Form 11 (short) for 2021 is prepared according to the form from Rosstat order No. 449 dated July 19, 2018 (as amended on August 31, 2018). Only non-profit structures (legal entities), regardless of the field of activity, government agencies and local governments should submit it. The report must be sent by the company to the statistical authorities in the constituent entity of the Russian Federation at the place of registration.

Reporting is prepared based on the results of the past year. It reflects the generalized and detailed value of fixed assets owned by non-profit organizations, the amount of increase or outflow of the assets in question.

The report consists of several parts:

- Title page on which you need to indicate the reporting interval, the name of the company and its registration details;

- Section 1, reflecting the availability and structure of fixed assets, the dynamics of changes in their value and composition in the year under review;

- Section 2, which records data on the separate divisions that NPOs have.

The deadline for submitting reports to the territorial bodies of Rosstat expires on April 1 in the year following the reporting range.

Who delivers it and when?

Order No. 384 explains who submits Form 11 (short) to statistics in 2021 - non-profit organizations. The level of ownership and type of activity does not affect the obligation to submit a statistical report. Documents are sent to Rosstat by budgetary, state and autonomous institutions, charitable foundations, public organizations, associations and unions. If an NPO has a separate division, it reports to the territorial statistics body separately - at its location.

The statistical standards also approved the deadline for submitting Form 11 (short) in 2021: submit the report by April 1, 2021.

What OS is included in the form?

There is a division of fixed assets into groups. Not all subtypes of OS are included in form number 11 (abbreviated). According to official documents, only funds put into operation before January 1, 2011, the amount of which ranges from 20 to 40 thousand rubles (inclusive), should be reflected. The amount of actual depreciation does not matter: it can either reach 100% or be lower than this figure. The method of calculating depreciation should be linear.

The following fixed assets do not need to be entered in the form columns:

- funds in the amount of up to 40 thousand rubles, the operation of which has not been started;

- funds in the category from 20 to 40 thousand rubles, the use of which began on January 1, 2011 with 100% accrual;

- funds up to 20 thousand rubles.

All budget sources (funds and others) must be strictly checked by an accountant for compliance with current requirements for filling out the form.

How to report

Despite the fact that the instructions for filling out Form 11 (short) 2021 provide for electronic and paper versions of submitting statistical reports, in 2021 respondents will report to Rosstat exclusively in electronic form (500-FZ dated December 30, 2020). The document is signed with an electronic signature and sent to the territorial statistics department.

IMPORTANT!

In 2021, a law was adopted on the introduction of an electronic format for statistical reporting for organizations. But there are exceptions: some SMEs have the right to report in the old way: both on paper and electronically.

ConsultantPlus experts discussed how an institution can fill out Form No. 11 (short) for 2021. Use these instructions for free.

Form N 11 (transaction)

Form No. 11 (transaction) was also updated for reporting for 2021. Let's look at the most significant changes.

General instructions for filling

The deadline for submitting the form has been postponed by 1 day. Previously this was June 30, starting with the 2021 report on July 1.

For separate divisions it was clarified: if they operate outside the Russian Federation, then information on them is not included in the form.

The instructions for filling out the form also included the following addition for legal successors of the transformed legal entity. From the moment of its creation, the legal successor must submit a report in the form (including data of the reorganized legal entity) within the period specified on the form for the period from the beginning of the reporting year in which the transformation took place.

Section I

From the table in Section I of the statistical form, column 4 “Depreciation group number” was removed.

They explained that in column 3 “Order number of the object” the number is indicated in Arabic numerals from 1 to 5. When moving to a new type of fixed assets, they begin to number again.

For column 6 “Full accounting cost of the object at the time of sale in the reporting year,” the following clarification was made. If an object is purchased or sold at the end of a financial lease (leasing) agreement, the full value under the agreement is indicated, not the purchase price.

What are the filling rules?

In the statistical form, you must fill out the title page and 4 sections. Step-by-step instructions on how to fill out Form 11 (short) for 2021 for respondents:

Step 1. Design the title page. Enter:

- respondent's name;

- mailing address;

- OKPO.

Step 2. Fill out section I. Enter the following indicators according to the list of fixed assets:

- unit of measurement;

- increases and decreases in total book value;

- availability of funds at full book value, taking into account changes due to bringing assets to fair and cadastral value;

- availability of funds at residual book value;

- accrued depreciation - column 11 of form 11 (short) is filled in according to accruals for the reporting year;

- depreciation of liquidated fixed assets;

- preferential cost of accounting for income - mark 1 (current), 2 (full) or 3 (residual, according to the balance sheet of the previous owner).

Step 3. Forming section II. We distribute information on the availability and movement of assets by type of economic activity of the respondent. All columns are filled in by analogy with section I. The type of cost of revenue accounting is not indicated here.

Step 4. Fill out section III. We reflect the fact of the presence of funds and their average age.

Step 5. Enter the data into section IV. We determine the average annual cost of fixed assets.

The statistical report is signed by the manager or an authorized employee. Be sure to indicate the date the document was generated and contact information for communicating with the respondent.

Form 11 (short) – instructions for filling out

The report form for 2021 has been updated, so the methodological material for preparing the document has also been changed. Instructions for compiling statistical reporting on the fixed assets of non-profit organizations are given in Order No. 799 dated November 30, 2017 (as amended on November 22, 2018). Innovations are due to the need to correlate budget accounting with the norms of federal accounting standards (FSBUs are mandatory for use in the public sector from January 1, 2021, therefore, according to the new rules, the report is compiled for 2021).

Completion of Form 11 (short) can be done manually or electronically. The report is submitted by personal delivery to specialists of the Rosstat division, by mail or through TKS. What to do if the enterprise has separate structures:

- if separate bodies are located in the same region with the parent institution, the report presents summary data for the entire company;

- if a separate division and the parent body of an enterprise are located in different constituent entities of the Russian Federation, a report is submitted for the legal entity without data on such a separate structure, and information on the separate body is reflected in a separate report.

If the company does not have fixed assets, reporting is generated with zero indicators, signed and sent to Rosstat. An alternative option is to send a letter to the statistical authorities about the non-submission of the report due to the lack of data for its preparation.

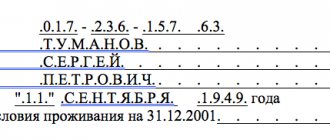

Form 11 (short) – instructions for registration

On the title page the year for which the company is reporting is entered. The full name of the NPO is entered; an abbreviated version of the name is given in brackets. Address data is indicated - zip code and legal address of the company. You must enter the OKPO code in the table block on the title page. If we are talking about a separate division, its TIN is entered.

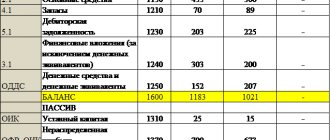

In Section 1, for groups of fixed assets, cost parameters for their increase (with detail by sources of assets) and decrease (with a deciphering of the ways of disposal of assets) are introduced. The price of fixed assets at the end of the reporting interval is shown in two versions - at full and at residual value. Additionally, accrued depreciation and amortization for liquidated objects that are recorded are identified (lines 01 – 14). All values are indicated in thousands of rubles.

Lines 15-17 show the cost of fixed assets with reference to the areas of activity of the non-profit organization.

Lines 18-29 indicate reference data reflecting the value of fixed assets in the environmental sector, the type of cost at which received assets are registered, and the average age of objects in different groups. Customers with unfinished construction must fill out lines 24-28.

Section 2 contains data on separate structures of non-profit organizations (if they exist): location, OKTMO code, main OKVED code, average annual cost of fixed assets.

At the end of the page, the signature of the responsible person (with a transcript), the date of submission of the report, and contact information (telephone and email) are affixed.

Form 11 (short) provides for the reflection of data on assets that are intended for repeated use (or for continuous operation for a period of more than 1 year) for the purpose of producing goods, providing services (market and non-market), for management needs or for third parties for a separate fee. Such assets may also be leased. The reporting must reflect data on objects that:

- shown in the balance sheet as part of fixed assets (buildings, structures, vehicles, equipment, investment real estate, construction in progress);

- are classified as tangible exploration assets;

- can be classified as intangible assets, including intangible exploration assets;

- are the results of research activities.

These assets must have a value greater than RUB 10,000. per unit (when we are talking about objects listed on off-balance sheet accounting account 21 “OS in operation”). There is no need to show fixed assets owned by public sector enterprises in the report if the price per unit of the asset is within 100,000 rubles. (for assets acquired before 2021, the cost threshold is set at RUB 40,000). Non-budgetary NPOs do not need to include in the report objects worth up to 40,000 rubles. (for assets purchased before 2011 – up to 20,000 rubles).

Normative base

Order of Rosstat No. 384 of July 15, 2020 “On approval of the federal statistical observation form for organizing federal statistical observation of the availability and movement of fixed assets (funds) and other non-financial assets”

Order of Rosstat No. 717 of November 29, 2019 “On approval of the Instructions for filling out federal forms statistical observation N 11 “Information on the availability and movement of fixed assets (funds) and other non-financial assets”, N 11 (brief) “Information on the availability and movement of fixed assets (funds) of non-profit organizations"»

Federal Law No. 500-FZ of December 30, 2020 “On Amendments to the Federal Law “On Official Statistical Accounting and the System of State Statistics in the Russian Federation” and Article 8 of the Federal Law “On the Fundamentals of State Regulation of Trade Activities in the Russian Federation””

KVED in 2012 – change of activities, sample of filling out form 11

During 2012, AFTER receiving a single tax certificate, it is necessary to change the types of activities to new ones 009:2010. Sample of filling out Form 11 for changing the KVED.

| Page 1 | page 2 | page 3 |

(images enlarge when clicked)

To change the KVED, you need to fill out an application - form 11. To do this, we first remember or find documents that indicate exactly what types of activities you registered - their codes and names. Next, we go to the Service website to assign codes for types of economic activity for KVED-2005 and KVED-2010, look for old types by code, compare, select new ones, copy the code and name.

Let's start filling out form 11. Form 11 is filled out exclusively in CAPITAL letters of the Ukrainian alphabet.

First, we indicate ALL types of activities that were registered previously, according to KVED 009:2005 - the full name of the type of activity and only in capital letters. Place a check mark next to it in the “Wickle” column. – i.e. We note the types that need to be excluded - these are all types of activities that have been registered. Next, we list the types of activities that need to be registered, according to the new KVED, and put a tick in the “On” column.

and forms 11 – for changing types of activities

Form 11 - Registration card for maintaining the registration of changes to information about a physical person - enterprise, which is located in the Unified Register of Legal Entities and Physical Persons - Entrepreneurs (550.5 KiB, downloaded : 56,789 times) Form 11 - Registration card for state registration of changes in information about an individual entrepreneur , which are contained in the Unified State Register of Legal Entities and Individual Entrepreneurs

If you have many types of activities, you need to add another sheet with a table listing the types of activities.

Form 11 with an additional page for entrepreneurs with many types of activities (970.5 KiB, downloaded: 25,861 times) Form 11 with an additional page for entrepreneurs with many types of activities

tpu.org.ua Dear visitors! Please note that a forum is open where you can ask questions, get answers and sign up to have answers delivered to your inbox! Discuss on the forum the article “Change of types of activities of KVED in 2012” GD Star Rating loading... KVED in 2012 - change of types of activities, sample of filling out form 11, 9.1 out of 10 based on 30 ratings Share:

What has changed in Form 11?

In the code part of the title page of Form 11 (statistics on fixed assets), a clarification has appeared that if there are separate divisions, the TIN is indicated on the title page in column “2”. If the organization does not have “separate sections”, you must indicate the OKPO code, as usual.

In the 1st section of the form, information about vehicles should now be displayed in line 06. In addition, such information should be taken into account when filling out line 05.

Information about computer technology, office equipment, radio communications, television and radio broadcasting, and library collections no longer needs to be displayed in separate lines. The new form does not have special lines for such fixed assets.