Free legal consultation by phone:

8

When sending an employee on a business trip, enterprise managers often resort to using public transport to reach the employee’s destination and his subsequent movement. In turn, workers who have their own means of transportation prefer to use a personal car for greater comfort and increased mobility. When reaching an agreement with the employer on choosing the second option, the parties must agree on the terms of the business trip, as well as prepare a list of accompanying documents. The following publication will help you learn more about the nuances of booking a business trip in a personal car.

Business trip by personal transport. The legislative framework

Chapter 24 of the Labor Code is devoted to business trips, which in its articles defines such a business trip and also establishes:

- guarantees for an employee when he is sent on a business trip;

- procedure for reimbursement of travel expenses in various conditions of business trips.

The general norms of the Labor Code of the Russian Federation are specified in the Regulations on the specifics of sending employees on business trips (approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749) - the main document establishing the procedure for sending employees to another location to perform tasks.

ATTENTION! The employer must prescribe the procedure for processing and paying for a business trip in a local regulatory act, for example, in the regulations on business trips. Read about the nuances of document preparation in the material “How to draw up a business trip regulation.”

general information

The use of business trips by employers is regulated by the Labor Code and other regulations. At the same time, he is obliged to guarantee the person sent on a business trip reimbursement of all his expenses. Registration of a business trip is carried out in accordance with established rules.

An employee can drive his own or a company car, or use public transport to travel. There is no minimum period for a business trip. Based on this, the employee can stay on a business trip for one day and receive appropriate compensation.

The duration of a business trip largely depends on the following factors:

- task scope;

- difficulty in completing the order;

- additional task characteristics.

There is also no maximum duration for a business trip. The norms that set a limit of 40 days for a business trip, excluding time on the road, were cancelled.

Do I need to enter into a car rental agreement?

There are 2 answers to the question “Should I enter into an agreement with an employee to rent a personal car?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

- It is safer to conclude an agreement and specify the amount of compensation. The amount of compensation for fuel and lubricants can be any, but only standard indicators can be taken into account in expenses:

- 1,200 rub. per month - if the engine volume is less than 2000 cm 3;

- 1,500 rub. per month - in case of exceeding 2,000 cm3.

IMPORTANT! Be sure to take a copy of the car registration certificate (Letter of the Ministry of Finance dated January 23, 2018 N 03-04-05/3235).

2. If an agreement is not concluded, then the employee is paid the entire amount for gasoline according to the advance report. The same amount is taken into account in tax expenses. In this case, disputes with tax authorities are possible, because They recommend paying for fuel and lubricants in accordance with the standards in this case as well.

In any case, issue a waybill. The document will serve as proof of real gasoline costs, because it indicates mileage, route, etc.

Arbitrage practice

In 2021, there is no uniformity of judicial practice regarding workers' compensation for business travel. The main questions are related to the validity of using a personal car for work purposes.

There may be situations where an employer verbally agrees to compensate for travel expenses, but later refuses to fulfill its obligations.

Such disputes require the assistance of a qualified specialist and are considered by the court taking into account the evidence presented by the parties.

Judicial practice is presented here.

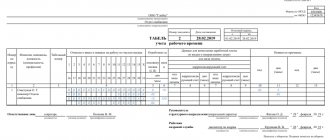

Features of preparing a waybill for a business trip in your car

If an employee goes on a business trip in his own car, it is strongly recommended to issue a waybill. Despite the fact that the tax service does not require the submission of such a document when checking an organization’s expenses, with a completed waybill it will be much easier to confirm both the fact of using the car for business purposes and the given calculation of gasoline consumption.

The waybill is drawn up in a form approved by Decree of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78, or independently developed by the organization. The use of the waybill form developed at the enterprise is permitted by the Ministry of Finance of Russia (letter of the Ministry of Finance of the Russian Federation dated August 25, 2009 No. 03-03-06/2/161) provided that the document contains the mandatory details established by the order of the Ministry of Transport of Russia dated September 11, 2021. No. 368 (recall that until 2021 Order No. 152 dated September 18, 2008 was in force).

Such details include (Section 1 of Order No. 368 of the Ministry of Transport of the Russian Federation):

- name and number of the waybill;

- information about the validity period of the document;

- information about the car owner;

- vehicle information;

- driver information;

- transportation information.

How to issue a waybill for a passenger car, see here.

Payment and compensation to an employee

As mentioned above, payments for the use of your car are made based on the calculation of 1,500 rubles per month.

Reimbursement is issued upon the employee's arrival at the office, based on the advance report, checks and receipts provided by him.

When using its own transport, the company compensates the employee for expenses due to depreciation, maintenance, repairs and lubricants. The amount of compensation is specified in the agreement with the employee and the local regulations of the company.

The director issues an order to pay compensation.

An employee using his or her own vehicle must provide the vehicle's registration certificate as proof of ownership of the vehicle.

Additionally, the fact of using the machine should be stated in the employment contract.

Compensation for using the machine for work purposes is paid in proportion to the time worked. There are no reimbursements for expenses during absence. Payment occurs once a month.

Taxation

The amount of taxable profit is reduced by the amount of costs incurred in reimbursing the employee for travel expenses.

However, since these costs already include fuels and lubricants, it will not be possible to deduct money spent on fuels and lubricants from the tax base of the enterprise.

If money is given for the use of a car, and not in the form of travel allowances, then all money paid to the employee in excess of the norm established by law is not counted as expenses.

Personal income tax is not charged to the employee for reimbursement of expenses, and social insurance contributions are not paid from it; the payment does not relate to the employee’s income subject to tax.

At the same time, since the legislation does not have clear language on this matter, conflict situations are possible both with the tax service and with social insurance funds if they consider the payment to be the income of a subordinate.

How do you go on a business trip?

As of January 1, 2016, some documents previously issued for business trips were canceled. So, now there is no need to formalize:

- official assignment;

- travel certificate;

- trip report.

In addition, the obligation to keep a log of posted workers has been abolished. To be fair, it is worth noting that some employers remained faithful to the previous procedure for documenting business trips and established the obligation to draw up the listed documents by internal orders of the organizations. However, even in such cases, the main document for sending on a business trip from the point of view of legislation is an order.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

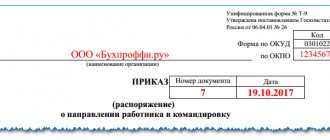

The specific form of the order is not approved by law. In this case, enterprises prefer to use unified forms of order No. T9 (on sending an employee on a business trip) or No. T9a (on sending a group of employees on a business trip), approved. Resolution of the State Statistics Committee of the Russian Federation dated 01/05/2004 No. 1, although from 01/01/2013 the use of forms of primary accounting documents is not mandatory.

The T-9 form can be downloaded from the link below.

In any case, the order must indicate the following information (Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ):

- name of company;

- date of preparation and number of the administrative document;

- employee details, name of his position;

- information about the place where the employee is sent to complete the task;

- duration of the business trip (dates of departure and arrival);

- purpose of the trip;

- details of the use of transport (personal, business, public, etc.);

- information about the organization that will reimburse the employee for travel expenses.

The order is signed by the head of the organization or an authorized employee. The posted worker must also sign the order, thus confirming the fact of familiarization with it.

A sample of filling out an order on form T-9 can be downloaded from the link below.

If repairs are required

If the employer and employee have not provided for all the specifics in the agreement on compensation for expenses for the use of personal vehicles for business purposes, then a controversial situation may arise regarding the payment of vehicle repair costs.

For example, depending on the nature of the vehicle breakdown, an employer may refuse to pay compensation for expenses incurred to repair a car that broke down while the employee was on a business trip. He can explain this by saying that the breakdown occurred before he was sent on a business trip, and the owner of the car hid this fact.

Please note! The cost of tire mounting will be reimbursed without any problems. To do this, you will need to provide a receipt from the workshop. Other damages may be compensated on an individual basis.

Reimbursement of travel expenses

According to Art. 168 of the Labor Code of the Russian Federation and clause 11 of Decree of the Government of the Russian Federation No. 749, the posted employee is reimbursed for the following expenses:

- for travel in both directions;

- for renting housing;

- daily allowance;

- other expenses determined by the employer.

Each organization sets the daily allowance amount independently (with the exception of government agencies). At the same time, it is important to remember that in accordance with the Tax Code of the Russian Federation (clause 3 of Article 217), only amounts in the amount of 700 rubles for business trips in Russia and 2,500 rubles for business trips abroad are not subject to tax on the income of individuals. Amounts above these standards are subject to taxation.

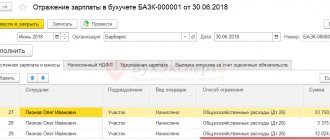

Upon returning from a business trip, the employee must submit an advance report to the accounting department, which is drawn up according to form No. AO-1, approved. Resolution of the State Statistics Committee of the Russian Federation dated August 1, 2001 No. 55. The following must be attached to the report:

- documents confirming housing expenses (receipts from the hotel or receipts for receiving money if the housing was rented from an individual);

- receipts for fuel and lubricants;

- waybill;

- memo.

The memo is intended to confirm the duration of the business trip. Such a document is drawn up in any form, however, in order to avoid misunderstandings during tax audits, it is recommended to establish the form of an internal memo in the internal documents of the organization.

An example of a service design:

If several employees were sent on a business trip in a personal car, then the waybill is issued only for the driver. Accordingly, if only the driver paid for gasoline, other business travelers should not submit receipts for payment for fuel and lubricants. If repairs to a personal vehicle are required during a business trip, maintenance costs will be reimbursed by the employer as part of the vehicle use agreement concluded between the employer and employee. Also, by agreement, the employee may be compensated for expenses associated with an accident that occurred while on a business trip (of course, if it was not the fault of the posted employee).

simplified tax system

The tax base of simplified organizations that pay income tax is not reduced by travel expenses (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

Simplified organizations that pay a single tax on the difference between income and expenses can include documented travel expenses as expenses (subclause 13, clause 1, article 346.16 of the Tax Code of the Russian Federation). At the same time, expenses for fuels and lubricants of organizations using the simplified tax system are taken into account in the same manner as organizations using the general taxation system (subclause 12, clause 1, article 346.16 of the Tax Code of the Russian Federation). VAT amounts on travel expenses will also reduce the tax base for the single tax (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).

For more information on tax accounting for fuel and lubricant expenses, see:

- How to reflect the purchase of fuels and lubricants for cash in tax accounting (special regime);

- How to record the purchase of fuels and lubricants using fuel cards;

- How to record the purchase of fuel and lubricants using coupons.