Accounts receivable is the debt of any type of entity to an organization as a result of economic relations, for the most part - credit trade or in installments. An organization is considered financially stable if the accounts receivable on the balance sheet exceed the amount of accounts payable. It gives the organization the right to make property claims against debtors.

This debt is considered in 3 positions, such as:

- Ability to repay loans;

- Part of the products sold but not yet paid for;

- Part of current assets.

Important: according to the accounting of accounts receivable performed by an accountant, its total can be seen on any date, but usually this value is calculated on the balance sheet date.

What is accounts receivable

The work of any organization is associated with the occurrence of debt. It comes in two types:

Take our proprietary course on choosing stocks on the stock market → training course

– accounts receivable

– accounts payable

Usually there are no difficulties in understanding what accounts payable is. If we explain it in terms familiar to the average person, then accounts payable are all the amounts that a company owes to its counterparties, the budget (in the form of taxes) or other creditors.

The opposite situation occurs when accounts receivable are formed. All amounts that the company expects to receive will be the amount of accounts receivable.

For example, a company overpaid VAT to the budget. The amount of tax that is transferred in excess of the accrued amount will be a receivable. The same situation arises if an organization transfers money to a counterparty on account of a future delivery. With regard to funds paid to employees: the “accounts receivable” includes wage debts to employees, as well as funds issued on account.

The amount of such debt is formed throughout the year and is reflected in the balance sheet in line 1230, in accordance with Order of the Ministry of Finance No. 66n dated July 2, 2010.

| IMPORTANT! In the vast majority of cases, the debt of counterparties to the organization is reflected in the balance sheet asset in the section reflecting the value of current assets |

How is the digital string encoding deciphered?

To understand the fundamental meaning of assigning a digital designation to the balance sheet line “Accounts receivable” - 1230, you need to take into account its role and place in the balance sheet as a whole. The encoding of this line (like any other in the balance sheet) is transcribed as follows:

- the first digit – belonging to the first and main document in accounting (to the balance sheet);

- the second digit - belonging to a specific section of assets (in this case, section 2 - “Current assets”);

- the third digit is an indicator of the resource’s liquidity (third after reserves and VAT);

- the fourth digit is intended to detail items according to their level of materiality (initially equal to zero).

Types of receivables in a company

All receivables are divided into two large groups:

- Long-term

- Short term

Both varieties fall into balance after a year.

All debts that are repaid within 12 months constitute short-term “receivables”. As a rule, such debt includes overpayment of taxes, shipments to counterparties “on credit,” or prepayment for goods or services.

Long-term debt appears when the debt is not paid off within a year. As for settlements with counterparties, the possibility of this type of debt arising should be specified in the agreement with the partner. However, if the counterparty simply does not pay its obligations for a long time, then such debt also belongs to the category of long-term.

Of course, it is in the interests of each organization to have a significant share of short-term debt out of the total amount of “receivables”.

It must be taken into account that no matter what type of debt, after missing the repayment deadline, it becomes overdue. It is not in the best interests of the company to have overdue accounts receivable .

There is often great doubt that the debt will ever be repaid. Often such overdue debts are never closed, that is, they become hopeless. A debt can be doubtful for three years, and then becomes uncollectible. Ultimately, such debt must be written off as a loss.

Off-balance sheet reflection

It is noteworthy that writing off debts as losses due to the insolvency of debtors is not the same as canceling the debt. Such debts must be reflected on the balance sheet for another five years from the date of write-off.

This is done so that it becomes possible to monitor the financial condition of counterparties and further attempts to collect debt amounts if the debtor’s property situation suddenly changes.

Which accounts make up the amount of accounts receivable?

When determining the amount of accounts receivable, it should be remembered that its amount is not formed on any one account, but consists of a set of values that are reflected in the debit balances of many accounts. This is enshrined in the order of the Ministry of Finance No. 94n dated October 31, 2000.

The calculation uses balances on the following accounts:

- If the company has a work in progress, then the turnover on account 46 will show the volume of work already completed

- Account 60. Shows the status of settlements with various suppliers

- Account 62 reflects the status of settlements for transactions with customers

- Accounts 68, 69. Show balances for settlements with the budget and extra-budgetary funds

- Accounts 70, 71, 73. They show the status of settlements with employees of the organization

- Account 75. This is the debt incurred in relation to the founders

- Account 76. Reflects settlements with other counterparties

How are account balances reflected?

All of the listed types of receivables correspond to their numbers, which are approved by a special Chart of Accounts, on the basis of which business transactions are recorded.

At the end of the year, each organization must draw up a financial report, which is called a balance sheet or Form No. 1. Debts of other persons to the company are included in the balance sheet as the sum of the expanded debit balance of a number of accounts minus the credit balance of 63 accounts. Debit account balances:

- 60 “Settlements with suppliers and contractors”;

- 62 “Settlements with buyers and customers”;

- 70 “Settlements with personnel for wages”;

- 71 “Settlements with accountable persons”;

- 73 “Settlements with personnel for other operations”;

- 75 “Settlements with founders”;

- 76 “Settlements with various debtors and creditors”;

- 68 “Calculations for taxes and fees”;

- 69 “Calculations for social insurance and security.”

Note from the author! This means that you cannot take the difference between the debit and credit balances for calculation. The balance sheet must include account balances that are simultaneously formed as debits and credits. Such accounts are called actively passive. The exception is the 70 count, since it is passive.

For example, on account 60 “Settlements with suppliers and contractors” at the end of the year there was a loan balance of 50,000 rubles.

The final statement, which reflects the calculations, looks like this: Table No. 1. Balance sheet for account 60

| Account, sub-account | Balance at the beginning of the period | Period transactions | balance at the end of period | |||

| Debit | Credit | Debit | Credit | Debit | Credit | |

| 60 | — | — | 200 000,00 | 250 000,00 | 50 000,00 | |

| 60.1 | — | — | 100 000,00 | 100 000,00 | 0,00 | |

| 60.2 | — | — | 100 000,00 | 150 000,00 | 50 000,00 | |

| Total | — | — | 200 000,00 | 250 000,00 | 50 000,00 | |

But for the purpose of displaying the balance sheet as an asset, you need to take the debit balance, that is, 200,000 rubles.

Receivables taken into the balance sheet may be short-term or long-term. Every month you need to check all contracts for overdue payments. By short-term we mean debts that must be repaid within one year.

Long-term liabilities must be repaid for a period of more than one year. Return periods are determined by agreement between the parties. For example, if the contract states that the customer must make the final payment one and a half years after receiving services, such a receivable will be considered long-term.

Doubtful debts and receivables

Currently, it is established at the legislative level that each organization, subject to certain conditions, must create a reserve for doubtful debts.

Such a reserve is created when there is debt from counterparties. In this case, one of the following conditions must be met:

- The debt must be overdue

- The company has information about serious problems in the financial sector of the counterparty

However, even if there are accounts receivable, a reserve may not be created if the company knows for certain that the debt will be repaid by the counterparty.

Accounting for created reserves is kept on account 63. In order to create a reserve, it is necessary to make accounting entry D91.2 K63. The same posting is used if the reserve needs to be increased (added).

The restoration of the reserve is reflected by posting D63 K91.1. But if the debt is hopeless and needs to be written off, an entry is made D63 K62 (or another accounting account for the counterparty).

Instructions for creating a reserve are contained in paragraph 7 of PBU 1/2008.

It is very important to remember that the provision for such debt is directly related to accounts receivable and its reflection in the company’s annual reports. When drawing up a balance sheet, the amount of the reserve reduces the amount of accounts receivable, the net amount is reflected in line 1230 of the balance sheet asset .

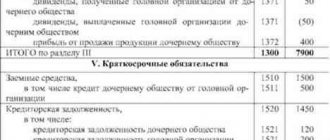

Section V. Current liabilities

Line 1510 “Borrowed funds”

The amount of borrowed funds of the organization (credits and borrowings, including bills and bonds) raised on a short-term basis, at the end of the reporting period, reflected in account 66 “Short-term loans” is indicated.

In accordance with clause 73 of the PBU for accounting, the debt on loans and credits received is shown taking into account the interest due at the end of the reporting period.

Please note: Amounts of outstanding interest on short-term borrowed funds, which, according to the terms of the agreement, are payable within a period not exceeding 12 months, are reflected as part of short-term borrowed funds. Amounts of outstanding interest, the payment period of which exceeds 12 months, are reflected in long-term borrowings.

Line 1520 “Accounts payable”

Accounts payable (line 1520) – indicates the amount of accounts payable, the circulation (repayment) period of which does not exceed 12 months after the reporting date.

Accounts payable are formed based on the following indicators:

— Advances, prepayments, overpayments received from buyers and customers.

— Debt to suppliers for purchased goods, works, services.

— Amounts of debt for taxes and fees.

— Amounts of debt on insurance premiums.

— Amounts of debt to employees and accountable persons.

— Amounts of other accounts payable.

In accordance with clause 74 of the PBU on accounting, the amounts reflected in the financial statements for settlements with banks and the budget must be agreed upon with the relevant organizations and are identical. Leaving unresolved amounts for these settlements on the balance sheet is not permitted.

The procedure for calculating the amount of receivables in the balance sheet

In order to calculate the amount of “receivables” to be reflected in the balance sheet, data from 10 accounting accounts is used.

To identify the correct debt balance for counterparties, it is necessary to generate settlement reconciliation acts and display the correct debt balance. This is necessary both for the organization itself and for the counterparty to correctly account for all obligations. After determining the amount of debt, its value can be transferred to the appropriate line of the balance sheet.

Let's give an example of filling out line 1230. At Romashka LLC, the account balances at the end of the year are as follows:

| Check | Debit balance | Credit balance |

| 60 | 10000 | 5000 |

| 62 | 25000 | 17000 |

| 63 | 8000 | |

| 76 | 3000 | 1000 |

Based on the given data, line 1230 will have the following meaning:

Page 1230 = 10000 + 25000 – 8000 + 3000 = 30000

Results

Long-term accounts receivable include all debts to the enterprise that are expected to be repaid within a period of time exceeding 12 months from the reporting date. When filling out financial statements, indicators of current and long-term debt are indicated together in line 1230 - with subsequent separate division into debt classified as current and non-current, in the form of an explanation to the balance sheet.

Currently, a widely used accounting software product is 1C.

With the help of which reports from this program can you assess the status of accounts receivable at an enterprise, see the material “How to view accounts receivable in 1C correctly?” You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Brief instructions for analyzing receivables

Analysis of debt in a company is important. During its implementation, many indicators are assessed, but even based on the dynamics of changes in debt indicators, some conclusions can already be drawn.

| Index | 2017 | 2018 | Height, % | Deviation, thousand rubles | ||

| Sum | Percent | Sum | Percent | |||

| Total | 233810 | 100 | 324306 | 100 | 138,7 | 90496 |

| Suppliers | 227 | 0,1 | 601 | 0,2 | 264,8 | 374 |

| Buyers | 233353 | 99,7 | 316614 | 97,5 | 2721,1 | 83261 |

| Taxes | 228 | 0,1 | 6204 | 1,9 | 44350 | 5976 |

| Other counterparties | 2 | 887 | 0,3 | 885 | ||

In accordance with the data presented in the table, we can conclude that the largest weight of debt falls on buyer debts. In addition, compared to 2021, in 2018 there was a general increase in receivables for all counterparties.

As for buyers, each of them needs to be considered more carefully, in terms of contracts. It is necessary to determine the dynamics of debt and its change in accordance with the level of revenue. Only after conducting a full analysis can we say what condition the receivables are in and what risks exist for the company.

Data retention period

The limitation period for accounts receivable is limited to 3 years. The period begins to be calculated from the moment of the last movement of funds with the counterparty. After this time, the amount is written off. To write off, it is necessary to notify the counterparty in advance about his debt, provide a written justification and issue an appropriate order. The debt is written off at a loss.

If the counterparty is insolvent, the debt is also written off as a loss. However, his debt is not completely eliminated. It is recorded for 5 years on off-balance sheet accounts. When the debtor's condition stabilizes, they have the right to collect the debt.

Advice: if there are doubtful debts (defined below), the manager must decide to insure them by creating a reserve on his own. Wiring: Dt.91/2 – Kt63

Reflection of accounts receivable in the notes to the balance sheet

It is extremely rare that by the end of the year, based on the results of the analysis of the balance sheet, no debts are identified. Usually these indicators are present.

When preparing the annual report, debt amounts are reflected in the corresponding line of the balance sheet, and must also be reflected in Form No. 5, which is an appendix and is an integral part of the annual reporting. To reflect receivables and payables, there is a special table that details what type of debt is present in the company and what specific indicators it consists of. Moreover, in the explanations the amount of “receivables” is indicated regardless of whether a reserve for doubtful debts has been created or not.

When drawing up the application form, it is necessary to take into account that long-term receivables are reflected in the section with non-current assets.

Experienced accounting specialists do not recommend reflecting the presence of overdue accounts receivable in the explanations; accordingly, do not fill out the table in this part. Such advice is given so that there are no questions from regulatory authorities.

Accounting data is used to fill out information in Form No. 5. You need to know that when filling out the tabular lines, data on the balances and turnover of accounts 62, 60, 68, 69, 70, 71, 73, 75, 76 are used. Everything related to reserves for doubtful debts is reflected in account 63. Data is collected in the context analysts.

What are the consequences of the appearance of large amounts of debt?

Different types of accounts receivable are reflected differently in accounting. Accordingly, when an organization has bad debts (especially in large amounts), the enterprise receives less profit. Naturally, it remains without working capital, and if there are many such debtors, the company simply will not be able to produce products, purchase raw materials, pay taxes and salaries to employees.

Such a situation is fraught not only with losses, but can even lead to bankruptcy of the company. That is why balance sheet line 1230, whatever one may say, is one of its important elements.

Acquiring debt: accounting nuances

When reflecting the acquisition in accounting, the buyer of debt must:

- check whether the acquired right to claim the debt meets the criteria for a financial investment;

- correctly form its initial amount.

To recognize a financial investment, the acquired receivables must be:

- potentially beneficial to its buyer - it can generate income;

- documented.

In addition, all financial risks (insolvency of the debtor, changes in the value of the debt, etc.) must be transferred to the buyer of the debt.

In order to reflect the purchased debt in accounting in a reliable estimate, it is necessary to correctly formulate its initial cost, calculated according to the formula (clauses 8–9 of PBU 19/02):

PSfv = FZ + KS + PS + PZ,

Where:

PSFv - the initial cost of the financial investment;

FZ - actual costs under the assignment agreement;

KS and PS - the cost of consulting, information and intermediary services related to the acquisition of receivables;

PP - other (other) costs associated with the acquisition of debt.

Find out the scheme for calculating the initial cost of various assets from the materials prepared by specialists on our website:

- “The initial cost of intangible assets is...”;

- “Accounting for fixed assets worth up to 100,000 rubles”.

How to adjust accounts receivable?

The amount resulting from adding the debit balances of the above accounts must be adjusted before it is reflected on line 1230 of the balance sheet. How to do it?

Firstly, it is necessary to subtract from it the credit balance of account 63 “Provisions for doubtful debts”, because the balance is compiled in a net assessment (clause 35 of PBU 4/99).

Secondly, the amount received must be reduced by the debit balance of subaccount 73-1 in terms of interest-bearing loans. After all, such loans should be reflected as part of financial investments on the same lines 1170 (if long-term) or 1240 (if short-term). However, interest accrued on such loans on line 1230 must be taken into account.

Thirdly, it is advisable to exclude the debit balance of account 60 in terms of advances and prepayments for work and services related to the construction of fixed assets from line 1230 and show it in line 1190 “Other non-current assets” of Section I of the balance sheet.

So, for example, when transferring an advance payment to the supplier, the following entry was made:

VAT on the transferred advance will be reflected, for example, like this:

Fifthly, line 1230 does not show VAT accrued for payment on advances received from buyers and reflected in the debit of accounts 62 or 76.

So, for example, when receiving an advance from the buyer, the following entry was made:

VAT accrued on the advance payment was reflected as follows:

Despite the fact that VAT on the advance was shown in the debit of account 62, it will not be reflected in line 1230.

What does the wage fund include?

The wage fund in the reporting includes the following subsections:

- monitoring labor productivity, ensuring its growth;

- control of labor discipline;

- monitoring the rational use of labor hours and compliance with production standards;

- finding ways to increase labor productivity;

- accurate calculation of the salary of each employee, its distribution among various cost areas;

- control of the correctness and timeliness of payments to company employees;

- control of payroll spending, etc.

The wage fund is the salary of employees, calculated taking into account:

- insurance contributions, including pension accruals - approximately 20%;

- personal income tax (NDFL) – 13%;

- contributions to health and social insurance funds – about 6%.

For example: an employee’s salary is 10 thousand rubles. It is necessary to add to this figure 20% for insurance premiums and pension contributions and 6% of the fund for health and social insurance. Thus, you need to budget 12,600 rubles for this employee’s salary. At the same time, he will receive only 8,700 rubles in his hands, since 13% will be deducted from the 10 thousand due to him to pay personal income tax. (The example does not take into account special tax regimes.)

The exact amounts of insurance contributions to state funds, monthly terms and liability for their violation are reflected in Federal Law No. 212 of July 24, 2009 (look for the edition with the latest changes and additions).

How to deal with risks

1.Set it in the contract

- penalties (fines, penalties), the possibility of withholding the debtor’s property and other punitive measures in case of non-payment;

- special conditions for the transfer of ownership of the product: transfer only at the time of payment (so that in the event of bankruptcy of the counterparty, you can return your property that has not been paid for);

- rules for adjusting the terms of cooperation (prices/guarantee periods/deferred payment terms, etc.) in the event of changes in market conditions;

- the possibility of unilaterally terminating the contract in the event of failure by the other party to fulfill the terms of this contract;

2. Create a reserve fund for the amount of doubtful debts;

- Use a differentiated approach to pricing: make prepayment or payment upon receipt significantly more profitable for consumers than on credit.

- If possible, take deposits from counterparties.