The procedure for filling out a payment order for bailiffs differs when withholding taxes and other deductions, namely, alimony and judicial penalties.

Special rules and official instructions do not relate to the procedure for issuing payments for non-budgetary collections, therefore a regular payment order is drawn up for such payments. All identification information is indicated in the “Purpose of payment” field, and the payer status, BCC and other tax fields are not required to be filled out.

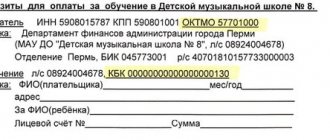

The purpose of payment refers to types of deduction (alimony for a specified period), attributes of writs of execution, details of alimony cases, indicating the information of the recipient of the withheld amount. A more specific composition of information is clarified with the bailiff service.

The procedure for filling out payments to the bailiffs will be different for tax deductions and for non-tax payments of the employee (for example, alimony, court penalties).

When an employee’s personal taxes are transferred to the account of the FSSP department based on writs of execution, the payment is drawn up according to the rules governing budget payments.

A payment order for payment under a writ of execution has its own design features:

- Field 60 (TIN of payers) – indicates the TIN of the individual whose obligations are being fulfilled. If an individual does not have a TIN, the number “0” is entered in this field.

- Field 102 (payer checkpoint) – enter the number “0”.

- Field 8 (payer’s name) – indicate the short name of the organization deducting the amount to the budget.

- Field 101 (payer status) - according to Appendix 5 to the order of the Ministry of Finance of the Russian Federation No. 107N dated November 12, 2013, these payments are marked with the status (number) “19”.

For more information about deductions based on a writ of execution from a pension, read the article: collection based on a writ of execution from a pension.

Kbk for paying alimony to bailiffs 2021

For example, this could be transport tax, debts to the Federal Tax Service, etc. and so on. It is worth noting that it will most likely not be possible to clarify this information with FSSP employees or your bailiff directly. They do not and should not have the necessary accounting skills.

A convenient (relatively) electronic service appeared only at the end of last year. As a result, I received an angry letter from the Pension Fund of the Russian Federation, I knew how much money should be left on the PC, and after 2-3 weeks they wrote it off from there themselves.

Sample of filling out a payment order form for bailiffs in 2021 ↑

The process of generating this type of document has a large number of different features. If possible, it is worth dealing with all of them in advance. This will avoid a variety of difficulties.

What OKTMO to write in a payment order when paying taxes in 2017, read here.

If for some reason there is simply no relevant experience in drawing up such documents, then you will need to carefully read the sample. This will avoid a large number of different difficulties.

The main issues that will need to be considered in advance include:

- step by step guide;

- instructions from the KBK;

- nuances for LLC;

- example of filling.

Step by step guide

The process of filling out a payment order must be carried out in a certain order. All nuances are reflected in Bank of Russia Regulation No. 383-P dated June 19, 2012.

The important factor is the purpose of the payment. If transfers of the appropriate type will be made to the Ministry of Finance, then its instructions should also be taken into account.

The fundamental regulatory document is Order of the Ministry of Finance No. 107n dated November 12, 2013.

The most significant nuance that should be remembered first of all is that individual fields are not allowed to be omitted. All of them must be filled out.

Otherwise, the bank simply will not accept such a document to execute payment on it. If there is a field that for some reason is unnecessary or there is no data to fill it in, simply enter the number 0.

In the standard form, fill out in the following order:

KBK instruction

One of the fields of almost all payment orders without exception is the budget classification code.

Video: how to make a payment order in 1C 8.3 to pay a supplier

It should be remembered that if such a document is generated for bailiffs, there is no need to indicate the BCC. Field No. 104, which is used to indicate this information, must be left blank.

Nuances for LLC

The format of the type of payment order under consideration is completely standard. That is why any difficulties usually do not arise when first familiarizing yourself with legislative acts.

At the same time, there are also no specific features depending on the organizational or legal form.

Filling example

If possible, it is advisable to familiarize yourself with an example of drawing up such an order in advance. All such documents are standard.

What is the order of payment in a payment order for salaries in 2017, read here.

For a sample payment slip for personal income tax penalties in 2021, see here.

The only exception is the need for deductions from the employee’s salary. In this case, the rules that are regulated for the corresponding contributions to the budget are used.

Photo: payment order

The formation of a payment order has a large number of different nuances and features. You can familiarize yourself with all of them in advance. This will avoid various difficulties.

Details for paying debts at the bailiff service of the Pervomaisky district

In addition, in the menu that appears as a list of payment options, you can familiarize yourself with all the ways to repay the debt to the FSSP for your enforcement proceedings. Perhaps you can find a payment option that is more convenient and economical for you.

The signs “No” and “–” are not indicated in field 108. If the individual’s TIN is filled in, the value “0” is allowed in this field.

- In fields 106 “Base of document”, 107 “Tax period” and 109 “Date of document” enter 0.

Sample of filling out a payment order to bailiffs For clarity, let’s look at filling out a payment order to the FSSP using a conditional example.

Payment according to writ of execution

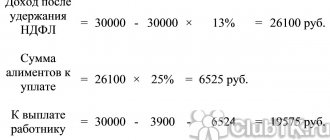

The procedure and principle of deduction from wages under writs of execution are prescribed in the regulations of the Labor and Family Codes, Federal Laws and Resolutions approved by the Government of the Russian Federation.

In accordance with Art. 242.1 of the BC RF, a copy of the arbitration court decision on the basis of which the corresponding writ of execution was issued must be attached to the writ of execution.

Payment must be made within five working days after receiving the writ of execution. The period for voluntary repayment of the debt amount is established by the bailiff service at the time of initiation of enforcement proceedings. Violation of the terms of payment under a writ of execution or by a court decision entails additional costs for the debtor, namely: an enforcement fee equal to 7% of the debt amount (but not less than 1000 rubles) - for individuals, and in the amount of 10,000 rubles - for legal entities persons

When is it necessary to indicate the BCC?

And yet there are cases when CBC is necessary. Thus, organizations and citizens most often pay debts after a court decision.

Expert opinion

Makarov Stanislav Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

Such debt includes outstanding credits, loans, etc. But some taxpayers do not comply with the court decision and do not pay the debt that is owed to them.

In this case, Art. 112 of the law of October 2, 2007 No. 229-FZ (as amended)

dated 12/02/2019). In accordance with this article, the violator is obliged to pay an enforcement fee.

When transferring it, you must indicate the corresponding BCC in field “104” of the payment order.

The BCC of bailiffs is required to be indicated in a number of other cases, mainly when paying fines, incl. judicial

The first three digits of the code (322) indicate the payment administrator (Federal Bailiff Service).

We present in the table the cases when the BCC is indicated for payments to the FSSP:

KBK: Federal Bailiff Service

State duty for entering information about a legal entity into the state register of legal entities engaged in the collection of overdue debts as the main activity

Income received as compensation to the federal budget for expenses aimed at covering procedural costs

Administrative fines established by Chapter 13 of the Code of the Russian Federation on Administrative Offences, for administrative offenses in the field of communications and information, imposed by judges of federal courts, officials of federal government bodies, institutions, the Central Bank of the Russian Federation (other fines)

Administrative fines established by Chapter 14 of the Code of the Russian Federation on Administrative Offences, for administrative offenses in the field of entrepreneurial activity and the activities of self-regulatory organizations, imposed by judges of federal courts, officials of federal government bodies, institutions, the Central Bank of the Russian Federation (other fines)

Administrative fines established by Chapter 17 of the Code of the Russian Federation on Administrative Offences, for administrative offenses encroaching on institutions of state power, imposed by judges of federal courts, officials of federal government bodies, institutions, the Central Bank of the Russian Federation (other fines)

Administrative fines established by Chapter 20 of the Code of the Russian Federation on Administrative Offences, for administrative offenses encroaching on public order and public safety, imposed by judges of federal courts, officials of federal government bodies, institutions, the Central Bank of the Russian Federation (other fines)

Fines established by Chapter 16 of the Criminal Code of the Russian Federation for crimes against life and health

Fines established by Chapter 17 of the Criminal Code of the Russian Federation for crimes against freedom, honor and dignity of the individual

Fines established by Chapter 20 of the Criminal Code of the Russian Federation for crimes against family and minors

Fines established by Chapter 21 of the Criminal Code of the Russian Federation for crimes against property

Fines established by Chapter 31 of the Criminal Code of the Russian Federation for crimes against justice

Judicial fines (monetary penalties) imposed by courts in cases provided for by the Criminal Code of the Russian Federation

Judicial fines imposed by courts in cases provided for by the Arbitration Procedural Code of the Russian Federation

Judicial fines imposed by courts in cases provided for by the Civil Procedure Code of the Russian Federation

Judicial fines (monetary penalties) imposed by courts in cases provided for by the Code of Administrative Procedure of the Russian Federation

Judicial fines (monetary penalties) imposed by courts in cases provided for by the Criminal Procedure Code of the Russian Federation

Incorrectly specified KBK in the payment order for payment to bailiffs is not a critical error. In this case, you just need to clarify your payment. If this is not done, the transferred money will be classified as unexplained payments.

The legal topic is very complex, but in this article we will try to answer the question “Kbk alimony 2021 for bailiffs.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

It depends on the nature of the cash withholdings. This means that for taxes and for non-tax payments of an employee (for example, alimony or traffic police fines) it does not match. Regarding non-budgetary collections, there are no special rules, as well as official instructions on the procedure for issuing payments.

Along with payments, KBK in 2021 must be indicated in some tax returns: for income tax, for VAT, for transport tax and when filling out calculations for insurance premiums. The obligation to withhold alimony and transfer it to the claimant arises immediately after receiving the writ of execution.

KBK in the payment order to the bailiffs: is it necessary or not?

KBK is a special digital code indicating state budget revenues. It consists of 20 digits, each of them has a specific meaning. This code allows government departments to determine for what purposes the funds were transferred. The decoding of the BCC is given in Order of the Ministry of Finance of Russia dated November 29, 2019 No. 207n. In the payment order, the digital code is indicated in field “104”.

The payment order can be filled out, for example, by the employer, who withholds a certain amount from the employee’s salary and transfers it to the bailiffs’ account. All deductions must be justified, and their legality must be documented. Such a document is a writ of execution; it should contain the necessary details for payment. But the BCC of bailiffs may not be indicated in the writ of execution.

Payment orders to bailiffs are of two types: to pay off debts on taxes, fines and extra-budgetary payments (these include payment of alimony, loan debt, etc.). The funds are first transferred to a special account, and then the FSSP redirects them to collectors (legal entities or individuals) for a specific BCC. In this regard, it is not necessary to indicate the BCC on the payment order.

If we are talking about carrying out extra-budgetary collections, there are no special requirements for drawing up a payment order. All information identifying the payment is indicated in the “Purpose of payment” field. But the KBK, taxpayer status and tax information are not reflected in the document.

When filling out a payment order for the transfer of tax debts to the bailiff (for example, when transferring deductions from an employee’s salary), you should be guided by the rules governing budget payments. In this case, “0” should be indicated in the “104” field.

Insurance premiums: how to fill out a payment order

After the entry into force of Chapter 34 of the Tax Code of the Russian Federation, insurance premiums directed to:. The rules for processing payment orders for tax payments are established by the Order of the Ministry of Finance of All employers who hire employees pay contributions from the amount of wages paid.

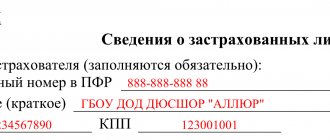

- TIN of the person who is the payer.

- Checkpoint of the citizen from whom deductions are made.

- The name of the payer is the organization that transfers the amounts of money collected from the individual.

- Payer status. In this case it will be 19.

- Code. If the payer has an identifier, then this should be entered.

- KBK. Such documents are marked with 0.

- The classification according to OKTMO is the one that relates to the location of the bailiff’s office to whose account the payment is made.

- A unique number of a document that can act as an identifier of an individual (for example, a civil passport number, SNILS, etc.)

Important aspects ↑

Today, the main purpose of the bailiff service is to collect funds from debtors.

Moreover, this procedure is carried out in various ways. The simplest and fastest way is to send a special payment order to the place of work of a specific defendant.

Based on the bailiffs' payment, the accounting service is obliged to make transfers accordingly in favor of the relevant person.

It is important to remember that failure to comply with such requirements risks not only administrative, but also criminal liability. Therefore, it is worth familiarizing yourself in advance with all the nuances in any way related to such documents.

The main issues that need to be studied in advance include the following:

What it is?

Today, a payment order to bailiffs means a special document that contains detailed information on the purpose of the payment of the type in question.

However, there are several different formats for such documentation. All papers of this type can be divided into the following categories:

If extra-budgetary collections are carried out, there is no need to follow special rules when drawing up payments. That is why in this case you can use the format of a standard payment order.

In such documents there is no need to reflect tax fields, as well as the status of the payer, and various budget classification codes.

All identifying information will be reflected in a special section called “payment purpose”. It is important to first consider all the features and nuances of drawing up such documentation.

Otherwise, all sorts of difficulties may arise. All features are presented in the relevant legislative acts.

Purpose of the document

A payment order for bailiffs has its main purpose. It consists of justifying the deduction of certain amounts from the amount accrued as remuneration to the employee in order to pay off any debts.

The basis for this is the writ of execution. Funds from such documents are always transferred to bailiffs.

Then they are sent directly to the organization, fund, to the individual to whom the debt exists.

In addition to the payment function, the document of this type performs some others:

- confirmation of the legality of certain deductions from the salary of an officially employed employee;

- streamlining accounting reporting;

- simplification of reporting procedures.

Despite the fact that if a payment order in some cases can be generated in a relatively “free” format, it is necessary to remember the importance of drawing it up in accordance with the standards.

There are quite a large number of different nuances associated with the formation of such a document. There are some important features to keep in mind.

Failure to complete a payment order correctly may result in the payment being sent incorrectly. As a result, the funds will not be transferred to the bailiffs.

This may become the basis for various types of sanctions from the Federal Tax Service and other government control bodies.

Normative base

Today there are quite a large number of legislative acts that regulate the work of bailiffs. At the same time, the issue of drawing up a payment order is discussed in detail in Chapter No. 46 of the Civil Code of the Russian Federation.

This legislative document includes the following:

If possible, before starting to compile the type of document under consideration, it is worth carefully studying the legislative acts indicated above.

This way it will be possible to minimize the likelihood of making mistakes when drawing up documentation and subsequent transfer of money.

Filling example

Most often, bailiffs send a payment order to organizations. The payment order for the enforcement fee is a document that regulates the repayment of the existing debt. For example, withholding money from an employee’s salary to pay off alimony or utility debt.

The main purpose of a payment order under writs of execution is to confirm the validity of deductions from an employee’s salary of funds to pay off the debt. The funds are written off in favor of the bailiffs.

After this, the funds are sent to an individual, organization or fund to pay off the debt owed to them.

How do bailiffs work?

The main task of bailiffs is to monitor the implementation of decisions made in court. They not only ensure the implementation of court decisions in material terms, but also collect fines from individuals and legal entities that do not repay their existing debt on a timely basis. Bailiffs search for debtors and find legal ways to collect existing debts from them. The most common debt collection mechanism is to send a payment order to the organization where the debtor works.

Rules for filling out a payment order

- TIN of the person who is the payer.

- Checkpoint of the citizen from whom deductions are made.

- The name of the payer is the organization that transfers the amounts of money collected from the individual.

- Payer status. In this case it will be 19.

- Code. If the payer has an identifier, then this should be entered.

- KBK. Such documents are marked with 0.

- The classification according to OKTMO is the one that relates to the location of the bailiff’s office to whose account the payment is made.

- A unique number of a document that can act as an identifier of an individual (for example, a civil passport number, SNILS, etc.)

Expert opinion

Makarov Stanislav Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

Budget income classification codes are divided not only by type of payment, but also by purpose. The payment of funds ordered by a court verdict is called payment under a writ of execution.

In order to pay a particular debt according to a court decision, you need to indicate in the payment order the details of the KBK according to the bailiffs’ writ of execution for 2021. In 2021, the ciphers of the corresponding year were used.

This article presents codes and a sample for filling out a payment order to bailiffs, since the preparation of this documentation has nuances.

Individuals and legal entities that owe money to organizations or third parties are more likely to pay their debts after a court decision. Such debts include: alimony, unpaid loans, loans from friends, relatives, banking organizations or damage.

But some citizens sometimes do not pay fines assessed by the court. Then Art. 122 Federal Law No. 229 of October 2, 2007 (as amended on December 27, 2018).

The article states that in such a situation, a citizen is obliged to pay the enforcement fee of bailiffs for 2021, the BCC of which is entered in field 104 of the payment order. The budget classification code for paying fees assigned by bailiffs is in this article.

Budget Classification Codes (BCC) used

Payment according to the writ of execution of the KBC - transfer to specially created digital codes, through which items of the federal budget are grouped. The concept was put into effect by the Budget Code of Russia on July 31, 1998 (Federal Law No. 14).

| No. | Receipt code (name) | Code |

| 1 | Revenues received by the federal budget as reimbursement of funds spent to cover procedural costs | 32211302030016000130 |

| 2 | Other income for the provision of paid services by recipients of federal budget funds | 32211301991016000130 |

| 3 | Other income that compensates for federal budget expenses | 32211302030016000130 |

| 4 | Performing fees | 32211501010016000140 |

| 5 | Monetary fines for violation of Russian legislation on the court and judicial system, on enforcement proceedings, court fines | 32211501010016000140 |

| 6 | Fines and other amounts withheld from persons guilty of crimes, compensation for property damage included in the federal budget | 32211501010016000140 |

| 7 | Monetary fines and other amounts collected from persons guilty of committing crimes, and in compensation for property damage, included in the budgets of the constituent entities of the Russian Federation | 32211501010016000140 |

| 8 | Monetary fines and other amounts collected from persons guilty of committing crimes, and in compensation for property damage, included in the budgets of city districts | 32211501010016000140 |

| 9 | Other non-tax deductions to the federal budget | 32211705010016000180 |

KBK 3220000000000000180

The legal topic is very complex, but in this article we will try to answer the question “Kbk for alimony to bailiffs 2021.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

“Site Administration” (hereinafter referred to as the Administration) - authorized employees to manage the site https://online-sovetnik.ru, who organize and (or) carry out the processing of personal data, and also determine the purposes of processing personal data, the composition of personal data to be processed , actions (operations) performed with personal data.1.1.2. "Personal

However, in 2021, in practice, there are cases when a legal entity (for example, a bank) needs to transfer alimony in favor of bailiffs. will indicate the employee’s tax identification number, enter 0 in the checkpoint, and designate himself as the payer; will indicate 19 as the payer status;