The leased item can be insured against the risks of loss, shortage or damage from the moment the property is delivered by the seller until the end of the contract. The parties acting as the insured and beneficiary, as well as the period of insurance of the leased asset, are determined by the contract, as follows from paragraph 1 of Article 21 of the Federal Law of October 29, 1998 No. 164-FZ “On financial lease (leasing)”. Thus, by agreement of the parties, the obligation to insure the leased asset can be assigned to both the lessor organization and the recipient organization. The insurance premium itself is a fee for a service that the policyholder, that is, the beneficiary, is obliged to pay to the insurer in the manner and within the time limits established by the contract (clause 1 of Article 954 of the Civil Code of the Russian Federation).

The first thing you should pay attention to is the provision of subparagraph 7 of paragraph 3 of Article 148 of the Tax Code. According to it, insurance services provided by insurance organizations are not subject to VAT. This means that the insurer does not present tax to the organization in the amount of the premium.

What are the postings for payment for asset insurance under leasing?

The accounts used depend on the plan adopted by the company. Accounting for various taxes takes place in a subaccount (account 68), for example:

- Account 68.2 – personal income tax payments.

- Account 68.1 – calculations of fees according to the simplified tax system;

Insurance accounting: frequently asked questions Question No. 1. On a business trip. On business, the employee was traveling by air. The insurance policy attached to the ticket does not indicate what type of insurance was used - compulsory or voluntary.

Does it need to be taken into account for tax purposes?

If the joint venture is issued separately, as an attachment to an air ticket, then the company cannot take such expenses into account when calculating income tax. Since, in accordance with Article 263 of the Tax Code of the Russian Federation, expenses for passengers’ DS are not provided. Question No. 2. A car was purchased for the management of the company and insurance was taken out. How should the cost of an MTPL policy be reflected in accounting?

The accounting procedure for a joint venture depends on the type of accounting. Info RS SMR for cash/taxation of profits in full is entered into the PR immediately after the contractor transfers funds to the insurer under the DS, if:

When can insurance benefits be denied?

- The insurance company went bankrupt . To avoid such a development, it is necessary to carefully check the financial position of the insurer.

- The insurer lost its license. Practice shows that this measure is often temporary. The insurance company quickly restores insurance activities after eliminating the violations that caused the suspension of the license.

- The policy has no legal force - it is a fake . Most often, this is the result of concluding an agreement with dubious fly-by-night companies.

- The CASCO insurance policy has expired . When a car is leased, insurance is usually issued for the entire period of the leasing transaction.

- The policyholder violated the terms of the contract . Example - during an accident, the car was driven by a driver not specified in the policy.

- Violation of deadlines for contacting the insurer . After the occurrence of the insured event, the policyholder contacted the insurance company later than the deadlines specified in the contract.

- Information is deliberately distorted and suppressed by the policyholder.

- An accident or other insured event occurred when the driver was under the influence of drugs or alcohol.

- Intentional damage to an insured vehicle.

- The insured did not provide the entire list of documents required to obtain compensation.

In the event that the insurance company refuses to pay compensation under CASCO insurance, the owner of the insured car can forward his claims to the management of the insurance company. If even here he does not receive a satisfactory answer, he has every right to file a claim in court . To do this, you need to collect the necessary documents and present all the facts in as much detail as possible.

Car insurance accounting

for the current month; Dt 20 (23, 26, 44...) – SP must be included in the expense.

month of the start of the agreement, and the insurance period is not more than a month, Kt 76-1 - the cost of insurance is considered an expense; For DS purchased not on the first day of the month, the amounts to be written off are calculated in proportion to the number of remaining days of the month; Dt-51 - return of part of the joint venture upon termination of the joint venture, Kt 76-1 - receipt of part of the joint venture, taking into account the period of validity of the joint venture in fact. For organizations using leasing (financial lease agreement), a different accounting of transactions is provided. (Understand how to keep accounting records in 72 hours) purchased > 8000 books of Legislative acts , obliging to insure property - no.

But there is a procedure for property insurance, it is provided for. Example 1. Calculations for contributions to insurance must be reflected in Dt 76-1. The paid fee is reflected in advance on the same day: Dt-76-1 Kt 51 – joint venture paid.

Who should apply for CASCO insurance - the owner or the user of the car?

During the leasing transaction, the lessee bears full responsibility for the transport. Therefore, it is he who must draw up a CASCO agreement in order to take care of the safety of the leased property. In this case, the recipient of the leased property does not take out insurance independently. In practice, all organizational issues are resolved by the lessor. The cost of insurance is distributed and included in regular payments under the leasing transaction.

This approach significantly reduces the financial burden on the lessee and also allows him to save time on selecting a reliable insurance company. Lessors strictly select insurers and cooperate only with trusted companies. This allows clients to receive good discounts and choose more favorable insurance rates.

Leasing questions and answers

Vladislav Egorov, Mr.

Moscow Our organization received equipment on lease in May, and leasing payments began to be paid from this month. The term of the leasing agreement is 3 years, the right of redemption is provided, the equipment is taken into account on our balance sheet. Now it is accounted for on account 08 and is not yet ready for operation due to the fact that the construction of the structure in which it is supposed to be used has not yet been completed.

What is the procedure for assigning leasing payments to expenses in accounting? At what point can we take them into account - before putting the equipment into operation or after?

We recommend reading: Is it possible to feed children with imported food in a kindergarten?

: In accounting, the leased asset, recorded on the balance sheet of the lessee, is a fixed asset.

Upon receipt, you made an entry to the debit of account 08 “Investments in non-current assets” and the credit of account 76 “Settlements with various debtors and creditors”, subaccount “Rental obligations”.

This entry had to be made for the entire amount of payments under the contract minus VAT; ; .

Payment of insurance premium

Payment of the premium

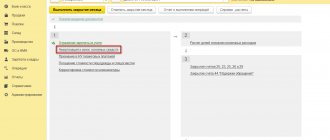

In order for insurance costs to be automatically evenly taken into account as expenses, it is necessary, at the stage of paying the insurance premium, to correctly fill out the document Write-off from the current account transaction type Other write-off in the Bank and cash desk - Bank - Bank statements - Write-off section.

The document states:

- Recipient - the counterparty to whose account the insurance premium is paid;

- Amount - the paid amount of the insurance premium according to the bank statement;

- Debit account - 76.01.9 “Payments (contributions) for other types of insurance”: this is a special account in 1C provided for paid insurance premiums;

- Counterparties - insurance company;

- Deferred expenses are parameters for automatic uniform recognition of CASCO expenses.

Postings according to the document

The document generates the posting:

- Dt 76.01.9 Kt - payment of insurance premium.

Insurance policy accounting

It is recommended to reflect the received CASCO policy on the balance sheet, since the organization is obliged to generate complete and reliable information about its activities and its property status (Article 13 of the Federal Law of December 6, 2011 N 402-FZ, clause 4, clause 32 of the Accounting Regulations and financial statements, approved by Order of the Ministry of Finance of the Russian Federation dated April 11, 1998 N 34n).

In 1C there is no special off-balance sheet account for accounting for policies, so you need to create it yourself, for example, account 013 “CASCO, DSAGO, CASCO policies.” PDF

BukhExpert8 advises keeping records both according to the elements of the directory Deferred Expenses and according to Fixed Assets . With such a set of analytics, it is possible, for example, to analyze for which vehicle the insurance expires.

Acceptance of an incoming CASCO policy for off-balance sheet accounting is formalized by the document Transaction entered manually, type of operation Transaction in the section Operations – Accounting – Transactions entered manually.

Accounting and tax accounting of leasing operations

It is from this account that all leasing operations begin. Using the example of Tekhnik LLC and Spusk LLC, we will analyze all the nuances of accounting.

You will find not only postings, but also detailed calculations. Tekhnik LLC received from Spusk LLC under agreement No. 25 dated 01/01/2021 to lease the A187 hydroelectric power station worth 1,296,000 rubles, including VAT 216,000 rubles.

In the accounting of Tekhnik LLC, the accountant will make the following entries under the leasing agreement: Debit 001 - 1,296,000 - equipment is put on off-balance sheet accounting Debit (20, 26, 44 - depending on the purposes for which the leased asset is used) Credit 76 - 30,000 — the monthly lease payment has been accrued (the accountant of Tekhnik LLC will make this entry monthly for three years)

Step-by-step instruction

On April 2, a Ford Mondeo was purchased.

On April 03, the Organization insured the car with PJSC IC Rosgosstrakh and paid a CASCO insurance premium in the amount of 84,000 rubles. for the period from April 4 of the current year to April 3 of the next.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Payment of insurance premium | |||||||

| April 03 | 76.01.9 | 51 | 84 000 | 84 000 | Payment of CASCO insurance premium | Write-off from current account - Other write-off | |

| 013 | 84 000 | Accounting for CASCO insurance policy | Manual entry - Operation | ||||

| Reflection in accounting for insurance premium costs for April | |||||||

| April 30 | 26 | 76.01.9 | 6 213,70 | 6 213,70 | 6 213,70 | Accounting for CASCO costs | Closing the month - Write-off of deferred expenses |

| Reflection in accounting for insurance premium costs for May | |||||||

| May 31 | 26 | 76.01.9 | 7 134,25 | 7 134,25 | 7 134,25 | Accounting for CASCO costs | Closing the month - Write-off of deferred expenses |

For the beginning of the example, see the publication:

- Purchase of a fixed asset: car

What are the postings for payment for asset insurance under leasing?

In this case, the entire amount of the advance payment minus VAT in tax accounting is recognized as an expense for profit tax purposes.

The total rental period is 36 months. The monthly payment is 36,000 rubles, including VAT (20%) 6,000 rubles. After three years, the equipment is purchased by Tekhnik LLC, the redemption price is already included in the monthly payments.

Important We would like to note that under the leasing agreement, services are provided throughout the entire contract and the fiscal authorities have no reason to assess compliance with the criteria of paragraph 4, paragraph 2 of Article 40 of the Tax Code of the Russian Federation on the comparability of leasing payments, because

individual payments cannot be considered as separate transactions, and the price under a leasing agreement must be analyzed in aggregate for all payments in the agreement. 2. The advance payment under the leasing agreement is offset in equal payments throughout the entire leasing term. Info In this case, when the property is accepted for accounting, account 76 reflects only the debt for the value of the property.

Leasing payments are accrued monthly on credit 20 of account in correspondence with account 76 in the amount of the difference between accrued depreciation and the amount of the monthly lease payment.

Expenses for voluntary and compulsory insurance

Expenses in the form of premiums for all types of compulsory property insurance, as well as for types of voluntary, provided for in paragraph 1 of Article 263 of the Tax Code of the Russian Federation, are other expenses associated with production and sales, based on subparagraph 5 of paragraph 1 of Article 253 of the Tax Code. Such expenses are recognized in tax accounting if they are justified, documented and incurred to carry out activities aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation). At the same time, expenses for mandatory types of insurance are taken into account for tax purposes within the limits of special tariffs approved by law and the requirements of international conventions.

The first thing you should pay attention to is the provision of subparagraph 7 of paragraph 3 of Article 148 of the Tax Code of the Russian Federation. According to it, insurance services provided by insurance organizations are not subject to VAT. This means that the insurer does not present tax to the organization in the amount of the premium.

If such rates are not approved, compulsory insurance costs are taken into account in the amount of actual costs, which follows from paragraph 2 of Article 263 of the Tax Code of the Russian Federation.

As for voluntary insurance, according to paragraphs 1 and 3 of Article 263 of the Tax Code of the Russian Federation, expenses for it are recognized in tax accounting in the amount of actual expenses.

Postings for leasing a car from the lessee

The use of special modes by legal entities is characterized by its own nuances, for example:

- when applying UTII, the calculation of tax payable is also carried out according to certain principles, which do not include the deduction from the tax base of the costs of payments under the leasing agreement.

- when applying the simplified tax system “income”, leasing expenses cannot be written off as a reduction in the tax base in the same way as other expenses for conducting business;

We recommend reading: Arrow check balance by card number

Further in the material we will talk about accounting for car leasing from legal entities located on OSNO.

We will not touch upon tax accounting issues, since there are some discrepancies in the professional literature and publications due to the fact that the legal issues of leasing accounting in the Russian Federation are not fully regulated. The issues of distinguishing between accounting and tax entries are presented in detail in the articles:

- ;

- .

- ;

In the concluded leasing agreement

What documents are required to apply for CASCO insurance?

The policyholder must provide the insurance company with:

- Statement;

- Passport - if the policyholder is an individual entrepreneur or individual. face;

- Documents about state registration - for companies and organizations;

- Package of documents for the car (PTS, STS);

- Leasing agreement;

- An agreement that the lessor gives the lessee the right to insure the car (required when the lessee becomes the policyholder);

- Vehicle technical inspection report;

- Driving documents of those who will be included in the insurance;

- Information about the anti-theft system.

This list can be shorter or longer - it all depends on the requirements of a particular insurance company.

Accounting for CASCO and OSAGO during leasing

Situation 1. The insurance premium is paid at a time.

In this case, its amount is taken into account in expenses evenly - in proportion to the number of calendar days of the agreement in the reporting (tax) period. Situation 2. The insurance premium is paid in installments (in parts), that is, insurance premiums are paid. If the contract specifies the periods for which insurance premiums are paid, then expenses for each payment are recognized evenly over the period corresponding to the period for payment of premiums (for example, half a year, quarter).

958 of the Civil Code of the Russian Federation, clause 1.16 of the OSAGO Rules, Letter of the Ministry of Finance dated March 18, 2010 N 03-03-06/3/6): - the refunded amount is not taken into account either in income or expenses;

Legal Aid Center

Every year, businesses that use transport buy insurance. They are taken into account in a special way. Expenses

The non-refundable part of the insurance premium under the CASCO agreement is written off from account 76.01.9 by analogy with the OSAGO agreement. For profit tax purposes, this amount can be taken into account by analogy with the possibility of accounting for these expenses under a compulsory motor liability insurance agreement (see Fig. 8). If an organization believes that this option is associated with tax risks, it can take into account the non-refundable part of the insurance premium as part of non-taxable expenses, fixing a constant difference (Fig.

9). Rice. OSAGO information must be taken into account as a police department. To account for costs, it would be optimal to use account 97 “Exp. Example

Costs for comprehensive insurance in tax accounting for leasing

Value added tax The amount of VAT presented by the lessor as part of the lease payment is accepted for deduction if there is an invoice from the lessor Organizational income tax For profit tax purposes, lease payments (excluding VAT) are considered other expenses related to production and sales Depreciation deductions produced by the party to the leasing agreement on whose balance sheet the leased asset is located.

If the agreement does not indicate the periods for which contributions are paid, then each payment is distributed over the entire term of the agreement (Letter of the Ministry of Finance dated May 14, 2012 N 03-03-06/1/245). If, upon early termination of the contract, the insurer returns part of the insurance premium to you, then (Art.

In accounting, the cost of the purchased leased property on the date of transfer of ownership is written off from off-balance sheet account 001. For tax accounting purposes, the redemption price is indicated by the parties in the purchase and sale agreement, and it is the amount of expenses for the purchase of a car (as opposed to leasing payments, which are payments for using a car).

Important Therefore, the redemption price forms the initial cost of the car.

Postings when buying or returning a car

As noted above, all accounting for leasing transactions, including repurchase/return of the car, depends on what conditions are specified in the contract. The drug we are considering will be characterized by the following common nuances:

- If the car is included in the balance sheet of the LP, then upon completion of the redemption payments from the LP, it must be transferred from the category of leased objects to the category of own objects:

| Posting Contents | Dt | CT | Note |

| The purchased car is transferred to own fixed assets | 01/ Fixed assets | 01/ Property under lease | In the amount in which it was capitalized upon receipt |

| We do the same with depreciation that we managed to accrue during the term of the contract. | 02/ Depreciation of leased property | 02/ Depreciation | In the amount that has accumulated on 02 for leasing at the time of redemption |

NOTE! After transferring the purchased car to your own fixed assets, you can deduct VAT on advances towards the redemption.

- If the car was taken into account on the LD balance sheet before the redemption, then the LP performs the following operations upon redemption:

| Posting Contents | Dt | CT | Note |

| The purchased car is removed from off-balance sheet accounting | 001/ Property under lease | In the amount in which it was capitalized upon receipt under the leasing agreement | |

| The purchased car is accepted for balance | 08 | 76 | At 76 there can be 2 accounting options:

|

Next, the LP keeps records of the purchased car as an ordinary fixed asset received, for example, during the purchase and sale. VAT on the purchase price is deducted in the standard manner.

The deduction of VAT from expenses incurred by the lessee when receiving property (for example, transportation), as well as from lease payments and the redemption value of leased property, is described in detail in the Ready-made solution from ConsultantPlus.

- Sometimes a situation arises when the car must be returned to the LD at the end of the contract. For the LP accounting department, this simplifies the accounting task, since usually if a car is subject to return, it does not go onto the LP balance sheet. Accounting for the disposal of such a car in this case will be similar to accounting for a regular lease. Upon completion of leasing payments and upon return of the car, it must be removed from off-balance sheet account 001. Payment of the redemption price will not be reflected in the LP, and the posting of the car to the balance sheet will not be reflected either.

All details related to the reflection by the lessee in the accounting of transactions under a vehicle leasing agreement are given in the Ready-made solution from ConsultantPlus.

Advantages and disadvantages

The advantage of leasing insurance is obvious to all parties to the transaction. Since the lessor remains the owner of the property, he is interested in its safety. It is also important for the tenant to ensure the safety of the leased object.

Among the disadvantages of insuring leased property, it is necessary to note the fact that the insurance policy leads to a slight increase in the cost of the property. But this drawback is compensated by the fact that both parties guarantee a refund if a risk occurs that entails damage or loss of the property.

Application of PBU 18/02

Particular attention should be paid to the requirements of PBU 18/02, since the procedure for taxation of bonuses depends on the accounting methodology for bonuses. Thus, with a one-time inclusion of the premium in expenses on the date of entry into force of the contract, when using the accrual method, expenses are recognized by the organization quarterly, and when using the cash method, expenses are not recognized. Thus, in the reporting period of payment of the insurance premium, a deductible temporary difference and a corresponding deferred tax asset are formed in accounting. This follows from paragraphs 11 and 14 of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n. The specified VVR and ONA are reduced (repaid) as insurance costs are recognized in tax accounting (clause 17 of PBU 18/02).

If expenses in the form of an insurance premium are recognized by an organization in accounting quarterly during the policy period when applying the accrual method, no differences arise between the procedure for recognizing expenses in accounting and tax accounting, and when using the cash method in the month of payment of the insurance premium in accounting, a taxable temporary the difference and the corresponding deferred tax liability (clauses 12, 15 of PBU 18/02). The specified NVR and IT are reduced (repaid) as expenses are recognized in accounting (clause 18 of PBU 18/02).

If expenses in the form of a premium are recognized by the organization as insurance costs relating to future periods and are subject to write-off by distributing them between reporting periods in the manner established by the organization, during the term of the contract when applying the accrual method of differences between the procedure for recognizing these expenses in accounting and tax accounting does not arise, and when using the cash method in the month of payment of the insurance premium, a taxable temporary difference and a corresponding deferred tax liability arise in accounting (clauses 12, 15 of PBU 18/02). The specified NVR and IT are reduced (repaid) as expenses are recognized in accounting (clause 18 of PBU 18/02).

Comprehensive insurance included in the lease payment accounting entries – questions for a lawyer – 2021

Then the costs associated with obtaining leased property and the cost of the object itself are written off from the credit account to the debit account, subaccount “Leased Property” (paragraph 2, clause 8 of the Instructions).

From the provisions of clauses 4, 7, 8 PBU 6/01 and para. 2 p.

Costs incurred by the lessee for delivery, bringing the leased asset to a state in which it is suitable for operation (including design, installation and commissioning work) are not subject to inclusion in the initial cost of the leased asset, accounted for under the financial lease (leasing) agreement on the balance sheet lessee (Resolution of the Federal Antimonopoly Service of the North-Western Territory dated 19.

Accounting and tax accounting of leasing from the lessee

Currently, the practice of communication between lessees and leasing companies with auditors and inspection bodies has developed, and a certain scheme of leasing transactions has been formed.

If, under the terms of the leasing agreement, the property is taken into account on the lessee’s balance sheet, upon receipt of the leased asset in the lessee’s accounting, the value of the property minus VAT is reflected in the debit of account 08 “Investments in non-current assets” in correspondence with the credit of account 76 “Settlements with various debtors and creditors”.

When a leased asset is accepted for accounting as part of fixed assets, its value is written off from credit 08 of account to debit 01 of account “Fixed Assets”. The accrual of leasing payments is reflected in the debit of account 76, subaccount, for example, “Settlements with the lessor” in correspondence with account 76, subaccount, for example, “Settlements for leasing payments”.

Postings for leasing a car from the lessee

The cost of redemption is included in payments 08 76/ Lease obligations The car is accepted on the balance sheet and the total amount of debt to LD is reflected. An entry is made for the total payments under the agreement for the entire period of its validity, minus VAT 19 76/ Lease obligations Input VAT is reflected (with all the amount taken into account by the previous entry) 01/ Leased property 08 The vehicle was put into operation as part of the operating system 76/ Lease obligations 76/ Leasing payments The periodic payment under the agreement is reflected The entry is made for each period for which payment is provided for in the agreement. For example, monthly. Posting amount - the entire amount of the next payment, including VAT 76/ Leasing payments 51 (50) Periodic payment paid 68 19 Accepted for VAT deduction In terms of the “closed” leasing payment for the expired period under the agreement.

Insurance of leased property, difficulties with the beneficiary, bank or lessor

At the same time, the choice by the policyholder of an insurance organization from the list specified by the bank is one of the informal conditions for obtaining a loan to finance a leasing transaction.

Let us note that in the Resolution of the Federal Antimonopoly Service of the Far Eastern District dated August 24, 2004 No. F03-A04/04-1/1824, the court recognized the right of the parties to the leasing agreement to insure property in favor of the beneficiary - the bank. If non-bank funds were raised to purchase the leased asset, then the beneficiary the insurance contract is the lessor.

In some cases, the beneficiary under an insurance contract for leased property may be the lessee, who, upon the occurrence of an insured event, can fulfill his obligation to pay lease payments at the expense of the amount of the insurance compensation received.

According to paragraph 1 of Article 929 of the Civil Code of the Russian Federation, under a property insurance contract, the insurer undertakes, for the payment stipulated by the contract (insurance premium), upon the occurrence of an event stipulated in the contract (insured event), to compensate the insured or beneficiary for losses caused as a result of this event in the insured property or losses in connection with other property interests of the policyholder (to pay insurance compensation) within the limits of the amount specified in the contract (sum insured).

Who pays for insurance when leasing?

But even in this case, the beneficiary will be the owner of the property, since by giving it to the lessee, he is exposed to risk. From these provisions, the erroneous conclusion is sometimes made that the insured during leasing can be the lessee or the lessor, and in any case only the owner of the item will receive insurance (lessor).

In fact, a third option is also possible: if the property was purchased by the lessor on credit, then the insurance contract, as a rule, is concluded in favor of the bank. Almost always, taking out CASCO insurance is a mandatory condition for leasing a car.

For the lessor, this is beneficial due to the confidence of receiving financial compensation if something happens to the machine during operation. The lessee in this case is forced to pay more, but he also receives some benefits.

The organization purchased a car on lease, it is listed on the lessor’s balance sheet

The insured and payer for CASCO and DSAGO is the lessor.

How should expenses be reflected for tax purposes (MTPL, DOSAGO, CASCO)? Can they be written off at once?

1 tbsp. 252 of the Tax Code of the Russian Federation, the general criterion for accepting any expenses for tax accounting is, in particular, the requirement of economic justification (validity) of expenses recognized for tax purposes. So, by virtue of paragraph 1 of Art.

252 of the Tax Code of the Russian Federation, for the purpose of taxing profits, the taxpayer has the right to reduce the income received by the amount of expenses incurred (except for the expenses specified in Art.

270 of the Tax Code of the Russian Federation), which recognize justified (economically justified) and documented costs (and in cases provided for in Art.

265 of the Tax Code of the Russian Federation, - losses) incurred (incurred) by the taxpayer. 49 art. 270 of the Tax Code of the Russian Federation).

Car insurance accounting

Posting: Dt 26 Kt 71. All other expenses of traveling employees are classified as PR (other production and sales expenses (P&R):

- payments and fees.

- the amount of rental housing,

- paperwork,

- amount spent on round trip tickets,

- daily allowance,

Car insurance is the most common type of insurance, which involves obtaining OSAGO (compulsory), DSAGO (voluntary insurance) and CASCO (death and theft) insurance policies.

Accounting for CASCO and OSAGO during leasing

The postings will be like this:

- D 76 - K 51 - Insurance premium transferred D 20 (23, 26, 44) - K 76 - Part of the costs for compulsory motor liability insurance (casco) is taken into account

- (30 kB) (139 kB) (99 kB) (92 kB) (56 kB) (72 kB)

Organization on OSNO. In accordance with the lease agreement for a vehicle (hereinafter referred to as the vehicle) with subsequent purchase, the organization issued (and paid for) MTPL vehicle insurance in April. In May we... Is it possible to partially write off a loss from car theft and how to show all this in the declaration? ✒ For accounting purposes, theft (hijacking) of a car is recognized as a disposal of a fixed asset item.

IN…. We sell OS. in 2014 switched to the simplified tax system (income-expenses) with OSNO OS was paid at the remaining cost.

Accounting for insurance of the leased asset

According to it, insurance services provided by insurance organizations are not subject to VAT. This means that the insurer does not present tax to the organization in the amount of the premium. If such rates are not approved, compulsory insurance costs are taken into account in the amount of actual costs, which follows from paragraph 2 of Article 263 of the Tax Code of the Russian Federation.

As for voluntary insurance, according to paragraphs 1 and 3 of Article 263 of the Tax Code of the Russian Federation, expenses for it are recognized in tax accounting in the amount of actual expenses.

Accounting on the balance sheet If the leased asset is accounted for on the balance sheet of the lessor, then its expenses for voluntary insurance are recognized for profit tax purposes on the basis of subparagraph 3 of paragraph 1 of Article 263 of the Tax Code of the Russian Federation.

- amount spent on round trip tickets,

- the amount of rental housing,

- daily allowance,

- paperwork,

- payments and fees.

Accounting for MTPL and CASCO policies: postings Auto insurance is the most common type of insurance, which involves obtaining MTPL (compulsory), DSAGO (voluntary insurance) and CASCO – insurance against death and theft. Every year, businesses that use transport buy insurance. They are taken into account in a special way. Expenses

Accounting for comprehensive insurance and compulsory insurance during leasing

Accounting for transactions under a leasing agreement is regulated by Order of the Ministry of Finance of the Russian Federation No. 15 dated February 17, 1997. Leasing entries depend on whose balance sheet the leased property is reflected on: the lessor or the lessee.

The party on whose balance sheet the leased property is accounted for must be indicated in the leasing agreement. Accounting for leasing when reflecting property on the lessor's balance sheet Leasing transactions correspond to the payment schedule located at the link.

If the leasing agreement provides for the reflection of the leased asset on the lessor’s balance sheet, the lessee reflects the leased property on off-balance sheet account 001 “Leased fixed assets”.

Leasing: postings

If the UNM is paid from the difference between profit and costs, then expenses for OSI reduce the cash/base. They should be taken into account when paying for the joint venture. When assessing UTII, the taxable base is imputed income.

Expenses according to SI do not affect calculations for UTII. When an enterprise uses UTII and OSNO property, insurance costs (OS and DS) are distributed, since when calculating cash/profit, expenses to which UTII tax/tax is applied are not taken into account. This rule does not apply to the price of property used in only one type of activity.

Accounting and tax accounting of leasing operations for the lessee. examples

Operation Account debit Account credit Amount, rub.

The leasing object was accepted for accounting (3,540,000 * 100 / 118) 08 “Investments in non-current assets” 76, sub-account “Lease obligations” 3,029,000 Submitted VAT by the lessor 19 76, sub-account “Lease obligations” 545,220 The object was accepted for accounting as part of fixed assets 01 “Fixed assets”, sub-account “Property under leasing” 08 3,029,000 Lease payment transferred (3,540,000 / 60) 76, sub-account “Debt on leasing payments” 51 59,000 Monthly lease payment was taken into account 76, sub-account “Lease obligations” » 76, subaccount “Debt on leasing payments” 59,000 Accepted for deduction of VAT regarding the leasing payment 68 19 9,000 Monthly depreciation was accrued (3,029,000 / 60) 20, 26, 44, etc.

Accounting for transactions under a leasing agreement with the lessee

Contributions paid by an enterprise for OS, DLS, and DPS are not subject to income tax. SP paid for employees, including dismissed ones, are exempt from personal income tax.

//www.youtube.com/watch?v=zDvuGOnAXes

VHI is voluntary individual insurance, therefore no tax is withheld from employees paid by the joint venture for VHI. The territoriality of the provision of services does not matter. JV under voluntary health insurance agreements.

There are no contributions if VHI is issued for a year. The costs of voluntary health insurance for personnel are taken into account when calculating cash/profit:

- if the contract is concluded for a period of more than a year. Recognize any period out of 12,

- when the clause on the provision of voluntary health insurance at the expense of the organization is indicated in the employment agreement,

- The insurer operates under a license.

Spending on voluntary health insurance reduces the non-profitable income to 6% of the labor costs of all employees of the enterprise.

Receipt of the leased asset: D 08 “Capital investments” subaccount “Purchase of individual fixed assets” -K 76 “Settlements with various debtors and creditors”. 2.

VAT accrued on the acquired property: D 08 “Capital investments” subaccount “Purchase of individual fixed assets” - K 76 “Settlements with various debtors and creditors”.

3. The leased asset is included in fixed assets: D 01 “Fixed assets” subaccount “Fixed assets received on lease” -K 08 “Capital investments” subaccount “Purchase of individual fixed assets”.

Monthly under a leasing agreement: 4.

Accrual of lease payments: D 76 “Settlements with various debtors and creditors” subaccount “Lease obligations” -K 76 “Settlements with various debtors and creditors” subaccount “Debt on leasing payments”. 5.

What are the postings for payment for asset insurance under leasing?

From the current lease payment) Dt 68 (Income tax) – Kt 77 – 630.48 (deferred tax liability reflected) Postings at the end of the leasing agreement Dt 01 (Own fixed assets) – Kt 01 (Fixed assets received under leasing) – 1,253,945 (reflects the receipt of ownership of the car) Dt 02 (Depreciation of leased property) – Kt 02 (Depreciation of own fixed assets) – 940,458.60 (accrued depreciation on the car is reflected) Postings within 12 months after the end of the leasing agreement Dt 20 – Kt 02 (Depreciation of own fixed assets) – 26,123.85 (depreciation on a car was accrued) Dt 77 – Kt 68 (Income tax) – 5,224.77 (reflecting a decrease in deferred tax liability) There is also a method in which the initial cost of the item leasing in accounting is equal to the cost of purchasing a car from the lessor, i.e.

We calculate the initial cost of a leased car

We purchase a truck under a leasing agreement, which is recorded on our balance sheet. Under the terms of the agreement, the lessor insures the car and includes the costs of CASCO insurance in the amount of lease payments (this can be seen from the transcript provided by the lessor). Can we formulate the initial cost of a car in accounting, taking into account CASCO?

: Yes. At the moment you receive the leased asset, you have a fixed asset in your accounting. For accounting purposes, its initial cost must include clause 8 of the Instructions, approved. By Order of the Ministry of Finance dated February 17, 1997 No. 15 (hereinafter referred to as the Directives), paragraphs. 7, 8 PBU 6/01:

Source: //advokat60.ru/34258-kakie-provodki-oplata-po-strakhovaniiu-os-po-lizingu.html