Every merchant, individual or organization fills out payment documents. And it doesn’t matter what payment documents are used, payment documents for the transfer of contributions, payment of wages to employees, all this must be filled out and sent according to the details.

This is why there are KBK codes, which can be deciphered as a budget classification code. For this classification, we are obliged to Russian Legislation (budget code). Each code implies its own organization to which amounts of money are transferred. All bank employees are familiar with this classification, because it is the KBK that is responsible for the receipt of funds. It will consider what KBK 00000000000000000130 is responsible for, and who fills it out.

What is KBK in a payment order?

The budget classification code in the payment slip is a special digital code that should indicate budget income and expenses.

An organization's accounting department encounters these codes when it makes a payment to the budget system, but most often does not understand what this sequence of numbers is and what it means in the payment order. What KBK and payment cards are available from January 1, 2021 can be viewed on this page - the classifier contains up-to-date information. But to understand the structure of the code, let's take a closer look at it. Let's look at what the KBK consists of, how important it is to indicate it correctly on the payment slip, and what to do with errors. The decoding is given in Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n.

In accordance with it, the BCC indicated in payment orders consists of 20 digits combined into groups. Each group has its own meaning.

New order

Order No. 65n, which established the key rules for the application of budget classification, ceases to be valid on December 31, 2018. From the new year 2021, updated standards will apply. Officials approved:

- Order No. 132n dated 06/08/2018, which contains a new procedure for the formation and application of BC codes.

- Order No. 209n dated November 29, 2017, which determines the procedure for applying KOSGU in accounting.

The innovations caused a flurry of questions and controversy. To resolve them, the Ministry of Finance issued additional clarifications on the procedure for applying new legal acts. The information is contained in Letters dated June 29, 2018 No. 02-05-10/45153 and dated August 10, 2018 No. 02-05-11/56735.

Now we will determine in detail what has changed in the codification of the income and expenditure parts of the bookkeeping system.

What does the budget classification code consist of?

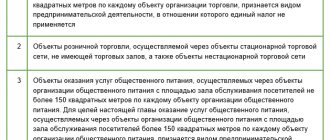

Each digit of the code indicated on the payment slip is also called a digit. The digits are combined into blocks as follows:

The first group is administrative. It consists of three digits and reflects the code of the chief revenue administrator. For example, the Federal Tax Service code in the payment order is 182; FSS code in the payment slip is 393.

The second block is profitable. It includes several information messages at once. The first of them (bit 4) is expressed in one digit and indicates the type of payment received. For example, the number 1 means that it came in the form of a tax, 2 - that it came in the form of gratuitous income, 3 - from business, etc.

Next comes a subgroup. These are two signs that indicate for what purpose the cash receipts from the payment order are intended. So, 01 - profit tax and income tax; 02 - tax or fee for social needs, 08 - state duty.

The table will help when filling out a payment order. It contains a detailed decoding of the KBK, the categories are indicated in a separate column.

| KBK structure | Category No. | What to indicate in a payment order |

| Income group | 4 |

|

| Income subgroup | 5, 6 | For tax and non-tax income:

|

The third block also includes a group and a subgroup (two and three numbers in a row, respectively).

The next element in the payment order defines the budget code and consists of two digits, designated as follows:

- 01 - federal;

- 02 - subject of the Federation;

- 03 - local, etc.

| KBK structure | Category No. | What to indicate in a payment order |

| Income item | 7 | Codes by which administrators classify incoming payments. The codes are indicated in Appendix 1.1 to the Directives approved by Order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n. |

| 8 | ||

| Sub-item of income | 9 | |

| 10 | ||

| 11 | ||

| Income element | 12,13 | Codes for distribution of payments - budgets:

|

Next are 4 key numbers that determine the “reason” for the payment (digit numbers in the BCC are 14, 15, 16, 17). It is important to understand here that there can be only three reasons:

- payment of the tax itself (fee, contribution);

- payment of penalties on it;

- payment of a fine thereunder.

So, for example, at the time of writing, when filling out payment orders, the following designations are generally accepted: payment - 1000, 2100 - penalties, 3000 - fine. For example:

- 182 1 0100 110 - when paying personal income tax to the budget;

- 182 1 0100 110 - upon payment of penalties for personal income tax;

- 182 1 0100 110 - payment of a fine.

And finally, the last three digits of any code are a classifier of the type of income (tax, non-tax, from property, etc.). For example, 010 is tax income; 130—receipts from the provision of paid services, work and compensation of costs; 150 - gratuitous receipts from budgets.

| KBK structure | Category No. | What to indicate in a payment order |

| Analytical group of budget income subtype | 18, 19, 20 | The values of the codes are approved by the Ministry of Finance of Russia, the financial body of the subject of the Russian Federation, municipal formation. If not approved, please indicate:

Items of disposal of non-financial assets:

|

BC RF art. 226

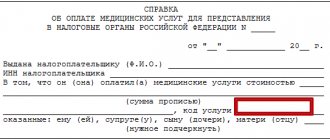

Based on the instructions of the Russian Federation on the application of the BCC in Art. 226 includes the following types of service provision:

- Research works.

- Engineering and technical services, conducting structural surveys.

- Demarcation of land boundaries.

- Standard design.

- Installation work. Installation of systems such as video surveillance, panic buttons.

- Providing insurance services.

- Ensuring security during secret events.

- Providing services for the protection of electronic document management.

- Typographic works (binder services, photocopying).

- Medical services.

- Collection services.

- Provision of paid vocational training services.

- Services provided to the organization for food for employees.

- Another similar range of services.

KBK field in a payment order

Each field in the payment order is assigned its own number.

The payment order has a separate field for KBK (this is the 104th field), and it must be filled out correctly (you can see the rules for filling out a payment order in the “Regulations on the rules for transferring funds” (approved by the Bank of Russia on June 19, 2012 No. 383-P If the BCC is indicated incorrectly on the payment slip, then the corresponding amount may be classified as unexplained payments. The Federal Treasury may classify it as “unclarified.” At the same time, an error in indicating the BCC on the payment slip can lead to arrears in taxes and insurance premiums.

Here is an example of a completed payment slip with entered data about the recipient:

- field 104 of the payment order indicates the KBK for transferring personal income tax;

- 105 - OKTMO;

- 106 - basis - current payment (abbreviated as TP);

- 107 - period (MS - abbreviated month);

- 108 - this field contains “0” (when paying on demand, the number of the document with the demand is entered in this field of the payment order);

- 109 - “0” (the payment field is intended to indicate the date of submission of the declaration or settlement. If the payment is made regardless of the submission of reports, “0” is always placed in this payment field);

- 110 - the field always remains empty in the payment order;

- 24 - brief purpose of payment: type of tax and payment period.

IMPORTANT!

In 2021, insurance premiums must be paid not to the funds, but to the tax inspectorates; accordingly, other account details are indicated in the payment slips. Payment of contributions for “injuries” is also transferred to the Social Insurance Fund.

Filling example

Most often, bailiffs send a payment order to organizations. The payment order for the enforcement fee is a document that regulates the repayment of the existing debt. For example, withholding money from an employee’s salary to pay off alimony or utility debt.

The main purpose of a payment order under writs of execution is to confirm the validity of deductions from an employee’s salary of funds to pay off the debt. The funds are written off in favor of the bailiffs.

After this, the funds are sent to an individual, organization or fund to pay off the debt owed to them.

If the KBK is incorrectly indicated on the payment, what to do?

The payer may receive a payment with an incorrect BCC. For example, KBK 392 1 1600 140 is indicated, how to fill out a payment order (2018) using this code? There is only one answer: there is no need to fill out such a payment form, since this code is no longer used. Previously, fines were paid to the Pension Fund of the Russian Federation using this code for late submission of reports on insurance premiums. Now tax accounting in the Pension Fund of Russia is administered by the Federal Tax Service, so the old KBK has lost its relevance. But if a mistake has already been made, you incorrectly indicated the KBK in the payment order and transferred money, then proceed as follows.

Step 1. An application must be sent to the tax office or the territorial branch of an extra-budgetary fund to clarify the details of the payment order. The application is written in any form. Please attach a copy of the payment slip with the bank's stamp to your application.

Step 2. Tax inspectors must make a decision on the issue of clarifying payment within 10 working days. This period begins to count from the date of application, when the inspectors received your application for clarification of payment, or from the date of signing (registration) of the act of joint reconciliation of calculations (if it was carried out).

Step 3. After the deadline has expired, be sure to order a tax certificate of settlements with the budget or a reconciliation report to make sure that the inspectors credited the amount to the correct BCC.

Since the KBK belongs to the group of details that allow one to determine the identity of the payment, if an erroneously specified KBK is detected in the order for the transfer of tax, the payer has the right to contact the tax authority with an application to clarify the identity of the payment. This position has been repeatedly expressed by the Ministry of Finance (for example, Letter dated January 19, 2017 No. 03-02-07/1/2145).

The role of bailiffs

Bailiffs are needed to monitor the implementation of decisions made by the court during legal proceedings. Moreover, they control not only the implementation of decisions made by the court in material terms. They are also responsible for collecting fines. That is, they perform the following actions:

- Find a person who owes money to the state budget

- Notify him of debts and the consequences of non-payment

- Find legal ways to collect the amounts of his debts from a given person

A fine will have to deal with bailiffs if he avoids fulfilling his court obligations in every possible way. In this case, he avoids paying the fine to which he is obliged to spend the funds. It is this executive body that must ensure that the calculated fine and penalties are transferred to the state budget.

Table of frequently used BCCs

| BCC for personal income tax (NDFL) | KBK on single income tax with simplification |

| KBK for land tax | KBK for payment of a single tax with a simplification of the difference between income and expenses |

| KBK for corporate property tax | KBK on water tax |

| KBK for the single tax on imputed income (UTII) | KBK for VAT 2020 |

| KBK for income tax | KBC for insurance premiums for 2021: pension, medical, social insurance |

| KBK on transport tax for legal entities and citizens | KBK for payment of income tax credited to the budgets of constituent entities of the Russian Federation |