as he completes the area of work entrusted to him. For example, he will make repairs to the premises.

In a situation where the contract states that it is valid until a certain date, the procedure for dismissing such an employee is different. The HR department must notify him three days before the date specified in the contract that his contract is ending.

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

Also, if, before the completion of the contract, the employee did not have time or was unable for some reason to complete the amount of work entrusted to him, the HR department needs to sign an additional agreement with such employee to extend the contract.

But we must not forget that a temporary employee can be fired before the end of the contract with him. This can be either at the initiative of the employer or at the employee’s own request.

A temporary employment contract without official registration can be concluded with any employee, if there are legal grounds for this.

By whom and when can a temporary employment contract be drawn up?

There are various situations when it is not possible to conclude an open-ended employment contract with an employee. For example, when hiring seasonal employees, or when registering an employee on maternity leave. Agree, given such factors, concluding an open-ended employment contract with an employee is simply impractical.

Also, a temporary contract can be drawn up with the following categories of persons: trainees, persons in alternative service, trainees, persons forced to engage in forced labor, foreign citizens, as well as deputies (during the agreed period for which they were elected).

You can also find out more about all the various nuances associated with temporary employment in Article 58 and Article 59 of the Labor Code of the Russian Federation.

When can you conclude a temporary employment contract with an employee without official employment:

- The basis for concluding a VTD will be in the event of a temporary absence of the main employee from his workplace.

- In the case when an employee must perform a certain amount of work: temporary and seasonal work.

- Performing work that goes beyond the employer’s usual activities and is one-time in nature.

- The basis for concluding a VTD will also be the period of internship or temporary training.

- Temporary increase in production work that is seasonal in nature.

- Referral of an employee to temporary work by the employment center.

- When sending an employee to work abroad.

- If a person is elected to an elective position.

In these cases, which are listed below, the employer has the right, according to Art. 59, Part 1 of the Labor Code of Russia to hire an employee temporarily without his consent.

There are also situations that require mutual agreement with the employee in order to accept him for temporary work. They are regulated in Article 59, Part 2 of the Labor Code of Russia.

- If the employer is a small business entity, this is also a possible basis for concluding a temporary contract.

- An employee who gets a job at retirement age.

- If an employee has medical contraindications, work for a long time.

- The employee is a part-time worker.

- Employees for management positions: director, chief accountant, deputy director.

- If the position for which the employee is applying involves admission on a competitive basis.

- With students who are studying full-time (full-time) education.

- Also, a temporary employment contract can be concluded with employees who are engaged in creative professions and when the execution of work requires moving to remote regions of the North.

If there is no basis for concluding a temporary employment contract without official employment in Article 59, paragraphs 1 and 2, the employer does not have the right to draw up a temporary employment contract with the employee, and also not to formalize it.

Calculation formula

The simplest and most convenient way to calculate the income of an hourly employee is to set the hourly rate. In this case, the employment contract specifies the tariff rate and the procedure for calculating the employee’s income for the billing period based on this value.

Total earnings for the billing period (Z) are the sum of the number of hours actually worked (H) multiplied by the tariff rate (T).

Z = H*T

Example of an employment contract with hourly wages:

For example, when concluding an employment contract with a nanny, it is indicated that an hour of her work costs 200 rubles.

At the same time, the nanny does not have a fixed schedule.

In such a situation, the only way to organize the calculation is to use this formula.

If we imagine that in a particular month a nanny with a tariff rate of 200 rubles/hour worked a total of 90 hours, then her monthly income will be 200 * 90 = 18,000 rubles.

If an hourly paid employee works in shifts, then his total earnings for the period (Z) can be calculated by multiplying the number of shifts worked (C) by the tariff rate (T).

Z=S*T

For example, a saleswoman paid hourly, working a 2/2 schedule from 8 a.m. to 8 p.m., has 14 shifts per month. With the cost of one hour of work being 100 rubles, for 12 hours of one shift the earnings are 1200 rubles (100*12). Accordingly, with 14 shifts per month, the employee receives 14*1200=16800 rubles.