Filling out the certificate begins by indicating the signatory by going to the “Details”

.

If the report is submitted by a tax agent, then in the “Manager”

his full name is indicated, but if by an authorized representative, then the full name of the representative and details of the document confirming his authority are indicated. Then, using the corresponding button on the “2-NDFL” tab, you need to add an employee. Next, the following fields are automatically filled in on the title page:

- the year for which the certificate is being submitted;

- certificate number and date of its preparation.

In the "Character"

“1” is automatically indicated, which corresponds to the fact that the certificate is submitted as annual reporting. If the certificate is filled out if it is impossible to withhold tax, then “2” is indicated in this field.

Attention! When drawing up a certificate by the legal successor of the tax agent, in the “Sign”

codes “3” and “4” are indicated respectively.

In the "Adjustment number"

“0” is automatically reflected in the primary certificate.

The corrective certificate must indicate the correction number (for example, “1”, “2”, etc.). When filling it out in the fields «№__»

and

“from__”

indicates the number of the previously submitted certificate and the new date of preparation.

When filling out the cancellation certificate, the code “99” is automatically indicated. This certificate is issued in the event that it is necessary to cancel the indicators in a previously submitted certificate. In this case, information about the tax agent and the individual recipient of the income is indicated from the initial certificate, and sections 2-3 and the appendix are not filled out.

Attention! When drawing up a corrective or canceling certificate by the legal successor of the tax agent in place of the one previously submitted by the tax agent in the fields «№__»

and

“from__”

indicates the number of the certificate previously submitted by the tax agent and the new date of preparation.

When filling out the field “To the Federal Tax Service (code)”

The code of the tax authority to which the certificate is submitted is reflected. It is specified automatically (the code that was specified when the client registered in the system), or is selected from the directory.

- Tax agent information

- Information about the individual who is the recipient of the income

- Income taxed at the rate of ___%

- Standard, social and property tax deductions

- Total income and tax amounts

- Comments and clarifications

What does 2-NDFL represent?

An income tax certificate is a document that provides information about sources of official profit, wages, sick pay, financial assistance, and calculated taxes for the year. The extract is provided to citizens working in Russia. The certificate can be obtained from the employer after a written request from the working individual. The period for receiving the document is 3 days, excluding weekends and holidays.

Annual reports 6-NDFL and 2-NDFL do not match the amount of tax withheld

Home » News » In two tax reports for personal income tax, 6-NDFL and 2-NDFL, there is the same indicator - the amount of income tax withheld. However, the values of this indicator reflected in the 6-NDFL calculation and the 2-NDFL certificate for the same period may not coincide.

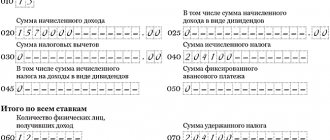

The Federal Tax Service of Russia drew attention to this in a letter dated July 1, 2016 No. For example, wages were accrued in December 2021, but were actually issued in January 2021. Accordingly, personal income tax was also withheld in January. The amount of tax withheld from the December salary will not be included in the calculation of 6-personal income tax for 2021. This amount must be indicated only in section 1 on line 040 “Amount of calculated tax.”

In line 070 “Amount of withheld tax,” personal income tax from December income will be taken into account only in the first quarter of 2021. The situation with 2-personal income tax is slightly different.

Purpose of the certificate

2-NDFL – a document that reflects the solvency of an employee. A citizen may request a certificate to confirm monthly income from a permanent place of work. The main purpose of the statement for an individual:

- applying for a loan from a financial institution

- receiving a state tax deduction

- participation in court proceedings

- pension calculation

- alimony calculation

- adoption, guardianship

- placement in another place of work

- visa application

- accrual of cash payments for unemployment, social benefits for low-income citizens

2-NDFL – legal confirmation of the official monthly profit of an individual. The document is required for processing payments, benefits, and proof of financial capacity in government departments and organizations.

A citizen has the right to make a request to obtain information about the correct calculation of wages and the correct write-off of income tax. The certificate is a mandatory document for calculating pension savings and insurance contributions.

The document is issued only by the employer, who is considered the employee’s tax representative in accordance with Art. 24 Tax Code of the Russian Federation. He must annually send reports to the Federal Tax Service on monetary deductions from the company’s employees. An individual entrepreneur cannot provide paper in his own name. To obtain a loan from a financial institution, proof of income requires a tax return.

Video about the new form 2-NDFL:

The Federal Tax Service requests a document for the administrative regulation of personal income tax. The annual provision of certificates from organizations makes it possible to identify non-transfer of funds to the state budget, the use of unestablished tax rates, and the fact of non-payment of mandatory payments.

Comments and clarifications

- Do I need to submit a zero certificate?

- What personal income tax rates apply depending on the taxpayer status?

- How to fill out a 2-NDFL certificate if the taxpayer’s status has changed during the tax period?

- What income does not need to be indicated on the 2-NDFL certificate?

- What income and deduction codes should I include in the certificate?

- How to submit 2-NDFL certificates if an organization (separate division) has changed its location during the year?

- How many 2-NDFL certificates must be submitted for an employee who first quit and was then rehired?

- How many 2-NDFL certificates must be submitted if an employee moves from one separate division of the organization to another?

- How to fill out a certificate if the amount of tax deductions exceeds the amount of income?

- How is overpayment of vacation pay reflected in the 2-NDFL certificate?

Do I need to submit a zero certificate?

In accordance with tax legislation, 2-NDFL certificates must be submitted by tax agents. If an organization in the reporting year did not pay an individual income from which personal income tax should be withheld, it means that it was not a tax agent and, therefore, should not submit a zero certificate.

What personal income tax rates apply depending on the taxpayer status?

| Taxpayer status | Code | Tax rate, % | |

| by labor income | for other income (dividends, financial benefits, etc.) | ||

| Tax resident | 1 | 13 | 9; 35 |

| Non-resident | 2 | 30 | 15; 30 |

| Non-resident – highly qualified specialist | 3 | 13 | 15; 30 |

| A non-resident is a participant in the state program for the voluntary resettlement of compatriots in the Russian Federation | 4 | 13 | 15; 30 |

| Refugees | 5 | 13 | 15; 30 |

| Foreigners working under a patent | 6 | 13 | 15; 30 |

* - an individual who, on the date of receipt of income, is in the Russian Federation for at least 183 calendar days within 12 consecutive months

How to fill out a 2-NDFL certificate if the taxpayer’s status has changed during the tax period?

Taxpayer status is determined as of the end of the year for which certificate 2-NDFL is submitted (letter of the Ministry of Finance dated November 15, 2012 No. 03-04-05/6-1305). If an employee is dismissed before the end of the year, his status is determined as of the date of dismissal.

If an employee became a resident during the year and retained this status at the end of the year (on the date of dismissal), then in the “Taxpayer Status”

2-NDFL certificate for such an employee indicates code “1”.

This rule does not apply only to foreigners working on a patent. For them, the code “6” is always entered in the “Taxpayer Status”

.

What income does not need to be indicated on the 2-NDFL certificate?

The certificate does not need to reflect income that is completely exempt from taxation in accordance with Art. 217 of the Tax Code of the Russian Federation (letter of the Ministry of Finance dated April 18, 2012 No. 03-04-06/8-118). These, for example, include: maternity benefits, monthly child care benefits, compensation payments, alimony, etc.

Attention! The tax agent must reflect in the 2-NDFL certificate those non-taxable incomes that are partially exempt from taxation. In particular, they are specified in paragraph 28 of Art. 217 of the Tax Code of the Russian Federation (material assistance, prizes, gifts).

What income and deduction codes should I include in the certificate?

Codes of income and deductions indicated in 2-NDFL certificates are filled out on the basis of the Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected] (as amended by the Order of the Federal Tax Service dated November 22, 2016 No. ММВ-7- 11/ [email protected] ).

For each income code, you can specify a specific list of deductions. The correspondence between the most commonly used income codes and deduction codes for 2-NDFL certificates is given in the following table:

| Revenue code | Deduction code reflected: | |

| in the application | in section 3 | |

| 1010 | 601 | |

| 1211 | 510 | |

| 1530 | 201, 208, 216, 218, 222, 618 | |

| 1531 | 202, 217, 219, 223 | |

| 1532 | 205, 206, 209 | |

| 1533 | 220 | |

| 1535 | 207, 210 | |

| 1536 | 203, 224 | |

| 1537 | 211 | |

| 1538 | 215 | |

| 1539 | 213 | |

| 1541 | 620 | |

| 2000 | 104, 105, 126-149, 311, 312, 320, 321, 324-328 | |

| 2001 | ||

| 2002 | ||

| 2010 | 403 | |

| 2012 | 104, 105, 126-149, 311, 312, 320, 321, 324-328 | |

| 2201-2209 | 404, 405 | |

| 2300 | ||

| 2530 | ||

| 2710 | ||

| 2720 | 501 | |

| 2730 | 502 | |

| 2740 | 505 | |

| 2760 | 503 | 104, 105, 126-149, 311, 312, 320, 321, 324-328 |

| 2761 | 506 | |

| 2762 | 508 | |

| 2790 | 507 | |

How to submit 2-NDFL certificates if an organization (separate division) has changed its location during the year?

In this case, the organization (separate division) must submit to the tax authority at its new location:

- 2-NDFL certificates filled out for the period of registration at the old address indicating OKTMO at the previous location;

- 2-NDFL certificates filled out for the period after registration at the new address indicating OKTMO at the new location.

Attention! All certificates indicate the checkpoint of the organization (separate division) assigned to the new address (letter of the Federal Tax Service of Russia dated December 29, 2016 No. BS-4-11 / [email protected] )

How many 2-NDFL certificates must be submitted for an employee who first quit and was then rehired?

If an employee quits within one calendar year and is then rehired, then one 2-NDFL certificate is issued for him for all income received from this employer both before dismissal and after rehiring.

How many 2-NDFL certificates must be submitted if an employee moves from one separate division of the organization to another?

If during a calendar year an employee of an organization received income in several separate divisions located on the territory of different municipalities (different OKTMO), then his income and personal income tax cannot be reflected in one 2-NDFL certificate. It is necessary to fill out several certificates regarding the number of checkpoint + OKTMO combinations with the same adjustment number for the same tax period (letter of the Federal Tax Service of Russia dated July 7, 2017 No. BS-4-11/ [email protected] ).

How to fill out a certificate if the amount of tax deductions exceeds the amount of income?

The procedure for filling out the 2-NDFL certificate provides for the reflection of the amount of tax deductions in an amount not exceeding the amount of income for the year, because the tax base cannot take a negative value.

How is overpayment of vacation pay reflected in the 2-NDFL certificate?

Overpayment of vacation pay is usually possible when an employee quits before the end of the calendar year for which he was granted paid leave. In this case, the employer can deduct from him the amount for unworked days of granted and paid leave. After recalculating vacation pay, the employer is obliged to submit to the tax authority a certificate (primary or updated), filled out taking into account the recalculated amounts of tax liabilities (letter of the Federal Tax Service of Russia dated October 11, 2017 No. GD-4-11/20479).

Providing 2-NDFL

A certificate of income of a person with official employment is issued by the head of an organization, enterprise, or private company. The employer must provide the document to the Federal Tax Service or to the employee upon his written request.

Table 1. Procedure and description of document submission.

| Issue object | The Federal Tax Service | Worker | |

| Information about the income of each employee during the year | Information about the profit of an employee from whom taxes were not collected during the year | Information about income at your own request | |

| Base | Mandatory requirement under Art. 230 Tax Code of the Russian Federation | Mandatory requirement under Art. 226 Tax Code of the Russian Federation | Written request under clause 3 of Art. 230 RF, art. 62 Labor Code of the Russian Federation |

| Number of copies | One | Two: one to the Federal Tax Service, the second to an employee of the organization | Specified in the application |

| Registration of a certificate | Original | Original | Original |

| Submission period | Before April 1 of the previous calendar year | Before March 1 of the expired tax period when the incident occurred | 3 working days |

| Presentation method |

|

|

|

The employer is obliged to provide the certificate only to the employee with whom the employment contract has been signed. For military personnel who have entered into a contract, the state acts as a tax agent. Submission of personal income tax form 2 is carried out at the Unified Settlement Center of the Russian Ministry of Defense.

Video about certificate authentication:

Help on form 2-NDFL in 2021

Home / Reporting for employees

| Download form 2-NDFL (valid until the end of 2021) View a sample of filling out the certificate Below are detailed instructions for filling out | The following situations are considered: 1. Income was taxed at different rates 2. Salary for December was paid in January |

ATTENTION!

From January 1, 2021, the 2-NDFL form will be updated again.

What has changed + new forms can be found in this article.

2-NDFL is an official document about the income of an individual received from a specific source (usually an organization or individual entrepreneur) and the personal income tax withheld from this income.

Organizations and individual entrepreneurs submit certificates only in case of payment of income to employees and other individuals. But individual entrepreneurs do not draw up form 2-NDFL for themselves.

You are required to submit certificates both to the tax office and to your employees.

2-NDFL employees are issued within three working days from submitting an application for a certificate. A certificate may be needed when leaving a job and moving to another job, filing tax deductions, applying to a bank for a loan, applying for a visa to a significant number of countries, applying for a pension, adopting a child, submitting documents for various benefits, etc. .

Due dates

Tax certificates are submitted once a year:

- no later than April 1 (until April 2, 2021, since the 1st is a day off);

- until March 1, if it is impossible to withhold personal income tax (certificates with sign 2).

Information about the income of non-employees in the company

In the following common cases, we must file income information for individuals not employed by the company:

- The company paid for the work/services under the contract;

- The LLC paid dividends to participants;

- Property was rented from an individual (for example, premises or a car);

- Gifts worth more than 4,000 rubles were presented;

- Financial assistance was provided to those not working in the organization/individual entrepreneur.

When not to submit 2-NDFL

There is no obligation to file 2-NDFL when:

- purchased real estate, a car, goods from an individual;

- the cost of gifts given by the company is less than RUB 4,000. (in the absence of other paid income);

- damage to health was compensated;

- financial assistance was provided to close relatives of a deceased employee/employee who retired from the organization or to the employee/retired employee himself in connection with the death of his family members.

In what format to submit 2-NDFL

1) If the number of completed tax certificates is 25 or more, you need to transmit 2-NDFL via telecommunication channels (via the Internet), for which an agreement must be concluded with a specialized organization (operator of electronic document flow between taxpayers and inspectorates).

The list of operators can be viewed on the tax service website. You can also use the Federal Tax Service website to submit certificates.

2) If the number is smaller, you can submit certificates on paper - bring them in person or send them by mail.

When submitting 2-NDFL in paper form, a register of information on income is also compiled - a consolidated document with data about the employer, the total number of certificates and a table of three columns, the first of which contains the numbers of the tax certificates submitted, the second indicates the full name of the employees, the third their dates of birth are indicated.

The register also reflects the date of submission of the certificates to the tax authority, the date of acceptance and the data of the tax officer who accepted the documents. The register is always filled out in 2 copies.

The current form of the register is given in the order of the Federal Tax Service of Russia dated September 16, 2011 No. ММВ-7-3/ [email protected] When submitting via the Internet, the register will be generated automatically and there is no need to create a separate document.

When accounting is carried out in a special program (for example, various versions of 1C Accounting), personal income tax reporting is generated automatically; all that remains is to double-check the correctness of filling out. Also, some developers offer separate programs for filling out personal income tax reporting (for example, the resource 2ndfl.ru).

Instructions for filling out the 2-NDFL certificate

Cap part

We indicate:

- The year for which 2-NDFL was compiled;

- Serial number of the certificate;

- Date of compilation.

Column "sign"

Specify the value:

- “1” – in all cases where personal income tax was withheld, if the certificate is submitted by a tax agent (“3” – if the form is submitted by the legal successor of the organization or its OP on the same grounds);

- “2” – when it was not possible to withhold personal income tax if the document is submitted by a tax agent (“4” – if the form is submitted by the legal successor on the same basis).

The need to provide 2-personal income tax with sign 2 may arise in such common cases as:

- Presenting a non-monetary gift worth more than 4,000 rubles to a person who is not an employee of the company;

- Payment of travel and accommodation for representatives of counterparties;

- Forgiveness of debt for a resigned employee.

It should be borne in mind that submitting a certificate with feature 2 does not cancel the obligation to submit a certificate with feature 1 for the same income recipient.

Column "Adjustment number"

When the certificate is submitted for the first time, “00” is entered. If we want to correct the information from the previously provided certificate, the column indicates a value greater than the previous one by one - 01.02, etc.

If a cancellation certificate is submitted to replace the one submitted earlier, “99” is indicated.

Note: when filling out the corrective document, the successor of the tax agent must indicate the number of the certificate submitted by the previously reorganized company and the new date of preparation.

Code of the tax office with which the organization or individual entrepreneur is registered

You can find out on the Federal Tax Service website through this service).

Section 1

OKTMO code

OKTMO is the All-Russian Classifier of Municipal Territories. The code can be viewed on the tax service website in this service).

Individual entrepreneurs on UTII and PSN indicate OKTMO at the place of business in relation to their employees employed in these types of business.

The legal successor of the tax agent fills out OKTMO at the location of the reorganized company (RP).

TIN and checkpoint

Extracted from the tax registration certificate. In 2-NDFL for employees of separate divisions, OKTMO and KPP of these divisions are indicated. Individual entrepreneurs do not indicate checkpoints.

If the certificate is submitted by the successor of the tax agent, the TIN/KPP of the legal successor is filled in.

Tax agent

The abbreviated (if absent, full) name of the organization (full name of the entrepreneur) is indicated.

If the certificate is submitted by the legal successor, the name of the reorganized company (RP) should be indicated.

Reorganization (liquidation) codes

In the “Form of reorganization” field, the codes of reorganization (liquidation) of the legal entity (LP) are indicated:

| Code | Name |

| 1 | Conversion |

| 2 | Merger |

| 3 | Separation |

| 5 | Accession |

| 6 | Division with simultaneous accession |

| 0 | Liquidation |

The codes of the reorganized company (OP) are entered in the TIN/KPP field.

If the certificate is not submitted for a reorganized legal entity (LE), these fields are not filled in.

If the title of the certificate contains the sign “3” or “4”, these fields must be filled in in the prescribed manner.

Section 2

Taxpayer status

Indicated by code from 1 to 6:

Code 1 - for all tax residents of the Russian Federation (persons staying in the territory of the Russian Federation for 183 or more calendar days within 12 consecutive months), and for those who stayed less than 183 days, the following codes are indicated:

- 2 – when the recipient of the income is not a resident and does not fall under other codes;

- 3 – if we invited a highly qualified specialist to work;

- 4 – if our employee is a participant in the program for the resettlement of compatriots;

- 5 – if the employee brought a certificate of recognition as a refugee or provision of temporary asylum in the Russian Federation;

- 6 – when our employee is accepted on the basis of a patent (foreign workers from countries whose citizens do not require entry visas to the Russian Federation, with the exception of those included in the Customs Union. For example, citizens of Azerbaijan, Tajikistan, Uzbekistan, Ukraine , temporarily staying in Russia, for the right to work for legal entities and individual entrepreneurs are required to obtain patents).

We determine the status at the end of the year for which information is submitted. Those. if the employee became a resident during the year, in the “Taxpayer Status” column we enter the number 1. This does not apply only to filling out certificates for those working on the basis of a patent (for them, code is always 6).

If the 2-NDFL is issued before the end of the year, the status is indicated as of the date the document was drawn up.

Country of citizenship code

Indicated in accordance with OKSM (All-Russian Classifier of Countries of the World). For example, for Russian citizens this is code 643. For codes for other countries, see this link.

Identity document code

Indicated according to the directory “Codes of types of documents proving the identity of the taxpayer” (see table below). Usually these are codes 21 (passport of a citizen of the Russian Federation) and 10 (passport of a foreign citizen). Next, indicate the series and number of the document.

| Code | Title of the document |

| 21 | Passport of a citizen of the Russian Federation |

| 03 | Birth certificate |

| 07 | Military ID |

| 08 | Temporary certificate issued in lieu of a military ID |

| 10 | Foreign citizen's passport |

| 11 | Certificate of consideration of an application for recognition of a person as a refugee on the territory of the Russian Federation on its merits |

| 12 | Residence permit in the Russian Federation |

| 13 | Refugee ID |

| 14 | Temporary identity card of a citizen of the Russian Federation |

| 15 | Temporary residence permit in the Russian Federation |

| 18 | Certificate of temporary asylum on the territory of the Russian Federation |

| 23 | Birth certificate issued by an authorized body of a foreign state |

| 24 | Identity card of a military personnel of the Russian Federation |

| 91 | Other documents |

Sections 3-5

Indicators (except for personal income tax) are reflected in rubles and kopecks. The tax amount is rounded according to arithmetic rules.

If we paid income that was not subject to personal income tax in full (the list of such income is given in Article 217 of the Tax Code of the Russian Federation), we do not include the amount of such income in 2-personal income tax. For example, 2-NDFL does not reflect:

- benefits for pregnancy and childbirth and child care up to 1.5 years;

- payment to the dismissed employee of severance pay in the amount of no more than three monthly salaries;

- one-time payment at the birth of a child in the amount of up to 50,000 rubles.

Section 3

It includes data:

- about income taxed at one of the rates (13, 15, 30, 35%);

- about tax deductions applicable to these types of income (in particular, amounts not subject to personal income tax).

Income received is reflected in chronological order, broken down by month and income code.

Employee income was taxed at different rates - how to fill it out?

If during the year one person received income subject to taxation at different rates, one certificate is filled out containing sections 3 - 5 for each rate. Those. all employee income, regardless of the type of income, must be included in one certificate.

If all the data does not fit on one sheet, fill out the second page of the certificate (in fact, we will have 2 completed 2-NDFL forms with the same number).

On the second page, indicate the page number of the certificate, fill in the heading “Certificate of income of an individual for ______ year No. ___ dated ___.___.___” (data in the header, including the number, are the same as on the first page), enter data in sections 3 and 5 (sections 1 and 2 are not filled in), the “Tax Agent” field (at the bottom of the document) is filled in. Each completed page is signed.

An example of such a situation is an organization issuing an interest-free loan to its employee. The recipient of the loan will have both income taxed at a rate of 13% (salary) and income subject to a rate of 35% (material benefit).

If dividends to a participant who works in the organization, they are reflected along with other income. There is no need to fill out separate sections 3 and 5 for dividends.

For example, on June 5, 2021, participant Nikiforov, who also works as Deputy General Director, was paid dividends of 450,000 rubles. In the data for June (see sample above), we will reflect wage income with code 2000 and dividend income with code 1010.

Income and deduction codes

Income and deduction codes are established by orders of the Federal Tax Service (the latest changes were approved by order dated October 24, 2017 No. ММВ-7-11/ [email protected] ). See the full list of income codes here.

But most often you will have to indicate the following:

| The most used deductions for this section:

|

See the full list of deduction codes here.

If there are no total indicators, a zero is entered in the certificate columns.

Salary for December was paid in January – how to reflect it?

In the certificate, income is reflected in the month in which such income is considered actually received according to the norms of the Tax Code. For example:

1) Our employee’s salary for December 2021 was paid on January 12, 2021 - we will reflect its amount in the certificate for 2021 as part of income for December (since, in accordance with paragraph 2 of Article 223 of the Tax Code, the date of receipt income in the form of wages is recognized as the last day of the month for which income is accrued in accordance with the employment contract).

2) For a craftsman working for us under a contract, payment for work completed in December 2021 was made on January 12, 2018 - this amount will be included in 2-NDFL for 2021 (since there are separate standards for payment for contracts of a civil law nature are not provided for by the Tax Code, therefore, we apply the general rule, according to which the date of actual receipt of income is defined as the day of its payment - clause 1 of Article 223 of the Tax Code of the Russian Federation).

Vacation pay is reflected in the certificate as part of the income of the month in which they were paid (Letter of the Ministry of Finance of the Russian Federation dated 06.06.2012 No. 03-04-08/8-139).

For example, our employee Nikiforov was on vacation from January 9 to January 21, 2021. Vacation pay was paid to him on December 29, 2021. In 2-NDFL for 2021 (see example of filling), we include the amount of vacation pay in income for December with code 2012.

Some types of income are not taxed up to certain limits. In 2-NDFL, opposite such income, you need to indicate the code and deduction amount in the amount of the non-taxable amount.

For example, for his birthday (September 10), employee Nikiforov was given a phone worth 18,000 rubles by the company. Because The cost of gifts for the year is not subject to personal income tax in an amount not exceeding 4,000 rubles. In the 2-NDFL certificate in the data for September (see example of filling) we will reflect:

- income 18,000 rub. with code 2720 (price of gifts);

- deduction 4000 rub. with code 501.

Section 4

The most commonly used deduction codes:

- 126, 127, 128 – deductions for the first, second, third and subsequent children;

- 311 – for expenses for the purchase of housing;

- 312 – for mortgage interest paid;

- 324 – for treatment expenses.

See the full list of codes here. Deductions are received exclusively by tax residents in respect of income taxed at a rate of 13% (except for dividends).

We can provide a social or property deduction at the place of work if the employee has brought a notification from the tax office about the right to such a deduction. Notification details are indicated at the bottom of section 4.

Section 5 states:

- Total amount of income from section 3 (add up the indicators in the “Amount of Income” column);

- Tax base (from the total amount of income we subtract the amount of deductions from the columns “Amount of deductions” of sections 3 and 4);

- The amount of tax calculated and withheld from this income (indicator in the column “tax base” * tax rate; in certificates with the attribute “2” (“4”), the amounts of calculated and withheld tax will differ);

- The amount transferred to the personal income tax budget.

The columns for information on fixed advance payments for a patent are filled out in certificates for those working on the basis of a patent based on information from the notice of confirmation of the right to a tax reduction received from the tax office.

In the “Tax Agent” column the following is indicated:

1 – when the certificate is presented by the head of the organization (successor company) in person or the certificate is sent with a digital signature of the head;

2 – in other cases (for example, when submitting 2-NDFL on paper by the chief accountant or courier).

Below are the details of the person who submitted the certificate and his signature.

The representative also indicates the power of attorney data.

Did you like the article? Share on social media networks:

- Related Posts

- Sample of filling out the KND form 1110018

- Form SZV-M in 2021 - monthly report

- Financial assistance in 6-NDFL

- Sample of filling out the SZV-M form

- Sample of filling out form 4-FSS (2nd quarter 2021)

- 6-NDFL for the whole year

- 6-NDFL for 9 months 2021 (3rd quarter)

- Form 6-NDFL in 2021

Discussion: 17 comments

- Elena:

02/01/2018 at 12:24Good afternoon. Please tell me, in section 5 on “tax amount transferred”, it is necessary to indicate the actual personal income tax transfers and salary payments in January for the accrued December salary, or will “calculated tax amount”, “withheld” and “transferred” be the same?

Answer

Alexei:

02/03/2018 at 04:04

Hello. If on the date of filing the 2-NDFL certificate the tax had already been withheld and paid to the budget, then it should be indicated as calculated, as withheld, and as transferred.

The fact of tax withholding and payment in 2021, and not in 2021, does not matter (letters of the Federal Tax Service of the Russian Federation dated 03/02/2015 No. BS-4-11/3283, dated 02/03/2012 No. ED-4-3/ [email protected] and No. ED-4-3/ [email protected] , dated 01/12/2012 No. ED-4-3/74). Thus, all Section 5 tax amounts will be the same.

Answer

02/13/2018 at 15:56

tell. An employee of mine purchased an apartment in 2021. He needs to submit a 2nd personal income tax certificate

Answer

- Alexei:

02/14/2018 at 16:45

Hello. If an employee was paid income during 2017, a 2-NDFL certificate must be submitted. Apparently, your question concerns how property deductions for purchased housing are reflected in the certificate.

The deduction is provided on the basis of a notification from the Federal Tax Service submitted by the employee and is reflected in 2-NDFL in the following order:

In section 4 you enter: deduction code “311” and the deduction amount.

Below you provide the details of the Federal Tax Service notification confirming your right to a property deduction.

The “Tax Base” column of Section 5 is filled out taking into account the amount of the deduction provided. If its size exceeds income, then the tax base is recognized as equal to 0.

Answer

03/24/2018 at 16:11

How to fill out section 5 in 2-NDFL, if the organization calculates salary monthly, pays with a delay of 9 months (in cash), and has never transferred personal income tax to the budget for the year (the account is blocked)? For example, the amount of tax calculated is 50,000 the amount of tax withheld is 20,000 the amount of tax transferred is 0

Answer

- Alexei:

03/25/2018 at 18:51

Hello. The following point is important here: whether the salary was issued and, accordingly, personal income tax was transferred before the submission of 2-NDFL certificates, that is, already in 2021. If you have paid off your obligations before submitting the certificate, fill out the form as usual.

If at the time of submitting the certificate there is a debt to employees and the tax has not been received into the budget, then in section 5 the indicators for the amount of tax calculated, withheld and transferred will differ, and the line “Amount of tax not withheld by the tax agent” will be filled in. In this case, after paying off obligations to employees and the budget, you will need to submit corrective certificates to the Federal Tax Service in Form 2-NDFL with the same number, but with a new date.

Answer

03/27/2018 at 21:11

Please tell me in form 2-NDFL for 2021 in the column “Tax amount transferred”:

1) Indicate the amount transferred for 2021 accruals? After all, the tax for December 2021 was also transferred in 2021.

2) How to distribute the tax among people if for November 2017 the tax amount calculated for all employees was 10,000 rubles, and 7,000 was paid to the budget? And the remaining 3,000 tax for November and tax for December have not yet been transferred.

Answer

- Alexei:

03/28/2018 at 00:54

Hello. If the tax for the past tax period was transferred to the budget before the date of submission of certificates in Form 2-NDFL to the Federal Tax Service, then such tax should have been included in these reports. Thus, the tax for December 2021 paid in Q1. 2021 should have been included in the primary reporting for 2021.

In cases where, on the date of submission of certificates in Form 2-NDFL, the tax has not been repaid in full, the amounts of calculated, withheld and transferred tax in Section 5 of the primary certificates will differ. After transferring personal income tax to the budget, the tax agent is required to submit corrective certificates, in section 5 of which the above amounts coincide.

Therefore, personal income tax for 2021 should not appear in certificates for 2021 (letter of the Federal Tax Service dated March 2, 2015 No. BS-4-11/3283).

As for the distribution of the amount of personal income tax not transferred, there are no official explanations on this issue, but there is the following opinion: since in this case the tax agent is clearly at fault, it is more logical for the personal income tax transferred from employee remuneration to be reflected in full, and the amount of the debt to be included in the manager’s certificates and founders.

Whether to follow this recommendation or distribute the amounts in proportion to the number of employees is up to you.

Answer

12/15/2018 at 19:02

Good evening! Can you please tell me that the 2-NDFL certificate must have the employer’s stamp?

Answer

01/15/2019 at 12:01

Good afternoon. How to generate (print) a 2-NDFL certificate for an employee? When printing from the program, it issues Appendix No. 1 to the order ММВ-7-11/566 dated 10/02/2018. Is this form suitable for issuing to employees? They will take it to the Federal Tax Service for reimbursement of costs.

Answer

01/24/2019 at 09:54

Good afternoon. Please tell me this is the situation. A husband and wife in an official marriage purchased an apartment, but the husband refused his share, but now he wants to receive a deduction for the purchase of this apartment, since his income is much higher than that of his wife. Does he have the right to make a deduction in 3-NDFL? We purchased the apartment in 2017, but never rented it out for 3-personal income tax.

Answer

02/05/2019 at 13:36

Good afternoon. If the accountant did not take into account the deduction of 4,000 rubles. from the gift and in the personal income tax report 2, this deduction is not indicated; will this be considered an error?

Answer

02/26/2019 at 20:28

Good evening. I don’t quite understand the answer to the question: Should the employer’s signature be stamped on the Form 2 personal income tax certificate?

Answer

01/23/2020 at 21:30

Please tell me, the amount of tax calculated is 54,000, withheld and transferred 9,600, and not withheld by the tax agent 44,600, what should I indicate in the 3NDFL certificate?

Answer

01/29/2020 at 16:35

Hello! My husband works in the Ministry of Internal Affairs. Recently he took out a certificate of 2nd personal income tax. In my opinion, paragraph 4 is filled in incorrectly. If 1400 per child, then it should be 16800 for each child. Deductions for two children. You can check and comment.

Answer

01/29/2020 at 16:37

I wanted to attach a scan, but it seems it’s not possible here. Now in the certificate in the deductions line it is 126-8400 and 127-8400. Certificate for 2021 for 12 months

Answer

02/04/2020 at 16:43

For which last months should 3 and 6 months be indicated in the certificate? A certificate must be submitted to the tax office for a package of documents for purchasing a home for a tax refund.

Answer

Leave a comment Cancel reply

Submission deadline

In accordance with Article 230 of the Tax Code of the Russian Federation, the tax agent of the institution, before April 1 of the current year, is obliged to submit information about the income included in the staff of employees for the past period. In accordance with paragraph 5 of Art. 226 of the Tax Code of the Russian Federation, the employer notifies the service within a month from the date of filing a certificate with the Federal Tax Service about the impossibility of collecting income tax.

According to Art. 62 of the Labor Code of the Russian Federation, an employee, at his own request, can receive a document on monthly profit within 3 days at any time.

When the indicators match

Coincidences between calculated and withheld personal income tax are observed in certain cases:

- Vacation payments. According to the tax service (letter of the Federal Tax Service No. BS-4-11 / [email protected] dated 01/08/16 and a number of others), the amounts of vacation pay that were accrued but not paid are not included in the reporting under f. 6-NDFL in the accrual period. They will be included in the calculation during the payment period. Accordingly, during the period of payment of vacation amounts, the calculated and withheld taxes on them in form 6-NDFL will coincide.

- Sick pay, in the taxable part, is reflected in the same way as vacation pay, like dividends: in the period of actual payment. Calculated and withheld taxes on amounts paid in a certain period will be identical in reporting forms.

- Vacation pay can be received by an employee in the form of compensation if he did not use his vacation and wrote a letter of resignation. On the last day of work he will receive the compensation amount. Calculated and withheld taxes in form 6-NDFL during the dismissal period for this employee will be the same (Letter of the Federal Tax Service No. BS-3-11 / [email protected] dated 11/05/16).

- Wages were received by employees in the same period as they were accrued. Accordingly, the calculated and withheld personal income tax for this period will coincide (letter from the tax service No. BS-4-11 / [email protected] dated 04/05/17). This situation often arises on the last working day of the year, when wages are calculated and paid. Note that, on the recommendation of the fiscal authorities, payment of such amounts to the budget should be made on the first working day of the next year (Tax Code of the Russian Federation, Art. 6.1-7).

Signing the certificate

Features of certification of tax documentation are regulated by Art. 9 Federal Law No. 402. The manager or his authorized representative can sign the 2-NDFL. An enterprise can create a document that will indicate individuals who have the right to certify employee income certificates.

The form contains fields for signature by the general director of the organization or an authorized citizen. When submitting 2-NDFL to the tax office, the certificate signed by an authorized representative must be supplemented with a supporting document. The paper authorizing the affixing of written certification is issued only by the management of the enterprise. The general director does not have the right to sign a document in his own name.

How to pass

Until the end of 2015, it was possible to submit certificates in form 2-NDFL in one of the following ways:

- in person or through a representative (on paper or electronic media);

- by registered mail with a list of attachments;

- via telecommunication channels.

This is stated in paragraphs 3–4 of the Procedure, approved by order of the Federal Tax Service of Russia dated September 16, 2011 No. ММВ-7-3/576.

From January 1, 2021, certificates can be submitted in only two ways:

- in electronic form via telecommunication channels;

- on paper (in person, through a representative or by mail with a list of attachments), if the number of certificates does not exceed 24 pieces.

This procedure also applies to forms 2-NDFL, which tax agents will submit for 2015. This follows from the provisions of paragraph 3 of Article 2 of the Law of May 2, 2015 No. 113-FZ.

For more information on how to submit certificates to tax inspectorates, see When and where to submit 2-NDFL certificates.

Tax agent information

Mandatory information about the organization:

- employer identification code

- Business name

- OKTMO code

For a legal entity, you must indicate a number containing information about the reason for registering the organization with the tax office. The enterprise classifier code allows you to enter the received data into a unified database of organizations and individual entrepreneurs in the Russian Federation. If an individual has income from several divisions, he must indicate the OKTMO of each.

2-NDFL and 6-NDFL: Federal Tax Service talks about typical mistakes

Accounting, taxation, reporting, IFRS, analysis of accounting information, 1C: Accounting

03/23/2017 subscribe to our channel

No later than April 3, tax agents must submit to the tax authorities annual forms on the income of individuals - certificate 2-NDFL and calculation 6-NDFL. Vladislav Volkov, head of the personal income tax department of the Department of Taxation of Personal Income and Administration of Insurance Contributions of the Federal Tax Service of Russia, spoke about common questions and the most typical mistakes when preparing these BUKH.1S reports.

New income and deduction codes By Order of the Federal Tax Service of Russia dated November 22, 2016 No. ММВ-7-11/ [email protected] new income and deduction codes were approved. The changes took effect on December 26, 2021. New codes for standard tax deductions have been introduced (126-149).

Amount of profit received

The third section of the 2-NDFL certificate indicates information about the income received for the requested tax period. Additional points:

income code- amount of income

- deduction code

- the amount of the deduction

The document contains the amount of profit for each month. The income code is entered according to the indicated figure. Deduction code is a digital designation of tax, registered in a single directory. The amount of the deduction indicates the obligatory payment of the employee.

Overpayment and underpayment

If there is an overpayment of tax amounts, first of all it is necessary to find out the reason. When it is not related to excessive tax withholding from an employee’s salary, which happens as a result of errors, it is possible to return the overpaid funds; to do this, you will have to contact the tax office with a corresponding request.

At the same time, it is not possible to count the overpayment as an asset for future payments due to some peculiarities of formation, as well as payment of interest to the budget. Thus, the overpayment should not be indicated in the 2-NDFL certificate.

In the case where overpayment of tax led to too large deductions from the salary, this must be noted in the certificate, and the excess must be returned to the employee. In the event of a return, it is necessary to distribute the excess withheld funds taking into account specific amounts. If the fee was underpaid, you should also find out the reason. When the underpayment has no connection with the enterprise’s inability to withhold tax, it must be paid before the certificate is submitted.

Thus, the organization first covers the underpaid funds, after which it generates documentation in which it distributes the amounts among employees and transmits certificates. In them, the amount of accrued tax must be equal to the withheld and transferred amounts.

If the underpayment of tax is caused precisely by the agent’s inability to receive and deduct tax, then the certificate must state that the withheld amount is equal to the amount transferred, but does not coincide with the accrued amount. In this case, the “Document Attribute” column is filled in, in which the number 2 is entered and the data is entered in the line for the amount of tax that was not withheld.

Established benefits

The fourth section is filled out for citizens with social benefits, property, standard, professional deductions. A tax deduction of the standard form is provided to citizens with a salary of less than 20 thousand rubles, in the care of minors, children from 18 to 24 years old, full-time students in higher and secondary specialized institutions.

The certificate contains the code, the date of registration of the document, and the code of the inspection that made the decision to establish the deduction.

Calculated and withheld personal income tax: what is the difference?

Individual entrepreneurs and organizations that hire employees are faced with the calculation and withholding of personal income tax. According to paragraph 1 of Article 226 of the Tax Code of the Russian Federation, their responsibility includes the calculation and withholding of income tax from employees’ salaries with the subsequent transfer of these amounts to the country’s budget.

Let’s be clear: what is the difference between calculated and withheld personal income tax. The tax agent, who is the employer, before issuing wages to the employee, must calculate the amount of personal income tax, which will then be withheld from the total wages and sent to the state budget. The calculated personal income tax is the same calculated amount.

It must be reflected in the certificate of form 2-NDFL.

This position is recorded in the column “Calculated tax amount”. Also see "". The calculated income tax is withdrawn from the amount of money that a company employee or a person working for an individual entrepreneur receives. Thus, the withheld personal income tax remains with the employer before the latter transfers it to the state budget.

The mentioned amount is also reflected in the 2-NDFL certificate.

Tax amount

In the document where income and mandatory payments from the monthly payment are recorded, 3 types of taxation are indicated:

- calculated - a payment the amount of which is equal to profit without deductions, multiplied by the single income tax rate

- withheld - a tax that is deducted from the salary of an employee of an organization

- transferred - the amount transferred by the employer to replenish the state treasury

Video about generating help in the 1C program:

The payment is calculated by the organization's accountant during the period of issuing monthly wages. When receiving income from sources with different tax rates, the amount is calculated for each type of profit.

Why is the calculated tax in the 2-NDFL certificate not equal to the withheld tax?

Published 10/23/2014 5:36 pm When generating 2-NDFL certificates for employees or when preparing annual reports, many are faced with a situation where for some person the amount of tax calculated is not equal to the amount withheld. Sometimes this is the correct behavior of the program, and the amounts should indeed differ, but most often there is a common error that appears due to incorrect program settings or an incorrect document entry algorithm. And first of all, we will talk about the settings of the programs 1C: Salaries and personnel management 8, 1C: Integrated automation 8 and 1C: UPP.8.

To check them, select the “Enterprise” tab on the desktop and find the “Accounting Settings” item. In the window that opens, go to the “Payroll calculation” tab and pay attention to the checkbox “When calculating personal income tax, take the calculated tax into account as withheld.”

Enumerated

The calculated tax is calculated according to a single rate from salary without taking into account social, property, and professional benefits. For correct calculation there is an algorithm of actions:

- Establish the object of taxation.

- Determine the tax base.

- Select a bet.

- Apply the amount of required deductions and benefits.

- Calculate the tax amount.

Calculation occurs monthly after the wages of an employee of the enterprise are established. When determining the final amount, the income tax rate is taken into account.

What does the amount of tax calculated and withheld mean in personal income tax certificate 2?

Every year at the end of the calendar year, legal entities that accrued and paid income to individuals.

persons during the reporting year, and also accrued and transferred personal income tax amounts to the treasury, and report this to the fiscal authorities. When compiling information, the accountant is faced with a circumstance when the calculated amounts are not equal to the withheld amounts. This situation is possible, but rare, so you need to double-check the completion of the report and the initial software settings.

If an overpayment of income tax indicators and, accordingly, an excessively withheld amount is detected, the tax agent finds out the reason for the occurrence.

It is possible that the overpayment occurred due to incorrectly calculated personal taxes. person, which means an error occurred during payroll calculation.

Impossibility of withholding personal income tax

The manager is obliged to notify the Federal Tax Service at the place of registration and the employee before March 1 of the expired tax period about the occurrence of a corresponding incident under paragraph 5 of Art. 226 Tax Code of the Russian Federation.

Grounds for the head of an organization not being able to withhold income tax:

- payment of wages in kind

- the occurrence of a material benefit for the taxpayer

- existence of salary arrears to the employee

- issuing gifts to an employee worth more than 4 thousand rubles, in the absence of subsequent monthly accruals

In accordance with paragraph 9 of Art. 226 of the Tax Code of the Russian Federation, a mercenary cannot independently pay income tax for another individual. According to paragraph 1 of Art. 228 of this regulatory act, an employee of an enterprise must calculate and pay a mandatory payment in the absence of withholding tax on monthly income, if the head of the organization has not notified the Federal Tax Service about this.

Penalty for not withholding or transferring

According to Article 123 of the Tax Code of the Russian Federation, if a company or individual entrepreneur had the opportunity to withhold and transfer personal income tax to the state budget, but for some reason this did not happen, penalties are imposed on the tax agent. Their size depends on the amount of tax not withheld or transferred: 20 percent of it.

Make sure that there are objective reasons for the impossibility of collecting the tax. Then there will be no concern about the amounts of personal income tax calculated and withheld, and what is the difference between them, and why it arose.

Read also

30.08.2016

Excess of withheld amount over transferred tax

The head of the organization transfers funds to the state budget monthly in a total amount without indicating the amount for each employee individually. The employer is obliged to deposit money into the treasury that matches the withheld tax. Tax agents must regularly submit reports indicating the funds transferred to the budget, the date of transfer for a certain time period, the rate, OKTMO/KPP code, and payment details.

When receiving 2-NDFL, there may be a discrepancy between the withheld and transferred amount. In accordance with paragraph 6 of Art. 52 of the Tax Code, the permissible deviation is 50 kopecks for rounding to whole rubles.

A common reason for discrepancies between numbers in documentation is a request for information ahead of the deadline established for the transfer of funds to the state by the employer. If violations have been established in the withholding and transfer of tax, the employee has the right to apply to the Labor Inspectorate, the Federal Tax Service, and file a complaint with the Prosecutor's Office for an inspection.

What does the amount of tax calculated and withheld mean in personal income tax certificate 2?

» Annually at the end of the calendar year, legal entities that accrued and paid income to individuals.

However, there is a way out - contact our company for the required certificate.

persons during the reporting year, and also accrued and transferred personal income tax amounts to the treasury, and report this to the fiscal authorities.

When compiling information, the accountant is faced with a circumstance when the calculated amounts are not equal to the withheld amounts. This situation is possible, but rare, so you need to double-check the completion of the report and the initial software settings. If an overpayment of income tax indicators and, accordingly, an excessively withheld amount is detected, the tax agent finds out the reason for the occurrence.

It is possible that the overpayment occurred due to incorrectly calculated personal taxes.

person, which means an error occurred during payroll calculation. In this case, these amounts are returned; for this, an application is submitted to the inspector.

Overpayments will not count towards future payments due to the peculiarities of the formation and transfer of income tax to the treasury.

Nuances of filling

The title of the document contains a sign in accordance with the withholding (1) or the impossibility of withholding (2) income tax. In the section where information about the employee is indicated, you need to indicate the employee's status. If the taxpayer has several sources of income with different rates, several sections on the amount of profit received are filled out in the document. The amount of wages and deductions is recorded in rubles and kopecks, and for calculated, withheld and transferred tax - in full rubles.

Types of accountable deductions

There are three types of taxes indicated in 2-NDFL:

- Calculated - when planning payments to employees, the company independently calculates the amount of tax, which is subsequently transferred to the budget. By the way, it is the deducted amount that is called the transferred tax. The calculated tax is equal to the amount of income from which the amount of deductions is removed, the result of which is multiplied by the amount of personal income tax, which according to the standard is 13%.

- Withheld - the company withholds a pre-calculated amount from a person’s salary or other income. That is, the withheld tax is displayed as an amount, which then goes to the budget, and the employee receives a salary with the amount already deducted.

- Transferred - represents the tax that was transferred by the tax agent as a budget replenishment.

Most often, difficulties arise when filling out the “Amount of tax transferred” column. After all, the company pays a full amount of tax from the entire state throughout the year. Unlike the rest of the documentation, in the 2-NDFL certificate it is necessary to distribute the tax separately for each employee. If you have paid as much as you need, then no difficulties are foreseen. Then the amount of calculated tax will be equal to the other two amounts. And this will allow you to effectively differentiate taxes from each employee.

Sometimes the deduction figures may not converge, and it is important to understand why the 2-NDFL certificate does not reflect the amount of tax transferred. There are various reasons for this. The most common situation is when an employee quits, and tax recalculation does not allow him to be retained. And when funds are transferred to the budget late, a certain underpayment results.

Filling example

Since 2021, the 2-NDFL certificate has undergone changes. To submit information to the Federal Tax Service, the head of the organization must fill out 3 sections of the document, consisting of a main sheet and an appendix:

- The first is information about an individual indicating TIN, full name, taxpayer status, date of birth, citizenship, series, passport number.

- The second is the total amount of income and tax for the past period.

- The third is information about possible deductions.

- Appendix - an indication of employee income for each month of the expired period.

When submitting a report in written or electronic form, the employer must draw up a register indicating information about the persons from whom tax is withheld. In the form requested by the taxpayer, 5 sections have been filled out since 2019. Basic provisions - information about the employee, employer, income indicating the taxable rate, deductions, total profit, taxes.

Tax document 2-NDFL reflects information about the income and obligatory payments made by an individual to the state budget for the calendar year. The form of the help depends on the presentation object. The information specified in the form is confirmation of the taxpayer's compliance with the legislation of the Russian Federation.

Top

Write your question in the form below

Filling out the certificate: step-by-step instructions

The Federal Tax Service, by its order dated October 30, 2015 and designated as No. ММВ-7-11/485, introduced the official form 2-NDFL with some changes. The structure of the certificate has remained unchanged, so experienced employers most likely will not have a question about how to fill out such a form. It consists of a title and five sections. Among the innovations, there are several indicators that should be included in the paper.

The title of the document should include information such as:

- Year of reporting, serial number of this form and date of preparation.

- Next comes the column “Sign” . It is marked with “1”. This will indicate that the form concerns the income of an individual and the tax that was withheld.

- The number with the adjustment is a new field. Two zeros are entered into it if the document is being filled out for the first time. In the future, all resubmissions of paper will be numbered. To cancel the certificate, put two nines in this column.

- Code according to the Federal Tax Service.

In the first section, information regarding the tax agent is filled in. So, you need to enter the OKTMO code, contact phone number, TIN, name and checkpoint of the agent. If you receive income from a separate department, you should enter a checkpoint according to the location of this organization.

The second section contains information about the individual who receives income:

- TIN of an individual. If there is a foreign employee, his TIN is placed in a new special column;

- the status of the one paying the fee. There are six categories here. Among the new ones are participants in state resettlement programs, foreign refugees, foreigners with a work permit;

- OKSM code;

- passport details.

The third section indicates the income that is subject to the interest rate and its amount. All calculations are based on data on income in kind and financial forms.

The fourth section is responsible for deductions for social, investment and property taxes. More information about what each section means can be found in the reference book “Codes of types of taxpayer deductions”.

The fifth section indicates the amount of income and tax in the form of total amounts. In this case, all amounts should be rounded to full numbers. This follows from the Letter of the Federal Tax Service, dated December 28, 2015 and designated No. BS-3-11/4997.

Let's sum it up

- 2-NDFL for 2021 must be submitted by 03/02/2020 (03/01/2020 falls on Sunday and is postponed to the first working day - Monday).

- If income is paid to more than 10 employees, the certificate must be submitted in electronic form using TKS.

- Two different certificates are prepared for the Federal Tax Service and the employee.

- The certificate must be issued to the employee within 3 working days from the date of receipt of the relevant request from him.

If you find an error, please select a piece of text and press Ctrl+Enter.